|

|

市場調査レポート

商品コード

1372131

フルーツワインの世界市場-2023年~2030年Global Fruit Wines Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フルーツワインの世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 189 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

フルーツワインの世界市場は、2022年に7億2,410万米ドルに達し、2023-2030年の予測期間中にCAGR 9.2%で成長し、2030年には14億6,410万米ドルに達すると予測されています。

ワインは、その味わいと栄養価の高さから人気の高いアルコール飲料のひとつです。国際ブドウ・ワイン機構によると、2022年には世界で232mhlのワインが消費されます。ブドウだけでなく、リンゴ、パイナップル、マンゴーなど様々な種類の果実からワインを開発し、より健康的で自然なアルコール飲料を消費者に提供しています。

果実酒の心地よい風味と香りが消費者の関心を集め、市場の需要を高めています。アルコール飲料に対する消費者の嗜好の変化と、低アルコールでより健康的な果実酒へのシフトが市場需要を牽引しています。果実酒は、ワインの特徴に加え、様々な果実の爽やかな味わいと健康上のメリットを提供します。さまざまな味が楽しめることが、世界の果実酒市場を補完する要因となっています。

飲食品のあらゆるカテゴリーでオーガニック製品の動向が高まる中、果実酒メーカーもオーガニック製品の消費者増加の需要を満たすため、オーガニック果実酒の市場投入に注力しています。例えば、2021年2月、ナガランドの女性起業家が、カナダから特別に輸入した原料を使用した100%オーガニックのドラゴンフルーツワインの発売を発表しました。

ダイナミクス

様々な風味の果実酒の入手可能性

果実酒に様々なフレーバーがあることは、市場成長を促進する重要な要因です。消費者は、製品群から様々な風味の選択肢を得ることができます。例えば、2022年11月、アルコール飲料会社であるHill Zill Wines社は、手作りのフルーツフレーバーワインのプレミアムシリーズである新製品Pomona'sを発表しました。マンゴー、ストロベリー、チョコレートの3種類のフレーバーがあります。

同様に2022年5月、リボリ・ファミリー・ワインズは最新セレクション「サン・アントニオ・フルーツ・ファーム」の発売を発表しました。同商品は米国初のデュアル・フルーツ・フレーバー・ワインと謳われています。ピーチ・パッションフルーツ、ストロベリー・グアバ、ブラックベリー・オレンジの3種類のフレーバーがあります。

革新的な製品の発売

世界市場における果実酒需要の増加は、市場競争も激化させています。メーカー各社は、市場で際立つために新しく革新的な製法に取り組んでいます。例えば、ナーシクを拠点とするSomanda Vineyardsは2020年8月、ザクロをベースにした果実酒Anarkaliをミディアム・スイートとオフ・ドライの2つのスタイルで発売しました。

アメリカ初のテトラ・ワイン・ブランドであるヴェンダンジュは、テトラパックに入ったバランスの良いワインの製造を開始しました。この製品は、500ml、1000ml、1500mlの3種類のサイズがあります。2023年6月、ヴァンダンジュはテトラパック・ブランドのフルーツ風味のワイン、バイブを発売しました。このフルーツ風味のワインは、フルーツポンチ、ストロベリーライムエード、ブルーラズベリー・レモネードの3種類のフレーバーがあります。

伝統的ワインの高い人気と果実酒加工の課題

伝統的なブドウ酒が非常に強力で確立された市場であるのに対し、果実酒市場はまだ確立された段階にあり、今やブドウではなくリンゴやイチゴなどの果物を使用する果実酒市場にとって主要な競争相手の一つとなっています。国際ブドウ・ワイン機構によると、2021年の世界のブドウ園の生ブドウ生産量は74.8トン、平均収量は10.2トン/ヘクタールです。伝統的なワインのみを好む消費者の高い嗜好は、市場の成長を抑制する可能性があります。

ワインの特性と果実の風味の完璧なバランスを維持するための複雑な条件は、ワインの製造中にメーカーにとってより大きな課題となり得る。加えて、酸の安定性の維持や糖分の調整といった技術的課題は、果実酒メーカーにとってより難しい問題となります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- さまざまなフレーバーのフルーツワインの入手可能性

- 革新的な製品の発売

- 抑制要因

- 伝統的なワインの高い人気と果実酒加工における課題

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 果実の種類別

- ブドウ

- リースリング

- シャルドネ

- ピノ・グリ

- ソーヴィニヨン・ブラン

- ストロベリー

- アップル

- 洋ナシ

- パイナップル

- チェリー

- その他

第8章 製品別

- スティルワイン

- スパークリングワイン

- 酒精強化ワイン

第9章 ワインタイプ別

- 蒸留酒

- 半蒸留

- 発酵

第10章 グレード別

- プレミアム

- 質量

第11章 パッケージ別

- ボトル

- 缶

第12章 流通チャネル別

- スーパーマーケットおよびハイパーマーケット

- 専門店

- eコマース

- その他

第13章 用途別

- 家庭用

- 業務用

第14章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第15章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第16章 企業プロファイル

- Field Stone Fruit Wines

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Lyme Bay Cider Co Ltd

- Ningxia Hong

- Sula Rasa

- Northern Compass

- Rhythm Winery

- Wildberry Beverages Pvt. Ltd.

- Elite Vintage Winery

- Hill Top Berry Farm & Winery

- St. James Winery

第17章 付録

Overview

Global Fruit Wines Market reached US$ 724.1 million in 2022 and is expected to reach US$ 1,464.1 million by 2030, growing with a CAGR of 9.2% during the forecast period 2023-2030.

Wines are one of the popular alcoholic beverages due to its taste and nutritional properties. According to the International Organisation of Vine and Wine, in 2022, 232 mhl of wine is consumed worldwide. In addition to grapes, manufacturers are developing wines from various types of fruits such as apples, pineapple and mango, to provide healthier and natural alcoholic beverages to the consumers.

The pleasant flavor and aroma of the fruit wine are gaining consumer attention, increasing the market demand. The changing consumer preferences for alcoholic beverages and the shift towards low-alcoholic and healthier fruity wines are driving the market demand. The fruit wines provide wine characteristics and also the refreshing taste and health benefits of various fruits. The availability of different tastes is the complementary factor for the global fruit wine market.

With the increasing trend of organic products in every category of food and beverage, fruit wine manufacturers are also focusing on the launch of organic fruit wines into the market to meet the demand for increasing organic product consumers. For instance, in February 2021, a woman entrepreneur in Nagaland announced the launch of 100% organic dragon fruit wine, from the ingredients that are specially imported from Canada.

Dynamics

Availability of Fruit Wines in Various Flavors

The wide availability of various flavors in fruit wines is the key factor driving the market growth. Consumers are given a variety of flavor choices in the product range. For instance, in November 2022, Hill Zill Wines, an alcoholic beverages company introduced its new product range, Pomona's, a premium range of handcrafted fruit-flavoured wines. The product is available in three flavours including mango, strawberry and chocolate.

Similarly, in May 2022, Riboli Family Wines announced the launch of thier latest selection San Antonio Fruit Farm. The product is claimed to be the first dual-fruit flavour wine in the U.S. The combined flavor launch attracts consumers towards the product. The product is available in three different flavours including Peach Passion Fruit, Strawberry Guava, and Blackberry Orange.

Innovative Product Launches

The increasing demand for fruit wines in the global market is also increasing the competition among market players. Manufacturers are taking up new and innovative methods of product preparation to stand out in the market. For instance, in August 2020, Nashik-based Somanda Vineyards launched Anarkali, a pomegranate-based fruit wine into two styles such as medium sweet and off-dry for consumers to choose according to thier choices, covering two categories of consumers.

Vendange, America's 1st Tetra Wine Brand, launched the crafting of well-balanced wines in Tetra Pak. The product is available in three different sizes varying from 500 ml, 1000 ml and 1500 ml. In June 2023, Vendange introduced Vibe, a Tetrapak brand of wine with fruit flavors. This fruit-forward wine is available in three flavours such as Fruit Punch, Strawberry Limeade, and Blue Raspberry Lemonade.

High Popularity of Traditional Wine and Challenges in Processing Fruit Wine

Fruits wine market is still in the establishing stage whereas traditional grape wine is a very strong and established market that is now one of the major competitors for the fruit wine market that uses fruits such as apples and strawberries rather than grapes. According to the International Organization of Vine and Wine, the world's vineyards produced 74.8 mt of fresh grapes with an average yield of 10.2 t/ha in 2021. The high preference of consumers towards only traditional wine can retrain the market growth.

The complex conditions to maintain the perfect balance between wine characteristics and fruit flavour can be a greater challenge for the manufacturer during the production of the wines. In addition, technical challenges such as maintaining acid stability and adjustments in sugar quantities can be harder problems for fruit wine manufacturers.

Segment Analysis

The global fruit wines market is segmented based on fruit type, product, wine type, grade, packaging, distribution channel, application, and region.

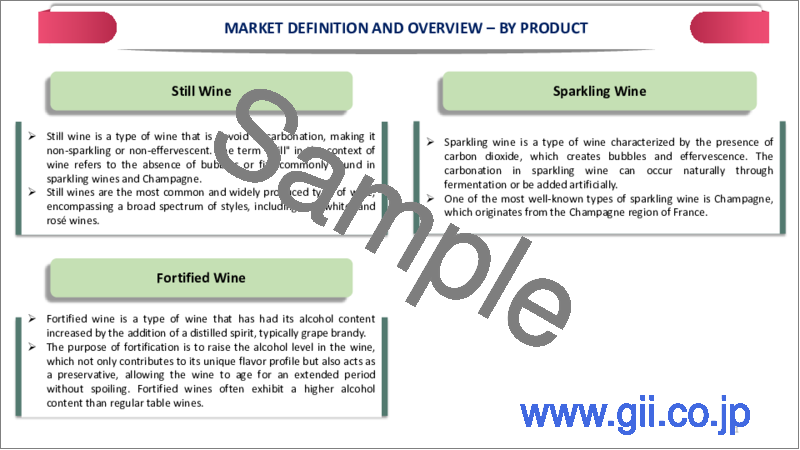

Increased Use of Sparkling Wine During Celebrations

The global fruit wines market is segmented based on product into sparkling wine, still wine and fortified wine. The sparkling wine segment accounted for the largest share of the global fruit wine market due to high consumer preference. The carbonation of the fruit wines makes it more attractive and tastier for the consumers to prefer them to pair this up with food. The special nature of these sparkling wines to choose them during celebrations and gathering drive the segment growth.

Manufacturers are introducing new and innovative types of sparkling fruit wines. For instance, in June 2022, Fruzzante, a brand from Hill Zill Wines Pvt Ltd, launched its one-of-its-kind sparkling 100% fruit wine in Delhi and Arunachal Pradesh. The product is available in various fruit types including mango, pineapple and orange.

The low-alcohol sparkling fruits are gaining immense popularity among health-conscious consumers. The new launches in this sector are driving the segment growth. In May 2021, the House of Gancia, producer of Italy's first sparkling wine, announced the launch of its new product line, Atto Primo. The new launch includes four low-alcohol real fruit flavour sparkling wines. The four flavors include lychee, peach, mango and blackberry.

Geographical Penetration

Increasing Demand for Healthier and Low Alcoholic Beverages

Asia-Pacific region dominated the global fruit wine market, due to the high acceptance of these wines in this region. The increasing health awareness among consumers is driving them towards healthier alcoholic beverages with low alcohol content. The increasing export and import potential of countries such as India and China in this region is positively driving the market growth.

The increasing government initiatives to improve the market in this region boost the market growth. The development of new processing and incubation units for fruit wines is increasing the market demand in this region. For instance, in September 2023, Meghalaya CM inaugurated the North East Fruit Wine Incubation Centre at the IHM campus in Shillong.

The government is taking the initiative to provide proper training for fruit-wine making to improve the production capacity and quality of fruit wine. For instance, in September 2023, the Ministry of Doners, the government of India announced the three-month residential training program on fruit wine-making sponsored by the Northeastern Council.

Competitive Landscape

The major global players in the market include: Field Stone Fruit Wines, Lyme Bay Cider Co Ltd, Ningxia Hong, Sula Rasa, Northern Compass, Rhythm Winery, Wildberry Beverages Pvt. Ltd., Elite Vintage Winery, Hill Top Berry Farm & Winery and St. James Winery.

COVID-19 Impact Analysis:

The outbreak of the COVID-19 pandemic moderately impacted the global fruit wine market. The sudden lockdown declaration in the nation resulted in the shutdown of various wine manufacturing units. The disruption in the distribution channel created imbalance in the demand-supply chains.

Wines are mostly preferred and were in high demand in social gatherings. The lockdown restricted various celebrations and gathering activities, decreasing the demand for the market. In addition, the closure of bars and wine shops created a bad impact on the market growth. The availability of these products in most of the e-commerce websites with various varieties and discounts is expected to impact the market growth positively.

Incraesed health awareness among consumers decreased the high alcohol consumption to maintain good immunity. Wines with lower alochol percentage became famous in the beverage sector in the pandemic situation. The health advantages linked with the fruit wines motivated consumers to take up these products, positively impacting the market growth.

Russia- Ukraine War Impact

The Russia-Ukraine war had a negative impact on many industrial sectors, including alcoholic beverages. The war resulted in supply chain disturbances disrupting the global fruit-wine supply chain. The war created import and export trade disruptions, resulting in economic disturbances for the market. The political and economic uncertainty created due to the war had a negative impact on the fruit wine market.

By Fruit Type

- Grape

- Strawberry

- Apple

- Pear

- Pineapple

- Cherry

- Others

By Product

- Still Wine

- Sparkling Wine

- Fortified Wine

By Wine Type

- Distilled

- Semi-Distilled

- Fermented

By Grade

- Premium

- Mass

By Packaging

- Bottle

- Can

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- E-Commerce

- Others

By Application

- Household

- Commercial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In October 2022, Treasury Wine Estates Ltd., the world's most admired premium wine company acquired Chateau Lanessan, one of the oldest estates in Bordeaux, France. The acquisition helped the wide expansion of the product in the global market.

- In September 2022, Portuguese wine company Abegoarioa Group announced the acquisition of Vidigal Wines, a Porta 6 wine producer. Through this acquisition, the Porta 6's wine has accomplished global popularity and increased sales in the global market.

- In July 2020, Pour Vineyard, a U.S.-based released a new product, Strawberry Sweet Fruit Wine into their product portfolio.

Why Purchase the Report?

- To visualize the global fruit wines market segmentation based on fruit type, product, wine type, grade, packaging, distribution channel, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of fruit wines market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global fruit wines market report would provide approximately 77 tables, 83 figures and 189 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Fruit Type

- 3.2. Snippet by Product

- 3.3. Snippet by Wine Type

- 3.4. Snippet by Grade

- 3.5. Snippet by Packaging

- 3.6. Snippet by Distribution Channel

- 3.7. Snippet by Application

- 3.8. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Availability of Fruit Wines in Various Flavors

- 4.1.1.2. Innovative Product Launches

- 4.1.2. Restraints

- 4.1.2.1. High Popularity of Traditional Wine and Challenges in Processing Fruit Wine

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Fruit Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Fruit Type

- 7.1.2. Market Attractiveness Index, By Fruit Type

- 7.2. Grape

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. Riesling

- 7.2.4. Chardonnay

- 7.2.5. Pinot Gris

- 7.2.6. Sauvignon Blanc

- 7.3. Strawberry

- 7.4. Apple

- 7.5. Pear

- 7.6. Pineapple

- 7.7. Cherry

- 7.8. Others

8. By Product

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 8.1.2. Market Attractiveness Index, By Product

- 8.2. Still Wine

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Sparkling Wine

- 8.4. Fortified Wine

9. By Wine Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Wine Type

- 9.1.2. Market Attractiveness Index, By Wine Type

- 9.2. Distilled

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Semi-Distilled

- 9.4. Fermented

10. By Grade

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 10.1.2. Market Attractiveness Index, By Grade

- 10.2. Premium

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Mass

11. By Packaging

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 11.1.2. Market Attractiveness Index, By Packaging

- 11.2. Bottle

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Can

12. By Distribution Channel

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.1.2. Market Attractiveness Index, By Distribution Channel

- 12.2. Supermarkets and Hypermarkets

- 12.2.1. Introduction

- 12.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3. Specialty Stores

- 12.4. E-commerce

- 12.5. Others

13. By Application

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.1.2. Market Attractiveness Index, By Application

- 13.2. Household

- 13.2.1. Introduction

- 13.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 13.3. Commercial

14. By Region

- 14.1. Introduction

- 14.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 14.1.2. Market Attractiveness Index, By Region

- 14.2. North America

- 14.2.1. Introduction

- 14.2.2. Key Region-Specific Dynamics

- 14.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Fruit Type

- 14.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Wine Type

- 14.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 14.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 14.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.2.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.2.10.1. U.S.

- 14.2.10.2. Canada

- 14.2.10.3. Mexico

- 14.3. Europe

- 14.3.1. Introduction

- 14.3.2. Key Region-Specific Dynamics

- 14.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Fruit Type

- 14.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Wine Type

- 14.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 14.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 14.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.3.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.3.10.1. Germany

- 14.3.10.2. U.K.

- 14.3.10.3. France

- 14.3.10.4. Italy

- 14.3.10.5. Spain

- 14.3.10.6. Rest of Europe

- 14.4. South America

- 14.4.1. Introduction

- 14.4.2. Key Region-Specific Dynamics

- 14.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Fruit Type

- 14.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Wine Type

- 14.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 14.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 14.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.4.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.4.10.1. Brazil

- 14.4.10.2. Argentina

- 14.4.10.3. Rest of South America

- 14.5. Asia-Pacific

- 14.5.1. Introduction

- 14.5.2. Key Region-Specific Dynamics

- 14.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Fruit Type

- 14.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Wine Type

- 14.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 14.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 14.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.5.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.5.10.1. China

- 14.5.10.2. India

- 14.5.10.3. Japan

- 14.5.10.4. Australia

- 14.5.10.5. Rest of Asia-Pacific

- 14.6. Middle East and Africa

- 14.6.1. Introduction

- 14.6.2. Key Region-Specific Dynamics

- 14.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Fruit Type

- 14.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Wine Type

- 14.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 14.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 14.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.6.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

15. Competitive Landscape

- 15.1. Competitive Scenario

- 15.2. Market Positioning/Share Analysis

- 15.3. Mergers and Acquisitions Analysis

16. Company Profiles

- 16.1. Field Stone Fruit Wines

- 16.1.1. Company Overview

- 16.1.2. Product Portfolio and Description

- 16.1.3. Financial Overview

- 16.1.4. Key Developments

- 16.2. Lyme Bay Cider Co Ltd

- 16.3. Ningxia Hong

- 16.4. Sula Rasa

- 16.5. Northern Compass

- 16.6. Rhythm Winery

- 16.7. Wildberry Beverages Pvt. Ltd.

- 16.8. Elite Vintage Winery

- 16.9. Hill Top Berry Farm & Winery

- 16.10. St. James Winery

LIST NOT EXHAUSTIVE

17. Appendix

- 17.1. About Us and Services

- 17.2. Contact Us