|

|

市場調査レポート

商品コード

1729654

日本のリアルタイム決済市場レポート:決済タイプ別、地域別、2025年~2033年Japan Real Time Payment Market Report by Type of Payment (P2P, P2B), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 日本のリアルタイム決済市場レポート:決済タイプ別、地域別、2025年~2033年 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 121 Pages

納期: 5~7営業日

|

全表示

- 概要

- 目次

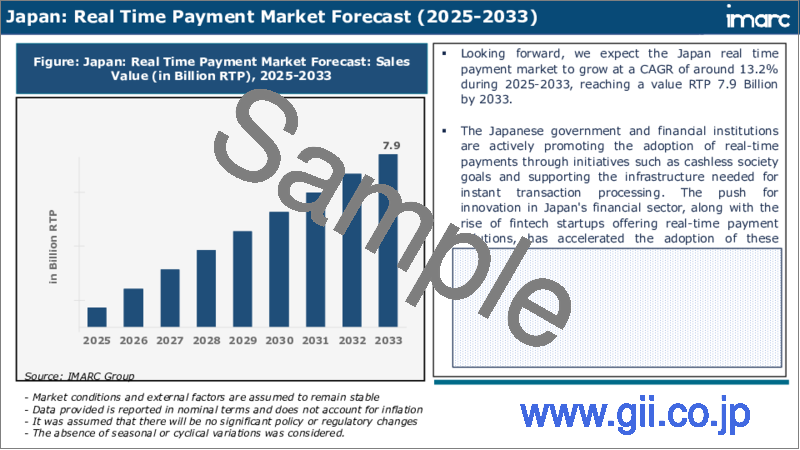

日本のリアルタイム決済の市場規模は2024年に24億RTPに達しました。IMARCグループは、2025年から2033年にかけての成長率(CAGR)は13.2%で、2033年には79億RTPに達すると予測しています。eコマースの拡大、地域のデジタル化へのシフト、デジタル決済ソリューションへの需要を生み出したスマートフォンの普及が、主に市場を牽引しています。

本レポートで扱う主な質問

- 日本のリアルタイム決済市場はこれまでどのように推移し、今後どのように推移するのか?

- COVID-19が日本のリアルタイム決済市場に与えた影響は?

- 日本のリアルタイム決済市場の決済タイプ別区分は?

- 日本のリアルタイム決済市場のバリューチェーンにおける様々なステージとは?

- 日本のリアルタイム決済の主な促進要因と課題は?

- 日本のリアルタイム決済市場の構造と主要プレーヤーは?

- 日本のリアルタイム決済市場における競合の程度は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 市場推定

- 調査手法

第3章 エグゼクティブサマリー

第4章 日本のリアルタイム決済市場:イントロダクション

- 概要

- 市場力学

- 業界動向

- 競合情報

第5章 日本のリアルタイム決済市場情勢

- 過去および現在の市場動向(2019~2024年)

- 市場予測(2025~2033年)

第6章 日本のリアルタイム決済市場:決済タイプ別の内訳

- P2P

- P2B

第7章 日本のリアルタイム決済市場:競合情勢

- 概要

- 市場構造

- 市場企業のポジショニング

- 主要成功戦略

- 競合ダッシュボード

- 企業評価象限

第8章 主要企業のプロファイル

第9章 日本のリアルタイム決済市場:業界分析

- 促進要因、抑制要因、機会

- ポーターのファイブフォース分析

- バリューチェーン分析

第10章 付録

Japan real time payment market size reached 2.4 Billion RTP in 2024. Looking forward, IMARC Group expects the market to reach 7.9 Billion RTP by 2033, exhibiting a growth rate (CAGR) of 13.2% during 2025-2033. The growing e-commerce as well as the regional shift towards digitalization and the proliferation of smartphones that have created a demand for digital payment solutions, is primarily driving the market.

Real time payment refers to a financial transaction processing system that enables instantaneous and immediate fund transfers between individuals, businesses, or institutions. Unlike traditional payment methods that involve delays due to batch processing or clearing times, real-time payments occur in a matter of seconds, providing a swift and efficient means of transferring money. This technology relies on advanced payment infrastructures and networks to facilitate instantaneous settlement, often 24/7, including weekends and holidays. Real time payments have become increasingly popular in recent years, revolutionizing the way people handle financial transactions. They offer benefits such as enhanced convenience, reduced processing costs, improved cash flow management, and greater transparency. Some commonly used real time payment systems include the Faster Payments Service (FPS) in the UK and the Real-Time Gross Settlement (RTGS) system in India. These systems have significantly accelerated the pace of financial transactions, empowering individuals and businesses with the ability to transfer funds in real time, supporting a wide range of financial activities, from bill payments to peer-to-peer transfers.

Japan Real Time Payment Market Trends:

The real time payment market in Japan is experiencing unprecedented growth, primarily driven by several key factors. Firstly, the increasing digitalization of financial services has paved the way for real time payment systems to flourish. As consumers and businesses increasingly demand instant, convenient, and efficient transactions, financial institutions are compelled to adopt real time payment solutions to remain competitive. Furthermore, the regional economy's evolution toward a 24/7 operational model has fueled the need for real time payment capabilities. This shift is particularly evident in the e-commerce sector, where consumers expect instantaneous payment confirmation, thereby boosting the demand for real time payment infrastructure. Additionally, regulatory initiatives and mandates have played a pivotal role in driving the adoption of real time payment systems. Governments and regulatory bodies in Japan have recognized the benefits of real time payments in reducing fraud, enhancing transparency, and fostering financial inclusion. As a result, they have actively promoted and enforced the implementation of real time payment frameworks. Moreover, the proliferation of mobile devices and the increasing popularity of mobile banking apps is expected to drive the real time payment market in Japan.

Japan Real Time Payment Market Segmentation:

Type of Payment Insights:

- P2P

- P2B

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key Questions Answered in This Report:

- How has the Japan real time payment market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan real time payment market?

- What is the breakup of the Japan real time payment market on the basis of type of payment?

- What are the various stages in the value chain of the Japan real time payment market?

- What are the key driving factors and challenges in the Japan real time payment?

- What is the structure of the Japan real time payment market and who are the key players?

- What is the degree of competition in the Japan real time payment market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Japan Real Time Payment Market - Introduction

- 4.1 Overview

- 4.2 Market Dynamics

- 4.3 Industry Trends

- 4.4 Competitive Intelligence

5 Japan Real Time Payment Market Landscape

- 5.1 Historical and Current Market Trends (2019-2024)

- 5.2 Market Forecast (2025-2033)

6 Japan Real Time Payment Market - Breakup by Type of Payment

- 6.1 P2P

- 6.1.1 Overview

- 6.1.2 Historical and Current Market Trends (2019-2024)

- 6.1.3 Market Forecast (2025-2033)

- 6.2 P2B

- 6.2.1 Overview

- 6.2.2 Historical and Current Market Trends (2019-2024)

- 6.2.3 Market Forecast (2025-2033)

7 Japan Real Time Payment Market - Competitive Landscape

- 7.1 Overview

- 7.2 Market Structure

- 7.3 Market Player Positioning

- 7.4 Top Winning Strategies

- 7.5 Competitive Dashboard

- 7.6 Company Evaluation Quadrant

8 Profiles of Key Players

- 8.1 Company A

- 8.1.1 Business Overview

- 8.1.2 Services Offered

- 8.1.3 Business Strategies

- 8.1.4 SWOT Analysis

- 8.1.5 Major News and Events

- 8.2 Company B

- 8.2.1 Business Overview

- 8.2.2 Services Offered

- 8.2.3 Business Strategies

- 8.2.4 SWOT Analysis

- 8.2.5 Major News and Events

- 8.3 Company C

- 8.3.1 Business Overview

- 8.3.2 Services Offered

- 8.3.3 Business Strategies

- 8.3.4 SWOT Analysis

- 8.3.5 Major News and Events

- 8.4 Company D

- 8.4.1 Business Overview

- 8.4.2 Services Offered

- 8.4.3 Business Strategies

- 8.4.4 SWOT Analysis

- 8.4.5 Major News and Events

- 8.5 Company E

- 8.5.1 Business Overview

- 8.5.2 Product Portfolio

- 8.5.3 Business Strategies

- 8.5.4 SWOT Analysis

- 8.5.5 Major News and Events

9 Japan Real Time Payment Market - Industry Analysis

- 9.1 Drivers, Restraints and Opportunities

- 9.1.1 Overview

- 9.1.2 Drivers

- 9.1.3 Restraints

- 9.1.4 Opportunities

- 9.2 Porters Five Forces Analysis

- 9.2.1 Overview

- 9.2.2 Bargaining Power of Buyers

- 9.2.3 Bargaining Power of Suppliers

- 9.2.4 Degree of Competition

- 9.2.5 Threat of New Entrants

- 9.2.6 Threat of Substitutes

- 9.3 Value Chain Analysis