|

市場調査レポート

商品コード

1907283

モバイル決済:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Mobile Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| モバイル決済:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

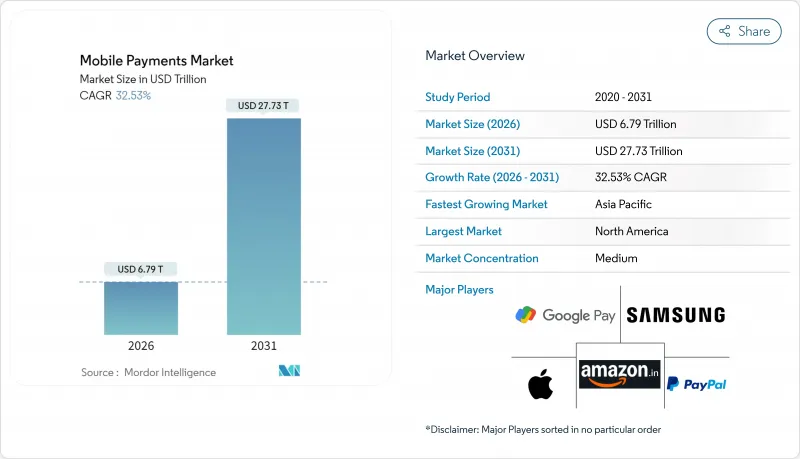

モバイル決済市場は2025年に5兆1,200億米ドルと評価され、2026年の6兆7,875億米ドルから2031年までに27兆7,309億米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは32.53%と見込まれます。

政府支援によるリアルタイム決済基盤の急速な普及、加盟店割引プログラムの補助金制度、スーパーアプリエコシステムを中心とした統合が、この拡大を支えています。NFC交通プロジェクトに牽引された強力な近接決済の導入は、遠隔商取引チャネルとの歴史的な格差を縮めており、一方、口座間ウォレットは従来型カードの経済性を引き続き圧迫しています。新興経済国では、従来のインフラを飛び越える形でモバイルファーストプラットフォームへの競争優位性が移行し、データ収益化や付加価値サービスにおける新たな収益源が育まれています。即時決済、プライバシー、越境相互運用性に対する規制当局の注目が高まる中、モバイル決済市場全体のビジネスモデルはさらに再構築されつつあります。

世界のモバイル決済市場の動向と洞察

UPIおよびPIXスタイルのリアルタイム決済基盤の爆発的普及

政府主導の即時決済システムは、仲介手数料を排除し24時間365日の利用可能性を提供することで決済経済を再構築し、カードネットワークに対して実質的なコスト優位性を生み出しています。ブラジルのPIXは2025年に月間60億件の取引を処理し、5年以内に電子商取引支出の58%がPIXを利用すると予測されています。インドのUPIも同様の規模を示しており、タイやその他のASEAN市場での地域的な普及を促しています。これらの国家主導の決済基盤はデータを現地化し、金融監督を強化し、モバイル決済市場を口座間決済モデルへと加速させています。新興市場が従来のインフラを迂回する中、従来のプロセッサーはシェアの浸食に直面しています。

加盟店手数料補助がQRコード普及を促進

インドとインドネシアにおける加盟店手数料無料化または大幅割引施策は、小規模小売店の導入障壁を劇的に低減し、QRコード普及を加速させております。インドは2024-25年度にUPI促進策として1,500カロールインドルピー(1億8,000万米ドル)を計上し、インドネシアのQRISは少額取引に加盟店手数料を課さないため、現金依存度の高い業界の正式化を推進しております。補助金が段階的に縮小される中、政策立案者は導入の成果を損なうことなく長期的な持続可能性を確保するため、段階的なMDR制度を計画しています。この取り組みは対象となる加盟店層を拡大し、モバイルネイティブ決済に対する国内での選好を確固たるものとし、モバイル決済市場をさらに押し上げています。

分散したトークン化規格がウォレット間の相互受容を阻害

不統一なトークン形式により、加盟店は複数のSDKを併用せざるを得ず、統合コストと決済時の摩擦が増大しています。マスターカードが2030年までに手動カード入力の廃止を公約したことは、業界がこの問題を認識している証左であり、同社取引の30%は既にトークン化されています。NFCフォーラムなどの団体が多目的タップ仕様を提案しているもの、採用状況は依然として不均一です。規格の統一が進まない限り、ウォレット間の相互受容性は遅れ、モバイル決済市場の成長を抑制する要因となります。

セグメント分析

2025年時点でモバイル決済市場の64.32%を非接触決済が占め、EC市場の勢いを反映しています。一方、小売・交通分野でのNFC普及拡大を背景に、近接決済は35.92%のCAGRで成長すると予測されます。非接触決済の標準化が食料品店やファストフード業界で進むにつれ、近接チャネルのモバイル決済市場規模は差を縮めつつあります。統一されたウォレット戦略により、スキャン購入、タップ乗車、アプリ内決済が単一インターフェースで提供され、チャネルの境界が曖昧になる一方でオムニチャネルでの顧客ロイヤルティが育まれています。技術ベンダーは、非接触と対面使用事例の安全性を同等に保つため、エッジセキュリティとトークンライフサイクル管理を重視しています。

交通機関での採用拡大は近接決済の規模拡大を示しています。カリフォルニア州ではデビットカードによる交通利用の非接触決済普及率が69%に達し、シンガポールではクラウド接続型カートに生体認証決済経路が統合されています。継続的な融合により、モバイル決済市場は「場所」ではなく「状況」が決済手段を決定する複合的な顧客体験へと移行しつつあります。

個人から事業者への決済フローは2025年に37.92%のシェアを占めましたが、小売業者が端末をアップグレードし、ソフトPOSを追加し、ロイヤルティ連動型タップ決済に注力するにつれ、店頭POS取引量はCAGR36.65%で拡大すると予測されています。店頭POSにおけるモバイル決済市場規模は、店舗が磁気ストライプからNFCやQRコードへ移行するにつれて拡大し、オムニチャネル連携を推進するアクワイアラーに利益をもたらします。個人間送金や新興のAIエージェント購入は、残高を商業エコシステムに還流させる補完的役割を果たし、ウォレットの定着性を維持します。

Visa、Mastercard、PayPalは現在、生体認証がAI交渉価格を引き起こし、決済ステップを圧縮する自律型ショッピング体験のプロトタイプを開発中です。自動化が取引カテゴリーの境界を曖昧にする中、プロバイダーは小売とP2Pの両コンテキストで紛争解決とデータプライバシー規則を調和させ、モバイル決済市場への信頼を維持する必要があります。

地域別分析

北米は確立されたカード決済基盤、広範なスマートフォン普及率、堅調なNFC端末カバー率を背景に、2025年には38.61%のシェアを維持しました。しかしながら、飽和状態に近づき、2024年に総額1,872億米ドルに達したスワイプ手数料を巡る加盟店との対立により、成長率は鈍化傾向にあります。クレジットカード競争法を含む規制当局の監視強化は、低コストなモバイルネイティブ決済手段の参入余地を生み出しています。反トラスト法判決を受けてAppleがアプリ内手数料モデルを縮小したことで、代替ウォレットの新たな流通経路が生まれ、モバイル決済市場はより競争的な経済構造へと移行しつつあります。

アジア太平洋地域は34.24%のCAGRで成長し、UPIやPixスタイルの決済システム、スーパーアプリエコシステムの普及が牽引役となっています。中国では電子商取引におけるウォレット普及率が82%に達し、インドではオンライン・実店舗を合わせて50%を超えています。2023年までにモバイルインターネット普及率は人口の51%に達し、現金利用率は2027年までに14%まで低下すると予測されています。各国政府はデジタル基盤を活用した補助金支給により、ウォレットの日常生活への浸透を促進。ASEAN QRコード連携などの地域間相互運用性枠組みが越境加盟店対応を促進し、モバイル決済市場を拡大しています。

欧州では即時決済義務化とデジタルユーロ試験導入により着実な進展が見られます。欧州中央銀行はオフライン機能要件と高度なプライバシー基準を明示し、あらゆるCBDCが既存スキームを補完するよう確保しています。ラテンアメリカではブラジルのPIXが急速な規模拡大を示し、2024年に640億件の取引を達成、NFC拡張を準備中です。コロンビアとアルゼンチンも同様の青写真を展開しています。中東・アフリカ地域では進展にばらつきが見られます。湾岸諸国ではスマートシティ決済基盤が先行する一方、アフリカではAML/KYC(資金洗浄対策/顧客確認)のボトルネックにより第二階層銀行の参入が遅れています。FlagrightのようなAI駆動型コンプライアンスベンダーはオンボーディング時間を80%短縮し、モバイル決済市場の将来的な成長を示唆しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストサポート(3ヶ月間)

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- アジア太平洋地域およびラテンアメリカにおけるUPIおよびPIX方式リアルタイム決済システムの急速な普及

- 補助対象の加盟店手数料(MDR)がインドとインドネシアにおけるQRコード普及を促進

- 中国および東南アジアの主要テクノロジー企業による「スーパーアプリ」エコシステムのロックインが市場を牽引

- NFC対応交通プロジェクト(例:MTA NYC OMNY)による都市近郊消費の加速

- 手数料無料のA2Aウォレット(iDEAL 2.0、ブラジルPix、FedNow)によるカード手数料の圧縮と取引量の移行

- 市場抑制要因

- 分散したトークン化基準がウォレット間相互利用を阻害

- 越境ウォレット決済における高いチャージバック率

- 米国における店舗内NFC相互運用性のギャップデュアルタップフローが市場を阻害

- AML/KYC関連の手続きが煩雑であるため、アフリカの第2層銀行における電子財布の顧客獲得が遅延しております

- バリューチェーン分析

- 規制とテクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- モバイル決済の将来展望(キャッシュレス化の進展、ウェアラブル端末の台頭、生体認証決済、ブロックチェーン技術の影響)

- 電子商取引におけるモバイル決済(電子財布の有用性、デジタルコマース支出(2021年および2025年)、モバイルコマース普及率、将来の発展など)

- 銀行業界への影響(モバイル技術への投資、銀行とMNO(移動体通信事業者)の提携、政府から個人への支払い(G2P)における機会など)

- 市場に対するマクロ経済動向の評価

第5章 市場規模と成長予測

- 決済方法別

- 近距離決済

- リモート決済

- 取引タイプ別

- Peer-to-Peer(P2P)

- 店頭販売時点情報管理(POS)

- Person-to-Merchan(P2M/決済)

- その他の取引タイプ

- 用途別

- 小売および電子商取引

- 運輸・物流

- ホスピタリティおよびフードサービス

- 政府および公共部門

- その他の用途(教育、医療)

- エンドユーザー別

- 個人向け

- ビジネス

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Alphabet(Google Pay)

- Apple Inc.

- Samsung Electronics(Samsung Pay)

- PayPal Holdings

- Amazon Pay

- Visa, Inc.

- American Express Inc.

- Mastercard

- Stripe, inc.

- Block Inc.(Square and Cash App)

- FIS(Worldpay)

- Fiserv(Clover)

- ACI Worldwide

- Adyen Inc.

- Ant Group(Alipay)

- Tencent(WeChat Pay)

- Paytm

- GrabPay

- Kakao Pay

- Mercado Pago

- MTN MoMo

- Comviva Tech.