|

|

市場調査レポート

商品コード

1748391

ジュース検査の世界市場:製品タイプ別、検査タイプ別、技術別、地域別 - 2030年までの予測Juice Testing Market by Product Type, Technology, Test Type, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ジュース検査の世界市場:製品タイプ別、検査タイプ別、技術別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月21日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のジュース検査の市場規模は、2025年には8億6,000万米ドルと推定され、予測期間中のCAGRは8.2%と見込まれており、2030年には12億8,000万米ドルに達すると予測されています。

クリーンラベル、アレルゲンフリー、減糖、低糖飲料に対する消費者の需要の高まりは、世界のジュース産業を再形成し、メーカーがより健康的で透明性の高い原料で製品を再製造するよう促しています。健康志向の消費者が、添加物を最小限に抑え、アレルゲンを含まず、糖分含有量の少ない飲料をますます求めるようになるにつれ、規制機関は表示と安全性の要件を厳しくしています。このシフトはジュース検査市場を大きく後押ししており、生産者は高度な検査を通じて栄養強調表示、アレルゲンの不存在、糖分低減を検証する必要があります。その結果、厳密な化学分析、栄養分析、アレルゲン分析のニーズが急速に拡大し、世界のジュース市場における品質保証と消費者の信頼が強化されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品タイプ別、検査タイプ別、技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

コールドプレスジュースは、その認知された健康上の利点、最小限の加工、クリーンラベルの魅力により、ジュース検査市場で最も急成長するセグメントとなる見込みです。消費者が人工添加物や保存料、過剰な糖分を含まない飲料を選ぶ傾向が強まる中、コールドプレスジュースはその純度と栄養保持率の高さで際立っています。このような嗜好の変化により、安全性、真正性、栄養成分表示への準拠を保証するための厳格な試験に対する需要が高まっています。メーカー各社は、賞味期限、微生物の安全性、原材料の完全性を確認するための高度な試験方法に投資しています。このセグメントの成長は、健康志向の市場におけるコールドプレスジュースのプレミアムな位置づけによっても後押しされています。

迅速/機器ベースの技術は、その高い精度、スピード、幅広い汚染物質や品質マーカーを検出する能力により、ジュース検査市場で最大のセグメントを占めています。これらの技術には、クロマトグラフィー(HPLC、GC-MS、LC-MS/MS)、分光法(UV、NIR、FTIR)、ポリメラーゼ連鎖反応(PCR)、酵素結合免疫吸着測定法(ELISA0029)、センサーベース技術などの高度な技術が含まれます。これらのツールは、ジュース製品中の残留農薬、マイコトキシン、防腐剤、その他の不純物を検出するために不可欠です。リアルタイム分析における効率性と安全基準への適合性により、製品の品質を維持し、消費者の安全を確保し、競争市場において厳しい規制要件を満たすことを目指す生産者にとって不可欠なものとなっています。

北米は、厳格な食品安全規制、消費者の健康意識の高まり、プレミアムジュースブランドの強い存在感により、ジュース検査市場で大きな市場シェアを占めています。FDA(米国食品医薬品局)やUSDA(米国農務省)のような規制機関は、飲食品の安全性に関して厳格なコンプライアンスを義務付けているため、メーカーは高度な検査技術への投資を余儀なくされています。クリーンラベル、オーガニック、コールドプレスジュースに対する需要の高まりは、真正性、アレルゲン、栄養分析を含む包括的な品質検査の必要性をさらに高めています。さらに、検査機関のネットワークが確立され、分析手法の技術革新が市場の成長を支えています。消費者の嗜好がより健康的で透明性の高いラベル付き飲料へとシフトする中、この地域では信頼性の高いジュース検査ソリューションに対する強い需要が引き続き見られます。

当レポートでは、世界のジュース検査市場について調査し、製品タイプ別、検査タイプ別、技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済見通し

- 市場力学

- 生成AIがジュース検査市場に与える影響

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- 規制状況

- 2025年の米国関税ジュース試験市場への影響

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 ジュース検査市場(製品タイプ別)

- イントロダクション

- フルーツジュース

- 野菜ジュース

- ミックスジュース

- 濃縮物

- コールドプレスジュース

- その他

第8章 ジュース検査市場(検査タイプ別)

- イントロダクション

- 微生物検査

- 化学検査

- 栄養成分分析

- 物理パラメータテスト

- アレルゲン検査

- 不正行為テスト

第9章 ジュース検査市場(技術別)

- イントロダクション

- 手動/従来型検査

- 迅速/機器ベースの検査

第10章 ジュース検査市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/サービス比較分析

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- EUROFINS SCIENTIFIC

- SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- ALS

- INTERTEK GROUP PLC

- MERIEUX NUTRISCIENCES CORPORATION

- TUV SUD

- AGILENT TECHNOLOGIES, INC.

- CERTIFIED GROUP

- ALFA CHEMISTRY

- CENTRE TESTING INTERNATIONAL GROUP CO., LTD.

- AGQ LABS

- TENTAMUS

- SYMBIO LABS

- FOODCHAIN ID

- LAUDA DR. R. WOBSER GMBH & CO. KG

- その他の企業

- DLG E.V.

- FARE LABS

- PACIFIC LAB

- ACCREDITEDTESTLABS

- AMLAB SERVICES PTE. LTD.

- LIFEASIBLE

- CO-LABORATORY

- SRI SHAKTHI FOOD TESTING LAB

- FERA SCIENCE LIMITED

- PRIMUSLABS

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 2 JUICE TESTING MARKET SHARE SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 EXPORT SCENARIO FOR HS CODE 2009, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 4 EXPORT SCENARIO FOR HS CODE 2009, BY COUNTRY, 2020-2024 (TONS)

- TABLE 5 IMPORT SCENARIO FOR HS CODE 2009, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 IMPORT SCENARIO OF HS CODE 2009, BY COUNTRY, 2020-2024 (TONS)

- TABLE 7 INDICATIVE PRICING ANALYSIS, BY REGION, 2024 (USD/PER SAMPLE)

- TABLE 8 INDICATIVE PRICING ANALYSIS, BY KEY PLAYERS, 2024 (USD/PER SAMPLE)

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY TECHNOLOGY, 2024 (USD/PER SAMPLE)

- TABLE 10 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 PATENTS PERTAINING TO JUICE TESTING MARKET AND RELATED PATENTS, 2016-2024

- TABLE 12 JUICE TESTING MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 JUICE TESTING MARKET: TARIFF FOR HS CODE 200990, 2023

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 EXPECTED IMPACT LEVEL ON TARGET PRODUCTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF

- TABLE 21 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES OF JUICE PRODUCTS

- TABLE 22 IMPACT OF PORTER'S FIVE FORCES ON JUICE TESTING MARKET

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TEST TYPES (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE PRODUCT TYPES

- TABLE 25 IDENTIFYING AND PREVENTING MICROBIAL CONTAMINATION IN BOTTLED JUICE

- TABLE 26 PROCESS MONITORING TO RESOLVE JUICE QUALITY ISSUES

- TABLE 27 ENHANCING FOOD AND BEVERAGE ANALYSIS WITH HIGH-PRESSURE ION CHROMATOGRAPHY

- TABLE 28 JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 29 JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 30 FRUIT JUICES: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 FRUIT JUICES: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 VEGETABLE JUICES: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 VEGETABLE JUICES: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 MIXED JUICES: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 MIXED JUICES: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 CONCENTRATES: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 CONCENTRATES: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 COLD-PRESSED JUICES: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 COLD-PRESSED JUICES: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OTHER PRODUCT TYPES: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 OTHER PRODUCT TYPES: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 JUICE TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 43 JUICE TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 44 MICROBIAL TESTS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 MICROBIAL TESTS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 CHEMICAL TESTS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 CHEMICAL TESTS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 NUTRITIONAL CONTENT ANALYSIS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 NUTRITIONAL CONTENT ANALYSIS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 PHYSICAL PARAMETER TESTS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 PHYSICAL PARAMETER TESTS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ALLERGEN TESTS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 ALLERGEN TESTS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 FRAUD TESTS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 FRAUD TESTS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 57 JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 58 JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (NO. OF TESTS IN THOUSAND)

- TABLE 59 JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (NO. OF TESTS IN THOUSAND)

- TABLE 60 MANUAL/CONVENTIONAL TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2020-2024 (USD MILLION)

- TABLE 61 MANUAL/CONVENTIONAL TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2025-2030 (USD MILLION)

- TABLE 62 MANUAL/CONVENTIONAL TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2020-2024 (NO. OF TESTS IN THOUSAND)

- TABLE 63 MANUAL/CONVENTIONAL TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2025-2030 (NO. OF TESTS IN THOUSAND)

- TABLE 64 MANUAL/CONVENTIONAL TESTING: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 MANUAL/CONVENTIONAL TESTING: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 CULTURE-BASED METHODS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 CULTURE-BASED METHODS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 TITRATION METHODS: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 TITRATION METHODS: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 RAPID/INSTRUMENT-BASED TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2020-2024 (USD MILLION)

- TABLE 71 RAPID/INSTRUMENT-BASED TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2025-2030 (USD MILLION)

- TABLE 72 RAPID/INSTRUMENT-BASED TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2020-2024 (NO. OF TESTS IN THOUSAND)

- TABLE 73 RAPID/INSTRUMENT-BASED TESTING: JUICE TESTING MARKET, BY SUB-TESTING, 2025-2030 (NO. OF TESTS IN THOUSAND)

- TABLE 74 RAPID/INSTRUMENT-BASED TESTING: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 RAPID/INSTRUMENT-BASED TESTING: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 CHROMATOGRAPHY: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 CHROMATOGRAPHY: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 SPECTROSCOPY: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 SPECTROSCOPY: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 POLYMERASE CHAIN REACTION: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 POLYMERASE CHAIN REACTION: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 ENZYME-LINKED IMMUNOSORBENT ASSAY: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 ENZYME-LINKED IMMUNOSORBENT ASSAY: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 SENSOR-BASED TECHNOLOGY: JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 SENSOR-BASED TECHNOLOGY: JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 JUICE TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 JUICE TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: JUICE TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: JUICE TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: JUICE TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: JUICE TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 US: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 101 US: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 102 CANADA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 103 CANADA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 104 MEXICO: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 105 MEXICO: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: JUICE TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 107 EUROPE: JUICE TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 109 EUROPE: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: JUICE TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 111 EUROPE: JUICE TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 113 EUROPE: JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 115 EUROPE: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 118 GERMANY: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 119 GERMANY: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 120 UK: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 121 UK: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 122 FRANCE: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 123 FRANCE: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 124 SPAIN: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 125 SPAIN: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 126 ITALY: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 127 ITALY: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 129 REST OF EUROPE: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: JUICE TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 131 ASIA PACIFIC: JUICE TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: JUICE TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: JUICE TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: JUICE TESTING MARKET, BY RAPID / INSTRUMENT-BASED TESTING TECHNOLOGIES, 2025-2030 (USD MILLION)

- TABLE 142 CHINA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 143 CHINA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 144 INDIA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 145 INDIA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 146 JAPAN: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 147 JAPAN: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 148 AUSTRALIA & NEW ZEALAND: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 149 AUSTRALIA & NEW ZEALAND: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 152 SOUTH AMERICA: JUICE TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 153 SOUTH AMERICA: JUICE TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 155 SOUTH AMERICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH AMERICA: JUICE TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: JUICE TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 159 SOUTH AMERICA: JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 161 SOUTH AMERICA: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 163 SOUTH AMERICA: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 164 BRAZIL: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 165 BRAZIL: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 166 ARGENTINA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 167 ARGENTINA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 168 REST OF SOUTH AMERICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 170 ROW: JUICE TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 171 ROW: JUICE TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 ROW: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 173 ROW: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 174 ROW: JUICE TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 175 ROW: JUICE TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 176 ROW: JUICE TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 177 ROW: JUICE TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 178 ROW: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 179 ROW: JUICE TESTING MARKET, BY MANUAL/CONVENTIONAL TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 180 ROW: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 181 ROW: JUICE TESTING MARKET, BY RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 183 MIDDLE EAST: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 184 AFRICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 185 AFRICA: JUICE TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 186 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN JUICE TESTING MARKET

- TABLE 187 JUICE TESTING MARKET: DEGREE OF COMPETITION

- TABLE 188 JUICE TESTING MARKET: REGIONAL FOOTPRINT

- TABLE 189 JUICE TESTING MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 190 JUICE TESTING MARKET: TEST TYPE FOOTPRINT

- TABLE 191 JUICE TESTING MARKET: KEY START-UPS/SMES

- TABLE 192 JUICE TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2024

- TABLE 193 JUICE TESTING MARKET: PRODUCT/SERVICE LAUNCHES AND ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 194 JUICE TESTING MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 195 JUICE TESTING MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 196 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 197 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 EUROFINS SCIENTIFIC: PRODUCT/SERVICE LAUNCHES

- TABLE 199 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY OVERVIEW

- TABLE 200 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: EXPANSIONS

- TABLE 202 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: DEALS

- TABLE 203 ALS: COMPANY OVERVIEW

- TABLE 204 ALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 ALS: PRODUCT/SERVICE LAUNCHES

- TABLE 206 ALS: DEALS

- TABLE 207 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 208 INTERTEK GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 210 INTERTEK GROUP PLC: DEALS

- TABLE 211 MERIEUX NUTRISCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 212 MERIEUX NUTRISCIENCES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 213 MERIEUX NUTRISCIENCES CORPORATION: DEALS

- TABLE 214 TUV SUD: COMPANY OVERVIEW

- TABLE 215 TUV SUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 217 AGILENT TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 AGILENT TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 219 AGILENT TECHNOLOGIES, INC.: DEALS

- TABLE 220 CERTIFIED GROUP: COMPANY OVERVIEW

- TABLE 221 CERTIFIED GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 CERTIFIED GROUP: EXPANSIONS

- TABLE 223 ALFA CHEMISTRY: COMPANY OVERVIEW

- TABLE 224 ALFA CHEMISTRY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 ALFA CHEMISTRY: PRODUCT/SERVICE LAUNCHES

- TABLE 226 CENTRE TESTING INTERNATIONAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 227 CENTRE TESTING INTERNATIONAL GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 AGQ LABS: COMPANY OVERVIEW

- TABLE 229 AGQ LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 AGQ LABS: EXPANSIONS

- TABLE 231 AGQ LABS: DEALS

- TABLE 232 TENTAMUS: COMPANY OVERVIEW

- TABLE 233 TENTAMUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 TENTAMUS: PRODUCT/SERVICE LAUNCHES

- TABLE 235 TENTAMUS: EXPANSIONS

- TABLE 236 SYMBIO LABS: COMPANY OVERVIEW

- TABLE 237 SYMBIO LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 FOODCHAIN ID: COMPANY OVERVIEW

- TABLE 239 FOODCHAIN ID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 LAUDA DR. R. WOBSER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 241 LAUDA DR. R. WOBSER GMBH & CO. KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 242 DLG E.V.: COMPANY OVERVIEW

- TABLE 243 DLG E.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 FARE LABS: COMPANY OVERVIEW

- TABLE 245 FARE LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 PACIFIC LAB: COMPANY OVERVIEW

- TABLE 247 PACIFIC LAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 ACCREDITEDTESTLABS: COMPANY OVERVIEW

- TABLE 249 ACCREDITEDTESTLABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 AMLAB SERVICES PTE. LTD.: COMPANY OVERVIEW

- TABLE 251 AMLAB SERVICES PTE. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ADJACENT MARKETS

- TABLE 253 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2017-2021 (USD MILLION)

- TABLE 254 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 255 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 256 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 JUICE TESTING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 JUICE TESTING MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)-COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (TOP-DOWN)

- FIGURE 6 JUICE TESTING MARKET: DATA TRIANGULATION

- FIGURE 7 MICROBIAL TESTS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 FRUIT JUICES PRODUCT TYPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 9 RAPID/INSTRUMENT-BASED TESTING TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 EUROPEAN MARKET TO BE DRIVEN BY STRICT REGULATIONS AND DEMAND FOR PREMIUM ORGANIC JUICES

- FIGURE 12 US TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

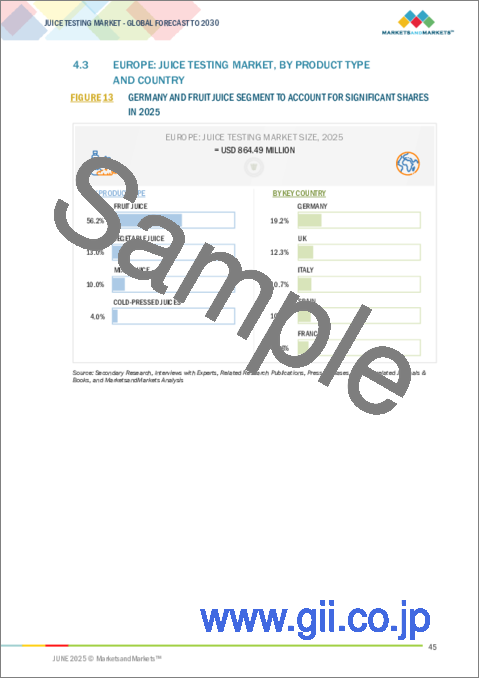

- FIGURE 13 GERMANY AND FRUIT JUICE SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARES IN 2025

- FIGURE 14 FRUIT JUICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 MICROBIAL TESTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 RAPID/INSTRUMENT-BASED TESTING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 MEDIAN INCOME/CONSUMPTION PER DAY BY COUNTRIES, 2013 VS. 2023

- FIGURE 18 GLOBAL HEALTH EXPENDITURE, 2012-2021

- FIGURE 19 JUICE TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 ADOPTION OF GEN AI IN JUICE TESTING

- FIGURE 21 JUICE TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 JUICE TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 EXPORT DATA FOR HS CODE 2009, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 IMPORT DATA FOR HS CODE 2009, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 25 INDICATIVE PRICING ANALYSIS, BY KEY PLAYERS, 2024

- FIGURE 26 JUICE TESTING MARKET: ECOSYSTEM

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR JUICE TESTING AND RELATED MARKET, 2015-2024

- FIGURE 30 PORTER'S FIVE FORCES ANALYSIS: JUICE TESTING MARKET

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TEST TYPES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE PRODUCT TYPES

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 34 JUICE TESTING MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 JUICE TESTING MARKET, BY TEST TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 36 JUICE TESTING MARKET, TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 37 GERMANY TO RECORD FASTEST GROWTH FROM 2025 TO 2030

- FIGURE 38 EUROPE: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 ANNUAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2024

- FIGURE 41 JUICE TESTING MARKET SHARE ANALYSIS, 2024

- FIGURE 42 JUICE TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 JUICE TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 44 JUICE TESTING MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 45 COMPANY VALUATION OF KEY VENDORS

- FIGURE 46 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 BRAND/SERVICE COMPARISON

- FIGURE 49 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 50 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY SNAPSHOT

- FIGURE 51 ALS: COMPANY SNAPSHOT

- FIGURE 52 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 53 TUV SUD: COMPANY SNAPSHOT

- FIGURE 54 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 55 CENTRE TESTING INTERNATIONAL GROUP CO., LTD.: COMPANY SNAPSHOT

The global market for juice testing is estimated to be valued at USD 0.86 billion in 2025 and is projected to reach USD 1.28 billion by 2030, at a CAGR of 8.2% during the forecast period. The rising consumer demand for clean-label, allergen-free, reduced-sugar, and low-sugar beverages is reshaping the global juice industry, driving manufacturers to reformulate products with healthier, more transparent ingredients. As health-conscious consumers increasingly seek out drinks with minimal additives, no allergens, and lower sugar content, regulatory bodies have tightened labeling and safety requirements. This shift is significantly boosting the juice testing market, as producers must validate nutritional claims, allergen absence, and reduced sugar levels through advanced testing. As a result, the need for rigorous chemical, nutritional, and allergen analyses is expanding rapidly, reinforcing quality assurance and consumer trust across global juice markets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Cold-pressed juice segment is expected to be the fastest-growing by product type in the juice testing market."

Cold-pressed juice is expected to be the fastest-growing segment in the juice testing market due to its perceived health benefits, minimal processing, and clean-label appeal. As consumers increasingly opt for beverages free from artificial additives, preservatives, and excessive sugar, cold-pressed juices stand out for their purity and nutrient retention. This shift in preference has driven the demand for rigorous testing to ensure safety, authenticity, and compliance with nutritional claims. Manufacturers are investing in advanced testing methods to verify the shelf life, microbial safety, and ingredient integrity. The segment's growth is also fueled by the premium positioning of cold-pressed juices in health-conscious markets.

"The rapid/instrument-based technologies segment holds the largest market share in the technology segment of the juice testing market."

Rapid/Instrument-based technologies represent the largest segment in the juice testing market due to their high accuracy, speed, and ability to detect a wide range of contaminants and quality markers. These technologies include advanced techniques such as chromatography (HPLC, GC-MS, LC-MS/MS), spectroscopy (UV, NIR, FTIR), polymerase chain reaction (PCR), enzyme-linked immunosorbent assay (ELISA0029), and sensor-based technologies. These tools are critical for detecting pesticide residues, mycotoxins, preservatives, and other adulterants in juice products. Their efficiency in real-time analysis and compliance with safety standards make them indispensable for producers aiming to maintain product quality, ensure consumer safety, and meet stringent regulatory requirements in a competitive market.

North America holds a significant market share in the global juice testing market.

North America holds a significant market share in the juice testing market, driven by its stringent food safety regulations, growing health consciousness among consumers, and a strong presence of premium juice brands. Regulatory bodies like the FDA and USDA enforce strict compliance for food & beverage safety, which compels manufacturers to invest in advanced testing technologies. The rising demand for clean-label, organic, and cold-pressed juices has further intensified the need for comprehensive quality testing, including authenticity, allergen, and nutritional analysis. Additionally, a well-established network of testing laboratories and technological innovation in analytical methods support market growth. As consumer preference shifts toward healthier and transparently labeled beverages, the region continues to witness strong demand for reliable juice testing solutions.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the juice testing market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), Merieux NutriSciences Corporation (France), Certified Group (US), TUV SUD (Germany), Symbio Labs (Australia), Alfa Chemistry (US), FoodChain ID (US), AGQ Labs (Spain), Tentamus (Germany), LAUDA DR. R. WOBSER GMBH & CO. KG (Germany), Centre Testing International (China), and Agilent Technologies, Inc. (US).

Other players include FARE Labs (India), Co-Laboratory (US), Pacific Lab (Singapore), AccreditedTestLabs (US), Amlab Services Pte. Ltd. (Singapore), DLG e.v. (Germany), Co-Laboratory (Singapore), Opal Research And Analytical Services (India), Fera Science Limited (UK), and Lilaba Analytical Laboratories (India).

Research Coverage:

This research report categorizes the juice testing market by product type (fruit juices, vegetable juices, mixed juices, concentrates, cold-pressed juices, and other product types), technology (manual/conventional testing technologies, and rapid/instrument-based testing technologies), test type (microbial testing, chemical testing, nutritional content testing, physical parameter testing, allergen testing, and fraud test), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the juice testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, service launches, mergers & acquisitions, and other recent developments associated with the juice testing market. Competitive analysis of upcoming startups in the juice testing market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape are covered in the study.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall juice testing and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing incidences of contamination and foodborne illnesses driving stricter regulatory requirements), restraints (high costs associated with advanced testing equipment and lab infrastructure), opportunities (expansion of testing services in emerging markets such as Africa), and challenges (adapting to evolving global food safety regulations) influencing the growth of the juice testing market.

- Service Launch/Innovation: Detailed insights on R&D activities and service launches in the juice testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the juice testing market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the juice testing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparisons, and product footprints of leading players such as Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), and Merieux NutriSciences Corporation (France) in the juice testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN JUICE TESTING MARKET

- 4.2 JUICE TESTING MARKET, BY COUNTRY

- 4.3 EUROPE: JUICE TESTING MARKET, BY PRODUCT TYPE AND COUNTRY

- 4.4 JUICE TESTING MARKET, BY PRODUCT TYPE

- 4.5 JUICE TESTING MARKET, BY TESTING TYPE

- 4.6 JUICE TESTING MARKET, BY TECHNOLOGY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INCREASE IN PER DAY MEDIAN INCOME OR CONSUMPTION

- 5.2.2 INCREASE IN GLOBAL HEALTH EXPENDITURE

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Expansion of food & beverage industry

- 5.3.1.2 Surge in global demand for juices

- 5.3.1.3 Rising occurrence of juice recalls highlighting growing need for juice testing

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost associated with advanced analytical technologies

- 5.3.2.2 Growth of advanced in-house juice testing infrastructure

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increased contamination risks to surge demand for juice testing

- 5.3.3.2 Stringent regulations to ensure product safety, authenticity, and quality

- 5.3.3.3 Rising need for testing services in emerging markets

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of global standardized testing protocols

- 5.3.4.2 Intricate and time-consuming multi-step procedures

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON JUICE TESTING MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI ON JUICE TESTING

- 5.4.3 CASE STUDIES

- 5.4.3.1 AI-driven juice testing revolutionizes quality, consistency, and compliance assurance

- 5.4.4 IMPACT ON JUICE TESTING MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SOURCING & JUICE PRODUCTION

- 6.3.2 IN-PROCESS QUALITY CONTROL

- 6.3.3 LABORATORY TESTING & CERTIFICATION

- 6.3.4 PACKAGING & LABELLING VERIFICATION

- 6.3.5 DISTRIBUTION & RETAIL QUALITY CHECKS

- 6.3.6 CONSUMER FEEDBACK & REGULATORY SURVEILLANCE

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO (HS CODE 2009)

- 6.4.2 IMPORT SCENARIO (HS CODE 2009)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 High-performance liquid chromatography

- 6.5.1.2 Gas chromatography-mass spectrometry

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Fourier-transform infrared spectroscopy

- 6.5.2.2 Inductively coupled plasma mass spectrometry

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Near-infrared spectroscopy

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- 6.6.2 INDICATIVE PRICING ANALYSIS, BY KEY PLAYERS, 2024

- 6.6.3 INDICATIVE PRICING ANALYSIS, BY TECHNOLOGY, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 SUPPLY SIDE

- 6.7.2 DEMAND SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF RELATED TO JUICE TESTING

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY LANDSCAPE

- 6.12.1 INTRODUCTION

- 6.12.2 NORTH AMERICA

- 6.12.2.1 US

- 6.12.2.2 Canada

- 6.12.2.3 Mexico

- 6.12.3 EUROPE

- 6.12.3.1 UK

- 6.12.3.2 Germany

- 6.12.4 ASIA PACIFIC

- 6.12.4.1 China

- 6.12.4.2 India

- 6.12.5 SOUTH AMERICA

- 6.12.5.1 Brazil

- 6.12.6 ROW

- 6.12.6.1 UAE

- 6.13 IMPACT OF 2025 US TARIFF-JUICE TESTING MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 DISRUPTION IN JUICE PRODUCTS

- 6.13.4 PRICE IMPACT ANALYSIS

- 6.13.5 IMPACT ON COUNTRY/REGION

- 6.13.5.1 US

- 6.13.5.2 Europe

- 6.13.5.3 China

- 6.13.6 IMPACT ON END-USE INDUSTRY

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREAT OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 CASE STUDY ANALYSIS

- 6.17 INVESTMENT AND FUNDING SCENARIO

7 JUICE TESTING MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 FRUIT JUICES

- 7.2.1 GROWING DEMAND IN ASIAN COUNTRIES TO DRIVE MARKET

- 7.3 VEGETABLE JUICES

- 7.3.1 DEMAND FOR LOW-SUGAR, NUTRIENT-RICH VEGETABLE JUICES TO DRIVE MARKET

- 7.4 MIXED JUICES

- 7.4.1 INNOVATION AND CONSUMER PREFERENCE SHIFT TO DRIVE MARKET

- 7.5 CONCENTRATES

- 7.5.1 HIGH CONSUMPTION OF ORGANIC JUICE CONCENTRATES TO BOOST DEMAND FOR ADVANCED TESTING

- 7.6 COLD-PRESSED JUICES

- 7.6.1 GROWING AWARENESS AND NUTRIENT-RICH PROPERTY TO DRIVE MARKET

- 7.7 OTHER PRODUCT TYPES

8 JUICE TESTING MARKET, BY TEST TYPE

- 8.1 INTRODUCTION

- 8.2 MICROBIAL TESTS

- 8.2.1 RISING CONTAMINATION IN JUICES TO BOOST DEMAND FOR PERIODICAL TESTS

- 8.3 CHEMICAL TESTS

- 8.3.1 INCREASED CONCERN REGARDING PESTICIDE RESIDUE TESTING TO DRIVE MARKET

- 8.4 NUTRITIONAL CONTENT ANALYSIS

- 8.4.1 RISING NEED FOR NUTRITIONAL LABELLING TO DRIVE MARKET

- 8.5 PHYSICAL PARAMETER TESTS

- 8.5.1 NEED FOR ASSESSING QUALITY, FLAVOR, AND STABILITY OF JUICE CONCENTRATES TO DRIVE MARKET

- 8.6 ALLERGEN TESTS

- 8.6.1 GROWING CONSUMER AWARENESS AND REGULATORY MEASURES TO DRIVE MARKET

- 8.7 FRAUD TESTS

- 8.7.1 RISING NEED TO PREVENT ADULTERATION AND PROTECT CONSUMER TRUST TO BOOST DEMAND

9 JUICE TESTING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 MANUAL/CONVENTIONAL TESTING

- 9.2.1 CULTURE-BASED METHODS

- 9.2.1.1 Need for safety, shelf life, and microbial quality assurance to drive growth for small manufacturers

- 9.2.2 TITRATION METHODS

- 9.2.2.1 Increasing need for accuracy and compliance to boost demand for nutritional testing

- 9.2.1 CULTURE-BASED METHODS

- 9.3 RAPID/INSTRUMENT-BASED TESTING

- 9.3.1 CHROMATOGRAPHY

- 9.3.1.1 Advanced techniques ensuring quality, safety, and nutritional transparency to drive market

- 9.3.2 SPECTROSCOPY

- 9.3.2.1 Quick moisture and sugar analysis by measuring molecular vibrations to drive market

- 9.3.3 POLYMERASE CHAIN REACTION

- 9.3.3.1 Advanced rapid microbial testing to drive market

- 9.3.4 ENZYME-LINKED IMMUNOSORBENT ASSAY

- 9.3.4.1 Rising prevalence of chemical and microbial testing to drive growth

- 9.3.5 SENSOR-BASED TECHNOLOGY

- 9.3.5.1 Cost-effectiveness and advanced AI-integrated technology to boost demand

- 9.3.1 CHROMATOGRAPHY

10 JUICE TESTING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Need for enhanced safety, quality, and compliance amid rising imports and health trends to boost demand for juice testing

- 10.2.2 CANADA

- 10.2.2.1 Rising product recalls and safety concerns to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Expansion of premium juice brands to boost demand for advanced quality and safety testing

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Rising exports ensuring quality and compliance to drive market

- 10.3.2 UK

- 10.3.2.1 Surge in health trends and innovation to drive demand for advanced juice testing

- 10.3.3 FRANCE

- 10.3.3.1 Soaring juice imports to accelerate demand for advanced quality and safety solutions

- 10.3.4 SPAIN

- 10.3.4.1 Expanding local juice production to drive market

- 10.3.5 ITALY

- 10.3.5.1 Private-label juice manufacturers to drive demand for trusted third-party juice testing services

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Evolving juice market spurs demand for advanced testing amid rising imports and health trends

- 10.4.2 INDIA

- 10.4.2.1 Rising demand for juices and consumer awareness to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Growing health awareness to drive demand for nutrient-rich juice and testing solutions

- 10.4.4 AUSTRALIA & NEW ZEALAND

- 10.4.4.1 Rising consumption of preservative-free juice products to drive market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Leadership in orange juice production to boost growth of juice testing market

- 10.5.2 ARGENTINA

- 10.5.2.1 Surge in fruit juice exports to drive demand for enhanced quality control

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 REST OF THE WORLD

- 10.6.1 MIDDLE EAST

- 10.6.1.1 Rise in innovative product launches to drive market

- 10.6.2 AFRICA

- 10.6.2.1 Rising awareness and diverse juice productions to boost demand for juice testing

- 10.6.1 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Regional footprint

- 11.5.5.3 Product type footprint

- 11.5.5.4 Test type footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 11.6.5.1 Detailed list of key start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/SERVICE COMPARATIVE ANALYSIS

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT/SERVICE LAUNCHES AND ENHANCEMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 EUROFINS SCIENTIFIC

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ALS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product/Service launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 INTERTEK GROUP PLC

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Expansions

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 MERIEUX NUTRISCIENCES CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 TUV SUD

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 AGILENT TECHNOLOGIES, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.8 CERTIFIED GROUP

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.8.4 MnM view

- 12.1.9 ALFA CHEMISTRY

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product/Service launches

- 12.1.9.4 MnM view

- 12.1.10 CENTRE TESTING INTERNATIONAL GROUP CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.11 AGQ LABS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.11.3.2 Deals

- 12.1.11.4 MnM view

- 12.1.12 TENTAMUS

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product/Service launches

- 12.1.12.3.2 Expansions

- 12.1.12.4 MnM view

- 12.1.13 SYMBIO LABS

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 MnM view

- 12.1.14 FOODCHAIN ID

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 MnM view

- 12.1.15 LAUDA DR. R. WOBSER GMBH & CO. KG

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 MnM view

- 12.1.1 EUROFINS SCIENTIFIC

- 12.2 OTHER PLAYERS

- 12.2.1 DLG E.V.

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 MnM view

- 12.2.2 FARE LABS

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 MnM view

- 12.2.3 PACIFIC LAB

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 MnM view

- 12.2.4 ACCREDITEDTESTLABS

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 MnM view

- 12.2.5 AMLAB SERVICES PTE. LTD.

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 MnM view

- 12.2.6 LIFEASIBLE

- 12.2.7 CO-LABORATORY

- 12.2.8 SRI SHAKTHI FOOD TESTING LAB

- 12.2.9 FERA SCIENCE LIMITED

- 12.2.10 PRIMUSLABS

- 12.2.1 DLG E.V.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 FOOD SAFETY TESTING MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 FOOD PATHOGEN TESTING MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS