|

|

市場調査レポート

商品コード

1449534

エンドウ豆タンパク質の世界市場:タイプ別、用途別、形態別、原料別、加工法別、地域別 - 予測(~2029年)Pea Protein Market by Type (Isolates, Concentrates and Textured), Application (Food, Beverages), Form (Dry, Wet), Source (Chickpeas, Yellow Split Peas, Lentils), Processing Method (Dry, Wet) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| エンドウ豆タンパク質の世界市場:タイプ別、用途別、形態別、原料別、加工法別、地域別 - 予測(~2029年) |

|

出版日: 2024年02月28日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

エンドウ豆タンパク質の市場規模は、予測期間中に12.0%のCAGRで推移し、2024年の21億米ドルから、2029年には37億米ドルの規模に成長すると予測されています。

健康意識の高まりとベジタリアンやビーガン食が好まれる傾向から、植物性タンパク質の代替品に対する需要が高まっており、エンドウ豆タンパク質のトレンドが形成されています。エンドウ豆は必須アミノ酸が豊富で、大豆や乳製品のような一般的なアレルゲンを含まないため、さまざまな食品・飲料製品向けの汎用性の高い原料となっています。さらに、持続可能な生産プロセスは環境への影響や倫理的な調達に対する消費者の関心の高まりに合致しています。加工技術の進歩もエンドウ豆タンパク質の味、食感、機能性を向上させ、さまざまな配合での利用を拡大しています。食品メーカーはますますエンドウ豆タンパク質を製品に取り入れるようになっており、市場におけるエンドウ豆タンパク質の存在感を高め、継続的な成長を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 検討単位 | 金額 (米ドル)・数量 (トン) |

| セグメント別 | タイプ・用途・形態・原料・加工法・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

イエロースプリットピーは、世界の市場で急速に人気を集めており、金額ベースで最大のシェアを持つと予測されています。イエロースプリットピーは、高タンパク質含有量、食品・飲料用途における汎用性、栽培における持続可能性、植物ベースの食事のトレンドとの調和により、市場を牽引する重要な役割を果たしています。イエロースプリットピーは、土壌中で窒素を固定する能力があるため持続可能な作物であり、合成肥料の必要性を減らすことができます。さらに、牛肉や鶏肉のような動物性タンパク質源に比べ、水や土地などの資源が比較的少なくて済みます。イエロースプリットピーの持続可能性は、環境に優しく倫理的に調達された製品に対する消費者の嗜好の高まりと一致しており、採用が促進されています。

形態別では、ドライ形態が金額ベースで市場を独占しています。エンドウ豆タンパク質のドライパウダーは、筋肉増強と全体的な健康に必要な必須アミノ酸を含む、濃縮された植物性タンパク源を提供します。消費者が特に植物性の食生活においてタンパク質の摂取を優先する中、ドライパウダーの栄養面での利点は市場の成長促進要因なっていますドライタイプは、液体やウェットタイプに比べ、保存、輸送、取り扱いが容易です。保存期間が長いため、製造業者は腐敗を心配することなくさまざまな食品や飲食品に取り入れることができ、全体的な効率と費用対効果を高めることができます。

予測期間中、アジア太平洋地域がもっとも高い成長率を示すと予測されています。United Nations Population Fund's (UNFPA) のState of World Population Reportによると、2023年半ばまでのインドの人口は14億2,860万人、中国は14億2,570万人と推定されています。アジア太平洋地域の人口の急増と食生活の変化が、植物性食品の需要を押し上げています。個人の健康、動物福祉、環境の持続可能性への懸念に後押しされた植物ベースの食生活の台頭が、ドライエンドウ豆タンパク質の需要を大幅に押し上げています。ベジタリアン、ビーガン、フレキシタリアンといったライフスタイルを採用する人が増えるにつれ、植物性タンパク質の代替品に対するニーズが高まっており、植物由来で栄養価が高いドライエンドウ豆タンパク質は好ましい選択肢として位置づけられ、同地域での採用が促進されています。

当レポートでは、世界のエンドウ豆タンパク質の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- サプライチェーン分析

- バリューチェーン分析

- 特許分析

- 規制状況

- エコシステムマップ

- 顧客のビジネスに影響を与える動向/ディスラプション

- 技術分析

- ポーターのファイブフォース分析

- 貿易データ分析

- 価格分析

- ケーススタディ分析

- 主要なステークホルダーと購入基準

- 主な会議とイベント

- 投資と資金調達のシナリオ

第7章 エンドウ豆タンパク質市場:タイプ別

- 分離物

- 濃縮物

- テクスチャード加工

第8章 エンドウ豆タンパク質市場:原料別

- イエロースプリットピー

- ヒヨコ豆

- レンズ豆

第9章 エンドウ豆タンパク質市場:形態別

- ドライ

- ウェット

第10章 エンドウ豆タンパク質市場:加工法別

- ドライ加工

- ウェット加工

第11章 エンドウ豆タンパク質市場:用途別

- 食品

- 肉代替品

- パフォーマンス栄養

- 機能性食品

- スナック

- ベーカリー製品

- 菓子類

- その他

- 飲料

- その他

第12章 エンドウ豆タンパク質市場:地域

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第13章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析:部門別

- 市場シェア分析

- ブランド/製品の比較

- 企業価値評価

- 主要企業:年間収益・成長率

- 財務指標

- 世界の主要市場参入企業のスナップショット

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- ROQUETTE FRERES

- ADM

- INGREDION

- KERRY GROUP PLC.

- GLANBIA PLC

- CARGILL, INCORPORATED

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- PURIS

- EMSLAND GROUP

- YANTAI SHUANGTA FOODS CO., LTD.

- BURCON

- AXIOM FOODS INC.

- SHANDONG JIANYUAN GROUP

- ET-CHEM

- AGT FOOD AND INGREDIENTS

- その他の企業

- THE GREEN LABS LLC

- COSUCRA

- NUTRI-PEA

- SOTEXPRO

- NATURZ ORGANICS

- FENCHEM INC

- PROEON

- SUN NUTRAFOODS

- INNOVOPRO

- CHICKP

第15章 隣接市場および関連市場

第16章 付録

The pea protein market is estimated at USD 2.1 billion in 2024 and is projected to reach USD 3.7 billion by 2029, at a CAGR of 12.0% from 2024 to 2029. Pea protein is trending in the market due to several key factors. As it caters to the growing demand for plant-based protein alternatives, fueled by increasing health awareness and preferences for vegetarian and vegan diets. It is rich in essential amino acids and free from common allergens like soy and dairy, makes it a versatile ingredient for a variety of food and beverage products. Additionally, its sustainable production process aligns with consumers' growing concerns about environmental impact and ethical sourcing. Advancements in processing technologies have also enhanced the taste, texture, and functionality of pea protein, expanding its use in various formulations. Food manufacturers are increasingly incorporating pea protein into their product offerings, driving its prominence in the market and facilitating continued growth in this segment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) and Volume (Tons) |

| Segments | By Type, By Application, By Form, By Source, By Processing Method and By Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

"Yellow split peas is gaining rapid popularity in the pea protein market across the globe and is forecasted to have largest market share in terms of value."

Yellow split peas play a significant role in driving the pea protein market due to their high protein content, versatility in food applications, sustainability in cultivation, and alignment with plant-based dietary trends, thereby enhancing the availability and appeal of pea protein as a sought-after ingredient in various food and beverage products. Yellow split peas are a sustainable crop choice due to their ability to fix nitrogen in the soil, reducing the need for synthetic fertilizers. Additionally, they require relatively fewer resources, such as water and land, compared to animal-based protein sources like beef or chicken. The sustainability of yellow split peas aligns with the growing consumer preference for eco-friendly and ethically sourced products, driving their adoption in the pea protein market.

"By form, dry form dominated the market for pea protein in value terms."

Dry pea protein powder offers a concentrated source of plant-based protein, containing essential amino acids necessary for muscle building and overall health. As consumers prioritize protein intake, particularly in plant-based diets, the nutritional benefits of dry pea protein powder drive its market growth. Dry pea protein is easy to store, transport, and handle compared to liquid or wet forms. Its extended shelf life makes it convenient for manufacturers to stock and incorporate into various food and beverage products without concerns about spoilage, enhancing overall efficiency and cost-effectiveness.

"Asia Pacific is projected to witness the highest growth rate during the forecast period."

India's population by mid-2023 is estimated at 1.4286 billion, and 1.4257 billion for China according to the United Nations Population Fund's (UNFPA) "State of World Population Report". Asia Pacific's burgeoning population and changing dietary habits are propelling the demand for plant based foods. The rise of plant-based diets, driven by concerns for personal health, animal welfare, and environmental sustainability, has significantly boosted the demand for dry pea protein. As more individuals adopt vegetarian, vegan, or flexitarian lifestyles, there is a growing need for plant-based protein alternatives, positioning dry pea protein as a preferred option due to its plant-derived origin and nutritional benefits, driving their adoption in the region.

The break-up of the profile of primary participants in the pea protein market:

- By Company: Tier 1- 40%, Tier 2- 20% and Tier 3- 40%.

- By Designation: CXO's: 26%, Managers: 30% and Executives: 44%

- By Region: North America - 20%, Europe - 20%, Asia Pacific - 40%, South America - 10% and RoW - 10%

Key Market Players

Key players operating in the pea protein market include Roquette Freres (France), Cargill, Incorporated (US), Glanbia PLC (Ireland), Kerry (Ireland), Ingredion Incorporated (US), Emsland Group (Germany), Yantai Shuangta Foods Co, Ltd (China), The Scoular Company (US), Burcan Nutrascience Corp (Canada), Shandong Jianyuan Group (China), ET-Chem (China), AGT Foods and Ingredients (Canada), The Green Labs LLC (US) and Axiom Foods Inc (US).

Research Coverage:

This research report categorizes the pea protein market by type (Isolates, Concentrates and Textured), application (Food, Beverages, and Other Applications), form (Dry and Wet), source (Chickpeas, Yellow Split Peas and Lentils), processing method and region (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the pea protein market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products and services; key strategies; contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the pea protein market. Competitive analysis of upcoming startups in the pea protein market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall pea protein market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing vegan population and popularity of plant-based products), restraints (High cost of raw material), opportunities (Increasing focus on innovation and developments of better pea protein extracts & products in global markets), and challenges (Supply constraints due to unstable production of peas hampering growth prospects) influencing the growth of the pea protein market.

- Product Development/Innovation: Detailed insights on research & development activities, and new product & service launches in the pea protein market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the pea protein market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the pea protein market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Roquette Freres (France), Cargill, Incorporated (US), Glanbia PLC (Ireland), Kerry (Ireland), Ingredion Incorporated (US), Emsland Group (Germany), Yantai Shuangta Foods Co, Ltd (China), The Scoular Company (US), Burcan Nutrascience Corp (Canada), Shandong Jianyuan Group (China), ET-Chem (China), AGT Foods and Ingredients (Canada), The Green Labs LLC (US) and Axiom Foods Inc (US) among others in the pea protein market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 PEA PROTEIN MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONAL SEGMENTATION

- 1.3.4 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2017-2022

- 1.4.2 VOLUME

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PEA PROTEIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of Interviews with Experts

- FIGURE 3 BREAKDOWN OF INTERVIEWS WITH EXPERTS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 PEA PROTEIN MARKET SIZE ESTIMATION - DEMAND SIDE

- FIGURE 5 PEA PROTEIN MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.2.2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 PEA PROTEIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 RECESSION MACRO INDICATORS

- FIGURE 8 INDICATORS OF RECESSION

- FIGURE 9 GLOBAL INFLATION RATE, 2013-2022

- FIGURE 10 GLOBAL GDP: 2013-2022 (USD TRILLION)

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON PEA PROTEIN MARKET

- FIGURE 12 PEA PROTEIN MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 3 PEA PROTEIN MARKET SNAPSHOT, 2024 VS. 2029

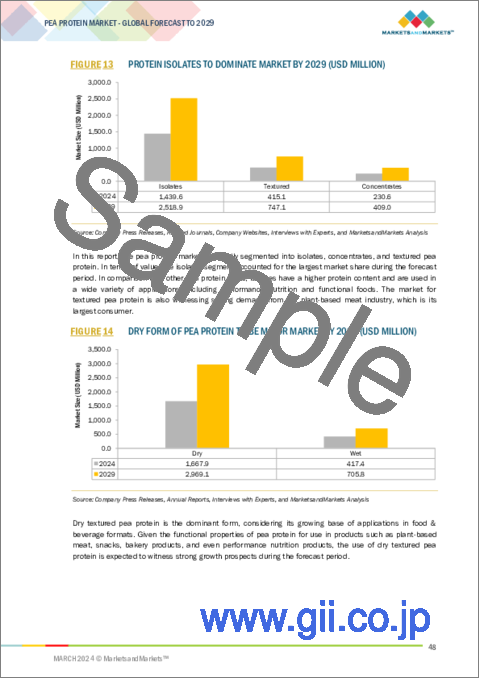

- FIGURE 13 PROTEIN ISOLATES TO DOMINATE MARKET BY 2029 (USD MILLION)

- FIGURE 14 DRY FORM OF PEA PROTEIN TO BE MAJOR MARKET BY 2029 (USD MILLION)

- FIGURE 15 YELLOW SPLIT PEAS TO BE MAJOR PEA PROTEIN SOURCE BY 2029 (USD MILLION)

- FIGURE 16 FOOD APPLICATIONS TO HOLD LARGEST SHARE IN PEA PROTEIN MARKET, 2029 (USD MILLION)

- FIGURE 17 PEA PROTEIN MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PEA PROTEIN MARKET

- FIGURE 18 RISING DEMAND FOR PLANT-BASED MEAT ALTERNATIVES AND FUNCTIONAL FOODS PRESENTS OPPORTUNITIES

- 4.2 EUROPE: PEA PROTEIN MARKET, BY TYPE & KEY COUNTRY

- FIGURE 19 ISOLATES ACCOUNTED FOR LARGEST SHARE OF EUROPEAN PEA PROTEIN MARKET IN 2023

- 4.3 PEA PROTEIN MARKET, BY TYPE

- FIGURE 20 PEA PROTEIN ISOLATES TO DOMINATE THROUGHOUT FORECAST PERIOD (USD MILLION)

- 4.4 PEA PROTEIN MARKET, BY SOURCE

- FIGURE 21 YELLOW SPLIT PEAS TO BE MAJOR SEGMENT FROM 2024 TO 2029 (USD MILLION)

- 4.5 PEA PROTEIN MARKET, BY FORM

- FIGURE 22 DRY PEA PROTEIN TO BE LARGER SEGMENT THROUGHOUT FORECAST PERIOD (USD MILLION)

- 4.6 PEA PROTEIN MARKET, BY APPLICATION

- FIGURE 23 FOOD TO BE DOMINANT APPLICATION THROUGHOUT FORECAST PERIOD (USD MILLION)

- 4.7 PEA PROTEIN MARKET: KEY COUNTRIES

- FIGURE 24 MARKET IN JAPAN TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATOR

- 5.2.1 GLOBAL PRODUCTION OF AND INNOVATION IN PEA CROPS

- FIGURE 25 GLOBAL CHICKPEA AND GREEN PEA PRODUCTION, 2016-2020 (MILLION TONNES)

- FIGURE 26 GLOBAL PEA PRODUCTION, 2021 (MILLION TONNES)

- 5.3 MARKET DYNAMICS

- FIGURE 27 PEA PROTEIN MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing vegan population and popularity of plant-based products

- FIGURE 28 TOP FIVE COUNTRIES WITH VEGAN POPULATION, 2020

- 5.3.1.2 Advancements in extraction and processing technologies

- FIGURE 29 GLOBAL RISE IN PATENTS GRANTED FOR NEW PEA PROTEIN EXTRACTION PROCESSES, 2018-2023

- FIGURE 30 TOP PATENT APPLICANT COMPANIES IN PEA PROTEIN MARKET, 2018-2023

- 5.3.1.3 Growing consumer awareness about nutritional benefits offered by pea and pea-based products

- 5.3.1.4 Increase in demand for gluten-free food products

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost of raw material

- 5.3.2.2 Low processing output, resulting in limited supply to manufacturers

- FIGURE 31 PEA EXTRACTION: INDUSTRIAL PROCESS

- FIGURE 32 PEA EXTRACTION: PILOT PROCESS

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing focus on innovation in global market

- 5.3.3.2 Hypoallergenic properties compared to other plant-based proteins

- TABLE 4 PROTEIN SOURCES: COMPARISON

- 5.3.3.3 Advancements in texture properties that support adoption in baking and meat processing

- 5.3.3.4 Rise in demand from pet food industry

- 5.3.4 CHALLENGES

- 5.3.4.1 Supply constraints due to unstable production of peas

- 5.3.4.2 Presence of alternative plant proteins

- FIGURE 33 PLANT-BASED PROTEINS: ESTABLISHED CROPS VS. FUTURE CROPS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 34 IMPORTANCE OF MANUFACTURING IN SUPPLY CHAIN OF PEA PROTEINS

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 35 RESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCING OF PEA PROTEIN CONTRIBUTE MAJOR VALUE

- 6.4 PATENT ANALYSIS

- FIGURE 36 NUMBER OF PATENTS GRANTED BETWEEN 2018 AND 2023

- FIGURE 37 TOP 10 INVESTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 5 PATENTS PERTAINING TO PEA PROTEINS, 2020-2023

- 6.5 REGULATORY LANDSCAPE

- 6.5.1 REGULATORY LANDSCAPE

- 6.5.1.1 North America

- 6.5.1.1.1 US

- 6.5.1.2 Europe

- 6.5.1.2.1 European Union

- 6.5.1.3 Asia Pacific

- 6.5.1.3.1 China

- 6.5.1.3.2 India

- 6.5.1.3.3 Japan

- 6.5.1.4 South America

- 6.5.1.4.1 Brazil

- 6.5.1.1 North America

- 6.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5.1 REGULATORY LANDSCAPE

- 6.6 ECOSYSTEM MAP

- FIGURE 38 PEA PROTEIN MARKET ECOSYSTEM

- FIGURE 39 PEA PROTEIN MARKET MAP

- TABLE 9 PEA PROTEIN MARKET: ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 40 TRENDS/DISRUPTIONS IMPACTING BUYERS IN PEA PROTEIN MARKET

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 FERMENTATION

- 6.8.2 IOT (INTERNET OF THINGS) TECHNOLOGY

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 PEA PROTEIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.9.2 BARGAINING POWER OF SUPPLIERS

- 6.9.3 BARGAINING POWER OF BUYERS

- 6.9.4 THREAT OF SUBSTITUTES

- 6.9.5 THREAT OF NEW ENTRANTS

- 6.10 TRADE DATA ANALYSIS

- TABLE 11 EXPORT DATA OF HS CODE 210610 FOR KEY COUNTRIES, 2020-2022 (KG)

- TABLE 12 IMPORT DATA OF HS CODE 210610 FOR KEY COUNTRIES, 2020-2022 (KG)

- 6.11 PRICING ANALYSIS

- 6.11.1 INTRODUCTION

- 6.11.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- FIGURE 41 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE (USD/KG)

- 6.11.3 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 13 PEA PROTEIN MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/TON)

- 6.11.4 AVERAGE SELLING PRICE TREND, BY TYPE

- FIGURE 42 AVERAGE SELLING PRICE TREND, BY TYPE (USD/TON)

- 6.12 CASE STUDY ANALYSIS: PEA PROTEIN MARKET

- TABLE 14 GLANBIA PLC DEVELOPS INGREDIENTS FOR BLUEBERRY PANCAKE PEA PROTEIN CEREAL

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN PEA PROTEIN MARKET

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN PEA PROTEIN MARKET

- 6.13.2 BUYING CRITERIA

- FIGURE 44 KEY BUYING CRITERIA FOR PEA PROTEIN TYPES

- TABLE 16 KEY BUYING CRITERIA FOR PEA PROTEIN TYPES

- 6.14 KEY CONFERENCES & EVENTS IN 2024

- TABLE 17 PEA PROTEIN MARKET: KEY CONFERENCES & EVENTS

- 6.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 45 INVESTMENT AND FUNDING SCENARIO

7 PEA PROTEIN MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 46 PEA PROTEIN MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- TABLE 18 PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 19 PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 20 PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 21 PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KT)

- 7.2 ISOLATES

- 7.2.1 GROWING INNOVATION FOR HIGH-QUALITY PROTEIN ISOLATES TO DRIVE SEGMENT

- TABLE 22 ISOLATES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 23 ISOLATES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

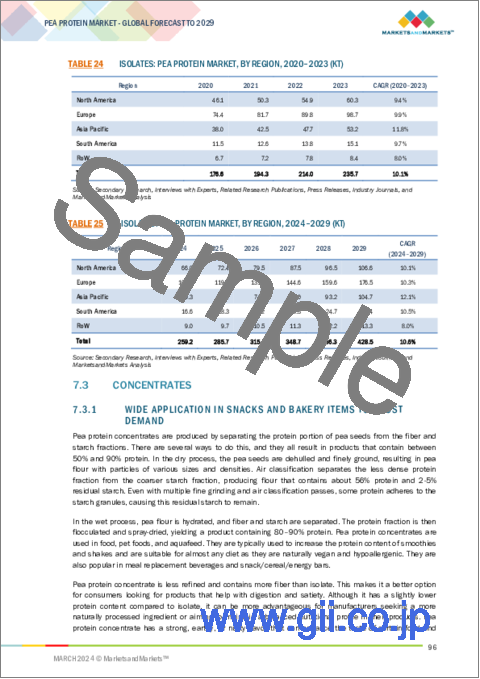

- TABLE 24 ISOLATES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 25 ISOLATES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (KT)

- 7.3 CONCENTRATES

- 7.3.1 WIDE APPLICATION IN SNACKS AND BAKERY ITEMS TO BOOST DEMAND

- TABLE 26 CONCENTRATES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 CONCENTRATES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 CONCENTRATES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 29 CONCENTRATES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (KT)

- 7.4 TEXTURED

- 7.4.1 NUTRITIONAL BENEFITS AND FUNCTIONAL ATTRIBUTES TO DRIVE DEMAND

- TABLE 30 TEXTURED: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 TEXTURED: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 TEXTURED: PEA PROTEIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 33 TEXTURED: PEA PROTEIN MARKET, BY REGION, 2024-2029 (KT)

8 PEA PROTEIN MARKET, BY SOURCE

- 8.1 INTRODUCTION

- TABLE 34 COMPARISON OF ESSENTIAL AMINO ACID PROFILES IN PEAS, SOYBEAN, RICE, AND WHEAT

- TABLE 35 AMINO ACID COMPOSITION OF LENTILS, PEAS, AND CHICKPEAS

- FIGURE 47 GLOBAL PRODUCTION OF PULSES (LAKH TONS), 2020

- FIGURE 48 PEA PROTEIN MARKET, BY SOURCE, 2024 VS. 2029 (USD MILLION)

- TABLE 36 PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 37 PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- 8.2 YELLOW SPLIT PEAS

- 8.2.1 HIGH PRODUCTION RATE AND PROTEIN CONTENT TO BOOST DEMAND

- TABLE 38 YELLOW SPLIT PEAS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 YELLOW SPLIT PEAS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 CHICKPEAS

- 8.3.1 IMPROVEMENTS IN PROCESSING TECHNOLOGY TO DRIVE GROWTH

- FIGURE 49 KEY COUNTRIES WITH CHICKPEA PRODUCTION (MILLION TONNES), 2019

- TABLE 40 CHICKPEAS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 CHICKPEAS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4 LENTILS

- 8.4.1 HIGH PRODUCTION, EASY AVAILABILITY, AND LOW COSTS TO DRIVE GLOBAL DEMAND

- TABLE 42 LENTILS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 LENTILS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

9 PEA PROTEIN MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 50 PEA PROTEIN MARKET, BY FORM, 2024 VS. 2029 (USD MILLION)

- TABLE 44 PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 45 PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- 9.2 DRY

- 9.2.1 DEMAND FOR PLANT-BASED MEATS AND SNACKS TO SUPPLEMENT SEGMENT GROWTH

- TABLE 46 DRY PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 DRY PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 WET

- 9.3.1 PERFORMANCE NUTRITION APPLICATIONS TO SUPPORT GROWTH

- TABLE 48 WET PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 WET PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

10 PEA PROTEIN MARKET, BY PROCESSING METHOD

- 10.1 DRY PROCESSING

- 10.1.1 INNOVATION IN DIVERSE FOOD SECTORS - KEY DRIVER

- 10.2 WET PROCESSING

- 10.2.1 SUPERIOR FUNCTIONALITY AND PURITY - KEY DRIVERS

11 PEA PROTEIN MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 51 PEA PROTEIN MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- TABLE 50 PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 51 PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 11.2 FOOD

- TABLE 52 FOOD: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 FOOD: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 FOOD: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 55 FOOD: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 11.2.1 MEAT SUBSTITUTES

- 11.2.1.1 Global trends of plant-based meats and veganism drive segment

- TABLE 56 MEAT SUBSTITUTES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 MEAT SUBSTITUTES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.2 PERFORMANCE NUTRITION

- 11.2.2.1 Increasing cases of lactose intolerance and adoption in supplements to drive adoption

- TABLE 58 PERFORMANCE NUTRITION: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 PERFORMANCE NUTRITION: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.3 FUNCTIONAL FOODS

- 11.2.3.1 Growing awareness about functional benefits of pea protein supports growth

- TABLE 60 FUNCTIONAL FOODS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 FUNCTIONAL FOODS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.4 SNACKS

- 11.2.4.1 Spike in demand for healthy snacking alternatives to drive demand

- TABLE 62 SNACKS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 SNACKS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.5 BAKERY PRODUCTS

- 11.2.5.1 Demand for healthy alternatives in baking applications

- FIGURE 52 TOP EXPORTERS AND IMPORTERS OF BAKED GOODS, 2021

- TABLE 64 BAKERY PRODUCTS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 BAKERY PRODUCTS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.6 CONFECTIONERIES

- 11.2.6.1 Consumer demand for healthier confectionery products to drive segment

- FIGURE 53 GLOBAL INCREASE IN CONFECTIONERY EXPORTS, 2004-2020

- TABLE 66 CONFECTIONERIES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 CONFECTIONERIES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.7 OTHER FOOD APPLICATIONS

- TABLE 68 OTHER FOOD APPLICATIONS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 OTHER FOOD APPLICATIONS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.3 BEVERAGES

- 11.3.1 EASY SOLUBILITY AND ADOPTION IN PLANT-BASED BEVERAGES TO SUPPORT GROWTH

- TABLE 70 BEVERAGES: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 BEVERAGES: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.4 OTHER APPLICATIONS

- 11.4.1 BENEFITS OF PEA PROTEINS IN ANIMAL HEALTH AND WELL-BEING TO DRIVE DEMAND

- TABLE 72 OTHER APPLICATIONS: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

12 PEA PROTEIN MARKET, REGION

- 12.1 INTRODUCTION

- FIGURE 54 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 74 PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 75 PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 PEA PROTEIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 77 PEA PROTEIN MARKET, BY REGION, 2024-2029 (KT)

- 12.2 NORTH AMERICA

- FIGURE 55 SHARE OF DEATHS ATTRIBUTED TO OBESITY IN NORTH AMERICA, 2019 (%)

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 56 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 57 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- TABLE 78 NORTH AMERICA: PEA PROTEIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: PEA PROTEIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 83 NORTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 84 NORTH AMERICA: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 87 NORTH AMERICA: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Rise of veganism and rising concerns about food sustainability to drive pea protein demand

- TABLE 92 US: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 93 US: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Rapid growth and expansion in market driven by high production volumes of dry pea

- FIGURE 58 GROWING PEA PRODUCTION IN CANADA, 2017-2020 (KT)

- TABLE 94 CANADA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 95 CANADA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Changing consumer preferences and plant-based food trend to boost market

- TABLE 96 MEXICO: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 97 MEXICO: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3 EUROPE

- FIGURE 59 GREENHOUSE GAS EMISSIONS FROM AVERAGE FOOD CONSUMPTION

- FIGURE 60 EUROPE: REGIONAL SNAPSHOT

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 61 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 62 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- TABLE 98 EUROPE: PEA PROTEIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 99 EUROPE: PEA PROTEIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 100 EUROPE: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 101 EUROPE: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 103 EUROPE: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 104 EUROPE: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 105 EUROPE: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 107 EUROPE: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 108 EUROPE: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 111 EUROPE: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.3.2 FRANCE

- 12.3.2.1 Rise in consumption of functional foods and strong production capacities to drive market

- TABLE 112 FRANCE: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 113 FRANCE: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.3 DENMARK

- 12.3.3.1 Investments and production facilities to contribute to market growth in Denmark

- TABLE 114 DENMARK: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 115 DENMARK: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Increasing veganism trend to drive demand for pea proteins

- FIGURE 63 GERMANY: HIGHEST CONSUMED PLANT-BASED FOOD PRODUCT BRANDS, 2019

- TABLE 116 GERMANY: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 117 GERMANY: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.5 UK

- 12.3.5.1 Focus on consumption of plant-based food alternatives to propel market growth

- TABLE 118 UK: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 119 UK: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Strong agricultural output and changing consumer preferences to drive market

- TABLE 120 SPAIN: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 121 SPAIN: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.7 THE NETHERLANDS

- 12.3.7.1 Government support and rising health issues among consumers to drive growth

- TABLE 122 NETHERLANDS: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 123 NETHERLANDS: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.8 ITALY

- 12.3.8.1 Strong competition from conventional protein sources to drive demand for pea protein

- TABLE 124 ITALY: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 125 ITALY: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.9 FINLAND

- 12.3.9.1 Increasing manufacturer presence to drive market

- TABLE 126 FINLAND: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 127 FINLAND: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.10 REST OF EUROPE

- TABLE 128 REST OF EUROPE: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 129 REST OF EUROPE: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 64 ASIA PACIFIC: REGIONAL SNAPSHOT

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 65 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 66 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- TABLE 130 ASIA PACIFIC: PEA PROTEIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PEA PROTEIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 135 ASIA PACIFIC: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 136 ASIA PACIFIC: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 137 ASIA PACIFIC: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 138 ASIA PACIFIC: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 139 ASIA PACIFIC: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 140 ASIA PACIFIC: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 141 ASIA PACIFIC: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 142 ASIA PACIFIC: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Rise in demand for meat protein substitutes to fuel market

- TABLE 144 CHINA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 145 CHINA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Growth of startups in plant-based food products segment to boost demand

- TABLE 146 INDIA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 147 INDIA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Increasing vegan culture makes country lucrative market for pea protein

- TABLE 148 JAPAN: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 149 JAPAN: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Rising environmental concerns fuel market growth

- TABLE 150 AUSTRALIA & NEW ZEALAND: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 151 AUSTRALIA & NEW ZEALAND: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 152 REST OF ASIA PACIFIC: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.5 SOUTH AMERICA

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 67 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 68 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- TABLE 154 SOUTH AMERICA: PEA PROTEIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 155 SOUTH AMERICA: PEA PROTEIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 158 SOUTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 159 SOUTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 160 SOUTH AMERICA: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 162 SOUTH AMERICA: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 163 SOUTH AMERICA: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 164 SOUTH AMERICA: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 165 SOUTH AMERICA: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 166 SOUTH AMERICA: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 167 SOUTH AMERICA: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 High demand for sports nutrition to boost market growth

- TABLE 168 BRAZIL: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 169 BRAZIL: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Increasing exports due to high quality of peas to boost market

- TABLE 170 ARGENTINA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 171 ARGENTINA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- 12.5.4.1 Increasing consumer preference for plant-based food for fitness and nutrition

- TABLE 172 REST OF SOUTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.6 REST OF THE WORLD

- 12.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 69 ROW: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 70 ROW: RECESSION IMPACT ANALYSIS, 2022-2023

- TABLE 174 REST OF THE WORLD: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 175 REST OF THE WORLD: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 176 REST OF THE WORLD: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 177 REST OF THE WORLD: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 178 REST OF THE WORLD: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 179 REST OF THE WORLD: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 180 REST OF THE WORLD: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 181 REST OF THE WORLD: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 182 REST OF THE WORLD: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 183 REST OF THE WORLD: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 184 REST OF THE WORLD: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 185 REST OF THE WORLD: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 186 REST OF THE WORLD: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 187 REST OF THE WORLD: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Increasing sports activities to propel market growth

- TABLE 188 MIDDLE EAST: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 189 MIDDLE EAST: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 190 MIDDLE EAST: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 191 MIDDLE EAST: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 192 MIDDLE EAST: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 193 MIDDLE EAST: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 194 MIDDLE EAST: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 195 MIDDLE EAST: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 196 MIDDLE EAST: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 197 MIDDLE EAST: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 198 MIDDLE EAST: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 199 MIDDLE EAST: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.6.2.2 UAE

- 12.6.2.3 Saudi Arabia

- 12.6.2.4 Rest of Middle East

- 12.6.3 AFRICA

- 12.6.3.1 Easy availability of raw materials to boost market

- FIGURE 71 AFRICAN COUNTRIES IMPORT DATA FOR HS CODE 210610, 2020

- TABLE 200 AFRICA: PEA PROTEIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 201 AFRICA: PEA PROTEIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 202 AFRICA: PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 203 AFRICA: PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 204 AFRICA: PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 205 AFRICA: PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 206 AFRICA: PEA PROTEIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 207 AFRICA: PEA PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 208 AFRICA: PEA PROTEIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 209 AFRICA: PEA PROTEIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 210 AFRICA: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 211 AFRICA: PEA PROTEIN MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- 12.6.3.2 South Africa

- 12.6.3.3 Nigeria

- 12.6.3.4 Rest of Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS STRATEGIES

- TABLE 212 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PEA PROTEIN MARKET

- 13.3 SEGMENTAL REVENUE ANALYSIS

- FIGURE 72 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018-2022 (USD BILLION)

- 13.4 MARKET SHARE ANALYSIS, 2023

- TABLE 213 PEA PROTEIN MARKET: DEGREE OF COMPETITION

- 13.5 BRAND/PRODUCT COMPARISON

- FIGURE 73 PEA PROTEIN MARKET: BRAND/PRODUCT COMPARISON

- 13.6 COMPANY VALUATION

- FIGURE 74 PEA PROTEIN MARKET: COMPANY VALUATION (USD BILLION)

- 13.7 KEY PLAYERS: ANNUAL REVENUE VS. GROWTH

- FIGURE 75 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 13.8 FINANCIAL METRICS

- FIGURE 76 EV/EBITDA, 2022 (USD BILLION)

- 13.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 77 PEA PROTEIN MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2023

- 13.10 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.10.1 STARS

- 13.10.2 EMERGING LEADERS

- 13.10.3 PERVASIVE PLAYERS

- 13.10.4 PARTICIPANTS

- FIGURE 78 PEA PROTEIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 13.10.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.10.5.1 Type footprint

- TABLE 214 PEA PROTEIN MARKET: COMPANY TYPE FOOTPRINT

- 13.10.5.2 Application footprint

- TABLE 215 PEA PROTEIN MARKET: APPLICATION FOOTPRINT

- 13.10.5.3 Region footprint

- TABLE 216 PEA PROTEIN MARKET: REGION FOOTPRINT

- 13.10.5.4 Company footprint

- FIGURE 79 PEA PROTEIN MARKET: COMPANY FOOTPRINT

- 13.11 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.11.1 PROGRESSIVE COMPANIES

- 13.11.2 RESPONSIVE COMPANIES

- 13.11.3 DYNAMIC COMPANIES

- 13.11.4 STARTING BLOCKS

- FIGURE 80 PEA PROTEIN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 13.11.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- TABLE 217 PEA PROTEIN MARKET: KEY STARTUPS/SMES

- TABLE 218 PEA PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.12 COMPETITIVE SCENARIO AND TRENDS

- 13.12.1 PRODUCT LAUNCHES

- TABLE 219 PEA PROTEIN MARKET: PRODUCT LAUNCHES, JANUARY 2019-AUGUST 2022

- 13.12.2 DEALS

- TABLE 220 PEA PROTEIN MARKET: DEALS, JANUARY 2019-JANUARY 2024

- 13.12.3 EXPANSIONS

- TABLE 221 PEA PROTEIN MARKET: EXPANSIONS, JANUARY 2019-JANUARY 2024

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 ROQUETTE FRERES

- TABLE 222 ROQUETTE FRERES: BUSINESS OVERVIEW

- FIGURE 81 ROQUETTE FRERES: COMPANY SNAPSHOT

- TABLE 223 ROQUETTE FRERES: PRODUCTS/ SOLUTIONS /SERVICES OFFERED

- TABLE 224 ROQUETTE FRERES: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 225 ROQUETTE FRERES: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.2 ADM

- TABLE 226 ADM: BUSINESS OVERVIEW

- FIGURE 82 ADM: COMPANY SNAPSHOT

- TABLE 227 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ADM: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 229 ADM: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.3 INGREDION

- TABLE 230 INGREDION: BUSINESS OVERVIEW

- FIGURE 83 INGREDION: COMPANY SNAPSHOT

- TABLE 231 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 INGREDION: PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2024

- TABLE 233 INGREDION: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 234 INGREDION: EXPANSION, JANUARY 2019-JANUARY 2024

- 14.1.4 KERRY GROUP PLC.

- TABLE 235 KERRY GROUP PLC.: BUSINESS OVERVIEW

- FIGURE 84 KERRY GROUP PLC.: COMPANY SNAPSHOT

- TABLE 236 KERRY GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 KERRY GROUP PLC.: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 238 KERRY GROUP PLC.: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.5 GLANBIA PLC

- TABLE 239 GLANBIA PLC: BUSINESS OVERVIEW

- FIGURE 85 GLANBIA PLC: COMPANY SNAPSHOT

- TABLE 240 GLANBIA PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 GLANBIA PLC: DEALS, JANUARY 2019-JANUARY 2024

- 14.1.6 CARGILL, INCORPORATED

- TABLE 242 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 86 CARGILL: COMPANY SNAPSHOT

- TABLE 243 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 CARGILL, INCORPORATED: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 245 CARGILL, INCORPORATED: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.7 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 246 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 87 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 247 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 249 INTERNATIONAL FLAVORS & FRAGRANCES INC.: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.8 PURIS

- TABLE 250 PURIS: BUSINESS OVERVIEW

- TABLE 251 PURIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 PURIS: DEALS, JANUARY 2019-JANUARY 2024

- 14.1.9 EMSLAND GROUP

- TABLE 253 EMSLAND GROUP: BUSINESS OVERVIEW

- TABLE 254 EMSLAND GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 EMSLAND GROUP: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 256 EMSLAND GROUP: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.10 YANTAI SHUANGTA FOODS CO., LTD.

- TABLE 257 YANTAI SHUANGTA FOODS CO., LTD.: BUSINESS OVERVIEW

- TABLE 258 YANTAI SHUANGTA FOODS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.11 BURCON

- TABLE 259 BURCON: BUSINESS OVERVIEW

- TABLE 260 BURCON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 BURCON: PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2024

- TABLE 262 BURCON: DEALS, JANUARY 2019-JANUARY 2024

- TABLE 263 BURCON: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 14.1.12 AXIOM FOODS INC.

- TABLE 264 AXIOM FOODS INC.: BUSINESS OVERVIEW

- TABLE 265 AXIOM FOODS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 AXIOM FOODS INC.: DEALS, JANUARY 2019-JANUARY 2024

- 14.1.13 SHANDONG JIANYUAN GROUP

- TABLE 267 SHANDONG JIANYUAN GROUP: BUSINESS OVERVIEW

- TABLE 268 SHANDONG JIANYUAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 ET-CHEM

- TABLE 269 ET-CHEM: BUSINESS OVERVIEW

- TABLE 270 ET-CHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.15 AGT FOOD AND INGREDIENTS

- TABLE 271 AGT FOOD AND INGREDIENTS: BUSINESS OVERVIEW

- TABLE 272 AGT FOOD AND INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 THE GREEN LABS LLC

- 14.2.2 COSUCRA

- 14.2.3 NUTRI-PEA

- 14.2.4 SOTEXPRO

- 14.2.5 NATURZ ORGANICS

- 14.2.6 FENCHEM INC

- 14.2.7 PROEON

- 14.2.8 SUN NUTRAFOODS

- 14.2.9 INNOVOPRO

- 14.2.10 CHICKP

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 ADJACENT MARKET STUDY LIMITATIONS

- 15.3 PLANT-BASED PROTEINS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.3 PLANT-BASED PROTEINS MARKET, BY NATURE

- TABLE 273 PLANT-BASED PROTEIN MARKET, BY NATURE, 2018-2022 (USD MILLION)

- TABLE 274 PLANT-BASED PROTEIN MARKET, BY NATURE, 2023-2028 (USD MILLION)

- 15.4 PEA PROCESSED INGREDIENTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.4.3 PEA PROCESSED INGREDIENTS MARKET, BY SOURCE

- TABLE 275 PEA PROCESSED INGREDIENTS MARKET, BY SOURCE, 2019-2026 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS