|

|

市場調査レポート

商品コード

1666279

北米の食肉代替原料市場:2030年までの予測 - 地域別分析 - ソース別、原料タイプ別、用途別North America Meat Substitute Ingredients Market Forecast to 2030 - Regional Analysis - by Source, Ingredient Type, and Application |

||||||

|

|||||||

| 北米の食肉代替原料市場:2030年までの予測 - 地域別分析 - ソース別、原料タイプ別、用途別 |

|

出版日: 2025年01月02日

発行: The Insight Partners

ページ情報: 英文 109 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の食肉代替原料市場は、2022年に6億5,933万米ドルとなり、2030年までには12億7,232万米ドルに達すると予測され、2022年から2030年までのCAGRは8.6%を記録すると予測されています。

植物性肉への需要の高まりが北米の食肉代替原料市場を牽引

ここ数年、環境の持続可能性に関する意識が著しく高まっています。気候変動は地球の自然生態系に影響を与え、人々の幸福に重大な脅威をもたらしています。世界の人口増加と都市化は、水、化石燃料、土地などの天然資源枯渇の主な原因であり、地球温暖化の一因となっています。世界人口の増加により、食糧需要も増加しています。人々は栄養所要量を満たすために動物性資源に大きく依存しています。このことが畜産業に大きな圧力をかけています。畜産業は、人為的な温室効果ガス排出の主な原因のひとつです。国連食糧農業機関(FAO)によれば、世界の畜産業は年間7.1ギガトンの二酸化炭素を排出しており、人為的温室効果ガス排出量の14.5%を占めています。業界の専門家によれば、畜産業が排出する二酸化炭素の量は、運輸業全体を合わせた量よりも多いといいます。Good Food Instituteによれば、植物由来の食肉は従来の食肉に比べ、温室効果ガス排出量(kg-CO2-eq/kg-meat)が30%から90%少ないです。食肉・畜産業が環境に与える悪影響に対する意識の高まりから、消費者は植物性食品への切り替えを急速に進めています。

Good Food Institute(GFI)とPlant Based Foods Association(PBFA)によると、2022年の米国小売における植物性食品市場は80億米ドルで、ドル売上は2021年から7%増加しました。

出典:植物性食品協会(PBFA)

定期的な肉食は糖尿病リスクを高める可能性があります。非政府組織ProVeg Internationalによると、オックスフォード大学が47万4,000人以上を対象に行った研究によると、未加工の赤身肉(牛肉や豚肉など)や加工肉(ベーコン、ソーセージ、ハムなど)を1日70グラム摂取すると、2型糖尿病の発症リスクが30%高まることがわかりました。さらに、植物性食品の摂取は、インスリン抵抗性、糖尿病前症、2型糖尿病のリスクを低下させます。このことは、持続可能な食習慣を取り入れることの利点を浮き彫りにしています。

世界中の消費者は、健康への関心の高まりと環境の持続可能性に関する意識の高まりから、菜食主義者のライフスタイルを採用しています。したがって、植物性食品への選好の高まりが、豆腐、大豆タンパク質、テンペ、エンドウ豆タンパク質など、植物性食品を作るために使用される原材料の需要を促進し、肉代替原材料市場を牽引しています。

北米の食肉代替原料市場概要

北米は、肉製品に代わるより健康的な代替食品を選ぶ個人の増加と菜食主義のトレンドの高まりにより、食肉代替原料市場にとって最も重要な地域の一つです。さらに、動物虐待や環境への悪影響に対する懸念が高まる中、同地域の消費者は大豆タンパク質、豆腐、テンペ、セイタンなどを原料とする肉代替製品を好んでいます。北米では、女性、特にミレニアル世代と若年層が植物由来の食品・飲料の中心的消費者です。これは主に、健康志向で、裕福で、大学教育を受けたアメリカ人のグループです。このように、植物性食肉は動物性食肉と同レベルである可能性があるというメディアの報道にもかかわらず、植物性食肉には健康と持続可能性のハレーションが絶えないため、植物性タンパク質は消費者にとって魅力的なのです。

世界保健機関(WHO)」によると、毎日平均14ポンドの赤身肉を摂取する人は、生涯を通じて結腸がんのリスクが17%高くなるといいます。そのため、消費者は植物性の肉製品を好む傾向が強く、それがこの地域における代用肉原料の需要を押し上げています。

同地域の食肉代替製品メーカーは、製品革新などの戦略的イニシアチブを絶えず取っており、それがこれらの製品の生産を開拓しています。例えば、2023年4月、米国を拠点とする植物性食肉のリーダーであるBeyond Meatは、ビヨンド・ステーキの最近の展開に続き、ビヨンド・ペパロニとビヨンド・チキン・フィレの発売を発表しました。このような代替肉製品の革新は、最終的にこの地域における代替肉原料の需要を押し上げます。

北米の食肉代替原料市場の収益と2030年までの予測(金額)

北米の食肉代替原料市場セグメンテーション

北米の食肉代替原料市場は、ソース、原料タイプ、用途、国に分類されます。

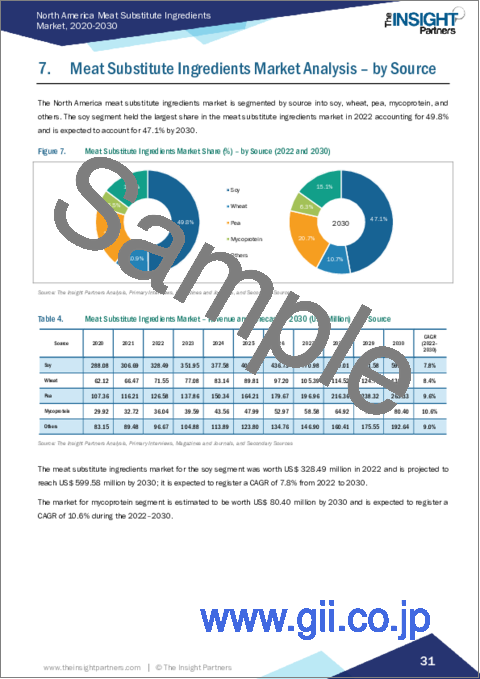

ソースに基づき、北米の食肉代替原料市場は大豆、小麦、エンドウ豆、マイコプロテイン、その他に分類されます。大豆セグメントは2022年に最大の市場シェアを占めました。

原料に基づき、北米の食肉代替原料市場は大豆タンパク質、エンドウ豆タンパク質、テンペ、豆腐、セイタン、その他に分類されます。大豆タンパク質セグメントは2022年に最大の市場シェアを占めました。

用途別では、北米の食肉代替原料市場はパテ、ナゲット、ソーセージ、ミートボール、その他に分類されます。2022年にはその他セグメントが最大の市場シェアを占めました。

国別では、北米の食肉代替原料市場は米国、カナダ、メキシコに区分されます。米国が2022年の北米食肉代替原料市場シェアを独占しました。

Crespel &Deiters GmbH Co KG、DuPont de Neumours Inc、Ingredion Inc、Wilmar International Ltd、Archer Daniels Midland Co、Axiom Foods Inc、The Scoular Co、Kerry Group Plc、Roquette Freres SAは、北米の食肉代替原料市場で事業を展開する主要企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 食肉代替原料市場の情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者または供給業者

- アプリケーション

- ベンダー一覧

第5章 食肉代替原料市場-主な市場力学

- 食肉代替原料市場-主な市場力学

- 市場促進要因

- 植物性食肉への需要の高まり

- 主な市場開拓企業による戦略的取り組み

- 市場抑制要因

- 植物性タンパク質に関連する風味の課題

- 市場機会

- 食肉代替製品の消費を促進する政府の取り組み

- 今後の動向

- 高まる菜食主義の動向

- 促進要因と抑制要因の影響

第6章 食肉代替原料市場:北米市場分析

- 食肉代替原料市場の収益、2020年~2030年

- 食肉代替原料市場の予測分析

第7章 食肉代替原料市場の分析-ソース別

- 大豆

- 小麦

- エンドウ豆

- マイコプロテイン

- その他

第8章 食肉代替原料市場の分析-原料タイプ別

- 大豆タンパク質

- エンドウ豆タンパク質

- テンペ

- 豆腐

- セイタン

- その他

第9章 食肉代替原料市場の分析-用途別

- パテ

- ナゲット

- ソーセージ

- ミートボール

- その他

第10章 北米の食肉代替原料市場:国別分析

- 北米市場概要

- 北米

- 米国

- カナダ

- メキシコ

- 北米

第11章 業界情勢

- 事業拡大

- 新製品開発

- 合併と買収

- パートナーシップ

第12章 企業プロファイル

- Crespel & Deiters GmbH & Co KG

- DuPont de Nemours Inc

- Ingredion Inc

- Wilmar International Ltd

- Archer-Daniels-Midland Co

- Axiom Foods Inc

- Kerry Group Plc

- Roquette Freres SA

- The Scoular Co

第13章 付録

List Of Tables

- Table 1. Meat Substitute Ingredients Market Segmentation

- Table 2. List of Vendors in Value Chain

- Table 3. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 5. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 6. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 7. North America: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 8. United States: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 9. United States: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 10. United States: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 11. Canada: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 12. Canada: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 13. Canada: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 14. Mexico: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 15. Mexico: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 16. Mexico: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

List Of Figures

- Figure 1. Meat Substitute Ingredients Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Meat Substitute Ingredients Market

- Figure 4. Registrations for the Veganuary Campaign from 2015 to 2021

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Meat Substitute Ingredients Market Revenue (US$ Million), 2020-2030

- Figure 7. Meat Substitute Ingredients Market Share (%) - by Source (2022 and 2030)

- Figure 8. Soy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Wheat: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Pea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Mycoprotein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Meat Substitute Ingredients Market Share (%) - by Ingredient Type (2022 and 2030)

- Figure 14. Soy Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Pea Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Tempeh: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Tofu: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Seitan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Meat Substitute Ingredients Market Share (%) - by Application (2022 and 2030)

- Figure 21. Patties: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Nuggets: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Sausages: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Meatballs: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. North America Meat Substitute Ingredients Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 27. North America: Meat Substitute Ingredients Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 28. United States: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 29. Canada: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 30. Mexico: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

The North America meat substitute ingredients market was valued at US$ 659.33 million in 2022 and is expected to reach US$ 1,272.32 million by 2030; it is estimated to record a CAGR of 8.6% from 2022 to 2030 .

Rising Demand for Plant-Based Meat Fuels North America Meat Substitute Ingredients Market

Over the past few years, awareness regarding environmental sustainability has increased significantly. Climate change has affected the earth's natural ecosystems and posed a significant threat to the well-being of people. Global population growth and urbanization are the primary causes of natural resource depletion, including water, fossil fuels, and land, contributing to global warming. Due to the rising global population, the demand for food is also increasing. People are heavily reliant on animal sources to meet their nutritional requirements. This factor has exerted high pressure on the livestock industry. The livestock industry is one of the key contributors to anthropogenic greenhouse gas emissions. According to the Food and Agriculture Organization (FAO) of the United Nations (UN), the worldwide livestock industry emits 7.1 gigatons of carbon dioxide per year, accounting for 14.5% of all human-caused greenhouse gas emissions. According to industry experts, livestock production emits more carbon dioxide than the whole transportation industry combined. As per the Good Food Institute, plant-based meat has 30-90% less greenhouse gas emissions (kg-CO2-eq/kg-meat) than conventional meat. Due to the rising awareness regarding the negative impacts of the meat and livestock industry on the environment, consumers are rapidly switching to plant-based food products.

According to the Good Food Institute (GFI) and the Plant Based Foods Association (PBFA), the plant-based food market in the US retail in 2022 was worth US$ 8 billion, with dollar sales up by 7% from 2021.

Source: The Plant Based Foods Association (PBFA)

Regular meat consumption may increase the risk of diabetes. According to ProVeg International, a nongovernment organization, a study by Oxford University of over 474,000 people found that daily consumption of 70 grams of unprocessed red meat (such as beef or pork) and processed meat (such as bacon, sausages, or ham) increased the risk of developing type 2 diabetes by 30%. Moreover, the consumption of plant-based food can reduce the risk of insulin resistance, prediabetes, and type 2 diabetes. This highlights the benefits of adopting sustainable food habits.

The consumers across the globe are adopting vegan lifestyle owing to increasing health concern and rising awareness about environmental sustainability. Thus, the increasing preference for plant-based food drives the demand for ingredients used to make plant-based food, such as tofu, soy protein, tempeh, and pea protein, thereby driving the meat substitute ingredients market.

North America Meat Substitute Ingredients Market Overview

North America is one of the most significant regions for the meat substitute ingredients market owing to the increasing number of individuals opting for healthier alternatives to meat products and the growing veganism trend. Moreover, with rising concerns about animal cruelty and its negative impact on the environment, consumers in the region prefer meat substitute products made from soy protein, tofu, tempeh, seitan, etc. In North America, women, especially millennials and younger population, are the core consumers of plant-based food and beverages. This is largely a group of health-focused, affluent, and college-educated Americans. Thus, the continuous health- and sustainability- halos around plant-based meat, despite media reports that such products may be on par with animal meat, make plant proteins appealing to consumers.

According to the "World Health Organization (WHO)," those who consume an average of 14 pounds of red meat each day are at a 17% greater risk of colon cancer throughout their lifetime. Thus, consumers significantly prefer plant-based meat products, which is boosting the demand for meat substitute ingredients in the region.

The meat substitute products manufacturers in the region are constantly taking strategic initiatives such as product innovation, which has pioneered the production of these products. For instance, in April 2023, Beyond Meat, a US-based leader in plant-based meat, announced the launch of Beyond Pepperoni and Beyond Chicken Fillet, building on their recent rollout of Beyond Steak. Such innovation in meat substitute products ultimately boosts the demand for meat substitute ingredients in the region.

North America Meat Substitute Ingredients Market Revenue and Forecast to 2030 (US$ Million)

North America Meat Substitute Ingredients Market Segmentation

The North America meat substitute ingredients market is categorized into source, ingredients type, application, and country.

Based on source, the North America meat substitute ingredients market is categorized into Soy, wheat, pea, mycoprotein, and others. The soy segment held the largest market share in 2022.

Based on ingredients, the North America meat substitute ingredients market is categorized into Soy protein, pea protein, tempeh, tofu, seitan, and others. The soy protein segment held the largest market share in 2022.

In terms of application, the North America meat substitute ingredients market is categorized into patties, nuggets, sausages, meatballs, and others. The others segment held the largest market share in 2022.

By country, the North America meat substitute ingredients market is segmented into the US, Canada, and Mexico. The US dominated the North America meat substitute ingredients market share in 2022.

Crespel & Deiters GmbH Co KG, DuPont de Neumours Inc, Ingredion Inc, Wilmar International Ltd, Archer Daniels Midland Co, Axiom Foods Inc, The Scoular Co, Kerry Group Plc, and Roquette Freres SA are some of the leading companies operating in the North America meat substitute ingredients market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Meat Substitute Ingredients Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.3 Distributors or Suppliers

- 4.3.4 Application

- 4.4 List of Vendors

5. Meat Substitute Ingredients Market - Key Market Dynamics

- 5.1 Meat Substitute Ingredients Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Rising Demand for Plant-Based Meat

- 5.2.2 Strategic Development Initiatives by Key Market Players

- 5.3 Market Restraints

- 5.3.1 Flavor Challenges Associated with Plant-Based Protein

- 5.4 Market Opportunities

- 5.4.1 Government Initiatives to Promote Consumption of Meat Alternative Products

- 5.5 Future Trends

- 5.5.1 Growing Veganism Trend

- 5.6 Impact of Drivers and Restraints:

6. Meat Substitute Ingredients Market - North America Market Analysis

- 6.1 Meat Substitute Ingredients Market Revenue (US$ Million), 2020-2030

- 6.2 Meat Substitute Ingredients Market Forecast Analysis

7. Meat Substitute Ingredients Market Analysis - by Source

- 7.1 Soy

- 7.1.1 Overview

- 7.1.2 Soy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Wheat

- 7.2.1 Overview

- 7.2.2 Wheat: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Pea

- 7.3.1 Overview

- 7.3.2 Pea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Mycoprotein

- 7.4.1 Overview

- 7.4.2 Mycoprotein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

8. Meat Substitute Ingredients Market Analysis - by Ingredient Type

- 8.1 Soy Protein

- 8.1.1 Overview

- 8.1.2 Soy Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Pea Protein

- 8.2.1 Overview

- 8.2.2 Pea Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Tempeh

- 8.3.1 Overview

- 8.3.2 Tempeh: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Tofu

- 8.4.1 Overview

- 8.4.2 Tofu: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Seitan

- 8.5.1 Overview

- 8.5.2 Seitan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

9. Meat Substitute Ingredients Market Analysis - by Application

- 9.1 Patties

- 9.1.1 Overview

- 9.1.2 Patties: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Nuggets

- 9.2.1 Overview

- 9.2.2 Nuggets: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Sausages

- 9.3.1 Overview

- 9.3.2 Sausages: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Meatballs

- 9.4.1 Overview

- 9.4.2 Meatballs: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Meat Substitute Ingredients Market - Country Analysis

- 10.1 North America Market Overview

- 10.1.1 North America: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 North America: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.1 United States: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.2.2 United States: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.2.3 United States: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.3 Canada: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.1 Canada: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.3.2 Canada: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.3.3 Canada: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.4 Mexico: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.4.1 Mexico: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.4.2 Mexico: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.4.3 Mexico: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1 North America: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Expansion

- 11.3 New Product Development

- 11.4 Merger and Acquisition

- 11.5 Partnerships

12. Company Profiles

- 12.1 Crespel & Deiters GmbH & Co KG

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 DuPont de Nemours Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Ingredion Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Wilmar International Ltd

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Archer-Daniels-Midland Co

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Axiom Foods Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Kerry Group Plc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Roquette Freres SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4

- 12.8.5 Financial Overview

- 12.8.6 SWOT Analysis

- 12.8.7 Key Developments

- 12.9 The Scoular Co

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners