|

|

市場調査レポート

商品コード

1279698

エンジニアリングプラスチックの世界市場- 2023-2030年Global Engineering Plastics Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エンジニアリングプラスチックの世界市場- 2023-2030年 |

|

出版日: 2023年05月26日

発行: DataM Intelligence

ページ情報: 英文 206 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場の概要

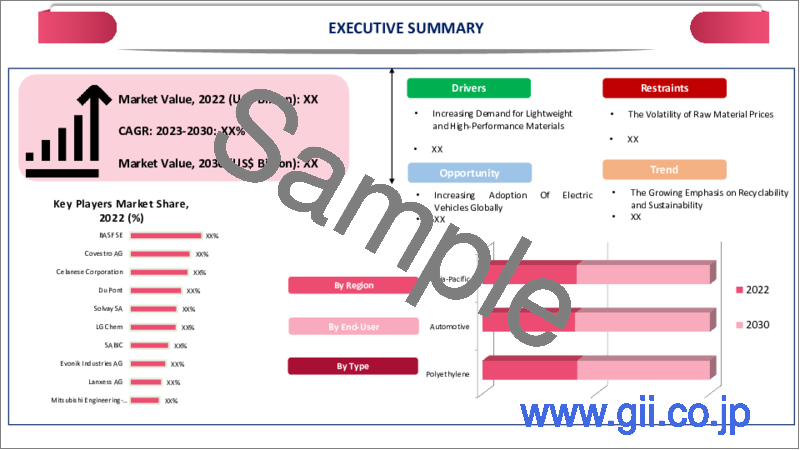

エンジニアリングプラスチックの世界市場は、2022年に764億9,064万米ドルに達し、2030年には1,203億2,811万米ドルに達することで有利な成長を遂げると予測されます。また、予測期間中(2023年~2030年)のCAGRは6.87%に達すると予想されています。

エンジニアリングプラスチックは、軽量化、設計の柔軟性など、自動車分野での用途が拡大しており、エンジニアリングプラスチックの市場シェアを高めています。さらに、エンジニアリングプラスチックは、自動車の重量を40%削減することができます。自動車製造におけるエンジニアリングプラスチックの継続的な使用は、市場の需要拡大に寄与しています。

さらに、中国、インド、ブラジルなどの新興国では、工業化と都市化が急速に進んでおり、自動車や建築などさまざまな用途でエンジニアリングプラスチックの需要が増加しています。

市場力学

軽量かつ高性能な材料への需要の高まり

航空宇宙産業では、航空機の軽量化が求められており、燃費の向上や運航コストの削減につながることから、軽量化材料の需要が高まっています。炭素繊維複合材料、チタン合金、アルミニウムなどの材料は、軽量かつ高強度であることから、航空宇宙用途で広く使用されています。さらに、軽量素材は航空機の性能と安全性を向上させることもできるため、これらの素材に対する需要の高まりにつながっています。

また、消費財業界も軽量・高機能材料の需要を牽引しています。例えば、電子機器、家電製品、スポーツ用品にエンジニアリングプラスチックを使用することで、これらの製品の重量を減らし、より携帯しやすく使いやすいものにすることができます。さらに、軽量化された材料は、これらの製品の性能と耐久性を向上させることができるため、需要の増加につながります。

原材料価格の変動

原材料価格の変動は、製造コストの上昇、需要の減少、業界への投資の制限につながるため、エンジニアリング材料市場の成長を阻害する重要な要因となっています。

さらに、原材料価格の変動は、エンジニアリング材料市場の企業にとって、生産コストや利益の計画・予測を困難にする可能性があります。これは不確実性とリスク回避につながり、市場への投資を制限し、成長を阻害する可能性があります。

COVID-19影響分析

COVID-19分析では、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格ダイナミクス(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需要-供給スペクトラム(取引制限、ロックダウンおよびその後の問題による需要と供給のシフト)、政府の取り組み(政府機関による市場、セクター、産業の活性化に関する取り組み)、メーカーの戦略的取り組み(COVID問題を軽減するためのメーカーの取り組み)についても説明する予定です。

目次

第1章 調査手法と範囲

- 調査手法

- 調査目的および調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

- タイプ別スニペット

- スニペット:エンドユーザー別

- スニペット:地域別

第4章 市場力学

- 影響要因

- 促進要因

- 軽量かつ高性能な素材への需要の高まり

- 抑制要因

- 原材料価格の変動

- 機会

- 技術的進歩

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 法規制の分析

第6章 COVID-19の分析

- COVID-19の分析

- COVID-19の前のシナリオ

- COVID-19期間中のシナリオ

- COVID-19後のシナリオ、または将来のシナリオ

- COVID-19の中での価格・ダイナミクス

- 需給スペクトル

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的な取り組み

- サマリー

第7章 タイプ別

- ポリエチレン

- 低密度ポリエチレン(LDPE)

- 中密度ポリエチレン(MDPE)

- 高密度ポリエチレン(HDPE)

- ポリカーボネート

- ポリエステル

- ポリプロピレン

- ポリウレタン

- ポリ塩化ビニル(PVC)

- ポリアミド

- アクリロニトリル・ブタジエン・スチレン(ABS)

- ナイロン

- ポリエチレンテレフタレート(PET)

- その他

第8章 エンドユーザー別

- 自動車

- コンシューマーエレクトロニクス

- 電気・電子

- パッケージング産業

- 医療分野

- 建設業界

- 機械工学

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A(合併・買収)分析

第11章 企業プロファイル

- BASF SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展状況

- Covestro

- Celanese Corporation

- Du Pont

- Solvay SA

- LG Chem

- Sabic

- Evonik Industries AG

- Lanxess AG

- Mitsubishi Engineering-Plastics Corporation

第12章 付録

Market Overview

The global engineering plastics market reached US$ 76490.64 million in 2022 and is projected to witness lucrative growth by reaching up to US$ 120328.11 million by 2030. The market is expected to exhibit a CAGR of 6.87% during the forecast period (2023-2030).

Engineering plastics are finding more applications in the automotive sector owing to their applications such as lightweight, design flexibility, and many more which boost the market share of engineering plastics. Moreover, these plastics can reduce the weight of automobiles by 40%. Continuous use of engineering plastics in automotive manufacturing contributes to raising the market demand.

Furthermore, emerging economies such as China, India, and Brazil are experiencing rapid industrialization and urbanization, leading to an increase in demand for engineering plastics in various applications such as automotive and construction.

Market Dynamics

Increasing Demand For Lightweight And High-Performance Materials

In the aerospace industry, the demand for lightweight materials is driven by the need to reduce the weight of aircraft, leading to improved fuel efficiency and reduced operating costs. Materials, such as carbon fiber composites, titanium alloys, and aluminum, are widely used in aerospace applications due to their lightweight and high-strength properties. Furthermore, lightweight materials can also improve the performance and safety of aircraft, leading to increased demand for these materials.

The consumer goods industry is also driving the demand for lightweight and high-performance materials. For instance, the use of engineering plastics in electronics, appliances, and sports equipment can reduce the weight of these products, making them more portable and user-friendly. Additionally, lightweight materials can enhance the performance and durability of these products, leading to increased demand.

The Volatility of Raw Material Prices

The volatility of raw material prices is a significant factor that is hampering the growth of the engineering materials market, as it can lead to higher production costs, reduced demand, and limited investment in the industry.

Moreover, the volatility of raw material prices can make it difficult for companies in the engineering materials market to plan and forecast their production costs and profits. This can lead to uncertainty and risk aversion, which may limit investment in the market and hinder its growth.

COVID-19 Impact Analysis

The COVID-19 analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with pricing dynamics (including pricing change during and post-pandemic comparing it with pre-COVID scenarios), demand-supply spectrum (shift in demand and supply owing to trading restrictions, lockdown and subsequent issues), government initiatives (initiatives to revive market, sector or industry by government bodies) and manufacturers strategic initiatives (what manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global engineering plastics market is segmented based on type, end-user and region.

The Growing Demand For Low-Cost, High-Strength, And Excellent Chemical-Resistant Material

Polyethylene in the engineering plastics market holds the largest market share covering nearly 50% at the global level. The cost-effectiveness of the material is the primary market driving factor. Polyethylene is a cost-effective material compared to other engineering plastics, making it an attractive option for manufacturers across various industries. It is one of the most affordable polymers, making it accessible to a wide range of applications.

Furthermore, polyethylene offers excellent versatility in terms of its properties, making it ideal for use in different applications. It is available in various grades, such as high-density polyethylene (HDPE) and low-density polyethylene (LDPE), which have different properties and can be tailored to meet specific requirements.

Geographical Analysis

Asia-Pacific's Strong Manufacturing Base For Engineering Plastics

Asia-Pacific holds the highest market share in the global engineering plastics market. Asia-Pacific has a strong manufacturing base, which has led to the growth of various industries, including automotive, construction, and electronics. The availability of a skilled workforce, low labor costs, and favorable government policies have attracted several manufacturers to the region, leading to increased demand for engineering plastics.

Competitive Landscape

The major global players in the market include: BASF SE, Covestro, Celanese Corporation, Du Pont, Solvay SA, LG Chem, Sabic, Evonik Industries AG, Lanxess AG and Mitsubishi Engineering-Plastics Corporation.

Why Purchase the Report?

- To visualize the global engineering plastics market segmentation based on type, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of engineering plastics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available in Excel consisting of key products of all the major players.

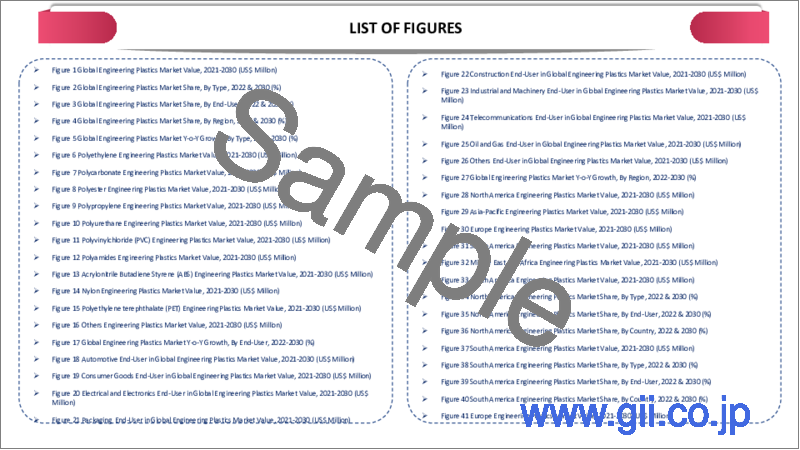

The global engineering plastics market report would provide approximately 53 tables, 59 figures and 206 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by End-User

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing demand for lightweight and high-performance materials

- 4.1.2. Restraints

- 4.1.2.1. The Volatility of Raw Material Prices

- 4.1.3. Opportunity

- 4.1.3.1. Technological Advancements

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Post COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Polyethylene*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. Low-Density Polyethylene (LDPE)

- 7.2.4. Medium Density Polyethylene (MDPE)

- 7.2.5. High-Density Polyethylene (HDPE)

- 7.3. Polycarbonate

- 7.4. Polyester

- 7.5. Polypropylene

- 7.6. Polyurethane

- 7.7. Polyvinylchloride (PVC)

- 7.8. Polyamides

- 7.9. Acrylonitrile Butadiene Styrene (ABS)

- 7.10. Nylon

- 7.11. Polyethylene terephthalate (PET)

- 7.12. Others

8. By End-User

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2. Market Attractiveness Index, By End-User

- 8.2. Automotive*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Consumer Electronics

- 8.4. Electrical and Electronics

- 8.5. Packaging Industry

- 8.6. Medical Applications

- 8.7. Construction Industry

- 8.8. Machine Engineering

- 8.9. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. The U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. The U.K.

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Russia

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. BASF SE *

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Covestro

- 11.3. Celanese Corporation

- 11.4. Du Pont

- 11.5. Solvay SA

- 11.6. LG Chem

- 11.7. Sabic

- 11.8. Evonik Industries AG

- 11.9. Lanxess AG

- 11.10. Mitsubishi Engineering-Plastics Corporation

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us