|

|

市場調査レポート

商品コード

1675364

食肉代替品の世界市場レポート:タイプ、供給源、カテゴリー、流通チャネル、地域別(2025年~2033年)Meat Substitutes Market Report by Type (Tofu & Tofu Ingredients, Tempeh, Textured Vegetable Protein, Seitan, Quorn, and Others), Source, Category, Distribution Channel, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 食肉代替品の世界市場レポート:タイプ、供給源、カテゴリー、流通チャネル、地域別(2025年~2033年) |

|

出版日: 2025年03月01日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界の食肉代替品の市場規模は、2024年に73億米ドルに達しました。IMARC Groupは、2025年~2033年の成長率(CAGR)は5.56%で、2033年には119億米ドルに達すると予測しています。市場を牽引している要因には、健康と栄養に関する個人の意識の高まり、動物福祉に関する倫理的配慮への関心の高まり、個人の持続可能性と環境への懸念など、さまざまなものがあります。

代替肉は、主に豆類、穀物、菌類などの植物性原料を利用して、動物性肉の味、食感、栄養プロファイルを再現するように設計された製品です。メーカー各社は、3Dプリントや細胞農業のような先端技術を採用し、従来の食肉に酷似した代用食肉を製造しています。持続可能性に重点を置いたこれらの製品は、動物性食品と比較してカーボンフットプリント、水の使用量、土地の必要量が少ないのが一般的です。さらに、代用肉はヴィーガン、ベジタリアン、フレキシタリアンなど多様な食生活のニーズに対応するため、消費者の裾野が広がっています。これらの製品はハンバーガー、ソーセージ、ナゲットなど様々な形態があり、スーパーマーケット、専門店、オンラインプラットフォームで入手できます。その結果、健康意識の高まり、環境問題、動物福祉に関する倫理的配慮から、代替肉は大衆の間で支持を集めています。

急速なグローバリゼーションと国際的な料理に接する機会の増加による食の嗜好の多様化は、予測期間中の食肉代替品市場の成長を刺激すると思われます。人々が食の選択肢を試してみようとする傾向が強まるにつれて、多用途で斬新な植物性製品に対する需要が高まります。さらに、植物由来製品のベンチャー企業に対する助成金や奨励金など、持続可能な農業や食品生産方法を奨励する政府の支援や規制の変更が増加していることも、市場の成長に寄与しています。こうした規制の仕組みにより、食肉代替品メーカーは事業を拡大し、より幅広い顧客層を獲得しやすくなっています。加えて、細胞農業や食品3Dプリントなどの食品技術の進歩が進んでいるため、従来の食肉と実質的に見分けがつかない製品の開発が可能になり、主流消費者の間でさらに受け入れが拡大しています。これに加え、経済的要因も極めて重要な役割を果たしています。特に動物性食品に偏った食生活に伴う長期的なヘルスケア費用を考慮すると、代替肉は長期的に費用対効果が高いと見なされるようになってきているからです。さらに、ソーシャルメディアの影響力の高まりや、植物由来の食生活を提唱する有名人の支持は、世論や購買行動に影響を与え、市場の成長を後押ししています。

食肉代替品市場の動向/促進要因:

健康・栄養意識の高まり

植物性タンパク質を豊富に含むバランスの取れた食事の利点に対する意識の高まりは、食肉代替品市場を前進させる重要な要因の一つです。コレステロール値の上昇や心血管疾患など、肉の大量消費に伴う健康への悪影響に対する消費者の意識が高まるにつれ、より健康的な代替食品への需要が高まり続けています。代用肉は通常、必須アミノ酸、ビタミン、ミネラルを提供する一方で、飽和脂肪酸は少なく、コレステロールはゼロです。健康と予防ヘルスケアへの関心の高まりは、特にミレニアル世代とZ世代の間で顕著であり、彼らは長期的な健康利益のためにライフスタイルの変化を積極的に取り入れています。その結果、健康と栄養に対する意識の高まりが、食肉代替品市場拡大の起爆剤となっています。

倫理的配慮の増加

動物福祉に関連する倫理的配慮が大衆の間で著しく高まっていることも、食肉代替品市場の成長を後押しする重要な要因となっています。畜産はしばしば、非人道的な処理や大量生産にまつわる倫理的ジレンマに懸念を抱かせます。その結果、従来の動物性食品に代わる、残酷な扱いのない食品を選ぶ人が増えています。アクティビズム、ドキュメンタリー、動物福祉に関する言説の増加は、この倫理的覚醒にさらに拍車をかけています。このような世界の変化は消費者の行動に影響を与え、メーカーは食肉代替品のような倫理的な選択肢を提供せざるを得なくなり、市場の成長に寄与しています。

環境への関心の高まり

持続可能性と環境保全も、食肉代替品の成長を刺激する主な要因です。伝統的な畜産は、森林破壊、温室効果ガスの排出、過剰な水の使用など、重大な環境問題に関連しています。一方、植物由来の代替食品は環境への影響がかなり低いです。気候変動と資源保護が世界の議論の中で注目され続ける中、持続可能な食料生産の必要性が急務となっています。食肉代替品市場は、環境に優しく、資源効率に優れた製品を提供することで、この高まる懸念に効果的に応え、持続可能な未来に向けた現実的な解決策となっています。

目次

第1章 序文

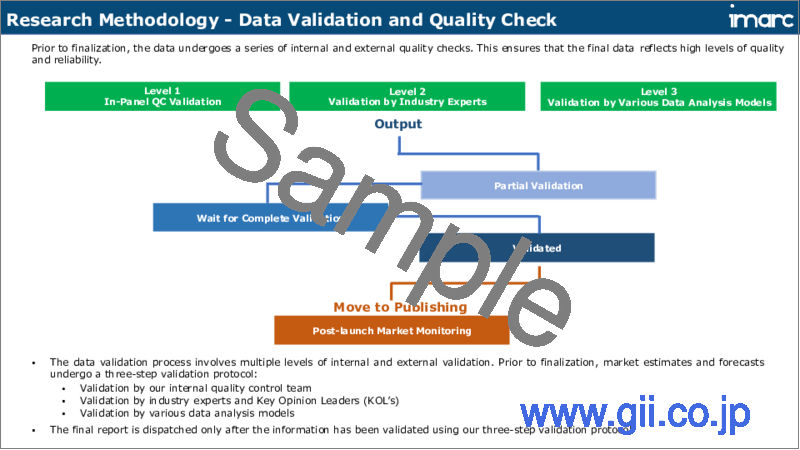

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の食肉代替品市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:タイプ別

- 市場内訳:供給源別

- 市場内訳:カテゴリー別

- 市場内訳:流通チャネル別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:タイプ別

- 豆腐と豆腐用材料

- テンペ

- テクスチャード植物性タンパク質(TVP)

- セイタン

- クォーン

- その他

第7章 市場内訳:供給源別

- 大豆

- 小麦

- マイコプロテイン

- その他

第8章 市場内訳:カテゴリー別

- 冷凍

- 冷蔵

- 常温保存可能

第9章 市場内訳:流通チャネル別

- スーパーマーケットとハイパーマーケット

- 健康食品店

- コンビニエンスストア

- その他

第10章 市場内訳:地域別

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- ラテンアメリカ

第11章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第14章 価格分析

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- The Nisshin Oillio Group

- Dupont

- Archer Daniels Midland

- Amy's Kitchen

- Conagra Brands

- Quorn Foods

- Cauldron Foods

- Campbell Soup Company

- VBites

- Blue Chip Group

- Field Roast

- Garden Protein International

- LightLife

- Sweet Earth Foods

- MGP Ingredients

- Tofurky

- Meatless

- Sonic Biochem Limited

List of Figures

- Figure 1: Global: Meat Substitutes Market: Major Drivers and Challenges

- Figure 2: Global: Meat Substitutes Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Meat Substitutes Market: Breakup by Type (in %), 2024

- Figure 4: Global: Meat Substitutes Market: Breakup by Source (in %), 2024

- Figure 5: Global: Meat Substitutes Market: Breakup by Category (in %), 2024

- Figure 6: Global: Meat Substitutes Market: Breakup by Distribution Channel (in %), 2024

- Figure 7: Global: Meat Substitutes Market: Breakup by Region (in %), 2024

- Figure 8: Global: Meat Substitutes Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 9: Global: Meat Substitutes Industry: SWOT Analysis

- Figure 10: Global: Meat Substitutes Industry: Value Chain Analysis

- Figure 11: Global: Meat Substitutes Industry: Porter's Five Forces Analysis

- Figure 12: Global: Meat Substitutes (Tofu & Tofu Ingredients) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Meat Substitutes (Tofu & Tofu Ingredients) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Meat Substitutes (Tempeh) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Meat Substitutes (Tempeh) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Meat Substitutes (Textured Vegetable Protein) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Meat Substitutes (Textured Vegetable Protein) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Meat Substitutes (Seitan) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Meat Substitutes (Seitan) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Meat Substitutes (Quorn) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Meat Substitutes (Quorn) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Meat Substitutes (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Meat Substitutes (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Meat Substitutes (Soy) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Meat Substitutes (Soy) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Meat Substitutes (Wheat) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Meat Substitutes (Wheat) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Meat Substitutes (Mycoprotein) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Meat Substitutes (Mycoprotein) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Meat Substitutes (Other Sources) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Meat Substitutes (Other Sources) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Meat Substitutes (Frozen) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Meat Substitutes (Frozen) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Meat Substitutes (Refrigerated) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Meat Substitutes (Refrigerated) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Global: Meat Substitutes (Shelf-Stable) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Global: Meat Substitutes (Shelf-Stable) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Global: Meat Substitutes Market: Sales through Supermarkets and Hypermarkets (in Million USD), 2019 & 2024

- Figure 39: Global: Meat Substitutes Market Forecast: Sales through Supermarkets and Hypermarkets (in Million USD), 2025-2033

- Figure 40: Global: Meat Substitutes Market: Sales through Health and Food Stores (in Million USD), 2019 & 2024

- Figure 41: Global: Meat Substitutes Market Forecast: Sales through Health and Food Stores (in Million USD), 2025-2033

- Figure 42: Global: Meat Substitutes Market: Sales through Convenience Stores (in Million USD), 2019 & 2024

- Figure 43: Global: Meat Substitutes Market Forecast: Sales through Convenience Stores (in Million USD), 2025-2033

- Figure 44: Global: Meat Substitutes Market: Sales through Other Distribution Channels (in Million USD), 2019 & 2024

- Figure 45: Global: Meat Substitutes Market Forecast: Sales through Other Distribution Channels (in Million USD), 2025-2033

- Figure 46: Asia Pacific: Meat Substitutes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Asia Pacific: Meat Substitutes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Europe: Meat Substitutes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Europe: Meat Substitutes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: North America: Meat Substitutes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: North America: Meat Substitutes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Middle East and Africa: Meat Substitutes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Middle East and Africa: Meat Substitutes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Latin America: Meat Substitutes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Latin America: Meat Substitutes Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

- Table 1: Global: Meat Substitutes Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Meat Substitutes Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Meat Substitutes Market Forecast: Breakup by Source (in Million USD), 2025-2033

- Table 4: Global: Meat Substitutes Market Forecast: Breakup by Category (in Million USD), 2025-2033

- Table 5: Global: Meat Substitutes Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

- Table 6: Global: Meat Substitutes Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 7: Global: Meat Substitutes Market Structure

- Table 8: Global: Meat Substitutes Market: Key Players

The global meat substitutes market size reached USD 7.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.56% during 2025-2033. There are various factors that are driving the market, which include the rising awareness among individuals about health and nutrition, increasing focus on ethical considerations related to animal welfare, and sustainability and environmental concerns among individuals.

Meat substitutes are products designed to replicate the taste, texture, and nutritional profile of animal-based meat, primarily utilizing plant-based ingredients such as legumes, grains, and fungi. Manufacturers are employing advanced technologies like 3D printing and cellular agriculture to produce meat substitutes that closely mimic traditional meat. With a focus on sustainability, these products typically have a lower carbon footprint, water usage, and land requirement compared to their animal-based counterparts. Moreover, meat substitutes cater to diverse dietary needs, including vegan, vegetarian, and flexitarian diets, thus widening their consumer base. These products come in various forms such as burgers, sausages, and nuggets, and are available across supermarkets, specialty stores, and online platforms. As a result, meat substitutes are gaining traction among the masses due to rising health awareness, environmental concerns, and ethical considerations related to animal welfare.

The diversification of culinary preferences, fueled by rapid globalization and increased exposure to international cuisines, will stimulate the growth of the meat substitutes market during the forecast period. As people become more willing to experiment with their food choices, the demand for versatile and novel plant-based products grows. Moreover, the rising government support and regulatory changes that encourage sustainable farming and food production methods, including grants and incentives for plant-based ventures, is contributing to market growth. These regulatory mechanisms are making it easier for meat substitute manufacturers to scale their operations and reach a broader customer base. In addition, ongoing advancements in food technology, such as cellular agriculture and 3D food printing, are enabling the development of products that are virtually indistinguishable from traditional meat, further augmenting their acceptance among mainstream consumers. Besides this, economic factors also play a crucial role, as meat substitutes are increasingly viewed as cost-effective in the long run, particularly when considering the long-term healthcare costs associated with diets rich in animal-derived products. Furthermore, the escalating influence of social media and celebrity endorsements advocating for plant-based diets are influencing public opinions and purchasing behaviors, thus fueling market growth.

Meat Substitutes Market Trends/Drivers:

Heightened Health and Nutrition Awareness

The growing awareness about the benefits of a balanced diet rich in plant-based proteins is one of the key factors propelling the meat substitutes market forward. As consumers become increasingly conscious of the adverse health effects associated with high meat consumption, such as elevated cholesterol levels and cardiovascular diseases, the demand for healthier alternatives continues to rise. Meat substitutes typically provide essential amino acids, vitamins, and minerals while containing fewer saturated fats and zero cholesterol. This heightened focus on well-being and preventative healthcare is particularly notable among millennials and Generation Z, who are more willing to adopt lifestyle changes for long-term health benefits. Consequently, increased health and nutrition awareness is serving as a catalyst for the expanding meat substitutes market.

Increase in Ethical Considerations

A significant rise in ethical considerations related to animal welfare among the masses has become a significant factor favoring the growth of the meat substitutes market. Animal agriculture often raises concerns about inhumane treatment and ethical dilemmas surrounding mass production. As a result, a growing segment of the population is opting for cruelty-free alternatives to conventional animal products. Activism, documentaries, and increased public discourse on animal welfare have further fueled this ethical awakening. This global shift is affecting consumer behavior and compelling manufacturers to offer ethical options, such as meat substitutes, thus contributing to market growth.

Rise in Environmental Concerns

Sustainability and environmental preservation are other major factors stimulating the growth of the meat substitutes market. Traditional animal farming has been linked to significant environmental issues, including deforestation, greenhouse gas emissions, and excessive water usage. On the other hand, plant-based alternatives have a considerably lower environmental impact. As climate change and resource conservation continue to gain prominence in global discussions, the need for sustainable food production becomes urgent. The meat substitutes market is effectively responding to this growing concern by providing products that are both eco-friendly and resource-efficient, making it a viable solution for a sustainable future.

Meat Substitutes Industry Segmentation:

Breakup by Type:

- Tofu & Tofu Ingredients

- Tempeh

- Textured Vegetable Protein (TVP)

- Seitan

- Quorn

- Others

Tofu & tofu ingredients represent the most popular type of meat substitute

Tofu has a long history and is well-established in many cuisines, especially in Asian countries, making it familiar to a large segment of consumers. Its relatively neutral taste and texture make it highly versatile, allowing it to be easily incorporated into a wide range of dishes, from savory to sweet. This flexibility appeals to both home cooks and professional chefs alike, contributing to its growing popularity. Nutritionally, tofu is a powerhouse, providing a balanced profile of essential amino acids, vitamins, and minerals, which meets the health and wellness criteria that many consumers are seeking. It is also usually lower in fat and calories compared to animal-based protein sources, aligning well with weight management and cardiovascular health goals.

Furthermore, tofu is comparatively affordable and readily available. It is usually less expensive than specialty meat substitutes, making it accessible to a broader demographic. Its widespread availability in grocery stores, specialty health food stores, and online platforms ensures that it remains a convenient choice for consumers. Apart from this, the simplicity of its production process, which involves coagulating soy milk and pressing it into blocks, makes it environmentally sustainable. This aligns well with the rising consumer concerns for eco-friendly food options, thus accelerating the sales of tofu and tofu ingredients, propelling the growth of this segment.

Breakup by Source:

- Soy

- Wheat

- Mycoprotein

- Others

Soy holds the largest share in the market

Soy is a complete protein, containing all nine essential amino acids required by the human body. Its rich nutritional profile makes it an ideal alternative to animal-based proteins, fulfilling consumer demand for health-conscious options. Moreover, soy has been extensively researched and its health benefits, including its potential to lower cholesterol levels and mitigate symptoms of menopause, are well-documented. From a manufacturing perspective, soy is highly versatile and easily adaptable to various food technologies. It can be processed into a multitude of forms such as tofu, tempeh, and textured vegetable protein, allowing for a wide range of meat substitute products. This flexibility in production enhances its attractiveness for both manufacturers and consumers.

Economic factors also contribute to soy's dominance in the market. Soybeans are a major global crop, and economies of scale make it a cost-effective option for both producers and consumers. The extensive supply chain and well-established infrastructure for soy production ensure a steady, reliable supply of raw material. Although all plant-based sources generally have lower environmental impact compared to animal-based proteins, soy cultivation is often more land-efficient than other protein crops. Therefore, soy-based meat substitutes are perceived as a more sustainable choice, which aligns with the increasing consumer focus on eco-friendly products, favoring segment growth.

Breakup by Category:

- Frozen

- Refrigerated

- Shelf-Stable

Frozen meat substitutes dominate the market

Frozen meat substitutes offer busy consumers a quick and easy option for meal preparation, aligning with the emerging trend of convenience foods. These frozen products often come pre-seasoned or pre-marinated, requiring minimal cooking skills and time, making them highly appealing to those leading fast-paced lives. Longer shelf-life is another major factor augmenting the popularity of frozen meat substitutes. Unlike fresh alternatives, frozen products can be stored for extended periods without compromising their nutritional value or taste. This longevity reduces food waste and allows consumers to stock up, providing both economical and practical benefits.

Moreover, advances in freezing technology have made it possible to preserve the texture, flavor, and nutritional content of meat substitutes effectively. High-quality frozen meat substitutes are now virtually indistinguishable from their fresh counterparts once cooked, removing previous stigmas associated with frozen foods being inferior in taste or nutritional value. In addition, the frozen category benefits from broader distribution capabilities. Frozen products can be transported over long distances and are less sensitive to temperature fluctuations, making them more accessible to consumers in areas where fresh meat substitutes may not be readily available. A combination of convenience, extended shelf-life, product quality, and broader distribution contributes to the escalating demand for frozen products, fueling the growth of this segment.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Health and Food Stores

- Convenience Stores

- Others

Meat substitutes are majorly distributed through supermarkets and hypermarkets

The main factors that are driving the growth of this segment are the widespread accessibility, consumer trust, and diverse product offerings of supermarkets and hypermarkets. These retail outlets provide a convenient one-stop shopping experience for consumers, making it easy to discover and purchase meat substitute products alongside their regular groceries. The extensive reach of these retail stores ensures that a wide range of consumers can access meat substitutes without having to travel far. This easy accessibility is crucial for capturing both health-conscious and environmentally aware consumers seeking alternatives to traditional animal-based products.

Additionally, supermarkets and hypermarkets have established themselves as reliable sources of food products, creating a sense of trust among consumers regarding the quality, safety, and authenticity of their products. This trust is especially important for meat substitutes, as consumers may be trying these products for the first time and rely on established retailers to provide accurate information. Also, these retail channels offer a broad selection of meat substitute brands and types, catering to different dietary preferences and tastes. This variety further encourages experimentation and allows consumers to choose products that align with their individual needs and preferences. Furthermore, rising promotions, product displays, and marketing campaigns by supermarkets and hypermarkets help raise awareness and boost sales of meat substitutes, thus driving the segment growth.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Europe exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Europe accounted for the largest market share.

Europe held the biggest market share due to evolving dietary preferences, environmental consciousness, robust regulatory support, and a rich cultural history of plant-based cuisine. European consumers are increasingly adopting flexitarian, vegetarian, and vegan diets, driven by health concerns and a growing awareness of the environmental impact of traditional meat consumption. The region also places a strong emphasis on sustainability and has a well-informed consumer base that values eco-friendly products. Meat substitutes, with their lower carbon footprint and reduced resource consumption, align well with these values.

Another major contributing aspect is favorable regulatory support. European governments and regulatory bodies are proactively promoting sustainable food production and reducing greenhouse gas emissions. This support encourages both manufacturers and consumers to embrace plant-based alternatives, thereby fueling the meat substitutes market. Europe's diverse culinary heritage also contributes to the market growth. Many European countries have a rich tradition of plant-based dishes that have been consumed for centuries. This cultural familiarity with plant-based foods has paved the way for a smoother transition to meat substitutes.

Moreover, Europe's well-developed retail infrastructure, including supermarkets, specialty health food stores, and online platforms, ensures easy accessibility to a wide array of meat substitute products. This availability, coupled with effective marketing and education campaigns, has helped build consumer interest and acceptance, further solidifying the position of Europe as a leading regional market for meat substitutes.

Competitive Landscape:

The market is experiencing steady growth as key players in the meat substitutes industry are actively engaged in product innovation, research and development (R&D), and strategic partnerships to maintain their competitive edge. The leading manufacturers are investing in advanced technologies to enhance the texture, taste, and nutritional profiles of their products, aiming to replicate the experience of consuming traditional meat. These industry players are also focusing on expanding their product portfolios to include a wider range of options, catering to diverse consumer preferences and dietary needs. Additionally, strategic collaborations with retailers, restaurants, and food service providers are helping these companies to broaden their market reach and amplify their brand presence, thereby shaping the evolving landscape of the meat substitutes market.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- The Nisshin Oillio Group, Ltd.

- E.I. Du Pont De Nemours and Company

- Archer-Daniels-Midland Company

- Amy's Kitchen

- Conagra Brands, Inc.

- Quorn Foods

- Cauldron Foods

- Campbell Soup Company

- VBites Foods Limited

- Blue Chip Group, Inc.

- Field Roast Grain Meat Co., Inc.

- Garden Protein International

- LightLife Foods

- Sweet Earth Foods

- MGP Ingredients Inc.

- The Tofurky Company, Inc.

- Meatless

- Sonic Biochem Extraction Pvt. Ltd.

Key Questions Answered in This Report

- 1.What was the size of the global meat substitutes market in 2024?

- 2.What is the expected growth rate of the global meat substitutes market during 2025-2033?

- 3.What are the key factors driving the global meat substitutes market?

- 4.What has been the impact of COVID-19 on the global meat substitutes market?

- 5.What is the breakup of the global meat substitutes market based on the type?

- 6.What is the breakup of the global meat substitutes market based on the source?

- 7.What is the breakup of the global meat substitutes market based on the category?

- 8.What is the breakup of the global meat substitutes market based on the distribution channel?

- 9.What are the key regions in the global meat substitutes market?

- 10.Who are the key players/companies in the global meat substitutes market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Meat Substitutes Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Type

- 5.5 Market Breakup by Source

- 5.6 Market Breakup by Category

- 5.7 Market Breakup by Distribution Channel

- 5.8 Market Breakup by Region

- 5.9 Market Forecast

6 Market Breakup by Type

- 6.1 Tofu & Tofu Ingredients

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Tempeh

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Textured Vegetable Protein (TVP)

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Seitan

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Quorn

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Others

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

7 Market Breakup by Source

- 7.1 Soy

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Wheat

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Mycoprotein

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Category

- 8.1 Frozen

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Refrigerated

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Shelf-Stable

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by Distribution Channel

- 9.1 Supermarkets and Hypermarkets

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Health and Food Stores

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Convenience Stores

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Others

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

10 Market Breakup by Region

- 10.1 Asia Pacific

- 10.1.1 Market Trends

- 10.1.2 Market Forecast

- 10.2 Europe

- 10.2.1 Market Trends

- 10.2.2 Market Forecast

- 10.3 North America

- 10.3.1 Market Trends

- 10.3.2 Market Forecast

- 10.4 Middle East and Africa

- 10.4.1 Market Trends

- 10.4.2 Market Forecast

- 10.5 Latin America

- 10.5.1 Market Trends

- 10.5.2 Market Forecast

11 SWOT Analysis

- 11.1 Overview

- 11.2 Strengths

- 11.3 Weaknesses

- 11.4 Opportunities

- 11.5 Threats

12 Value Chain Analysis

13 Porter's Five Forces Analysis

- 13.1 Overview

- 13.2 Bargaining Power of Buyers

- 13.3 Bargaining Power of Suppliers

- 13.4 Degree of Competition

- 13.5 Threat of New Entrants

- 13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 The Nisshin Oillio Group

- 15.3.2 Dupont

- 15.3.3 Archer Daniels Midland

- 15.3.4 Amy's Kitchen

- 15.3.5 Conagra Brands

- 15.3.6 Quorn Foods

- 15.3.7 Cauldron Foods

- 15.3.8 Campbell Soup Company

- 15.3.9 VBites

- 15.3.10 Blue Chip Group

- 15.3.11 Field Roast

- 15.3.12 Garden Protein International

- 15.3.13 LightLife

- 15.3.14 Sweet Earth Foods

- 15.3.15 MGP Ingredients

- 15.3.16 Tofurky

- 15.3.17 Meatless

- 15.3.18 Sonic Biochem Limited