|

市場調査レポート

商品コード

1690986

ドイツの植物性たんぱく質:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Germany Plant Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ドイツの植物性たんぱく質:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 218 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

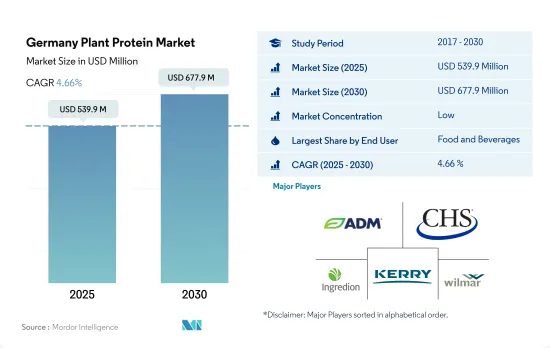

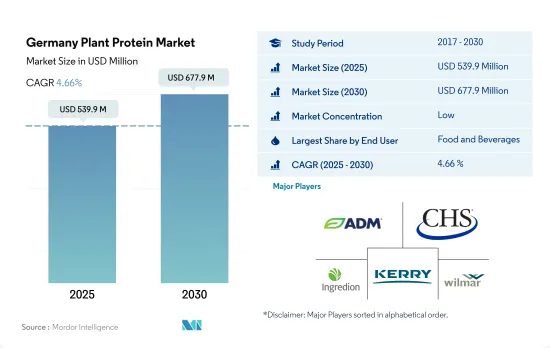

ドイツの植物性たんぱく質市場規模は2025年に5億3,990万米ドルと推定され、2030年には6億7,790万米ドルに達すると予測され、予測期間中(2025-2030年)のCAGRは4.66%で成長します。

ドイツにおける乳糖不耐症人口の増加と天然製品に対する需要の高まりが、このセグメントの成長を牽引しています。

- エンドユーザー別では、持続可能な代替品として植物性食品への嗜好が高まっていることが主因で、市場は飲食品セグメントが牽引しています。同市場は主に食肉代替品セグメントによって牽引され、2022年には金額ベースで約25%のシェアを占めたが、これは菜食主義の動向の高まりによる食肉代替品への需要の高まりによるものです。この動向は、菜食主義に対する消費者の関心の高まりと、同国における乳糖不耐症人口の増加に共鳴しています。ドイツは2022年、菜食主義者の数で欧州第2位となりました。同国には250万人以上の菜食主義者が居住しており、同国は植物性食品や食肉代替産業で有名です。

- サプリメントは、いくつかの健康上の利点があるため、予測期間中のCAGRは7.15%で、市場で最も急成長するセグメントと予想されます。ドイツの消費者の間では、体重管理と一般的な健康と幸福が大きな関心事であり、様々なサプリメントにおける植物性たんぱく質の需要増加の原動力となっています。米やエンドウ豆などの植物性たんぱく質は、低アレルギー性であり、乳糖不耐症に悩む人々の栄養価の高い代替品として人気を集めています。2022年にはドイツの人口の約16%が乳糖不耐症であり、植物性たんぱく質の高い需要につながっています。

- パーソナルケアおよび化粧品業界における植物性たんぱく質の使用は、抗酸化剤、ミネラルオイル、アルコールなどの他の効果的な生物活性成分が普及しているため、まだ初期段階にあります。より環境に優しいライフスタイルに対するドイツの人々の関心が、菜食主義を謳った自然で植物ベースの美容製品への需要を押し上げています。ドイツは欧州で最も菜食主義者が多く、2016年の130万人から2020年には260万人に倍増します。

ドイツの植物性たんぱく質市場動向

植物性たんぱく質の消費拡大が原料分野の主要企業にチャンスをもたらす

- ドイツの植物性たんぱく質市場は、その機能的効率性、大豆、小麦、エンドウ豆などの信頼性の高い植物性たんぱく質製品が提供するコスト競合、様々な加工食品への応用の増加により、消費者のビーガン食への転換が進んでいることが牽引しています。大豆たんぱく質はあらゆる年齢層にとって健康的であり、適切な身体機能の維持に役立つと考えられています。代替植物性たんぱく質は、飲食品やサプリメント分野で広く使用されています。これらは大豆、小麦、その他の野菜などの供給源から得られるが、これらは飲食品セグメントに欠かせないものであり、ドイツにおける植物性たんぱく質消費を後押ししています。より多くの消費者がビーガン食を好むようになり、ドイツにおけるビーガン人口は倍増し、2016年から2020年にかけて260万人に達し、人口の3.2%を占めるようになりました。

- 食肉消費を抑制することで肥満や糖尿病などの様々な疾病を減少させようとする政府の好意的な政策により、小麦たんぱく質への消費者シフトが進む可能性があります。ドイツでは人口の少なくとも7.2%が糖尿病を患っており、そのほとんどが2型糖尿病です。糖尿病患者の数は、今後20年間で大幅に増加すると予想されています。

- クリーンラベル原料への需要の高まりと食品当局による厳しい表示規制により、食品メーカーは天然原料の採用を余儀なくされています。そのため、同市場で事業を展開する原料メーカーは、増大する需要に対応し競争上の優位性を獲得するため、革新的な原料の開発に注力しています。ドイツではビーガン食品の需要が高まっており、乳糖不耐症の消費者も増加しています。その結果、植物性たんぱく質全体の消費量は2017年の47gから2022年には53gに増加しました。

大豆、小麦、エンドウ豆の生産は、植物性たんぱく質原料メーカーの原料として大きく貢献しています。

- 2023年、冬小麦の面積はドイツの穀物生産面積の半分弱(48%)を占めました。2019~2020年の小麦生産量は2,420万トンに達し、前年の2,030万トンから増加しました。ドイツの農家は2022年収穫の冬小麦を前年より0.6%多い289万ヘクタールで栽培していました。

- ドイツにおける大豆の栽培面積は増加の一途をたどり、2020年には32,900ヘクタールを超えます。このうち最も多いのはバイエルン州とバーデン・ヴュルテンベルク州(26,700ヘクタール)で、残りはその他の連邦州(各数百ヘクタール)です。ドイツ政府の大豆栽培奨励プログラムは成功を収め、2020年産大豆の作付面積は13.8%増の32,900ヘクタールに拡大したが、収穫の見通しは立っていないです。同国における大豆生産量は、2016年から2020年にかけて110%の増加を記録しました。

- 過去10年間で、ドイツのエンドウ豆生産量は約3倍に増加しました。ドイツでは現在、農家は国内の全耕地の2%弱でエンドウ豆を栽培しています。連邦農務省が目標とするたんぱく質作物・耕作地戦略は、2030年までに栽培を10%まで増やし、農家にとってより魅力的なものにすることを目指しています。多くの食品メーカーが、「シュニッツェル」パスタ、ヨーグルト、飲料、アイスクリーム、スポーツバーなど、さまざまな食品にエンドウ豆たんぱく質の原料を要求しているため、種子会社KWSも時代に合わせて動いており、エンドウ豆での育種成功をさらに拡大したいと考えています。

ドイツの植物性たんぱく質産業の概要

ドイツの植物性たんぱく質市場は断片化されており、上位5社で17.09%を占めています。この市場の主要企業は以下の通りです。 Archer Daniels Midland Company, CHS Inc., Ingredion Incorporated, Kerry Group PLC and Wilmar International Ltd(sorted alphabetically).

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第3章 主要産業動向

- エンドユーザー市場規模

- ベビーフードおよび乳児用調製乳

- ベーカリー

- 飲料

- 朝食用シリアル

- 調味料/ソース

- 菓子類

- 乳製品および乳製品代替製品

- 高齢者栄養・医療栄養

- 肉・鶏肉・魚介類および肉代替製品

- RTE/RTC食品

- スナック

- スポーツ/パフォーマンス栄養

- 動物飼料

- パーソナルケアと化粧品

- たんぱく質消費動向

- 植物

- 生産動向

- 植物

- 規制の枠組み

- ドイツ

- バリューチェーンと流通チャネル分析

第4章 市場セグメンテーション

- たんぱく質タイプ

- ヘンプたんぱく質

- エンドウ豆たんぱく質

- ポテトたんぱく質

- 米たんぱく質

- 大豆たんぱく質

- 小麦たんぱく質

- その他の植物性たんぱく質

- エンドユーザー

- 動物飼料

- 飲食品

- サブエンドユーザー別

- ベーカリー

- 飲料

- 朝食用シリアル

- 調味料/ソース

- 菓子類

- 乳製品・乳製品代替品

- 肉・鶏肉・魚介類および肉代替製品

- RTE/RTC食品

- スナック

- パーソナルケアと化粧品

- サプリメント

- サブエンドユーザー別

- ベビーフードおよび乳児用調製乳

- 高齢者栄養と医療栄養

- スポーツ/パフォーマンス栄養

第5章 競合情勢

- 主要な戦略動向

- 市場シェア分析

- 企業情勢

- 企業プロファイル.

- A. Costantino & C. spa

- Archer Daniels Midland Company

- Brenntag SE

- CHS Inc.

- Glanbia PLC

- Ingredion Incorporated

- Kerry Group PLC

- Lantmannen

- Roquette Frere

- Sudzucker AG

- Wilmar International Ltd

第6章 CEOへの主な戦略的質問

第7章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 市場力学(DROs)

- 情報源と参考文献

- 図表一覧

- 主要洞察

- データパック

- 用語集

The Germany Plant Protein Market size is estimated at 539.9 million USD in 2025, and is expected to reach 677.9 million USD by 2030, growing at a CAGR of 4.66% during the forecast period (2025-2030).

Increasing lactose-intolerant population in Germany with growing demand for natural products is driving the segmental growth

- By end user, the market is led by the food and beverages segment, majorly due to the increasing preference for plant-based foods as a sustainable alternative. It was mainly driven by the meat alternatives segment, with a share of around 25% by value in 2022, due to the growing demand for meat substitutes owing to the rising trend of veganism. The trend resonates with consumers' growing interest in veganism and the increasing lactose-intolerant population in the country. Germany ranked second in Europe in terms of the number of vegans in 2022. More than 2.5 million vegans reside in the nation, and the country is renowned for its plant-based and meat alternative industries.

- Supplements are anticipated to be the fastest-growing segment in the market, with a CAGR of 7.15% during the forecast period, owing to their several health benefits. Weight management and general health and well-being are the major concerns among German consumers, and they act as driving factors for the increasing demand for plant protein in various supplements. Plant proteins, such as rice and peas, are gaining popularity for being hypoallergenic and a nutritious alternative for people suffering from lactose intolerance. About 16% of the German population was lactose intolerant in 2022, leading to a high demand for plant-based proteins.

- The usage of plant proteins in the personal care and cosmetic industry is still at a nascent stage due to the prevalence of other effective bioactive ingredients such as antioxidants, mineral oils, and alcohol. The German population's interest in a greener lifestyle is boosting the demand for natural and plant-based beauty products with vegan claims. Germany has the most number of vegans in Europe, which doubled from 1.3 million in 2016 to 2.6 million in 2020.

Germany Plant Protein Market Trends

The consumption growth of plant protein fuels opportunities for key players in the ingredients segment

- The German plant protein market is driven by consumers' increasing conversion toward vegan diets due to their functional efficiency, the cost competitiveness offered by reliable plant protein products such as soy, wheat, and pea, and their increasing application in various processed foods. Soy protein is considered healthy for all age groups and helps maintain proper body functions. Plant-based protein alternatives are widely used in the food and beverage and supplement segments. They can be derived from sources such as soy, wheat, and other vegetables, which are essential parts of the food and beverage segment, boosting plant protein consumption in Germany. As more consumers increased their preference for vegan diets, the number of vegans in Germany doubled, reaching 2.6 million people and accounting for 3.2% of the population from 2016 to 2020.

- Favorable government policies to reduce various diseases, such as obesity and diabetes, by controlling meat consumption may result in a growing consumer shift toward wheat protein. At least 7.2% of the population in Germany has diabetes, most of them type 2 diabetes. The number of people with diabetes is expected to increase significantly over the next two decades.

- The growing demand for clean-label ingredients and stringent labeling regulations by food authorities are compelling food manufacturers to adopt natural ingredients. Thus, ingredient manufacturers operating in the market focus on developing innovative ingredients to cater to the growing demand and achieve a competitive advantage. Germany has a rising demand for vegan food products and an increasing number of lactose-intolerant consumers. As a result, the overall plant protein consumption increased from 47 g in 2017 to 53 g in 2022.

Soy, wheat, and pea production contributes majorly as raw material for plant protein ingredients manufacturers

- In 2023, the winter wheat area accounted for just under half (48%) of the area under grain production in Germany. Wheat production for 2019-2020 reached 24.2 million tons, up from 20.3 million tons in the previous year. Farmers in Germany were growing winter wheat for harvest in 2022 on 2.89 million hectares, 0.6% more than the previous year.

- The area under soybean cultivation in Germany has grown continuously to reach over 32,900 ha in 2020. The biggest part of this area is found in Bavaria and Baden-Wuerttemberg (26,700 ha), with the rest in the other federal states (several hundred ha each). The German government's program to encourage soybean cultivation has been successful, with plantings for the 2020 crop expanding by 13.8% to 32,900 ha, but with no harvest forecast available. The soybean production in the country recorded an increase of 110% in 2020 since 2016.

- Over the past ten years, pea production in Germany has almost tripled. In Germany, farmers currently grow pea crops on just under 2% of the total arable land in the country. The Federal Ministry of Agriculture's targeted protein crop and arable farming strategy aims to increase cultivation to 10% by 2030 and make it more attractive for farmers. The seed company KWS is also moving with the times and wants to expand its breeding successes with peas further, as many food manufacturers are demanding pea protein ingredients in a variety of foods such as "schnitzels" pasta, yogurt, drinks, ice cream, and sports bars.

Germany Plant Protein Industry Overview

The Germany Plant Protein Market is fragmented, with the top five companies occupying 17.09%. The major players in this market are Archer Daniels Midland Company, CHS Inc., Ingredion Incorporated, Kerry Group PLC and Wilmar International Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Plant

- 3.3 Production Trends

- 3.3.1 Plant

- 3.4 Regulatory Framework

- 3.4.1 Germany

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Protein Type

- 4.1.1 Hemp Protein

- 4.1.2 Pea Protein

- 4.1.3 Potato Protein

- 4.1.4 Rice Protein

- 4.1.5 Soy Protein

- 4.1.6 Wheat Protein

- 4.1.7 Other Plant Protein

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Confectionery

- 4.2.2.1.6 Dairy and Dairy Alternative Products

- 4.2.2.1.7 Meat/Poultry/Seafood and Meat Alternative Products

- 4.2.2.1.8 RTE/RTC Food Products

- 4.2.2.1.9 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 A. Costantino & C. spa

- 5.4.2 Archer Daniels Midland Company

- 5.4.3 Brenntag SE

- 5.4.4 CHS Inc.

- 5.4.5 Glanbia PLC

- 5.4.6 Ingredion Incorporated

- 5.4.7 Kerry Group PLC

- 5.4.8 Lantmannen

- 5.4.9 Roquette Frere

- 5.4.10 Sudzucker AG

- 5.4.11 Wilmar International Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms