|

市場調査レポート

商品コード

1911715

ジェネラルアビエーション:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)General Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ジェネラルアビエーション:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 300 Pages

納期: 2~3営業日

|

概要

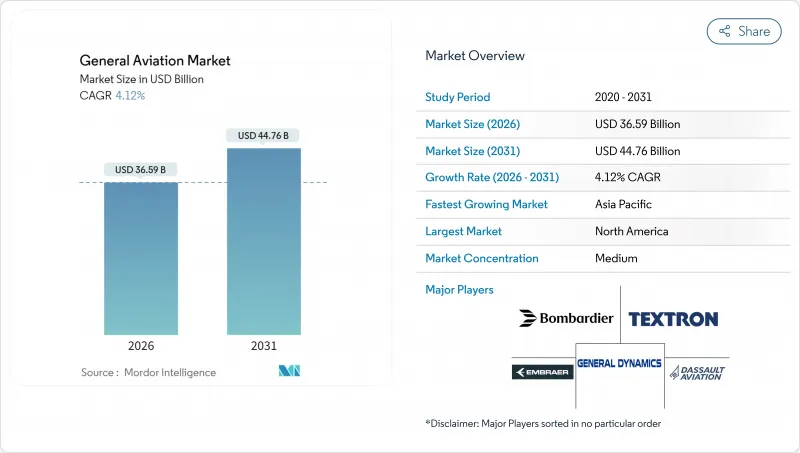

ジェネラルアビエーション市場は2025年に351億5,000万米ドルと評価され、2026年の365億9,000万米ドルから2031年までに447億6,000万米ドルに達すると予測されております。

予測期間(2026年~2031年)におけるCAGRは4.12%と見込まれております。

着実な富の創出、企業の収益性、そしてポイントツーポイント移動の魅力の高まりが、この勢いを支えています。ビジネス旅行は引き続き高収益需要を牽引していますが、電気垂直離着陸機(eVTOL)プログラムの認証プロセスが進展するにつれ、市場環境は広がりを見せています。分譲所有プラットフォームがアクセスを拡大する一方、発展途上国におけるインフラ整備が新たな路線を開拓しています。既存のタービン推進システムは確固たる地位を維持していますが、バッテリーの進歩と持続可能な航空燃料(SAF)のインセンティブが、よりクリーンな運航の基盤を整えています。

世界のジェネラルアビエーション市場の動向と洞察

高所得者層の増加と企業収益の拡大

堅調な資産拡大がプレミアム機需要を牽引しており、富裕層(HNWIs)は時間とプライバシーを特に重視しています。2024年の大幅な収益回復後、大企業は経営陣の生産性確保と混雑したハブ空港の回避を目的に航空機を増強しました。アジア太平洋地域は新規富裕層の40%を生み出しましたが、空港密度では依然として遅れを取っており、大陸間をノンストップで飛行可能な中型・大型キャビンのジェット機への需要が高まっています。機体計画担当者は、定期航空会社と比較して追跡可能な生産性向上を指摘し、購入の正当性を強化しています。その結果、安定した納入パイプラインが形成され、ジェネラルアビエーション市場は航空業界全体の周期性から守られています。

機材近代化と更新サイクル

北米のビジネスジェット機の中央年齢は2024年に20年を超え、運航会社は旧式機体を低燃費モデルへ更新する動きを加速させています。最新フライトデッキは安全性と接続性の向上をもたらし、改修費用を上回る価値を提供します。欧州では騒音規制の強化により、基準不適合機の早期退役が進み、新造機需要を押し上げています。複数機を保有する部門においては、デジタルによる全機体の健康状態監視が基本要件となりました。したがって、近代化への支出はライフサイクルコストの削減と運航信頼性の向上を図る戦略的投資として位置付けられています。

高騰する取得・運用コスト

2024年にはサプライチェーンの逼迫により部品コストが上昇し、航空機の定価が8~12%上昇しました。燃料価格の変動と予備部品の価格上昇が時間当たりの運用予算にさらなる圧力を加えています。保険引受会社はパイロット不足リスクの評価を背景に保険料を引き上げ、金利上昇は債務返済負担を増大させました。通貨安の新興市場では、ドル建て取引がさらに手頃でなくなりました。こうした差し迫ったコスト障壁により、長期的なファンダメンタルズが健全であるにもかかわらず、一部の購入決定が先送りされる可能性があります。

セグメント分析

ビジネスジェットは2025年、ジェネラルアビエーション市場シェアの46.36%を占め、時間厳守が求められる企業移動における優位性を示しました。大型キャビンプラットフォームは、大陸間直行便の航続距離と高快適性レイアウトにより収益面で主導的立場にあります。中型機は地域ミッション向けに経済性のバランスが取れており、一方ライトジェットは短距離移動を目的とするオーナーパイロットやチャーターブローカーを惹きつけています。先進的航空モビリティであるeVTOLセグメントは現時点では比較的小規模です。しかしながら、認証のハードルが下がり、都市部の混雑が普及を促進するにつれ、このセグメントはCAGR3.62%が見込まれています。回転翼機は依然としてポイントツーポイントの緊急輸送や実用任務に不可欠ですが、eVTOLプラットフォームによる都市部での競合が激化しています。

新規設計の多様な開発パイプラインは、OEM各社の確固たる自信を裏付けております。ジョビー・アビエーション社は2024年に米連邦航空局(FAA)の主要認証基準を達成し、サービス開始が間近であることを示しました。ターボプロップおよびピストン固定翼機カテゴリーは、滑走路制約により短距離離着陸性能が求められる訓練・貨物・地域接続のニッチ市場で引き続き活躍しております。全体として、多様なミッションセットがジェネラルアビエーション市場を単一セグメントの不振から保護する役割を果たしております。

2025年時点で、従来型ピストンエンジンおよびタービンエンジンはジェネラルアビエーション市場の90.98%を占めました。ビジネスジェットでは、高高度性能と世界の整備ネットワークのサポートからタービンエンジンが主流です。ピストンエンジンは導入コストの低さから訓練用機材の主力であり続けています。全電気推進システムは現時点では小規模ながら、電池エネルギー密度の向上に伴いCAGR4.49%で進展しています。ハイブリッド電気コンセプトは航続距離の課題を解決しつつ、初期の持続可能性目標を達成しています。認証機関はメーカーと連携し、電動推進システムの安全基準を最終化しており、これにより2020年代末までの広範な普及に向けた基盤が整いつつあります。

運用コストの優位性、特に短距離訓練や都市間シャトル用途における利点が、導入の決定的要因として浮上しています。地方空港における充電インフラ整備プロジェクトは再生可能エネルギー義務化と連動し、エコシステム整備を加速させています。しかしながら、バッテリーが長距離ミッションのニーズを満たすまでは、従来型タービンがジェネラルアビエーション市場で主導権を維持する見込みです。

地域別分析

北米は2025年時点でジェネラルアビエーション市場シェアの51.12%を占め、米国における20万機以上の稼働機数と高密度な空港ネットワークが基盤となっています。成熟した資金調達ルート、包括的な整備網、豊富なパイロット人材が地域の主導的地位を強化しています。カナダでは資源探査や遠隔地域へのアクセスに航空を活用し、メキシコでは観光回廊においてプライベートチャーター機によるポイントツーポイントの高級旅客輸送が依存されています。企業の財務基盤の強さと安定した残存価値のパフォーマンスが、地域の機体近代化サイクルを構築しています。

アジア太平洋地域は2031年までCAGR6.33%と最も急速に成長する市場です。中国が今世紀末までに500のジェネラルアビエーション空港を整備する計画は、地域の航空ネットワークを再構築します。インドでは経済成長がチャーター需要を押し上げており、インフラのボトルネックも官民連携により徐々に解消されつつあります。日本と韓国は高い技術導入率を維持し、航空電子機器と持続可能性の革新を促進、その波及効果は世界の機体に広がっています。オーストラリアの運航会社は、人口希薄な内陸部における鉱業支援や医療支援のため、引き続きジェネラルアビエーションを活用しています。

欧州は、密集した企業回廊と洗練されたチャーターネットワークに支えられ、確固たるシェアを維持しています。厳格な環境規制が機体更新を加速させ、OEMメーカーに持続可能な航空燃料対応を促しています。EUの調和化努力が摩擦緩和を図っているもの、ブレグジット関連の関税・規制の相違が国境を越えた運航を複雑化させています。中東・アフリカでは天然資源プロジェクトとVIP輸送が需要を支えていますが、規制の成熟度のばらつきやインフラの不足が、短期的な機体拡大を抑制しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリーおよび主要な調査結果

第4章 主要産業動向

- 富裕層(HNWI)動向分析

- 北米

- 欧州

- アジア太平洋地域

- 南米

- 中東・アフリカ

第5章 市場情勢

- 市場概要

- 市場促進要因

- 高所得富裕層(HNWI)人口の増加と企業利益の拡大

- 機材の近代化と更新サイクル

- 分譲所有権およびチャータープラットフォームの拡大

- 発展途上国における新興のジェネラルアビエーションインフラ

- 都市航空モビリティ(UAM)回廊の統合

- 持続可能な航空燃料(SAF)導入促進策の活用状況

- 市場抑制要因

- 高い取得・運用コスト

- 厳格な騒音・排出ガス規制

- パイロット人材不足

- 航空電子機器サプライチェーンの混乱

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターの五力分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第6章 市場規模と成長予測

- 航空機タイプ別

- ビジネスジェット

- 大型ジェット

- 中型ジェット機

- ライトジェット/超軽量ジェット

- ターボプロップ固定翼機

- ピストン固定翼

- 回転翼航空機

- 先進的航空モビリティeVTOL

- ビジネスジェット

- 推進タイプ別

- 従来型ピストン/タービン

- ハイブリッド電気

- 完全電気式

- 所有形態別

- 完全私有

- 分譲所有

- チャーター/エアタクシー事業者

- 教育機関および学術機関

- 政府および特殊任務オペレーター

- エンドユーザーアプリケーション別

- ビジネス/法人向け輸送サービス

- 個人およびレジャー飛行

- 特殊任務(情報・監視・偵察、監視、法執行)

- 緊急医療/航空救急

- パイロット訓練

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- スペイン

- イタリア

- ロシア

- オランダ

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- インドネシア

- オーストラリア

- タイ

- マレーシア

- フィリピン

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- コロンビア

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- カタール

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- アルジェリア

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第7章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Bombardier Inc.

- Textron Inc.

- Embraer S.A.

- Cirrus Design Corporation(Aviation Industry Corporation of China)

- Piper Aircraft, Inc.

- COMPAGNIE DAHER SA

- Leonardo S.p.A.

- Airbus SE

- Honda Aircraft Company(Honda Motor Co., Ltd.)

- Robinson Helicopter Company

- Costruzioni Aeronautiche TECNAM S.p.A.

- MD Helicopters, LLC

- Joby Aero, Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Dassault Aviation SA

- Pilatus Aircraft Ltd.

- Diamond Aircraft Industries GmbH

- Epic Aircraft, LLC

- Archer Aviation Inc.

- Gulfstream Aerospace Corporation(General Dynamics Corporation)

第8章 市場機会と将来の展望

- ホワイトスペースとアンメットニーズの評価