|

|

市場調査レポート

商品コード

1848833

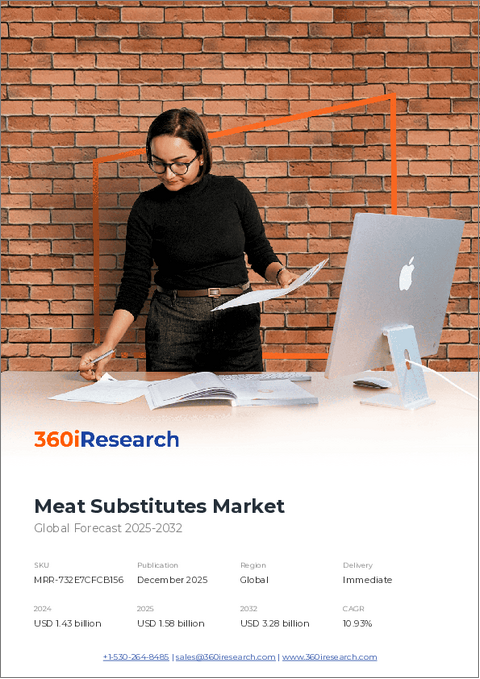

代替肉市場:製品タイプ別、流通チャネル別、由来別、形態別、エンドユーザー別 - 世界予測、2025年~2032年Meat Substitutes Market by Product Type, Distribution Channel, Source, Form, End-User - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 代替肉市場:製品タイプ別、流通チャネル別、由来別、形態別、エンドユーザー別 - 世界予測、2025年~2032年 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

概要

代替肉市場は、2032年までにCAGR 13.14%で90億1,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 33億5,000万米ドル |

| 推定年2025 | 38億米ドル |

| 予測年2032 | 90億1,000万米ドル |

| CAGR(%) | 13.14% |

消費者シフト、生産革新、チャネルの必要性を結びつけ、経営者の意思決定を導く代替肉市場の戦略的枠組み

エグゼクティブサマリーはまず、代替肉の状況を、消費者の健康動向、持続可能性の目標、植物性タンパク質と発酵由来タンパク質の急速な技術革新のダイナミックな交差点として枠組みづけることから始める。需要の原動力は現在、従来のフレキシタリアン消費者だけでなく、コスト的に安定し、供給力に優れた従来の食肉に代わるものを求める一般家庭や業務用食肉業者にまで広がっています。原材料の技術や生産規模が向上するにつれ、かつてはニッチな専門店の棚にしか並んでいなかった製品が、日常的な食事シーンや中核的な外食メニューに登場するようになり、製品開発者やチャネル・マネージャーにとって新たな判断基準が生まれつつあります。

このイントロダクションでは、個別の製品指標よりも戦略的背景を重視しています。規制当局の監視、原材料の調達、小売店の品揃えの決定が、競争上の優位性をますます明確にしていることを強調しています。さらに、ハイブリッド製剤やテクスチャード・プロテイン・システムの台頭は、官能的な期待を再構築しつつあります。このような進化する環境の中に読者を位置づけることで、本レポートは、研究開発、製造の柔軟性、サプライチェーン・パートナーシップへの投資に優先順位をつけるために必要な視点をリーダーに提供します。

市場参入を成功させるには、製品のイノベーションと流通能力およびエンドユーザーの要求を一致させる必要があることを、マクロ要因から現実的な影響へと移行するイントロダクションで強調しています。意思決定者は、短期的な混乱と長期的な変革を乗り切るために、技術的準備、チャネル統合、消費者受容というレンズを通して市場を見るべきです。

プロテインプラットフォームにおける技術的ブレークスルー、消費者の優先事項の進化、小売および食品サービスの品揃え戦略が、競争力学をどのように再構築しているか

市場は、原料革新の加速、チャネル浸透の拡大、規制当局の注目の高まりにより、変革的シフトを経験しています。マイコプロテイン発酵と精密発酵法の進歩が新たな食感と風味のプロファイルを可能にする一方、エンドウ豆、大豆、小麦タンパク質の機能性の向上が単一原料への依存を低減しています。こうした技術的進歩は、ハンバーガー、ミートボール、ミンチ、ナゲット、ソーセージなど、動物由来のものと同等になるよう改良されつつある製品イノベーションによって補完されています。

同時に、流通チャネルも多様化しています。コンビニエンスストアやスーパーマーケットでは、外出時やバリュー重視のシーンに対応するため、冷凍品やチルド品の品揃えが見直され、一方、オンライン小売では、高級品や特殊なSKUへのアクセスが拡大しています。専門店とデジタル・プラットフォームは、依然として新規配合の重要なインキュベーターであり続けているが、小売業者がより多くの棚スペースを割り当て、補完的なカテゴリーとのクロスマーチャンダイジングを推進するにつれて、主流への採用が加速しています。フルサービス・レストラン、施設向けケータリング、クイックサービス・レストランを含むフードサービス・セクターも、消費者の要望と企業の持続可能性目標の両方に応えて、主要なメニュー構成に代用肉を組み込もうとしています。

こうしたシフトは、健康や環境への影響をめぐる消費者の心理の変化によってさらに複雑化し、こうした消費者の心理は実験を後押しすると同時に、クリーン・ラベルの表示や原材料の透明性への期待を高めています。その結果、メーカーと小売業者は、市場の変革の勢いを活用するために、官能的性能、サプライチェーンの弾力性、チャネル固有のパッケージングと冷蔵戦略を調和させる統合イノベーション・ロードマップを採用しなければならないです。

2025年に導入された米国の関税によって、業界全体の調達、配合、サプライチェーンの回復力戦略がどのように再構成されたか

2025年の米国関税発動は、代用肉生産者にとって、インプットの調達、価格戦略、グローバルサプライチェーン設計にわたって重層的な影響をもたらしました。関税措置によって特定の輸入インプットと中間財の実質コストが上昇したため、メーカーはサプライヤー・ポートフォリオを再評価し、ニアショアリング・イニシアチブを加速させることになりました。調達チームの対応として、国内での委託製造に軸足を移したり、単一市場のショックへのエクスポージャーを軽減するために複数原産地調達契約を結んだりしたところもあります。

業務面では、関税の影響で可能な限り原材料の代替に重点を置くようになり、配合担当者は利益率と製品性能を維持するために代替タンパク質の配合や機能性結合剤を評価しています。小売および外食産業のバイヤーは、コスト転嫁をめぐる監視の目を強めており、そのためメーカー各社は段階的な製品ラインとサイズのバリエーションを採用し、中核的な家庭用および施設用の顧客にとっての値ごろ感を維持するよう促されています。同時に、垂直的に統合された発酵または共同製造能力を持つ企業は、コスト・インフレの一部を内部化し、急激な価格変動から川下チャネルを保護することができるため、相対的な優位性を見出しています。

戦略的には、関税の影響で、長期契約によるヘッジ、ロジスティクス計画の強化、在庫管理に関する話し合いが加速しています。企業は、関税投入物への依存度を下げる研究開発と、SKUの迅速な改良を可能にする製造柔軟性への投資の間で、資本配分のバランスを調整しつつあります。その正味の効果は、単なる業務上の必要性ではなく、競争上の差別化の源泉としてのサプライチェーンの強靭性に改めて焦点が当てられていることです。

詳細なセグメンテーション分析により、製品タイプ、流通チャネル、由来、形態、エンドユーザーの需要が、どのように差別化された市場投入ルートを定義するかを明らかに

製品、流通、供給源、形態、エンドユーザーの区別を分析することで、セグメンテーションに関する重要な洞察が浮かび上がり、成長ポケットと実行リスクが収束する場所が明らかになります。製品タイプ別に見ると、市場力学はハンバーガー、ミートボール、ミンチ、ナゲット、ソーセージで顕著に異なります。ハンバーガーは引き続き主流の関心と買い物客のエントリー・ポイントを支えるが、ナゲットとミートボールはしばしば家族での食事機会や利便性に基づくリピート購入を促進します。ミンチは、ソースや調理済み料理への汎用性を重視することで、従来のひき肉と直接競合する傾向があるが、ソーセージは、製造上の選択に影響を与える独特のケーシング、調味料、調理性能を必要とします。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 植物由来のハンバーガーに本物の肉の風味を再現するため、発酵ベースの動物由来でないヘムの採用が増加

- 培養細胞と植物性タンパク質をブレンドしたハイブリッド製品の開発、コスト効率と味覚を向上

- 商業規模で乳製品や肉タンパク質を生産するための精密発酵スタートアップへの投資増加

- 消費者の需要がクリーンラベル原料へと移行し、代替肉配合の透明性が高まる

- プレミアムステーキの食感と外観を模倣した菌糸体ベースのホールカット代替品の出現

- 米国、EU、アジア太平洋市場における培養肉製品の規制承認の道筋

- 植物由来のオメガ源の需要が高まるにつれ、冷凍および冷蔵のビーガンシーフード類似品の小売が急速に拡大

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 代替肉市場:製品タイプ別

- ハンバーガー

- ミートボール

- ミンチ

- ナゲット

- ソーセージ

第9章 代替肉市場:流通チャネル別

- コンビニエンスストア

- オンライン小売

- 専門店

- スーパーマーケット・ハイパーマーケット

第10章 代替肉市場:由来別

- マイコプロテイン

- エンドウ豆プロテイン

- 大豆プロテイン

- 小麦プロテイン

第11章 代替肉市場:形態別

- 常温

- 冷蔵

- 冷凍

第12章 代替肉市場:エンドユーザー別

- フードサービス

- フルサービスレストラン

- ケータリングサービス

- クイックサービスレストラン

- 家庭用

第13章 代替肉市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第14章 代替肉市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第15章 代替肉市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Beyond Meat, Inc.

- Impossible Foods Inc.

- The Kellogg Company

- Quorn Foods Limited

- Maple Leaf Foods Inc.

- Unilever PLC

- Nestle S.A.

- The Hain Celestial Group, Inc.

- The Tofurky Company

- The Meatless Farm Co. Ltd.