|

|

市場調査レポート

商品コード

1773179

植物性組織化タンパク質(TVP)の世界市場:タイプ別、由来別、用途別、性質別、地域別 - 2030年までの予測Textured Vegetable Protein Market Report by Type (Slices, Chunks, Flakes, Granules), Source (Soy, Pea, Wheat), Application (Meat Analogues, Bars & Snacks, Ready-to-Eat Meals), Nature (Organic, Conventional), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 植物性組織化タンパク質(TVP)の世界市場:タイプ別、由来別、用途別、性質別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月16日

発行: MarketsandMarkets

ページ情報: 英文 237 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の植物性組織化タンパク質(TVP)の市場規模は、2025年に18億8,000万米ドルと予測され、予測期間中のCAGRは7.1%と見込まれており、2030年には26億5,000万米ドルに達すると予測されています。

既存企業や独創的な新規参入企業は、研究開発を駆使して、競争が激しく細分化されたTVP市場の成長を推進しています。Roquette、Cargill、Archer Daniels Midland(ADM)は、TVPの品質と品揃えを強化し、広範な供給網と先進技術を活用して業界をリードしています。例えば、ADMによるSojaproteinの買収のような合併は、非遺伝子組み換え大豆たん白市場での地位を強化しています。対照的に、IngredionとRoquetteは、クリーンラベルでアレルゲンフリーの製品を求める消費者の需要を満たすため、エンドウ豆をベースにした特殊なTVP製品を発表しました。さらに、オーガニックやグルテンフリーのTVPなど、特定の消費者ニーズに合わせた特殊製品を開発する新興企業が台頭しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(KT) |

| セグメント別 | タイプ別、由来別、用途別、性質別、地域別 |

| 対象地域 | 北米、欧州、南米、アジア太平洋、RoW |

TVP市場は活況を呈していますが、大豆や小麦由来のアレルゲンは、詳細な表示や製造上の制限が必要なため、成長の妨げになる可能性があります。さらに、TVPの製造に必要な操業やエネルギーに関連するコストは大きく、特に小規模な独立系メーカーにとっては、最終的に利益率に影響する可能性があります。また、エンドウ豆タンパクのような原材料のコストは、動物性タンパク源よりもかなり高いため、価格への感度が重要な地域での市場拡大が制限されます。

倫理的・環境的な懸念が、植物性組織化タンパク質業界を大きく牽引しています。過剰な水の浪費、温室効果ガスの排出、森林伐採など、畜産業が環境に与える悪影響により、消費者は持続可能な食品オプションの必要性をより強く認識するようになっています。対照的に、大豆、エンドウ豆、小麦などの植物由来のTVPは、動物性タンパク質よりも二酸化炭素排出量が少ないです。この持続可能性の利点は、環境意識の高い消費者、特に持続可能な食品の生産を促進する規制がある欧州などの地域の消費者を惹きつけています。自分の価値観に沿うために植物ベースの食事を選ぶ消費者が増えており、動物福祉などの倫理的関心がますます重要になっています。

TVP市場にはかなりの成長機会がありますが、いくつかの制約がその可能性を十分に発揮する妨げとなっています。第一の課題は、TVP製品の官能特性にあります。多くの消費者は、風味、テクスチャー、口当たりの点で、植物性タンパク質は従来の食肉に比べて魅力に欠けると認識しています。これらの点を強化することを目的とした技術革新が進行中であるにもかかわらず、かなりのギャップが残っており、広く購入・消費される上での障壁となっています。これは特に、非ベジタリアンやフレキシタリアンなど、肉中心の感覚に慣れている潜在力の高い消費者層で顕著です。

TVPチャンクは、食感や口当たりが肉の塊に似ている大きめの一口サイズの断片です。この塊を使った料理は、こってりしたシチュー、炒め物、ケバブに最適です。チャンクは万能で、味をよく吸収する一方、噛みごたえがあり、ヴィーガンだけでなくフレキシタリアンにもアピールできます。TVPチャンクは、レストランやカフェテリアでの外食のほか、現実的な代替肉への需要が旺盛な欧米でも人気があります。チャンクはペットフードにも採用されており、マーケティングのチャンネルがさらに広がっています。肉のような食感を再現するには高度な技術が必要で、その結果コストが高くなります。しかし、ハイエンドで需要の高い市場への進出は、TVP市場の主要な成長要因となっています。

北米は、高い消費者意識、確立された植物性食品ブランド、小売・外食インフラにより、TVP市場の市場シェアでリードしています。フレキシタリアンやビーガンといった健康志向の消費者の間で肉代替食品の採用が増加していることが、購買の伸びを支えています。米国とカナダの大手食品メーカーと新興新興企業は、食感や栄養成分だけでなく味も改善したTVPベースの製品を開発するため、研究開発に多額の投資を行っています。各国政府が主催する持続可能な食品への取り組みや、食肉生産による環境への影響に対する懸念の高まりも、世界のTVP市場における北米の優位性を支えています。

アジア太平洋は、健康意識率の向上、都市化レベルの上昇、食生活の嗜好の変化により、植物性組織化タンパク質(TVP)市場の急成長が見込まれています。中国、インド、日本、オーストラリアなどの国々における人口水準の上昇と所得水準の向上が、手頃な価格で持続可能な蛋白源に対する需要を高めています。この地域には大豆消費に関連した長い農業の伝統があり、その結果、TVP製品に対する消費者の受け入れレベルが高くなっています。このため、国内外の企業はアジア太平洋で既存の事業と製品ポートフォリオを拡大し、この大きな成長機会を利用しようとしています。さらに、持続可能な農業への取り組みに対する政府の支援と、植物性タンパク質への投資レベルの増加が、この地域のTVP市場を押し上げています。

当レポートでは、植物性組織化タンパク質市場をタイプ、由来、性質、用途、地域に基づいて区分しています。考察の面では、競合情勢、最終用途分析、企業プロファイルといった様々なレベルの分析に焦点を当てており、これらを合わせて、植物性組織化タンパク質市場の新興&高成長セグメント、高成長地域、国、政府の取り組み、市場促進要因・課題、市場抑制要因・課題に関する見解を構成・考察しています。主な業界参入企業の詳細な分析は、彼らの事業概要、ソリューション、サービス、主要戦略、契約、パートナーシップ、協定、新製品の発売、合併、買収、および植物性組織化タンパク質市場に関連する最近の動向についての洞察を提供するために行われました。当レポートでは、植物性組織化タンパク質市場のエコシステムにおける今後の新興企業の競合分析をカバーしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 生成AI/AIが植物性組織化タンパク質市場に与える影響

第6章 植物性組織化タンパク質市場(タイプ別)

- イントロダクション

- スライス

- フレーク

- チャンク

- 顆粒

第7章 植物性組織化タンパク質市場(由来別)

- イントロダクション

- 大豆

- エンドウ

- 小麦

- その他

第8章 植物性組織化タンパク質市場(用途別)

- イントロダクション

- 肉の類似品

- レディトゥイート食品

- バー&スナック

- その他

第9章 植物性組織化タンパク質市場(性質別)

- イントロダクション

- オーガニック

- 従来型

第10章 植物性組織化タンパク質市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2022年~2024年

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- ADM

- CARGILL, INCORPORATED

- ROQUETTE FRERES

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- INGREDION

- DSM-FIRMENICH

- MGP

- PURIS

- BENEO

- AXIOM FOODS, INC.

- THE SCOULAR COMPANY

- SHANDONG YUXIN BIO-TECH CO., LTD.

- GUSHEN BIOLOGICAL TECHNOLOGY GROUP CO., LTD.

- FOODCHEM INTERNATIONAL CORPORATION

- DACSA GROUP

- その他の企業

- SHANDONG WONDERFUL BIOTECH CO., LTD.

- SUN NUTRAFOODS

- CROWN SOYA PROTEIN GROUP COMPANY

- HOYA FOODS

- SOTEXPRO

- LIVING FOODS

- PRANA ORGANIC

- ND LABS INC

- BLATTMANN SCHWEIZ AG

- SONIC BIOCHEM

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 2 TEXTURED VEGETABLE PROTEIN MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 4 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 5 SLICES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 6 SLICES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7 FLAKES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 8 FLAKES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 9 CHUNKS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 10 CHUNKS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 11 GRANULES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 12 GRANULES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 14 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 15 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (KILOTON)

- TABLE 16 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 17 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 18 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 20 SOY: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 21 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 24 PEA: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 25 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 28 WHEAT: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 29 OTHER SOURCES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 OTHER SOURCES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

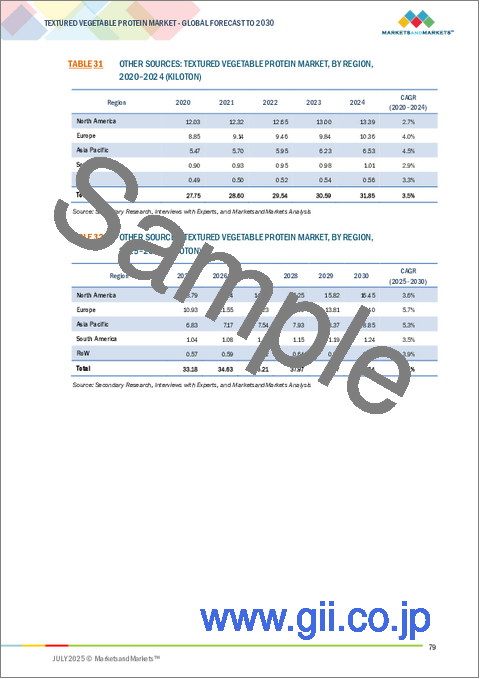

- TABLE 31 OTHER SOURCES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 32 OTHER SOURCES: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 33 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 34 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 35 MEAT ANALOGUES: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 MEAT ANALOGUES: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 READY-TO-EAT MEALS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 READY-TO-EAT MEALS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 BARS & SNACKS: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 BARS & SNACKS: TEXTURIZED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER APPLICATIONS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2020-2024 (USD MILLION)

- TABLE 44 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 45 ORGANIC: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 ORGANIC: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CONVENTIONAL: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 CONVENTIONAL: TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 52 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 53 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 56 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 57 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (KILOTON)

- TABLE 62 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 63 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2020-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 67 US: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 68 US: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 CANADA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 70 CANADA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 MEXICO: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 72 MEXICO: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 74 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 76 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 77 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 78 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 80 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (KILOTON)

- TABLE 82 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 83 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 84 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2020-2024 (USD MILLION)

- TABLE 86 EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 87 GERMANY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 88 GERMANY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 UK: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 90 UK: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 FRANCE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 92 FRANCE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 ITALY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 94 ITALY: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 SPAIN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 96 SPAIN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 98 REST OF EUROPE: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 102 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 103 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (KILOTON)

- TABLE 108 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 109 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2020-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 113 CHINA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 114 CHINA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 INDIA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 116 INDIA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 JAPAN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 118 JAPAN: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 AUSTRALIA & NEW ZEALAND: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 120 AUSTRALIA & NEW ZEALAND: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 124 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 126 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 127 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 128 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 130 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 131 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (KILOTON)

- TABLE 132 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 133 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 134 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2020-2024 (USD MILLION)

- TABLE 136 SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 137 BRAZIL: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 138 BRAZIL: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 ARGENTINA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 140 ARGENTINA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 REST OF SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 142 REST OF SOUTH AMERICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 144 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 146 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 147 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 148 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 150 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 151 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2020-2024 (KILOTON)

- TABLE 152 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 153 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 154 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2020-2024 (USD MILLION)

- TABLE 156 ROW: TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 AFRICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 160 AFRICA: TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TEXTURED VEGETABLE PROTEIN MARKET, 2020-2024

- TABLE 162 TEXTURED VEGETABLE PROTEIN MARKET: DEGREE OF COMPETITION

- TABLE 163 TEXTURED VEGETABLE PROTEIN MARKET: TYPE FOOTPRINT

- TABLE 164 TEXTURED VEGETABLE PROTEIN MARKET: NATURE FOOTPRINT

- TABLE 165 TEXTURED VEGETABLE PROTEIN MARKET: APPLICATION FOOTPRINT

- TABLE 166 TEXTURED VEGETABLE PROTEIN MARKET: REGIONAL FOOTPRINT

- TABLE 167 TEXTURED VEGETABLE PROTEIN MARKET: KEY START-UPS/SMES

- TABLE 168 TEXTURED VEGETABLE PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2024

- TABLE 169 TEXTURED VEGETABLE PROTEIN MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 170 TEXTURED VEGETABLE PROTEIN MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 171 TEXTURED VEGETABLE PROTEIN MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 172 ADM: COMPANY OVERVIEW

- TABLE 173 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 ADM: PRODUCT LAUNCHES

- TABLE 175 ADM: DEALS

- TABLE 176 ADM: EXPANSIONS

- TABLE 177 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 178 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 180 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 181 ROQUETTE FRERES: COMPANY OVERVIEW

- TABLE 182 ROQUETTE FRERES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 ROQUETTE FRERES: PRODUCT LAUNCHES

- TABLE 184 ROQUETTE FRERES: DEALS

- TABLE 185 ROQUETTE FRERES: EXPANSIONS

- TABLE 186 INTERNATIONAL FLAVOURS & FRAGRANCES INC.: COMPANY OVERVIEW

- TABLE 187 INTERNATIONAL FLAVOURS & FRAGRANCES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 INTERNATIONAL FLAVOURS & FRAGRANCES INC.: PRODUCT LAUNCHES

- TABLE 189 INTERNATIONAL FLAVOURS & FRAGRANCES INC.: DEALS

- TABLE 190 INGREDION: COMPANY OVERVIEW

- TABLE 191 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 INGREDION: PRODUCT LAUNCHES

- TABLE 193 INGREDION: DEALS

- TABLE 194 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 195 DSM-FIRMENICH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 DSM-FIRMENICH: PRODUCT LAUNCHES

- TABLE 197 DSM-FIRMENICH: DEALS

- TABLE 198 MGP: COMPANY OVERVIEW

- TABLE 199 MGP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 MGP: PRODUCT LAUNCHES

- TABLE 201 MGP: EXPANSIONS

- TABLE 202 PURIS: COMPANY OVERVIEW

- TABLE 203 PURIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 PURIS: PRODUCT LAUNCHES

- TABLE 205 PURIS: EXPANSIONS

- TABLE 206 BENEO: COMPANY OVERVIEW

- TABLE 207 BENEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 BENEO: DEALS

- TABLE 209 BENEO: EXPANSIONS

- TABLE 210 AXIOM FOODS, INC.: COMPANY OVERVIEW

- TABLE 211 AXIOM FOODS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 AXIOM FOODS, INC.: PRODUCT LAUNCHES

- TABLE 213 THE SCOULAR COMPANY: COMPANY OVERVIEW

- TABLE 214 THE SCOULAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SHANDONG YUXIN BIO-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 216 SHANDONG YUXIN BIO-TECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 GUSHEN BIOLOGICAL TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 218 GUSHEN BIOLOGICAL TECHNOLOGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 FOODCHEM INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 220 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 DACSA GROUP: COMPANY OVERVIEW

- TABLE 222 DACSA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 SHANDONG WONDERFUL BIOTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 224 SHANDONG WONDERFUL BIOTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 SUN NUTRAFOODS: COMPANY OVERVIEW

- TABLE 226 SUN NUTRAFOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 CROWN SOYA PROTEIN GROUP COMPANY: COMPANY OVERVIEW

- TABLE 228 CROWN SOYA PROTEIN GROUP COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HOYA FOODS: COMPANY OVERVIEW

- TABLE 230 HOYA FOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SOTEXPRO: COMPANY OVERVIEW

- TABLE 232 SOTEXPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 ADJACENT MARKETS TO TEXTURED VEGETABLE PROTEIN

- TABLE 234 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 235 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 236 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2019-2023 (KILOTON)

- TABLE 237 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2024-2029 (KILOTON)

- TABLE 238 PEA PROTEIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 239 PEA PROTEIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 240 PEA PROTEIN MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 241 PEA PROTEIN MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 242 MEAT SUBSTITUTES MARKET, BY PRODUCT, 2017-2020 (USD MILLION)

- TABLE 243 MEAT SUBSTITUTES MARKET, BY PRODUCT, 2021-2027 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TEXTURED VEGETABLE PROTEIN MARKET: RESEARCH DESIGN

- FIGURE 3 TEXTURED VEGETABLE PROTEIN MARKET: DEMAND-SIDE CALCULATION

- FIGURE 4 TEXTURED VEGETABLE PROTEIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 TEXTURED VEGETABLE PROTEIN MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- FIGURE 6 TEXTURED VEGETABLE PROTEIN MARKET: DATA TRIANGULATION

- FIGURE 7 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 8 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 GROWING AWARENESS OF HEALTH BENEFITS OF PLANT-BASED PROTEIN TO DRIVE MARKET

- FIGURE 13 SOY SEGMENT & US TO ACCOUNT FOR LARGEST SHARES IN NORTH AMERICAN MARKET IN 2025

- FIGURE 14 SOY TO ACCOUNT FOR LARGEST MARKET IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 15 SOY SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES DURING FORECAST PERIOD

- FIGURE 16 US TO ACCOUNT FOR LARGEST MARKET SHARE (BY VALUE) IN 2025

- FIGURE 17 GLOBAL PRODUCTION OF CHICKPEAS AND GREEN PEAS, 2018-2022 (MILLION TONNES)

- FIGURE 18 GLOBAL PEA PRODUCTION, BY COUNTRY, 2021 (MILLION TONNES)

- FIGURE 19 US PLANT-BASED MARKET, 2019-2022 (BILLION)

- FIGURE 20 TEXTURED VEGETABLE PROTEIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 PLANT-BASED MEAT AND SEAFOOD PRODUCT CATEGORY, 2023

- FIGURE 22 AVERAGE UNIT PRICES OF PLANT-BASED VS. ANIMAL-BASED PRODUCTS BY CATEGORY, 2020

- FIGURE 23 ADOPTION OF GEN AI IN F00D & BEVERAGE PRODUCTION PROCESS

- FIGURE 24 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 25 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 26 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 27 TOTAL US PLANT-BASED PRODUCT SALES, 2023 (USD BILLION)

- FIGURE 28 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE, 2025 VS. 2030 (USD MILLION)

- FIGURE 29 CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 TEXTURED VEGETABLE PROTEIN MARKET: REVENUE ANALYSIS OF KEY PLAYERS 2020-2024 (USD BILLION)

- FIGURE 33 TEXTURED VEGETABLE PROTEIN MARKET: MARKET SHARE ANALYSIS

- FIGURE 34 TEXTURED VEGETABLE PROTEIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 35 TEXTURED VEGETABLE PROTEIN MARKET: COMPANY FOOTPRINT

- FIGURE 36 TEXTURED VEGETABLE PROTEIN MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 37 COMPANY VALUATION OF KEY VENDORS, 2024 (USD BILLION)

- FIGURE 38 EV/EBITDA OF KEY COMPANIES, 2024

- FIGURE 39 BRAND/PRODUCT COMPARISON

- FIGURE 40 ADM: COMPANY SNAPSHOT

- FIGURE 41 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 42 INTERNATIONAL FLAVOURS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 43 INGREDION: COMPANY SNAPSHOT

- FIGURE 44 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 45 MGP: COMPANY SNAPSHOT

The global textured vegetable protein (TVP) market is estimated at USD 1.88 billion in 2025 and is projected to reach USD 2.65 billion by 2030, at a CAGR of 7.1% during the forecast period. Established businesses and creative new entrants are driving growth in the fiercely competitive and fragmented TVP market using research and development. Roquette, Cargill, and Archer Daniels Midland (ADM) are leading the industry by enhancing TVP quality and range and by utilizing their extensive supply networks and advanced technologies. For instance, mergers such as ADM's purchase of Sojaprotein have strengthened its position in the market for non-GMO soy protein. In contrast, Ingredion and Roquette have introduced specialized pea-based TVP products to satisfy consumer demand for clean-label and allergen-free products. Additionally, startups are emerging by developing specialty goods tailored to specific consumer needs, such as organic or gluten-free TVP.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (KT) |

| Segments | By Type, Source, Nature, Application, and Region |

| Regions covered | North America, Europe, South America, Asia Pacific, and RoW |

Although the TVP market is thriving, allergens from soy and wheat may hinder its growth due to the need for detailed labeling and manufacturing restrictions. Additionally, the costs related to operations and the energy required to produce TVP are significant and can ultimately affect profit margins, particularly for smaller and independent manufacturers. The cost of raw materials, such as pea protein, is also significantly higher than that of animal-based protein sources, thus limiting market expansion in regions where price sensitivity is crucial.

"Organic segment is expected to grow at the highest CAGR during the forecast period"

Ethical and environmental concerns significantly drive the textured vegetable protein industry. The negative impacts of animal husbandry on the environment, including excessive water waste, greenhouse gas emissions, and deforestation, have made consumers more aware of the need for sustainable food options. In contrast, TVP, which is derived from plant sources such as soybeans, peas, and wheat, emits less carbon dioxide than animal protein. This sustainability benefit attracts environmentally conscious consumers, particularly in regions such as Europe, where regulations promote the production of sustainable food. An increasing number of consumers are opting for plant-based diets to align with their values, which makes ethical concerns such as animal welfare increasingly significant.

The TVP market presents considerable growth opportunities; however, several constraints hinder its full potential. A primary challenge lies in the sensory profiles of TVP products. Many consumers perceive plant-based proteins as less appealing compared to traditional meat in terms of flavor, texture, and mouthfeel. Despite ongoing innovations aimed at enhancing these aspects, a substantial gap remains, acting as a barrier to widespread purchase and consumption. This is particularly evident among high-potential segments, such as non-vegetarian and flexitarian consumers, who are accustomed to a meat-centric sensory experience.

"Chunks type segment is projected to hold a major share during the forecast period"

TVP chunks are larger, bite-sized pieces that resemble meat chunks in texture and mouthfeel. Cooking with these chunks is ideal for heavy stews, stir-fries, and kebabs. Chunks are versatile and good at absorbing flavors while offering good chewiness that would appeal to both vegan as well as flexitarian customers. TVP chunks are popular in Europe and North America, where there is an immense demand for realistic meat alternatives, besides food service in restaurants and cafeterias. Chunks are also employed in pet food, affording even more channels for marketing. They require advanced technology to replicate a meat-like texture, which subsequently increases their costs. However, their venture into high-end, in-demand markets serves as a primary growth factor for the TVP market.

"North America leads in market share, while Asia Pacific emerges as the fastest growing region in the textured vegetable protein market"

North America leads in market share in the TVP market due to high consumer awareness, established plant-based food brands, and retail and foodservice infrastructure. The increased adoption of meat alternatives among health-focused consumers, such as flexitarians and vegans, has supported purchase growth. Major food manufacturers and emerging startups in the US and Canada are investing significantly in R&D to develop TVP-based products with improved taste, as well as texture and nutritional content. Efforts to create sustainable food initiatives sponsored by governments and increased concerns about the environmental impact of meat production have also supported North America's dominance in the global TVP market.

The Asia Pacific region is expected to be the fastest-growing market for textured vegetable protein due to increasing health awareness rates, rising urbanization levels, and changes in dietary preferences. Rising population levels and improved income levels in countries such as China, India, Japan, and Australia have increased the demand for affordable and sustainable sources of protein. This region has long agricultural traditions associated with soy consumption, resulting in high levels of consumer acceptance of TVP products. Thus, local and international companies are expanding their existing operations and product portfolios in Asia Pacific to tap into this significant growth opportunity. Additionally, increasing government support for sustainable agriculture initiatives and investment levels in plant-based proteins boosts the TVP market across the region.

The Break-up of Primaries:

By Company Type: Tire 1 - 35%, Tire 2 - 40%, Tire 3 - 25%

By Designation: CXOs - 30%, Managers - 50%, Executives - 20%

By Region: North America - 25%, Europe - 25%, Asia Pacific - 30%, South America - 10%, RoW - 10%

Key players in this market include ADM (US), Roquette Freres (France), Ingredion (US), dsm-firmenich (Netherlands), The Scoular Company (US), Beneo (Germany), International Flavors & Fragrances, Inc. (US), Cargill, Incorporated (US), MGP (US), PURIS (US), Shandong Yuxin Bio-Tech Co., Ltd. (China), Gushen Biological Technology Group, Co., Ltd. (China), Axiom Foods, Inc. (US), Foodchem International Corporation (China), and Dacsa Group (Spain).

Research Coverage:

The report segments the textured vegetable protein market based on type, source, nature, application, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the textured vegetable protein market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, key strategies, contracts, partnerships, agreements, new product launches, mergers, and acquisitions, and recent developments associated with the textured vegetable protein market. Competitive analysis of upcoming startups in the textured vegetable protein market ecosystem is covered in this report.

Reasons to Buy this Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall textured vegetable protein market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights into the following pointers:

- Analysis of key drivers (growing adoption of meat alternatives among consumers, increase in health cognizance among consumers, innovations and developments augmenting vegan trend, and growth in investments and collaborations in plant-sourced food business) restraints (allergies associated with vegetable protein sources and processing complexities) opportunities (economical solutions using plant-based ingredients and developments in extraction of textured vegetable protein from new source), and challenges (stringent government regulations and safety concerns due to inclusion of GM ingredients and unpleasant flavor of soy)

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the textured vegetable protein market

- Market Development: Comprehensive information about lucrative markets - analyzing the textured vegetable protein market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the textured vegetable protein market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as ADM (US), Roquette Freres (France), Ingredion (US), dsm-firmenich (Netherlands), The Scoular Company (US), Beneo (Germany), International Flavors & Fragrances, Inc. (US), Cargill, Incorporated (US), MGP (US), PURIS (US), Shandong Yuxin Bio-Tech Co., Ltd. (China), Gushen Biological Technology Group, Co., Ltd. (China), Axiom Foods, Inc. (US), Foodchem International Corporation (China), and Dacsa Group (Spain)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.5.1 CURRENCY/VALUE UNIT

- 1.5.2 VOLUME CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary profiles

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Estimating market size using top-down approach

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TEXTURED VEGETABLE MARKET

- 4.2 NORTH AMERICAN TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE AND COUNTRY

- 4.3 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE (VOLUME)

- 4.4 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE AND REGION

- 4.5 TEXTURED VEGETABLE PROTEIN MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL PRODUCTION OF PEA CROPS AND GREEN PEAS

- 5.2.2 GROWING HEALTH TRENDS

- 5.2.3 CONSUMER SHIFT TOWARD PLANT-BASED NUTRITION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing demand for meat alternatives

- 5.3.1.2 Breakthroughs in food science and processing technologies

- 5.3.1.3 Surge in investments and collaborations in plant-sourced food business

- 5.3.2 RESTRAINTS

- 5.3.2.1 Allergies associated with vegetable protein sources

- 5.3.2.2 Complexities in processing textured vegetable proteins

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Economical solutions using plant-based ingredients

- 5.3.3.2 Shift from traditional extraction sources of textured vegetable protein to new sources

- 5.3.4 CHALLENGES

- 5.3.4.1 Stringent government regulations

- 5.3.4.2 High cost of production

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GENERATIVE AI/AI ON TEXTURED VEGETABLE PROTEIN MARKET

- 5.4.1 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS

- 5.4.2 CASE STUDY ANALYSIS

- 5.4.2.1 AI Bobby: Optimizing Protein Gelation

- 5.4.2.2 GreenProtein AI: Extrusion Optimization

- 5.4.2.3 Cradle: Designing Novel TVP Proteins

- 5.4.3 IMPACT OF AI ON TEXTURED VEGETABLE PROTEIN MARKET

- 5.4.4 IMPACT OF GEN AI ON ADJACENT ECOSYSTEM

6 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 SLICES

- 6.2.1 CHANGING LIFESTYLE AND INCREASING HEALTH AWARENESS TO BOOST DEMAND FOR TVP SLICES AS MEAT SUBSTITUTE

- 6.3 FLAKES

- 6.3.1 HIGH PROTEIN AND LOW FATS IN TEXTURED VEGETABLE PROTEIN FLAKES TO DRIVE MARKET

- 6.4 CHUNKS

- 6.4.1 CUSTOMIZABLE FLAVOR OPTIONS TO ADD TO POPULARITY OF TEXTURED VEGETABLE PROTEIN CHUNKS

- 6.5 GRANULES

- 6.5.1 USE OF GRANULES AS MEAT EXTENDERS AND EASY STORING OPTIONS TO DRIVE MARKET

7 TEXTURED VEGETABLE PROTEIN MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 SOY

- 7.2.1 HIGH SHELF-LIFE AND LOW CALORIES IN SOYMEAL PRODUCTS TO BOOST DEMAND

- 7.3 PEA

- 7.3.1 USE OF TEXTURED PEA PROTEIN IN DIFFERENT PRODUCTS TO DRIVE MARKET

- 7.4 WHEAT

- 7.4.1 EXCELLENT BINDING CHARACTERISTICS OF WHEAT TO INCREASE ITS USAGE IN ALTERNATIVE MEAT PRODUCTS

- 7.5 OTHER SOURCES

8 TEXTURED VEGETABLE PROTEIN MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 MEAT ANALOGUES

- 8.2.1 INCREASING USE OF MEAT ALTERNATIVES IN VARIOUS FOOD APPLICATIONS TO DRIVE MARKET

- 8.3 READY-TO-EAT MEALS

- 8.3.1 CONSUMER PREFERENCE FOR CONVENIENCE, NUTRITION, AND SUSTAINABILITY IN FOOD CHOICES TO DRIVE MARKET

- 8.4 BARS & SNACKS

- 8.4.1 HEALTHY SNACKING HABITS TO DRIVE PARADIGM SHIFT IN CONSUMER BEHAVIOR FOR TEXTURED PROTEINS

- 8.5 OTHER APPLICATIONS

9 TEXTURED VEGETABLE PROTEIN MARKET, BY NATURE

- 9.1 INTRODUCTION

- 9.2 ORGANIC

- 9.2.1 AVAILABILITY OF LOW-COST ORGANIC PROTEIN TO INCREASE DEMAND FOR ORGANIC TEXTURED VEGETABLE PROTEIN

- 9.3 CONVENTIONAL

- 9.3.1 GROWTH OF CONVENTIONAL FARMING DUE TO LOW POPULARITY OF ORGANIC FARMING TO FOSTER MARKET GROWTH

10 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Need to enhance production capacity and meet rising consumer demand for innovative plant-based options to drive market

- 10.2.2 CANADA

- 10.2.2.1 Increasing awareness about functional health benefits of healthier diet to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Changing consumer preferences toward vegan products to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Growing concerns over sustainability and increasing vegan population to drive market

- 10.3.2 UK

- 10.3.2.1 Increasing government investments in plant-based protein to fuel demand for textured vegetable proteins

- 10.3.3 FRANCE

- 10.3.3.1 Collaboration between different stakeholders in plant-based protein industry to drive market

- 10.3.4 ITALY

- 10.3.4.1 Shifting opinion on meat consumption toward sustainable alternatives to boost demand for textured vegetable proteins

- 10.3.5 SPAIN

- 10.3.5.1 Rising demand for meat alternatives due to growing inclination toward nutritious food to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Higher production capabilities and cheap labor to boost market

- 10.4.2 INDIA

- 10.4.2.1 Influence of Western culture to fuel vegan trends and result in increased demand for textured vegetable protein

- 10.4.3 JAPAN

- 10.4.3.1 Rise in awareness surrounding meat processing and health concerns to boost market

- 10.4.4 AUSTRALIA AND NEW ZEALAND

- 10.4.4.1 Consumer preferences and sustainability to accelerate market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Rising veganism trend and increasing awareness of health and environmental issues to trigger market growth

- 10.5.2 ARGENTINA

- 10.5.2.1 Rising funding and growing environmental and animal welfare concerns in plant-based protein industry to fuel market growth

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 REST OF THE WORLD

- 10.6.1 MIDDLE EAST

- 10.6.1.1 Need for plant-based protein and presence of global players to drive market

- 10.6.2 AFRICA

- 10.6.2.1 Growing awareness and adoption of plant-based protein to boost market for textured vegetable protein

- 10.6.1 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Type footprint

- 11.5.5.3 Nature footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Regional footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 11.6.5.1 Detailed list of key start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ADM

- 12.1.1.1 Business overview

- 12.1.1.2 Product/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 CARGILL, INCORPORATED

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ROQUETTE FRERES

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 INGREDION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 DSM-FIRMENICH

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.4 MnM view

- 12.1.7 MGP

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.8 PURIS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Expansions

- 12.1.8.4 MnM view

- 12.1.9 BENEO

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Expansions

- 12.1.9.4 MnM view

- 12.1.10 AXIOM FOODS, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.4 MnM view

- 12.1.11 THE SCOULAR COMPANY

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 MnM view

- 12.1.12 SHANDONG YUXIN BIO-TECH CO., LTD.

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 MnM view

- 12.1.13 GUSHEN BIOLOGICAL TECHNOLOGY GROUP CO., LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 MnM view

- 12.1.14 FOODCHEM INTERNATIONAL CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 MnM view

- 12.1.15 DACSA GROUP

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 MnM view

- 12.1.1 ADM

- 12.2 OTHER PLAYERS

- 12.2.1 SHANDONG WONDERFUL BIOTECH CO., LTD.

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 MnM view

- 12.2.2 SUN NUTRAFOODS

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 MnM view

- 12.2.3 CROWN SOYA PROTEIN GROUP COMPANY

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 MnM view

- 12.2.4 HOYA FOODS

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 MnM view

- 12.2.5 SOTEXPRO

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 MnM view

- 12.2.6 LIVING FOODS

- 12.2.7 PRANA ORGANIC

- 12.2.8 ND LABS INC

- 12.2.9 BLATTMANN SCHWEIZ AG

- 12.2.10 SONIC BIOCHEM

- 12.2.1 SHANDONG WONDERFUL BIOTECH CO., LTD.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 PLANT-BASED PROTEIN MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 PEA PROTEIN MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.5 MEAT SUBSTITUTES MARKET

- 13.5.1 MARKET DEFINITION

- 13.5.2 MARKET OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS