|

|

市場調査レポート

商品コード

1716313

放出制御と徐放性肥料市場の2032年までの予測:タイプ別、作物タイプ別、施用形態別、地域別の世界分析Controlled and Slow Release Fertilizers Market Forecasts to 2032 - Global Analysis By Type (Controlled Release Fertilizers, Slow Release Fertilizers, Nitrification and Urease Inhibitors and Other Types), Crop Type, Mode of Application and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 放出制御と徐放性肥料市場の2032年までの予測:タイプ別、作物タイプ別、施用形態別、地域別の世界分析 |

|

出版日: 2025年04月03日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の放出制御と徐放性肥料市場は2025年に26億6,000万米ドルを占め、予測期間中のCAGRは8.3%で成長し、2032年には46億5,000万米ドルに達する見込みです。

放出制御や徐放性肥料と呼ばれる特殊な栄養源は、時間をかけて徐々に栄養分を放出し、植物の吸収効率を高め、栄養損失を減らすように作られています。放出制御肥料(CRF)には、水分や温度に反応して養分の放出を制御するために、コーティングや化学的変化が使用されます。徐放性肥料(SRF)は、加水分解や微生物の働きによって自然に分解され、養分を持続的に供給します。長期間にわたって植物に一貫した効果的な栄養素の供給を保証することで、どちらの品種も土壌の健全性を高め、溶出を減らし、持続可能な農業を促進します。

世界人口の増加と食糧安全保障への懸念

放出制御と徐放性肥料は、窒素の利用効率を高め、農業収量を増やすと同時に、環境への悪影響を軽減します。食糧安全保障への懸念から、農家は栄養素を安定的に供給し、損失を最小限に抑えて生産量を増大させる最先端の肥料を使用するようになります。これらの肥料は土壌劣化の抑制にも役立つため、長期的な農業の持続可能性が確保されます。世界の食糧生産を支えるため、政府や組織は法律や補助金を通じて肥料の使用を奨励しています。世界の食糧需要の増大に対応して、放出制御と徐放性肥料の市場は着実に拡大しています。

従来の肥料に比べて高コスト

特に低開発国では、農家は生産費を削減するために、より安価な選択肢を選ぶ。中小規模の農家は、こうした最先端肥料にかかる初期費用が足かせとなっています。長期的な利点に関する知識が不足しているため、導入率はさらに低下します。これらの肥料は、生産費や研究費が高いため、価格に敏感な地域では利用しにくいです。その結果、放出制御と徐放性肥料の商業的拡大は限定的なものとなっています。

精密農業の成長

作物に正確に栄養分を供給し収量を増やすため、農家はこれらの肥料をますます使用するようになっています。GPSやIoTのような最先端技術は、正確な施肥を可能にすることで、環境への悪影響を軽減します。持続可能な農業を推進するため、放出制御肥料は温室効果ガスの排出と溶出を低減します。世界中で食糧需要が高まっているため、農家は収量を最大化するために最先端の施肥技術を使わざるを得ないです。一般に、効率的で持続可能な農業を実現するための放出制御と徐放性肥料の使用は、精密農業によって加速されています。

従来型肥料と有機肥料の競合

従来型肥料は、初期コストが安く、すぐに栄養分を利用できるため、農家に好まれることが多いです。有機肥料は持続可能な農法を支援し、環境に配慮する消費者にアピールします。徐放性肥料は、有機農業に対する政府の優遇措置や規制支援によってさらに複雑になっています。新興国市場では、高度な肥料に関する知識や普及率が低いため、市場の拡大はさらに制約されます。このため、放出制御と徐放性肥料の市場は、こうした確立された代替品に比べて成長しにくいです。

COVID-19の影響

COVID-19の大流行は、サプライチェーンの制約、労働力不足、農業活動の低下により、徐放性肥料市場を混乱させました。ロックダウンは生産と流通に影響を与え、肥料の入手の遅れにつながりました。農家は経済的な不安に直面し、購入の意思決定に影響を与えました。しかし、政府が食糧安全保障と持続可能な農業を優先したため、市場は回復しました。労働力不足の中、収量を最大化するための高効率肥料への需要が高まり、精密農業や環境に優しいソリューションへの注目度が高まったことが、パンデミック後の市場成長をさらに後押ししました。

予測期間中、穀物・穀類分野が最大となる見込み

穀物・穀類分野は、養分効率と作物収量の向上により、予測期間中最大の市場シェアを占めると予想されます。溶出を抑え、植物の継続的な成長を保証することで、これらの肥料は安定した養分の供給を提供します。洗練された施肥方法のニーズは、トウモロコシ、米、小麦のような主食作物に対する世界の需要の高まりによって煽られています。持続可能な農法に沿って、放出制御肥料は土壌の健全性を高め、環境への影響を軽減します。穀物・穀類栽培では、精密農業の普及によって徐放性肥料の需要がさらに高まっています。

土壌施用分野は予測期間中に最も高いCAGRが見込まれる

予測期間中、植物への効率的な養分供給により、土壌施用分野が最も高い成長率を示すと予測されます。土壌の肥沃度を高め、養分の溶出を減らし、環境への影響を最小限に抑えます。農家は、施用が容易で作物収量への効果が長期間持続するこの方法を好みます。持続可能で費用対効果の高い施肥への需要が、この方法の採用をさらに後押ししています。精密農業が普及するにつれて、土壌施用放出制御肥料は引き続き力強い市場成長を遂げています。

最大のシェアを持つ地域:

予測期間中、アジア太平洋地域は、持続可能な農法に対する需要の高まりにより、最大の市場シェアを占めると予想されます。中国、インド、日本のような国々は、土壌の健全性を改善し、栄養損失を最小限に抑えるために高度な肥料を採用しています。肥料の効率的な使用を促進する政府の取り組みや、精密農業への投資の増加が市場拡大を後押ししています。環境に優しい肥料への嗜好の高まりや、園芸作物や畑作物における高効率の養分管理の必要性は、さらに放出制御と徐放性肥料の採用拡大に寄与しています。

CAGRが最も高い地域:

予測期間中、北米地域は作物収穫効率の向上により、最も高いCAGRを示すと予測されます。農家は養分の損失を最小限に抑え、土壌の健全性を向上させるためにこれらの肥料を採用しています。技術の進歩と精密農業は、さらにその採用を後押ししています。有機農業や環境に優しいソリューションの人気が高まっていることも、市場拡大に寄与しています。さらに、肥料の効率的な利用を促進する政府の取り組みや、高度な配合への研究投資が、この地域の市場成長を支えています。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査資料

- 1次調査資料

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の放出制御と徐放性肥料市場:タイプ別

- 放出制御肥料(CRF)

- ポリマーコーティング肥料

- 硫黄コーティング肥料

- ポリマー硫黄コーティング肥料

- 徐放性肥料(SRF)

- 尿素ホルムアルデヒド

- 尿素イソブチルアルデヒド

- 尿素アセトアルデヒド

- 硝化およびウレアーゼ抑制剤

- 硝化抑制剤

- ウレアーゼ抑制剤

- その他のタイプ

第6章 世界の放出制御と徐放性肥料市場:作物タイプ別

- 穀物

- 油糧種子と豆類

- 果物と野菜

- 芝生と観賞用植物

- その他の作物タイプ

第7章 世界の放出制御と徐放性肥料市場:施用形態別

- 葉面散布

- 土壌への施用

- 施肥灌水

- 種子コーティングとドレッシング

- 根浸し

- その他の施用形態

第8章 世界の放出制御と徐放性肥料市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、ジョイントベンチャー

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイリング

- Haifa Group

- Yara International

- Nutrien

- Coromandel International

- ICL Group Ltd.

- CF Industries Holdings Inc.

- The Mosaic Company

- K+S AG

- ScottsMiracle-Gro Company

- Compo Expert GmbH

- Agrium Inc.

- Kingenta Ecological Engineering Group Co., Ltd.

- Shikefeng Chemical Industry

- Kugler Company

- JNC Corporation

- SK Specialties

- Ekompany International B.V.

- Andersons, Inc.

List of Tables

- Table 1 Global Controlled and Slow Release Fertilizers Market Outlook, By Region (2024-2032) ($MN)

- Table 2 Global Controlled and Slow Release Fertilizers Market Outlook, By Type (2024-2032) ($MN)

- Table 3 Global Controlled and Slow Release Fertilizers Market Outlook, By Controlled Release Fertilizers (CRF) (2024-2032) ($MN)

- Table 4 Global Controlled and Slow Release Fertilizers Market Outlook, By Polymer-coated fertilizers (2024-2032) ($MN)

- Table 5 Global Controlled and Slow Release Fertilizers Market Outlook, By Sulfur-coated fertilizers (2024-2032) ($MN)

- Table 6 Global Controlled and Slow Release Fertilizers Market Outlook, By Polymer-sulfur-coated fertilizers (2024-2032) ($MN)

- Table 7 Global Controlled and Slow Release Fertilizers Market Outlook, By Slow Release Fertilizers (SRF) (2024-2032) ($MN)

- Table 8 Global Controlled and Slow Release Fertilizers Market Outlook, By Urea-formaldehyde (2024-2032) ($MN)

- Table 9 Global Controlled and Slow Release Fertilizers Market Outlook, By Urea-isobutyraldehyde (2024-2032) ($MN)

- Table 10 Global Controlled and Slow Release Fertilizers Market Outlook, By Urea-acetaldehyde (2024-2032) ($MN)

- Table 11 Global Controlled and Slow Release Fertilizers Market Outlook, By Nitrification and Urease Inhibitors (2024-2032) ($MN)

- Table 12 Global Controlled and Slow Release Fertilizers Market Outlook, By Nitrification inhibitors (2024-2032) ($MN)

- Table 13 Global Controlled and Slow Release Fertilizers Market Outlook, By Urease inhibitors (2024-2032) ($MN)

- Table 14 Global Controlled and Slow Release Fertilizers Market Outlook, By Other Types (2024-2032) ($MN)

- Table 15 Global Controlled and Slow Release Fertilizers Market Outlook, By Crop Type (2024-2032) ($MN)

- Table 16 Global Controlled and Slow Release Fertilizers Market Outlook, By Cereals & grains (2024-2032) ($MN)

- Table 17 Global Controlled and Slow Release Fertilizers Market Outlook, By Oilseeds & pulses (2024-2032) ($MN)

- Table 18 Global Controlled and Slow Release Fertilizers Market Outlook, By Fruits & vegetables (2024-2032) ($MN)

- Table 19 Global Controlled and Slow Release Fertilizers Market Outlook, By Turf & ornamentals (2024-2032) ($MN)

- Table 20 Global Controlled and Slow Release Fertilizers Market Outlook, By Other Crop Types (2024-2032) ($MN)

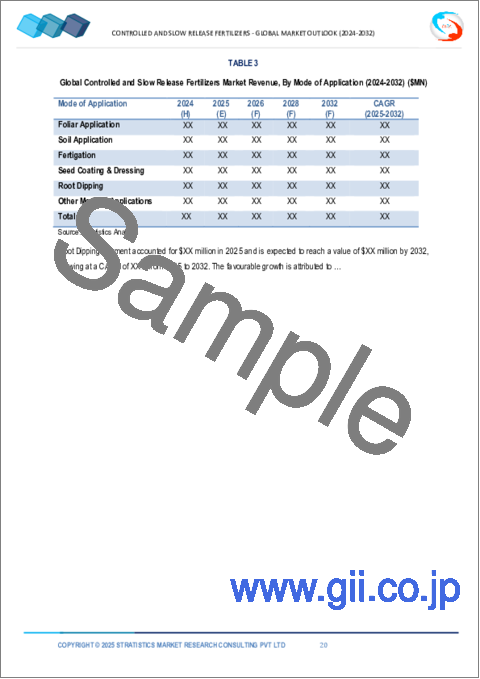

- Table 21 Global Controlled and Slow Release Fertilizers Market Outlook, By Mode of Application (2024-2032) ($MN)

- Table 22 Global Controlled and Slow Release Fertilizers Market Outlook, By Foliar application (2024-2032) ($MN)

- Table 23 Global Controlled and Slow Release Fertilizers Market Outlook, By Soil application (2024-2032) ($MN)

- Table 24 Global Controlled and Slow Release Fertilizers Market Outlook, By Fertigation (2024-2032) ($MN)

- Table 25 Global Controlled and Slow Release Fertilizers Market Outlook, By Seed Coating & Dressing (2024-2032) ($MN)

- Table 26 Global Controlled and Slow Release Fertilizers Market Outlook, By Root Dipping (2024-2032) ($MN)

- Table 27 Global Controlled and Slow Release Fertilizers Market Outlook, By Other Mode of Applications (2024-2032) ($MN)

Note: Tables for North America, Europe, APAC, South America, and Middle East & Africa Regions are also represented in the same manner as above.

According to Stratistics MRC, the Global Controlled and Slow Release Fertilizers Market is accounted for $2.66 billion in 2025 and is expected to reach $4.65 billion by 2032 growing at a CAGR of 8.3% during the forecast period. Specialised nutrient sources called controlled and slow-release fertilisers are made to release nutrients gradually over time, increasing plant absorption efficiency and reducing nutrient loss. Coatings or chemical alterations are used in controlled-release fertilisers (CRFs) to control the release of nutrients in response to moisture or temperature. Slow-release fertilisers (SRFs) provide a sustained supply of nutrients by breaking down naturally through hydrolysis or microbial action. By guaranteeing a consistent and effective delivery of nutrients to plants over an extended period of time, both varieties enhance soil health, lessen leaching, and promote sustainable agriculture.

Market Dynamics:

Driver:

Rising global population & food security concerns

Slow-release and controlled fertilisers increase the efficiency of nitrogen utilisation, increasing agricultural yields while reducing their negative effects on the environment. Concerns about food security drive farmers to use cutting-edge fertilisers that offer a steady supply of nutrients, minimising losses and increasing output. Long-term agricultural sustainability is ensured by these fertilisers, which also aid in reducing soil degradation. In order to support the world's food production, governments and organisations are encouraging their use through laws and subsidies. In response to the growing global demand for food, the market for controlled and slow-release fertilisers is expanding steadily.

Restraint:

High cost compared to conventional fertilizers

Farmers choose less expensive options to cut production expenses, particularly in underdeveloped nations. Small and medium-sized farmers are deterred by the upfront costs associated with these cutting-edge fertilisers. Adoption rates are further decreased by a lack of knowledge regarding long-term advantages. These fertilisers are less available in price-sensitive areas due to high production and research expenditures. Consequently, regulated and slow-release fertilisers continue to have limited commercial expansion.

Opportunity:

Growth in precision farming

In order to precisely supply nutrients to crops and increase yields, farmers are using these fertilisers more and more. By enabling accurate application, cutting-edge technologies like GPS and IoT reduce their negative effects on the environment. In order to promote sustainable agriculture, controlled-release fertilisers lower greenhouse gas emissions and leaching. The growing demand for food around the world forces farmers to use cutting-edge fertilisation techniques to maximise yield. In general, the use of regulated and slow-release fertilisers for efficient and sustainable agriculture is accelerated by precision farming.

Threat:

Competition from traditional & organic fertilizers

Conventional fertilisers are frequently preferred by farmers because of their reduced initial costs and instant nutrient availability. Organic fertilisers support sustainable farming methods and appeal to consumers who care about the environment. Slow-release fertilisers are further complicated by government incentives and regulatory support for organic farming. The market's expansion is further constrained by developing nations' low knowledge and uptake of sophisticated fertilisers. Because of this, the market for controlled and slow-release fertilisers finds it difficult to grow in comparison to these established substitutes.

Covid-19 Impact

The COVID-19 pandemic disrupted the controlled and slow-release fertilizers market due to supply chain constraints, labour shortages, and reduced agricultural activities. Lockdowns affected production and distribution, leading to delays in fertilizer availability. Farmers faced economic uncertainties, impacting purchasing decisions. However, the market rebounded as governments prioritized food security and sustainable farming. Increased demand for high-efficiency fertilizers to maximize yields amid labour shortages further drove market growth post-pandemic, with a rising focus on precision agriculture and environmentally friendly solutions.

The cereals & grains segment is expected to be the largest during the forecast period

The cereals & grains segment is expected to account for the largest market share during the forecast period by enhanced nutrient efficiency and crop yield. By lowering leaching and guaranteeing continuous plant growth, these fertilisers offer a consistent supply of nutrients. The need for sophisticated fertilisation methods is fuelled by the growing demand for staple crops like corn, rice, and wheat worldwide. In line with sustainable farming methods, controlled-release fertilisers enhance soil health and reduce environmental effect. In cereal and grain cultivation, the demand for slow-release fertilisers is further boosted by the growing use of precision farming.

The soil application segment is expected to have the highest CAGR during the forecast period

Over the forecast period, the soil application segment is predicted to witness the highest growth rate, due to efficient nutrient delivery to plants. It enhances soil fertility, reducing nutrient leaching and minimizing environmental impact. Farmers prefer this method due to its ease of application and long-lasting effects on crop yield. The demand for sustainable and cost-effective fertilization further boosts its adoption. As precision farming gains traction, soil-applied controlled-release fertilizers continue to witness strong market growth.

Region with largest share:

During the forecast period, the Asia Pacific region is expected to hold the largest market share due to rising demand for sustainable agricultural practices. Countries like China, India, and Japan are adopting advanced fertilizers to improve soil health and minimize nutrient loss. Government initiatives promoting efficient fertilizer use and increasing investments in precision farming are fueling market expansion. The growing preference for eco-friendly fertilizers and the need for high-efficiency nutrient management in horticulture and field crops further contribute to the rising adoption of controlled and slow-release fertilizers.

Region with highest CAGR:

Over the forecast period, the North America region is anticipated to exhibit the highest CAGR, owing to enhanced crop yield efficiency. Farmers are adopting these fertilizers to minimize nutrient loss and improve soil health. Technological advancements and precision farming are further boosting their adoption. The rising popularity of organic farming and environmentally friendly solutions also contributes to market expansion. Additionally, government initiatives promoting efficient fertilizer use and research investments in advanced formulations are supporting market growth across the region.

Key players in the market

Some of the key players profiled in the Controlled and Slow Release Fertilizers Market include Haifa Group, Yara International, Nutrien, Coromandel International, ICL Group Ltd., CF Industries Holdings Inc., The Mosaic Company, K+S AG, ScottsMiracle-Gro Company, Compo Expert GmbH, Agrium Inc., Kingenta Ecological Engineering Group Co., Ltd., Shikefeng Chemical Industry, Kugler Company, JNC Corporation, SK Specialties, Ekompany International B.V. and Andersons, Inc.

Key Developments:

In March 2024, Haifa Group signed a collaborative agreement with Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL) of India. This partnership aims to enhance innovation and sustainability in plant nutrition and agriculture in India, providing farmers with advanced solutions to improve crop yields and quality while focusing on resource preservation and environmental protection.

In December 2023, Yara International acquired Agribios Italiana, an organic fertilizer company, to strengthen its portfolio in organic-based fertilizers. This acquisition aligns with Yara's strategy to expand its sustainable agriculture solutions, enhancing its market presence in eco-friendly fertilizers while supporting global demand for sustainable and controlled-release nutrient solutions.

Types Covered:

- Controlled Release Fertilizers (CRF)

- Slow Release Fertilizers (SRF)

- Nitrification and Urease Inhibitors

- Other Types

Crop Types Covered:

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Other Crop Types

Mode of Applications Covered:

- Foliar Application

- Soil Application

- Fertigation

- Seed Coating & Dressing

- Root Dipping

- Other Mode of Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2024, 2025, 2026, 2028, and 2032

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Emerging Markets

- 3.7 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Controlled and Slow Release Fertilizers Market, By Type

- 5.1 Introduction

- 5.2 Controlled Release Fertilizers (CRF)

- 5.2.1 Polymer-Coated Fertilizers

- 5.2.2 Sulfur-Coated Fertilizers

- 5.2.3 Polymer-Sulfur-Coated Fertilizers

- 5.3 Slow Release Fertilizers (SRF)

- 5.3.1 Urea-Formaldehyde

- 5.3.2 Urea-Isobutyraldehyde

- 5.3.3 Urea-Acetaldehyde

- 5.4 Nitrification And Urease Inhibitors

- 5.4.1 Nitrification Inhibitors

- 5.4.2 Urease Inhibitors

- 5.5 Other Types

6 Global Controlled and Slow Release Fertilizers Market, By Crop Type

- 6.1 Introduction

- 6.2 Cereals & Grains

- 6.3 Oilseeds & Pulses

- 6.4 Fruits & Vegetables

- 6.5 Turf & Ornamentals

- 6.6 Other Crop Types

7 Global Controlled and Slow Release Fertilizers Market, By Mode of Application

- 7.1 Introduction

- 7.2 Foliar Application

- 7.3 Soil Application

- 7.4 Fertigation

- 7.5 Seed Coating & Dressing

- 7.6 Root Dipping

- 7.7 Other Mode of Applications

8 Global Controlled and Slow Release Fertilizers Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 Haifa Group

- 10.2 Yara International

- 10.3 Nutrien

- 10.4 Coromandel International

- 10.5 ICL Group Ltd.

- 10.6 CF Industries Holdings Inc.

- 10.7 The Mosaic Company

- 10.8 K+S AG

- 10.9 ScottsMiracle-Gro Company

- 10.10 Compo Expert GmbH

- 10.11 Agrium Inc.

- 10.12 Kingenta Ecological Engineering Group Co., Ltd.

- 10.13 Shikefeng Chemical Industry

- 10.14 Kugler Company

- 10.15 JNC Corporation

- 10.16 SK Specialties

- 10.17 Ekompany International B.V.

- 10.18 Andersons, Inc.