|

市場調査レポート

商品コード

1683504

中東の植物性たんぱく質:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Middle East Plant Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 中東の植物性たんぱく質:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 218 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

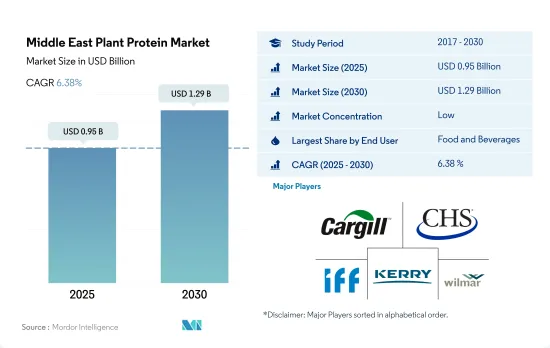

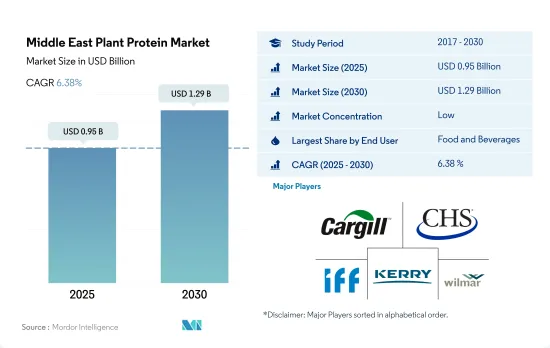

中東の植物性たんぱく質の市場規模は2025年に9億5,000万米ドルと推定され、2030年には12億9,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは6.38%で成長する見込みです。

中東におけるビーガンおよびフレキシタリアン消費者の増加が飲食品セグメントの市場シェアを押し上げています。

- 用途別では、飲食品産業が同地域における植物性たんぱく質の主要用途分野です。F&Bセグメントにおけるたんぱく質の需要は、主にたんぱく質の機能性に対する需要の増加やたんぱく質が豊富な食事に対する意識などの要因によって牽引されています。F&B分野では、肉/鶏肉/シーフードおよび肉代替製品のサブセグメントが2022年に33.19%の主要数量シェアを占めました。サウジアラビアでは、商店やレストランがさまざまな菜食主義者やベジタリアン向けの製品を提供しており、肉食から植物性食品への移行を可能にしています。世界の他の地域からの観光客も、同地域の代用肉市場の成長に貢献しています。さらに、食品加工方法の進歩に伴い、代用肉サブセグメントにおける需要も大幅に増加しています。同サブセグメントは予測期間中に6.09%のCAGRで推移すると予測されます。

- しかし、スナック菓子は最も急成長しているサブセグメントであり、予測期間中に金額ベースで10.16%のCAGRで推移すると予測されます。消費者の間食に対する意識も高まっています。消費者は、栄養価の高い天然素材を含み、健康やウェルネスに役立つ謳い文句や表示がない、より健康的なスナックを選ぶようになっています。

- F&B分野は動物飼料が続き、大豆たんぱく質がアプリケーションシェアの大半を占めています。2022年には、動物飼料セグメントにおける植物性たんぱく質需要の約81%は、その豊富な入手可能性と低価格のために大豆たんぱく質によって満たされました。さらに、マメ科植物由来の原料は動物飼料用の植物たんぱく質の主要な供給源であり、その生産は農場と飼料メーカーの両方にさまざまな利益をもたらします。

大手企業による戦略的投資と国内での菜食主義の高まりが相まって、サウジアラビアが最高市場シェアを占めています。

- 国別では、サウジアラビアが中東市場でトップの座を維持し、2022年にはイランがこれに続いた。同市場は、特に主要企業による大規模投資の恩恵を受けており、これが強固な市場構造と組織的な販売につながっています。とはいえ、上位2ヵ国が市場で最も急成長していることに変わりはないです。予測期間中のCAGRは8.36%で、イランが数量ベースで最も速い成長率を記録するとみられます。サウジアラビア政府は、大豆たんぱく質ミールなどの動物飼料製品を含む動物飼料補助金の最新リストを発表しました。エンドウタンパクは、政府支援の増加に伴い、動物飼料分野で予測期間中に数量ベースで最高のCAGR 8.08%を記録すると予測されます。

- 同地域の植物性たんぱく質市場は、主に飲食品セグメントが牽引しており、数量ベースでCAGR 6.10%を記録しました。中東、特にアラブ首長国連邦では、ビーガン食品と植物性肉に対する需要が増加しています。中東の大手食品ブランド数社は、ビーガン用の肉やその他の食品を強調しています。

- トルコのビーガン&ベジタリアン協会は、長い間ビーガン食を提唱してきました。ディディムで開催されたものを含め、最近開催されたいくつかの地域のフェスティバルは、菜食主義の人気を高めるのに役立っています。クスクス、ファラフェル、フムスなど、伝統的な郷土料理や国民食の多くは、もともと肉を使わないベジタリアン料理です。菜食主義者の増加と、特にアラブ首長国連邦のような近代化しつつある国々におけるアレルゲンフリーのソースに対する需要の高まりが、価値の成長をさらに促進しています。その結果、エンドウ豆たんぱく質のような供給源は、肉代替食品に組み込まれた場合、大豆たんぱく質の代用品として機能する能力により、脚光を浴びています。

中東の植物性たんぱく質市場の動向

中東全域での健康志向の高まりにより、植物性たんぱく質の消費は安定した成長を遂げます。

- グラフは、バーレーン、エジプト、イラン、イラク、クウェート、オマーン、サウジアラビア、トルコ、アラブ首長国連邦を含む国々における植物性たんぱく質の一人当たり消費量を示しています。植物性たんぱく質が健康に良いという認識が広まり、様々なプラットフォームを通じて広まり、この地域の人口のかなりの部分が健康志向のライフスタイルを受け入れています。その結果、植物性たんぱく質を組み込んだ食品に対する需要が急増しています。この地域の消費者の旺盛な購買力に後押しされ、この需要の高まりは予測期間において植物性たんぱく質市場を推進するものと思われます。この地域の企業は、オーガニック製品に対する需要の高まりに対応するため、天然由来の原料にますます目を向けるようになっています。

- 一例として、Cutetonic社は100%オーガニックのエンドウ豆たんぱく質パウダーをsaudi.desertcart.comのような人気のあるオンラインショッピングプラットフォームで購入できるようにし、この地域の大規模なオンライン顧客基盤を開拓しています。サウジアラビアでは、若年層の栄養補助食品への需要が拡大しています。一部の消費者の間で乳糖や大豆を含まない選択肢が好まれることから、エンドウ豆たんぱく質の需要は近い将来急増すると予想されます。さらに、同地域の植物性たんぱく質市場は、他国との貿易協定強化の恩恵を受けることになります。欧米の食事動向に影響された菜食主義への志向の高まりと、肥満対策への協調的な取り組みにより、現地の人々の植物性たんぱく質への関心が高まっています。このシフトは、大豆ベースのたんぱく質に対する需要の高まりによってさらに促進され、主要な業界プレーヤーは大豆ベースの成分で製品を強化するよう促されています。

サウジアラビアとイランが植物性たんぱく質生産で中東市場をリード

- グラフは、サウジアラビアとイランにおける米や小麦などの植物性たんぱく質の生産量を示しています。この地域では、米と小麦を原料とする植物性たんぱく質が主要な植物性たんぱく質の形態として浮上しています。この地域には穀物生産地域があるが、水不足のため、人口を養うために輸入に頼っています。国際穀物協会(IGC)は、2016-17年の近東アジアにおける穀物総生産量を6,470万トン、イランを2,040万トン、イラクを480万トン、シリアを140万トン、トルコを3,490万トンと予測しています。その他は340万トンとなります。例えば、中東のコメ生産量は約290万トンです。

- この地域は穀物の輸入が多く、近東アジアの穀物輸入総量は5,140万トンです。サウジアラビアの輸入量は1,530万トン、イランは920万トン、トルコは670万トンです。そのうち小麦は490万トン。輸入の内訳は、近東アジアからの小麦が2,440万トン、エジプトからの小麦が1,150万トン。トルコの小麦輸入量は490万トンで、イラクとイランが250万トン、イエメンが310万トンを輸入しています。

- 2016年、サウジアラビアは小麦の国内生産を奨励するための長年の政策を放棄しました。サウジ政府は、特定の作物の生産で比較優位にある外国に投資し、その製品をサウジに再輸出することを農業企業に奨励しています。このイニシアチブの対象となる作物には、小麦、米、大麦、イエローコーン、大豆、青飼料が含まれます。サウジアラビア政府は、サウジアラビアの投資家(企業および個人)が食料安全保障イニシアチブに参加することを奨励するため、財政的インセンティブを提供しています。

中東の植物性たんぱく質産業の概要

中東の植物性たんぱく質市場は断片化されており、上位5社で10.99%を占めています。この市場の主要企業は以下の通りです。Cargill, Incorporated, CHS Inc., International Flavors & Fragrances, Inc., Kerry Group PLC and Wilmar International Ltd(sorted alphabetically).

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第3章 主要産業動向

- エンドユーザー市場規模

- ベビーフードおよび乳児用調製乳

- ベーカリー

- 飲料

- 朝食用シリアル

- 調味料/ソース

- 菓子類

- 乳製品および乳製品代替製品

- 高齢者栄養・医療栄養

- 肉・鶏肉・魚介類および肉代替製品

- RTE/RTC食品

- スナック

- スポーツ/パフォーマンス栄養

- 動物飼料

- パーソナルケアと化粧品

- たんぱく質消費動向

- 植物

- 生産動向

- 植物

- 規制の枠組み

- UAEとサウジアラビア

- バリューチェーンと流通チャネル分析

第4章 市場セグメンテーション

- たんぱく質タイプ

- ヘンプたんぱく質

- エンドウ豆たんぱく質

- ポテトたんぱく質

- 米たんぱく質

- 大豆たんぱく質

- 小麦たんぱく質

- その他の植物性たんぱく質

- エンドユーザー

- 動物飼料

- 飲食品

- サブエンドユーザー別

- ベーカリー

- 飲料

- 朝食用シリアル

- 調味料/ソース

- 菓子類

- 乳製品・乳製品代替品

- 肉・鶏肉・魚介類および肉代替製品

- RTE/RTC食品

- スナック

- パーソナルケアと化粧品

- サプリメント

- サブエンドユーザー別

- ベビーフードおよび乳児用調製粉乳

- 高齢者栄養と医療栄養

- スポーツ/パフォーマンス栄養

- 国別

- イラン

- サウジアラビア

- アラブ首長国連邦

- その他中東地域

第5章 競争情勢

- 主要な戦略的動き

- 市場シェア分析

- 企業情勢

- 企業プロファイル(世界レベルの概要、市場レベルの概要、主要事業セグメント、財務、従業員数、主要情報、市場ランク、市場シェア、製品・サービス、最近の動向分析を含む)

- Axiom Foods Inc.

- Cargill, Incorporated

- CHS Inc.

- International Flavors & Fragrances, Inc.

- Kerry Group PLC

- Wilmar International Ltd

第6章 CEOへの主な戦略的質問

第7章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 市場力学(DROs)

- 情報源と参考文献

- 図表一覧

- 主要洞察

- データパック

- 用語集

The Middle East Plant Protein Market size is estimated at 0.95 billion USD in 2025, and is expected to reach 1.29 billion USD by 2030, growing at a CAGR of 6.38% during the forecast period (2025-2030).

Rising number of vegan and flexitarian consumers in the Middle East has boosted the market share of the food and beverage segment

- By application, the food and beverage industry is the leading application segment for plant proteins in the region. The demand for proteins in the F&B segment is primarily driven by factors such as the increasing demand for protein functionalities and awareness about protein-rich diets. Under F&B, the meat/poultry/seafood and meat alternative products sub-segment accounted for the major volume share of 33.19% in 2022. In Saudi Arabia, shops and restaurants offer different vegan and vegetarian products, enabling people to shift from meat to plant-based foods. Tourism from other parts of the world is also contributing to the growth of the meat substitute market in the region. Moreover, as food processing methods are advancing, the demand in the meat substitute sub-segment has risen substantially. The sub-segment is projected to register a value CAGR of 6.09% during the forecast period.

- However, snacks is the fastest-growing sub-segment, and it is projected to register a CAGR of 10.16% in value during the forecast period. Consumers are also becoming more aware of their snacking choices. They are opting for healthier snacks containing nutritious and natural ingredients and free from claims and labels that benefit their health and wellness.

- The F&B segment was followed by animal feed, with the majority of the application share recorded by soy proteins. In 2022, about 81% of plant protein demand in the animal feed segment was met by soy protein due to its abundant availability and lower price points. Further, legume-based ingredients are a key source of plant proteins for animal feed, and their production can provide a range of benefits both on farms and for feed manufacturers.

Strategic investments by leading players, coupled with rising veganism across the country, has resulted in Saudi Arabia holding the highest market share

- By country, Saudi Arabia maintained its top position in the Middle Eastern market, followed by Iran in 2022, primarily driven by the F&B segment. The market has benefited from large investments, especially by leading companies, which has led to a solid market structure and organized sales. Nonetheless, the top two countries also remain the fastest-growing in the market. During the forecast period, with a CAGR of 8.36%, Iran is set to record the fastest growth rate by volume. The Government of Saudi Arabia released an up-to-date list of animal feed subsidies, including animal feed products, such as soy protein meal. Pea protein is projected to register the highest CAGR of 8.08% by volume during the forecast period in the animal feed segment, with increasing government support.

- The plant-based protein market in the region is mostly driven by the food and beverage segment, which registered a CAGR of 6.10% by volume. Demand for vegan food and plant-based meat is increasing in the Middle East, particularly in the United Arab Emirates. Several major Middle Eastern food brands emphasize vegan meat and other foods.

- The Vegan & Vegetarian Association of Turkey has long advocated for a vegan diet. Several recent regional festivals, including one in Didim, have helped increase veganism's popularity. Many traditional regional and national dishes, like couscous, falafel, and hummus, are already naturally meat-free and vegetarian. Increased veganism and rising demand for allergen-free sources, especially in modernizing countries like the United Arab Emirates, are further driving the value growth. As a result, sources like pea protein have been gaining prominence due to their ability to act as a substitute for soy protein when incorporated into meat substitutes.

Middle East Plant Protein Market Trends

Plant protein consumption to witness steady growth with a rise in health-conscious population across the Middle East

- The graph illustrates the per capita consumption of plant protein in countries including Bahrain, Egypt, Iran, Iraq, Kuwait, Oman, Saudi Arabia, Turkey, and the United Arab Emirates. With a growing awareness of the health benefits associated with plant proteins, largely disseminated through various platforms, a significant portion of the population in the region has embraced a health-conscious lifestyle. Consequently, the demand for food products incorporating plant proteins has surged. Bolstered by the region's robust consumer purchasing power, this heightened demand is poised to propel the plant protein market in the forecast period. Regional companies are increasingly turning to naturally derived ingredients to meet the escalating demand for organic products.

- As an example, Cutetonic has made its 100% organic pea protein powder available on popular online shopping platforms like saudi.desertcart.com, tapping into the region's sizable online customer base. The country's expanding young demographic is driving a notable appetite for dietary supplements. Given a preference for lactose- and soy-free options among a segment of consumers, the demand for pea protein is anticipated to surge in the near future. Furthermore, the plant protein market in the region is set to benefit from bolstered trade agreements with other nations. With a growing inclination towards veganism, influenced by Western dietary trends, and a concerted effort to combat obesity, the local population is increasingly turning to plant proteins. This shift is further fueled by a rising demand for soy-based proteins, prompting key industry players to enhance their offerings with soy-based ingredients.

Saudi Arabia and Iran lead the Middle Eastern market in terms of plant protein production

- The graph depicts the production of plant proteins such as rice and wheat in Saudi Arabia and Iran. Plant proteins sourced from rice and wheat emerged as the major plant protein forms in the region. The region has grain-producing areas, but with water scarcity, the region is dependent on imports to feed its population. The International Grains Council (IGC) projects total grains production in 2016-17 in Near East Asia at 64.7 million tons, with Iran at 20.4 million tons, Iraq at 4.8 million tons, Syria at 1.4 million tons, and Turkey at 34.9 million tons. It puts others at 3.4 million tons to make up the total. For instance, the volume of rice production in the Middle East was approximately 2.9 million metric tons.

- The region is a big importer of grains, with total grain imports by Near East Asia at 51.4 million tons. Saudi Arabia's imports are put at 15.3 million tons, with Iran's at 9.2 million tons and Turkey's at 6.7 million tons. Of the total, 4.9 million tons is wheat. The imports include 24.4 million tons of wheat from Near East Asia and 11.5 million from Egypt. Turkey's wheat imports are 4.9 million tons, with Iraq and Iran importing 2.5 million tons and Yemen importing 3.1 million tons of wheat.

- In 2016, Saudi Arabia abandoned a long-standing policy designed to encourage local wheat production. The Saudi government is encouraging agricultural companies to invest in foreign countries that have comparative advantages in producing certain crops and re-export their products back to Saudi Arabia. The crops targeted by this initiative include wheat, rice, barley, yellow corn, soybeans, and green forage. The Saudi government provides financial incentives to encourage Saudi investors (companies and individuals) to participate in food security initiatives.

Middle East Plant Protein Industry Overview

The Middle East Plant Protein Market is fragmented, with the top five companies occupying 10.99%. The major players in this market are Cargill, Incorporated, CHS Inc., International Flavors & Fragrances, Inc., Kerry Group PLC and Wilmar International Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Plant

- 3.3 Production Trends

- 3.3.1 Plant

- 3.4 Regulatory Framework

- 3.4.1 UAE and Saudi Arabia

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Protein Type

- 4.1.1 Hemp Protein

- 4.1.2 Pea Protein

- 4.1.3 Potato Protein

- 4.1.4 Rice Protein

- 4.1.5 Soy Protein

- 4.1.6 Wheat Protein

- 4.1.7 Other Plant Protein

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Confectionery

- 4.2.2.1.6 Dairy and Dairy Alternative Products

- 4.2.2.1.7 Meat/Poultry/Seafood and Meat Alternative Products

- 4.2.2.1.8 RTE/RTC Food Products

- 4.2.2.1.9 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

- 4.3 Country

- 4.3.1 Iran

- 4.3.2 Saudi Arabia

- 4.3.3 United Arab Emirates

- 4.3.4 Rest of Middle East

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Axiom Foods Inc.

- 5.4.2 Cargill, Incorporated

- 5.4.3 CHS Inc.

- 5.4.4 International Flavors & Fragrances, Inc.

- 5.4.5 Kerry Group PLC

- 5.4.6 Wilmar International Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms