|

|

市場調査レポート

商品コード

1392172

リアルタイム決済市場規模:コンポーネント別、展開モデル別、決済タイプ別、組織規模別、エンドユーザー別&予測、2023-2032年Real-Time Payments Market Size-By Component (Solution, Service), Deployment Model (On-premises, Cloud), Payment Type (Person-to-Person, Person-to-Business, Business-to-Consumer, Business-to-Business), Organization Size, End-user & Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| リアルタイム決済市場規模:コンポーネント別、展開モデル別、決済タイプ別、組織規模別、エンドユーザー別&予測、2023-2032年 |

|

出版日: 2023年10月17日

発行: Global Market Insights Inc.

ページ情報: 英文 250 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のリアルタイム決済市場は、決済処理の高速化ニーズの高まり、デジタル化の進展、金融包摂の重視の高まりなどを背景に、2032年までのCAGRが26%を超えると予想されています。

FEDが2022年に発表した記事によると、調査回答者の約8割がビジネス取引でより迅速な決済を利用することに関心を示しています。さらに、83%がフィンテック決済アプリやデジタルウォレットを時々利用していました。スピードと効率が最重要視される時代において、企業も消費者も同様に、リアルタイム処理を提供する決済ソリューションを求めています。リアルタイム決済の瞬時性はこの需要に対応し、従来の決済方法を超越した変革的な金融体験を提供します。

さらに、eコマース、デジタルバンキング、モバイル決済プラットフォームの急増は、リアルタイム決済ソリューションの緊急性を浮き彫りにしており、同市場の大幅な成長を後押ししています。

サービス分野は、2032年までに大幅な成長が見込まれます。決済ゲートウェイから不正検知システムに至る包括的なサービス・コンポーネントは、リアルタイム決済システムのシームレスな運用を確保する上で極めて重要です。企業や金融機関がユーザーエクスペリエンスの向上に努める中、セキュリティ、効率性、信頼性を保証する堅牢なサービスコンポーネントへの需要が高まっています。

特にデータ・セキュリティが最重要視される分野での導入が増加していることから、オンプレミス導入分野のシェアは予測期間中に顕著な成長が見込まれます。企業がサイバーセキュリティの複雑さに取り組む中、オンプレミス展開ではリアルタイム決済システム専用の管理された環境が提供されます。このモデルでは、機密性の高い金融データが組織のインフラ内に留まるため、データ漏洩や不正アクセスに関する懸念に対処できます。データセキュリティと法規制コンプライアンスを重視する傾向が強まっていることが、オンプレミス展開分野を後押ししています。

アジア太平洋地域のリアルタイム決済市場は、スマートフォンの普及、インターネットへのアクセス環境の向上、急成長するフィンテックエコシステムに牽引され、2032年まで急速な成長が見込まれています。中国やインドなどの国々ではデジタル決済の導入が急増しており、リアルタイム決済ソリューションは日々の金融取引に不可欠なものとなっています。キャッシュレス経済の導入に注力し、リアルタイム決済システムが広く受け入れられていることが、この地域の市場見通しを形成します。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 リアルタイム決済市場の業界洞察

- COVID-19の影響

- ロシア・ウクライナ戦争の影響

- エコシステム分析

- テクノロジーとイノベーションの展望

- 特許分析

- 主要ニュースとイニシアチブ

- パートナーシップ/コラボレーション

- 合併/買収

- 投資

- 製品上市とイノベーション

- 規制状況

- 影響要因

- 促進要因

- デジタル決済の普及

- 即時の金融取引処理に対する消費者の需要の高まり

- スマートフォンやデジタル機器の普及

- 迅速かつ安全な資金移動に対するニーズの高まり

- 業界の潜在的リスク&課題

- セキュリティ侵害のリスク

- 規制コンプライアンス

- 促進要因

- 成長可能性分析

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 各社の市場シェア

- 主要市場プレーヤーの競合分析

- Visa Inc.

- PayPal Holdings, Inc.

- Mastercard, Inc.

- Fiserv, Inc.

- FIS Inc.

- ACI Worldwide, Inc.

- Finastra

- 競合のポジショニング・マトリックス

- 戦略展望マトリックス

第5章 リアルタイム決済市場推計・予測:コンポーネント別

- 主要動向:コンポーネント別

- ソリューション

- サービス

第6章 リアルタイム決済市場推計・予測:決済タイプ別

- 主要動向:決済タイプ別

- 個人間(P2P)

- 個人間(P2B)

- 企業対消費者(B2C)

- 企業間(B2B)

- その他

第7章 リアルタイム決済市場推計・予測:展開モデル別

- 主要動向:展開モデル別

- クラウドベース

- オンプレミス

第8章 リアルタイム決済市場推計・予測:組織規模別

- 主要動向:組織規模別

- 中小企業

- 大企業

第9章 リアルタイム決済市場推計・予測:エンドユーザー別

- 主要動向:エンドユーザー別

- BFSI

- 小売

- ヘルスケア

- 政府機関

- IT・通信

- 製造業

- その他

第10章 リアルタイム決済市場推計・予測:地域別

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 東南アジア

- ニュージーランド

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- UAE

- サウジアラビア

- 南アフリカ

第11章 企業プロファイル

- ACI Worldwide, Inc.

- Finastra

- FIS Inc.

- Fiserv, Inc.

- Jack Henry

- JPMorgan Chase & Co.

- Mastercard, Inc.

- Montran Corp.

- PayPal Holdings, Inc.

- SWIFT

- Temenos AG

- Visa Inc.

- Volante Technologies Inc.

- Western Union

- Worldline SA

Data Tables

- TABLE 1 Global real-time payments market 360 degree synopsis, 2018-2032

- TABLE 2 Real-time payments market, 2018 - 2022,

- TABLE 3 Real-time payments market, 2023 - 2032,

- TABLE 4 Real-time payments TAM, 2023 - 2032

- TABLE 5 Real-time payments market, by region, 2018 - 2022 (USD Million)

- TABLE 6 Real-time payments market, by region, 2023 - 2032 (USD Million)

- TABLE 7 Real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 8 Real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 9 Real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 10 Real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 11 Real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 12 Real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 13 Real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 14 Real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 15 Real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 16 Real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 17 COVID-19 impact on the North America real-time payments market

- TABLE 18 COVID-19 impact on the Europe real-time payments market

- TABLE 19 COVID-19 impact on the Asia Pacific real-time payments market

- TABLE 20 COVID-19 impact on the Latin America real-time payments market

- TABLE 21 COVID-19 impact on the MEA real-time payments market

- TABLE 22 Vendor matrix

- TABLE 23 Patent analysis

- TABLE 24 Industry impact forces

- TABLE 25 Company market share, 2022

- TABLE 26 Competitive analysis of major market players, 2022

- TABLE 27 Solution market, 2018 - 2022 (USD Million)

- TABLE 28 Solution market, 2023 - 2032 (USD Million)

- TABLE 29 Services market, 2018 - 2022 (USD Million)

- TABLE 30 Services market, 2023 - 2032 (USD Million)

- TABLE 31 Person-to-person (P2P) market, 2018 - 2022 (USD Million)

- TABLE 32 Person-to-person (P2P) market, 2023 - 2032 (USD Million)

- TABLE 33 Person-to-business (P2B) market, 2018 - 2022 (USD Million)

- TABLE 34 Person-to-business (P2B) market, 2023 - 2032 (USD Million)

- TABLE 35 Business-to-business (B2B) market, 2018 - 2022 (USD Million)

- TABLE 36 Business-to-business (B2B) market, 2023 - 2032 (USD Million)

- TABLE 37 Business-to-consumer (B2C) market, 2018 - 2022 (USD Million)

- TABLE 38 Business-to-consumer (B2C) market, 2023 - 2032 (USD Million)

- TABLE 39 Others market, 2018 - 2022 (USD Million)

- TABLE 40 Others market, 2023 - 2032 (USD Million)

- TABLE 41 On-premises market, 2018 - 2022 (USD Million)

- TABLE 42 On-premises market, 2023 - 2032 (USD Million)

- TABLE 43 Cloud-based market, 2018 - 2022 (USD Million)

- TABLE 44 Cloud-based market, 2023 - 2032 (USD Million)

- TABLE 45 SMEs market, 2018 - 2022 (USD Million)

- TABLE 46 SMEs market, 2023 - 2032 (USD Million)

- TABLE 47 Large enterprises market, 2018 - 2022 (USD Million)

- TABLE 48 Large enterprises market, 2023 - 2032 (USD Million)

- TABLE 49 BFSI market, 2018 - 2022 (USD Million)

- TABLE 50 BFSI market, 2023 - 2032 (USD Million)

- TABLE 51 Retail market, 2018 - 2022 (USD Million)

- TABLE 52 Retail market, 2023 - 2032 (USD Million)

- TABLE 53 Healthcare market, 2018 - 2022 (USD Million)

- TABLE 54 Healthcare market, 2023 - 2032 (USD Million)

- TABLE 55 Government market, 2018 - 2022 (USD Million)

- TABLE 56 Government market, 2023 - 2032 (USD Million)

- TABLE 57 IT & Telecom market, 2018 - 2022 (USD Million)

- TABLE 58 IT & Telecom market, 2023 - 2032 (USD Million)

- TABLE 59 Manufacturing market, 2018 - 2022 (USD Million)

- TABLE 60 Manufacturing market, 2023 - 2032 (USD Million)

- TABLE 61 Others market, 2018 - 2022 (USD Million)

- TABLE 62 Others market, 2023 - 2032 (USD Million)

- TABLE 63 North America real-time payments market, 2018 - 2022 (USD Million)

- TABLE 64 North America real-time payments market, 2023 - 2032 (USD Million)

- TABLE 65 North America real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 66 North America real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 67 North America real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 68 North America real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 69 North America real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 70 North America real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 71 North America real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 72 North America real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 73 North America real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 74 North America real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 75 U.S. real-time payments market, 2018 - 2022 (USD Million)

- TABLE 76 U.S. real-time payments market, 2023 - 2032 (USD Million)

- TABLE 77 U.S. real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 78 U.S. real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 79 U.S. real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 80 U.S. real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 81 U.S. real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 82 U.S. real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 83 U.S. real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 84 U.S. real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 85 U.S. real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 86 U.S. real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 87 Canada real-time payments market, 2018 - 2022 (USD Million)

- TABLE 88 Canada real-time payments market, 2023 - 2032 (USD Million)

- TABLE 89 Canada real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 90 Canada real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 91 Canada real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 92 Canada real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 93 Canada real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 94 Canada real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 95 Canada real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 96 Canada real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 97 Canada real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 98 Canada real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 99 Europe real-time payments market, 2018 - 2022 (USD Million)

- TABLE 100 Europe real-time payments market, 2023 - 2032 (USD Million)

- TABLE 101 Europe real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 102 Europe real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 103 Europe real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 104 Europe real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 105 Europe real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 106 Europe real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 107 Europe real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 108 Europe real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 109 Europe real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 110 Europe real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 111 UK real-time payments market, 2018 - 2022 (USD Million)

- TABLE 112 UK real-time payments market, 2023 - 2032 (USD Million)

- TABLE 113 UK real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 114 UK real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 115 UK real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 116 UK real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 117 UK real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 118 UK real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 119 UK real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 120 UK real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 121 UK real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 122 UK real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 123 Germany real-time payments market, 2018 - 2022 (USD Million)

- TABLE 124 Germany real-time payments market, 2023 - 2032 (USD Million)

- TABLE 125 Germany real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 126 Germany real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 127 Germany real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 128 Germany real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 129 Germany real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 130 Germany real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 131 Germany real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 132 Germany real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 133 Germany real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 134 Germany real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 135 France real-time payments market, 2018 - 2022 (USD Million)

- TABLE 136 France real-time payments market, 2023 - 2032 (USD Million)

- TABLE 137 France real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 138 France real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 139 France real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 140 France real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 141 France real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 142 France real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 143 France real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 144 France real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 145 France real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 146 France real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 147 Italy real-time payments market, 2018 - 2022 (USD Million)

- TABLE 148 Italy real-time payments market, 2023 - 2032 (USD Million)

- TABLE 149 Italy real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 150 Italy real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 151 Italy real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 152 Italy real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 153 Italy real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 154 Italy real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 155 Italy real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 156 Italy real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 157 Italy real-time payments market, by end-user, 2018 - 2022 (USD Million)

- TABLE 158 Italy real-time payments market, by end-user, 2023 - 2032 (USD Million)

- TABLE 159 Spain real-time payments market, 2018 - 2022 (USD Million)

- TABLE 160 Spain real-time payments market, 2023 - 2032 (USD Million)

- TABLE 161 Spain real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 162 Spain real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 163 Spain real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 164 Spain real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 165 Sapin real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 166 Spain real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 167 Spain real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 168 Spain real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 169 Spain real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 170 Spain real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 171 Russia real-time payments market, 2018 - 2022 (USD Million)

- TABLE 172 Russia real-time payments market, 2023 - 2032 (USD Million)

- TABLE 173 Russia real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 174 Russia real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 175 Russia real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 176 Russia real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 177 Russia real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 178 Russia real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 179 Russia real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 180 Russia real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 181 Russia real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 182 Russia real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 183 Asia Pacific real-time payments market, 2018 - 2022 (USD Million)

- TABLE 184 Asia Pacific real-time payments market, 2023 - 2032 (USD Million)

- TABLE 185 Asia Pacific real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 186 Asia Pacific real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 187 Asia Pacific real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 188 Asia Pacific real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 189 Asia Pacific real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 190 Asia Pacific real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 191 Asia Pacific real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 192 Asia Pacific real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 193 Asia Pacific real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 194 Asia Pacific real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 195 China real-time payments market, 2018 - 2022 (USD Million)

- TABLE 196 China real-time payments market, 2023 - 2032 (USD Million)

- TABLE 197 China real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 198 China real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 199 China real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 200 China real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 201 China real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 202 China real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 203 China real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 204 China real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 205 China real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 206 China real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 207 India real-time payments market, 2018 - 2022 (USD Million)

- TABLE 208 India real-time payments market, 2023 - 2032 (USD Million)

- TABLE 209 India real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 210 India real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 211 India real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 212 India real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 213 India real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 214 India real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 215 India real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 216 India real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 217 India real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 218 India real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 219 Japan real-time payments market, 2018 - 2022 (USD Million)

- TABLE 220 Japan real-time payments market, 2023 - 2032 (USD Million)

- TABLE 221 Japan real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 222 Japan real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 223 Japan real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 224 Japan real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 225 Japan real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 226 Japan real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 227 Japan real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 228 Japan real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 229 Japan real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 230 Japan real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 231 South Korea real-time payments market, 2018 - 2022 (USD Million)

- TABLE 232 South Korea real-time payments market, 2023 - 2032 (USD Million)

- TABLE 233 South Korea real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 234 South Korea real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 235 South Korea real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 236 South Korea real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 237 South Korea real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 238 South Korea real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 239 South Korea real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 240 South Korea real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 241 South Korea real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 242 South Korea real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 243 Southeast Asia real-time payments market, 2018 - 2022 (USD Million)

- TABLE 244 Southeast Asia real-time payments market, 2023 - 2032 (USD Million)

- TABLE 245 Southeast Asia real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 246 Southeast Asia real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 247 Southeast Asia real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 248 Southeast Asia real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 249 Southeast Asia real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 250 Southeast Asia real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 251 Southeast Asia real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 252 Southeast Asia real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 253 Southeast Asia real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 254 Southeast Asia real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 255 ANZ real-time payments market, 2018 - 2022 (USD Million)

- TABLE 256 ANZ real-time payments market, 2023 - 2032 (USD Million)

- TABLE 257 ANZ real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 258 ANZ real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 259 ANZ real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 260 ANZ real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 261 ANZ real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 262 ANZ real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 263 ANZ real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 264 ANZ real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 265 ANZ real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 266 ANZ real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 267 Latin America real-time payments market, 2018 - 2022 (USD Million)

- TABLE 268 Latin America real-time payments market, 2023 - 2032 (USD Million)

- TABLE 269 Latin America real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 270 Latin America real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 271 Latin America real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 272 Latin America real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 273 Latin America real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 274 Latin America real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 275 Latin America real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 276 Latin America real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 277 Latin America real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 278 Latin America real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 279 Brazil real-time payments market, 2018 - 2022 (USD Million)

- TABLE 280 Brazil real-time payments market, 2023 - 2032 (USD Million)

- TABLE 281 Brazil real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 282 Brazil real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 283 Brazil real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 284 Brazil real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 285 Brazil real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 286 Brazil real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 287 Brazil real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 288 Brazil real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 289 Brazil real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 290 Brazil real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 291 Mexico real-time payments market, 2018 - 2022 (USD Million)

- TABLE 292 Mexico real-time payments market, 2023 - 2032 (USD Million)

- TABLE 293 Mexico real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 294 Mexico real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 295 Mexico real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 296 Mexico real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 297 Mexico real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 298 Mexico real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 299 Mexico real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 300 Mexico real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 301 Mexico real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 302 Mexico real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 303 Argentina real-time payments market, 2018 - 2022 (USD Million)

- TABLE 304 Argentina real-time payments market, 2023 - 2032 (USD Million)

- TABLE 305 Argentina real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 306 Argentina real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 307 Argentina real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 308 Argentina real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 309 Argentina real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 310 Argentina real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 311 Argentina real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 312 Argentina real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 313 Argentina real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 314 Argentina real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 315 MEA real-time payments market, 2018 - 2022 (USD Million)

- TABLE 316 MEA real-time payments market, 2023 - 2032 (USD Million)

- TABLE 317 MEA real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 318 MEA real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 319 MEA real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 320 MEA real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 321 MEA real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 322 MEA real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 323 MEA real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 324 MEA real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 325 MEA real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 326 MEA real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 327 UAE real-time payments market, 2018 - 2022 (USD Million)

- TABLE 328 UAE real-time payments market, 2023 - 2032 (USD Million)

- TABLE 329 UAE real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 330 UAE real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 331 UAE real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 332 UAE real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 333 UAE real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 334 UAE real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 335 UAE real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 336 UAE real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 337 UAE real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 338 UAE real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 339 South Africa real-time payments market, 2018 - 2022 (USD Million)

- TABLE 340 South Africa real-time payments market, 2023 - 2032 (USD Million)

- TABLE 341 South Africa real-time payments market, by component, 2018 - 2022 (USD Million)

- TABLE 342 South Africa real-time payments market, by component, 2023 - 2032 (USD Million)

- TABLE 343 South Africa real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 344 South Africa real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 345 South Africa real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 346 South Africa real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 347 South Africa real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 348 South Africa real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 349 South Africa real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 350 South Africa real-time payments market, by End-user, 2023 - 2032 (USD Million)

- TABLE 351 Saudi Arabia real-time payments market, 2018 - 2022 (USD Million)

- TABLE 352 Saudi Arabia real-time payments market, 2023 - 2032 (USD Million)

- TABLE 353 Saudi Arabia real-time payments market, by payment type, 2018 - 2022 (USD Million)

- TABLE 354 Saudi Arabia real-time payments market, by payment type, 2023 - 2032 (USD Million)

- TABLE 355 Saudi Arabia real-time payments market, by deployment model, 2018 - 2022 (USD Million)

- TABLE 356 Saudi Arabia real-time payments market, by deployment model, 2023 - 2032 (USD Million)

- TABLE 357 Saudi Arabia real-time payments market, by organization size, 2018 - 2022 (USD Million)

- TABLE 358 Saudi Arabia real-time payments market, by organization size, 2023 - 2032 (USD Million)

- TABLE 359 Saudi Arabia real-time payments market, by End-user, 2018 - 2022 (USD Million)

- TABLE 360 Saudi Arabia real-time payments market, by End-user, 2023 - 2032 (USD Million)

Charts & Figures

- FIG 1 GMI's report coverage in the global real-time payments market

- FIG 2 Industry segmentation

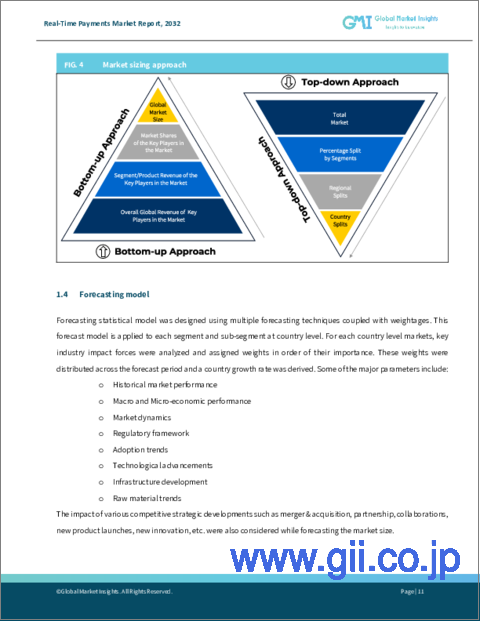

- FIG 3 Forecast calculation

- FIG 4 Profile break-up of primary respondents

- FIG 5 Real-time payments market 360 degree synopsis, 2018 - 2032

- FIG 6 Real-time payments ecosystem analysis

- FIG 7 Profit margin analysis

- FIG 8 Growth potential analysis

- FIG 9 Porter's analysis

- FIG 10 PESTEL analysis

- FIG 11 Competitive analysis of major market players, 2022

- FIG 12 Competitive positioning matrix

- FIG 13 Strategic outlook matrix

- FIG 14 Real-time payments market, by component, 2022 & 2032

- FIG 15 Real-time payments market, by payment type, 2022 & 2032

- FIG 16 Real-time payments market, by deployment model, 2022 & 2032

- FIG 17 Real-time payments market, by organization size, 2022 & 2032

- FIG 18 Real-time payments market, by end-user, 2022 & 2032

- FIG 19 SWOT Analysis, ACI Worldwide, Inc.

- FIG 20 SWOT Analysis, Finastra

- FIG 21 SWOT Analysis, FIS Inc.

- FIG 22 SWOT Analysis, Fiserv, Inc.

- FIG 23 SWOT Analysis, Jack Henry

- FIG 24 SWOT Analysis, JPMorgan Chase & Co.

- FIG 25 SWOT Analysis, Mastercard, Inc.

- FIG 26 SWOT Analysis, Montran Corp.

- FIG 27 SWOT Analysis, PayPal Holdings, Inc.

- FIG 28 SWOT Analysis, SWIFT

- FIG 29 SWOT Analysis, Temenos AG

- FIG 30 SWOT Analysis, Visa Inc.

- FIG 31 SWOT Analysis, Volante Technologies Inc.

- FIG 32 SWOT Analysis, Western Union

- FIG 33 SWOT Analysis, Worldline SA

The global real-time payments market is expected to record over 26% CAGR through 2032, driven by the increasing need for faster payment processing, the rise of digitalization, and a growing emphasis on financial inclusion.

According to an article by FED in 2022, nearly 80% survey responders expressed interest in utilizing faster payments for business transactions. Additionally, 83% used fintech payment apps or digital wallets occasionally. In an era where speed and efficiency are paramount, businesses and consumers alike are seeking payment solutions that provide real-time processing. The instantaneous nature of real-time payments caters to this demand, offering a transformative financial experience that transcends traditional payment methods.

Furthermore, the surge in e-commerce, digital banking, and mobile payment platforms underscores the urgency for real-time payment solutions, positioning the market for substantial growth.

The overall real-time payments industry is classified based on component, deployment model, payment type, organization size, end-user, and region.

The service segment is poised to witness substantial gains by 2032. The comprehensive service components, ranging from payment gateways to fraud detection systems, are crucial in ensuring the seamless operation of real-time payment systems. As businesses and financial institutions strive to enhance user experiences, the demand for robust service components that guarantee security, efficiency, and reliability is escalating.

The on-premises deployment segment share is expected to grow notably over the forecast period, owing to increased adoption, particularly in sectors where data security is of paramount importance. As businesses grapple with the complexities of cybersecurity, on-premises deployment offers a dedicated and controlled environment for real-time payment systems. This model ensures that sensitive financial data remains within the confines of the organization's infrastructure, addressing concerns related to data breaches and unauthorized access. The growing emphasis on data security and regulatory compliance is propelling the on-premises deployment segment.

Asia Pacific real-time payments market is expected to grow swiftly through 2032 driven by increasing smartphone penetration, rising internet accessibility, and a burgeoning fintech ecosystem. Countries like China and India are witnessing a surge in digital payment adoption, with real-time payment solutions becoming integral to daily financial transactions. The focus on adopting cashless economy and the widespread acceptance of real-time payment systems will shape the regional market outlook.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Real-time payments market 360 degree synopsis, 2018 - 2032

- 2.2 Business trends

- 2.2.1 Total Addressable Market (TAM), 2023 - 2032

- 2.3 Regional trends

- 2.4 Component trends

- 2.5 Payment type trends

- 2.6 Deployment model trends

- 2.7 Organization size trends

- 2.8 End-user trends

Chapter 3 Real-Time Payments Market Industry Insights

- 3.1 Impact of COVID-19

- 3.2 Impact of the Russia-Ukraine war

- 3.3 Industry ecosystem analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.6.1 Partnership/Collaboration

- 3.6.2 Merger/Acquisition

- 3.6.3 Investment

- 3.6.4 Product launch & innovation

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising adoption of digital payments

- 3.8.1.2 Increasing consumer demand for instant financial transaction processing

- 3.8.1.3 Extensive use of smartphones and digital devices

- 3.8.1.4 Rising need for swift and secure fund transfers

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Risk of security breaches

- 3.8.2.2 Regulatory compliance

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2022

- 4.1 Introduction

- 4.2 Company market share, 2022

- 4.3 Competitive analysis of major market players, 2022

- 4.3.1 Visa Inc.

- 4.3.2 PayPal Holdings, Inc.

- 4.3.3 Mastercard, Inc.

- 4.3.4 Fiserv, Inc.

- 4.3.5 FIS Inc.

- 4.3.6 ACI Worldwide, Inc.

- 4.3.7 Finastra

- 4.4 Competitive positioning matrix, 2022

- 4.5 Strategic outlook matrix, 2022

Chapter 5 Real-Time Payments Market Estimates & Forecast, By Component (Revenue)

- 5.1 Key trends, by component

- 5.2 solution

- 5.3 Services

Chapter 6 Real-Time Payments Market Estimates & Forecast, By Payment type (Revenue)

- 6.1 Key trends, by payment type

- 6.2 Person-to-person (P2P)

- 6.3 Person-to-business (P2B)

- 6.4 Business-to-consumer (B2C)

- 6.5 Business-to-business (B2B)

- 6.6 Others

Chapter 7 Real-Time Payments Market Estimates & Forecast, By Deployment Model (Revenue)

- 7.1 Key trends, by deployment model

- 7.2 Cloud-based

- 7.3 On-premises

Chapter 8 Real-Time Payments Market Estimates & Forecast, By Organization Size (Revenue)

- 8.1 Key trends, by organization size

- 8.2 SMEs

- 8.3 Large enterprises

Chapter 9 Real-time payments Market Estimates & Forecast, By End-user (Revenue)

- 9.1 Key trends, by end-user

- 9.2 BFSI

- 9.3 Retail

- 9.4 Healthcare

- 9.5 Government

- 9.6 IT & telecom

- 9.7 Manufacturing

- 9.8 Others

Chapter 10 Real-Time Payments Market Estimates & Forecast, By Region (Revenue)

- 10.1 Key trends, by region

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Southeast Asia

- 10.4.6 ANZ

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ACI Worldwide, Inc.

- 11.2 Finastra

- 11.3 FIS Inc.

- 11.4 Fiserv, Inc.

- 11.5 Jack Henry

- 11.6 JPMorgan Chase & Co.

- 11.7 Mastercard, Inc.

- 11.8 Montran Corp.

- 11.9 PayPal Holdings, Inc.

- 11.10 SWIFT

- 11.11 Temenos AG

- 11.12 Visa Inc.

- 11.13 Volante Technologies Inc.

- 11.14 Western Union

- 11.15 Worldline SA