|

|

市場調査レポート

商品コード

1666281

アジア太平洋の食肉代替原料市場:2030年までの予測 - 地域別分析 - ソース別、原料タイプ別、用途別Asia Pacific Meat Substitute Ingredients Market Forecast to 2030 - Regional Analysis - by Source, Ingredient Type, and Application |

||||||

|

|||||||

| アジア太平洋の食肉代替原料市場:2030年までの予測 - 地域別分析 - ソース別、原料タイプ別、用途別 |

|

出版日: 2025年01月02日

発行: The Insight Partners

ページ情報: 英文 112 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の食肉代替原料市場は、2022年に5億363万米ドルとなり、2030年までには9億4,530万米ドルに達すると予測され、2022年から2030年までのCAGRは8.2%を記録すると推定されます。

食肉代替製品の消費を促進する政府の取り組みがアジア太平洋の食肉代替原料市場を牽引

各国の政府機関は、環境問題への関心の高まりとこれらの製品が提供する健康上の利点により、植物性食肉の消費を促進しています。さらに、各国政府は植物性食肉製品の研究開発および新製品発表に積極的に投資しています。2021年、韓国の農業・食品・農村地域省は、食品と農業に特化した複数のサブファンドを持つ7,030万米ドルの基金を設立しました。Green Bio Fundの投資対象は、特に植物由来および栽培食肉企業に言及されています。さらに2022年6月、インド食品安全基準局(FSSAI)はヴィーガン食品規制を最終決定し、動物性食品を使用しない食品成分のための独立した規制枠組みを確立しました。また、米国政府は、オーストラリア最大のパルスタンパク質原料製造能力を構築するため、Australian Plant Proteinsが主導するプロジェクトを支援するため、7,600万米ドルを拠出すると発表しました。さらに、中国政府は2021年に新たな食生活指針を制定し、同国の肉消費量を50%削減する計画を発表しました。同国保健省は、個人が1日に摂取する肉の量を40gから75gに抑えるよう勧告しました。

これらの措置は、GHG排出量を大幅に削減すると同時に、公衆衛生を強化することを目的としています。こうした勧告や政府機関の影響力は、代替肉製品に対する需要をさらに押し上げます。このように、様々な政府機関による継続的な投資と支援は、予測期間中、市場に有利な成長機会を提供すると予想されます。

アジア太平洋の食肉代替原料市場概要

アジア太平洋の食肉代替原料市場は一貫して成長しています。同地域における食肉代替原料の需要に寄与しているいくつかの要因としては、菜食主義者やベジタリアンの人口の急増、新興国における植物性食品への需要の高まりが挙げられます。さらに、豚肉のトリチノーシス、家禽のサルモネラ、羊肉のスクレイピー、魚介類のビブリオ病やノロウイルス感染など、食品中の微生物汚染に起因する疾病事例の増加が、植物由来の代替肉への消費者の傾斜を促しています。

アジア経済圏の政府もまた、植物由来のイノベーションへの支援を強化しました。2022年3月、習近平国家主席は二中全会(中国で最も重要な年次政治会議)において、植物由来および微生物由来のタンパク質の多様化を明確に呼びかけました。中国では、政府の指針により、植物由来の肉や代替タンパク質の人気が高まっています。2021年、中国政府は公衆衛生の向上と温室効果ガスの大幅削減のため、国民の食肉消費量を50%削減する計画を発表しました。さらに2022年6月、インド食品安全基準局(FSSAI)は、動物性食品を使用しないビーガン食品に対する個別の規制枠組みを確定しました。同地域におけるこうした政府の取り組みが食肉代替製品の需要を押し上げ、同地域の食肉代替原料市場を牽引しています。

アジア太平洋の食肉代替原料市場の収益と2030年までの予測(金額)

アジア太平洋の食肉代替原料市場のセグメンテーション

アジア太平洋の食肉代替原料市場は、ソース、原料タイプ、用途、国に分類されます。

ソースに基づき、アジア太平洋の食肉代替原料市場は大豆、小麦、エンドウ豆、マイコプロテイン、その他に分類されます。大豆セグメントは2022年に最大の市場シェアを占めました。

原料に基づき、アジア太平洋の食肉代替原料市場は大豆タンパク質、エンドウ豆タンパク質、テンペ、豆腐、セイタン、その他に分類されます。大豆タンパク質セグメントは2022年に最大の市場シェアを占めました。

用途別では、アジア太平洋の食肉代替原料市場はパテ、ナゲット、ソーセージ、ミートボール、その他に分類されます。2022年にはその他セグメントが最大の市場シェアを占めました。

国別では、アジア太平洋の食肉代替原料市場はオーストラリア、中国、日本、インド、韓国、その他アジア太平洋に区分されます。2022年のアジア太平洋の食肉代替原料市場シェアは中国が独占しました。

Crespel &Deiters GmbH Co KG、DuPont de Neumours Inc、Ingredion Inc、Wilmar International Ltd、Archer Daniels Midland Co、Kerry Group Plc、Roquette Freres SA、The Scoular Coは、アジア太平洋の食肉代替原料市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の食肉代替原料市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者または供給業者

- アプリケーション

第5章 アジア太平洋の食肉代替原料市場-主な市場力学

- 食肉代替原料市場-主な市場力学

- 市場促進要因

- 植物性食肉への需要の高まり

- 主な市場開拓企業による戦略的取り組み

- 市場抑制要因

- 植物性タンパク質に関連する風味の課題

- 市場機会

- 食肉代替製品の消費を促進する政府の取り組み

- 今後の動向

- 高まる菜食主義の動向

- 促進要因と抑制要因の影響

第6章 食肉代替原料市場:アジア太平洋市場分析

- 食肉代替原料市場の収益、2020年~2030年

- 食肉代替原料市場の予測分析

第7章 アジア太平洋の食肉代替原料市場分析:ソース別

- 大豆

- 小麦

- エンドウ豆

- マイコプロテイン

- その他

第8章 アジア太平洋の食肉代替原料市場分析:原料タイプ別

- 大豆タンパク質

- エンドウ豆タンパク質

- テンペ

- 豆腐

- セイタン

- その他

第9章 アジア太平洋の食肉代替原料市場分析:用途別

- パテ

- ナゲット

- ソーセージ

- ミートボール

- その他

第10章 アジア太平洋の食肉代替原料市場:国別分析

- アジア太平洋市場の概要

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋

- アジア太平洋

第11章 業界情勢

- 事業拡大

- 新製品開発

- 合併と買収

- パートナーシップ

第12章 企業プロファイル

- Crespel & Deiters GmbH & Co KG

- DuPont de Nemours Inc

- Ingredion Inc

- Wilmar International Ltd

- Archer-Daniels-Midland Co

- Kerry Group Plc

- Roquette Freres SA

- The Scoular Co

第13章 付録

List Of Tables

- Table 1. Meat Substitute Ingredients Market Segmentation

- Table 2. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Source

- Table 4. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Ingredient Type

- Table 5. Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 6. Asia Pacific: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 7. China: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 8. China: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 9. China: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 10. Japan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 11. Japan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 12. Japan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 13. India: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 14. India: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 15. India: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 16. Australia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 17. Australia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 18. Australia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 19. South Korea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 20. South Korea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 21. South Korea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

- Table 22. Rest of APAC: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Source

- Table 23. Rest of APAC: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Ingredient Type

- Table 24. Rest of APAC: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million) - by Application

List Of Figures

- Figure 1. Meat Substitute Ingredients Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Meat Substitute Ingredients Market

- Figure 4. Registrations for the Veganuary Campaign from 2015 to 2021

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Meat Substitute Ingredients Market Revenue (US$ Million), 2020-2030

- Figure 7. Meat Substitute Ingredients Market Share (%) - by Source (2022 and 2030)

- Figure 8. Soy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

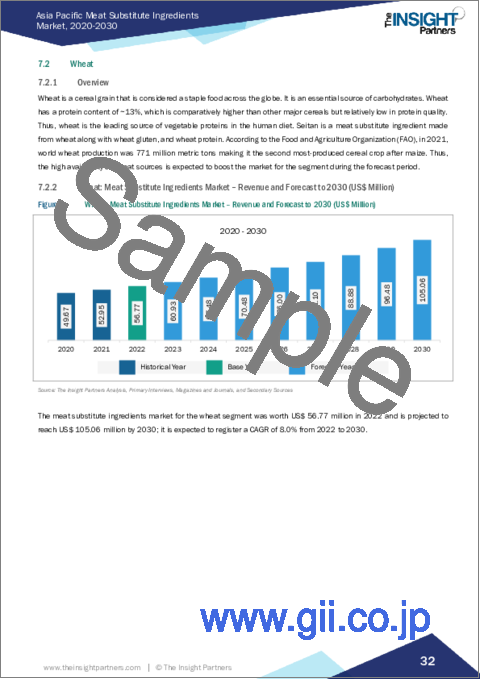

- Figure 9. Wheat: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Pea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Mycoprotein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Meat Substitute Ingredients Market Share (%) - by Ingredient Type (2022 and 2030)

- Figure 14. Soy Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Pea Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Tempeh: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Tofu: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Seitan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Meat Substitute Ingredients Market Share (%) - by Application (2022 and 2030)

- Figure 21. Patties: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Nuggets: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Sausages: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Meatballs: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Asia Pacific: Meat Substitute Ingredients Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 27. Asia Pacific: Meat Substitute Ingredients Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 28. China: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 29. Japan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 30. India: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 31. Australia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 32. South Korea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

- Figure 33. Rest of APAC: Meat Substitute Ingredients Market - Revenue and Forecast to 2030(US$ Million)

The Asia Pacific meat substitute ingredients market was valued at US$ 503.63 million in 2022 and is expected to reach US$ 945.30 million by 2030; it is estimated to record a CAGR of 8.2% from 2022 to 2030 .

Government Initiatives to Promote Consumption of Meat Alternative Products Drive Asia Pacific Meat Substitute Ingredients Market

Government bodies across various countries are promoting the consumption of plant-based meat owing to the rising environmental concerns and health benefits offered by these products. Additionally, the governments are actively investing in R&D and new product launches of plant-based meat products. In 2021, the South Korean Ministry of Agriculture, Food and Rural Affairs established a US$ 70.3 million fund with several sub-funds dedicated to food and agriculture. The Green Bio Fund investments specifically mentioned plant-based and cultivated meat companies. Moreover, in June 2022, the Food Safety and Standards Authority of India (FSSAI) finalized the Vegan Foods Regulations and established a separate regulatory framework for food ingredients free from animal products. Also, the government announced US$ 76 million to support a project led by Australian Plant Proteins to create the largest pulse protein ingredient manufacturing capability in Australia, which is expected to generate up to US$ 2.6 billion in plant-based exports by 2032. Moreover, by establishing new dietary guidelines in 2021, the government of China announced plans to lower the country's meat consumption by 50%. The country's health ministry recommended that individuals consume only between 40 g and 75 g of meat per day.

These measures aim to enhance public health while reducing GHG emissions significantly. Such recommendations and the influence by government agencies further boost the demand for alternative meat products. Thus, the continuous investment and support by various government bodies are expected to offer lucrative growth opportunities to the market during the forecast period.

Asia Pacific Meat Substitute Ingredients Market Overview

The meat substitute ingredients market in Asia Pacific is growing consistently. A few factors contributing to the demand for meat substitute ingredients in the region are a surging vegan and vegetarian population and rising demand for plant-based food in emerging countries. Further, increasing cases of diseases caused by microbial contamination in food-such as trichinosis from pork, salmonella from poultry, scrapie from lamb, and vibrio illness and norovirus infections from fish products-drive consumer inclination toward plant-based meat alternatives.

The governments of Asian economies also boosted support for plant-based innovation. In March 2022, at the Two Sessions (China's most important annual political conference), President Xi Jinping explicitly called for protein diversification from plant-based and microorganism sources. In China, the popularity of plant-based meat and protein alternatives is increasing due to government guidelines. In 2021, the Chinese government announced plans to lower its citizens' meat consumption by 50% to enhance public health and significantly reduce greenhouse gas emissions. Additionally, in June 2022, the Food Safety and Standards Authority of India (FSSAI) finalized a separate regulatory framework for vegan food that is free from animal products. Such government initiatives in the region boost the demand for meat substitute products, thereby driving the market for meat substitute ingredients in the region.

Asia Pacific Meat Substitute Ingredients Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Meat Substitute Ingredients Market Segmentation

The Asia Pacific meat substitute ingredients market is categorized into source, ingredients type, application, and country.

Based on source, the Asia Pacific meat substitute ingredients market is categorized into Soy, wheat, pea, mycoprotein, and others. The soy segment held the largest market share in 2022.

Based on ingredients, the Asia Pacific meat substitute ingredients market is segmented into soy protein, pea protein, tempeh, tofu, seitan, and others. The soy protein segment held the largest market share in 2022.

In terms of application, the Asia Pacific meat substitute ingredients market is categorized into patties, nuggets, sausages, meatballs, and others. The others segment held the largest market share in 2022.

By country, the Asia Pacific meat substitute ingredients market is segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific meat substitute ingredients market share in 2022.

Crespel & Deiters GmbH Co KG, DuPont de Neumours Inc, Ingredion Inc, Wilmar International Ltd, Archer Daniels Midland Co, Kerry Group Plc, Roquette Freres SA, and The Scoular Co are some of the leading companies operating in the Asia Pacific meat substitute ingredients market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Meat Substitute Ingredients Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.3 Distributors or Suppliers

- 4.3.4 Application

5. Asia Pacific Meat Substitute Ingredients Market - Key Market Dynamics

- 5.1 Meat Substitute Ingredients Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Rising Demand for Plant-Based Meat

- 5.2.2 Strategic Development Initiatives by Key Market Players

- 5.3 Market Restraints

- 5.3.1 Flavor Challenges Associated with Plant-Based Protein

- 5.4 Market Opportunities

- 5.4.1 Government Initiatives to Promote Consumption of Meat Alternative Products

- 5.5 Future Trends

- 5.5.1 Growing Veganism Trend

- 5.6 Impact of Drivers and Restraints:

6. Meat Substitute Ingredients Market - Asia Pacific Market Analysis

- 6.1 Meat Substitute Ingredients Market Revenue (US$ Million), 2020-2030

- 6.2 Meat Substitute Ingredients Market Forecast Analysis

7. Asia Pacific Meat Substitute Ingredients Market Analysis - by Source

- 7.1 Soy

- 7.1.1 Overview

- 7.1.2 Soy: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Wheat

- 7.2.1 Overview

- 7.2.2 Wheat: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Pea

- 7.3.1 Overview

- 7.3.2 Pea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Mycoprotein

- 7.4.1 Overview

- 7.4.2 Mycoprotein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Meat Substitute Ingredients Market Analysis - by Ingredient Type

- 8.1 Soy Protein

- 8.1.1 Overview

- 8.1.2 Soy Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Pea Protein

- 8.2.1 Overview

- 8.2.2 Pea Protein: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Tempeh

- 8.3.1 Overview

- 8.3.2 Tempeh: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Tofu

- 8.4.1 Overview

- 8.4.2 Tofu: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Seitan

- 8.5.1 Overview

- 8.5.2 Seitan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Meat Substitute Ingredients Market Analysis - by Application

- 9.1 Patties

- 9.1.1 Overview

- 9.1.2 Patties: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Nuggets

- 9.2.1 Overview

- 9.2.2 Nuggets: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Sausages

- 9.3.1 Overview

- 9.3.2 Sausages: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Meatballs

- 9.4.1 Overview

- 9.4.2 Meatballs: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Meat Substitute Ingredients Market - Country Analysis

- 10.1 Asia Pacific Market Overview

- 10.1.1 Asia Pacific: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 Asia Pacific: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 China: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.1 China: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.2.2 China: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.2.3 China: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.3 Japan: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.1 Japan: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.3.2 Japan: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.3.3 Japan: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.4 India: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.4.1 India: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.4.2 India: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.4.3 India: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.5 Australia: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.5.1 Australia: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.5.2 Australia: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.5.3 Australia: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.6 South Korea: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.6.1 South Korea: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.6.2 South Korea: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.6.3 South Korea: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1.7 Rest of APAC: Meat Substitute Ingredients Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.7.1 Rest of APAC: Meat Substitute Ingredients Market Breakdown, by Source

- 10.1.1.7.2 Rest of APAC: Meat Substitute Ingredients Market Breakdown, by Ingredient Type

- 10.1.1.7.3 Rest of APAC: Meat Substitute Ingredients Market Breakdown, by Application

- 10.1.1 Asia Pacific: Meat Substitute Ingredients Market - Revenue and Forecast Analysis - by Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Expansion

- 11.3 New Product Development

- 11.4 Merger and Acquisition

- 11.5 Partnerships

12. Company Profiles

- 12.1 Crespel & Deiters GmbH & Co KG

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 DuPont de Nemours Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Ingredion Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Wilmar International Ltd

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Archer-Daniels-Midland Co

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Kerry Group Plc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Roquette Freres SA

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 The Scoular Co

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners