|

市場調査レポート

商品コード

1796404

エンドウ豆タンパク質市場:産業動向・世界の予測 (~2035年):製品タイプ・形態・原料・加工法・用途・エンドユーザー・流通・企業規模・主要地域別Pea Protein Market, Till 2035: Distribution by Type of Product, Form, Source, Processing Method, Application, End User, Distribution, Company Size, and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| エンドウ豆タンパク質市場:産業動向・世界の予測 (~2035年):製品タイプ・形態・原料・加工法・用途・エンドユーザー・流通・企業規模・主要地域別 |

|

出版日: 2025年08月22日

発行: Roots Analysis

ページ情報: 英文 165 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

エンドウ豆タンパク質市場:概要

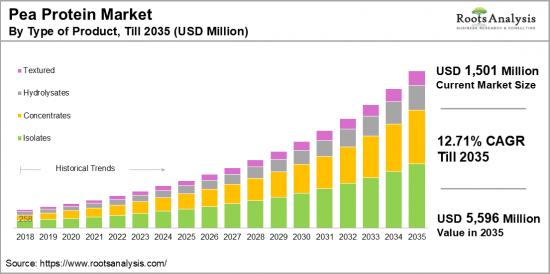

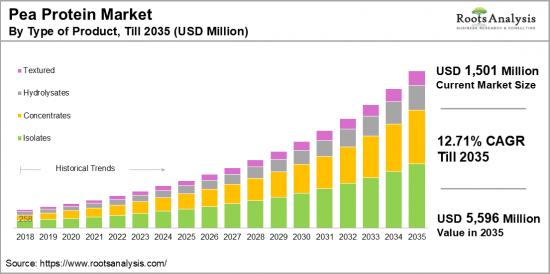

Roots Analysisによると、世界のエンドウ豆タンパク質の市場規模は、現在の15億100万米ドルから2035年までに55億9,600万米ドルまで、2035年までの予測期間中に12.71%のCAGRで成長すると予測されています。

エンドウ豆タンパク質市場の機会:分類

製品タイプ

- 濃縮物

- 加水分解物

- 分離物

- テクスチャード

形態

- ガス

- 液体

- 固体

原料

- ひよこ豆

- レンズ豆

- イエロースプリットピー (黄えんどう豆)

- その他

加工法

- 乾式

- 湿式

用途

- 動物飼料

- ベーカリー製品

- 飲料

- 栄養補助食品

- 幼児栄養

- 代用肉

- 化粧品

- その他

エンドユーザー

- 動物飼料メーカー

- 食品加工業者

- 一般家庭

- その他

流通タイプ

- オンラインチャネル

- 薬局

- 専門店

- スーパーマーケット/ハイパーマーケット

- その他

企業規模

- 中小企業

- 大企業

地域

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米諸国

- 欧州

- オーストリア

- ベルギー

- デンマーク

- フランス

- ドイツ

- アイルランド

- イタリア

- オランダ

- ノルウェー

- ロシア

- スペイン

- スウェーデン

- スイス

- 英国

- その他の欧州諸国

- アジア

- 中国

- インド

- 日本

- シンガポール

- 韓国

- その他のアジア諸国

- ラテンアメリカ

- ブラジル

- チリ

- コロンビア

- ベネズエラ

- その他のラテンアメリカ諸国

- 中東・北アフリカ

- エジプト

- イラン

- イラク

- イスラエル

- クウェート

- サウジアラビア

- アラブ首長国連邦

- その他の中東・北アフリカ諸国

- 世界のその他の地域

- オーストラリア

- ニュージーランド

- その他の国

エンドウ豆タンパク質市場:成長と動向

エンドウ豆タンパク質は、イエローピー(Pisum sativum)から抽出される高品質の植物由来タンパク質です。その優れた栄養成分、機能特性、多様な食事嗜好との適合性から、栄養補助食品や食品原料として広く利用されています。一般的に、エンドウ豆タンパク質は重量比で80~85%がタンパク質であり、非常に優れたタンパク源とされています。

エンドウ豆のタンパク質は、乾式または湿式で製造することができ、分離物、濃縮物、テクスチャードなど、さまざまな製品があります。分離物は、精製度とタンパク質濃度が高いため、最も好まれる製品です。このような背景から、エンドウ豆タンパク質の市場は、菜食主義者の食事や植物性タンパク質の選択肢に対する世界の関心の高まりに後押しされ、今後数年間で著しい成長が見込まれています。

特に、近年は植物性タンパク質に対する需要が大幅に急増し、エンドウ豆タンパク質市場に新たな展望が生まれています。エンドウ豆タンパク質の利点に貢献しているもう一つの重要な要因は、必須アミノ酸、ビタミン、鉄分などのミネラルを含む栄養的利点であり、総合的な健康をサポートしています。さらに、その低アレルギー性、消化のしやすさ、菜食主義者やベジタリアンへの適合性、持続可能性などが市場の需要を押し上げています。

その結果、業界内の企業はこの成長機会を活かすために、生産能力を拡大し、研究開発に投資して、より良い風味、食感、栄養プロファイルを持つ新しいエンドウ豆タンパク質製品の開発を進めています。植物性食への需要増加とエンドウ豆タンパク質の利点に加え、技術革新の進展も相まって、予測期間中にエンドウ豆タンパク質市場はさらなる拡大が見込まれています。

当レポートでは、世界のエンドウ豆タンパク質の市場を調査し、 市場概要、背景、市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 序文

第2章 調査手法

第3章 経済的およびその他のプロジェクト特有の考慮事項

第4章 マクロ経済指標

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 競合情勢

第8章 企業プロファイル

- 章の概要

- Axiom Foods

- Burcon Nutrascience

- Cargill

- DuPont

- Fenchem

- Glanbia

- Nutri-Pea

- Shandong Jianyuan Group

- The Green Labs

- The Scoular Company

第9章 バリューチェーン分析

第10章 SWOT分析

第11章 世界のエンドウ豆タンパク質市場

第12章 製品タイプ別の市場機会

第13章 形態別の市場機会

第14章 原料別の市場機会

第15章 加工法別の市場機会

第16章 用途別の市場機会

第17章 エンドユーザー別の市場機会

第18章 流通タイプ別の市場機会

第19章 企業規模別の市場機会

第20章 北米におけるエンドウ豆タンパク質の市場機会

第21章 欧州におけるエンドウ豆タンパク質の市場機会

第22章 アジアにおけるエンドウ豆タンパク質の市場機会

第23章 中東・北アフリカにおけるエンドウ豆タンパク質の市場機会

第24章 ラテンアメリカにおけるエンドウ豆タンパク質の市場機会

第25章 世界のその他の地域におけるエンドウ豆タンパク質の市場機会

第26章 表形式データ

第27章 企業・団体一覧

第28章 カスタマイズの機会

第29章 ROOTSサブスクリプションサービス

第30章 著者詳細

Pea Protein Market Overview

As per Roots Analysis, the global pea protein market size is estimated to grow from USD 1,501 million in the current year to USD 5,596 million by 2035, at a CAGR of 12.71% during the forecast period, till 2035.

The opportunity for pea protein market has been distributed across the following segments:

Type of Product

- Concentrates

- Hydrolysates

- Isolates

- Textured

Type of Form

- Gas

- Liquid

- Solid

Type of Source

- Chickpeas

- Lentils

- Yellow Split Peas

- Others

Type of Processing Methods

- Dry Processing

- Wet Processing

Type of Application

- Animal Feed

- Bakery Goods

- Beverages

- Dietary Supplements

- Infant Nutrition

- Meat Substitutes

- Personal Cosmetics

- Others

Type of End User

- Animal Feed Manufacturers

- Food Processors

- Households

- Others

Type of Distribution

- Online Channels

- Pharmacies

- Specialty Stores

- Supermarkets / Hypermarkets

- Others

Company Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

PEA PROTEIN MARKET: GROWTH AND TRENDS

Pea protein is a high-quality, plant-derived protein sourced from yellow peas (Pisum sativum). It is commonly used as a nutritional supplement and ingredient in food due to its impressive nutritional content, functional attributes, and compatibility with various dietary preferences. Typically, pea protein consists of 80-85% protein by weight, making it an excellent protein source.

Pea protein can be produced through either dry or wet methods, resulting in a range of products, including isolates, concentrates, and textured forms. The isolate is the most favored product due to its high level of refinement and protein concentration. In this context, the market for pea protein is expected to witness remarkable growth in the coming years, driven by a rising interest in vegan diets and plant-based protein options globally.

Notably, there has been a significant surge in the demand for plant-based protein over the past few years, creating fresh prospects for the pea protein market. Another important factor contributing to the benefits of pea protein is its nutritional benefits, which include an array of essential amino acids, vitamins, and minerals like iron, which supports overall well-being. Additionally, its hypoallergenic properties, ease of digestion, and suitability for vegans and vegetarians, along with its sustainability, boost its market demand.

Consequently, to capitalize on these opportunities, companies in the industry are increasing their production capabilities by investing in research and development to create new pea protein products with enhanced taste, texture, and nutritional profiles. Owing to the increasing demand for plant-based diets and the advantages of pea protein, coupled with advancements in technology, the pea protein market is expected to increase during the forecast period.

PEA PROTEIN MARKET: KEY SEGMENTS

Market Share by Type of Product

Based on type of product, the global pea protein market is segmented into concentrates, hydrolysates, isolates, and textured. According to our estimates, currently, isolates segment captures the majority share of the market. Pea protein isolate typically comprises around 85-90% protein, which makes it particularly attractive for nutritional supplements and protein-rich foods that appeal to consumers pursuing high-protein diets. As a result, it is commonly incorporated into nutritional supplements like meat alternatives, energy drinks, fruit blends, and baked goods. However, the concentrates segment is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Form

Based on type of form, the pea protein market is segmented into gas, liquid, and solid. According to our estimates, currently, solid form of the pea protein captures the majority of the market. This can be attributed to the rising demand for pea protein in powdered form, which offers a streamlined formulation process that allows for precise measurement and consistent distribution in food and beverage products. Additionally, its extended shelf-life, lighter weight, reduced volume, lower spoilage risk, and decreased transportation costs for both manufacturers and consumers further drive the growth of this segment.

However, liquid forms of pea protein, such as those found in juices and energy drinks, is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Source

Based on type of source, the pea protein market is segmented into chickpeas, lentils, yellow split peas, and others. According to our estimates, currently, yellow split peas segment captures the majority share of the market. Yellow split peas are a key factor in boosting market demand because they are high in protein, making them an excellent protein source.

Additionally, these legumes are not only abundant in protein, but they also offer numerous nutritional advantages such as fiber, vitamins, and minerals, contributing to the increasing demand for plant-based protein options. However, chickpeas segment, is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Processing Method

Based on type of processing method, the pea protein market is segmented into dry processing methods and wet processing methods. According to our estimates, currently, the dry processing segment captures the majority share of the market. Additionally, this segment is anticipated to experience a relatively higher growth rate during the forecast period.

This can be attributed to the benefits offered by dry processing, which enables the creation of a diverse array of pea protein products, such as concentrates and isolates, with different protein levels and functionalities tailored to distinct applications and consumer needs.

Market Share by Area of Application

Based on area of application, the pea protein market is segmented into animal feed, bakery goods, beverages, dietary supplements, infant nutrition, meat substitutes, personal cosmetics, and others. According to our estimates, currently, bakery goods segment capture the majority share of the market. This can be attributed to the increasing demand for plant-based protein in the baking sector for creating items like protein brownies, cookies, superfood bites, diet truffles, and protein snacks.

Further, the desire to improve nutritional value and addressing sustainability issues are additional factors that contribute to the rising demand for pea protein in the baking industry. However, the dietary supplements segment, is expected to grow at a relatively higher CAGR during the forecast period, due to heightened awareness and the adoption of fitness practices and healthy living, which boosts the need for protein-rich supplements.

Market Share by End User

Based on end user, the pea protein market is segmented into animal feed manufacturers, food processors, households, and others. According to our estimates, currently, food processors segment captures the majority share of the market. This can be attributed to the increasing demand for plant-based, allergen-free, and high-protein options, its adaptability, functional characteristics, and alignment with health and sustainability trends render it an essential ingredient across various food applications.

Market Share by Company Size

Based on company size, the pea protein market is segmented into small, medium-sized enterprises (SMEs) and large enterprises. According to our estimates, currently, large size companies capture the majority share of the market. This can be attributed to their ample resources, economies of scale, and extensive global distribution networks. Additionally, their strategic partnerships and capability to meet regulatory standards enable them to maintain their dominant status in the international market.

In contrast, SMEs are expected to experience a relatively higher CAGR during this forecast period. This can be attributed to their focus on innovation, targeting niche markets, and emphasizing sustainability. Furthermore, their local manufacturing, partnerships, and direct engagement with consumers broaden their market presence and assist in expanding their outreach.

Market Share by Type of Distribution

Based on type of distribution, the pea protein market is segmented into supermarkets / hypermarkets, specialty stores, online channels, pharmacies, and others. According to our estimates, currently, supermarket and hypermarket sector capture the majority share of the market. This can be attributed to the widespread availability of supermarkets, customer trust, greater product visibility, and a comprehensive shopping experience. In addition to market penetration, successful consumer engagement strategies are important for driving market growth.

However, online retail channels are expected to experience a relatively higher CAGR during this forecast period, due to their convenience, detailed product information, competitive pricing, diverse options, and easy access.

Market Share by Geographical Regions

Based on geographical regions, the pea protein market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. The increasing popularity of lifestyles such as veganism, vegetarianism, and flexitarianism significantly boosts the demand for plant-based protein sources like pea protein. Additionally, advancements in food technology and product innovation, a strong presence of established market players, heightened consumer awareness, and efficient distribution networks are significantly driving market growth in North America.

However, market in Asia Pacific is expected to grow at a higher CAGR during the forecast period, due to its growing population and evolving dietary preferences. The rising demand for food and beverages in countries such as China and India, which has a vast consumer base, offers significant opportunities for the integration of pea protein into a wide range of products. Further, government efforts to promote sustainable farming practices and support the cultivation of peas as a protein-dense crop provide considerable prospects for pea protein producers in this region.

Example Players in Pea Protein Market

- Axiom Foods

- Burcon Nutrascience

- Cargill

- Cosucra Groupe Warcoing

- DuPont

- Emsland

- Fenchem

- Glanbia

- Ingredion

- Martin & Pleasance

- Nutri-Pea

- Roquette Freres

- Shandong Jianyuan Group

- Sotexpro

- The Green Labs

- The Scoular Company

- Yantai Shuangta Food

PEA PROTEIN MARKET: RESEARCH COVERAGE

The report on the pea protein market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the pea protein market, focusing on key market segments, including [A] type of product, [B] type of form, [C] type of source, [D] type of processing method, [E] type of application, [F] type of end user, [G] type of distribution, [H] company size, and [I] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the pea protein market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the pea protein market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the pea protein market.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in pea protein market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.4. Research and Development Heads

- 2.4.2.5.2. Technical Experts

- 2.4.2.5.3. Subject Matter Experts

- 2.4.2.5.4. Scientists

- 2.4.2.5.4. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.5.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.5.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Pea Protein

- 6.2.1. Type of Product

- 6.2.2. Type of Form

- 6.2.3. Type of Source

- 6.2.4. Type of Processing Method

- 6.2.5. Type of Application

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Pea Protein: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. Axiom Foods*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.7. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.1. Axiom Foods*

information in the public domain

- 8.2.2. Burcon Nutrascience

- 8.2.3. Cargill

- 8.2.4. DuPont

- 8.2.5. Fenchem

- 8.2.6. Glanbia

- 8.2.7. Nutri-Pea

- 8.2.8. Shandong Jianyuan Group

- 8.2.9. The Green Labs

- 8.2.10. The Scoular Company

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL PEA PROTEIN MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Pea Protein Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Pea Protein Market for Concentrates: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.7. Pea Protein Market for Hydrolysates: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.8. Pea Protein Market for Isolates: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.9. Pea Protein Market for Textured: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF FOAM

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Pea Protein Market for Gas: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7. Pea Protein Market for Liquid: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8. Pea Protein Market for Solid: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF SOURCE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Pea Protein Market for Chickpeas: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7. Pea Protein Market for Lentils: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.8. Pea Protein Market for Yellow Split Peas: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.9. Pea Protein Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.10. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF PROCESSING METHOD

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Pea Protein Market for Dry Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.7. Pea Protein Market for Wet Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Pea Protein Market for Animal Feed: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.7. Pea Protein Market for Bakery Goods: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.8. Pea Protein Market for Beverages: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.9. Pea Protein Market for Dietary Supplements: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.10. Pea Protein Market for Infant Nutrition: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.11. Pea Protein Market for Meat Substitutes: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.12. Pea Protein Market for Personal Cosmetics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.13. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF END USER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Pea Protein Market for Animal Feed Manufacturers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.7. Pea Protein Market for Food Processors: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.8. Pea Protein Market for Households: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.9. Pea Protein Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.10. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF DISTRIBUTION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Pea Protein Market for Online Channels: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.7. Pea Protein Market for Pharmacies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.8. Pea Protein Market for Specialty Stores: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.9. Pea Protein Market for Supermarkets / Hypermarkets: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.10. Pea Protein Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.11. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Pea Protein Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. Pea Protein Market for Large Enterprises: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR PEA PROTEIN IN NORTH AMERICA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Pea Protein Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.1. Pea Protein Market in the US: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.2. Pea Protein Market in Canada: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.3. Pea Protein Market in Mexico: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.4. Pea Protein Market in Other North American Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR PEA PROTEIN IN EUROPE

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Pea Protein Market in Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.1. Pea Protein Market in the Austria: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.2. Pea Protein Market in Belgium: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.3. Pea Protein Market in Denmark: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.4. Pea Protein Market in France: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.5. Pea Protein Market in Germany: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.6. Pea Protein Market in Ireland: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.7. Pea Protein Market in Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.8. Pea Protein Market in the Netherlands: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.9. Pea Protein Market in Norway: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.10. Pea Protein Market in Russia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.11. Pea Protein Market in Spain: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.12. Pea Protein Market in Sweden: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.13. Pea Protein Market in Switzerland: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.14. Pea Protein Market in the UK: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.15. Pea Protein Market in Other European Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR PEA PROTEIN IN ASIA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Pea Protein Market in Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.1. Pea Protein Market in China: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.2. Pea Protein Market in India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.3. Pea Protein Market in Japan: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.4. Pea Protein Market in Singapore: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.5. Pea Protein Market in South Korea: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.6. Pea Protein Market in Other Asian Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR PEA PROTEIN IN MIDDLE EAST AND NORTH AFRICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Pea Protein Market in Middle East and North Africa (MENA): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.1. Pea Protein Market in Egypt: Historical Trends (Since 2018) and Forecasted Estimates (Till 205)

- 23.6.2. Pea Protein Market in Iran: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.3. Pea Protein Market in Iraq: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.4. Pea Protein Market in Israel: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.5. Pea Protein Market in Kuwait: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.6. Pea Protein Market in Saudi Arabia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.7. Pea Protein Market in United Arab Emirates (UAE): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.8. Pea Protein Market in Other MENA Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR PEA PROTEIN IN LATIN AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Pea Protein Market in Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.1. Pea Protein Market in Argentina: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.2. Pea Protein Market in Brazil: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.3. Pea Protein Market in Chile: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.4. Pea Protein Market in Colombia Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.5. Pea Protein Market in Venezuela: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.6. Pea Protein Market in Other Latin American Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR PEA PROTEIN IN REST OF THE WORLD

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Pea Protein Market in Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.1. Pea Protein Market in Australia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.2. Pea Protein Market in New Zealand: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.3. Pea Protein Market in Other Countries

- 25.7. Data Triangulation and Validation