|

|

市場調査レポート

商品コード

1715201

北米の人材派遣・人材紹介市場:2031年までの予測 - 地域別分析 - 人材派遣タイプ別、人材紹介チャネル別、エンドユーザー別North America Staffing and Recruitment Market Forecast to 2031 - Regional Analysis - by Staffing Type (Temporary and Permanent), Recruitment Channel (Online, Hybrid, and Offline), and End User |

||||||

|

|||||||

| 北米の人材派遣・人材紹介市場:2031年までの予測 - 地域別分析 - 人材派遣タイプ別、人材紹介チャネル別、エンドユーザー別 |

|

出版日: 2025年02月11日

発行: The Insight Partners

ページ情報: 英文 133 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

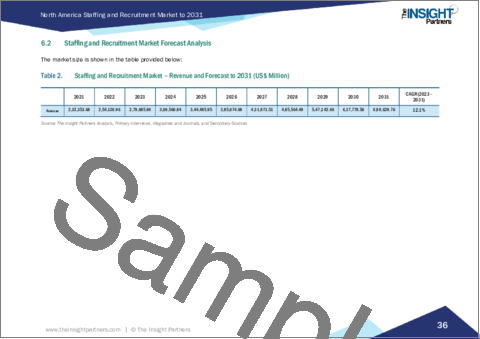

北米の人材派遣・人材紹介市場は、2023年に2,796億8,590万米ドルと評価され、2031年には6,986億2,976万米ドルに達すると予測され、2023年から2031年までのCAGRは12.1%と推定されます。

BFSIとITセクターにおける大きな雇用機会が北米の人材派遣・人材紹介市場を後押し

世界レベルのBFSIとIT産業は、かつてないペースで成長しています。世界銀行のデータによると、中小企業(SME)は雇用創出と世界経済の発展に大きく貢献しています。中小企業は世界の企業の約90%を占め、雇用の50%以上を占めています。同資料によると、2030年までに、民間部門を拡大するための政府のイニシアティブと支援により、中小企業は約6億の雇用を創出するといいます。中小企業セクターの成長は、持続可能な開発に不可欠な経済成長に大きな影響を与えています。中小企業は雇用を創出し、所得を生み出し、起業家精神とイノベーションの機会を提供することでイノベーションを促進し、ビジネスの生産性と経済成長を高めます。中小企業の拡大は、経済により多くの雇用機会を生み出しています。このような要因により、市場は間もなく活性化すると予測されます。BFSI業界では、開発、IT管理、ITアナリストの需要が増加しているため、新規雇用の約3分の1をテクノロジーが占めています。Project Management Institute, Inc.によると、今後数年間はプロジェクト管理職の空席が膨大になると予想されており、プロジェクト管理職をすべて埋めるには毎年230万人近くの従業員が必要とされています。企業は、市場競争力を維持することで戦略的価値を提供するため、問題解決能力や関係構築能力のある人材の採用に注力しており、こうしたポジションを満たす人材派遣・人材紹介のプロフェッショナルが必要とされています。

北米の人材派遣・人材紹介市場の概要

北米の人材派遣・人材紹介市場の主役は米国、カナダ、メキシコです。北米は、先進的な新技術の開発と受け入れの面で主導的な地域です。人材派遣・人材紹介業界は、さまざまな人的資源管理(HRM)ソリューションプロバイダーの存在により、大幅に増加すると予測されています。米国の企業は、給与計算、勤怠管理、人材管理など数多くの業務にHRM(人的資源管理)ソリューションを導入することで、従業員の効率と生産性を高めることに注力しており、これが市場を活性化しています。クラウドベースのソリューションは、雇用主にとって堅牢な処理とソフトウェアへのアクセスのしやすさを提供します。Glassdoorによると、求人1件につき250件以上の応募があるといいます。AIベースのインテリジェントなアルゴリズムの使用は、雇用主が職務内容に密接に一致する候補者のプロファイルをフィルタリングするのをサポートします。中小企業(SME)やその他の雇用主によるAI、クラウド、自動化などの新技術導入の高まりが、この地域の世界の人材派遣・人材紹介市場を後押ししています。

米国とカナダは、最新技術の先進国とみなされています。人材派遣・人材紹介業界の急増は主に、新技術への容易なアクセス、医薬品製造の増加、新興市場における人件費の高騰に起因しています。過去5年間における技術の使用の高まりは、この地域における人材派遣・人材紹介ソフトウェアに燃料を供給しています。Bullhorn, Inc.、Avionte、Ceipal Corp.など、この業界で著名な人材派遣ソフトウェアプロバイダーは、顧客基盤を拡大するために買収や製品投入に注力しており、それによってこの地域の市場成長を後押ししています。例えば、2022年1月、Bullhorn, Inc.はAbleを買収し、世界中の人材派遣会社に多額の投資を行いました。この買収により、Bullhorn, Inc.は事業を近代化し、候補者の取りこぼしを減らしています。また、カナダは石炭、金属、石油産業の発展により、安価に電力を利用できるようになり、製造業にとって有利な国になりつつあります。製造施設の拡大により、カナダではより多くの雇用機会が創出されており、雇用者の間で人材派遣・人材紹介サービスに対する需要が高まっています。このように、革新的な技術へのアクセスが拡大することで、企業は生産コストと時間を削減できるようになり、生産プロセスが変化しています。さらに、メキシコの製造業も、FDI誘致のための政府のイニシアティブ、米国への近接性、北米自由貿易協定(NAFTA)の支援によるコスト競合の達成能力により、著しい成長を遂げています。このような有利な見通しは、この地域の企業が自動化への高額投資を行うことを促し、人材派遣・人材紹介市場の成長を支えています。

北米の人材派遣・人材紹介市場の収益と2031年までの予測(金額)

北米の人材派遣・人材紹介市場のセグメンテーション

北米の人材派遣・人材紹介市場は、人材派遣タイプ、人材紹介チャネル、エンドユーザー、国に分類されます。

人材派遣タイプに基づき、北米の人材派遣・人材紹介市場は派遣と正社員に二分されます。2023年の市場シェアは臨時雇用セグメントが大きくなりました。

採用チャネルの観点から、北米の人材派遣・人材紹介市場はオンライン、ハイブリッド、オフラインに分類されます。オンラインセグメントが2023年に最大の市場シェアを占めました。

エンドユーザー別では、北米の人材派遣・人材紹介市場はIT・通信、BFSI、ヘルスケア、小売・eコマース、その他に分類されます。2023年の市場シェアは、IT・通信セグメントが最大でした。さらに、ヘルスケア分野は病院・クリニック、製薬、その他に細分化されます。

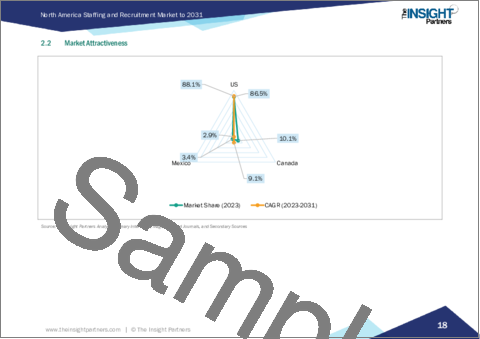

国別に見ると、北米の人材派遣・人材紹介市場は米国、カナダ、メキシコに区分されます。2023年の北米の人材派遣・人材紹介市場シェアは米国が独占しました。

Adecco Group AG、Alliance Recruitment Agency、Brunel International NV、Hays Plc、Korn Ferry、Morgan Philips Group SA、NES Fircroft、Randstad NVは、北米の人材派遣・人材紹介市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の人材派遣・人材紹介市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の人材派遣・人材紹介市場:主要市場力学

- 市場促進要因

- BFSIとITセクターにおける大きな雇用機会

- 若者人口の増加

- 市場抑制要因

- 有資格求職者の不足

- 市場機会

- 世界のリモートワークとハイブリッドビジネスモデルの採用拡大

- 今後の動向

- 自動化とAI主導の採用活動

- 促進要因と抑制要因の影響

第6章 人材派遣・人材紹介市場:北米分析

- 人材派遣・人材紹介市場の収益、2021年~2031年

- 人材派遣・人材紹介市場の予測分析

第7章 北米の人材派遣・人材紹介市場分析:人材派遣タイプ別

- 派遣

- 正社員

第8章 北米の人材派遣・人材紹介市場分析:人材紹介チャネル別

- オンライン

- ハイブリッド

- オフライン

第9章 北米の人材派遣・人材紹介市場分析:エンドユーザー別

- IT・通信

- BFSI

- ヘルスケア

- 小売・eコマース

- その他

第10章 北米の人材派遣・人材紹介市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第13章 企業プロファイル

- Adecco Group AG

- Alliance Recruitment Agency

- Brunel International NV

- Hays plc

- Korn Ferry

- Morgan Philips Group SA

- NES Fircroft

- Randstad NV

第14章 付録

List Of Tables

- Table 1. North America Staffing and Recruitment Market Segmentation

- Table 2. Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Staffing Type

- Table 4. Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Recruitment Channel

- Table 5. Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 6. North America: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 7. United States: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Staffing Type

- Table 8. United States: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Recruitment Channel

- Table 9. United States: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 10. United States: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Healthcare

- Table 11. Canada: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Staffing Type

- Table 12. Canada: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Recruitment Channel

- Table 13. Canada: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. Canada: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Healthcare

- Table 15. Mexico: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Staffing Type

- Table 16. Mexico: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Recruitment Channel

- Table 17. Mexico: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 18. Mexico: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million) - by Healthcare

- Table 19. Heat Map Analysis by Key Players

- Table 20. List of Abbreviation

List Of Figures

- Figure 1. North America Staffing and Recruitment Market Segmentation, by Country

- Figure 2. Ecosystem: Staffing and Recruitment Market

- Figure 3. Staffing and Recruitment Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Staffing and Recruitment Market Revenue (US$ Million), 2021-2031

- Figure 6. Staffing and Recruitment Market Share (%) - by Staffing Type (2023 and 2031)

- Figure 7. Temporary: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Permanent: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Staffing and Recruitment Market Share (%) - by Recruitment Channel (2023 and 2031)

- Figure 10. Online: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Hybrid: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Offline: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Staffing and Recruitment Market Share (%) - by End User (2023 and 2031)

- Figure 14. IT & Telecom: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. BFSI: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Healthcare: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Hospitals & Clinics: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Pharmaceutical: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Others: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Retail & E-Commerce: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Others: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. North America Staffing and Recruitment Market, by Key Country - Revenue (2023) (US$ Million)

- Figure 23. North America: Staffing and Recruitment Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 24. United States: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Canada: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Mexico: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Company Positioning & Concentration

The North America staffing and recruitment market was valued at US$ 2,79,685.90 million in 2023 and is expected to reach US$ 6,98,629.76 million by 2031; it is estimated to register a CAGR of 12.1% from 2023 to 2031.

Huge Job Opportunities in BFSI and IT Sectors Fuel North America Staffing and Recruitment Market

The BFSI and IT industry at global level is growing at an unprecedented pace. According to The World Bank data, small and medium enterprises (SMEs) play a major contributor to job creation and global economic development. It represents around 90% of businesses and over 50% of employment worldwide. According to the same source, by 2030, SMEs will create approximately 600 million jobs, due to government initiatives & support to expand the private sector. The growth in the SME sector has had a significant impact on economic growth, which is essential for sustainable development. SMEs help to create jobs, generate income, and promote innovation by providing opportunities for entrepreneurship and innovation, which increases business productivity and economic growth. The expansion of SMEs is generating more job opportunities in the economy. These factors are projected to fuel the market soon. Within the BFSI industry, technology accounts for about a third of all new jobs, owing to increasing demand for development, IT management, and IT analyst roles. According to Project Management Institute, Inc., vast vacancies for project management positions are expected to open in the coming years, and nearly 2.3 million employees are needed to fill all the project management-oriented positions each year. Companies are focusing on hiring problem solvers and relationship builders to deliver strategic value by remaining competitive in the market, which requires staffing and recruitment professionals to fill these positions.

North America Staffing and Recruitment Market Overview

The US, Canada, and Mexico are the major contributors to the North America staffing and recruitment market . North America is a leading region in terms of developing and accepting new, advanced technologies. The staffing and recruitment industry is projected to increase significantly due to the presence of various human resource management (HRM) solution providers. Businesses in the US are focusing on enhancing employee's efficiency and productivity by implementing HRM (human resource management) solutions in numerous activities such as payroll, time & attendance, and talent management, which fuels the market. Cloud-based solutions offer robust processing and ease of accessing the software for employers. According to Glassdoor, each job opening gets more than 250 applications. The use of AI-based intelligent algorithms supports employers in filtering the candidate's profiles that match closely to the job descriptions. The rising adoption of new technologies such as AI, cloud, and automation by small & medium size enterprises (SMEs) and other employers is boosting the global staffing and recruitment market in the region.

The US and Canada are considered developed countries in terms of modern technologies. The proliferation of staffing and recruitment industry is mainly attributed to easy access to new technologies, a rise in pharmaceutical manufacturing, and a surge in labor costs in emerging markets. The rising use of technologies in the last five years has fueled the staffing and recruitment software in the region. Prominent staffing software providers in the industry, such as Bullhorn, Inc.; Avionte; and Ceipal Corp.; are focusing on acquisitions and product launches to increase their customer base, thereby boosting the market growth in the region. For instance, in January 2022, Bullhorn, Inc. acquired Able to make significant investments in staffing agencies across the globe. With this acquisition, Bullhorn, Inc. is modernizing its business and reducing candidate drop-out. Also, Canada is becoming a more favorable country for manufacturing activities due to the availability of power at a lower cost, owing to advancements in the coal, metal, and oil industries. The expansion of manufacturing facilities is creating more job opportunities in Canada, which increases the demand for staffing and recruitment services among employers. Thus, the growing access to innovative technologies is transforming production processes along with enabling enterprises to reduce their production costs and time. Further, the manufacturing sector in Mexico is also witnessing significant growth due to government initiatives for attracting FDIs, its proximity to the US, and its ability to achieve cost-competitiveness with the support of the North American Free Trade Agreement (NAFTA). Such favorable prospects are encouraging businesses in the region to make high investments in automation, which is supporting the growth of the staffing and recruitment market.

North America Staffing and Recruitment Market Revenue and Forecast to 2031 (US$ Million)

North America Staffing and Recruitment Market Segmentation

The North America staffing and recruitment market is categorized into staffing type, recruitment channel, end user, and country.

Based on staffing type, the North America staffing and recruitment market is bifurcated into temporary and permanent. The temporary segment held a larger market share in 2023.

In terms of recruitment channel, the North America staffing and recruitment market is categorized into online, hybrid, and offline. The online segment held the largest market share in 2023.

By end user, the North America staffing and recruitment market is segmented into IT & telecom, BFSI, healthcare, retail & e-commerce, and others. The IT & telecom segment held the largest market share in 2023. Furthermore, the healthcare segment is sub segmented into hospitals & clinics, pharmaceutical, and others.

Based on country, the North America staffing and recruitment market is segmented into the US, Canada, and Mexico. The US dominated the North America staffing and recruitment market share in 2023.

Adecco Group AG, Alliance Recruitment Agency, Brunel International NV, Hays Plc, Korn Ferry, Morgan Philips Group SA, NES Fircroft, and Randstad NV, are some of the leading companies operating in the North America staffing and recruitment market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Staffing and Recruitment Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in Value Chain

5. North America Staffing and Recruitment Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Huge Job Opportunities in BFSI and IT Sectors

- 5.1.2 Rise in Youth Population

- 5.2 Market Restraints

- 5.2.1 Lack of Qualified Job Seekers

- 5.3 Market Opportunities

- 5.3.1 Growing Adoption of Remote Working and Hybrid Business Model Across the Globe

- 5.4 Future Trends

- 5.4.1 Automation and AI-Driven Recruitment

- 5.5 Impact of Drivers and Restraints:

6. Staffing and Recruitment Market - North America Analysis

- 6.1 Staffing and Recruitment Market Revenue (US$ Million), 2021-2031

- 6.2 Staffing and Recruitment Market Forecast Analysis

7. North America Staffing and Recruitment Market Analysis - by Staffing Type

- 7.1 Temporary

- 7.1.1 Overview

- 7.1.2 Temporary: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Permanent

- 7.2.1 Overview

- 7.2.2 Permanent: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Staffing and Recruitment Market Analysis - by Recruitment Channel

- 8.1 Online

- 8.1.1 Overview

- 8.1.2 Online: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Hybrid

- 8.2.1 Overview

- 8.2.2 Hybrid: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Offline

- 8.3.1 Overview

- 8.3.2 Offline: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Staffing and Recruitment Market Analysis - by End User

- 9.1 IT & Telecom

- 9.1.1 Overview

- 9.1.2 IT & Telecom: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 BFSI

- 9.2.1 Overview

- 9.2.2 BFSI: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Healthcare

- 9.3.1 Overview

- 9.3.2 Healthcare: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.3 Hospitals & Clinics

- 9.3.3.1 Overview

- 9.3.3.2 Hospitals & Clinics Market: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.4 Pharmaceutical

- 9.3.4.1 Overview

- 9.3.4.2 Pharmaceutical: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5 Others

- 9.3.5.1 Overview

- 9.3.5.2 Others: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Retail & E-Commerce

- 9.4.1 Overview

- 9.4.2 Retail & E-Commerce: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Staffing and Recruitment Market - Country Analysis

- 10.1 North America Staffing and Recruitment Market Overview

- 10.1.1 North America: Staffing and Recruitment Market Breakdown - by Country, 2023 and 2031 (%)

- 10.1.1.1 North America: Staffing and Recruitment Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 United States: Staffing and Recruitment Market Breakdown, by Staffing Type

- 10.1.1.2.2 United States: Staffing and Recruitment Market Breakdown, by Recruitment Channel

- 10.1.1.2.3 United States: Staffing and Recruitment Market Breakdown, by End User

- 10.1.1.2.4 United States: Staffing and Recruitment Market Breakdown, by Healthcare

- 10.1.1.3 Canada: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 Canada: Staffing and Recruitment Market Breakdown, by Staffing Type

- 10.1.1.3.2 Canada: Staffing and Recruitment Market Breakdown, by Recruitment Channel

- 10.1.1.3.3 Canada: Staffing and Recruitment Market Breakdown, by End User

- 10.1.1.3.4 Canada: Staffing and Recruitment Market Breakdown, by Healthcare

- 10.1.1.4 Mexico: Staffing and Recruitment Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 Mexico: Staffing and Recruitment Market Breakdown, by Staffing Type

- 10.1.1.4.2 Mexico: Staffing and Recruitment Market Breakdown, by Recruitment Channel

- 10.1.1.4.3 Mexico: Staffing and Recruitment Market Breakdown, by End User

- 10.1.1.4.4 Mexico: Staffing and Recruitment Market Breakdown, by Healthcare

- 10.1.1 North America: Staffing and Recruitment Market Breakdown - by Country, 2023 and 2031 (%)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

- 12.4 Merger and Acquisition

13. Company Profiles

- 13.1 Adecco Group AG

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Alliance Recruitment Agency

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Brunel International NV

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Hays plc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Korn Ferry

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Morgan Philips Group SA

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 NES Fircroft

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Randstad NV

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index