|

|

市場調査レポート

商品コード

1666284

欧州の食肉代替原料市場:2030年までの予測 - 地域別分析 - ソース別、原料タイプ別、用途別Europe Meat Substitute Ingredients Market Forecast to 2030 - Regional Analysis - by Source, Ingredient Type, and Application |

||||||

|

|||||||

| 欧州の食肉代替原料市場:2030年までの予測 - 地域別分析 - ソース別、原料タイプ別、用途別 |

|

出版日: 2025年01月02日

発行: The Insight Partners

ページ情報: 英文 109 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の食肉代替原料市場は、2022年に8億2,968万米ドルとなり、2030年までには14億8,203万米ドルに達すると予測され、2022年から2030年までのCAGRは7.5%を記録すると予測されています。

主な市場開拓の取り組みが欧州の食肉代替原料市場を牽引

欧州の食肉代替原料メーカーは、消費者を惹きつけ市場の地位を向上させるため、製品革新、合併買収、事業拡大などの戦略的開拓に多額の投資を行っています。さらに、菜食主義の動向と植物性食品への選好の高まりにより、植物性肉製品メーカーの間で食肉代替原料の需要が増加しています。そのため、主要メーカーは需要の増加に対応するため、さまざまな食肉代替原料を発売しています。例えば、Axiom Foodsは、黄エンドウから作られた新しいエンドウ豆タンパク質を発売し、様々な植物ベースの肉製品で肉の代替品や肉エクステンダーとして主に使用されています。同様に、2022年11月、International Flavors & Fragrances Inc(IFF)は、大豆ベースの植物性タンパク質原料であるSupro Texを発売しました。この原料は80%のタンパク質を含み、動物肉に匹敵するプロファイルを持っています。主要メーカーによるこうした製品の上市は、食肉代替原料市場の成長を促進します。主要メーカーは、顧客により良いサービスを提供し、高まる需要を満たすために、買収、拡大、生産能力の拡大といった戦略を採用しています。例えば、2021年1月、英国を拠点とするビーガン食品会社VBitesは、SpinneysとWaitroseという2つのスーパーマーケット・チェーンとのリスティングを獲得し、地域全体で事業を拡大しました。VBitesは、植物由来の肉、魚、チーズ、乳製品の代替品を提供しています。このように、主要市場企業のこうした戦略的開拓は、企業が国内市場を拡大し、国際市場で競争力を獲得するのに役立っています。

欧州の食肉代替原料市場概要

欧州の食肉代替原料市場は、ドイツ、フランス、スペイン、英国などの国々における植物由来の肉製品に対する大きな需要のおかげで著しく成長しています。健康志向の高まりと菜食主義の動向が、欧州を食肉代替原料の重要な市場にしています。Good Food Institute(GFI)によると、2022年には植物性食肉の売上だけで21億米ドルを占め、2020年と比較して19%増加しました。同様に、The Smart Protein Project reportによると、ドイツにおける植物性食品の販売額は2018年から2020年の間に97%増加し、販売量は80%増加しました。さらに、動物福祉と環境の持続可能性に対する意識の高まりから、消費者は植物由来の肉製品に高い関心を寄せています。

欧州では、消費者の需要が動物性タンパク質から植物性タンパク質にシフトしているため、植物性食肉製品の人気が高まっています。このような植物性食肉製品への傾倒は、健康意識、持続可能性の問題、倫理的または宗教的見解、環境問題、動物の権利など、さまざまな要因に関連しています。世界保健機関(WHO)によると、エンドウ豆や大豆を含む天然の脂肪やタンパク質を摂取することで、健康な腸内環境などいくつかの健康上のメリットが得られるといいます。したがって、この地域における健康意識の高まりは、大豆、綿実、エンドウ豆、空豆、小麦などの天然植物性タンパク質から作られる代替肉への需要をさらに押し上げています。

主要市場企業は、食肉代替原料の需要増に対応するため、欧州諸国でのプレゼンスを拡大しています。例えば、2021年9月、食肉代替原料の世界的リーダーであり、植物性タンパク質のパイオニアであるRoquette Freresは、Vic-Sur-Aisne(フランス、Hauts-de-France)の敷地内に2,000平方メートルの専門知識センターの開設を発表しました。このセンターは植物タンパク質の技術革新に完全に特化しています。この戦略により、同社は製品ラインと事業規模を世界的に拡大することができました。このように、前述のすべての要因により、食肉代替原料の需要は予測期間中に欧州で成長すると予想されます。

欧州の食肉代替原料市場収益と2030年までの予測(金額)

欧州の食肉代替原料市場セグメンテーション

欧州の食肉代替原料市場は、ソース、原料タイプ、用途、国に分類されます。

ソースに基づき、欧州の食肉代替原料市場は大豆、小麦、エンドウ豆、マイコプロテイン、その他に区分されます。大豆セグメントは2022年に最大の市場シェアを占めました。

原料に基づき、欧州の食肉代替原料市場は大豆タンパク質、エンドウ豆タンパク質、テンペ、豆腐、セイタン、その他に分類されます。大豆タンパク質セグメントは2022年に最大の市場シェアを占めました。

用途別では、欧州の食肉代替原料市場はパテ、ナゲット、ソーセージ、ミートボール、その他に分類されます。その他セグメントが2022年に最大の市場シェアを占めました。

国別では、欧州の食肉代替原料市場はドイツ、フランス、イタリア、英国、ロシア、その他欧州に区分されます。その他欧州が2022年の欧州の食肉代替原料市場シェアを独占しました。

Crespel &Deiters GmbH Co KG、SOTEXPRO SA、DuPont de Neumours Inc、Ingredion Inc、Wilmar International Ltd、Archer Daniels Midland Co、Kerry Group Plc、Roquette Freres SAは、欧州の食肉代替原料市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州の食肉代替原料市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者または供給業者

- アプリケーション

第5章 欧州の食肉代替原料市場-主要な市場力学

- 食肉代替原料市場-主要な市場力学

- 市場促進要因

- 植物性食肉への需要の高まり

- 主な市場開拓企業による戦略的取り組み

- 市場抑制要因

- 植物性タンパク質に関連する風味の課題

- 市場機会

- 食肉代替製品の消費を促進する政府の取り組み

- 今後の動向

- 高まる菜食主義の動向

- 促進要因と抑制要因の影響

第6章 食肉代替原料市場-欧州市場分析

- 食肉代替原料市場の収益、2020年~2030年

- 食肉代替原料市場の予測分析

第7章 欧州の食肉代替原料市場分析:ソース別

- 大豆

- 小麦

- エンドウ豆

- マイコプロテイン

- その他

第8章 欧州の食肉代替原料市場分析:原料タイプ別

- 大豆タンパク質

- エンドウ豆タンパク質

- テンペ

- 豆腐

- セイタン

- その他

第9章 欧州の食肉代替原料市場分析:用途別

- パテ

- ナゲット

- ソーセージ

- ミートボール

- その他

第10章 欧州の食肉代替原料市場:国別分析

- 欧州市場概要

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 欧州

第11章 業界情勢

- 事業拡大

- 新製品開発

- 合併と買収

- パートナーシップ

第12章 企業プロファイル

- Crespel & Deiters GmbH & Co KG

- SOTEXPRO SA

- DuPont de Nemours Inc

- Ingredion Inc

- Wilmar International Ltd

- Archer-Daniels-Midland Co

- Kerry Group Plc

- Roquette Freres SA

第13章 付録

List Of Tables

- Table 1. Meat Substitute Ingredients Market Segmentation

- Table 2. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 4. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 5. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 6. Europe: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 7. Germany: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 8. Germany: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 9. Germany: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 10. United Kingdom: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 11. United Kingdom: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 12. United Kingdom: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 13. France: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 14. France: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 15. France: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 16. Italy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 17. Italy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 18. Italy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 19. Russia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 20. Russia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 21. Russia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 22. Rest of Europe: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 23. Rest of Europe: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 24. Rest of Europe: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

List Of Figures

- Figure 1. Meat Substitute Ingredients Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Meat Substitute Ingredients Market

- Figure 4. Registrations for the Veganuary Campaign from 2015 to 2021

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Meat Substitute Ingredients Market Revenue (US$ Million), 2020-2030

- Figure 7. Meat Substitute Ingredients Market Share (%) - by Source (2022 and 2030)

- Figure 8. Soy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Wheat: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Pea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Mycoprotein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Meat Substitute Ingredients Market Share (%) - by Ingredient Type (2022 and 2030)

- Figure 14. Soy Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Pea Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Tempeh: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Tofu: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Seitan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Meat Substitute Ingredients Market Share (%) - by Application (2022 and 2030)

- Figure 21. Patties: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Nuggets: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Sausages: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Meatballs: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Europe: Meat Substitute Ingredients Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 27. Europe: Meat Substitute Ingredients Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 28. Germany: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. United Kingdom: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 30. France: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 31. Italy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 32. Russia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Rest of Europe: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

The Europe meat substitute ingredients market was valued at US$ 829.68 million in 2022 and is expected to reach US$ 1,482.03 million by 2030; it is estimated to record a CAGR of 7.5% from 2022 to 2030 .

Strategic Development Initiatives by Key Market Players Drive Europe Meat Substitute Ingredients Market

Europe meat substitute ingredients manufacturers are investing significantly in strategic development initiatives such as product innovation, merger & acquisition, and expansion of their businesses to attract consumers and enhance their market position. Moreover, the demand for meat substitute ingredients is increasing among plant-based meat product manufacturers due to the growing trend of veganism and increasing preference for plant-based food. Thus, key manufacturers are launching various meat substitute ingredients to cater to the increasing demand. For instance, Axiom Foods launched a new pea protein, made from Pisum sativum yellow peas, that is majorly used as a meat replacement and a meat extender in various plant-based meat products. Similarly, in November 2022, International Flavors & Fragrances Inc (IFF) launched Supro Tex-a soy-based plant protein ingredient. The ingredient contains 80% protein, giving it a profile comparable to animal meat. Such product launches by key market players drive the growth of the meat substitute ingredients market. Major manufacturers are employing strategies such as acquisition, expansion, and production capacity scaleup to serve their customers better and satisfy their growing demands. For instance, in January 2021, a UK-based vegan food company, VBites, expanded its operations across the region by winning listings with two supermarket chains named Spinneys and Waitrose. VBites offers plant-based meat, fish, cheese, and dairy alternatives. Thus, such strategic development initiatives by key market players help companies extend their domestic reach and gain a competitive edge in international markets.

Europe Meat Substitute Ingredients Market Overview

The meat substitute ingredients market in Europe is significantly growing owing to the considerable demand for plant-based meat products in countries such as Germany, France, Spain, and the UK. The increasing health consciousness and the rising trend of veganism have made Europe a significant market for meat substitute ingredients. According to Good Food Institute (GFI), plant-based meat sales alone accounted for US$ 2.1 billion in 2022-up 19% compared with 2020. Similarly, according to "The Smart Protein Project report," the sales value of plant-based food in Germany grew by 97% during 2018-2020, while the sales volume increased by 80%. Moreover, consumers are highly inclined toward plant-based meat products due to rising awareness of animal welfare and environmental sustainability.

The popularity of plant-based meat products is increasing in Europe due to the shift in consumer demand from animal protein to plant protein. This inclination toward plant-based meat products is associated with various factors, such as health awareness, sustainability issues, ethical or religious views, environmental concerns, and animal rights. According to the World Health Organization (WHO), consuming natural fats and proteins, including pea and soy, can offer several health benefits, including a healthy gut. Thus, rising health awareness in the region further boosts the demand for meat alternatives made from natural plant-based proteins such as soy, cottonseed, peas, fava beans, and wheat.

The key market players are expanding their presence in European countries to cater to the increasing demand for meat substitute ingredients. For instance, in September 2021, Roquette Freres-a global leader in meat substitute ingredients and a pioneer of plant proteins, announced the opening of a center of expertise of 2,000 square meters on its site in Vic-Sur-Aisne (Hauts-de-France, France). This center is fully dedicated to plant protein innovation. This strategy also helped the company to expand its product line and business dimensions globally. Thus, due to all the aforementioned factors, the demand for meat substitute ingredients is expected to grow in Europe during the forecast period.

Europe Meat Substitute Ingredients Market Revenue and Forecast to 2030 (US$ Million)

Europe Meat Substitute Ingredients Market Segmentation

The Europe meat substitute ingredients market is categorized into source, ingredients type, application, and country.

Based on source, the Europe meat substitute ingredients market is segmented into soy, wheat, pea, mycoprotein, and others. The soy segment held the largest market share in 2022.

Based on ingredients, the Europe meat substitute ingredients market is categorized into soy protein, pea protein, tempeh, tofu, seitan, and others. The soy protein segment held the largest market share in 2022.

In terms of application, the Europe meat substitute ingredients market is segmented into patties, nuggets, sausages, meatballs, and others. The others segment held the largest market share in 2022.

By country, the Europe meat substitute ingredients market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe meat substitute ingredients market share in 2022.

Crespel & Deiters GmbH Co KG, SOTEXPRO SA, DuPont de Neumours Inc, Ingredion Inc, Wilmar International Ltd, Archer Daniels Midland Co, Kerry Group Plc, and Roquette Freres SA are some of the leading companies operating in the Europe meat substitute ingredients market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Meat Substitute Ingredients Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.3 Distributors or Suppliers

- 4.3.4 Application

5. Europe Meat Substitute Ingredients Market - Key Market Dynamics

- 5.1 Meat Substitute Ingredients Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Rising Demand for Plant-Based Meat

- 5.2.2 Strategic Development Initiatives by Key Market Players

- 5.3 Market Restraints

- 5.3.1 Flavor Challenges Associated with Plant-Based Protein

- 5.4 Market Opportunities

- 5.4.1 Government Initiatives to Promote Consumption of Meat Alternative Products

- 5.5 Future Trends

- 5.5.1 Growing Veganism Trend

- 5.6 Impact of Drivers and Restraints:

6. Meat Substitute Ingredients Market - Europe Market Analysis

- 6.1 Meat Substitute Ingredients Market Revenue (US$ Million), 2020-2030

- 6.2 Meat Substitute Ingredients Market Forecast Analysis

7. Europe Meat Substitute Ingredients Market Analysis - by Source

- 7.1 Soy

- 7.1.1 Overview

- 7.1.2 Soy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

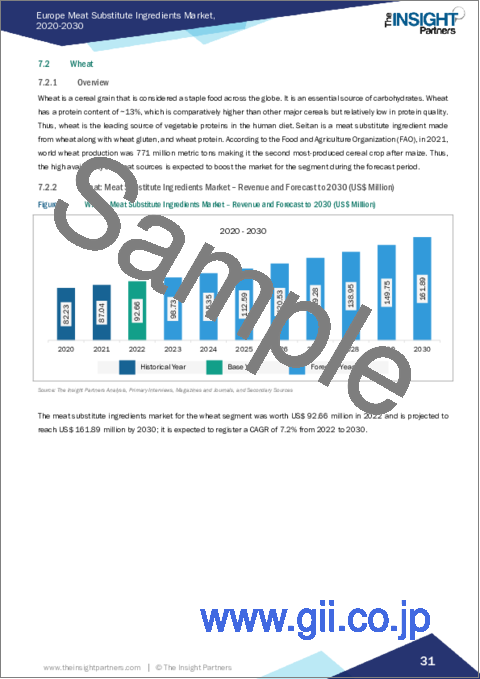

- 7.2 Wheat

- 7.2.1 Overview

- 7.2.2 Wheat: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Pea

- 7.3.1 Overview

- 7.3.2 Pea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Mycoprotein

- 7.4.1 Overview

- 7.4.2 Mycoprotein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

8. Europe Meat Substitute Ingredients Market Analysis - by Ingredient Type

- 8.1 Soy Protein

- 8.1.1 Overview

- 8.1.2 Soy Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Pea Protein

- 8.2.1 Overview

- 8.2.2 Pea Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Tempeh

- 8.3.1 Overview

- 8.3.2 Tempeh: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Tofu

- 8.4.1 Overview

- 8.4.2 Tofu: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Seitan

- 8.5.1 Overview

- 8.5.2 Seitan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

9. Europe Meat Substitute Ingredients Market Analysis - by Application

- 9.1 Patties

- 9.1.1 Overview

- 9.1.2 Patties: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Nuggets

- 9.2.1 Overview

- 9.2.2 Nuggets: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Sausages

- 9.3.1 Overview

- 9.3.2 Sausages: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Meatballs

- 9.4.1 Overview

- 9.4.2 Meatballs: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

10. Europe Meat Substitute Ingredients Market - Country Analysis

- 10.1 Europe Market Overview

- 10.1.1 Europe: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 Europe: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Germany: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.1 Germany: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.2.2 Germany: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.2.3 Germany: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.3 United Kingdom: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.1 United Kingdom: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.3.2 United Kingdom: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.3.3 United Kingdom: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.4 France: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.4.1 France: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.4.2 France: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.4.3 France: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.5 Italy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.5.1 Italy: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.5.2 Italy: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.5.3 Italy: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.6 Russia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.6.1 Russia: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.6.2 Russia: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.6.3 Russia: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.7 Rest of Europe: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.7.1 Rest of Europe: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.7.2 Rest of Europe: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.7.3 Rest of Europe: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1 Europe: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Expansion

- 11.3 New Product Development

- 11.4 Merger and Acquisition

- 11.5 Partnerships

12. Company Profiles

- 12.1 Crespel & Deiters GmbH & Co KG

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 SOTEXPRO SA

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 DuPont de Nemours Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Ingredion Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Wilmar International Ltd

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Archer-Daniels-Midland Co

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Kerry Group Plc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Roquette Freres SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners