|

市場調査レポート

商品コード

1686181

砂糖代替品-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Sugar Substitutes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 砂糖代替品-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 159 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

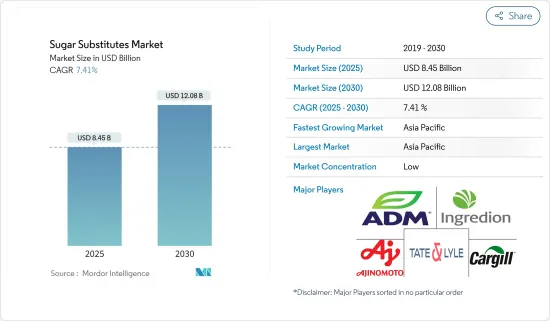

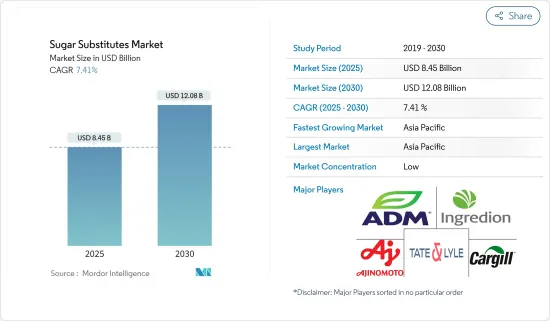

砂糖代替品市場規模は2025年に84億5,000万米ドルと予測され、予測期間中(2025年~2030年)のCAGRは7.41%で、2030年には120億8,000万米ドルに達すると予測されます。

主なハイライト

- 国内の消費者の健康意識の高まりと、すぐに食べられる食品や飲食品の需要の高さ、食品への支出の増加が、調査対象市場の成長を牽引しています。また近年、精製糖に代わる健康的な代替食品への需要が大幅に増加しています。

- 例えば、国際食品情報評議会(IFIC)によると、2022年にはZ世代の31%、ミレニアル世代の30%、X世代の23%の消費者がカロリーゼロ/低カロリー甘味料に傾倒しています。この背景には、砂糖が健康に与える悪影響に対する意識の高まりがあります。

- 砂糖を過剰に摂取し続けると、虫歯や虫歯、肥満、2型糖尿病、心臓病、高血圧、その他多くの有害な健康状態につながる可能性があります。また、カロリーは摂取できるが栄養素が制限されるため、栄養不足の原因にもなります。言い換えれば、加糖は、栄養的にほとんどメリットのないエンプティ・カロリーなのです。そのため消費者は、ステビア、アスパルテーム、ソルビトール、マルチトール、ネオテーム、アセスルファム、D-タガトースなど、低カロリーでヘルシーな砂糖代替品を求めています。

- 市場の著名なメーカーは、消費者の信頼と信用を得るために、有名な組織による製品の認証を取得しています。また、革新的な高強度甘味料の導入にも力を入れています。

- 例えば、Sweegen社は2022年にカロリーゼロの高強度甘味料Brazzeinで幅広い甘味料ポートフォリオを拡充しました。この製品は、長年のイノベーション・パートナーであるコナゲン社との共同開発によるもので、コナゲン社はこれを商業生産に拡大しました。このような技術革新は、調査期間中の砂糖代替品の需要にプラスの影響を与えると思われます。

砂糖代替品市場の動向

個人の健康意識が市場を牽引

- 砂糖の過剰摂取は、虫歯、肥満、糖尿病、心臓病、高血圧など、いくつかの健康問題を引き起こす可能性があります。そのため、こうした健康への悪影響に対する意識の高まりと健康志向の高まりが、個人に添加糖分の摂取制限を促しています。国際食品情報評議会(IFIC)の調査によると、2023年には米国成人の61%が食事中の糖分を制限しようとしていると報告されています。

- 糖質を制限したり避けたりする理由を理解するために2022年に実施された別の調査では、回答者の約41パーセントのうち、体重が増えるのを避けるためという説明が最も多く挙げられたことが明らかになりました。回答者の約38%が食生活を改善するため、36%が体重を減らすため、35%が将来の健康状態を予防するため、23%が既存の健康状態を管理するために砂糖の摂取を制限していると答えました。

- 糖尿病や肥満が蔓延するにつれ、消費者はより健康的なライフスタイルを送ろうと努力しています。消費者は血糖値の上昇を抑えるため、カロリーゼロの天然甘味料を求めています。従って、ステビアは消費者の要求に合致しているため、需要は伸びると予想されます。

- さらに、健康志向の消費者は、糖分や甘味料が添加された高度に精製された飲食品や飲料を避け、健康的な食品として認識される低糖製品を選ぶようになっています。IFICの統計によると、米国では回答者の37%近くが「低糖質」という言葉が最も健康的な食品を定義していると答えています。そのため、飲食品メーカーはカロリーや糖分を含まない砂糖代替食品にシフトしています。

アジア太平洋が大きな市場シェアを占める

- アジア太平洋地域は現在、世界の砂糖代替品市場のシェアの大半を占めています。この大きな成長の背景には、人口の拡大、健康志向の高まり、慢性疾患の有病率の上昇などが主な要因として挙げられます。

- 天然および有機製品の動向の高まりが、この地域における天然甘味料の需要を押し上げています。さらに、モンクフルーツ甘味料、ステビア、ヤーコンシロップなどの砂糖代替品は比較的持続可能であり、この地域で絶大な人気を得ています。さらに、食生活パターンの変化とともに、白砂糖が健康に及ぼす悪影響に対する消費者の意識の高まりが市場を牽引しています。また、大手企業は革新的で持続可能な製品を発売するため、提携や買収に積極的に取り組んでいます。

- 例えば、2021年1月、Tate &LyleとCodexisは、2つの最新甘味料、Dolcia Prima AlluloseとTasteva M Stevia Sweetenerの生産を改善するために協力関係を拡大しました。このほか、いくつかの国の規制機関が、消費者製品における砂糖代替物の使用を許可しました。このため、顧客のニーズに応え、全体的な売上を伸ばすために低カロリー製品を導入しようとする飲食品会社の間では、代替甘味料の需要が高まっています。

砂糖代替品産業の概要

砂糖代替品の世界市場は競争が激しく、各国の有力な地域企業や国内企業が存在します。強固な消費者基盤を構築するための主要戦略として、合併、拡大、買収、提携が重視されています。これとともに、主要企業は消費者の間でブランドの存在感を高めるため、製品開発にも力を入れています。

市場の主要企業には、Cargill Incorporated、Tate &Lyle PLC、味の素株式会社、Ingredion Incorporated、ADMなどがあります。当該市場における市場プレイヤーの地位を決定する主な要因は、高度な技術と高品質を備えた新製品の継続的な発売です。そのため、各ブランドは甘さ、品質、革新性において自社製品を差別化し、競合優位性を獲得しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 消費者のクリーンラベル砂糖代替品への傾斜

- 糖尿病および肥満人口からの砂糖代替物への需要

- 市場抑制要因

- 低コストの甘味料の入手可能性

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- アセスルファムカリウム

- アドバンテーム

- アスパルテーム

- ネオテーム

- サッカリン

- スクラロース

- ステビア

- その他のタイプ

- 用途

- 食品

- 焼き菓子・シリアル

- 菓子類

- 乳製品および乳製品代替品

- ソース、調味料、ドレッシング

- その他の食品用途

- 飲料

- 医薬品

- 食品

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米

- 欧州

- スペイン

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- 南アフリカ

- アラブ首長国連邦

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- 最も活発な企業

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Tate & Lyle PLC

- Ingredion Inc.

- Ajinomoto Co., Inc

- Cargill Inc

- Morita Kagaku Kogyo Co. Ltd

- JK Sucralose Inc.

- Manus Bio Inc.

- Archer Daniels Midland Company

- Xianghua GL Stevia Co

- GLG Life Tech Corp.

第7章 市場機会と今後の動向

The Sugar Substitutes Market size is estimated at USD 8.45 billion in 2025, and is expected to reach USD 12.08 billion by 2030, at a CAGR of 7.41% during the forecast period (2025-2030).

Key Highlights

- The increasing health consciousness among consumers in the country, coupled with the high demand for ready-to-eat food and beverages and increased spending on food, are driving the growth of the market studied. Also, in recent years, there has been a significant rise in the demand for healthy alternatives to refined sugar.

- For instance, in 2022, according to the International Food Information Council (IFIC), 31% of Gen Z, 30% of millennials, and 23% of Gen X consumers are inclined towards no/low-calorie sweeteners. This can be attributed to increasing awareness among individuals about the negative health impact of sugar.

- Consistently consuming excess sugar can lead to tooth decay and cavities, obesity, type 2 diabetes, heart disease, high blood pressure, and many other detrimental health conditions. It can even contribute to nutrient deficiencies due to providing calories but limiting nutrients. In other words, added sugars are empty calories offering little to no nutritional benefit. Therefore, consumers are seeking healthy sugar substitutes, such as stevia, aspartame, sorbitol, maltitol, neotame, acesulfame, and D-tagatose, as they are low in calories.

- Prominent manufacturers in the market are certifying their product offerings by renowned organizations to gain consumer trust and confidence. They are also focusing on innovating and introducing high-intensity sweeteners.

- For instance, in 2022, Sweegen expanded its extensive sweetener portfolio with the zero-calorie, high-intensity sweetener Brazzein. The product was developed in collaboration with long-term innovation partner Conagen, which has scaled it to commercial production. Such innovations will likely positively influence the demand for sugar substitutes during the study period.

Sugar Substitutes Market Trends

Health Consciousness Among Individuals Drives the Market

- Excess sugar intake can lead to several health problems, including tooth decay, obesity, diabetes, heart disease, and high blood pressure. Therefore, the increasing awareness of these adverse health impacts and the rising health consciousness encourage individuals to limit their intake of added sugars. According to a survey by the International Food Information Council (IFIC), 61 percent of United States adults were reportedly trying to limit sugars in their diet in 2023.

- Another study conducted in 2022 to understand the reasons behind limiting or avoiding sugars reveals that avoiding gaining weight was the most frequently mentioned explanation amongst approximately 41 percent of respondents. About 38 percent of respondents said they limit their sugar intake to improve their diet, 36 percent to lose weight, 35 percent to prevent a future health condition, and 23 percent to manage an existing health condition.

- As diabetes and obesity become more prevalent, consumers strive to live a healthier lifestyle. They are looking for natural sweeteners with zero calories to keep their blood glucose levels in check. Therefore, it is expected that the demand for stevia will grow as it is aligned with the requirements of the consumers.

- Moreover, health-conscious consumers are avoiding highly refined foods and beverages with added sugars and sweeteners and opting for low-sugar products as they are perceived to be a healthy food option. The statistics by IFIC show that nearly 37 percent of respondents in the United States said that the term "low in sugar" best defines healthy food to them. Therefore, food and beverage manufacturers are shifting to sugar substitutes as they don't contain calories or sugar.

Asia-Pacific Holds a Major Market Share

- Asia-Pacific currently accounts for the majority of the share of the global sugar substitute market. The primary factors behind this significant growth include the expanding population, the increasing number of health-conscious individuals, and the rising prevalence of chronic medical conditions.

- The rising trend of natural and organic products has boosted the demand for natural sweeteners in the region. Furthermore, sugar substitutes, such as monk fruit sweetener, stevia, and yacon syrup, are comparatively sustainable and have gained immense popularity in the region. Moreover, increased consumer awareness about the adverse health impact of white sugar, along with changing dietary patterns, is driving the market. Also, major players are indulging in partnerships and acquisitions to launch innovative and sustainable products.

- For instance, in January 2021, Tate & Lyle and Codexis expanded their collaboration to improve the production of two of its newest sweeteners, Dolcia Prima Allulose and Tasteva M Stevia Sweetener. Besides this, regulatory bodies in several countries authorized the use of sugar substitutes in consumer products. This, in turn, drives the demand for alternative sweeteners among food and beverage companies to introduce low-caloric products to capitalize on customers' needs and drive their overall sales.

Sugar Substitutes Industry Overview

The global market for sugar substitutes is highly competitive, with the presence of prominent regional and domestic players in different countries. Emphasis is given to mergers, expansions, acquisitions, and partnerships as key strategies for building a solid consumer base. Along with this, the leading companies are also focusing on product developments to boost their brand presence among consumers.

Some major players in the market include Cargill Incorporated, Tate & Lyle PLC, Ajinomoto Co., Inc., Ingredion Incorporated, and ADM. The prime factors determining the market players' position in the concerned market are the continuous launch of new products with advanced technology and high quality. Thus, brands differentiate their products in sweetness, quality, and innovation to gain a competitive advantage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Consumer Inclination Toward Clean-label Sugar Substitute

- 4.1.2 Demand For Sugar Substitutes From Diabetic and Obese Population

- 4.2 Market Restraints

- 4.2.1 Availability of Low-cost Sweeteners

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Acesulfame Potassium

- 5.1.2 Advantame

- 5.1.3 Aspartame

- 5.1.4 Neotame

- 5.1.5 Saccharin

- 5.1.6 Sucralose

- 5.1.7 Stevia

- 5.1.8 Other Types

- 5.2 Application

- 5.2.1 Food

- 5.2.1.1 Baked Foods and Cereals

- 5.2.1.2 Confectionery

- 5.2.1.3 Dairy and Dairy Alternatives

- 5.2.1.4 Sauces, Condiments, and Dressings

- 5.2.1.5 Othe r Food Applications

- 5.2.2 Beverage

- 5.2.3 Pharmaceuticals

- 5.2.1 Food

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Tate & Lyle PLC

- 6.4.2 Ingredion Inc.

- 6.4.3 Ajinomoto Co., Inc

- 6.4.4 Cargill Inc

- 6.4.5 Morita Kagaku Kogyo Co. Ltd

- 6.4.6 JK Sucralose Inc.

- 6.4.7 Manus Bio Inc.

- 6.4.8 Archer Daniels Midland Company

- 6.4.9 Xianghua GL Stevia Co

- 6.4.10 GLG Life Tech Corp.