|

|

市場調査レポート

商品コード

1359922

乳製品代替品の世界市場 (~2028年):原料 ・用途・流通チャネル・配合・地域別Dairy Alternatives Market by Source (Soy, Almond, Coconut, Oats, Hemp), Application (Milk, Yogurt, Ice Creams, Cheese, Creamers), Distribution Channel (Retail, Online Stores, Foodservice), Formulation and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 乳製品代替品の世界市場 (~2028年):原料 ・用途・流通チャネル・配合・地域別 |

|

出版日: 2023年10月05日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の乳製品代替品の市場規模は、2023年の270億米ドルから、予測期間中は10.1%のCAGRで推移し、2028年には436億米ドルの規模に成長すると予測されています。

健康への関心の高まりと消費者の認識の変化が、乳製品代替製品に対する需要を推進しています。こうした製品の売上は、セグメンテーションや多様化といったマーケティング戦略を採用することで伸ばすことができます。その目的は、健康志向の消費者、ベジタリアン、フレキシタリアン、ビーガンの間でより多くの需要を生み出すことです。適切な販売チャネルを通じて、適切な場所に製品を配置することが重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額(米ドル) |

| 部門別 | 供給源・製剤・用途・流通チャネル・栄養素・地域別 |

| 対象地域 | 北米・南米・欧州・アジア太平洋・その他の地域 |

販促戦略の戦略的応用が、同市場の成長を効果的に増幅させる見通しです。アーモンドミルクの生産者は、自社ブランドを乳製品代替品のカテゴリーに巧みに位置づけることで、大きな人気を集め、大幅な成長を目の当たりにしています。健康志向の高まりとライフスタイルの変化が、乳製品代替品市場の拡大の触媒として作用しています。さらに、植物由来の飲料メーカーが革新的なフレーバーの導入、製品の保存期間の延長、栄養プロファイルの強化に継続的に取り組んでいることから、乳製品代替品市場は今後数年も成長が見込まれる市場となっています。

オンラインチャネルを通じて流通する乳製品代替品市場は、注文のしやすさから予測期間中11.9%のCAGRで最も高い成長を遂げると予測されています。業界の数多くの有力企業が、オンラインチャネルを通じた製品の販売に乗り出しています。多くの総合的なオンラインプラットフォームがデジタル領域に移行し、消費者がより手間をかけずに購入できるようになっています。さらに、こうしたバーチャルの小売業者は、特定の乳製品不使用食品について多様な選択肢を示し、多くの場合、従来の実店舗での小売と比較して割引価格で提供することで、より幅広い顧客層の取り込みを図っています。

地域別では、北米地域が予測期間中に9.0%のCAGRで推移し、2028年には90億米ドルの規模に成長すると予測されています。乳製品代替品の健康上の利点と食品・飲料への幅広い応用が、北米の乳製品代替品市場の成長を促進しています。

当レポートでは、世界の乳製品代替品の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 人口増加による食料需要の増大

- 大豆生産量の増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 概要

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- 市場エコシステム分析

- 乳製品代替品市場の購入者に影響を与える動向/ディスラプション

- 特許分析

- 主要な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主要なステークホルダーと購入基準

第7章 乳製品代替品市場:原料別

- 大豆

- 牛乳

- ヨーグルト

- その他

- アーモンド

- 牛乳

- ヨーグルト

- その他

- ココナッツ

- 牛乳

- ヨーグルト

- その他

- 米

- 牛乳

- ヨーグルト

- その他

- オーツ麦

- 牛乳

- ヨーグルト

- その他

- 麻

- 牛乳

- ヨーグルト

- その他

- その他

第8章 乳製品代替品市場:配合別

- フレーバーあり

- フレーバーなし

第9章 乳製品代替品市場:用途別

- 牛乳

- アイスクリーム

- ヨーグルト

- チーズ

- クリーマー

- バター

- その他

第10章 乳製品代替品市場:流通チャネル別

- 小売

- スーパーマーケット/ハイパーマーケット

- 健康食品店

- 薬局

- コンビニエンスストア

- その他

- フードサービス

- オンラインストア

第11章 乳製品代替品市場:栄養成分別

- タンパク質

- スターチ

- ビタミン

- その他

第12章 乳製品代替品市場:地域別

- 景気後退のマクロ経済指標

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第13章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の過去の収益分析

- 年間収益VS.主要企業の成長

- 主要企業のEBITDA

- 主要企業が採用した戦略

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の企業評価クアドラント

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION

- THE HAIN CELESTIAL GROUP, INC.

- BLUE DIAMOND GROWERS

- SUNOPTA

- FREEDOM FOODS GROUP LIMITED

- VALSOIA S.P.A.

- OATLY GROUP AB

- SANITARIUM

- EDEN FOODS, INC.

- NUTRIOPS, S.L.

- EARTH'S OWN

- TRIBALLAT NOYAL

- GREEN SPOT CO., LTD.

- HILAND DAIRY

- ELMHURST MILKED DIRECT LLC

- スタートアップ/SME

- RIPPLE FOODS

- KITE HILL

- RUDE HEALTH

- CALIFIA FARMS, LLC

- PANOS BRANDS

- PUREHARVEST

- ONE GOOD

- VLY

- MIYOKO'S CREAMERY

- DAIYA FOODS INC.

第15章 隣接市場および関連市場

第16章 付録

The global market for dairy alternatives is estimated to be valued at USD 27.0 Billion in 2023 and is projected to reach USD 43.6 Billion by 2028, at a CAGR of 10.1% during the forecast period. The rising health concerns and the changing consumer perception have fueled the demand for dairy alternative products. The sales of these products can be increased by adopting marketing strategies such as segmentation and diversification. The objective is to create more demand among health-conscious consumers, vegetarians, flexitarians, and vegans. It is crucial to position the product in the right place through the right sales channel.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Source, By Formulation, By Application, By Distribution Channel, By Nutrient and By Region |

| Regions covered | North America, South America, Europe, Asia Pacific, and Rest of the World |

The strategic application of promotional strategies has effectively amplified growth prospects within this market. Producers of almond milk, by adeptly situating their brands within the dairy alternatives category, have garnered significant popularity and witnessed substantial growth. The surge in health consciousness and shifts in lifestyle choices have acted as catalysts for the expansion of the dairy alternatives market. Furthermore, the continuous commitment of plant-based beverage manufacturers to introduce innovative flavors, extend product shelf life, and enhance nutritional profiles positions the dairy alternatives market for projected growth in the years ahead. Nonetheless, the market faces challenges in terms of high production costs and the limited availability of raw materials.

"The flavored sub-segment in the formulation segment is estimated to grow at a CAGR of 10.4% during the forecast period."

The market offers a variety of flavored and sweetened dairy alternatives, including options like dairy-free yogurt, milk, and frozen desserts, in response to evolving consumer preferences and as a means for manufacturers to diversify their product offerings. The addition of flavor enhances the taste appeal of dairy alternatives such as soy, rice, and oat milk. Furthermore, blended versions of flavored and sweetened products are in high demand. Among the available flavored plant-based products, vanilla and chocolate are the most prevalent, followed by flavors like peach, strawberry, blueberry, and mango. Companies have introduced fruit-flavored products to broaden their consumer base and expand their market presence. For instance, Dream Frozen Yogurt by The Hain Celestial Group (US) is a notable example of a flavored and sweetened dairy alternative product. To achieve creamier textures, many product launches incorporate ingredients such as coconuts or blends like coconut and oat, along with other plant-based alternatives. Rich dessert flavors such as hazelnut fudge brownies or blood orange mimosas can enhance non-dairy yogurts, yogurt beverages, ice cream, and frozen treats. Dairy-free flavors improve the taste and texture of alternatives. Added at the start of production, they neutralize bases, mask flavors, and add mouthfeel. Flavored, unsweetened, dairy-free options are popular due to health-consciousness and wide flavor range. Suitable for diabetics.

"The dairy alternatives market distributed through online channels is projected to grow at the highest CAGR of 11.9% during the forecast period due to ease of ordering."

Numerous prominent players in the industry have embarked on the journey of offering their products for sale through online channels. This strategic move not only benefits consumers by simplifying the ordering process but also ensures convenient doorstep delivery. Many comprehensive online platforms have transitioned to the digital realm, making it more hassle-free for consumers to make their purchases. Moreover, these virtual retailers present a diverse range of options for specific dairy-free food products, often at discounted rates in comparison to traditional brick-and-mortar retail, aimed at enticing a broader customer base.

The utilization of online services has witnessed a significant uptick in both developed and developing markets. This growth can be attributed to the swifter accessibility and cost-effectiveness that online shopping offers. Additionally, several online service providers go the extra mile by furnishing in-depth information about various gluten-free food product brands, empowering consumers to make informed choices. Over the past decade, the surge in online shopping frequency has opened lucrative opportunities not only for established online giants but also for regional domestic e-retailers. Notable names in this domain include industry giants like Amazon, specialized platforms like Vegan Online, and health-conscious choices like Goodness Direct.

"North America to grow at the CAGR of 9.0% during the forecast period, in dairy alternatives market to reach a value of USD 9.0 billion by 2028."

The health benefits of dairy alternatives and their vast application in food & beverage products fuel the growth of the North American dairy alternatives market. According to the Dietary Guidelines for Americans, 2020-2025, 65% of young children, 34% of adolescents, and 20% of adult Americans consume milk as a beverage. Americans generally consume dairy in the form of cheese in pizzas, sandwiches, and pasta dishes. According to the same source, around 74% of adults are overweight, and 35% are prediabetic. The cases of lactose intolerance and milk allergies are also on the rise. Thus, the guidelines recommend the consumption of low-fat and fortified soy dairy alternatives for healthy nutritional balance. These factors, along with the increasing health consciousness among consumers, are driving the dairy alternatives market in the region. The WhiteWave Foods Company (US), Archer Daniels Midland Company (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US), and SunOpta Inc. (Canada) are some of the major players in the North American dairy alternatives market. Many of these players are focusing on innovation and expansion.

Since 2021, the Hain Celestial Group (US) has been focused on expanding its product portfolio in the plant-based diet category and acquisitions in North America. Dairy alternatives such as rice, hazelnut, and hemp are also on a surge in the North American market owing to their nutritional benefits.

The break-up of the profile of primary participants in the dairy alternatives market:

- By Company Type: Tier 1 - 30%, Tier 2 - 30%, Tier 3 - 40%

- By Designation: CXO's level - 40%, Managers- 25%, Executives - 35%

- By Region: North America -16%, Europe - 30%, Asia Pacific - 40%, RoW- 14%

Major key players in the dairy alternatives market are Danone North America Public Benefit Corporation (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US) .

Research Coverage:

This research report categorizes the dairy alternatives market by Source (soy, almond, coconut, rice, oats, hemp, other sources), Formulation (Flavored, plain), Application (milk, ice cream , yogurt, cheese, creamers, butter, other applications), Distribution Channel (retail, online stores, foodservice), by nutrient (protein, starch, vitamins, other nutrients) and by region (North America, Europe, Asia Pacific, South America, RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the dairy alternatives market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, and agreements. New service launches, mergers and acquisitions, and recent developments associated with the dairy alternatives market. Competitive analysis of upcoming startups in the dairy alternatives market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall dairy alternatives market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growth in consumer preference for vegan diet, evolving dietary lifestyles, Increase in cases of lactose intolerance and milk allergies), restraints (volatile prices of raw materials, allergy concerns among consumers of soy products), opportunities (growth in demand in emerging markets such as sweet and confectionary, favorable marketing and correct positioning of dairy alternatives, changes in lifestyles of consumers), and challenges (limited availability of raw materials, low awareness among consumers) influencing the growth of the dairy alternatives market.

- New product launch/Innovation: Detailed insights on research & development activities, and new product launches in the dairy alternatives market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the dairy alternatives market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the dairy alternatives market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Danone North America Public Benefit Corporation (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US), SunOpta (Canada), Sanitarium (New Zealand) and others in the dairy alternatives market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- FIGURE 1 DAIRY ALTERNATIVES MARKET SEGMENTATION

- 1.3.1 STUDY SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 7 DAIRY ALTERNATIVES MARKET SNAPSHOT, BY SOURCE, 2023 VS. 2028

- FIGURE 8 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 DAIRY ALTERNATIVES MARKET, BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN DAIRY ALTERNATIVES MARKET

- FIGURE 11 RISING DEMAND FOR DAIRY ALTERNATIVES DUE TO INCREASING CASES OF LACTOSE INTOLERANCE

- 4.2 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY FORMULATION & COUNTRY

- FIGURE 12 FLAVORED FORMULATION AND CHINA TO ACCOUNT FOR LARGEST SEGMENTAL SHARES IN 2023

- 4.3 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL & REGION

- FIGURE 13 RETAIL TO DOMINATE ACROSS MOST REGIONS DURING FORECAST PERIOD

- 4.4 DAIRY ALTERNATIVES MARKET, BY KEY COUNTRY

- FIGURE 14 CHINA DOMINATED DAIRY ALTERNATIVES MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN FOOD DEMAND FROM GROWING POPULATION

- FIGURE 15 POPULATION PROJECTED TO REACH MORE THAN 9.5 BILLION BY 2050

- 5.2.2 INCREASE IN SOYBEAN PRODUCTION

- FIGURE 16 SOYBEAN PRODUCTION, BY KEY COUNTRY, 2016-2020 (MILLION TON)

- 5.3 MARKET DYNAMICS

- FIGURE 17 MARKET DYNAMICS: DAIRY ALTERNATIVES MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Growth in consumer preference for plant-based diet

- FIGURE 18 UK: FASTEST-GROWING TAKEAWAY CUISINES, 2016-2019

- 5.3.1.1.1 Nutritional benefits of plant-derived dairy substitutes

- TABLE 2 NUTRITIONAL CONTENT OF PLANT-BASED MILK PRODUCTS

- 5.3.1.1.2 Rise in consumers shift toward plant-based nutrition

- 5.3.1.1.3 Evolution in dietary lifestyles toward newer trends

- 5.3.1.1.4 Increase in lactose intolerance and milk allergy cases

- TABLE 3 LACTOSE CONTENT IN DAIRY FOOD PRODUCTS

- 5.3.2 RESTRAINTS

- 5.3.2.1 Volatile prices of raw materials

- 5.3.2.2 Allergy concerns among consumers of soy products

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emerging markets for premium vegan confections

- 5.3.3.2 Effective marketing strategies and correct positioning of dairy alternatives

- 5.3.3.3 Changes in lifestyles and prospects for manufacturers in emerging economies

- 5.3.4 CHALLENGES

- 5.3.4.1 Limited availability of raw materials

- 5.3.4.2 Low awareness among consumers

6 INDUSTRY TRENDS

- 6.1 OVERVIEW

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 19 SUPPLY CHAIN INTEGRITY IN DAIRY ALTERNATIVES MARKET

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- 6.3.1 SOURCING

- 6.3.2 PROCESSING

- 6.3.3 MANUFACTURING

- 6.3.4 PACKAGING & STORAGE

- 6.3.5 DISTRIBUTION

- 6.3.6 SALES CHANNEL

- 6.4 TRADE ANALYSIS

- 6.4.1 ALMONDS

- TABLE 4 TOP TEN IMPORTERS AND EXPORTERS OF ALMONDS, 2022 (KT)

- 6.4.2 SOYBEANS

- TABLE 5 TOP TEN IMPORTERS AND EXPORTERS OF SOYBEANS, 2022 (KT)

- 6.4.3 OATS

- TABLE 6 TOP TEN IMPORTERS AND EXPORTERS OF OATS, 2022 (KT)

- 6.4.4 RICE

- TABLE 7 TOP TEN IMPORTERS AND EXPORTERS OF RICE, 2022 (KT)

- 6.4.5 COCONUT

- TABLE 8 TOP TEN IMPORTERS AND EXPORTERS OF COCONUT, 2022 (KT)

- 6.4.6 HEMP

- TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF HEMP, 2022 (KT)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 WET PROCESSING METHOD FOR PRODUCING DAIRY ALTERNATIVE MILK

- 6.5.2 DRY PROCESSING METHOD FOR PRODUCING DAIRY ALTERNATIVE MILK

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- FIGURE 21 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION (USD/LITER)

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 10 DAIRY ALTERNATIVES MARKET: AVERAGE SELLING PRICE TREND, BY REGION, (USD/LITER)

- 6.6.3 AVERAGE SELLING PRICE TREND, BY APPLICATION

- TABLE 11 DAIRY ALTERNATIVES MARKET: AVERAGE SELLING PRICE. BY APPLICATION, (USD/LITER)

- 6.7 MARKET ECOSYSTEM ANALYSIS

- FIGURE 22 DAIRY ALTERNATIVES MARKET: ECOSYSTEM VIEW

- TABLE 12 DAIRY ALTERNATIVES MARKET: ECOSYSTEM MAPPING

- FIGURE 23 MARKET MAP

- 6.8 TRENDS/DISRUPTIONS IMPACTING BUYERS IN DAIRY ALTERNATIVES MARKET

- FIGURE 24 REVENUE SHIFT IN DAIRY ALTERNATIVES MARKET

- 6.9 PATENT ANALYSIS

- TABLE 13 LIST OF MAJOR PATENTS PERTAINING TO DAIRY ALTERNATIVES MARKET, 2013-2022

- FIGURE 25 NUMBER OF PATENTS GRANTED, 2013-2022

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED

- 6.10 KEY CONFERENCES & EVENTS

- TABLE 14 DETAILED LIST OF KEY CONFERENCES & EVENTS, 2022-2023

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 CODEX ALIMENTARIUS COMMISSION

- 6.11.2 FOOD AND DRUG ADMINISTRATION (FDA)

- 6.11.3 THE SOYFOODS ASSOCIATION OF AMERICA

- 6.11.3.1 Classification of Soymilk

- TABLE 15 SOYMILK COMPOSITION

- 6.11.4 FOOD STANDARDS AUSTRALIA NEW ZEALAND (FSANZ)

- TABLE 16 SOME MANDATORY ADVISORY STATEMENTS GIVEN BY FSANZ

- 6.11.5 EUROPEAN COURT OF JUSTICE

- TABLE 17 LIST OF KEY REGULATORY BODIES FOR DAIRY ALTERNATIVES

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 IMPACT OF PORTER'S FIVE FORCES

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 DANONE NORTH AMERICA LAUNCHED DAIRY-LIKE SEGMENT BY INTRODUCING SILK NEXTMILK AND SO DELICIOUS WONDERMILK

- 6.13.2 BLUE DIAMOND GROWERS PARTNERED WITH GROUP LALA TO ESTABLISH NETWORK IN MEXICO

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY APPLICATION

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY APPLICATION

- 6.14.2 BUYING CRITERIA

- TABLE 20 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS, BY KEY APPLICATION

- FIGURE 28 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS, BY KEY APPLICATION

7 DAIRY ALTERNATIVES MARKET, BY SOURCE

- 7.1 INTRODUCTION

- FIGURE 29 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- TABLE 21 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 22 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 7.2 SOY

- 7.2.1 WIDESPREAD ACCESSIBILITY AND POPULARITY OF SOY-DERIVED ITEMS TO BOOST GROWTH

- 7.2.2 MILK

- FIGURE 30 HISTORICAL & PROJECTED SOYMILK SALES, 2016-2022 (USD MILLION)

- 7.2.3 YOGURT

- 7.2.4 OTHER SOY APPLICATIONS

- FIGURE 31 SOY-BASED PRODUCT CONSUMPTION, BY APPLICATION, 2019

- TABLE 23 SOY-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 SOY-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 ALMOND

- 7.3.1 RISE IN DEMAND FOR MIXED ALMOND-DERIVED ITEMS SUPPLY TO DRIVE MARKET

- 7.3.2 MILK

- 7.3.3 YOGURT

- 7.3.4 OTHER ALMOND APPLICATIONS

- FIGURE 32 ALMOND PRODUCT CONSUMPTION, BY APPLICATION, 2019

- TABLE 25 ALMOND-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 ALMOND-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 COCONUT

- 7.4.1 COCONUT'S APPEALING TASTE AND NUTRITIONAL BENEFITS TO BOLSTER GROWTH

- 7.4.2 MILK

- 7.4.3 YOGURT

- 7.4.4 OTHER COCONUT APPLICATIONS

- FIGURE 33 COCONUT PRODUCT CONSUMPTION, BY APPLICATION, 2019

- TABLE 27 COCONUT-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 COCONUT-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 RICE

- 7.5.1 DECREASED POTENTIAL FOR ALLERGIES AND LESS DISTINCTIVE TASTE TO DRIVE RICE SEGMENT

- 7.5.2 MILK

- 7.5.3 YOGURT

- 7.5.4 OTHER RICE APPLICATIONS

- FIGURE 34 RICE PRODUCT CONSUMPTION, BY APPLICATION, 2019

- TABLE 29 RICE-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 RICE-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 OATS

- 7.6.1 RICH NUTRITIONAL CONTENT OF OAT-DERIVED DAIRY ALTERNATIVES TO DRIVE MARKET

- 7.6.2 MILK

- 7.6.3 YOGURT

- 7.6.4 OTHER OAT APPLICATIONS

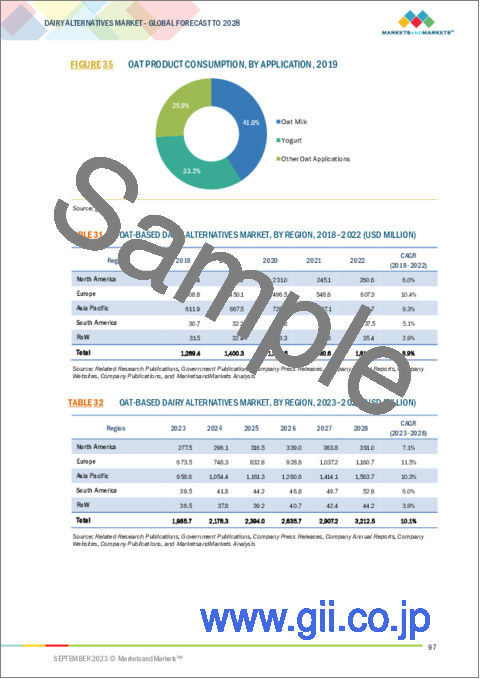

- FIGURE 35 OAT PRODUCT CONSUMPTION, BY APPLICATION, 2019

- TABLE 31 OAT-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 OAT-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 HEMP

- 7.7.1 RISE IN HEALTH AWARENESS REGARDING HEMP-BASED DAIRY ALTERNATIVES TO PROPEL MARKET

- 7.7.2 MILK

- 7.7.3 YOGURT

- 7.7.4 OTHER HEMP APPLICATIONS

- FIGURE 36 HEMP PRODUCT CONSUMPTION, BY APPLICATION, 2019

- TABLE 33 HEMP-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 HEMP-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 OTHER SOURCES

- TABLE 35 NUTRITIONAL COMPARISON OF KEY COMMERCIALLY AVAILABLE PLANT-BASED MILK ALTERNATIVES

- TABLE 36 FUNCTIONAL COMPONENTS OF PLANT-BASED MILK ALTERNATIVES AND THEIR HEALTH BENEFITS

- TABLE 37 OTHER SOURCE-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 OTHER SOURCE-BASED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DAIRY ALTERNATIVES MARKET, BY FORMULATION

- 8.1 INTRODUCTION

- FIGURE 37 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023 VS. 2028 (USD MILLION)

- TABLE 39 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 40 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- 8.2 FLAVORED

- 8.2.1 INCREASE IN DEMAND FOR PALATABLE BUT HEALTHIER DAIRY ALTERNATIVES TO DRIVE GROWTH

- TABLE 41 FLAVORED DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 FLAVORED DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 PLAIN

- 8.3.1 VERSATILITY OF APPLICATION OF PLAIN ALTERNATIVES TO BOLSTER GROWTH

- TABLE 43 PLAIN DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 PLAIN DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DAIRY ALTERNATIVES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 38 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 45 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 46 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (MILLION LITERS)

- TABLE 48 DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (MILLION LITERS)

- 9.2 MILK

- 9.2.1 HIGHER AWARENESS ABOUT HEALTH BENEFITS OF MILK ALTERNATIVES TO BOOST GROWTH

- FIGURE 39 PLANT-BASED MILK SALES, 2016-2022 (USD MILLION)

- TABLE 49 NUTRITIONAL COMPOSITION OF PLANT-BASED MILK ALTERNATIVES (PER 100 ML)

- TABLE 50 DAIRY ALTERNATIVES MARKET IN MILK APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 DAIRY ALTERNATIVES MARKET IN MILK APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 9.3 ICE CREAM

- 9.3.1 BENEFITS OF CHOLESTEROL-AND FAT-FREE DESSERTS TO DRIVE GROWTH

- TABLE 52 DAIRY ALTERNATIVES MARKET IN ICE CREAM APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 DAIRY ALTERNATIVES MARKET IN ICE CREAM APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 9.4 YOGURT

- 9.4.1 INCREASE IN POPULARITY OF FORTIFIED YOGURT TO PROPEL MARKET GROWTH

- TABLE 54 DAIRY ALTERNATIVES MARKET IN YOGURT APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 DAIRY ALTERNATIVES MARKET IN YOGURT APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 9.5 CHEESE

- 9.5.1 HIGH REPEAT BUYING RATES OF PLANT-BASED CHEESE TO DRIVE GROWTH

- TABLE 56 DAIRY ALTERNATIVES MARKET IN CHEESE APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 DAIRY ALTERNATIVES MARKET IN CHEESE APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 9.6 CREAMERS

- 9.6.1 HEAVY INVESTMENTS IN R&D TO MEET GROWING DEMAND FOR DAIRY-FREE CREAMERS TO DRIVE GROWTH

- TABLE 58 DAIRY ALTERNATIVES MARKET IN CREAMER APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 DAIRY ALTERNATIVES MARKET IN CREAMER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 9.7 BUTTER

- 9.7.1 LOWER SATURATED FATS, WITH SIMILAR FUNCTIONALITIES TO DAIRY BUTTER, TO DRIVE ADOPTION OF PLANT-BASED BUTTER

- TABLE 60 NUTRITIONAL COMPOSITION OF PLANT-BASED BUTTER (PER 100 ML)

- TABLE 61 DAIRY ALTERNATIVES MARKET IN BUTTER APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 DAIRY ALTERNATIVES MARKET IN BUTTER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER APPLICATIONS

- TABLE 63 DAIRY ALTERNATIVES MARKET IN OTHER APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 DAIRY ALTERNATIVES MARKET IN OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

10 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- FIGURE 40 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

- TABLE 65 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2018-2022 (USD MILLION)

- TABLE 66 DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- 10.2 RETAIL

- TABLE 67 RETAIL DISTRIBUTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 68 RETAIL DISTRIBUTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 69 RETAIL DISTRIBUTION CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 RETAIL DISTRIBUTION CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.1 SUPERMARKETS/HYPERMARKETS

- 10.2.1.1 Greater convenience and availability of multiple food options for consumers to drive segment

- TABLE 71 SUPERMARKET/HYPERMARKET DISTRIBUTION CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 SUPERMARKET/HYPERMARKET DISTRIBUTION CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.2 HEALTH FOOD STORES

- 10.2.2.1 Prioritizing clean and nutritious food choices for health benefits to encourage segment expansion

- TABLE 73 HEALTH FOOD STORE DISTRIBUTION CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 HEALTH FOOD STORE DISTRIBUTION CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.3 PHARMACIES

- 10.2.3.1 Increase in health issues and prescriptions for allergies to spur growth

- TABLE 75 PHARMACY DISTRIBUTION CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 PHARMACY DISTRIBUTION CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.4 CONVENIENCE STORES

- 10.2.4.1 Higher demand for easy access and convenience to customers to boost growth

- TABLE 77 CONVENIENCE STORE DISTRIBUTION CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 CONVENIENCE STORE DISTRIBUTION CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.5 OTHER RETAIL CHANNELS

- TABLE 79 OTHER RETAIL CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 OTHER RETAIL CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 FOOD SERVICES

- 10.3.1 RISE IN NEED TO ACCOMMODATE CHANGING CONSUMER PREFERENCES TO DRIVE GROWTH

- TABLE 81 FOOD SERVICE CHANNELS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 FOOD SERVICE CHANNELS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 ONLINE STORES

- 10.4.1 DEMAND FOR QUICK ACCESSIBILITY AND COST-EFFECTIVE PURCHASES TO PROPEL MARKET

- TABLE 83 ONLINE STORES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 ONLINE STORES MARKET, BY REGION, 2023-2028 (USD MILLION)

11 DAIRY ALTERNATIVES MARKET, BY NUTRIENT

- 11.1 INTRODUCTION

- TABLE 85 NUTRIENT CONTENT IN DAIRY ALTERNATIVES(PER 100 ML)

- 11.2 PROTEIN

- 11.3 STARCH

- 11.4 VITAMINS

- 11.5 OTHER NUTRIENTS

12 DAIRY ALTERNATIVES MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 41 SPAIN TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 86 DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 87 DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 88 DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (MILLION LITERS)

- TABLE 89 DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (MILLION LITERS)

- 12.2 MACROECONOMIC INDICATORS OF RECESSION

- FIGURE 42 INDICATORS OF RECESSION

- FIGURE 43 GLOBAL INFLATION RATES, 2011-2022

- FIGURE 44 GLOBAL GDP, 2011-2022 (USD TRILLION)

- FIGURE 45 RECESSION INDICATORS AND THEIR IMPACT ON DAIRY ALTERNATIVES MARKET

- FIGURE 46 DAIRY ALTERNATIVES MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST, 2023

- 12.3 NORTH AMERICA

- 12.3.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 47 NORTH AMERICA: INFLATION RATES, BY COUNTRY, 2017-2022

- FIGURE 48 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, RECESSION IMPACT ANALYSIS, 2023

- TABLE 90 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (MILLION LITERS)

- TABLE 99 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (MILLION LITERS)

- TABLE 100 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2018-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 12.3.2 US

- 12.3.2.1 High income of families to drive demand for dairy alternatives

- FIGURE 49 US: PLANT-BASED MILK RETAIL MARKET, 2019-2022 (USD BILLION)

- TABLE 104 US: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 105 US: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.3.3 CANADA

- 12.3.3.1 Change in consumer preference toward protein-rich dairy substitutes to boost growth

- TABLE 106 CANADA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 107 CANADA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.3.4 MEXICO

- 12.3.4.1 Urbanization and environment-consciousness to propel market

- FIGURE 50 MEXICO: SOY FOOD SALES, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 108 MEXICO: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 109 MEXICO: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4 EUROPE

- FIGURE 51 EUROPE: DAIRY ALTERNATIVES MARKET SNAPSHOT

- 12.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 52 EUROPE: INFLATION RATES, BY COUNTRY 2017-2022

- FIGURE 53 EUROPE: DAIRY ALTERNATIVES MARKET, RECESSION IMPACT ANALYSIS, 2023

- TABLE 110 EUROPE: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 111 EUROPE: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 113 EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 114 EUROPE: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 115 EUROPE: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 116 EUROPE: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 117 EUROPE: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 EUROPE: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (MILLION LITERS)

- TABLE 119 EUROPE: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (MILLION LITERS)

- TABLE 120 EUROPE: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2018-2022 (USD MILLION)

- TABLE 121 EUROPE: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 123 EUROPE: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 12.4.2 UK

- 12.4.2.1 Inclination among younger consumers toward healthy, vegan products to propel market

- TABLE 124 UK: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 125 UK: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.3 GERMANY

- 12.4.3.1 Growth in vegetarianism to drive market

- FIGURE 54 GERMANY: PLANT-BASED FOOD SALES, BY APPLICATION, 2022 (USD MILLION)

- TABLE 126 GERMANY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 127 GERMANY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.4 ITALY

- 12.4.4.1 High consumption of cheese in Italian cuisine to spur growth

- FIGURE 55 ITALY: PLANT-BASED CHEESE SALES, 2020-2022 (USD MILLION)

- TABLE 128 ITALY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 129 ITALY: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.5 FRANCE

- 12.4.5.1 Dairy giants expanding to provide alternatives to boost growth

- FIGURE 56 FRANCE: PLANT-BASED MILK SALES, 2021-2022 (USD MILLION)

- TABLE 130 FRANCE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 131 FRANCE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.6 SPAIN

- 12.4.6.1 Demand for dairy replacements and expansion of supermarket vegetarian and vegan lines to bolster growth

- TABLE 132 SPAIN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 133 SPAIN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.7 REST OF EUROPE

- TABLE 134 REST OF EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 135 REST OF EUROPE: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.5 ASIA PACIFIC

- FIGURE 57 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET SNAPSHOT

- 12.5.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 58 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 59 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, RECESSION IMPACT ANALYSIS, 2023

- TABLE 136 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (MILLION LITERS)

- TABLE 145 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (MILLION LITERS)

- TABLE 146 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2018-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 12.5.2 CHINA

- 12.5.2.1 Adoption of soy-derived dairy alternatives in various Chinese cuisines to drive growth

- TABLE 150 CHINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 151 CHINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.5.3 JAPAN

- 12.5.3.1 Scope for high-protein healthy products in traditional recipes to boost growth

- TABLE 152 JAPAN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 153 JAPAN: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.5.4 AUSTRALIA & NEW ZEALAND

- 12.5.4.1 Consumer interest in paying premium for fitness products to propel market

- TABLE 154 AUSTRALIA & NEW ZEALAND: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 155 AUSTRALIA & NEW ZEALAND: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.5.5 INDIA

- 12.5.5.1 Growth in demand for dairy-free substitutes in traditional sweets to boost market

- TABLE 156 INDIA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 157 INDIA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.5.6 REST OF ASIA PACIFIC

- TABLE 158 REST OF ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.6 SOUTH AMERICA

- 12.6.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 60 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 61 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, RECESSION IMPACT ANALYSIS, 2023

- TABLE 160 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 162 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 164 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 165 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 166 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 167 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 168 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (MILLION LITERS)

- TABLE 169 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (MILLION LITERS)

- TABLE 170 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2018-2022 (USD MILLION)

- TABLE 171 SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 172 SOUTH AMERICA: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 173 SOUTH AMERICA: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 12.6.2 BRAZIL

- 12.6.2.1 Demand for soy-based clean label products to drive market

- TABLE 174 BRAZIL: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 175 BRAZIL: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.6.3 ARGENTINA

- 12.6.3.1 Production of soy to help meet vegan, gluten-and fat-free demands

- TABLE 176 ARGENTINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 177 ARGENTINA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.6.4 REST OF SOUTH AMERICA

- TABLE 178 REST OF SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 179 REST OF SOUTH AMERICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.7 REST OF THE WORLD (ROW)

- 12.7.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 62 ROW: INFLATION RATES, BY KEY REGION, 2017-2022

- FIGURE 63 ROW: DAIRY ALTERNATIVE MARKET, RECESSION IMPACT ANALYSIS, 2023

- TABLE 180 ROW: DAIRY ALTERNATIVES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 181 ROW: DAIRY ALTERNATIVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 182 ROW: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 183 ROW: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 184 ROW: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 185 ROW: DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 186 ROW: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 187 ROW: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 188 ROW: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2018-2022 (MILLION LITERS)

- TABLE 189 ROW: DAIRY ALTERNATIVES MARKET, BY APPLICATION, 2023-2028 (MILLION LITERS)

- TABLE 190 ROW: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2018-2022 (USD MILLION)

- TABLE 191 ROW: DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 192 ROW: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 193 ROW: RETAIL DISTRIBUTION CHANNEL MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 12.7.2 MIDDLE EAST

- 12.7.2.1 High demand for lactose-free and low-cholesterol products to boost growth

- TABLE 194 MIDDLE EAST: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 195 MIDDLE EAST: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.7.3 AFRICA

- 12.7.3.1 Rise in urbanization and growth in retail chains to drive market demand

- TABLE 196 AFRICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 197 AFRICA: DAIRY ALTERNATIVES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- TABLE 198 DAIRY ALTERNATIVES MARKET: DEGREE OF COMPETITION

- 13.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 64 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022 (USD BILLION)

- 13.4 ANNUAL REVENUE VS. GROWTH OF KEY PLAYERS

- FIGURE 65 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 13.5 EBITDA OF KEY PLAYERS

- FIGURE 66 EBITDA, 2022 (USD BILLION)

- 13.6 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 199 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 67 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 13.7.5 KEY COMPANY FOOTPRINT

- TABLE 200 KEY COMPANY FOOTPRINT, BY FORMULATION

- TABLE 201 KEY COMPANY FOOTPRINT, BY SOURCE

- TABLE 202 KEY COMPANY FOOTPRINT, BY APPLICATION

- TABLE 203 KEY COMPANY FOOTPRINT, BY REGION

- TABLE 204 OVERALL KEY COMPANY FOOTPRINT

- 13.8 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 STARTING BLOCKS

- 13.8.3 RESPONSIVE COMPANIES

- 13.8.4 DYNAMIC COMPANIES

- FIGURE 68 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 13.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 205 LIST OF KEY STARTUPS/SMES

- TABLE 206 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- TABLE 207 DAIRY ALTERNATIVES MARKET: PRODUCT LAUNCHES, 2020-2023

- 13.9.2 DEALS

- TABLE 208 DAIRY ALTERNATIVES MARKET: DEALS, 2021

- 13.9.3 OTHERS

- TABLE 209 DAIRY ALTERNATIVES MARKET: OTHERS, 2020-2023

14 COMPANY PROFILES

(Business overview, Products offered, Recent developments & MnM View)**

- 14.1 KEY PLAYERS

- 14.1.1 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION

- TABLE 210 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: BUSINESS OVERVIEW

- FIGURE 69 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: COMPANY SNAPSHOT

- TABLE 211 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: PRODUCTS OFFERED

- TABLE 212 DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION: PRODUCT LAUNCHES

- 14.1.2 THE HAIN CELESTIAL GROUP, INC.

- TABLE 213 THE HAIN CELESTIAL GROUP, INC.: BUSINESS OVERVIEW

- FIGURE 70 THE HAIN CELESTIAL GROUP, INC.: COMPANY SNAPSHOT

- TABLE 214 THE HAIN CELESTIAL GROUP, INC.: PRODUCTS OFFERED

- 14.1.3 BLUE DIAMOND GROWERS

- TABLE 215 BLUE DIAMOND GROWERS: BUSINESS OVERVIEW

- FIGURE 71 BLUE DIAMOND GROWERS: COMPANY SNAPSHOT

- TABLE 216 BLUE DIAMOND GROWERS: PRODUCTS OFFERED

- TABLE 217 BLUE DIAMOND GROWERS: PRODUCT LAUNCHES

- 14.1.4 SUNOPTA

- TABLE 218 SUNOPTA: BUSINESS OVERVIEW

- FIGURE 72 SUNOPTA: COMPANY SNAPSHOT

- TABLE 219 SUNOPTA: PRODUCTS OFFERED

- TABLE 220 SUNOPTA: DEALS

- TABLE 221 SUNOPTA: PRODUCT LAUNCHES

- TABLE 222 SUNOPTA: OTHERS

- 14.1.5 FREEDOM FOODS GROUP LIMITED

- TABLE 223 FREEDOM FOODS GROUP LIMITED: BUSINESS OVERVIEW

- FIGURE 73 FREEDOM FOODS GROUP LIMITED: COMPANY SNAPSHOT

- TABLE 224 FREEDOM FOODS GROUP LIMITED: PRODUCTS OFFERED

- 14.1.6 VALSOIA S.P.A.

- TABLE 225 VALSOIA S.P.A: BUSINESS OVERVIEW

- FIGURE 74 VALSOIA SPA: COMPANY SNAPSHOT

- TABLE 226 VALSOIA S.P.A: PRODUCTS OFFERED

- 14.1.7 OATLY GROUP AB

- TABLE 227 OATLY GROUP AB: BUSINESS OVERVIEW

- FIGURE 75 OATLY GROUP AB: COMPANY SNAPSHOT

- TABLE 228 OATLY GROUP AB: PRODUCTS OFFERED

- TABLE 229 OATLY GROUP AB: PRODUCT LAUNCHES

- 14.1.8 SANITARIUM

- TABLE 230 SANITARIUM: BUSINESS OVERVIEW

- TABLE 231 SANITARIUM: PRODUCTS OFFERED

- 14.1.9 EDEN FOODS, INC.

- TABLE 232 EDEN FOODS, INC.: BUSINESS OVERVIEW

- TABLE 233 EDEN FOODS, INC.: PRODUCTS OFFERED

- 14.1.10 NUTRIOPS, S.L.

- TABLE 234 NUTRIOPS, S.L.: BUSINESS OVERVIEW

- TABLE 235 NUTRIOPS, S.L.: PRODUCTS OFFERED

- 14.1.11 EARTH'S OWN

- TABLE 236 EARTH'S OWN: BUSINESS OVERVIEW

- TABLE 237 EARTH'S OWN: PRODUCTS OFFERED

- 14.1.12 TRIBALLAT NOYAL

- TABLE 238 TRIBALLAT NOYAL: BUSINESS OVERVIEW

- TABLE 239 TRIBALLAT NOYAL: PRODUCTS OFFERED

- 14.1.13 GREEN SPOT CO., LTD.

- TABLE 240 GREEN SPOT CO., LTD.: BUSINESS OVERVIEW

- TABLE 241 GREEN SPOT CO., LTD.: PRODUCTS OFFERED

- 14.1.14 HILAND DAIRY

- TABLE 242 HILAND DAIRY: BUSINESS OVERVIEW

- TABLE 243 HILAND DAIRY: PRODUCTS OFFERED

- 14.1.15 ELMHURST MILKED DIRECT LLC

- TABLE 244 ELMHURST MILKED DIRECT LLC: BUSINESS OVERVIEW

- TABLE 245 ELMHURST MILKED DIRECT LLC: PRODUCTS OFFERED

- 14.2 STARTUPS/SMES

- 14.2.1 RIPPLE FOODS

- TABLE 246 RIPPLE FOODS: BUSINESS OVERVIEW

- TABLE 247 RIPPLE FOODS: PRODUCTS OFFERED

- 14.2.2 KITE HILL

- TABLE 248 KITE HILL: BUSINESS OVERVIEW

- TABLE 249 KITE HILL: PRODUCTS OFFERED

- TABLE 250 KITE HILL: PRODUCT LAUNCHES

- 14.2.3 RUDE HEALTH

- TABLE 251 RUDE HEALTH: BUSINESS OVERVIEW

- TABLE 252 RUDE HEALTH: PRODUCTS OFFERED

- 14.2.4 CALIFIA FARMS, LLC

- TABLE 253 CALIFIA FARMS, LLC: BUSINESS OVERVIEW

- TABLE 254 CALIFIA FARMS, LLC: PRODUCTS OFFERED

- TABLE 255 CALIFIA FARMS, LLC: PRODUCT LAUNCHES

- 14.2.5 PANOS BRANDS

- TABLE 256 PANOS BRANDS: BUSINESS OVERVIEW

- TABLE 257 PANOS BRANDS: PRODUCTS OFFERED

- 14.2.6 PUREHARVEST

- TABLE 258 PUREHARVEST: COMPANY OVERVIEW

- 14.2.7 ONE GOOD

- TABLE 259 ONE GOOD: COMPANY OVERVIEW

- 14.2.8 VLY

- TABLE 260 VLY: COMPANY OVERVIEW

- 14.2.9 MIYOKO'S CREAMERY

- TABLE 261 MIYOKO'S CREAMERY: COMPANY OVERVIEW

- 14.2.10 DAIYA FOODS INC.

- TABLE 262 DAIYA FOODS INC.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 263 MARKETS ADJACENT TO DAIRY ALTERNATIVES MARKET

- 15.2 RESEARCH LIMITATIONS

- 15.3 PLANT-BASED PROTEIN MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.3 PLANT-BASED PROTEIN MARKET, BY SOURCE

- TABLE 264 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 265 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- 15.3.4 PLANT-BASED PROTEIN MARKET, BY REGION

- TABLE 266 PLANT-BASED PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 267 PLANT-BASED PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 15.4 ALMOND INGREDIENTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.4.3 ALMOND INGREDIENTS MARKET, BY TYPE

- TABLE 268 ALMOND INGREDIENTS MARKET, BY TYPE, 2018-2025 (KT)

- 15.4.4 ALMOND INGREDIENTS MARKET, BY REGION

- TABLE 269 ALMOND INGREDIENTS MARKET, BY REGION, 2018-2025 (KT)

- TABLE 270 ALMOND INGREDIENTS MARKET, BY REGION, 2018-2025 (USD MILLION)

16 APPENDIX

- 16.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.2 CUSTOMIZATION OPTIONS

- 16.3 RELATED REPORTS

- 16.4 AUTHOR DETAILS