|

|

市場調査レポート

商品コード

1536664

油脂の世界市場:由来別、形態別、タイプ別、用途別、地域別 - 2029年までの予測Fats & Oils Market by Type (Vegetable Oils and Fats), Source (Vegetables and Animals), Form (Liquid and Solid), Application (Food and Industrial), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 油脂の世界市場:由来別、形態別、タイプ別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月13日

発行: MarketsandMarkets

ページ情報: 英文 353 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の油脂の市場規模は、2024年には2,718億米ドルになるとみられ、今後3.6%のCAGRで拡大し、2029年には3,237億米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル)、数量(KT) |

| セグメント別 | 由来別、形態別、タイプ別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

油脂市場は今日、新たな科学的発見と特定の油脂の健康効果によってヘッジされています。食生活の動向も変化し、消費者の嗜好も変化しています。例えば、JAMA Network Openが2024年2月に発表した大規模研究では、1日7g以上のオリーブオイルの摂取は、米国成人の認知症による死亡率を28%減少させるという結果が報告されました。このことは、加齢に伴う認知機能の低下を抑制する重要な要因として、食生活への感度が高まっていることを強調しています。

味や料理の面だけでなく、消費者の中には、オリーブオイルの潜在的な健康効果を好む人もいます。こうして、製造業者は需要に追いつき、食品製造に使用される油の種類に関して消費者の嗜好を変え、健康志向の選択と一致するようにしています。従って、その利点が科学的に検証されるにつれて、より健康的な油の市場は需要を伸ばし、油脂業界の情勢を再構築しています。

大豆油は、世界の油脂市場において植物油の中で最も急成長しているセグメントとして浮上しており、特に様々な産業におけるその多様な用途に牽引されています。米国における大豆油の消費量は、いくつかの重要なセクターで極めて重要な役割を担っていることを反映しています。例えば、食品業界では、大豆油はマーガリンやサラダ油、食用油として大量に使用されており、United Soybean Boardによると、MY2022/23の消費量はそれぞれ11万4,270トン、360万トンとなっています。このため、大豆は調理や一般的な食品調理のための重要な万能食材となっています。

当レポートでは、世界の油脂市場について調査し、由来別、形態別、タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 生成AIが食品・飲料の原料・添加物に与える影響

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析/市場マップ

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 2024年~2025年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 油脂市場(由来別)

- イントロダクション

- 野菜

- 動物

第8章 油脂市場(形態別)

- イントロダクション

- 液体

- 固体(結晶質)

第9章 油脂市場(タイプ別)

- イントロダクション

- 植物油

- 脂肪

第10章 油脂市場(用途別)

- イントロダクション

- 食品

- 工業

第11章 油脂市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- ADM

- WILMAR INTERNATIONAL LTD

- CARGILL, INCORPORATED

- BUNGE

- KUALA LUMPUR KEPONG BERHAD

- OLAM AGRI HOLDINGS PTE LTD.

- MEWAH GROUP

- ASSOCIATED BRITISH FOODS PLC

- UNITED PLANTATIONS BERHAD

- AJINOMOTO CO., INC.

- FUJI OIL CO., LTD.

- AAK AB

- K. S. OILS LIMITED

- OLEO-FATS

- MANILDRA GROUP

- BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U.

- CSM INGREDIENTS

- SD GUTHRIE INTERNATIONAL ZWIJNDRECHT REFINERY B.V.

- MUSIM MAS GROUP

- RICHARDSON INTERNATIONAL LIMITED

- その他の企業

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATE, 2020-2023

- TABLE 3 FATS & OILS MARKET SNAPSHOT, 2024 VS. 2029

- TABLE 4 TOP 10 EXPORTERS OF HS CODE 293629, 2019-2023 (USD THOUSAND)

- TABLE 5 TOP 10 EXPORTERS OF HS CODE 293629, 2019-2023 (TONS)

- TABLE 6 TOP 10 IMPORTERS OF HS CODE 293629, 2019-2023 (USD THOUSAND)

- TABLE 7 TOP 10 IMPORTERS OF HS CODE 293629, 2019-2023 (TONS)

- TABLE 8 AVERAGE SELLING PRICE (ASP), BY VEGETABLE OIL TYPE, 2020-2023 (USD/TON)

- TABLE 9 AVERAGE SELLING PRICE (ASP), BY FAT TYPE, 2020-2023 (USD/TON)

- TABLE 10 AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2023 (USD/TON)

- TABLE 11 FATS & OILS MARKET: ECOSYSTEM

- TABLE 12 LIST OF MAJOR PATENTS PERTAINING TO FATS & OILS MARKET, 2020-2023

- TABLE 13 FATS & OILS MARKET: KEY DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 IMPACT OF PORTER'S FIVE FORCES ON FATS & OILS MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FATS & OILS PRODUCT TYPES

- TABLE 20 KEY BUYING CRITERIA FOR FATS & OILS PRODUCT TYPES

- TABLE 21 FATS & OILS MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 22 FATS & OILS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 23 FATS & OILS MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 24 FATS & OILS MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 25 VEGETABLE FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 VEGETABLE FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 VEGETABLE FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 28 VEGETABLE FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 29 ANIMAL FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 ANIMAL FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 ANIMAL FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 32 ANIMAL FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 33 FATS & OILS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 34 FATS & OILS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 35 LIQUID FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 LIQUID FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 SOLID FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 SOLID FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 40 FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 41 FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 42 FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 43 PALM OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 PALM OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 PALM OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 46 PALM OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 47 SOYBEAN OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 SOYBEAN OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 SOYBEAN OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 50 SOYBEAN OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 51 SUNFLOWER OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 SUNFLOWER OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 SUNFLOWER OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 54 SUNFLOWER OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 55 RAPESEED OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 RAPESEED OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 RAPESEED OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 58 RAPESEED OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 59 OLIVE OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 OLIVE OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 OLIVE OIL: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 62 OLIVE OIL: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 63 OTHER OILS: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 OTHER OILS: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 OTHER OILS: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 66 OTHER OILS: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 67 FATS & OILS MARKET: BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 68 FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 69 FATS & OILS MARKET: BY FAT TYPE, 2020-2023 (KT)

- TABLE 70 FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 71 BUTTER & MARGARINE: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 BUTTER & MARGARINE: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 BUTTER & MARGARINE: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 74 BUTTER & MARGARINE: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 75 TALLOW & GREASE: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 TALLOW & GREASE: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 TALLOW & GREASE: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 78 TALLOW & GREASE: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 79 LARD: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 LARD: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 LARD: FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 82 LARD: FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 83 FATS & OILS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 FATS & OILS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 FATS & OILS MARKET, BY FOOD APPLICATION, 2020-2023 (USD MILLION)

- TABLE 86 FATS & OILS MARKET, BY FOOD APPLICATION, 2024-2029 (USD MILLION)

- TABLE 87 FOOD: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 FOOD: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 TYPES OF SPREADS AND THEIR DESCRIPTIONS

- TABLE 90 INDUSTRIAL: FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 INDUSTRIAL: FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 FATS & OILS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 FATS & OILS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 FATS & OILS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 95 FATS & OILS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 96 NORTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 97 NORTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (KT)

- TABLE 99 NORTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 100 NORTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 103 NORTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 104 NORTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 105 NORTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 107 NORTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 108 NORTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 111 NORTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 112 NORTH AMERICA: FATS & OILS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: FATS & OILS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: FATS & OILS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 115 NORTH AMERICA: FATS & OILS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 116 US: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 117 US: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 118 US: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 119 US: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 120 US: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 121 US: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 122 US: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 123 US: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 124 CANADA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 125 CANADA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 126 CANADA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 127 CANADA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 128 CANADA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 129 CANADA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 130 CANADA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 131 CANADA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 132 MEXICO: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 133 MEXICO: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 134 MEXICO: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 135 MEXICO: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 136 MEXICO: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 137 MEXICO: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 138 MEXICO: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 139 MEXICO: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 140 EUROPE: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 141 EUROPE: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 EUROPE: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (KT)

- TABLE 143 EUROPE: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 144 EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 145 EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 146 EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 147 EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 148 EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 149 EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 150 EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 151 EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 152 EUROPE: FATS & OILS MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 153 EUROPE: FATS & OILS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 154 EUROPE: FATS & OILS MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 155 EUROPE: FATS & OILS MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 156 EUROPE: FATS & OILS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 157 EUROPE: FATS & OILS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 158 EUROPE: FATS & OILS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 159 EUROPE: FATS & OILS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 160 GERMANY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 161 GERMANY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 162 GERMANY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 163 GERMANY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 164 GERMANY: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 165 GERMANY: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 166 GERMANY: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 167 GERMANY: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 168 UK: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 169 UK: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 170 UK: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 171 UK: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 172 UK: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 173 UK: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 174 UK: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 175 UK: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 176 FRANCE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 177 FRANCE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 178 FRANCE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 179 FRANCE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 180 FRANCE: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 181 FRANCE: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 182 FRANCE: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 183 FRANCE: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 184 ITALY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 185 ITALY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 186 ITALY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 187 ITALY: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 188 ITALY: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 189 ITALY: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 190 ITALY: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 191 ITALY: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 192 SPAIN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 193 SPAIN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 194 SPAIN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 195 SPAIN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 196 SPAIN: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 197 SPAIN: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 198 SPAIN: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 199 SPAIN: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 200 RUSSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 201 RUSSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 202 RUSSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 203 RUSSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 204 RUSSIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 205 RUSSIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 206 RUSSIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 207 RUSSIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 208 NETHERLANDS: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 209 NETHERLANDS: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 210 NETHERLANDS: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 211 NETHERLANDS: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 212 NETHERLANDS: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 213 NETHERLANDS: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 214 NETHERLANDS: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 215 NETHERLANDS: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 216 REST OF EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 217 REST OF EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 218 REST OF EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 219 REST OF EUROPE: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 220 REST OF EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 221 REST OF EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 222 REST OF EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 223 REST OF EUROPE: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 224 ASIA PACIFIC: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 225 ASIA PACIFIC: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 226 ASIA PACIFIC: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (KT)

- TABLE 227 ASIA PACIFIC: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 228 ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 229 ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 230 ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 231 ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 232 ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 233 ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 234 ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 235 ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 236 ASIA PACIFIC: FATS & OILS MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 237 ASIA PACIFIC: FATS & OILS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 238 ASIA PACIFIC: FATS & OILS MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 239 ASIA PACIFIC: FATS & OILS MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 240 ASIA PACIFIC: FATS & OILS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 241 ASIA PACIFIC: FATS & OILS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 242 ASIA PACIFIC: FATS & OILS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 243 ASIA PACIFIC: FATS & OILS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 244 CHINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 245 CHINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 246 CHINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 247 CHINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 248 CHINA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 249 CHINA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 250 CHINA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 251 CHINA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 252 INDIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 253 INDIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 254 INDIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 255 INDIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 256 INDIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 257 INDIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 258 INDIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 259 INDIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 260 JAPAN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 261 JAPAN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 262 JAPAN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 263 JAPAN: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 264 JAPAN: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 265 JAPAN: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 266 JAPAN: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 267 JAPAN: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 268 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 269 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 270 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 271 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 272 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 273 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 274 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 275 AUSTRALIA & NEW ZEALAND: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 276 INDONESIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 277 INDONESIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 278 INDONESIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 279 INDONESIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 280 INDONESIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 281 INDONESIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 282 INDONESIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 283 INDONESIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 284 MALAYSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 285 MALAYSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 286 MALAYSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 287 MALAYSIA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 288 MALAYSIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 289 MALAYSIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 290 MALAYSIA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 291 MALAYSIA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 292 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 295 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 296 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 298 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 299 REST OF ASIA PACIFIC: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 300 SOUTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 301 SOUTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 302 SOUTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (KT)

- TABLE 303 SOUTH AMERICA: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 304 SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 305 SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 306 SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 307 SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 308 SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 309 SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 310 SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 311 SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 312 SOUTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 313 SOUTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 314 SOUTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 315 SOUTH AMERICA: FATS & OILS MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 316 SOUTH AMERICA: FATS & OILS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 317 SOUTH AMERICA: FATS & OILS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 318 SOUTH AMERICA: FATS & OILS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 319 SOUTH AMERICA: FATS & OILS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 320 BRAZIL: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 321 BRAZIL: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 322 BRAZIL: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 323 BRAZIL: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 324 BRAZIL: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 325 BRAZIL: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 326 BRAZIL: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 327 BRAZIL: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 328 ARGENTINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 329 ARGENTINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 330 ARGENTINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 331 ARGENTINA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 332 ARGENTINA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 333 ARGENTINA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 334 ARGENTINA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 335 ARGENTINA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 336 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 337 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 338 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 339 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 340 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 341 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 342 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 343 REST OF SOUTH AMERICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 344 ROW: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 345 ROW: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 346 ROW: FATS & OILS MARKET, BY COUNTRY, 2020-2023 (KT)

- TABLE 347 ROW: FATS & OILS MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 348 ROW: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 349 ROW: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 350 ROW: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 351 ROW: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 352 ROW: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 353 ROW: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 354 ROW: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 355 ROW: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 356 ROW: FATS & OILS MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 357 ROW: FATS & OILS MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 358 ROW: FATS & OILS MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 359 ROW: FATS & OILS MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 360 ROW: FATS & OILS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 361 ROW: FATS & OILS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 362 ROW: FATS & OILS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 363 ROW: FATS & OILS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 364 MIDDLE EAST: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 365 MIDDLE EAST: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 366 MIDDLE EAST: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 367 MIDDLE EAST: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 368 MIDDLE EAST: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 369 MIDDLE EAST: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 370 MIDDLE EAST: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 371 MIDDLE EAST: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 372 AFRICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (USD MILLION)

- TABLE 373 AFRICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (USD MILLION)

- TABLE 374 AFRICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2020-2023 (KT)

- TABLE 375 AFRICA: FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024-2029 (KT)

- TABLE 376 AFRICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (USD MILLION)

- TABLE 377 AFRICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (USD MILLION)

- TABLE 378 AFRICA: FATS & OILS MARKET, BY FAT TYPE, 2020-2023 (KT)

- TABLE 379 AFRICA: FATS & OILS MARKET, BY FAT TYPE, 2024-2029 (KT)

- TABLE 380 OVERVIEW OF STRATEGIES ADOPTED BY KEY FATS & OILS VENDORS

- TABLE 381 FATS & OILS MARKET: DEGREE OF COMPETITION

- TABLE 382 FATS & OILS MARKET: REGION FOOTPRINT

- TABLE 383 FATS & OILS MARKET: TYPE FOOTPRINT

- TABLE 384 FATS & OILS MARKET: APPLICATION FOOTPRINT

- TABLE 385 FATS & OILS MARKET: SOURCE FOOTPRINT

- TABLE 386 FATS & OILS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2023

- TABLE 387 FATS & OILS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 388 FATS & OILS MARKET: PRODUCT LAUNCHES, FEBRUARY 2023

- TABLE 389 FATS & OILS MARKET: DEALS, AUGUST 2021-JUNE 2024

- TABLE 390 FATS & OILS MARKET: EXPANSIONS, NOVEMBER 2020-NOVEMBER 2023

- TABLE 391 FATS & OILS MARKET: OTHER DEALS/DEVELOPMENTS, MAY 2020-2024

- TABLE 392 ADM: COMPANY OVERVIEW

- TABLE 393 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 394 ADM: EXPANSIONS

- TABLE 395 ADM: OTHER DEALS/DEVELOPMENTS

- TABLE 396 WILMAR INTERNATIONAL LTD: COMPANY OVERVIEW

- TABLE 397 WILMAR INTERNATIONAL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 WILMAR INTERNATIONAL LTD: DEALS

- TABLE 399 WILMAR INTERNATIONAL LTD: EXPANSIONS

- TABLE 400 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 401 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 402 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 403 CARGILL, INCORPORATED: DEALS

- TABLE 404 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 405 CARGILL, INCORPORATED: OTHER DEALS/DEVELOPMENTS

- TABLE 406 BUNGE: COMPANY OVERVIEW

- TABLE 407 BUNGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 BUNGE: DEALS

- TABLE 409 KUALA LUMPUR KEPONG BERHAD: COMPANY OVERVIEW

- TABLE 410 KUALA LUMPUR KEPONG BERHAD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 411 KUALA LUMPUR KEPONG BERHAD: DEALS

- TABLE 412 OLAM AGRI HOLDINGS PTE LTD.: COMPANY OVERVIEW

- TABLE 413 OLAM AGRI HOLDINGS PTE LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 414 OLAM AGRI HOLDINGS PTE LTD: OTHER DEALS/DEVELOPMENTS

- TABLE 415 MEWAH GROUP: COMPANY OVERVIEW

- TABLE 416 MEWAH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 417 ASSOCIATED BRITISH FOODS PLC: COMPANY OVERVIEW

- TABLE 418 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 419 UNITED PLANTATIONS BERHAD: COMPANY OVERVIEW

- TABLE 420 UNITED PLANTATIONS BERHAD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 421 AJINOMOTO CO., INC.: COMPANY OVERVIEW

- TABLE 422 AJINOMOTO CO., INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 423 FUJI OIL CO., LTD.: COMPANY OVERVIEW

- TABLE 424 FUJI OIL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 425 FUJI OIL CO., LTD.: EXPANSIONS

- TABLE 426 AAK AB: COMPANY OVERVIEW

- TABLE 427 AAK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 428 AAK AB: DEALS

- TABLE 429 K. S. OILS LIMITED: COMPANY OVERVIEW

- TABLE 430 K. S. OILS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 431 OLEO-FATS: COMPANY OVERVIEW

- TABLE 432 OLEO-FATS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 433 MANILDRA GROUP: COMPANY OVERVIEW

- TABLE 434 MANILDRA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 435 BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U.: COMPANY OVERVIEW

- TABLE 436 BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 437 CSM INGREDIENTS: COMPANY OVERVIEW

- TABLE 438 CSM INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 439 SD GUTHRIE INTERNATIONAL ZWIJNDRECHT REFINERY B.V.: COMPANY OVERVIEW

- TABLE 440 SD GUTHRIE INTERNATIONAL ZWIJNDRECHT REFINERY B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 441 SD GUTHRIE INTERNATIONAL ZWIJNDRECHT REFINERY B.V.: OTHER DEALS/DEVELOPMENTS

- TABLE 442 MUSIM MAS GROUP: COMPANY OVERVIEW

- TABLE 443 MUSIM MAS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 444 RICHARDSON INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 445 RICHARDSON INTERNATIONAL LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 446 RICHARDSON INTERNATIONAL LIMITED: DEALS

- TABLE 447 GOODHOPE ASIA HOLDINGS LTD: COMPANY OVERVIEW

- TABLE 448 VEGA FOODS: COMPANY OVERVIEW

- TABLE 449 ALAMI COMMODITIES SDN BHD: COMPANY OVERVIEW

- TABLE 450 GEMINI EDIBLES & FATS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 451 IFFCO: COMPANY OVERVIEW

- TABLE 452 ADJACENT MARKETS TO FATS & OILS MARKET

- TABLE 453 EDIBLE OILS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 454 EDIBLE OILS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 455 ESSENTIAL OILS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 456 ESSENTIAL OILS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 457 SPECIALTY FATS & OILS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 458 SPECIALTY FATS & OILS MARKET, BY REGION, 2020-2026 (USD MILLION)

List of Figures

- FIGURE 1 FATS & OILS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 FATS & OILS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 FATS & OILS MARKET SIZE CALCULATION: SUPPLY-SIDE ANALYSIS

- FIGURE 5 FATS & OILS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SOYBEAN OIL TO BE LARGEST SEGMENT OF FATS & OILS MARKET DURING FORECAST PERIOD

- FIGURE 8 BUTTER & MARGARINE TO BE LARGEST FAT TYPE SEGMENT OF FATS & OILS MARKET DURING FORECAST PERIOD

- FIGURE 9 VEGETABLE SOURCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 LIQUID FORM SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 11 FOOD APPLICATION SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 RISE IN INNOVATION WITH HEALTHIER OIL ALTERNATIVES TO MEET GROWING CONSUMER DEMAND

- FIGURE 14 CHINA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2024

- FIGURE 16 PALM OIL SEGMENT TO LEAD FATS & OILS MARKET DURING FORECAST PERIOD

- FIGURE 17 BUTTER & MARGARINE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 LIQUID FORM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 VEGETABLE SOURCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 FOOD APPLICATION TO LEAD FATS & OILS MARKET DURING FORECAST PERIOD

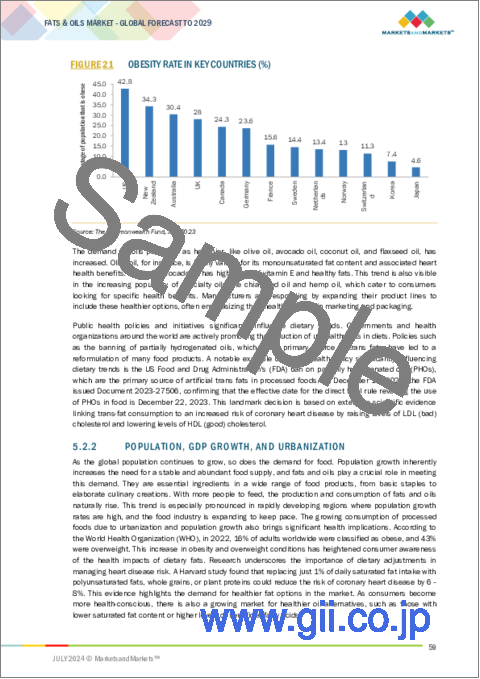

- FIGURE 21 OBESITY RATE IN KEY COUNTRIES (%)

- FIGURE 22 GLOBAL POPULATION GROWTH, 1950-2050 (BILLION)

- FIGURE 23 GDP GROWTH, 2016-2023 (TRILLION)

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FATS & OILS MARKET

- FIGURE 25 GLOBAL: VEGETABLE OILS PRODUCTION, 2017-2021 (MILLION TONNES)

- FIGURE 26 ADOPTION OF GEN AI IN FOOD & BEVERAGE PRODUCTION PROCESS

- FIGURE 27 FATS & OILS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 VALUE CHAIN ANALYSIS: FATS & OILS MARKET

- FIGURE 29 EXPORT VALUE OF VEGETABLE FATS & OILS FOR KEY COUNTRIES, 2019-2023 (USD THOUSAND)

- FIGURE 30 IMPORT VALUE OF VEGETABLE FATS & OILS FOR KEY COUNTRIES, 2019-2023 (USD THOUSAND)

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY VEGETABLE OIL TYPE (USD/TON)

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY FAT TYPE (USD/TON)

- FIGURE 33 AVERAGE SELLING PRICE TREND, BY REGION (USD/TON)

- FIGURE 34 KEY PLAYERS IN FATS & OILS ECOSYSTEM

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 36 NUMBER OF PATENTS GRANTED FOR FATS & OILS MARKET, 2013-2023

- FIGURE 37 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FATS & OILS MARKET, 2013-2023

- FIGURE 38 PORTER'S FIVE FORCES ANALYSIS: FATS & OILS MARKET

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FATS & OILS PRODUCT TYPES

- FIGURE 40 KEY BUYING CRITERIA FOR FATS & OILS PRODUCT TYPES

- FIGURE 41 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 42 FATS & OILS MARKET, BY SOURCE, 2024 VS. 2029 (USD MILLION)

- FIGURE 43 FATS & OILS MARKET SIZE, BY FORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 44 FATS & OILS MARKET, BY VEGETABLE OIL TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 45 SOYBEAN OIL INPUTS FOR BIODIESEL PRODUCTION IN US, 2019-2023

- FIGURE 46 FATS & OILS MARKET, BY FAT TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 47 FATS & OILS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 48 ITALY AND CHINA TO BE FASTEST-GROWING COUNTRIES IN FATS & OILS MARKET DURING FORECAST PERIOD (VALUE)

- FIGURE 49 EUROPE: FATS & OILS MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: FATS & OILS MARKET SNAPSHOT

- FIGURE 51 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST THREE YEARS, 2021-2023 (USD BILLION)

- FIGURE 52 SHARE OF LEADING COMPANIES IN FATS & OILS MARKET, 2023

- FIGURE 53 COMPANY VALUATION OF KEY FATS & OILS VENDORS

- FIGURE 54 EV/EBITDA OF KEY COMPANIES

- FIGURE 55 BRAND/PRODUCT COMPARISON ANALYSIS, BY TYPE

- FIGURE 56 FATS & OILS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 57 FATS & OILS MARKET: COMPANY FOOTPRINT

- FIGURE 58 FATS & OILS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 59 ADM: COMPANY SNAPSHOT

- FIGURE 60 WILMAR INTERNATIONAL LTD: COMPANY SNAPSHOT

- FIGURE 61 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 62 BUNGE: COMPANY SNAPSHOT

- FIGURE 63 KUALA LUMPUR KEPONG BERHAD: COMPANY SNAPSHOT

- FIGURE 64 OLAM AGRI HOLDINGS PTE LTD: COMPANY SNAPSHOT

- FIGURE 65 MEWAH GROUP: COMPANY SNAPSHOT

- FIGURE 66 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 67 UNITED PLANTATIONS BERHAD: COMPANY SNAPSHOT

- FIGURE 68 AJINOMOTO CO., INC.: COMPANY SNAPSHOT

- FIGURE 69 FUJI OIL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 70 AAK AB: COMPANY SNAPSHOT

The global fats & oils market is estimated to be valued at USD 271.8 billion in 2024 and is projected to reach USD 323.7 billion by 2029, at a CAGR of 3.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD), Volume (KT) |

| Segments | By Type, Source, Form, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The fats and oils market is today hedged by new scientific discoveries and health benefits being unlocked for particular oils. Trends in diets have been remade, and consumer preferences have been altered. For example, a large study published by JAMA Network Open in February 2024 reported that the intake of seven or more grams of olive oil per day was associated with a 28% reduction in death rates from dementia in American adults. This underlines the increased sensitivity to dietary practices as an important factor in containing age-related cognitive decline.

It's not only the taste/culinary aspect; some consumers prefer their oil for its potential health effects. Manufacturers are thus catching up to the demands, changing consumer preferences with regard to the kinds of oils used in food production to match and align with health-orientated choices. Accordingly, with scientific validation of its benefits, the marketplace for healthier oils grows in demand, restructuring the landscape of the fats and oils industry.

"Soybean oil among vegetable oil types emerges as the fastest-growing segment during the forecast period."

Soybean oil has emerged as the fastest-growing segment among vegetable oils in the global fats and oils market, particularly driven by its diverse applications across various industries. Soybean oil consumption in the United States indeed mirrors its pivotal role in some of the important sectors. For example, in the food industry, soybean oil has large uses in margarine and salad or cooking oils, where MY2022/23 consumption figures stand at 114.27 thousand metric tons and 3.60 million metric tons respectively, according to the United Soybean Board. This makes it an important all-around ingredient for cooking and general food preparation.

Apart from the food sector, soybean oil has significant applications in various other industrial sectors. For example, in the case of biofuel production, it is very commonly used and has a large contribution to environmental sustainability efforts; the consumption figures reach 5.67 million MT for MY 2022/23. Also finding a place in soybean oil are lubricants, working fluids, paints, coatings, inks polyols, plastics, and a wide array of solvents and specialty chemicals, all running into good quantities of consumption. That it has had the ability to grow at these rates underlines soybean oil's versatility and increasing adaptability in these multiple industries, driven by its propitious properties and fast-growing recognition worldwide as a viable and sustainable alternative to food and industrial applications. That growth in soybean oil consumption underlines more than any other statistic its key role in determining the future character of the global fats and oils market.

"Food application is the dominant market in the fats & oils market."

Apart from flavor and texture, fats and oils in cookery, baking, and preservation of foods generally play dual roles with added functions in the line of nutrition and shelf-life extension. Their domain of applicability within the food industry is very wide, covering frying, sauteing, emulsification, and improvement in the texture of bakery and confectionary products. For example, soybean oil, sunflower oil, and palm oil have very high smoke points and are found in continuous use at high temperatures in frying. This makes them perfect for the production of crispy textures with fried foods while maintaining quality over successive cycles of frying, which is important in commercial food service operations.

They are core ingredients in food processing and used as carriers of fat-soluble vitamins, antioxidants, and flavors. Further, they provide a base for spreads, sauces, dressings, and processed meat applications through their effects on mouthfeel, stability, and general sensory appeal in the formulation of such products. Success in mayonnaise, for example, relies on oils that provide both the creamy texture and emulsification function to ensure consistent quality and taste. This is associated with a very broad span of uses for culinary techniques, food processing, and product formulation in underpinning their place in the regard of consumer expectations for taste, texture, and nutritional value across a broad span of foodstuffs. Changing consumer preferences in terms of health and sustainability mean that innovation in the fats and oils market is not at an end, as it introduces new formulations and sources that can help meet consumer demand while delivering the core functionality in food applications.

The break-up of the profile of primary participants in the fats & oils market:

- By Company Type: Tier 1 - 20%, Tier 2 - 50%, and Tier 3 - 30%

- By Designation: C Level - 31%, Director Level - 24%, Others - 45%

- By Region: North America - 24%, Europe - 29%, Asia Pacific - 32%, South America - 12% and Rest of the World - 3%

Prominent companies include ADM (US), Wilmar International Ltd (Singapore), Cargill, Incorporated (US), Bunge (US), Kaula Lumpur Kepong Berhad (Malaysia), Olam Agri Holdings Pte Ltd (India), Unilever (UK), Mewah Group (Singapore), Associated British Foods plc (UK), United Plantations Berhad (Malaysia), Ajinomoto Co., Inc. (Japan), Fuji Oil Co., Ltd. (Japan), Oleo-Fats (Philippines), Borges Agricultural and Industrial Edible Oils, S.A.U. (Spain), K S Oils Limited (India), CSM Ingredients (US), SD Guthrie International Zwijndrecht Refinery B.V. (Netherlands), Musim Mas Group (Singapore), Richardson International Limited (Canada), and AAK AB (UK) among others.

Research Coverage:

This research report categorizes the fats & oils market by type (Vegetable Oils, and Fats), Source (Vegetables, and Animals), Form (Liquid, and Solid), Application (Food and Industrial), and Region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report covers information about the key factors, such as drivers, restraints, opportunities, and challenges impacting the growth of the fats & oils market. It also provides a detailed analysis of the major players in the market including their business overview, products offered; key strategies; partnerships, new product launches, expansions, and acquisitions. Competitive benchmarking of upcoming startups in the fats & oils market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall fats & oils market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for food boosting global consumption of vegetable oils, Increased consumption of bakery & confectionery and processed food products, and Growing demand for biodiesel), restraints (Labeling of fat & oil products and the safety issues), opportunities (Emerging application of fats and oils as substitutes of trans-fats, and Growth in microencapsulation of fats and oils), and challenges (High capital investments in extraction, and High dependence on imports, leading to high costs of end-products) influencing the growth of the fats & oils market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the fats & oils market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the fats & oils market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the fats & oils market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as ADM (US), Wilmar International Ltd (Singapore), Cargill, Incorporated (US), Bunge (US), Kaula Lumpur Kepong Berhad (Malaysia), Olam Agri Holdings Pte Ltd (India), Manildra Group (Australia), Mewah Group (Singapore), Associated British Foods plc (UK), United Plantations Berhad (Malaysia), Ajinomoto Co., Inc. (Japan), Fuji Oil Co., Ltd. (Japan), Oleo-Fats (Philippines), Borges Agricultural and Industrial Edible Oils, S.A.U. (Spain), K S Oils Limited (India), CSM Ingredients (US), SD Guthrie International Zwijndrecht Refinery B.V. (Netherlands), Musim Mas Group (Singapore), Richardson International Limited (Canada), and AAK AB (Sweden), among others in the fats & oils market strategies. The report also helps stakeholders understand the fats & oils market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY/VALUE UNIT

- 1.4.2 VOLUME UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary profiles

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FATS & OILS MARKET

- 4.2 FAST & OILS MARKET: KEY REGIONAL SUBMARKETS

- 4.3 ASIA PACIFIC: FATS & OILS MARKET, BY OIL TYPE & COUNTRY

- 4.4 FATS & OILS MARKET, BY VEGETABLE OIL TYPE

- 4.5 FATS & OILS MARKET, BY FAT TYPE

- 4.6 FATS & OILS MARKET, BY FORM

- 4.7 FATS & OILS MARKET, BY SOURCE

- 4.8 FATS & OILS MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWING HEALTH TRENDS AND CONSUMER PREFERENCES

- 5.2.2 POPULATION, GDP GROWTH, AND URBANIZATION

- 5.2.3 PREVALENCE OF DEPRESSION AND ANXIETY DISORDERS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing oilseeds production

- 5.3.1.2 Increasing demand for food boosting global consumption of vegetable oils

- 5.3.1.2.1 Increase in consumption of bakery & confectionery and processed food products

- 5.3.1.3 Growing demand for biodiesel

- 5.3.2 RESTRAINTS

- 5.3.2.1 Labeling of fat & oil products and safety issues

- 5.3.2.2 High price volatility

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emerging application of fats and oils as substitutes for trans-fats

- 5.3.3.2 Growth in microencapsulation of fats and oils

- 5.3.3.3 Consumer preference shifting toward healthier oil alternatives

- 5.3.4 CHALLENGES

- 5.3.4.1 High capital investments in extraction

- 5.3.4.2 High dependence on imports, leading to high costs of end products

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Flavor and ingredient innovation

- 5.4.3.2 AI-enabled digital tools for consumer understanding and product development

- 5.4.3.3 Personalized AI-developed nutrition platform

- 5.4.3.4 AI and cloud technology to address challenges in food & beverage industry

- 5.4.4 IMPACT ON FATS & OILS MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING & PROCUREMENT

- 6.3.3 CRUSHING, REFINING, AND PRODUCTION

- 6.3.4 SAFETY & QUALITY

- 6.3.5 MARKETING & DISTRIBUTION

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO OF FATS & OILS (VEGETABLE FATS AND OILS)

- 6.4.2 IMPORT SCENARIO OF FATS & OILS (VEGETABLE FATS AND OILS)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Fortification and enrichment technologies

- 6.5.1.2 Trans-fat reduction technologies

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Ultrasound technology to enhance degumming efficiency

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Nanotechnology to create nanoemulsions and nanoencapsulation

- 6.5.3.2 DNA sequencing and genotyping

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM ANALYSIS/MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 PATENT ANALYSIS

- 6.9.1 LIST OF MAJOR PATENTS

- 6.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Canada

- 6.11.3 EUROPE

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 India

- 6.11.4.2 China

- 6.11.4.3 Rest of Asia Pacific

- 6.11.5 SOUTH AMERICA

- 6.11.5.1 Brazil

- 6.11.6 REST OF THE WORLD

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 VEGETABLE OILS ENHANCEMENT WITH ELIMINATION OF PARTIALLY HYDROGENATED OILS (PHOS)

- 6.14.2 NUTRITIONAL QUALITY INCREASED BY ELIMINATING PARTIALLY HYDROGENATED OILS

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 FATS & OILS MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 VEGETABLES

- 7.2.1 INCREASE IN AWARENESS ABOUT HEALTHY DIETS AMONG PEOPLE TO DRIVE MARKET

- 7.3 ANIMALS

- 7.3.1 ENHANCED VALUE OF ANIMAL-SOURCE PRODUCTS IN CULINARY APPLICATIONS TO PROPEL MARKET

8 FATS & OILS MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.1.1 FACTORS AFFECTING PHYSICAL CHARACTERISTICS OF FATS AND OILS

- 8.2 LIQUID

- 8.2.1 HIGH DEMAND IN HOUSEHOLDS AND HOTELS TO DRIVE MARKET

- 8.3 SOLID (CRYSTALLINE)

- 8.3.1 SOLID FORM CRYSTALLIZES ANIMAL- AND VEGETABLE-DERIVED FATS, MAKING THEM MORE CREAMY

9 FATS & OILS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 VEGETABLE OILS

- 9.2.1 PALM OIL

- 9.2.1.1 Absence of linolenic acid contributes to palm oil's stability against oxidative deterioration, enhances its appeal, and drives market

- 9.2.2 SOYBEAN OIL

- 9.2.2.1 High amount of essential fatty acids makes soybean oil healthier alternative

- 9.2.3 SUNFLOWER OIL

- 9.2.3.1 Use of sunflower oil in food as well as industrial applications to drive market

- 9.2.4 RAPESEED OIL

- 9.2.4.1 Substantial investment in rapeseed crushing facilities exemplifies growing demand for rapeseed oil and drives market expansion

- 9.2.5 OLIVE OIL

- 9.2.5.1 Significant contributions from major producers to drive global market

- 9.2.6 OTHER OILS

- 9.2.1 PALM OIL

- 9.3 FATS

- 9.3.1 BUTTER & MARGARINE

- 9.3.1.1 Nutritional benefits of butter, alongside margarine's evolution to address health concerns to drive growth

- 9.3.2 TALLOW & GREASE

- 9.3.2.1 Growing role in providing sustainable, renewable energy source to drive market

- 9.3.3 LARD

- 9.3.3.1 Growing popularity as versatile and ethically preferred fat alternative to drive market

- 9.3.1 BUTTER & MARGARINE

10 FATS & OILS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 FOOD

- 10.2.1 GROWING DEMAND FOR HEALTHIER AND MORE SUSTAINABLE OPTIONS TO DRIVE INNOVATION AND MARKET GROWTH

- 10.2.2 FOOD PRODUCT MANUFACTURING

- 10.2.2.1 Bakery products

- 10.2.2.2 Confectionery products

- 10.2.2.3 Processed foods & beverages

- 10.2.2.3.1 Snacks & savory

- 10.2.2.3.2 R.T.E. foods/Convenience foods

- 10.2.2.3.3 Sauces, spreads, and dressings

- 10.2.2.3.4 Others (dairy products, meat products, and beverages)

- 10.2.3 FOODSERVICE

- 10.2.4 RETAIL

- 10.3 INDUSTRIAL

- 10.3.1 INCREASED DEMAND FOR VEGETABLE OIL IN DEVELOPED COUNTRIES FOR USE IN BIODIESEL PRODUCTION

- 10.3.2 BIODIESEL

- 10.3.3 OLEOCHEMICALS

- 10.3.4 ANIMAL FEED

11 FATS & OILS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Strong volume-based demand for soybean and rapeseed oils to drive sale of fats & oils

- 11.2.2 CANADA

- 11.2.2.1 High consumption rates for rapeseed, palm, and coconut oils in processed food industry to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Bakery and confectionery sectors to lead demand dynamics for fats and oils

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Policy and regulatory initiatives to drive consumption of healthier, clean-labeled fats and oils

- 11.3.2 UK

- 11.3.2.1 Significant reduction in saturated fats in dietary habits to drive sales of healthier variants of vegetable oils

- 11.3.3 FRANCE

- 11.3.3.1 Culinary aspects of French market favor significant utilization of fats and oils

- 11.3.4 ITALY

- 11.3.4.1 Popularity of high-quality, PDO and PGI-certified olive oils to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Greater share of animal-based food products in Spanish diets to drive market

- 11.3.6 RUSSIA

- 11.3.6.1 Robust in-home consumption of fat-rich foods to drive market

- 11.3.7 NETHERLANDS

- 11.3.7.1 Dutch fats & oils market to thrive on resilient production and trade dynamics

- 11.3.8 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Robust production, consumption, and import dynamics for palm and soybean oils to drive market

- 11.4.2 INDIA

- 11.4.2.1 Promising consumption patterns arising from processed food products growth to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Health-conscious consumers to drive demand for clean-labeled fats and oils

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Growing popularity of rapeseed, olive, and sunflower oils to drive market

- 11.4.5 INDONESIA

- 11.4.5.1 Robust per capita consumption of fats and oils

- 11.4.6 MALAYSIA

- 11.4.6.1 Favorable production patterns and promising consumption of palm oil to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Increasing production of biofuel to drive market for vegetable oils

- 11.5.2 ARGENTINA

- 11.5.2.1 Significant export of soybean oil to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 ROW

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Inclusion of fats & oils in Middle Eastern culture to drive market

- 11.6.2 AFRICA

- 11.6.2.1 Africa offers large potential market for vegetable fats and oils

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 EV/EBITDA

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 Source footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ADM

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 WILMAR INTERNATIONAL LTD

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 CARGILL, INCORPORATED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 BUNGE

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 KUALA LUMPUR KEPONG BERHAD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 OLAM AGRI HOLDINGS PTE LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.4 MnM view

- 13.1.7 MEWAH GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.4 MnM view

- 13.1.8 ASSOCIATED BRITISH FOODS PLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.4 MnM view

- 13.1.9 UNITED PLANTATIONS BERHAD

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.4 MnM view

- 13.1.10 AJINOMOTO CO., INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.4 MnM view

- 13.1.11 FUJI OIL CO., LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.4 MnM view

- 13.1.12 AAK AB

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.4 MnM view

- 13.1.13 K. S. OILS LIMITED

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.4 MnM view

- 13.1.14 OLEO-FATS

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.4 MnM view

- 13.1.15 MANILDRA GROUP

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.4 MnM view

- 13.1.16 BORGES AGRICULTURAL & INDUSTRIAL EDIBLE OILS, S.A.U.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.4 MnM view

- 13.1.17 CSM INGREDIENTS

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.4 MnM view

- 13.1.18 SD GUTHRIE INTERNATIONAL ZWIJNDRECHT REFINERY B.V.

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.4 MnM view

- 13.1.19 MUSIM MAS GROUP

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.19.3 Recent developments

- 13.1.19.4 MnM view

- 13.1.20 RICHARDSON INTERNATIONAL LIMITED

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Solutions/Services offered

- 13.1.20.3 Recent developments

- 13.1.20.4 MnM view

- 13.1.1 ADM

- 13.2 OTHER PLAYERS

- 13.2.1 GOODHOPE ASIA HOLDINGS LTD - FATS & OILS MARKET

- 13.2.2 VEGA FOODS - FATS & OILS MARKET

- 13.2.3 ALAMI COMMODITIES SDN BHD - FATS & OILS MARKET

- 13.2.4 GEMINI EDIBLES & FATS INDIA LIMITED - FATS & OILS MARKET

- 13.2.5 IFFCO - FATS & OILS MARKET

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 EDIBLE OILS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 ESSENTIAL OILS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.5 SPECIALTY FATS & OILS MARKET

- 14.5.1 MARKET DEFINITION

- 14.5.2 SPECIALTY FATS

- 14.5.3 SPECIALTY OILS

- 14.5.4 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS