|

|

市場調査レポート

商品コード

1324202

代替肉市場の2030年までの予測:製品、形態、由来、動物タイプ、原材料、機能、流通チャネル、地域別の世界分析Meat Substitutes Market Forecasts to 2030 - Global Analysis By Product, Format, Source, Animal Type, Ingredient, Functionality, Distribution Channel and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 代替肉市場の2030年までの予測:製品、形態、由来、動物タイプ、原材料、機能、流通チャネル、地域別の世界分析 |

|

出版日: 2023年08月01日

発行: Stratistics Market Research Consulting

ページ情報: 英文 175+ Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の代替肉市場は2023年に21億3,000万米ドルを占め、予測期間中のCAGRは6.4%で成長し、2030年には33億1,000万米ドルに達する見込みです。

代替肉は「肉類似品」と呼ばれることもあり、風味、食感、外観が豚、牛、鶏などの特定の形態の肉に似せて作られています。これらの代替肉は、大豆、小麦、エンドウ豆のタンパク質など、さまざまな植物性タンパク質から作られています。これらの化学物質には、健康に良い効果がいくつかあります。これらの商品は主に、動物性肉への依存を代替または軽減するために作られました。動物の肉に比べ、より健康的でエコロジーだと言われています。

フォーブス誌によれば、世界人口の70%近くが肉の消費を控えています。赤身肉の消費量が多いと、消費者の間で大腸がんが発生することが調査によって判明しました。

菜食主義者の増加

動物の搾取を止めるため、動物と強い感情的結びつきを持つ人々の大半が菜食主義者になりつつあります。このような食習慣の変化により、食事の中で肉の代わりとなり、同等の量の高タンパク質栄養素を摂取できる、健康的でおいしい商品を求める消費者の需要を満たす新しい商品の開発が必要となっています。健康的で持続可能な食生活に対する世界の意識の高まりにより、植物性タンパク質を原料とする代替肉食品への需要が高まっています。60%の人々がこの移行を恒久的なものにすることを計画しており、人口のかなりの部分が動物性タンパク質の摂取量を減らすか制限することに焦点を当てています。フレキシタリアンやビーガンの増加は市場拡大を促進すると予想されます。

複雑な製造工程

植物から作られる代用肉の製造方法は非常に複雑です。植物由来の代用肉も含め、製品は製造過程で多くの加工を経る。特に植物性食代替肉のような品目では、肉の香りを香料化学物質で再現することはできないです。その結果、消費者に満足のいく味覚を提供できない、味気ない商品が生み出されています。完成品は様々な材料を使って作られるため、製造業者はバッチ製造のような技術を利用しています。その結果、植物性食肉の生産コスト全体が上昇しています。

押出・加工技術の進歩

加工と押し出しは、代替肉市場において極めて重要です。エンドウ豆、大豆、小麦のタンパク質は加工中に抽出されます。従来の乾式抽出工程では、タンパク質濃縮物が46~60%、プロテイン粉が20~40%のタンパク質しか得られないです。しかし、コアサン社によれば、新しい押し出し可能な脂肪技術の助けを借りれば、霜降りのような、よりリアルな脂肪の質感を持つ植物性食肉を製造することができます。この方法では、脂肪をエクストルーダーに通し、タンパク質と混合することで、脂肪とタンパク質を物理的に結合させ、優れた成分を作り出すことができます。こうした技術開拓が市場拡大を促進しています。

アレルギーへの懸念

何百年もの間、食物不耐症やアレルギーが記録されてきました。代替肉は不健康で、加工度が高いです。代替肉製品では、タンパク質濃度がかなり高いことが多く、その結果、非常に重度のアレルギー反応を引き起こす可能性があります。大豆、エンドウ豆、小麦、その他の代替食品を多く食べると、深刻な反応が起こり、免疫系が著しく損なわれます。こうした健康上の問題はすべて、市場の拡大を妨げています。

COVID-19の影響:

COVID-19パンデミックの発生は食肉セクターに悪影響を及ぼし、サプライチェーンと製造工程の混乱を引き起こしたため、代替食肉に大きな利益をもたらしました。この時期、病気の蔓延を食い止めるために工場が閉鎖された結果、食肉製品の需要と供給の間に大きなギャップが市場に生じた。このことは、植物性食肉の生産者にとっては、市場の需要を見極め、新たな市場への参入や新たな食代替肉の導入によって会社を成長させるチャンスとなっています。

予測期間中、分離株セグメントが最大となる見込み

分離物セグメントは有利な成長を遂げると推定されます。食代替肉物では、タンパク質含有量の関係で、食代替肉物は分離物または純粋な形態で入手可能であり、これらはタンパク質ベースの食品や飲食品の生産者に好まれ、好まれています。大豆、エンドウ豆、米、キャノーラは、分離タンパク質のさまざまな供給源の一部です。タンパク質含有量の増加、保湿性の向上、乳化に加え、分離大豆タンパク質は食肉製品の食感を改善するために使用されます。分離大豆たん白は細菌発酵により、低脂肪、低オリゴ糖、低繊維質で、鼓腸を起こしにくいです。こうした要素がこのセグメントの拡大を促進しています。

量販店セグメントは予測期間中最も高いCAGRが見込まれる

量販店セグメントは予測期間中に最も速いCAGRの成長が見込まれます。クリーンミート製品の市場で最も人気のある流通方法のひとつが量販店です。顧客は、スーパーマーケットやWalmartやTargetのような格安小売店の市場通路で手に入る幅広い選択肢から食品を選ぶことができます。加えて、これらの店は新しい料理アイテムを提供し、特別価格で顧客の購買意欲をそそる。その結果、このチャネルは今後数年間で急成長すると予想されます。

最大のシェアを持つ地域:

予測期間中、北米が最大の市場シェアを占めると予測されています。Good Food Instituteによると、米国は2018年に世界で植物性商品の消費量がトップクラスでした。環境意識の高まりと健康的なライフスタイルへの嗜好の結果として、乳製品と肉の代替品の採用が同国の重要な動向となっています。ハンバーガー、タコス、その他の好まれている食品を含む様々な食品の調理に代替肉が使用されるようになった結果、小売食品チェーンで販売される商品の量は近年大幅に増加しています。

CAGRが最も高い地域:

中東・アフリカは予測期間中CAGRが最も高いと予測されます。この地域では、植物由来の肉に対する消費者の知識の高まり、気候変動に対する関心の高まり、健康とウェルビーイングに対する関心の高まりを受けて、代替タンパク質と代替肉の市場が急速に拡大しています。観光産業が盛んになるにつれて、様々な料理を作るための高級飲食店における代替肉製品のニーズが大幅に高まっています。さらに近年、ザンビアや南アフリカのようなアフリカ諸国では、ハンバーガーやナゲットのような植物性代替肉の消費が大幅に拡大しています。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下のいずれかの無料カスタマイズオプションをご提供いたします:

- 企業プロファイル

- 追加市場プレイヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 仮定

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 製品分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の代替肉市場:製品別

- ソーセージ

- パティ

- ミートボール

- ホットドッグ

- クランブルズ&グラウンド

- ナゲット

- その他の製品

第6章 世界の代替肉市場:形態別

- 常温保存可能

- 冷蔵

- 冷凍

第7章 世界の代替肉市場:由来別

- テクスチャード

- 分離物

- 濃縮物

第8章 世界の代替肉市場:動物タイプ別

- 牛肉

- 鶏

- 豚肉

- 魚

- ヤギ

第9章 世界の代替肉市場:原材料別

- テクスチャード植物性タンパク質

- 大豆由来成分

- 小麦由来の原材料

- その他

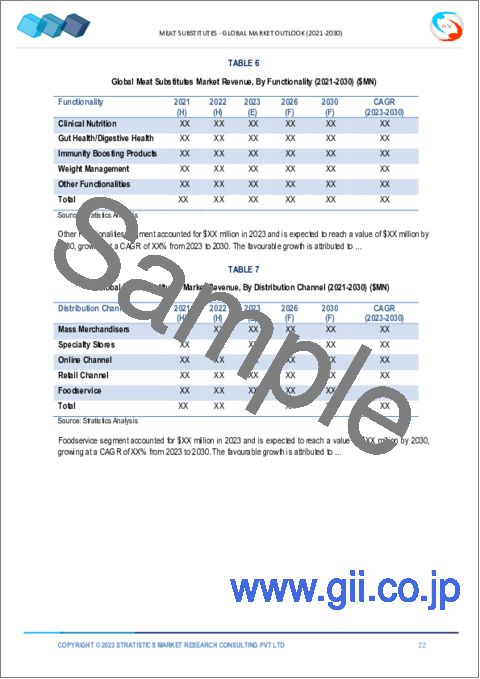

第10章 世界の代替肉市場:機能別

- 臨床栄養学

- 腸の健康/消化器の健康

- 免疫力を高める製品

- 体重管理

- その他の機能

第11章 世界の代替肉市場:流通チャネル別

- 量販店

- 専門店

- オンラインチャンネル

- 小売チャネル

- 食品サービス

第12章 世界の代替肉市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第13章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第14章 会社概要

- Batory Foods

- Beyond Meat

- ADM

- Impossible Foods

- Ingredion Incorporated

- Kellogg Company

- Kerry Group

- Tyson Foods

- Roquette Freres

- JBS SA

- Sunfed

- Conagra Brands, Inc.

- Nestle S.A.

- Hain Celestial Group

- Unilever Group

- Amy's Kitchen, Inc

- Pinnacle Foods

- Atlantic Natural Foods LLC

- Pacific Foods of Oregon Inc

- Fry Group Foods

List of Tables

- Table 1 Global Meat Substitutes Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Meat Substitutes Market Outlook, By Product (2021-2030) ($MN)

- Table 3 Global Meat Substitutes Market Outlook, By Sausages (2021-2030) ($MN)

- Table 4 Global Meat Substitutes Market Outlook, By Patties (2021-2030) ($MN)

- Table 5 Global Meat Substitutes Market Outlook, By Meatballs (2021-2030) ($MN)

- Table 6 Global Meat Substitutes Market Outlook, By Hot Dogs (2021-2030) ($MN)

- Table 7 Global Meat Substitutes Market Outlook, By Crumbles & Grounds (2021-2030) ($MN)

- Table 8 Global Meat Substitutes Market Outlook, By Nuggets (2021-2030) ($MN)

- Table 9 Global Meat Substitutes Market Outlook, By Other Products (2021-2030) ($MN)

- Table 10 Global Meat Substitutes Market Outlook, By Format (2021-2030) ($MN)

- Table 11 Global Meat Substitutes Market Outlook, By Shelf-stable (2021-2030) ($MN)

- Table 12 Global Meat Substitutes Market Outlook, By Refrigerated (2021-2030) ($MN)

- Table 13 Global Meat Substitutes Market Outlook, By Frozen (2021-2030) ($MN)

- Table 14 Global Meat Substitutes Market Outlook, By Source (2021-2030) ($MN)

- Table 15 Global Meat Substitutes Market Outlook, By Textured (2021-2030) ($MN)

- Table 16 Global Meat Substitutes Market Outlook, By Isolates (2021-2030) ($MN)

- Table 17 Global Meat Substitutes Market Outlook, By Concentrates (2021-2030) ($MN)

- Table 18 Global Meat Substitutes Market Outlook, By Animal Type (2021-2030) ($MN)

- Table 19 Global Meat Substitutes Market Outlook, By Beef (2021-2030) ($MN)

- Table 20 Global Meat Substitutes Market Outlook, By Chicken (2021-2030) ($MN)

- Table 21 Global Meat Substitutes Market Outlook, By Pork (2021-2030) ($MN)

- Table 22 Global Meat Substitutes Market Outlook, By Fish (2021-2030) ($MN)

- Table 23 Global Meat Substitutes Market Outlook, By Goat (2021-2030) ($MN)

- Table 24 Global Meat Substitutes Market Outlook, By Ingredient (2021-2030) ($MN)

- Table 25 Global Meat Substitutes Market Outlook, By Textured Vegetable Proteins (2021-2030) ($MN)

- Table 26 Global Meat Substitutes Market Outlook, By Soy-based Ingredients (2021-2030) ($MN)

- Table 27 Global Meat Substitutes Market Outlook, By Wheat-based Ingredients (2021-2030) ($MN)

- Table 28 Global Meat Substitutes Market Outlook, By Other Ingredients (2021-2030) ($MN)

- Table 29 Global Meat Substitutes Market Outlook, By Functionality (2021-2030) ($MN)

- Table 30 Global Meat Substitutes Market Outlook, By Clinical Nutrition (2021-2030) ($MN)

- Table 31 Global Meat Substitutes Market Outlook, By Gut Health/Digestive Health (2021-2030) ($MN)

- Table 32 Global Meat Substitutes Market Outlook, By Immunity Boosting Products (2021-2030) ($MN)

- Table 33 Global Meat Substitutes Market Outlook, By Weight Management (2021-2030) ($MN)

- Table 34 Global Meat Substitutes Market Outlook, By Other Functionalities (2021-2030) ($MN)

- Table 35 Global Meat Substitutes Market Outlook, By Distribution Channel (2021-2030) ($MN)

- Table 36 Global Meat Substitutes Market Outlook, By Mass Merchandisers (2021-2030) ($MN)

- Table 37 Global Meat Substitutes Market Outlook, By Specialty Stores (2021-2030) ($MN)

- Table 38 Global Meat Substitutes Market Outlook, By Online Channel (2021-2030) ($MN)

- Table 39 Global Meat Substitutes Market Outlook, By Retail Channel (2021-2030) ($MN)

- Table 40 Global Meat Substitutes Market Outlook, By Foodservice (2021-2030) ($MN)

Note: Tables for North America, Europe, APAC, South America, and Middle East & Africa Regions are also represented in the same manner as above.

According to Stratistics MRC, the Global Meat Substitutes Market is accounted for $2.13 billion in 2023 and is expected to reach $3.31 billion by 2030 growing at a CAGR of 6.4% during the forecast period. meat substitute sometimes called a "meat analogue," is made to resemble certain forms of meat, such as hog, beef, and chicken, in terms of flavour, texture, and appearance. These alternatives are made from various plant proteins, such as soy, wheat, and pea proteins. These chemicals have several positive health effects. These goods were primarily created to replace or lessen our reliance on animal flesh. Compared to meat from animals, they are said to be healthier and more ecologically friendly.

According to Forbes, nearly 70% of the world's population is cutting down on meat consumption. Researchers found high consumption of red meat causes colorectal cancer among consumers.

Market Dynamics:

Driver:

Increasing number of vegans

To stop the exploitation of animals, the majority of people who have strong emotional bonds with animals are becoming vegans. This shift in eating habits necessitates the development of new goods that satisfy consumer demand for wholesome and delicious goods that may take the place of meat in a meal and provide a comparable amount of high-protein nutrients. The demand for meat substitutes made from plant proteins increased due to the increased worldwide awareness of wholesome and sustainable diets. 60% of people plan to make this transition permanent, and a sizeable section of the population is focused on lowering or limiting their intake of animal proteins. The rise in flexitarians and vegans is anticipated to fuel market expansion.

Restraint:

Complex manufacturing process

The manufacturing method used to create meat substitutes made from plants is quite complex. Products go through a lot of processing throughout the production process, including plant-based meat alternatives. The fragrance of meat cannot be replicated by flavouring chemicals, especially for items like plant-based meat substitutes. As a result, bland-tasting items that don't provide consumers a satisfying taste experience have been created. Manufacturers utilise techniques like batch manufacturing because the finished product is made using various materials. The entire cost of producing plant-based meat goes up as a result.

Opportunity:

Technological advancements in extrusion and processing

Processing and extrusion are crucial in the market for meat alternatives. Proteins from peas, soy, and wheat are extracted during processing. Traditional dry extraction processes result in protein concentrates with 46% to 60% protein and protein flour with just 20% to 40% protein. But with the help of new extrudable fat technology, it is possible to produce plant-based meats with more realistic fat textures, such marbling, according to Coasun. The method enables the physical linking of fat and protein to produce a superior component by putting fat through an extruder and then mixing it with protein. These technical developments are promoting market expansion.

Threat:

Allergy concerns

For hundreds of years, food intolerances and allergies have been recorded. The meat replacements are unhealthy and heavily processed. In meat replacement products, the protein concentration is frequently fairly high, which might result in very severe allergic responses. Increased soy, pea, wheat, and other replacement eating produces severe responses and seriously impairs the immune system. All of these health issues are impeding market expansion.

COVID-19 Impact:

The COVID-19 pandemic's emergence had a detrimental effect on the meat sector and greatly benefited meat alternatives since it caused supply chain and manufacturing process disruptions. A big gap between the supply and demand of meat products was established in the market as a result of the closure of factories at this time to stop the illness from spreading. This presented a chance for producers of plant-based meat to determine the demands of the market and grow their company by entering new markets or by introducing new meat substitutes.

The isolates segment is expected to be the largest during the forecast period

The isolates segment is estimated to have a lucrative growth. In meat substitutes, due to the protein content, meat replacements are available in isolates or pure forms, which are well-liked and favoured by producers of protein-based foods and beverages. Soy, pea, rice, and canola are a few of the different sources of protein isolates. In addition to increasing the protein content, improving moisture retention, and emulsifying, soy protein isolates are used to improve the texture of meat products. Due to bacterial fermentation, isolates are low in fat, oligosaccharides, and fibre and less likely to produce flatulence. These elements are promoting the segment's expansion.

The mass merchandisers segment is expected to have the highest CAGR during the forecast period

The mass merchandisers segment is anticipated to witness the fastest CAGR growth during the forecast period. One of the most popular distribution methods for clean meat products on the market is mass merchandiser. Customers have the ability to select their food product from a broad selection of alternatives that are accessible in the market aisles at supermarkets and budget retailers like Walmart and Target. Additionally, these shops provide new culinary items and give special prices to entice customers to buy the products. As a result, this channel is anticipated to have rapid growth in the years to come.

Region with largest share:

North America is projected to hold the largest market share during the forecast period. According to the Good Food Institute, the US was one of the top consumers of plant-based goods worldwide in 2018. The adoption of dairy and meat substitutes has become a significant trend in the nation as a result of growing environmental consciousness and preference for a healthy lifestyle. The amount of goods sold in retail food chains has grown significantly in recent years as a result of the growing use of meat substitutes in the preparation of a variety of food products, including burgers, tacos, and other well-liked food items.

Region with highest CAGR:

Middle East & Africa is projected to have the highest CAGR over the forecast period. The market for alternative proteins and meats has been expanding quickly in this area as a result of rising consumer knowledge of plant-based meat, growing concern about climate change, and rising interest in health and wellbeing. The need for alternative meat products in high-end dining establishments for creating various cuisines has substantially increased as the tourist industry is flourishing. Additionally, in recent years, the consumption of plant-based meat alternatives such burgers and nuggets has greatly expanded in African nations like Zambia and South Africa.

Key players in the market:

Some of the key players profiled in the Meat Substitutes Market include: Batory Foods, Beyond Meat, ADM, Impossible Foods, Ingredion Incorporated, Kellogg Company, Kerry Group, Tyson Foods, Roquette Freres, JBS SA, Sunfed, Conagra Brands, Inc., Nestle S.A., Hain Celestial Group, Unilever Group, Amy's Kitchen, Inc, Pinnacle Foods, Atlantic Natural Foods LLC, Pacific Foods of Oregon Inc and Fry Group Foods.

Key Developments:

In April 2023, ADM announced its new cutting-edge, plant-based innovation lab, located in ADM's Biopolis research hub in Singapore. The new lab enabled the company to develop next-level, on-trend, and nutritious products, catering to the needs of the Asia Pacific market.

In April 2022, Kellogg's partnered with Benson Hill to supply the raw materials to manufacture alternative meat products. It partnered with Morningstar Farms, owned by Kellogg's, to supply soy components that are used to manufacture alternative meat products.

In November 2022, Ingredion Incorporated Ingredion Incorporated entered into an agreement with its joint venture partners to acquire 100% of Verdient Foods (Canada), a manufacturer of plant-based protein. This acquisition is expected to enable Ingredion Incorporated to cater to the rising consumer demand for plant-based foods.

In February 2022, Beyond Meat, Inc. announced a three-year global strategic agreement with McDonald's Corporation. Under this agreement, Beyond Meat, Inc. became the preferred supplier for a new plant-based burger patty for McPlant, a plant-based burger.

In November 2021, Tyson Foods Inc. announced the launch of its plant-based protein brand Raised & Rooted in Europe.

Products Covered:

- Sausages

- Patties

- Meatballs

- Hot Dogs

- Crumbles & Grounds

- Nuggets

- Other Products

Formats Covered:

- Shelf-stable

- Refrigerated

- Frozen

Sources Covered:

- Textured

- Isolates

- Concentrates

Animal Types Covered:

- Beef

- Chicken

- Pork

- Fish

- Goat

Ingredients Covered:

- Textured Vegetable Proteins

- Soy-based Ingredients

- Wheat-based Ingredients

- Other Ingredients

Functionalities Covered:

- Clinical Nutrition

- Gut Health/Digestive Health

- Immunity Boosting Products

- Weight Management

- Other Functionalities

Distribution Channels Covered:

- Mass Merchandisers

- Specialty Stores

- Online Channel

- Retail Channel

- Foodservice

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Meat Substitutes Market, By Product

- 5.1 Introduction

- 5.2 Sausages

- 5.3 Patties

- 5.4 Meatballs

- 5.5 Hot Dogs

- 5.6 Crumbles & Grounds

- 5.7 Nuggets

- 5.8 Other Products

6 Global Meat Substitutes Market, By Format

- 6.1 Introduction

- 6.2 Shelf-stable

- 6.3 Refrigerated

- 6.4 Frozen

7 Global Meat Substitutes Market, By Source

- 7.1 Introduction

- 7.2 Textured

- 7.3 Isolates

- 7.4 Concentrates

8 Global Meat Substitutes Market, By Animal Type

- 8.1 Introduction

- 8.2 Beef

- 8.3 Chicken

- 8.4 Pork

- 8.5 Fish

- 8.6 Goat

9 Global Meat Substitutes Market, By Ingredient

- 9.1 Introduction

- 9.2 Textured Vegetable Proteins

- 9.3 Soy-based Ingredients

- 9.4 Wheat-based Ingredients

- 9.5 Other Ingredients

10 Global Meat Substitutes Market, By Functionality

- 10.1 Introduction

- 10.2 Clinical Nutrition

- 10.3 Gut Health/Digestive Health

- 10.4 Immunity Boosting Products

- 10.5 Weight Management

- 10.6 Other Functionalities

11 Global Meat Substitutes Market, By Distribution Channel

- 11.1 Introduction

- 11.2 Mass Merchandisers

- 11.3 Specialty Stores

- 11.4 Online Channel

- 11.5 Retail Channel

- 11.6 Foodservice

12 Global Meat Substitutes Market, By Geography

- 12.1 Introduction

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 Italy

- 12.3.4 France

- 12.3.5 Spain

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 Japan

- 12.4.2 China

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 New Zealand

- 12.4.6 South Korea

- 12.4.7 Rest of Asia Pacific

- 12.5 South America

- 12.5.1 Argentina

- 12.5.2 Brazil

- 12.5.3 Chile

- 12.5.4 Rest of South America

- 12.6 Middle East & Africa

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 Qatar

- 12.6.4 South Africa

- 12.6.5 Rest of Middle East & Africa

13 Key Developments

- 13.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 13.2 Acquisitions & Mergers

- 13.3 New Product Launch

- 13.4 Expansions

- 13.5 Other Key Strategies

14 Company Profiling

- 14.1 Batory Foods

- 14.2 Beyond Meat

- 14.3 ADM

- 14.4 Impossible Foods

- 14.5 Ingredion Incorporated

- 14.6 Kellogg Company

- 14.7 Kerry Group

- 14.8 Tyson Foods

- 14.9 Roquette Freres

- 14.10 JBS SA

- 14.11 Sunfed

- 14.12 Conagra Brands, Inc.

- 14.13 Nestle S.A.

- 14.14 Hain Celestial Group

- 14.15 Unilever Group

- 14.16 Amy's Kitchen, Inc

- 14.17 Pinnacle Foods

- 14.18 Atlantic Natural Foods LLC

- 14.19 Pacific Foods of Oregon Inc

- 14.20 Fry Group Foods