|

|

市場調査レポート

商品コード

1327322

拡張現実 (AR) ショッピングの世界市場 (~2028年):デバイスタイプ (HMD・スマートミラー・ハンドヘルドデバイス)・用途 (試着ソリューション・企画&設計・情報システム)・市場タイプ (アパレル・ジュエリー・食料品)・提供区分・地域別Augmented Reality (AR) Shopping Market by Device Type (HMD, Smart Mirror, Handheld Device), Application (Try-on Solution, Planning & Designing, Information System), Market Type (Apparel, Jewelry, Groceries), Offering and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 拡張現実 (AR) ショッピングの世界市場 (~2028年):デバイスタイプ (HMD・スマートミラー・ハンドヘルドデバイス)・用途 (試着ソリューション・企画&設計・情報システム)・市場タイプ (アパレル・ジュエリー・食料品)・提供区分・地域別 |

|

出版日: 2023年07月14日

発行: MarketsandMarkets

ページ情報: 英文 259 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の拡張現実 (AR) ショッピングの市場規模は、2023年の34億米ドルから、予測期間中は28.0%のCAGRで推移し、2028年には116億米ドルの規模に成長すると予測されています。

拡張現実 (AR) ショッピング市場の成長を促進する主な要因は、オンラインショッピングとEコマースプラットフォームの採用の拡大、ブランドの差別化へのニーズを促す競合の拡大、スマートフォンの普及とARアプリの成長です。さらに、保管コストの削減と効率的な在庫管理、人件費の削減も参入事業者に新たな成長機会をもたらすと予想されています。

家具・照明の部門が予測期間中に最大のシェアを記録すると予測されています。ARを活用することで、顧客は自分のスペースで家具や照明製品をバーチャルに視覚化することができ、十分な情報に基づいた購買決定が可能となります。この没入的でインタラクティブなアプローチは、顧客体験を向上させ、エンゲージメントを高める見通しです。

当レポートでは、世界の拡張現実 (AR) ショッピングの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 主要技術動向

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主要ステークホルダーと購入基準

- ケーススタディ分析

- 貿易データ

- 関税・法規制

- 顧客の事業に影響を与える動向/ディスラプション

- 主要な会議とイベント

第6章 拡張現実 (AR) ショッピング市場:技術別

- マーカーベースAR

- パッシブマーカー

- アクティブマーカー

- マーカーレスAR

- 技術別

- タイプ別

第7章 拡張現実 (AR) ショッピング市場:エンドユーザー別

- Eコマース/店舗外

- 小売/店内

第8章 拡張現実 (AR) ショッピング市場:提供区分別

- ハードウェア

- ディスプレイ・プロジェクター

- カメラ

- センサー

- ソフトウェア・サービス

- ソフトウェア開発キット

- AR視覚化ソフトウェア

- ARコンテンツ管理システム

- サービス

第9章 拡張現実 (AR) ショッピング市場:デバイスタイプ別

- ARヘッドマウントディスプレイ

- スマートARミラー

- ハンドヘルドデバイス

第10章 拡張現実 (AR) ショッピング市場:用途別

- 試着ソリューション

- 企画・設計

- 広告・マーケティング

- 情報システム

第11章 拡張現実 (AR) ショッピング市場:市場タイプ別

- 衣服

- 家具・照明

- ジュエリー

- 美容・化粧品

- フットウェア

- 食料品

- その他

第12章 拡張現実 (AR) ショッピング市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第13章 競合情勢

- 市場評価の枠組み

- 市場シェア分析

- 過去の収益分析

- スタートアップ/中小企業の評価マトリックス

- 企業フットプリント

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ALPHABET INC.(GOOGLE)

- APPLE INC.

- MICROSOFT

- META

- PTC

- SEIKO EPSON CORPORATION

- WIKITUDE GMBH

- MAGIC LEAP, INC.

- 3D CLOUD BY MARXENT

- VUZIX CORPORATION

- BLIPPAR

- その他の企業

- AUGMENT

- VIEWAR GMBH

- ZUGARA, INC.

- GROOVE JONES

- SCIENCESOFT USA CORPORATION

- 8TH WALL(NIANTIC)

- SKETCHFAB, INC.

- MAGIC MIRROR

- HOLITION LTD.

- OVERLY

- ZAPPAR LTD.

- FINGENT

- KUDAN

- INDE

- OBSESS

- ORIIENT

第15章 付録

The Augmented Reality (AR) shopping market is projected to reach USD 11.6 billion by 2028 from USD 3.4 billion in 2023 at a CAGR of 28.0% during the forecast period. The major factors driving the growth of Augmented Reality (AR) shopping market are Growing adoption of online shopping and e-commerce platforms, rising competition in market driving the need for brand differentiation, and increasing smartphone penetration & growth of AR apps. Moreover, the lower cost of storage and efficient inventory management, and reduced labor cost are expected to carve out new growth opportunities for market players.

Furniture & Lighting to register the largest market share during the forecast period

The AR shopping market in the furniture and lighting industry has witnessed significant growth as more companies integrate augmented reality technology into their shopping experiences. By leveraging AR, customers can virtually visualize furniture and lighting products in their own spaces, enabling them to make informed purchasing decisions. This immersive and interactive approach enhances the customer experience and increases engagement.

Try-on Solutions to register the largest share during the forecast period

Virtual try-on technology has become a major trend in e-commerce, allowing customers to virtually try on products before purchasing. Companies like Warby Parker, L'Oreal, and Bolle, Nike, and GAP have implemented this technology, providing customers with the ability to cycle through various colors and models of products using smart mirrors or AR filters on mobile devices. This innovation has been particularly valuable during the shift towards e-commerce in the past few years. AR try-on filters bring the in-person shopping experience to the comfort of customers' homes. Moreover, the rising demand of AR technology for enhancing shopping experience is catered by the integration of smart AR mirrors in retail stores. By integrating AR technology into mirrors, brands can continue leveraging emerging technologies even as customers return to brick-and-mortar locations. These factors are driving the growth of AR shopping market for try-on solutions.

The break-up of profile of primary participants in the Augmented Reality (AR) shopping market-

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30% , Others - 35%

- By Region Type: North America - 40%, Europe - 25%, Asia Pacific - 20%, Rest of the World - 15%

The major players in the Augmented Reality (AR) shopping market with a significant global presence include PTC (US), Alphabet Inc., (US), Microsoft (US), Apple (US), Meta (US) and others.

Research Coverage

The report segments the Augmented Reality (AR) shopping market and forecasts its size by end use, offering, device type, application, market type, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall Augmented Reality (AR) shopping market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing adoption of online shopping and e-commerce platforms, rising competition in market driving the need for brand differentiation, growing demand for personalized shopping experience, increasing smartphone penetration & growth of AR apps are the major factors driving the market growth), restraints ( high cost of AR technology, limited availability of AR device, lack of compatibility and interoperability, and privacy and security concerns associated with the use of AR), opportunities (lower cost of storage and inventory management efficiency, and reduced labor cost), and challenges (the lower cost of storage and efficient inventory management, and reduced labor cost)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Augmented Reality (AR) shopping market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Augmented Reality (AR) shopping market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Augmented Reality (AR) shopping market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like PTC (US), Alphabet Inc., (US), Microsoft (US), Apple (US), Meta (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

- 1.2.2 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

- 1.2.3 INCLUSIONS AND EXCLUSIONS AT DEVICE TYPE LEVEL

- 1.2.4 INCLUSIONS AND EXCLUSIONS AT MARKET TYPE LEVEL

- 1.2.5 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

- 1.2.6 INCLUSIONS AND EXCLUSIONS AT END USE LEVEL

- 1.2.7 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

- 1.3 STUDY SCOPE

- FIGURE 1 AUGMENTED REALITY (AR) SHOPPING MARKET SEGMENTATION

- 1.3.1 AUGMENTED REALITY (AR) SHOPPING MARKET: REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 AUGMENTED REALITY (AR) SHOPPING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3.3 GROWTH FORECAST ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- 2.4 RECESSION IMPACT ANALYSIS

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 AR SHOPPING MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 AR SHOPPING MARKET: GLOBAL SNAPSHOT

- FIGURE 9 SOFTWARE AND SERVICES SEGMENT TO ACQUIRE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 AR HMDS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF AR SHOPPING MARKET DURING FORECAST PERIOD

- FIGURE 11 FURNITURE AND LIGHTING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 TRY-ON SOLUTIONS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AR SHOPPING MARKET

- FIGURE 14 PRESENCE OF ESTABLISHED TECHNOLOGY PLAYERS TO DRIVE MARKET

- 4.2 AR SHOPPING MARKET, BY OFFERING

- FIGURE 15 SOFTWARE AND SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 AR SHOPPING MARKET, BY MARKET TYPE

- FIGURE 16 FURNITURE AND LIGHTING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 AR SHOPPING MARKET, BY DEVICE TYPE

- FIGURE 17 AR HMDS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 AR SHOPPING MARKET, BY APPLICATION

- FIGURE 18 TRY-ON SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 NORTH AMERICA: AR SHOPPING MARKET, BY APPLICATION AND COUNTRY, 2022

- FIGURE 19 FURNITURE AND LIGHTING HELD LARGEST MARKET SHARE IN NORTH AMERICA (2022)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 AR SHOPPING MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of online shopping and e-commerce platforms

- 5.2.1.2 Need for brand differentiation

- 5.2.1.3 Growing demand for personalized shopping experience

- 5.2.1.4 Increasing use of smartphones and growth of AR apps

- FIGURE 21 GLOBAL SMARTPHONE SHIPMENTS, 2014-2022 (MILLION UNITS)

- FIGURE 22 IMPACT ANALYSIS OF DRIVERS IN AR SHOPPING MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of AR technology

- 5.2.2.2 Limited availability of AR devices

- 5.2.2.3 Lack of compatibility and interoperability

- 5.2.2.4 Privacy and security concerns

- FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS IN AR SHOPPING MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Lower cost of storage and efficient inventory management

- 5.2.3.2 Reduced labor cost

- FIGURE 24 IMPACT ANALYSIS OF OPPORTUNITIES IN AR SHOPPING MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Need for skilled personnel

- 5.2.4.2 Technical limitations

- 5.2.4.3 Consumer acceptance

- FIGURE 25 IMPACT ANALYSIS OF CHALLENGES IN AR SHOPPING MARKET

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 26 AR SHOPPING MARKET: VALUE CHAIN ANALYSIS

- TABLE 3 AR SHOPPING MARKET: VALUE CHAIN ANALYSIS

- 5.4 AR SHOPPING MARKET ECOSYSTEM ANALYSIS

- FIGURE 27 AR SHOPPING MARKET ECOSYSTEM ANALYSIS

- 5.5 KEY TECHNOLOGY TRENDS

- 5.5.1 RELATED TECHNOLOGIES

- 5.5.1.1 Mixed Reality (MR)

- 5.5.1.2 Computer Vision

- 5.5.2 UPCOMING TECHNOLOGIES

- 5.5.2.1 Extended Reality (XR)

- 5.5.2.2 Spatial Computing

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Internet of Things (IoT)

- 5.5.3.2 Artificial Intelligence (AI)

- 5.5.1 RELATED TECHNOLOGIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY DEVICE TYPE

- FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS, BY DEVICE TYPE

- 5.6.2 AVERAGE SELLING PRICE TREND

- FIGURE 29 AVERAGE SELLING PRICE TREND IN AR SHOPPING MARKET

- 5.7 PATENT ANALYSIS

- TABLE 4 PATENTS FILED FROM JANUARY 2012 TO DECEMBER 2022

- FIGURE 30 NUMBER OF PATENTS GRANTED FOR AR SHOPPING MARKET

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (JANUARY 2012-DECEMBER 2022)

- TABLE 5 TOP 20 PATENT OWNERS FROM JANUARY 2012 TO DECEMBER 2022

- TABLE 6 KEY PATENTS RELATED TO AR SHOPPING MARKET

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 AR SHOPPING MARKET: PORTER'S FIVE FORCES ANALYSIS, 2022

- FIGURE 33 IMPACT OF PORTER'S FIVE FORCES ON AR SHOPPING MARKET, 2022

- TABLE 7 AR SHOPPING MARKET: PORTER'S FIVE FORCES ANALYSIS- 2022

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AR DEVICES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AR SHOPPING MARKET (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR DEVICE TYPES IN AR SHOPPING MARKET

- TABLE 9 KEY BUYING CRITERIA IN AR SHOPPING MARKET

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ENHANCED WINE SHOPPING EXPERIENCE BY IMPLEMENTING AR

- TABLE 10 VUFORIA ENGINE ENHANCED WINE SHOPPING EXPERIENCE BY IMPLEMENTING AR IN VIVINO'S APP

- 5.10.2 DEVELOPMENT OF APP TO CATER TO POTENTIAL HOMEBUYERS TO AVOID COSTS OF PHYSICAL STAGING

- TABLE 11 ARCORE DEVELOPED CURATE APP TO CATER TO DIVERSE DESIGN TASTES AND NEEDS OF POTENTIAL BUYERS

- 5.10.3 ENHANCED SHOPPING EXPERIENCE FOR CUSTOMERS OF AUTA SUPER

- TABLE 12 AR APP ENHANCED SHOPPING EXPERIENCE FOR CUSTOMERS WITH COMPREHENSIVE PRODUCT CATALOG

- 5.10.4 EFFECTIVE CUSTOMER SUPPORT FOR MERCEDES-BENZ

- TABLE 13 VUFORIA ENGINE PROVIDED EFFICIENT AND EFFECTIVE CUSTOMER SUPPORT FOR MERCEDES-BENZ

- 5.11 TRADE DATA

- TABLE 14 HS CODE: 900490, EXPORT VALUES FOR MAJOR COUNTRIES, 2018-2022 (USD MILLION)

- FIGURE 36 HS CODE: 900490, EXPORT VALUES FOR MAJOR COUNTRIES, 2018-2022

- TABLE 15 HS CODE: 900490, IMPORT VALUES FOR MAJOR COUNTRIES, 2018-2022 (USD MILLION)

- FIGURE 37 HS CODE: 8537, IMPORT VALUES FOR MAJOR COUNTRIES, 2018-2022

- 5.12 TARIFF AND REGULATIONS

- 5.12.1 TARIFFS

- TABLE 16 MFN TARIFFS FOR PRODUCTS UNDER HS CODE: 900490 EXPORTED BY CHINA

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2.1 North America

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.3 STANDARDS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 38 REVENUE SHIFT IN AR SHOPPING MARKET

- 5.14 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 17 AR SHOPPING MARKET: LIST OF CONFERENCES AND EVENTS

6 AUGMENTED REALITY (AR) SHOPPING MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 MARKER-BASED AR

- 6.2.1 PASSIVE MARKERS

- 6.2.2 ACTIVE MARKERS

- 6.3 MARKERLESS AR

- 6.3.1 MARKERLESS AR, BY TECHNOLOGY

- 6.3.1.1 Model-based tracking

- 6.3.1.2 Image-based tracking

- 6.3.2 MARKERLESS AR, BY TYPE

- 6.3.2.1 Projection-based AR

- 6.3.2.2 Superimposition-based AR

- 6.3.2.3 Location-based AR

- 6.3.1 MARKERLESS AR, BY TECHNOLOGY

7 AUGMENTED REALITY (AR) SHOPPING MARKET, BY END USE

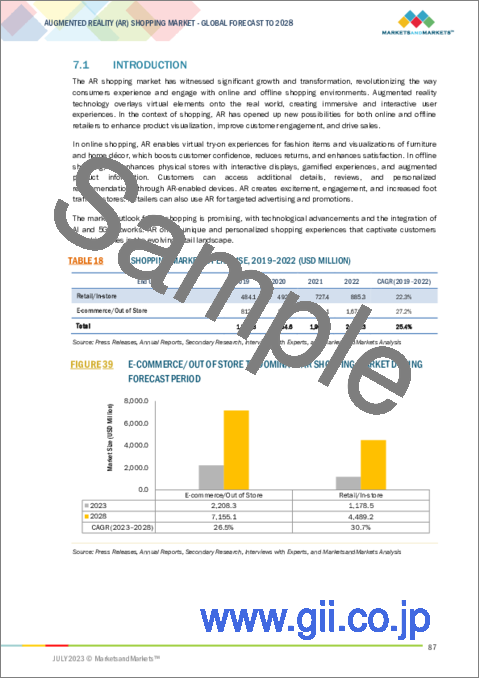

- 7.1 INTRODUCTION

- TABLE 18 AR SHOPPING MARKET, BY END USE, 2019-2022 (USD MILLION)

- FIGURE 39 E-COMMERCE/OUT OF STORE TO DOMINATE AR SHOPPING MARKET DURING FORECAST PERIOD

- TABLE 19 AR SHOPPING MARKET, BY END USE, 2023-2028 (USD MILLION)

- 7.2 E-COMMERCE/OUT OF STORE

- 7.2.1 INCREASING DEMAND FOR IMMERSIVE AND INTERACTIVE SHOPPING TO DRIVE GROWTH

- TABLE 20 E-COMMERCE/OUT OF STORE: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 40 TRY-ON SOLUTIONS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 21 E-COMMERCE/OUT OF STORE: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.3 RETAIL/IN-STORE

- 7.3.1 BRAND DIFFERENTIATION AND SEAMLESS SHOPPING EXPERIENCE TO DRIVE MARKET

- TABLE 22 RETAIL/IN-STORE: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 41 INFORMATION SYSTEMS TO HAVE HIGHEST GROWTH IN AR SHOPPING MARKET

- TABLE 23 RETAIL/IN-STORE: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

8 AUGMENTED REALITY (AR) SHOPPING MARKET, BY OFFERING

- 8.1 INTRODUCTION

- TABLE 24 AR SHOPPING MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- FIGURE 42 SOFTWARE AND SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 25 AR SHOPPING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 8.2 HARDWARE

- TABLE 26 HARDWARE: AR SHOPPING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- FIGURE 43 DISPLAYS AND PROJECTORS TO HAVE HIGHEST GROWTH IN HARDWARE SEGMENT DURING FORECAST PERIOD

- TABLE 27 HARDWARE: AR SHOPPING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 8.2.1 DISPLAYS AND PROJECTORS

- 8.2.1.1 Growing demand in retail stores to drive market

- 8.2.2 CAMERAS

- 8.2.2.1 Need for object recognition and tracking to drive market

- 8.2.3 SENSORS

- 8.2.3.1 Immersive AR experience to drive market

- 8.2.3.2 Accelerometers

- 8.2.3.2.1 Growing demand for tracking device movement to drive market

- 8.2.3.3 Gyroscopes

- 8.2.3.3.1 Growing demand for tracking device orientation to drive market

- 8.2.3.4 Magnetometers

- 8.2.3.4.1 Need to accurately determine user movement to drive market

- 8.2.3.5 Proximity sensors

- 8.2.3.5.1 Growing need to detect presence of nearby objects to drive market

- 8.2.3.6 Other hardware

- 8.3 SOFTWARE AND SERVICES

- TABLE 28 SOFTWARE: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 44 TRY-ON SOLUTIONS TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 29 SOFTWARE: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.3.1 SOFTWARE DEVELOPMENT KITS

- 8.3.1.1 Growing need for development of AR apps to drive market

- 8.3.2 AR VISUALIZATION SOFTWARE

- 8.3.2.1 Need to create lifelike models of products to drive market

- 8.3.3 AR CONTENT MANAGEMENT SYSTEMS

- 8.3.3.1 Increasing demand to create and manage 3D models, animation, and videos to drive market

- 8.3.4 SERVICES

- 8.3.4.1 Growing need for enhanced shopping experience in retail stores to drive market

9 AUGMENTED REALITY (AR) SHOPPING MARKET, BY DEVICE TYPE

- 9.1 INTRODUCTION

- TABLE 30 AR SHOPPING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- FIGURE 45 AR HMDS TO HOLD DOMINANT MARKET POSITION DURING FORECAST PERIOD

- TABLE 31 AR SHOPPING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- 9.2 AR HEAD-MOUNTED DISPLAYS

- 9.2.1 GROWING NEED FOR IMMERSIVE AND INTERACTIVE SHOPPING EXPERIENCES TO DRIVE GROWTH

- TABLE 32 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 46 INFORMATION SYSTEMS TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 33 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 34 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 35 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 36 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2019-2022 (THOUSAND UNITS)

- TABLE 37 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- 9.3 SMART AR MIRRORS

- 9.3.1 INCREASING ADOPTION BY RETAILERS TO DRIVE GROWTH

- TABLE 38 SMART AR MIRRORS: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 47 TRY-ON SOLUTIONS TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 39 SMART AR MIRRORS: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.4 HANDHELD DEVICES

- 9.4.1 INCREASED USE OF SMARTPHONES AND GROWTH OF AR APPS TO DRIVE MARKET

- TABLE 40 HANDHELD DEVICES: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD THOUSAND)

- TABLE 41 HANDHELD DEVICES: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

10 AUGMENTED REALITY (AR) SHOPPING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- TABLE 42 AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 48 TRY-ON SOLUTIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 43 AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2 TRY-ON SOLUTIONS

- 10.2.1 INCREASED INTEGRATION OF AR FEATURES IN E-COMMERCE AND SMART AR MIRRORS TO DRIVE MARKET

- TABLE 44 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- FIGURE 49 SMART AR MIRRORS TO DOMINATE TRY-ON SOLUTIONS MARKET DURING FORECAST PERIOD

- TABLE 45 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 46 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 47 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 48 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 49 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- 10.3 PLANNING AND DESIGNING

- 10.3.1 GROWING ADOPTION OF E-COMMERCE PLATFORMS FOR SHOPPING TO DRIVE MARKET

- TABLE 50 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 51 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 52 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 53 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- 10.4 ADVERTISING AND MARKETING

- 10.4.1 SHIFT IN FOCUS TOWARD EXPERIENTIAL MARKETING TO DRIVE MARKET

- TABLE 54 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- FIGURE 50 HANDHELD DEVICES TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 55 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 56 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 57 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 58 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 59 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- 10.5 INFORMATION SYSTEMS

- 10.5.1 GROWING NEED FOR INTERACTIVE AR SOLUTIONS TO DRIVE MARKET

- TABLE 60 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 61 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 62 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 63 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

11 AUGMENTED REALITY (AR) SHOPPING MARKET, BY MARKET TYPE

- 11.1 INTRODUCTION

- TABLE 64 AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- FIGURE 51 FURNITURE AND LIGHTING TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 65 AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- 11.2 APPAREL

- 11.2.1 INCREASED INTEGRATION OF VIRTUAL TRY-ON FEATURES TO DRIVE MARKET

- TABLE 66 APPAREL: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 52 TRY-ON SOLUTIONS TO DOMINATE APPAREL MARKET DURING FORECAST PERIOD

- TABLE 67 APPAREL: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 68 APPAREL: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 APPAREL: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 72 EUROPE: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 73 EUROPE: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 76 REST OF THE WORLD: AR SHOPPING APPAREL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 REST OF THE WORLD: AR SHOPPING APPAREL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 FURNITURE AND LIGHTING

- 11.3.1 DEVELOPMENT OF ADVANCED MARKERLESS TRACKING AND OBJECT RECOGNITION ALGORITHMS TO DRIVE MARKET

- TABLE 78 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 53 PLANNING AND DESIGNING TO DOMINATE FURNITURE AND LIGHTING MARKET DURING FORECAST PERIOD

- TABLE 79 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 80 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 84 EUROPE: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 85 EUROPE: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 88 REST OF THE WORLD: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 REST OF THE WORLD: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 JEWELRY

- 11.4.1 ONLINE SHOPPING TO DRIVE MARKET

- TABLE 90 JEWELRY: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 91 JEWELRY: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 92 JEWELRY: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 JEWELRY: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 96 EUROPE: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 100 REST OF THE WORLD: AR SHOPPING JEWELRY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 101 REST OF THE WORLD: AR SHOPPING JEWELRY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 BEAUTY AND COSMETICS

- 11.5.1 DEVELOPMENT OF ACCURATE VIRTUAL TRY-ON FEATURES TO DRIVE MARKET

- TABLE 102 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 103 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 104 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 105 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 108 EUROPE: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 109 EUROPE: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 FOOTWEAR

- 11.6.1 INCREASING ADOPTION OF 3D IMAGING TO DRIVE MARKET

- TABLE 114 FOOTWEAR: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 FOOTWEAR: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 FOOTWEAR: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 117 FOOTWEAR: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 120 EUROPE: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 121 EUROPE: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 124 REST OF THE WORLD: AR SHOPPING FOOTWEAR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 125 REST OF THE WORLD: AR SHOPPING FOOTWEAR MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 GROCERIES

- 11.7.1 WIDESPREAD ADOPTION OF AR-ENABLED SMARTPHONES TO DRIVE MARKET

- TABLE 126 GROCERIES: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 54 ADVERTISING AND MARKETING TO GROW AT FASTEST PACE DURING FORECAST PERIOD

- TABLE 127 GROCERIES: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 GROCERIES: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 129 GROCERIES: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 133 EUROPE: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 136 REST OF THE WORLD: AR SHOPPING GROCERIES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 137 REST OF THE WORLD: AR SHOPPING GROCERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 OTHER MARKET TYPES

- TABLE 138 OTHER MARKET TYPES: AR SHOPPING MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 OTHER MARKET TYPES: AR SHOPPING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 OTHER MARKET TYPES: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 141 OTHER MARKET TYPES: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 144 EUROPE: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 145 EUROPE: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 148 REST OF THE WORLD: AR SHOPPING OTHER MARKET TYPES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 149 REST OF THE WORLD: AR SHOPPING OTHER MARKET TYPES, BY REGION, 2023-2028 (USD MILLION)

12 AUGMENTED REALITY (AR) SHOPPING MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 55 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 150 AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 151 AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 56 NORTH AMERICA: AR SHOPPING MARKET SNAPSHOT

- TABLE 152 NORTH AMERICA: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: AR SHOPPING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 155 NORTH AMERICA: AR SHOPPING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.1 RECESSION IMPACT ANALYSIS

- 12.2.2 US

- 12.2.2.1 Presence of established technology providers to drive market

- 12.2.3 CANADA

- 12.2.3.1 Increasing adoption of AR in retail and e-commerce to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Strong economic growth and government initiatives to drive market

- 12.3 EUROPE

- FIGURE 57 EUROPE: AR SHOPPING MARKET SNAPSHOT

- TABLE 156 EUROPE: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 157 EUROPE: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- TABLE 158 EUROPE: AR SHOPPING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 159 EUROPE: AR SHOPPING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.1 RECESSION IMPACT ANALYSIS

- 12.3.2 GERMANY

- 12.3.2.1 Thriving augmented reality ecosystem to drive market

- 12.3.3 UK

- 12.3.3.1 Adoption by major retailers to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Growing advertising and marketing to drive market

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 58 ASIA PACIFIC: AR SHOPPING MARKET SNAPSHOT

- TABLE 160 ASIA PACIFIC: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AR SHOPPING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AR SHOPPING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1 RECESSION IMPACT ANALYSIS

- 12.4.2 CHINA

- 12.4.2.1 Increasing economic growth and presence of advanced technology providers to drive market

- 12.4.3 INDIA

- 12.4.3.1 Massive e-commerce consumer base to drive market

- 12.4.4 JAPAN

- 12.4.4.1 Technological innovations and consumer acceptance to drive market

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Technological advancements in AR hardware to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 REST OF THE WORLD

- TABLE 164 REST OF THE WORLD: AR SHOPPING MARKET, BY MARKET TYPE, 2019-2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: AR SHOPPING MARKET, BY MARKET TYPE, 2023-2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: AR SHOPPING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: AR SHOPPING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.5.1 RECESSION IMPACT

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Rapid urbanization and interest of global players to drive market

- 12.5.3 MIDDLE EAST & AFRICA

- 12.5.3.1 Growing luxury retail market and e-commerce to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 MARKET EVALUATION FRAMEWORK

- TABLE 168 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 59 COMPANIES ADOPTED PARTNERSHIP AS KEY GROWTH STRATEGY (2019-2022)

- 13.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

- 13.2.2 PRODUCT PORTFOLIO

- 13.2.3 GEOGRAPHIC PRESENCE

- 13.2.4 MANUFACTURING AND DISTRIBUTION FOOTPRINT

- 13.3 MARKET SHARE ANALYSIS, 2022

- TABLE 169 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN AR SHOPPING MARKET, 2022

- 13.4 HISTORICAL REVENUE ANALYSIS, 2018-2022

- FIGURE 60 HISTORICAL REVENUE ANALYSIS OF MAJOR COMPANIES IN AR SHOPPING MARKET, 2018-2022 (USD BILLION)

- 13.5 COMPANY EVALUATION MATRIX

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 61 AR SHOPPING MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.6 STARTUP/SME EVALUATION MATRIX

- 13.6.1 COMPETITIVE BENCHMARKING

- TABLE 170 AR SHOPPING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 171 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: AR APPLICATIONS

- TABLE 172 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: OFFERING

- TABLE 173 COMPETITIVE BENCHMARKING OF STARTUPS/SMES: REGION

- 13.6.2 PROGRESSIVE COMPANIES

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- 13.6.5 STARTING BLOCKS

- FIGURE 62 AR SHOPPING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 13.7 COMPANY FOOTPRINT

- TABLE 174 AR SHOPPING MARKET: COMPANY FOOTPRINT

- TABLE 175 AR SHOPPING MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 176 AR SHOPPING MARKET: COMPANY OFFERING TYPE FOOTPRINT

- TABLE 177 AR SHOPPING MARKET: COMPANY REGION FOOTPRINT

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- TABLE 178 AR SHOPPING MARKET: PRODUCT LAUNCHES, 2019-2023

- 13.8.2 DEALS

- TABLE 179 AR SHOPPING MARKET: DEALS, 2019-2023

- 13.8.3 OTHERS

- TABLE 180 AR SHOPPING MARKET: OTHER STRATEGIES, 2019-2023

14 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 ALPHABET INC. (GOOGLE)

- TABLE 181 ALPHABET INC. (GOOGLE): COMPANY OVERVIEW

- FIGURE 63 ALPHABET INC. (GOOGLE): COMPANY SNAPSHOT

- TABLE 182 ALPHABET INC. (GOOGLE): PRODUCT LAUNCHES

- TABLE 183 ALPHABET INC. (GOOGLE): DEALS

- 14.2.2 APPLE INC.

- TABLE 184 APPLE INC.: COMPANY OVERVIEW

- FIGURE 64 APPLE INC.: COMPANY SNAPSHOT

- TABLE 186 APPLE INC.: DEALS

- 14.2.3 MICROSOFT

- TABLE 187 MICROSOFT: COMPANY OVERVIEW

- FIGURE 65 MICROSOFT: COMPANY SNAPSHOT

- TABLE 188 MICROSOFT: PRODUCT LAUNCHES

- TABLE 189 MICROSOFT: DEALS

- 14.2.4 META

- TABLE 190 META: COMPANY OVERVIEW

- FIGURE 66 META: COMPANY SNAPSHOT

- TABLE 191 META: PRODUCT LAUNCHES

- 14.2.5 PTC

- TABLE 192 PTC: COMPANY OVERVIEW

- FIGURE 67 PTC: COMPANY SNAPSHOT

- TABLE 193 PTC: PRODUCT LAUNCHES

- TABLE 194 PTC: DEALS

- 14.2.6 SEIKO EPSON CORPORATION

- TABLE 195 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- FIGURE 68 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- TABLE 196 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 197 SEIKO EPSON CORPORATION: DEALS

- 14.2.7 WIKITUDE GMBH

- TABLE 198 WIKITUDE GMBH: COMPANY OVERVIEW

- 14.2.8 MAGIC LEAP, INC.

- TABLE 199 MAGIC LEAP, INC.: COMPANY OVERVIEW

- TABLE 200 MAGIC LEAP, INC.: PRODUCT LAUNCHES

- TABLE 201 MAGIC LEAP, INC.: DEALS

- 14.2.9 3D CLOUD BY MARXENT

- TABLE 202 3D CLOUD BY MARXENT: COMPANY OVERVIEW

- TABLE 203 3D CLOUD BY MARXENT: PRODUCT LAUNCHES

- TABLE 204 3D CLOUD BY MARXENT: DEALS

- 14.2.10 VUZIX CORPORATION

- TABLE 205 VUZIX CORPORATION: COMPANY OVERVIEW

- FIGURE 69 VUZIX CORPORATION: COMPANY SNAPSHOT

- TABLE 206 VUZIX CORPORATION: PRODUCT LAUNCHES

- TABLE 207 VUZIX CORPORATION: DEALS

- TABLE 208 VUZIX CORPORATION: OTHERS

- 14.2.11 BLIPPAR

- TABLE 209 BLIPPAR: COMPANY OVERVIEW

- TABLE 210 BLIPPAR: PRODUCT LAUNCHES

- TABLE 211 BLIPPAR: DEALS

- 14.3 OTHER PLAYERS

- 14.3.1 AUGMENT

- 14.3.2 VIEWAR GMBH

- 14.3.3 ZUGARA, INC.

- 14.3.4 GROOVE JONES

- 14.3.5 SCIENCESOFT USA CORPORATION

- 14.3.6 8TH WALL (NIANTIC)

- 14.3.7 SKETCHFAB, INC.

- 14.3.8 MAGIC MIRROR

- 14.3.9 HOLITION LTD.

- 14.3.10 OVERLY

- 14.3.11 ZAPPAR LTD.

- 14.3.12 FINGENT

- 14.3.13 KUDAN

- 14.3.14 INDE

- 14.3.15 OBSESS

- 14.3.16 ORIIENT

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS