|

|

市場調査レポート

商品コード

1401294

AI採用の世界市場:2023年~2030年Global AI Recruitment Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| AI採用の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 218 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

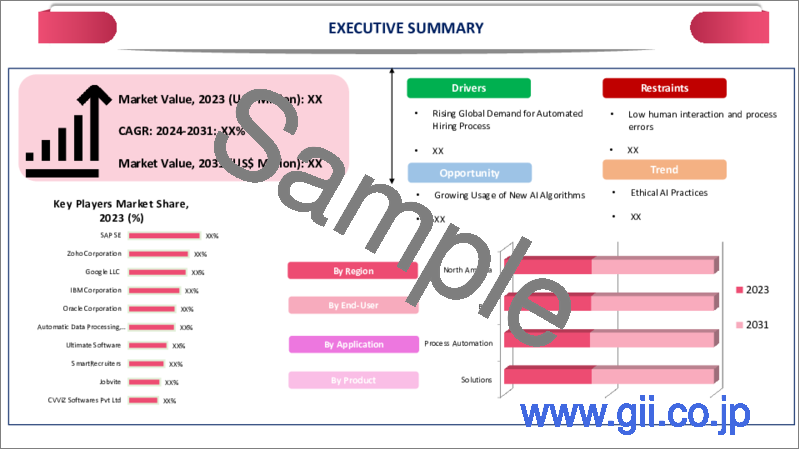

世界のAI採用市場は、2022年に6億540万米ドルに達し、2023年から2030年にかけてCAGR 6.7%で成長し、2030年には10億1,910万米ドルに達すると予測されます。

市場におけるAI採用ソリューションとサービスの利用可能性が高まっていることが、市場成長を後押ししています。2023年9月20日、InCruiter社は、よりスマートで公平な採用を実現するAI面接ソリューションInCBotを発表しました。InCBotは、候補者の体験を向上させ、一方通行のビデオ面接を実施し、一流の人材を確保するのに役立ちます。InCBotは、さまざまな役割、業界、経験レベルにわたって24時間365日シームレスに面接を実施し、候補者と雇用者の双方にリアルタイムのフィードバック、提案、洞察を提供することで、面接体験をかつてないレベルに引き上げます。

AI採用ツールは、データ分析と予測モデリングを活用し、採用動向と採用結果に関する洞察を提供します。データ主導のアプローチにより、企業は十分な情報に基づいた意思決定を行い、採用戦略を継続的に最適化することができます。AIアルゴリズムは大規模なデータセットを分析し、スキルや資格が求人要件に密接に合致する候補者を特定します。その結果、候補者の絞り込みがより正確かつ効率的になり、採用の質が向上します。

北米がAI採用市場で最大の市場シェアを占めているのは、リモートワークの増加によりバーチャル採用ソリューションの需要が高まっているためです。AI採用ソリューションとソフトウェアの採用拡大が、予測期間中の地域別市場成長を後押しします。

例えば、2023年11月16日、TD SYNNEX Direction of Technology Reportによると、北米のチャネルパートナーは、投資とスキル習得の両方を通じて、データ分析、人工知能(AI)、サイバーセキュリティなどの高成長技術能力の拡大に注力しています。MS Power Userが2023年に発表したデータによると、米国では83%の企業が人事部門にAIを導入しています。

ダイナミクス

採用プロセスの自動化に対する世界の需要の高まり

AI採用ツールによって促進される自動化された採用プロセスは、採用の様々な段階に必要な時間と労力を大幅に削減します。この効率化は、採用ワークフローを合理化し、ポジションを迅速に埋めることを目指す組織にとって極めて重要です。デジタル化が進む昨今、求人広告には多くの応募が集まる。自動化されたシステムは、大量の履歴書や候補者データを効率的に処理し、採用担当者が採用プロセスのより戦略的な側面に集中できるようにします。

Talent Alpha Sp.z.o.o.aが2022年に実施した調査によると、採用担当者の67%が、AIはコスト削減だけでなく採用にも良い影響を与えると信じています。調査対象者の5人中4人は、AIが近いうちに非常に進化し、これらのプログラムが重要な採用や解雇の決定を行うようになると考えています。人事担当者の68%は、AIがより偏見をなくし、機会均等を実現することに大きな期待を寄せています。

技術の進歩

機械学習アルゴリズムは、AI採用ツールのインテリジェンスと学習機能を支えています。アルゴリズムは膨大なデータセットを分析してパターンを特定し、候補者の成功を予測し、候補者マッチングの精度を継続的に向上させる。予測分析では、過去のデータを使って将来の動向や結果を予測します。AI採用の文脈では、予測分析は、組織が候補者のソーシング、採用戦略、人員計画について情報に基づいた意思決定を行うのに役立ちます。

パンデミックは、HR業界の技術的進歩やデジタル化を加速させました。採用はますますソフトウェアとアルゴリズムに依存するようになっています。Talent Alpha Sp. z.o.o.が2022年に発表したデータによると、世界の企業の半数が2022年にテクノロジーへの支出を増やすことを決定し、そのうち84%がデジタル化の計画を持っています。組織は、ソーシング・プロセスを促進するために、オートメーションへの投資を大幅に増やしました。53%のプロフェッショナルにとって、テクノロジーの飛躍的進歩が仕事の未来を形作る最も重要な要因になるというのも不思議ではないです。38%の雇用主が新しい雇用テクノロジーに投資しています。

人的交流の欠如と意識の低さ

求職者は、採用プロセスにおける個人的なやりとりを評価することが多いです。人間的な交流がないと、共感や理解の欠如、候補者のプロファイルや状況の微妙な側面に対処する能力の欠如が懸念されます。人間の採用担当者は、候補者との信頼関係を築き、雇用主ブランディングと長期的な従業員満足度にとって極めて重要です。AIだけに頼ると、人間味に欠け、このようなつながりを築く効果が低いと思われるかもしれないです。

AI採用ツールの成長にとって大きな障壁となるのは、こうしたテクノロジーの機能やメリットに関する組織や人事担当者の認識不足です。これは、未知なるものへの恐れや、雇用の場が奪われることへの懸念から、AIツールの採用に対する抵抗につながる可能性があります。認知度の低さは、AIツールの効果的な導入につながらない可能性があります。組織はAI採用ソリューションの特徴や機能を十分に活用できず、効率や意思決定への影響を制限してしまう可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 採用プロセスの自動化に対する世界の需要の高まり

- 技術の進歩

- 抑制要因

- 人間関係の欠如と意識の低さ

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 製品別

- ソリューション別

- サービス別

第8章 用途別

- プロセスオートメーション

- キャンペーン

- 候補者スクリーニング

- 候補者コミュニケーション

- その他

第9章 エンドユーザー別

- 小売・eコマース

- 銀行、金融、保険

- ヘルスケア

- ホスピタリティ

- エネルギー

- 政府機関

- 企業

- 製造業

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- SAP SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Zoho Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- Automatic Data Processing, LCC

- Ultimate Software

- SmartRecruiters

- Jobvite

- CVViZ Softwares Pvt Ltd

第13章 付録

Overview

Global AI Recruitment Market reached US$ 605.4 Million in 2022 and is expected to reach US$ 1,019.1 Million by 2030, growing with a CAGR of 6.7% during the forecast period 2023-2030.

The growing availability of AI recruitment solutions and services in the market helps to boost the market growth. On September 20, 2023, InCruiter launched InCBot, an AI interview solution for smarter and unbiased hiring. It helps to enhance candidate experiences, conduct one-way video interviews and secure top-tier talent. InCBot seamlessly conducts interviews 24/7 across various roles, industries and experience levels, while providing real-time feedback, suggestions and insights to both candidates and employers, thereby elevating the interview experience to an unprecedented level.

AI recruitment tools leverage data analytics and predictive modeling to provide insights into recruitment trends and hiring outcomes. The data-driven approach enables organizations to make informed decisions and continuously optimize their recruitment strategies. AI algorithms analyze large datasets to identify candidates whose skills and qualifications closely match the job requirements. The results in more accurate and efficient candidate shortlisting, improving the quality of hires.

North America accounted largest market share in the AI Recruitment market due to the rise of remote work has increased the demand for virtual hiring solutions. Growing adoption of AI recruitment solutions and software helps to boost regional market growth over the forecast period.

For instance, on November 16, 2023, TD SYNNEX Direction of Technology Report showed that channel partners in North America are focused on expanding their high-growth technology capabilities like data analytics, artificial intelligence (AI) and cybersecurity through both investment and skill acquisition. According to the data given by MS Power User in 2023, in United States, 83% of companies have adopted AI in HR.

Dynamics

Rising Demand of Automated Hiring Process Globally

Automated hiring processes, facilitated by AI recruitment tools, significantly reduce the time and effort required for various stages of recruitment. The efficiency is crucial for organizations looking to streamline their hiring workflows and fill positions quickly. Nowadays job postings attract a large number of applications due to growing digitalization. Automated systems efficiently handle high volumes of resumes and candidate data, ensuring that recruiters focus on more strategic aspects of the hiring process.

According to the data given by Talent Alpha Sp. z.o.o a Survey in 2022, 67% of recruitment professionals believe that AI has a positive impact on hiring and not just in cutting costs. 4 out of 5 of those surveyed believe that AI will soon be so advanced that these programs will handle key hiring and firing decisions. 68% of HR professionals have high hopes that AI will be more bias-free and enable more equal opportunities.

Technological Advancements

Machine learning algorithms power the intelligence and learning capabilities of AI recruitment tools. The algorithms analyze vast datasets to identify patterns, predict candidate success and continuously improve the accuracy of candidate matching. Predictive analytics uses historical data to forecast future trends and outcomes. In the context of AI recruitment, predictive analytics helps organizations make informed decisions about candidate sourcing, hiring strategies and workforce planning.

The pandemic has accelerated the technological advancement in the HR industry as well as its digitalization. Hiring has become increasingly dependent on software and algorithms. According to the data given by Talent Alpha Sp. z.o.o in 2022, half of companies globally have decided to increase spending on technology 2022 and 84% of them have a plan for digitalization. Organizations invested significantly more in automation to foster sourcing processes. It's little wonder then that technology breakthroughs for 53% of professionals will be the most significant factor in shaping the future of work. 38% of employers are investing in new hiring technologies.

Lack of Human Interaction and Low Awareness

Candidates often appreciate personal interaction during the hiring process. The absence of human interaction can lead to concerns about a lack of empathy, understanding and the ability to address nuanced aspects of a candidate's profile or situation. Human recruiters build trust and relationships with candidates, which is crucial for employer branding and long-term employee satisfaction. Relying solely on AI may be perceived as impersonal and less effective in building these connections.

A significant barrier to the growth of AI recruitment tools is the lack of awareness among organizations and HR professionals about the capabilities and benefits of these technologies. The can lead to resistance to adopting AI tools due to fear of the unknown or concerns about job displacement. Low awareness can result in the ineffective implementation of AI tools. Organizations may not fully utilize the features and functionalities of AI recruitment solutions, limiting their impact on efficiency and decision-making.

Segment Analysis

The global AI Recruitment market is segmented based on product, application, end-user and region.

Growing Adoption of AI Recruitment Solutions in the Various Industries

Based on the product, the AI recruitment market is divided into solutions and services. AI recruitment solutions segment is growing over the forecast period 2023-2030 due to its growing efficiency and time savings. AI recruitment solutions automate and streamline various aspects of the hiring process, saving time for recruiters and HR professionals. Automated resume screening, candidate matching and scheduling significantly reduce the time spent on repetitive tasks.

The growing availability of AI recruitment solutions in the market helps to boost segment growth. For instance, on August 09, 2023, Harver launched an AI-powered Harver CHAT solution to optimize candidate engagement in hiring. It is designed to automate and streamline the application experience for candidates while boosting the employer brand. The newly launched AI chat solution replaces the need for application forms by engaging candidates with always-on messaging.

Geographical Penetration

Growing Early Adoption of AI in North America

North America accounted for the largest market share in the global AI recruitment market due to the rapid adoption of Artificial Intelligence. The growing number of tech giants and startups that actively invest in and develop AI technologies, including those related to recruitment. North America boasts a well-established and robust IT infrastructure. The infrastructure supports the implementation and integration of AI recruitment tools and platforms into existing systems, making it easier for companies to adopt and utilize these technologies.

Major key players in the region launched new products for AI recruitment that help boost the regional market growth of the global AI recruitment market. For instance, on April 05, 2023, Comeet, a leading provider of collaborative recruiting software launched its new AI Assistant, designed to enable better hiring decisions and improve candidate experience and promote diversity and inclusion.

Competitive Landscape

The major global players in the market include SAP SE, Zoho Corporation, Google LLC, IBM Corporation oracle Corporation, Automatic Data Processing, LCC, Ultimate Software, SmartRecruiters, Jobvite and CVViZ Softwares Pvt Ltd.

COVID-19 Impact Analysis

The pandemic accelerated the adoption of remote work, leading to increased demand for virtual recruitment solutions. AI tools that facilitate remote hiring processes, such as video interviews, virtual assessments and automated screening, became more crucial. The economic impact of the pandemic resulted in fluctuations in the job market. Some industries experienced a surge in hiring (e.g., healthcare, e-commerce), while others faced significant challenges (e.g., hospitality, travel). AI recruitment platforms had to adapt to changing demand and market dynamics.

With disruptions to traditional recruitment processes organizations sought efficiency through automation. AI-powered tools helped streamline workflows, automate repetitive tasks and manage large volumes of applications efficiently. The pandemic prompted shifts in the skills demanded by employers. AI tools that assist in skill assessments and identify relevant candidate skills became more critical. Additionally, there was an increased focus on reskilling and upskilling programs and AI could play a role in identifying training needs.

Russia-Ukraine War Impact Analysis

Geopolitical events, especially conflicts lead to economic uncertainty. Businesses become more cautious about their investments, including spending on technologies such as AI recruitment tools. War or geopolitical tensions contribute to market volatility, impacting investor confidence and corporate decision-making. Companies delay or scale back their technology investments in such uncertain environments. The conflict leads to disruptions in the global supply chain, it affects the production and availability of hardware components and infrastructure necessary for AI technologies.

Geopolitical events influence the movement of talent across borders. Changes in immigration policies or security concerns affect the ability of companies to attract and retain skilled AI professionals. Companies reassess their global strategies and focus on regions that are perceived as more stable. The led to changes in demand for AI recruitment solutions in different geographic areas. Governments introduce new policies and regulations in response to geopolitical events. Changes in regulatory environments impact the development, deployment and use of AI technologies in recruitment.

By Product

- Solution

- Services

By Application

- Process automation

- Campaigning

- Candidate screening

- Candidate communication

- Others

By End-User

- Retail and ecommerce

- Banking, financial and insurance

- Healthcare

- Hospitality

- Energy

- Government

- Enterprise

- Manufacturing

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On December 05, 2023, RedNevada. AI the leading provider of AI-enabled software launched RAI, the most comprehensive and advanced recruitment and resourcing co-pilot solution in the market. The tool was extensively tested with a wide range of pilot customers across multiple geographies and industries to ensure efficiency and cost saving and that it properly assisted the people who will directly benefit from a toolset such as RAI.

- On October 09, 2023, Kelly Arc, a new online recruitment platform launched a recruitment platform for AI and automation talent. The AI tool closes the gap by connecting top talent, such as developers, analysts and project managers, with pioneering jobs.

- On October 30, 2023, India Quotient-backed edtech startup Masai School launched an artificial intelligence (AI)-powered platform for job seekers and recruiters. It helps job-seekers find relevant listings after a detailed competency assessment with the help of 90-minute interviews with tech leads in Indian companies.

Why Purchase the Report?

- To visualize the global AI recruitment market segmentation based on product, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of AI recruitment market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

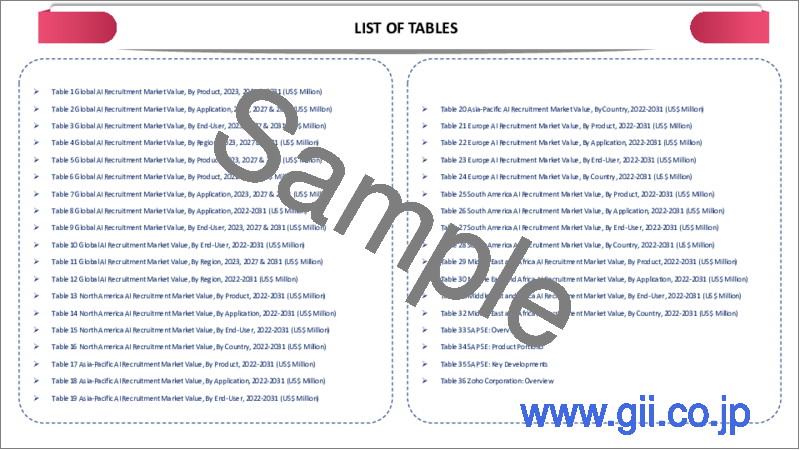

The global AI recruitment market report would provide approximately 61 tables, 64 figures and 218 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Application

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Demand of Automated Hiring Process Globally

- 4.1.1.2. Technological Advancements

- 4.1.2. Restraints

- 4.1.2.1. Lack of Human Interaction and Low Awareness

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Solution*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Services

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Process Automation*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Campaigning

- 8.4. Candidate screening

- 8.5. Candidate communication

- 8.6. Others

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Retail and E-commerce*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Banking, financial and insurance

- 9.4. Healthcare

- 9.5. Hospitality

- 9.6. Energy

- 9.7. Government

- 9.8. Enterprise

- 9.9. Manufacturing

- 9.10. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. SAP SE*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Zoho Corporation

- 12.3. Google LLC

- 12.4. IBM Corporation

- 12.5. Oracle Corporation

- 12.6. Automatic Data Processing, LCC

- 12.7. Ultimate Software

- 12.8. SmartRecruiters

- 12.9. Jobvite

- 12.10. CVViZ Softwares Pvt Ltd

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us