|

|

市場調査レポート

商品コード

1678869

食品・飲料用金属缶の世界市場:製造タイプ別、材料タイプ別、内圧度別、コーティングタイプ別、用途別、飲料缶容量別、地域別 - 2029年までの予測Food and Beverage Metal Cans Market by Fabrication Type (2 Piece Cans, 3 Piece Cans), Application (Food and Beverage), Coating Type, Material Type, Beverage Can Capacity, Degree of Internal Pressure, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 食品・飲料用金属缶の世界市場:製造タイプ別、材料タイプ別、内圧度別、コーティングタイプ別、用途別、飲料缶容量別、地域別 - 2029年までの予測 |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 326 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

食品・飲料用金属缶の市場規模は、2024年に504億2,000万米ドルとなりました。

同市場は、2024年から2029年までに7.0%のCAGRで拡大し、2029年には707億2,000万米ドルに達すると予測されています。金属缶は、消費者と規制基準の両方を遵守しながら、賞味期限を延長する強力で改ざんを防止する包装を提供するために重要です。業界全体で広く使用されているこれらの缶は、炭酸飲料、ジュース、エネルギー飲料、アルコール飲料、缶詰の野菜、果物、スープ、ソース、調理済み食品など、さまざまな製品の包装に採用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象台数 | 金額、台数(10億個) |

| セグメント別 | 製造タイプ別、材料タイプ別、内圧度別、コーティングタイプ別、用途別、飲料缶容量別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋地域、南米、その他南米地域 |

エンドユーザーには、大規模食品製造会社、老舗飲料ブランド、新興クラフトビールメーカー、清涼飲料メーカー、利便性と持続可能性を優先する消費者が含まれます。市場の成長は、環境問題への懸念から100%リサイクル可能な缶への需要が高まっていること、軽量で持ち運び可能なパッケージングを好む消費者がいること、缶が汚染や腐敗から製品を保護する能力があることなどが要因となっています。

各国政府は、使い捨てプラスチック包装を阻止する規制をますます実施するようになっており、生産者とエンドユーザーを、リサイクルが容易でライフサイクルが長い金属缶のような、より環境に優しい代替品の採用に駆り立てています。消費者は、プラスチック汚染とその生態系への影響に対する懸念から、プラスチックよりも金属を積極的に選ぶようになっており、金属缶の需要を高めています。

金属缶は非常に環境に優しくリサイクル可能であり、さらに持続可能性に敏感なエンドユーザーは、環境保全への影響を最小限に抑えた包装ソリューションへの需要を促進しています。企業はカーボンフットプリントの縮小、リサイクル性の向上、よりエコロジカルな生産方法の導入に注力しています。軽量化技術の開発により、強度を犠牲にすることなく缶の製造に使用される金属量が削減され、コスト削減と環境に優しい影響の軽減に役立っています。

QRコード、拡張現実、センサーなどの新たなスマート技術が金属缶に組み合わされ、消費者の関心を高め、製品情報を提供し、鮮度を追跡します。生鮮食品/飲料の。さらに、リシーラブル缶、より簡単な開封機構、ユニークな缶の形状といったイノベーションが、包装の簡便性とバリエーションを高めています。

主要参入企業はクローズドループリサイクルシステムを導入しており、そこで使用済みの缶は再びリサイクルされます。ゼロ・ウェイスト運動もまた、生産と消費のすべての段階で廃棄物を削減する金属包装を設計するようメーカーを後押ししており、これは金属缶の設計とライフサイクル戦略に影響を及ぼしています。

当レポートでは、世界の食品・飲料用金属缶市場について調査し、製造タイプ別、材料タイプ別、内圧度別、コーティングタイプ別、用途別、飲料缶容量別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

第6章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 生成AIが食品・飲料用金属缶市場に与える影響

第7章 業界動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

第8章 食品・飲料用金属缶市場(製造タイプ別)

- イントロダクション

- 2ピース

- 3ピース

第9章 食品・飲料用金属缶市場(材料タイプ別)

- イントロダクション

- アルミ

- スチール

第10章 食品・飲料用金属缶市場(内圧度別)

- イントロダクション

- 真空缶

- 加圧缶

第11章 食品・飲料用金属缶市場(コーティングタイプ別)

- イントロダクション

- ホワイトベースコーティング

- 光沢のあるコーティング

第12章 食品・飲料用金属缶市場(用途別)

- イントロダクション

- 食品

- 飲料

第13章 食品・飲料用金属缶市場(飲料缶容量別)

- イントロダクション

- 100ミリリットル

- 150ミリリットル

- 200ミリリットル

- 310ミリリットル

- 330ミリリットル

- その他

第14章 食品・飲料用金属缶市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- タイ

- インドネシア

- 日本

- オーストラリアとニュージーランド

- その他

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第15章 競合情勢

- 概要

- 主要参入企業の戦略/有力企業

- 収益分析

- 主要企業の年間収益と成長率

- 主要企業のEBITDA

- 主要市場参入企業の世界的スナップショット

- 市場シェア分析、2023年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- CROWN HOLDINGS, INC.

- BALL CORPORATION

- ARDAGH GROUP

- CANPACK GROUP

- TOYO SEIKAN GROUP HOLDINGS, LTD.

- SILGAN HOLDINGS INC.

- CPMC HOLDINGS LIMITED

- CCL INDUSTRIES

- SHETRON GROUP

- KIAN JOO GROUP

- ENVASES

- UNIVERSAL CAN CORPORATION

- INDEPENDENT CAN COMPANY

- VISY

- MAUSER PACKAGING SOLUTIONS

- その他の企業

- P. WILKINSON CONTAINERS LTD.

- LAGEEN FOOD PACKAGING

- MASSILLY HOLDING S.A.S

- JAMESTRONG PACKAGING

- KINGCAN HOLDINGS LIMITED

- MULLER AND BAUER GMBH & CO. KG.

- HINDUSTAN TIN WORKS LIMITED

- VOBEV

- SCAN HOLDINGS

- ALNA PACKAGING CO. LTD.

第17章 隣接市場と関連市場

第18章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2020-2023

- TABLE 2 FOOD & BEVERAGE METAL CANS MARKET SHARE SNAPSHOT, 2024 VS. 2029 (USD BILLION)

- TABLE 3 IMPACT OF MACROECONOMIC FACTORS

- TABLE 4 SIGNIFICANT BEVERAGE COMPANY INVESTMENTS IN TWO-PIECE BEVERAGE CANS IN 2024

- TABLE 5 PACKAGING MATERIAL RECYCLING RATES FOR PAPER AND WOOD, 2017-2020

- TABLE 6 TOP 10 EXPORTERS OF HS CODE 731021, 2020-2023 (USD)

- TABLE 7 TOP 10 EXPORTERS OF HS CODE 731021, 2020-2023 (KG)

- TABLE 8 TOP 10 IMPORTERS OF HS CODE 731021, 2020-2023 (USD)

- TABLE 9 TOP 10 IMPORTERS OF HS CODE 731021, 2020-2023 (KG)

- TABLE 10 AVERAGE SELLING PRICE, BY FABRICATION TYPE, 2020-2023 (USD/UNIT)

- TABLE 11 AVERAGE SELLING PRICE, BY REGION, 2020-2023 (USD/UNIT)

- TABLE 12 FOOD & BEVERAGE METAL CANS MARKET: ECOSYSTEM

- TABLE 13 PATENTS PERTAINING TO FOOD & BEVERAGE METAL CANS, 2020-2024

- TABLE 14 KEY CONFERENCES & EVENTS IN FOOD & BEVERAGE METAL CANS MARKET, 2024-2025

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 FOOD & BEVERAGE METAL CANS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD & BEVERAGE METAL CANS

- TABLE 20 KEY BUYING CRITERIA FOR KEY METAL CAN APPLICATIONS

- TABLE 21 BEVERAGE CANS TO BE ESTHETICALLY APPEALING

- TABLE 22 BALL CORPORATION: AI INTEGRATION ENHANCING EFFICIENCY

- TABLE 23 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 24 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

- TABLE 25 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (BILLION UNITS)

- TABLE 26 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (BILLION UNITS)

- TABLE 27 2-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 28 2-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 29 2-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 30 2-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 31 3-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 32 3-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 33 3-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 34 3-PIECE: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 35 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (USD BILLION)

- TABLE 36 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (USD BILLION)

- TABLE 37 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (BILLION UNITS)

- TABLE 38 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (BILLION UNITS)

- TABLE 39 ALUMINUM: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 40 ALUMINUM: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 41 ALUMINUM: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 42 ALUMINUM: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 43 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 44 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 45 STEEL: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 46 STEEL: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 47 STEEL: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 48 STEEL: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 49 FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (USD BILLION)

- TABLE 50 FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (USD BILLION)

- TABLE 51 FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (BILLION UNITS)

- TABLE 52 FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (BILLION UNITS)

- TABLE 53 WHITE BASE COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 54 WHITE BASE COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 55 WHITE BASE COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 56 WHITE BASE COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 57 BRIGHT COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 58 BRIGHT COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 59 BRIGHT COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 60 BRIGHT COATING: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 61 FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 62 FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 63 FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 64 FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 65 FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 66 FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 67 FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 68 FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 69 FRUITS & VEGETABLES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 70 FRUITS AND VEGETABLES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 71 FRUITS & VEGETABLES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 72 FRUITS & VEGETABLES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 73 CONVENIENCE FOODS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 74 CONVENIENCE FOODS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 75 CONVENIENCE FOODS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 76 CONVENIENCE FOODS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 77 PET FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 78 PET FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 79 PET FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 80 PET FOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 81 MEAT & SEAFOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 82 MEAT & SEAFOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 83 MEAT & SEAFOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 84 MEAT & SEAFOOD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 85 OTHER FOOD PRODUCTS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 86 OTHER FOOD PRODUCTS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 87 OTHER FOOD PRODUCTS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 88 OTHER FOOD PRODUCTS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 89 BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 90 BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 91 BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 92 BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 93 ALCOHOLIC BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 94 ALCOHOLIC BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 95 ALCOHOLIC BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 96 ALCOHOLIC BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 97 CARBONATED SOFT DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 98 CARBONATED SOFT DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 99 CARBONATED SOFT DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 100 CARBONATED SOFT DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 101 SPORTS & ENERGY DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 102 SPORTS & ENERGY DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 103 SPORTS & ENERGY DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 104 SPORTS & ENERGY DRINKS: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 105 OTHER BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 106 OTHER BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 107 OTHER BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 108 OTHER BEVERAGES: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 109 FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE CAN CAPACITY, 2020-2023 (USD BILLION)

- TABLE 110 FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE CAN CAPACITY, 2024-2029 (USD BILLION)

- TABLE 111 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 112 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 113 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 114 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 115 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 116 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 117 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (BILLION UNITS)

- TABLE 118 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (BILLION UNITS)

- TABLE 119 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 120 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

- TABLE 121 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (BILLION UNITS)

- TABLE 122 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (BILLION UNITS)

- TABLE 123 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (USD BILLION)

- TABLE 124 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (USD BILLION)

- TABLE 125 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (BILLION UNITS)

- TABLE 126 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (BILLION UNITS)

- TABLE 127 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (USD BILLION)

- TABLE 128 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (USD BILLION)

- TABLE 129 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (BILLION UNITS)

- TABLE 130 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (BILLION UNITS)

- TABLE 131 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 132 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 133 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 134 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 135 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 136 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 137 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 138 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 139 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 140 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 141 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 142 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 143 US: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 144 US: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 145 US: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 146 US: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 147 CANADA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 148 CANADA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 149 CANADA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 150 CANADA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 151 MEXICO: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 152 MEXICO: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 153 MEXICO: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 154 MEXICO: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 155 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 156 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 157 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (BILLION UNITS)

- TABLE 158 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (BILLION UNITS)

- TABLE 159 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 160 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

- TABLE 161 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (BILLION UNITS)

- TABLE 162 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (BILLION UNITS)

- TABLE 163 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (USD BILLION)

- TABLE 164 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (USD BILLION)

- TABLE 165 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (BILLION UNITS)

- TABLE 166 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (BILLION UNITS)

- TABLE 167 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 168 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 169 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 170 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 171 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 172 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 173 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 174 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 175 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 176 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 177 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 178 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 179 CHINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 180 CHINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 181 CHINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 182 CHINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 183 INDIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 184 INDIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 185 INDIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 186 INDIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 187 THAILAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 188 THAILAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 189 THAILAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 190 THAILAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 191 INDONESIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 192 INDONESIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 193 INDONESIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 194 INDONESIA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 195 JAPAN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 196 JAPAN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 197 JAPAN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 198 JAPAN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 199 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 200 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 201 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 202 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 203 REST OF ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 204 REST OF ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 205 REST OF ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 206 REST OF ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 207 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 208 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 209 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (BILLION UNITS)

- TABLE 210 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (BILLION UNITS)

- TABLE 211 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 212 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

- TABLE 213 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (BILLION UNITS)

- TABLE 214 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (BILLION UNITS)

- TABLE 215 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (USD BILLION)

- TABLE 216 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (USD BILLION)

- TABLE 217 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (BILLION UNITS)

- TABLE 218 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (BILLION UNITS)

- TABLE 219 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (USD BILLION)

- TABLE 220 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (USD BILLION)

- TABLE 221 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (BILLION UNITS)

- TABLE 222 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (BILLION UNITS)

- TABLE 223 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 224 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 225 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 226 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 227 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 228 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 229 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 230 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 231 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 232 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 233 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 234 EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 235 GERMANY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 236 GERMANY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 237 GERMANY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 238 GERMANY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 239 UK: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 240 UK: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 241 UK: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 242 UK: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 243 FRANCE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 244 FRANCE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 245 FRANCE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 246 FRANCE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 247 SPAIN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 248 SPAIN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 249 SPAIN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 250 SPAIN: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 251 ITALY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 252 ITALY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 253 ITALY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 254 ITALY: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 255 REST OF EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 256 REST OF EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 257 REST OF EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 258 REST OF EUROPE: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 259 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 260 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 261 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2020-2023 (BILLION UNITS)

- TABLE 262 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COUNTRY, 2024-2029 (BILLION UNITS)

- TABLE 263 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 264 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

- TABLE 265 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (BILLION UNITS)

- TABLE 266 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (BILLION UNITS)

- TABLE 267 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (USD BILLION)

- TABLE 268 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (USD BILLION)

- TABLE 269 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (BILLION UNITS)

- TABLE 270 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (BILLION UNITS)

- TABLE 271 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (USD BILLION)

- TABLE 272 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (USD BILLION)

- TABLE 273 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (BILLION UNITS)

- TABLE 274 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (BILLION UNITS)

- TABLE 275 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 276 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 277 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 278 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 279 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 280 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 281 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 282 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 283 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 284 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 285 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 286 SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 287 BRAZIL: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 288 BRAZIL: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 289 BRAZIL: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 290 BRAZIL: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 291 ARGENTINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 292 ARGENTINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 293 ARGENTINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 294 ARGENTINA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 295 REST OF SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 296 REST OF SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 297 REST OF SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 298 REST OF SOUTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 299 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 300 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 301 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2020-2023 (BILLION UNITS)

- TABLE 302 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2024-2029 (BILLION UNITS)

- TABLE 303 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 304 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

- TABLE 305 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (BILLION UNITS)

- TABLE 306 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (BILLION UNITS)

- TABLE 307 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (USD BILLION)

- TABLE 308 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (USD BILLION)

- TABLE 309 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2020-2023 (BILLION UNITS)

- TABLE 310 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE, 2024-2029 (BILLION UNITS)

- TABLE 311 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (USD BILLION)

- TABLE 312 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (USD BILLION)

- TABLE 313 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2020-2023 (BILLION UNITS)

- TABLE 314 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE, 2024-2029 (BILLION UNITS)

- TABLE 315 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 316 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 317 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 318 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 319 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 320 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 321 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 322 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY FOOD SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 323 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (USD BILLION)

- TABLE 324 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (USD BILLION)

- TABLE 325 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2020-2023 (BILLION UNITS)

- TABLE 326 REST OF THE WORLD: FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGES SUBSEGMENT, 2024-2029 (BILLION UNITS)

- TABLE 327 MIDDLE EAST: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 328 MIDDLE EAST: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 329 MIDDLE EAST: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 330 MIDDLE EAST: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 331 AFRICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 332 AFRICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 333 AFRICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2020-2023 (BILLION UNITS)

- TABLE 334 AFRICA: FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION, 2024-2029 (BILLION UNITS)

- TABLE 335 STRATEGIES ADOPTED BY KEY PLAYERS IN FOOD & BEVERAGE METAL CANS MARKET

- TABLE 336 FOOD & BEVERAGE METAL CANS MARKET: INTENSITY OF COMPETITIVE RIVALRY (CONSOLIDATED)

- TABLE 337 FOOD & BEVERAGE METAL CANS MARKET: REGION FOOTPRINT

- TABLE 338 FOOD & BEVERAGE METAL CANS MARKET: TYPE FOOTPRINT

- TABLE 339 FOOD & BEVERAGE METAL CANS MARKET: APPLICATION FOOTPRINT

- TABLE 340 FOOD & BEVERAGE METAL CANS MARKET: KEY STARTUPS/SMES

- TABLE 341 FOOD & BEVERAGE METAL CANS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023

- TABLE 342 FOOD & BEVERAGE METAL CANS MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2024

- TABLE 343 FOOD & BEVERAGE METAL CANS MARKET: DEALS, JANUARY 2020-AUGUST 2024

- TABLE 344 FOOD & BEVERAGE METAL CANS MARKET: EXPANSIONS, JANUARY 2020-AUGUST 2024

- TABLE 345 FOOD & BEVERAGE METAL CANS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-AUGUST 2024

- TABLE 346 CROWN HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 347 CROWN HOLDINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 CROWN HOLDINGS, INC.: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 349 CROWN HOLDINGS, INC.: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 350 CROWN HOLDINGS, INC: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 351 BALL CORPORATION: COMPANY OVERVIEW

- TABLE 352 BALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 BALL CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 354 BALL CORPORATION: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 355 BALL CORPORATION: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 356 ARDAGH GROUP: COMPANY OVERVIEW

- TABLE 357 ARDAGH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 358 ARDAGH GROUP: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 359 ARDAGH GROUP: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 360 CANPACK GROUP: COMPANY OVERVIEW

- TABLE 361 CANPACK GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 CANPACK GROUP: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 363 TOYO SEIKAN GROUP HOLDINGS, LTD.: COMPANY OVERVIEW

- TABLE 364 TOYO SEIKAN GROUP HOLDINGS, LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 TOYO SEIKAN GROUP HOLDINGS, LTD: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 366 TOYO SEIKAN GROUP HOLDINGS, LTD: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 367 SILGAN HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 368 SILGAN HOLDINGS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 SILGAN HOLDINGS INC.: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 370 CPMC HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 371 CPMC HOLDINGS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 372 CPMC HOLDINGS LIMITED: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 373 CCL INDUSTRIES: COMPANY OVERVIEW

- TABLE 374 CCL INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 CCL INDUSTRIES: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 376 CCL INDUSTRIES: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 377 SHETRON GROUP: COMPANY OVERVIEW

- TABLE 378 SHETRON GROUP : PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 KIAN JOO GROUP: COMPANY OVERVIEW

- TABLE 380 KIAN JOO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 KIAN JOO GROUP: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 382 ENVASES: COMPANY OVERVIEW

- TABLE 383 ENVASES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 384 ENVASES: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 385 ENVASES: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 386 ENVASES: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 387 UNIVERSAL CAN CORPORATION: COMPANY OVERVIEW

- TABLE 388 UNIVERSAL CAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 INDEPENDENT CAN COMPANY: COMPANY OVERVIEW

- TABLE 390 INDEPENDENT CAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 391 VISY: COMPANY OVERVIEW

- TABLE 392 VISY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 MAUSER PACKAGING SOLUTIONS: COMPANY OVERVIEW

- TABLE 394 MAUSER PACKAGING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 395 MAUSER PACKAGING SOLUTIONS: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 396 MAUSER PACKAGING SOLUTIONS: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 397 P. WILKINSON CONTAINERS LTD.: COMPANY OVERVIEW

- TABLE 398 P. WILKINSON CONTAINERS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 399 LAGEEN FOOD PACKAGING: COMPANY OVERVIEW

- TABLE 400 LAGEEN FOOD PACKAGING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 401 MASSILLY HOLDING S.A.S: COMPANY OVERVIEW

- TABLE 402 MASSILLY HOLDING S.A.S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 403 JAMESTRONG PACKAGING: COMPANY OVERVIEW

- TABLE 404 JAMESTRONG PACKAGING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 405 KINGCAN HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 406 KINGCAN HOLDINGS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 407 MULLER AND BAUER GMBH & CO. KG.: COMPANY OVERVIEW

- TABLE 408 HINDUSTAN TIN WORKS LIMITED: COMPANY OVERVIEW

- TABLE 409 VOBEV: COMPANY OVERVIEW

- TABLE 410 SCAN HOLDINGS: COMPANY OVERVIEW

- TABLE 411 ALNA PACKAGING CO. LTD.: COMPANY OVERVIEW

- TABLE 412 ADJACENT MARKETS TO FOOD & BEVERAGE METAL CANS MARKET

- TABLE 413 BEVERAGE PACKAGING MARKET, BY PACKAGING TYPE, 2015-2018 (USD BILLION)

- TABLE 414 BEVERAGE PACKAGING MARKET, BY PACKAGING TYPE, 2019-2026 (USD BILLION)

- TABLE 415 FRESH FOOD PACKAGING MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 FOOD & BEVERAGE METAL CANS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF INTERVIEWS WITH EXPERTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 FOOD & BEVERAGE METAL CANS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 FOOD & BEVERAGE METAL CANS MARKET SIZE CALCULATION: SUPPLY-SIDE ANALYSIS

- FIGURE 6 FOOD & BEVERAGE METAL CANS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 2-PIECE CANS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 ALUMINUM CANS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 BRIGHT COATING SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 BEVERAGES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 13 GROWING TREND OF RTD BEVERAGES TO SIGNIFICANTLY DRIVE DEMAND IN US AND EUROPE

- FIGURE 14 US LARGEST CONSUMER IN NORTH AMERICA, DRIVEN BY HIGH DEMAND FOR SOFT DRINKS, ENERGY DRINKS, AND BEER

- FIGURE 15 US ESTIMATED TO ACCOUNT FOR LARGEST SHARE (BY VALUE) IN 2024

- FIGURE 16 2-PIECE FOOD & BEVERAGE METAL CANS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 ALUMINUM SEGMENT ESTIMATED TO DOMINATE MARKET IN 2024

- FIGURE 18 BRIGHT COATING SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 19 BEVERAGES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 ALUMINUM PRICE HISTORY

- FIGURE 21 FOOD & BEVERAGE METAL CANS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 ADOPTION OF GEN AI IN FOOD & BEVERAGE METAL CANS MARKET

- FIGURE 23 FOOD & BEVERAGE METAL CANS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 FOOD & BEVERAGE METAL CANS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF METAL CANS OF KEY PLAYERS, BY COATING TYPE, 2023 (USD/UNIT)

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY MATERIAL TYPE, 2020-2023 (USD/UNIT)

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/UNIT)

- FIGURE 28 KEY PLAYERS IN FOOD & BEVERAGE METAL CANS ECOSYSTEM

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 NUMBER OF PATENTS GRANTED BETWEEN 2014 AND 2024

- FIGURE 31 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FOOD & BEVERAGE METAL CANS MARKET, 2014-2024

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS: FOOD & BEVERAGE METAL CANS MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING METAL CANS FOR DIFFERENT APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP METAL CAN APPLICATIONS

- FIGURE 35 2-PIECE CANS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 ALUMINUM SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ALUMINUM: FOOD & BEVERAGE METAL CANS MARKET BY SUBSEGMENT, 2023 (VALUE)

- FIGURE 38 BRIGHT COATING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 BEVERAGES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 330 ML CAN CAPACITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 CHINA PROJECTED TO RECORD HIGHEST CAGR IN FOOD & BEVERAGE METAL CANS MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: FOOD & BEVERAGE METAL CANS MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 45 ANNUAL REVENUE, 2023 (USD BILLION) VS. REVENUE GROWTH, 2021-2023

- FIGURE 46 EBITDA, 2023 (USD BILLION)

- FIGURE 47 FOOD & BEVERAGE METAL CANS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2023

- FIGURE 48 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY KEY TYPE OF FOOD & BEVERAGE METAL CANS MARKET

- FIGURE 49 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 50 FOOD & BEVERAGE METAL CANS MARKET: COMPANY FOOTPRINT

- FIGURE 51 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- FIGURE 52 CROWN HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 53 BALL CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 ARDAGH GROUP: COMPANY SNAPSHOT

- FIGURE 55 TOYO SEIKAN GROUP HOLDINGS, LTD.: COMPANY SNAPSHOT

- FIGURE 56 SILGAN HOLDINGS INC.: COMPANY SNAPSHOT

- FIGURE 57 CPMC HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 58 CCL INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 59 SHETRON GROUP: COMPANY SNAPSHOT

- FIGURE 60 KIAN JOO GROUP: COMPANY SNAPSHOT

The food and beverage metal cans market is estimated at USD 50.42 billion in 2024 and is projected to reach USD 70.72 billion by 2029, at a CAGR of 7.0% from 2024 to 2029. Metal cans are crucial for providing strong, tamper-evident packaging that extends shelf life while adhering to both consumer and regulatory standards. Widely used across the industry, these cans are employed for packaging a variety of products, including carbonated drinks, juices, energy drinks, alcoholic beverages, as well as canned vegetables, fruits, soups, sauces, and ready-to-eat meals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value, Volume (Bn Units) |

| Segments | By Application, Degree of Internal Pressure, Material Type, Fabrication Type, Coating Type, Beverage Can Capacity, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America and Rest of the World |

End-users encompass large-scale food manufacturing companies, well-established beverage brands, emerging craft brewers, soft drink producers, and consumers who prioritize convenience and sustainability. The market's growth is driven by factors such as the rising demand for 100% recyclable cans due to environmental concerns, consumer preference for lightweight and portable packaging, and the cans' ability to protect products from contamination and spoilage.

Disruption in the Metal Can Packaging market: Governments are increasingly implementing regulations that daunt single-use plastic packaging, driving producers and end users to adopt more eco-friendly substitutes like metal cans, which are easier to recycle and have a longer life cycle. Consumers are actively choosing metal over plastic due to concerns over plastic contamination and its ecological impact, enhancing demand for metal cans.

Sustianable and Eco- friendly Packagying - Metal cans are highly eco-friendly/ recyclable, and moreover the sustainability-conscious end users are driving demand for packaging solutions with minimum conservation impact. Companies are focusing on shrinking carbon footprints, enhancing recyclability, and accepting more ecological production methods. Developments in lightweight technology are lowering the amount of metal used in can production without negotiating strength, helping to cut costs and reducing the eco-friendly impact.

Innovation in Can Design and Functionality - Emerging smart technologies, such as QR codes, augmented reality, and sensors, are being combined into metal cans to augment consumer engagements, and provide product information, and track freshness. Of the perishable food/ beverage. Additionally, innovations like resealable cans, easier opening mechanisms, and unique can shapes are providing enhanced ease and variation in the packagying.

Circular Economy & Zero-Waste Initiatives - Major Players are implementing closed-loop recycling systems, where used cans are recycled again, and thus the reducing the need for virgin materials and supporting a circular economy model. Zero-waste movements are also pushing manufacturers to design metal packaging that reduces waste at all stages of production and consumption, which is influencing metal can design and life cycle strategies.

"Aluminum cans gaining rapid popularity in the food and beverage metal cans market across the globe and is forecasted to have largest market share in terms of value."

Aluminum beverage cans are sustainable, functional, and boast a modern design. They house a variety of beverages under pull tabs or screw tops and are the only beverage containers that can be infinitely recycled. Lightweight and easy to stack, aluminum cans are highly efficient for shipping and storage.

These cans chill beverages quickly, offer an excellent 360-degree surface for labeling, and-most importantly-preserve flavor and freshness. The future of sustainable beverage packaging is rooted in aluminum.

"By application, beverage in the food and beverage metal cans market across the globe and is forecasted to have largest market share "

Beverage cans are entirely recyclable, allowing for sustainable packaging that can be continuously reprocessed without compromising performance or quality. Their lightweight and durable nature makes them ideal for active lifestyles, providing a dependable option with minimal risk of breakage. Additionally, these cans come in a variety of sizes, shapes, and decoration options, enabling brands to express their unique identity through custom-printed designs, which helps consumers connect with the brands they prefer.

"US to grow at the highest CAGR for North America authentication and brand protection market"

The United States is witnessing the highest growth rate in the authentication and brand protection market, driven by several key factors. The presence of major industry players, along with a substantial customer base, significantly contributes to this growth. Advancements in authentication and brand protection technologies are also fueling market expansion. Furthermore, the implementation of stringent regulations to combat counterfeiting activities has been instrumental in fostering the market's development in the country.

The break-up of the profile of primary participants in the food and beverage metal cans market:

- By Company: Tier 1- 40.0%, Tier 2- 20.0% and Tier 3- 40.0%.

- By Designation: CXO's: 26.0%, Managers: 30.0% and Executives: 44.0%

- By Region: North America - 20.0%, Europe - 20.0%, Asia Pacific - 40.0%, South America - 10.0% and RoW - 10.0%

Key Market Players

Key players operating in the food and beverage metal cans market include Crown Holdings, Inc (US), Ball Corporation (US), Silgan Holdings Inc. (US), Ardagh Group (Luxembourg), CCL Industries (US), CAN-PACK S.A (Poland), Kian-Joo Group (Malaysia), CPMC Holdings (China), Envases Group (Spain), and Toyo Seikan Group Holdings, Ltd. (Japan).

Research Coverage:

This research report categorizes the food and beverage metal cans market By Application, By Degree of Internal Pressure, By Material Type, By Fabrication Type, By Coating Type, By Beverage Can Capacity and region (North America, Europe, Asia Pacific, South America, and the Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the food and beverage metal cans market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products and services; key strategies; contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the food and beverage metal cans market. Competitive analysis of upcoming startups in the food and beverage metal cans market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall food and beverage metal cans market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Recyclable properties of metal cans, High nutritional value, extended shelf life, and low prices of canned foods, convenience factors spurring innovations in can manufacturing, growing importance of sustainability among customers), restraints (Stringent government regulations, move towards alternative packing options), opportunities (Growing on-the-go snacking trends and portable nature of metal cans, emerging economies offer high growth potential), and challenges (High usage of plastic packaging due to lower cost, growth in the trend of biodegradable packaging, raw material availability and tarrifs) influencing the growth of the food and beverage metal cans market.

- Product Development/Innovation: Detailed insights on research & development activities, and new product & service launches in the food and beverage metal cans market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the food and beverage metal cans market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the food and beverage metal cans market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Key players operating in the food and beverage metal cans market include Crown Holdings, Inc (US), Ball Corporation (US), Silgan Holdings Inc. (US), Ardagh Group (Luxembourg), CCL Industries (US), CAN-PACK S.A (Poland), Kian-Joo Group (Malaysia), CPMC Holdings (China), Envases Group (Spain), and Toyo Seikan Group Holdings, Ltd. (Japan) among others in the food and beverage metal cans market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOOD & BEVERAGE METAL CANS MARKET

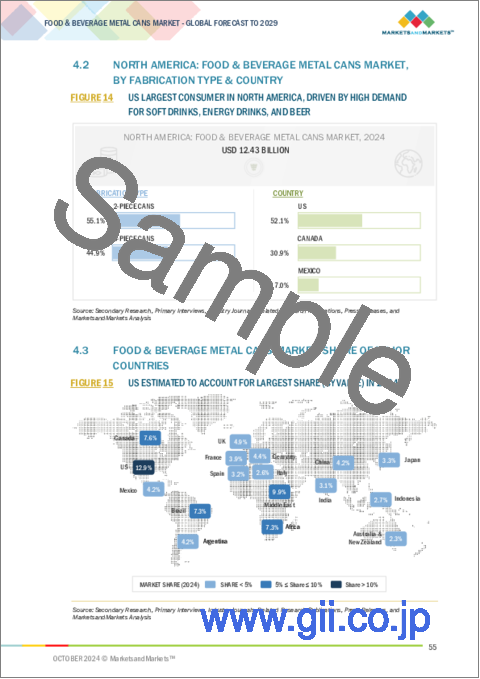

- 4.2 NORTH AMERICA: FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE & COUNTRY

- 4.3 FOOD & BEVERAGE METAL CANS MARKET: SHARE OF MAJOR COUNTRIES

- 4.4 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE AND REGION

- 4.5 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL AND REGION

- 4.6 FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE AND REGION

- 4.7 FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW

6 MARKET OVERVIEW

- 6.1 INTRODUCTION

- 6.2 MACROECONOMIC INDICATORS

- 6.2.1 GLOBALLY INCREASING URBAN POPULATION

- 6.2.2 RAW MATERIAL COST

- 6.2.3 ENVIRONMENTAL REGULATIONS

- 6.2.4 SUSTAINABILITY TRENDS

- 6.3 MARKET DYNAMICS

- 6.3.1 DRIVERS

- 6.3.1.1 Rising demand for two-piece beverage cans due to superior functionality and cost-efficiency

- 6.3.1.2 Growing inclination toward lightweight and durable metal cans

- 6.3.1.3 Retainment of nutritional value, extension of shelf life, and low prices of canned foods

- 6.3.1.4 Demand for convenience foods spurring innovations in can manufacturing

- 6.3.2 RESTRAINTS

- 6.3.2.1 Stringent government regulations

- 6.3.2.2 Consumer shift toward alternative options for packaging

- 6.3.3 OPPORTUNITIES

- 6.3.3.1 Growing on-the-go snacking trends and portability of metal cans

- 6.3.3.2 Increasing awareness regarding sustainable printing and coating solutions

- 6.3.4 CHALLENGES

- 6.3.4.1 Rising trend of biodegradable packaging

- 6.3.4.2 High usage of plastic packaging due to lower cost

- 6.3.4.3 Declining aluminium can recycling rates in US

- 6.3.1 DRIVERS

- 6.4 IMPACT OF GEN AI ON FOOD & BEVERAGE METAL CANS MARKET

- 6.4.1 USE OF GEN AI IN FOOD & BEVERAGE METAL CANS MARKET

7 INDUSTRY TRENDS

- 7.1 INTRODUCTION

- 7.2 SUPPLY CHAIN ANALYSIS

- 7.3 VALUE CHAIN ANALYSIS

- 7.3.1 RESEARCH AND PRODUCT DEVELOPMENT

- 7.3.2 RAW MATERIAL SOURCING

- 7.3.3 PRODUCTION AND PROCESSING

- 7.3.4 DISTRIBUTION

- 7.3.5 MARKETING AND SALES

- 7.3.6 END USER

- 7.4 TRADE ANALYSIS

- 7.4.1 EXPORT SCENARIO RELATED TO HS CODE 731021-COMPLIANT PRODUCTS

- 7.4.1.1 Export scenario of metal cans related to food & beverages

- 7.4.2 IMPORT SCENARIO RELATED TO HS CODE 731021-COMPLIANT PRODUCTS

- 7.4.2.1 Import scenario of metal cans related to food & beverages

- 7.4.1 EXPORT SCENARIO RELATED TO HS CODE 731021-COMPLIANT PRODUCTS

- 7.5 TECHNOLOGY ANALYSIS

- 7.5.1 IOT IN PACKAGING INDUSTRY

- 7.5.2 NANOTECHNOLOGY IN FOOD PACKAGING INDUSTRY

- 7.6 PRICING ANALYSIS

- 7.6.1 AVERAGE SELLING PRICE TREND OF METAL CANS OF KEY PLAYERS, BY COATING TYPE

- 7.6.2 AVERAGE SELLING PRICE TREND, BY FABRICATION TYPE

- 7.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 7.7 ECOSYSTEM ANALYSIS

- 7.7.1 DEMAND SIDE

- 7.7.2 SUPPLY SIDE

- 7.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 7.9 PATENT ANALYSIS

- 7.10 KEY CONFERENCES & EVENTS, 2024-2025

- 7.11 TARIFF AND REGULATORY LANDSCAPE

- 7.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.11.2 FOOD & BEVERAGE METAL CANS REGULATIONS IN NORTH AMERICA

- 7.11.2.1 US

- 7.11.2.2 Canada

- 7.11.3 FOOD & BEVERAGE METAL CANS REGULATIONS IN EUROPE

- 7.11.4 FOOD & BEVERAGE METAL CANS REGULATIONS IN ASIA PACIFIC

- 7.11.4.1 China

- 7.11.4.2 India

- 7.12 PORTER'S FIVE FORCES ANALYSIS

- 7.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 7.12.2 BARGAINING POWER OF SUPPLIERS

- 7.12.3 BARGAINING POWER OF BUYERS

- 7.12.4 THREAT OF SUBSTITUTES

- 7.12.5 THREAT OF NEW ENTRANTS

- 7.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 7.13.1 KEY STAKEHOLDERS AND BUYING PROCESS

- 7.13.2 BUYING CRITERIA

- 7.14 CASE STUDY ANALYSIS

- 7.14.1 BEVERAGE CANS TO BE ESTHETICALLY APPEALING

- 7.14.2 BALL CORPORATION: AI INTEGRATION ENHANCING EFFICIENCY

8 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE

- 8.1 INTRODUCTION

- 8.2 2-PIECE

- 8.2.1 GROWING DEMAND FOR BEVERAGES AND CONVENIENCE FOODS TO DRIVE MARKET

- 8.3 3-PIECE

- 8.3.1 RISING DEMAND DUE TO VERSATILITY AND ENHANCED PRODUCT PROTECTION TO BOOST MARKET

9 FOOD & BEVERAGE METAL CANS MARKET, BY MATERIAL TYPE

- 9.1 INTRODUCTION

- 9.2 ALUMINUM

- 9.2.1 SUPERIOR FORMABILITY AND WORKABILITY, ALONG WITH RECYCLABILITY, TO PROPEL MARKET

- 9.2.2 STANDARD GRADE ALUMINUM

- 9.2.3 HIGH-STRENGTH ALUMINUM

- 9.3 STEEL

- 9.3.1 STRENGTH, DURABILITY, AND EXCELLENT BARRIER PROPERTIES TO BOOST MARKET

- 9.3.2 TIN-PLATED STEEL

- 9.3.3 TIN-FREE STEEL

10 FOOD & BEVERAGE METAL CANS MARKET, BY DEGREE OF INTERNAL PRESSURE

- 10.1 INTRODUCTION

- 10.2 VACUUM CANS

- 10.2.1 PRESERVATION OF FRESHNESS AND QUALITY OF CONTENTS TO BOOST MARKET

- 10.3 PRESSURIZED CANS

- 10.3.1 EFFICIENT, CONTROLLED DISPENSING, ENABLING EASE OF PRODUCT USE TO PROPEL MARKET

11 FOOD & BEVERAGE METAL CANS MARKET, BY COATING TYPE

- 11.1 INTRODUCTION

- 11.2 WHITE BASE COATING

- 11.2.1 ECO-FRIENDLY, COST-EFFICIENT COATINGS ENABLING DURABILITY AND ENHANCED PRINTABILITY TO DRIVE MARKET

- 11.3 BRIGHT COATING

- 11.3.1 ESTHETIC PRESENTATION AND ENHANCED BRAND VISIBILITY TO DRIVE MARKET

12 FOOD & BEVERAGE METAL CANS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 FOOD

- 12.2.1 FRUITS & VEGETABLES

- 12.2.1.1 Maintenance of freshness and nutritional quality to boost market

- 12.2.2 CONVENIENCE FOODS

- 12.2.2.1 Portability due to metal cans to drive market

- 12.2.3 PET FOOD

- 12.2.3.1 Demand for premium, high-quality food products to boost market

- 12.2.4 MEAT & SEAFOOD

- 12.2.4.1 Preservation of quality, taste, and texture to propel market

- 12.2.5 OTHER FOOD PRODUCTS

- 12.2.1 FRUITS & VEGETABLES

- 12.3 BEVERAGES

- 12.3.1 ALCOHOLIC BEVERAGES

- 12.3.1.1 Maintenance of taste, quality, and freshness to drive market

- 12.3.2 CARBONATED SOFT DRINKS

- 12.3.2.1 Superior carbonation retention, preservation of fizzy texture, and enhanced taste to drive market

- 12.3.3 SPORTS & ENERGY DRINKS

- 12.3.3.1 Protection by maintaining product integrity and quality to propel market

- 12.3.4 OTHER BEVERAGES

- 12.3.1 ALCOHOLIC BEVERAGES

13 FOOD & BEVERAGE METAL CANS MARKET, BY BEVERAGE CAN CAPACITY

- 13.1 INTRODUCTION

- 13.2 100 ML

- 13.2.1 COMPACT SIZE FOR ON-THE-GO LIFESTYLES AND HEALTH-CONSCIOUS CONSUMERS TO DRIVE DEMAND

- 13.3 150 ML

- 13.3.1 SLEEK DESIGN, ELEGANT BRANDING, AND ENHANCED PERCEPTION OF LUXURY AND ESTHETICS TO BOOST DEMAND

- 13.4 200 ML

- 13.4.1 FAVORED CHOICE AMONG FAMILIES AND HEALTH-CONSCIOUS CONSUMERS TO DRIVE DEMAND

- 13.5 310 ML

- 13.5.1 GROWING TREND TOWARD HEALTHIER BEVERAGE OPTIONS TO PROPEL MARKET GROWTH

- 13.6 330 ML

- 13.6.1 VERSATILITY FOR WIDE RANGE OF BEVERAGES TO PROPEL MARKET

- 13.7 OTHER CAN CAPACITIES

14 FOOD & BEVERAGE METAL CANS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Significant production of processed food and beverages relying on metal packaging to boost market

- 14.2.2 CANADA

- 14.2.2.1 Regulations for sustainable packaging to create new opportunities for market players

- 14.2.3 MEXICO

- 14.2.3.1 Boom in beer production to fuel market

- 14.2.1 US

- 14.3 ASIA PACIFIC

- 14.3.1 CHINA

- 14.3.1.1 Rising international demand for canned food to drive market

- 14.3.2 INDIA

- 14.3.2.1 Population growth and rising disposable incomes to drive market expansion

- 14.3.3 THAILAND

- 14.3.3.1 Booming beverage and packaged food sectors to drive market

- 14.3.4 INDONESIA

- 14.3.4.1 Changing consumer preferences toward convenience and longer shelf-life products to boost market

- 14.3.5 JAPAN

- 14.3.5.1 Government emphasis on flexible and eco-friendly packaging to boost market

- 14.3.6 AUSTRALIA & NEW ZEALAND

- 14.3.6.1 Emphasis on use of recyclable materials for food & beverage packaging to drive market

- 14.3.7 REST OF ASIA PACIFIC

- 14.3.1 CHINA

- 14.4 EUROPE

- 14.4.1 GERMANY

- 14.4.1.1 Transition from glass and plastic packaging to metal packaging to boost market

- 14.4.2 UK

- 14.4.2.1 Rising customer demand and exports to drive demand

- 14.4.3 FRANCE

- 14.4.3.1 Significant food & beverage industry to drive growth

- 14.4.4 SPAIN

- 14.4.4.1 Large alcoholic and non-alcoholic beverage industries to boost market

- 14.4.5 ITALY

- 14.4.5.1 Export of processed food to fuel market growth

- 14.4.6 REST OF EUROPE

- 14.4.1 GERMANY

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Rising demand for packaged food to boost market

- 14.5.2 ARGENTINA

- 14.5.2.1 Extension of shelf life of food & beverages through packaging to propel market

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD (ROW)

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Increasing consumer preference for canned carbonated and non-carbonated beverages to fuel market

- 14.6.2 AFRICA

- 14.6.2.1 Rapid urbanization and shifting consumer preferences toward sports and energy drinks to drive market growth

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH

- 15.5 KEY PLAYERS' EBITDA

- 15.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 15.7 MARKET SHARE ANALYSIS, 2023

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 15.9.1 STARS

- 15.9.2 EMERGING LEADERS

- 15.9.3 PERVASIVE PLAYERS

- 15.9.4 PARTICIPANTS

- 15.9.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 15.9.5.1 Company footprint

- 15.9.5.2 Region footprint

- 15.9.5.3 Product type footprint

- 15.9.5.4 Application footprint

- 15.10 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 15.10.1 PROGRESSIVE COMPANIES

- 15.10.2 RESPONSIVE COMPANIES

- 15.10.3 DYNAMIC COMPANIES

- 15.10.4 STARTING BLOCKS

- 15.10.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 15.10.5.1 Detailed list of key startups/SMEs

- 15.10.5.2 Competitive benchmarking of key startups/SMEs

- 15.11 COMPETITIVE SCENARIO

- 15.11.1 PRODUCT LAUNCHES

- 15.11.2 DEALS

- 15.11.3 EXPANSIONS

- 15.11.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 CROWN HOLDINGS, INC.

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.3.2 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 BALL CORPORATION

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 ARDAGH GROUP

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 CANPACK GROUP

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Deals

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 TOYO SEIKAN GROUP HOLDINGS, LTD.

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 SILGAN HOLDINGS INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.4 MnM view

- 16.1.6.4.1 Right to win

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 CPMC HOLDINGS LIMITED

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Expansions

- 16.1.7.4 MnM view

- 16.1.8 CCL INDUSTRIES

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.3.2 Deals

- 16.1.8.4 MnM view

- 16.1.9 SHETRON GROUP

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 MnM view

- 16.1.10 KIAN JOO GROUP

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.10.4 MnM view

- 16.1.11 ENVASES

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Expansions

- 16.1.11.4 MnM view

- 16.1.12 UNIVERSAL CAN CORPORATION

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 MnM view

- 16.1.13 INDEPENDENT CAN COMPANY

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 MnM view

- 16.1.14 VISY

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 MnM view

- 16.1.15 MAUSER PACKAGING SOLUTIONS

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Deals

- 16.1.15.3.2 Expansions

- 16.1.15.4 MnM view

- 16.1.1 CROWN HOLDINGS, INC.

- 16.2 OTHER PLAYERS

- 16.2.1 P. WILKINSON CONTAINERS LTD.

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 MnM view

- 16.2.2 LAGEEN FOOD PACKAGING

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 MnM view

- 16.2.3 MASSILLY HOLDING S.A.S

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 MnM view

- 16.2.4 JAMESTRONG PACKAGING

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 MnM view

- 16.2.5 KINGCAN HOLDINGS LIMITED

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 MnM view

- 16.2.6 MULLER AND BAUER GMBH & CO. KG.

- 16.2.7 HINDUSTAN TIN WORKS LIMITED

- 16.2.8 VOBEV

- 16.2.9 SCAN HOLDINGS

- 16.2.10 ALNA PACKAGING CO. LTD.

- 16.2.1 P. WILKINSON CONTAINERS LTD.

17 ADJACENT AND RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.3 BEVERAGE PACKAGING MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.4 FRESH FOOD PACKAGING MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 MARKET OVERVIEW

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS