|

市場調査レポート

商品コード

1632106

中東・アフリカのモバイル決済:市場シェア分析、産業動向、成長予測(2025年~2030年)Middle East and Africa Mobile Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 中東・アフリカのモバイル決済:市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

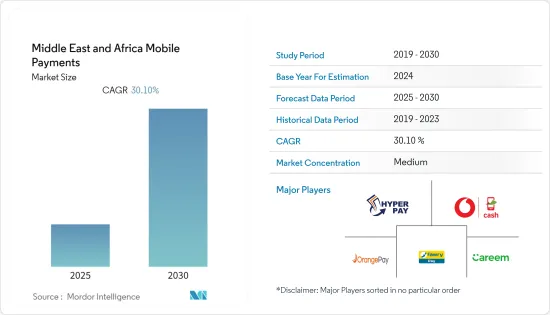

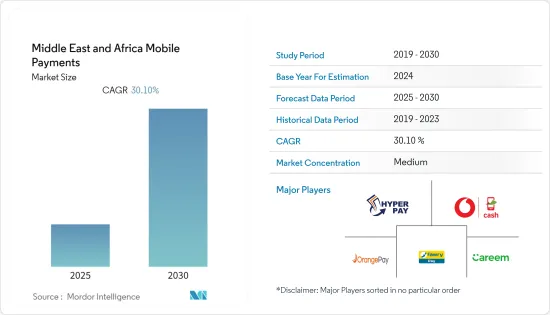

中東・アフリカのモバイル決済市場は予測期間中に30.1%のCAGRで推移する見込み。

主要ハイライト

- オンライン小売ショッピング、リチャージ、送金などのオンラインビジネスを通じたeコマース産業の成長により、モバイル決済システムが台頭しています。

- ブロードバンド接続数の増加や、安価な料金でインターネットを利用できるようになったことなどの要因により、オンラインの世界は急速に成長しています。eコマースにおける決済はキャッシュレスであることがほとんどで、電子的な手段で処理する必要があります。このため、モバイル決済の需要が高まっている

- スマートフォンが全モバイル機器の約80%を占めるようになった現在、キャッシュレス取引の増加は、既存企業や新興企業の両方にビジネス機会をもたらします。

- COVID-19の蔓延はモバイル決済の普及を促し、パンデミックによる消費者習慣の変化は世界の決済の活性化につながると予想されます。さらに、COVID-19以降、モバイル決済の受け入れは改善し、長期的にはより大きな役割を果たすと予想されます。現金はウイルスを媒介する可能性があると考えられているため、政府や規制機関はその使用を控えています。

中東・アフリカのモバイル決済市場動向

インターネット普及率の上昇とeコマースの成長

- 中東は、インターネットと銀行の普及率が対照的な国々で構成されています。カタール、バーレーン、アラブ首長国連邦では90%であるのに対し、イエメン、シリア、イラクでは40%に満たないです。しかし、各国での普及率向上に注力することで、調査対象市場の成長に弾みがつくと予想されます。

- さらに、Accentureは2022年2月、アラブ首長国連邦中央銀行(CBアラブ首長国連邦)から主要企業コンソーシアムのリーダーとして選ばれ、国家決済システム戦略の実行を支援しました。Accentureは、現在Nexi Groupの傘下にあるSIAとG42と共同で、今後5年間にわたり国家即時決済プラットフォーム(IPP)を構築・運用します。

- 一方、アフリカでは、ナイジェリアや南アフリカなど、携帯電話の契約数が飛躍的に伸びている国々が対象です。ナイジェリアでは、小売決済は依然として現金が主流だが、デジタル取引、特にモバイル決済が急成長しています。ナイジェリアではここ数年、利便性と取引のしやすさを求めて電子決済サービスの導入が急増しています。

- EZDubaiが発表したレポートによると、2021年中にすべてのカテゴリーでeコマースサイトのオンライン購入を適応させた消費者は、2020年と比べて増加しており、回答者の平均75%が通常オンラインで購入しています。

- 中東諸国は、一人当たりのGDPが高く、インターネットが普及しているため、eコマースのさらなる発展を可能にする強力な立場にあります。アラブ首長国連邦とカタールは、インターネットの普及率が90%を超えており、最も強い立場にあります。両国とも家庭への光ファイバー接続の導入に成功しており、この地域で最もアクティブなモバイルブロードバンド契約を有しています。

- 多くの大手小売業者は、オンライン販売を拡大し、顧客の商品へのアクセスを改善するために、モバイルアプリを開発・強化しています。アラブ首長国連邦通信規制庁の最新データによると、アラブ首長国連邦における購買アプリの52%は食品、飲料、医薬品に特化しています。eコマースの継続的な成長により、同地域でのモバイル決済の導入が進むと予想されます。

サウジアラビアが力強い成長を遂げる

- サウジアラビアは、2030年までにモバイル決済の目標を70%に達成する計画です。オンライン決済やキャッシュレス決済はビジョン2030計画の一部です。サウジアラビア金融庁(SAMA)は、現金への依存度を下げるため、電子決済を奨励しています。より多くの人々がキャッシュレス決済を利用するようになり、現金の使用は激減しています。

- サウジアラビア金融庁(SAMA)は、MADA(電子決済ネットワーク)のインフラ機能の強化に注力し、銀行やNBIにPOS(販売時点情報管理)、スマートフォン決済アプリ、電子財布などの電子決済チャネルの開発を奨励しています。

- さらに、フィンテックに優しい決済環境へ向けた規制状況の動向は、フィンテック、通信会社、さらには小売業者など、現地の決済環境が急速に拡大する中、同国がデジタルの方向に進んでいることを意味しています。

- Mastercardの調査によると、サウジアラビアの消費者の4人に3人近くが、パンデミック以前よりもオンラインショッピングを利用しており、オンラインショッピングの急速な成長を示唆しています。この調査では、買い物客がいかに急速に現金から離れ、接触不要のデジタル決済を選んでいるかについての重要な洞察が示されています。このような洞察により、サウジアラビアをはじめとする地域全体の電子小売業者や企業がオンラインショッピングにシフトし、迅速で便利かつ安全な取引を実現できるようになっています。

中東・アフリカのモバイル決済産業概要

中東・アフリカのモバイル決済は適度に集中しており、Hyperpay、Vodafone Cash、OrangePay、MyFawry、CareemPayといった大手数社に独占されています。市場シェアが突出しているこれらの大手企業は、海外における顧客基盤の拡大に注力しています。

- 2022年7月-Careemのペイメントソリューションは、送金プラットフォームのDenariiの買収を発表しました。

- 2022年5月-Mastercardは、中東・北アフリカ(MENA)におけるデジタル決済ソリューションの導入を促進するため、eコマース決済サービスを提供するサウジアラビアのHyperPayとの提携を発表しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 中東・アフリカのモバイル決済市場の市場規模・推定

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- インターネット普及率の上昇とeコマース・Mコマース市場の成長

- モバイル環境におけるロイヤルティ特典の増加

- 市場課題

- モバイル決済に伴うセキュリティ問題

- 市場機会

- デジタル決済の成長を奨励する政府施策により、庶民の間でのリアルタイム決済の成長が期待されます。

- モバイル決済産業における主要規制と基準

- 産業におけるビジネスモデルの分析

- モバイルウォレットの市場浸透の増加に関する分析(主要国の地域別内訳付き)

- 実現技術に関する分析(NFC、QRなどを含む範囲)

- モバイルコマースの成長と市場への影響に関する解説

第6章 市場セグメンテーション

- タイプ別(相対的な普及率による市場シェア)

- 近接

- リモート

- 国別

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- エジプト

- ナイジェリア

- ケニア

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Vodafone Egypt(Vodafone Cash)

- Orange S.A.(Orange Money)

- Fawry(MyFawry)

- Careem(CareemPay)

- HyperPay INC

- PALMPAY LIMITED(PalmPay)

- MTN Group(MTN MoMoPay)

- Saudi Digital Payment Company(STC Pay)

- SADAD

- Beam AG(Beam)

- Klip

- Bayan Payments Ltd(BayanPay)

- Payit Wallet(Payit)

第8章 投資分析

第9章 市場の将来展望

目次

Product Code: 91340

The Middle East and Africa Mobile Payments Market is expected to register a CAGR of 30.1% during the forecast period.

Key Highlights

- The rising growth in the e-commerce industry through online businesses such as online retail shopping, recharges, money transfer, and so on is giving rise to mobile payment systems.

- The online world is growing rapidly owing to factors like the rising number of broadband connections and internet availability at cheaper rates. Most of the time, payments in e-commerce are cashless, which implies that they must be processed by electronic means. This has been raising the demand for mobile payments mechanism.

- The rise of cashless transactions presents opportunities for businesses, both established and start-ups, as smartphones are now accounting for about 80% of all mobile devices, there will be considerable potential for innovation, including using mobile phones to direct payments.

- The spread of the COVID-19 has encouraged the adoption of mobile, payments as shifts in consumer habits caused by the pandemic are expected to boost payments globally. Further, the acceptance of mobile payment methods is expected to improve post-COVID-19 and play a more substantial role in the long term. With cash being seen as a potential carrier for the virus, governments and regulatory bodies discourage its use.

Middle East and Africa Mobile Payments Market Trends

Increasing internet penetration and growth of E-commerce in the region

- The Middle East consists of countries with contrasting internet and banking penetration rates. The distribution is 90% in Qatar, Bahrain, and UAE, whereas less than 40% in Yemen, Syria, and Iraq, indicating the varying internet and banking penetration rates. However, the focus on increasing penetration across countries is expected to provide impetus to the growth of the studied market.

- Moreover, in February 2022, Accenture was selected by the Central Bank of the UAE (CBUAE) to lead a consortium of companies and help them execute its National Payment Systems Strategy. In collaboration with SIA, now part of Nexi Group, and G42, Accenture will build and operate the National Instant Payment Platform (IPP) over the next five years.

- On the other hand, Africa covers countries such as Nigeria and South Africa, where mobile subscriptions are growing at an exponential rate. In Nigeria, cash still dominates retail payments, but digital transactions, especially mobile payments, are growing strongly. The country has witnessed a surge in the adoption of electronic payment services over the last few years for convenience and ease of transactions.

- According to a report launched by EZDubai, more consumers had adapted online purchases of E-commerce websites across all categories during 2021 compared to 2020, with an average of 75 % of respondents typically purchasing online.

- Countries in the Middle East are in a strong position to enable further e-commerce development growth due to high GDP per capita and internet penetration. The UAE and Qatar have the strongest position, with internet penetration above 90%. Both countries have successfully implemented fiber access in homes and have the highest active mobile-broadband subscriptions in the region.

- Many big retailers developed and enhanced mobile apps to increase online sales and improve customers' access to the products. According to the latest data from the Telecommunications Regulatory Authority of UAE, 52% of purchasing apps in the UAE specializing in food, beverage, and pharmaceutical products. The continuous growth of e-commerce is expected to drive the adoption of mobile payments in the region.

Saudi Arabia to witness strong growth

- Saudi Arabia is planning to achieve a Mobile-payment target of 70% by 2030. Online or cashless payments are a part of the Vision 2030 Plan. The Saudi Arabian Monetary Authority (SAMA) has been encouraging electronic payments and settlements to reduce the reliance on cash. Usage of cash has been reducing drastically as more and more people have started using cashless modes of transaction.

- The Saudi Arabian Monetary Authority (SAMA) is focusing on enhancing MADA (an electronic payment network) infrastructure capabilities and encouraging banks and NBIs to develop electronic payment channels such as point of sale (PoS), smartphone payment apps, and electronic wallets.

- Additionally, the growing regulatory trends toward a fintech-friendly payments environment signify that the country is moving in a digital direction, with the local payments landscape expanding rapidly to include fintech, telecoms companies, and even retailers.

- A Mastercard study suggests the rapid growth of online shopping, with nearly three out of four Saudi consumers shopping more online than they did pre- pandemic. The study provides significant insights into how shoppers have rapidly moved away from cash and opted for contact-free and digital payment experiences. These insights are enabling e-retailers and businesses in Saudi and across the region to shift toward online shopping and deliver fast, convenient, and secure transactions.

Middle East and Africa Mobile Payments Industry Overview

The Middle East And Africa Mobile Payments is moderately concentrated and dominated by a few major players like Hyperpay, Vodafone Cash, OrangePay, MyFawry, and CareemPay These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries.

- July 2022 - Careem payment solution has announced the acquisition with Denarii a money transfer platform, where it can expand its remittance to connect with customers by using the proprietary technology of Denarii.

- May 2022 - Mastercard has announced a partnership with Saudi Arabia's HyperPay, an e-commerce payment services provider, to boost the adoption of digital payment solutions in the Middle East and North Africa (MENA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates of Middle East and Africa Mobile Payments Market

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing internet penetration and growing E-commerce & M-commerce market

- 5.1.2 Increasing number of loyalty benefits in mobile environment

- 5.2 Market Challenges

- 5.2.1 Security issues associated with mobile payments

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Mobile Payments Industry

- 5.5 Analysis of Business Models in the Industry

- 5.6 Analysis of the Increasing Market Penetration of Mobile Wallets with a regional breakdown of key countries

- 5.7 Analysis on Enabling Technologies (Coverage to include NFC, QR, etc.)

- 5.8 Commentary on the growth of Mobile Commerce and its influence on the Market

6 MARKET SEGMENTATION

- 6.1 By Type (Market share in percentage based on relative adoption)

- 6.1.1 Proximity

- 6.1.2 Remote

- 6.2 By Country

- 6.2.1 Middle-East and Africa

- 6.2.1.1 United Arab Emirates

- 6.2.1.2 Saudi Arabia

- 6.2.1.3 Egypt

- 6.2.1.4 Nigeria

- 6.2.1.5 Kenya

- 6.2.1 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vodafone Egypt (Vodafone Cash)

- 7.1.2 Orange S.A. (Orange Money)

- 7.1.3 Fawry (MyFawry)

- 7.1.4 Careem (CareemPay)

- 7.1.5 HyperPay INC

- 7.1.6 PALMPAY LIMITED (PalmPay)

- 7.1.7 MTN Group (MTN MoMoPay)

- 7.1.8 Saudi Digital Payment Company (STC Pay)

- 7.1.9 SADAD

- 7.1.10 Beam AG (Beam)

- 7.1.11 Klip

- 7.1.12 Bayan Payments Ltd (BayanPay)

- 7.1.13 Payit Wallet (Payit)