|

市場調査レポート

商品コード

1849842

拡張現実:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Augmented Reality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 拡張現実:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月30日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

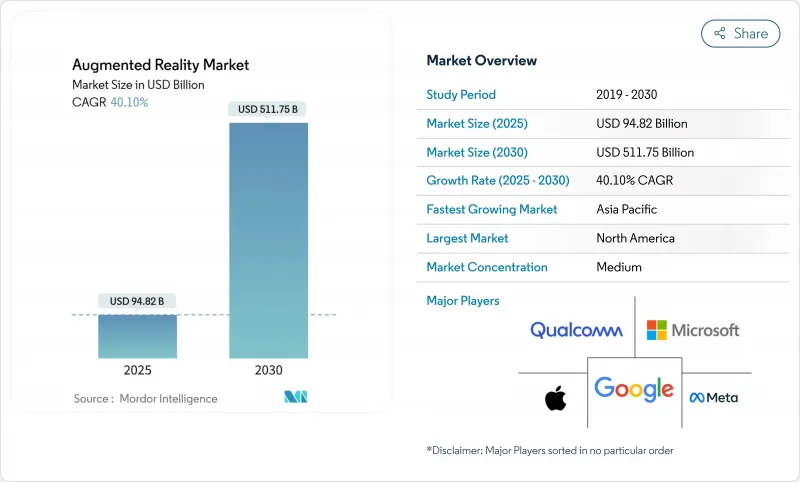

拡張現実市場規模は2025年に948億2,000万米ドルに達し、CAGR 40.1%を反映して2030年には5,117億5,000万米ドルに上昇すると予測されています。

5Gネットワークが遅延の障壁を取り除き、主権のAI政策がデバイス上での推論を推進し、アップルのVision Proが空間コンピューティングのユースケースを検証するにつれて、需要は加速します。製造、ヘルスケア、エネルギー分野の企業は、意思決定サイクルを短縮するためにデジタルツインオーバーレイを標準化し、ジェネレーティブAIツールはコンテンツ開発時間を数ヶ月から数日に短縮しています。導波管やMicroLEDのハードウェア革新は続いているが、クラウド中心のソフトウェア・プラットフォームはさらに急速に成長しており、企業は重いインフラなしでグローバルな工場にパイロットを拡大できるようになっています。企業が機密データを消費者向けスマートフォンから管理された産業用エンドポイントに移行するのに伴い、セキュリティ強化されたARスタックとエッジ最適化されたレンダリングが既定の要件になりつつあります。

世界の拡張現実市場の動向と洞察

5G対応低遅延モバイルネットワーク

スタンドアロン5Gで達成可能な20ミリ秒以下のラウンドトリップタイムは、共有ホログラムのリアルタイム位置更新を可能にします。エリクソンは、空間データトラフィックを優先するエッジコンピューティングスライスを介してデバイスが接続された場合、ARセッションの持続時間が長くなると報告しています。チェコ共和国の原子力発電所など、プライベート5Gを採用している製造現場では、ガイド付き検査時の効率向上と安全性の向上が記録されています。通信事業者は、拡張現実市場を音声収入の減少を補うプレミアムアップセルと見ており、開発者にサービス品質層を公開するネットワークAPIへの投資を促しています。テラビットのスループットを目標とする6Gの準備は、テザリングなしでボリュームのあるビデオをストリーミングする軽量メガネを可能にし、2桁成長の予測を強化します。

スマートフォン普及率の上昇とAR対応アプリ

アジア太平洋地域では、2024年に1億3,000万人のモバイル加入者が増加し、普及率は51%に達し、ARコマースのための肥沃なインストールベースが形成されます。IKEAとL'Orealの小売パイロットでは、顧客がリアルスケールで商品を視覚化することで、滞留時間が10分を超えることが示されています。スマートフォンの光学系は屋内ナビゲーションではまだ苦戦しており、大阪大学はドリフトによる乗り物酔いを観察しています。とはいえ、スマートフォンは、初めてARを使う多くのユーザーにとって、大衆向けメガネよりも先に開発者のエコシステムを育成するオンランプであることに変わりはないです。

ヘッドマウントディスプレイのバッテリー寿命と人間工学

現在のデバイスは100g近い重さで、2時間を超える動作はめったにないです。アップルのVision Proは、マイクロOLEDの高輝度がバッテリーを急速に消耗させるというトレードオフを強調しています。東京大学の研究者は、ヘッドセットから電力消費をシフトさせるために、オフボードの「ビーミング・ディスプレイ」を提案しています。HoloLens 2のエネルギー・プロファイリングによると、ディスプレイの輝度が消費電力の62%を占めており、ソフトウェアによる調光とシーンを考慮したレンダリングによって、セッションを5分の1にまで伸ばせることが示唆されています。産業用ユーザーは、限られたタスクのためにより重い機器を受け入れているが、大量消費者の取り込みは、真の一日中使えるウェアラブルにかかっています。

セグメント分析

2024年の拡張現実市場売上の67.5%はハードウェアが占める。コンポーネントベンダーは、導波路効率とMicroLEDの輝度を押し上げ、バッテリ寿命を延ばし、屋外での使用を可能にします。サムスンのLEDoSロードマップは、2027年までの量産を目標としており、企業用とライフスタイル用メガネの両方に適したスリムな光学系を約束しています。ハードウェアが不可欠であることに変わりはないが、クラウドファーストのプラットフォームにより、企業は既存のモバイルデバイスでARを試験的に導入できるようになり、小規模な工場や診療所の障壁が低くなっています。その結果、ソフトウェアのCAGRは42.0%を記録し、2030年までに収益格差が縮小すると見られています。サードパーティのOEMに成熟したオペレーティングシステムをプリロードさせるライセンシング戦略は、PCのエコシステムを反映し、デバイス間でのアプリケーションの移植性を加速させる。

クラウド・オーケストレーション・ツールは、CADアセンブリをシーケンス化されたホログラフィック命令に自動変換するジェネレーティブAIモジュールを組み込み、導入時間を3分の2に短縮します。サブスクリプション価格は、投資を資本支出から運用予算にシフトさせ、企業のデジタル化指令に合致させる。このようなデバイスコストの低下とプラットフォームの高度化の融合が、拡張現実市場の持続的な拡大を支えています。

導波路と回折オプティクスは、2024年の市場収益の51.3%を占めています。SCHOTTの新クリム施設はガラスブランクスの生産能力を引き上げるが、MicroLEDイノベーションが既存シェアを侵食しています。Mojo VisionのモノリシックRGBアレイは、消費電力を半減させながら6,350 PPIを実現し、従来のディスプレイを凌駕しました。フォックスコンがポロテックと提携し、2025年にウエハー加工を開始することは、サプライチェーンが大量生産に向けた準備を進めていることを示しています。歩留まりが向上すれば、MicroLEDモジュールは開発者向けキットから消費者向けアイウェアに移行し、コスト構造が変化し、屋外での視認性が向上します。

メーカーはMicroLEDパネルをパンケーキレンズや多層膜コーティングと組み合わせてコントラストを高める。液晶オンシリコンは、特にコンパクトさが日中の視認性に優先するトレーニング用キオスク端末など、格安ヘッドセットには依然として適しています。予測期間中、MicroLEDの急速な効率向上により、まず高性能の使用事例が転換され、その後、中位クラスの製品に波及し、拡張現実市場全体の技術ロードマップが再構築されると予想されます。

地域分析

北米が2024年の拡張現実市場売上の38.6%を占め、優位を占める。防衛および公共安全機関からの政府契約は、堅牢なヘッドセットの安定した需要を提供し、FDAの予測可能な承認経路は医療への展開を加速します。ベンチャー投資はシリコンバレーとシアトルに集中し、後にメキシコとカナダで製造パートナーシップを拡大するプラットフォーム新興企業に資金を提供し、地域のエコシステムを強化しています。

アジア太平洋地域のCAGR見通しは40.8%と最も高く、中国の3兆3,300億元の研究開発資金が部品鋳造所やソフトウェア研究所に助成金を供給しています。日本の富嶽スパコンは、リアルタイムの空間マッピングのためのアルゴリズム・トレーニングをサポートし、国内の光学サプライヤーに利益をもたらしています。韓国のメタバース青写真は、55億ウォンの奨励金を背景に、2026年までに220社の没入型技術企業の育成を目指しています。この地域のモバイル経済は、GDPに8,800億米ドルの影響を与え、膨大な消費者対応市場を確保し、拡張現実市場全体のハードウェアのスケールアップをスムーズにします。

欧州はバランスの取れた軌道を維持しています。ドイツはARを活用して自動車や機械の組み立てラインを最適化し、2桁の品質向上を達成。EUのGDPR対応圧力により、ベンダーはプライバシー保護設計の組み込みを余儀なくされ、後に世界的な規範となります。フランスとオランダのスマートシティファンドは、公共交通機関のARナビゲーションパイロットに資金を提供し、市民に親しみを持たせています。アジア太平洋地域の成長は遅れているが、欧州の製造業の厳しさは拡張現実市場のかなりの部分を支え、世界中で採用されている安全基準を形成しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 5G対応の低遅延モバイルネットワーク

- スマートフォンの普及率の上昇とAR対応アプリ

- 企業トレーニングとフィールドサービスの効率性向上

- 迅速なARコンテンツ作成のための生成AIツール

- リアルタイムIoTデータのための産業用デジタルツインオーバーレイ

- Apple Vision-Pro主導の空間コンピューティングエコシステムの推進

- 市場抑制要因

- ヘッドマウントディスプレイのバッテリー寿命と人間工学

- プライバシーとデータセキュリティに関する懸念

- 光導波路ガラス供給のボトルネック

- 断片化された開発者標準とクロスプラットフォームの問題

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- クラウドコンピューティング

- 人工知能

- サイバーセキュリティ

- デジタルサービス

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

- マクロ経済動向の市場への影響評価

第5章 市場規模と成長予測

- 提供別

- ハードウェア

- スタンドアロンHMD

- テザーHMD

- スクリーンレスビューア

- ソフトウェア

- ハードウェア

- コアテクノロジー

- OLED/マイクロOLED

- マイクロLED

- 導波路と回折光学

- 液晶オンシリコン(LCOS)

- 用途別

- リモートアシスタンスとメンテナンス

- 製品の視覚化と構成

- ナビゲーションとマッピング

- ソーシャルフィルターとコミュニケーションフィルター

- その他の用途

- エンドユーザー別

- ゲームとエンターテイメント

- 教育

- ヘルスケア

- 小売り

- 自動車・輸送

- その他のエンドユーザー分野

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Microsoft Corporation

- Google LLC(Alphabet)

- Meta Platforms Inc.

- Apple Inc.

- Snap Inc.

- Niantic Inc.

- PTC Inc.

- Vuzix Corporation

- Magic Leap Inc.

- Seiko Epson Corporation

- RealWear Inc.

- Lenovo Group Ltd.

- Fujitsu Ltd.

- Kopin Corporation

- Qualcomm Technologies Inc.

- Unity Technologies

- Dynabook Europe GmbH

- Optinvent SA

- Immersion Corporation