|

市場調査レポート

商品コード

1687065

英国の貨物・物流:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)United Kingdom Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 英国の貨物・物流:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 362 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

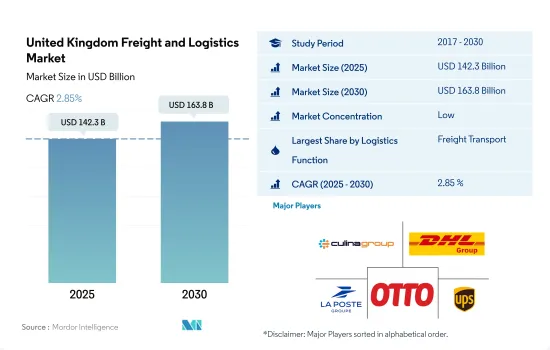

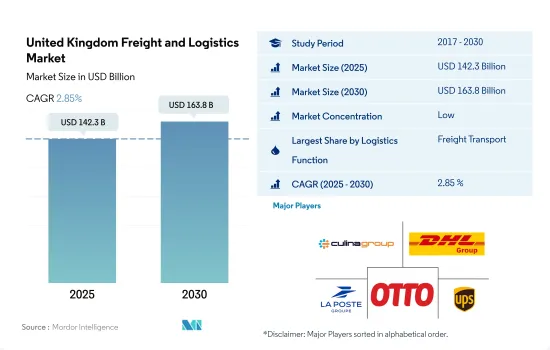

英国の貨物・物流市場規模は2025年に1,423億米ドルと推定・予測され、2030年には1,638億米ドルに達し、予測期間(2025年~2030年)のCAGRは2.85%で成長すると予測されます。

eコマース、インフラ開発、技術導入を促進する戦略の立ち上げが市場の需要を牽引しています。

- 英国は2040年までに新型大型貨物車のゼロエミッション達成を目指しています。予測によると、英国の電気トラック市場の2020年から2026年までのCAGRは約70%と堅調で、2026年の販売台数は2,167台に達すると予測されます。このうち、25台中22台が中型電気トラックになると予想されています。注目すべき開発として、アマゾンは2022年、同社の配送車両に電気大型貨物車(HGV)5台を導入し、年間10万マイルを走行させる計画を発表しました。この取り組みにより、二酸化炭素排出量が170トン以上削減される見込みです。英国は、長距離電気トラックに電力を供給するための全国的な架線網の構築に積極的に取り組んでおり、輸送の脱炭素化という2050年の目標に合致しています。

- eコマースの急成長は、英国の運輸部門にとって大きな起爆剤となっています。予測によると、英国のeコマース収益は2025年までに1,795億米ドルに達します。2023年には、アパレルやバッグなどのファッション製品のeコマース売上が大幅に急増し、53億8,000万米ドル以上増加して約438億9,000万米ドルに達しました。この上昇傾向は今後も続くと予想され、ファッション市場のeコマース販売による収益は2025年までに約543億6,000万米ドルに達すると予測されます。

英国の貨物・物流市場の動向

消費者向けフルフィルメントセンターの需要増加により、英国の倉庫数は2027年までに21万4,000に達する見込み

- 2024年5月、DPワールドは、顧客競争力強化のための5,000万英ポンド(6,092万米ドル)の投資の一環として、コベントリーにこれまでで最大の倉庫、59万8,000平方フィートの施設を開設しました。これは、2023年9月にビスターに開設した27万平方フィートの音楽・ビデオ流通倉庫に続くもので、英国の物理的な音楽の70%、ホームエンターテイメント製品の35%を取り扱う。DPワールドはこれまでにも、バートン・アポン・トレントに7万5,000平方フィートの倉庫を、ロンドン・ゲートウェイの物流ハブに23万平方フィートのマルチユーザー倉庫を開設しています。サウサンプトンとロンドン・ゲートウェイのハブとともに、78カ国で事業を展開するDPワールドは、世界貿易の10%を管理しています。このようなイニシャティブは、このセクターからのGDP貢献を押し上げると期待されています。

- 英国の大型倉庫の数は急速に増加しています。2027年までに、世界全体で5万平方フィート以上の倉庫は約21万4,000棟になると予想されています。これらの倉庫の多くはeコマース・フルフィルメント・センターとして機能し、2027年までに全倉庫の約18%が消費者向けフルフィルメント用となります。この増加は、貿易物流ハブとして運営される倉庫の割合が消費者向けフルフィルメントセンターにシフトし始め、eコマースの世界の拡大を示唆しています。

英国政府は燃料価格に大きな影響を及ぼしており、燃料税と付加価値税(標準税率20%)がガソリンと軽油価格の大半を占めています。

- 2022年8月、原油価格は100米ドルを割り込み、1バレル90.63米ドルで1ヵ月を終えました。2023年にはさらに値下がりし、5月には1バレル72.50米ドルまで下がりました。2024年3月、英国のガソリン価格は1リットル当たり平均150.1ペソとなり、2023年11月以来の高値となりました。これは中東情勢の緊迫化による原油価格の上昇とポンド安ドル高によるものです。全体的なインフレ率は緩和しているもの、ガソリンと軽油の価格は3月に上昇しました。原油価格は、2024年4月のイスラエルによるイランへの報復攻撃で急騰した後、下落しました。

- 2024年6月、英国政府は2030年までにジェット燃料に少なくとも10%の持続可能な航空燃料(SAF)を義務付ける計画を確認しました。現在、SAFは希少であり、従来の燃料よりも高価であるため、航空分野での使用を増やすことは困難です。SAFは、世界のジェット燃料の0.1%未満です。政府によるSAFの義務化は、法制化の承認を経て、2025年1月に開始される予定です。これは、2050年までに航空機の純排出量ゼロを目指す2022年の「ジェット・ゼロ」戦略に続くものです。

英国の貨物・物流産業の概要

英国の貨物・物流市場は断片化されており、この市場の主要企業は、Culina Group、DHL Group、La Poste Group(DPD Group、CitySprint(UK)Ltd.を含む)、Otto Group(Evri Limitedを含む)、United Parcel Service of America, Inc.-UPS(Coyote Logisticsを含む)の5社である(アルファベット順)。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 レポートのオファー

第3章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第4章 主要産業動向

- 人口動態

- 経済活動別GDP分布

- 経済活動別GDP成長率

- インフレ率

- 経済パフォーマンスとプロファイル

- eコマース産業の動向

- 製造業の動向

- 運輸・倉庫業のGDP

- 輸出動向

- 輸入動向

- 燃料価格

- トラック輸送コスト

- タイプ別トラック保有台数

- 物流実績

- 主要トラックサプライヤー

- モーダルシェア

- 海上貨物輸送能力

- 定期船の接続性

- 寄港地とパフォーマンス

- 運賃動向

- 貨物トン数の動向

- インフラ

- 規制の枠組み(道路と鉄道)

- 英国

- 規制の枠組み(海上・航空)

- 英国

- バリューチェーンと流通チャネル分析

第5章 市場セグメンテーション

- エンドユーザー産業

- 農業、漁業、林業

- 建設業

- 製造業

- 石油・ガス、鉱業、採石業

- 卸売・小売業

- その他

- 物流機能

- クーリエ、エクスプレス、小包(CEP)

- 仕向地別

- 国内

- 国際

- 貨物輸送

- 輸送モード別

- 航空

- 海上・内水道

- その他

- 貨物輸送

- 輸送手段別

- 航空

- パイプライン

- 鉄道

- 道路

- 海上・内陸水路

- 倉庫保管

- 温度管理

- 温度管理なし

- 温度管理

- その他のサービス

- クーリエ、エクスプレス、小包(CEP)

第6章 競合情勢

- 主要な戦略動向

- 市場シェア分析

- 企業情勢

- 企業プロファイル.

- Advanced Supply Chain Group

- Americold(including Americold Whitchurch)

- Ballyvesey Holdings Limited(including Montgomery Transport)

- CMA CGM Group(including CEVA Logistics)

- Culina Group

- DACHSER

- Delamode Group(formerly Xpediator PLC)

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DP World(including P&O Ferrymasters)

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Europa Worldwide Group

- Expeditors International of Washington, Inc.

- FedEx

- GBA Logistics

- Gregory Distribution Ltd.

- Hellmann Worldwide Logistics

- Hoyer Group(including Hoyer UK Ltd)

- Huboo

- Kinaxia Logistics Limited(including Mark Thompson Transport)

- Kuehne+Nagel

- La Poste Group(including DPD Group, and CitySprint(UK)Ltd.)

- Lineage, Inc.

- Maritime Group Ltd.

- Meachers Global Logistics

- Otto Group(including Evri Limited)

- Owens Group

- Pall-Ex Group

- PD Ports(owned by Brookfield Asset Management)

- Peel Ports Group

- Rhenus Group

- Samskip

- SITRA Group(including Abbey Logistics Group)

- Solstor UK Limited

- Swain Group

- Turners(Soham)Ltd.

- United Parcel Service of America, Inc.-UPS(including Coyote Logistics)

- W H Malcolm Ltd.

- Walden Group(including Moviantio)

- Whistl UK Ltd.

- Wincanton PLC

第7章 CEOへの主な戦略的質問

第8章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 市場力学(市場促進要因、抑制要因、機会)

- 技術の進歩

- 情報源と参考文献

- 図表リスト

- 主要洞察

- データパック

- 用語集

- 為替レート

The United Kingdom Freight and Logistics Market size is estimated at 142.3 billion USD in 2025, and is expected to reach 163.8 billion USD by 2030, growing at a CAGR of 2.85% during the forecast period (2025-2030).

E-commerce, infrastructure development, and strategy launches will boost technology adoption are leading the market demand

- The UK aims to achieve zero-emission status for new heavy goods vehicles by 2040. Projections indicate a robust CAGR of nearly 70% for the UK's electric truck market from 2020 to 2026, with sales forecasted to hit 2,167 units in 2026. Of these, approximately 22 out of every 25 vehicles are expected to be medium-duty electric trucks. In a notable development, Amazon announced plans in 2022 to introduce five electric heavy goods vehicles (HGVs) into its delivery fleet, covering a distance of 100,000 miles annually. This initiative is anticipated to reduce carbon emissions by over 170 tonnes. The UK is actively working on establishing a nationwide network of overhead wires to power long-distance electric trucks, aligning with its 2050 goal of decarbonizing transportation.

- The rapid growth of e-commerce is a major catalyst for the UK's transportation sector. Projections indicate that e-commerce revenue in the UK will reach USD 179.5 billion by 2025. In 2023, revenue from e-commerce sales of fashion products, including apparel and bags, saw a significant surge, rising by over USD 5.38 billion to approximately USD 43.89 billion. This upward trend is expected to continue, with revenue from e-commerce sales in the fashion market projected to reach around USD 54.36 billion by 2025.

United Kingdom Freight and Logistics Market Trends

The UK's warehouse count is expected to reach 214,000 by 2027 due to a rise in demand for consumer fulfillment centers

- In May 2024, DP World opened its largest warehouse yet, a 598,000 sq ft facility in Coventry, as part of a GBP 50 million (USD 60.92 million) investment to boost customer competitiveness. This follows the September 2023 opening of a 270,000 sq ft music and video distribution warehouse in Bicester, handling 70% of the UK's physical music and 35% of home entertainment products. Previously, DP World opened a 75,000 sq ft site in Burton upon Trent and a 230,000 sq ft multi-user warehouse at London Gateway's logistics hub. Alongside its hubs at Southampton and London Gateway, operating in 78 countries, DP World manages 10% of global trade. Such initiaves are expected to boost the GDP contribution from the sector.

- The number of large warehouses in the United Kingdom is rapidly increasing. By 2027, there are expected to be around 214,000 warehouses larger than 50,000 square feet globally. Many of these warehouses are to serve as e-commerce fulfillment centers, and approximately 18% of all warehouses will be for consumer fulfillment by 2027. This increase suggests the global expansion of e-commerce as the proportion of warehouses operating as trade distribution hubs begins to shift in favor of consumer fulfillment centers.

UK government has a major influence on fuel prices, and both fuel duty and VAT (standard 20% rate) make up majority of the petrol and diesel prices

- In August 2022, the oil price dropped under USD 100 and finished the month at USD 90.63 a barrel. Prices dropped further in 2023, and by May, a barrel of oil was down to USD 72.50. In March 2024, petrol prices in the UK averaged 150.1p per litre, the highest since November 2023. This is due to rising oil prices due to Middle East tensions and a weaker pound against the dollar. Although overall inflation has eased, petrol and diesel prices increased in March. Oil prices have since dropped after spiking following Israel's retaliatory attack on Iran in April 2024.

- In June 2024, the UK government confirmed it plans to require at least 10% sustainable aviation fuel (SAF) in jet fuel by 2030. Currently, SAF is scarce and more expensive than traditional fuels, making it challenging to increase its use in aviation. SAF represents less than 0.1% of jet fuel globally. The government's SAF mandate, pending legislative approval, is set to start in January 2025. This follows the 2022 "Jet Zero" strategy aiming for net-zero emissions in aviation by 2050.

United Kingdom Freight and Logistics Industry Overview

The United Kingdom Freight and Logistics Market is fragmented, with the major five players in this market being Culina Group, DHL Group, La Poste Group (including DPD Group, and CitySprint (UK) Ltd.), Otto Group (including Evri Limited) and United Parcel Service of America, Inc. - UPS (including Coyote Logistics) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 United Kingdom

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 United Kingdom

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Advanced Supply Chain Group

- 6.4.2 Americold (including Americold Whitchurch)

- 6.4.3 Ballyvesey Holdings Limited (including Montgomery Transport)

- 6.4.4 CMA CGM Group (including CEVA Logistics)

- 6.4.5 Culina Group

- 6.4.6 DACHSER

- 6.4.7 Delamode Group (formerly Xpediator PLC)

- 6.4.8 Deutsche Bahn AG (including DB Schenker)

- 6.4.9 DHL Group

- 6.4.10 DP World (including P&O Ferrymasters)

- 6.4.11 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.12 Europa Worldwide Group

- 6.4.13 Expeditors International of Washington, Inc.

- 6.4.14 FedEx

- 6.4.15 GBA Logistics

- 6.4.16 Gregory Distribution Ltd.

- 6.4.17 Hellmann Worldwide Logistics

- 6.4.18 Hoyer Group (including Hoyer UK Ltd)

- 6.4.19 Huboo

- 6.4.20 Kinaxia Logistics Limited (including Mark Thompson Transport)

- 6.4.21 Kuehne+Nagel

- 6.4.22 La Poste Group (including DPD Group, and CitySprint (UK) Ltd.)

- 6.4.23 Lineage, Inc.

- 6.4.24 Maritime Group Ltd.

- 6.4.25 Meachers Global Logistics

- 6.4.26 Otto Group (including Evri Limited)

- 6.4.27 Owens Group

- 6.4.28 Pall-Ex Group

- 6.4.29 PD Ports (owned by Brookfield Asset Management)

- 6.4.30 Peel Ports Group

- 6.4.31 Rhenus Group

- 6.4.32 Samskip

- 6.4.33 SITRA Group (including Abbey Logistics Group)

- 6.4.34 Solstor UK Limited

- 6.4.35 Swain Group

- 6.4.36 Turners (Soham) Ltd.

- 6.4.37 United Parcel Service of America, Inc. - UPS (including Coyote Logistics)

- 6.4.38 W H Malcolm Ltd.

- 6.4.39 Walden Group (including Moviantio)

- 6.4.40 Whistl UK Ltd.

- 6.4.41 Wincanton PLC

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate