|

|

市場調査レポート

商品コード

1496685

コールドチェーン市場- 世界および地域別分析:用途別、タイプ別、温度タイプ別、地域別 - 分析と予測(2024年~2034年)Cold Chain Market - A Global and Regional Analysis: Focus on Application, Type, Temperature Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| コールドチェーン市場- 世界および地域別分析:用途別、タイプ別、温度タイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年06月19日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

コールドチェーン市場は、温度変化に敏感な製品の保存と輸送に不可欠であり、世界のロジスティクス産業において急速に拡大している分野です。

飲食品、医薬品、化学品などの分野にまたがるコールドチェーンは、一連の冷蔵生産、保管、流通活動を含みます。楽観的な予測では、コールドチェーンの市場規模は、2024年に2,374億3,000万米ドルになるとみられ、今後は9.08%のCAGRで拡大し、2034年には5,660億3,000万米ドルに達すると予測されています。この市場は、生鮮品の完全性と品質を維持するためだけでなく、公衆衛生と安全を確保するためにも極めて重要です。世界経済が成長し、消費者の要求が進化するにつれ、効率的なコールドチェーンの重要性がかつてないほど明白になっています。人口増加、都市化、所得の増加により、新鮮で高品質な生鮮食品や高度な医療品への需要が高まっており、これらの食品はすべて、原産地から消費地までの綿密な温度管理を必要とします。このことが、コールドチェーン市場の大幅な成長と技術進歩の舞台となっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価額 | 2,374億3,000万米ドル |

| 2034年の予測 | 5,660億3,000万米ドル |

| CAGR | 9.08% |

コールドチェーン業界で最も注目すべき動向のひとつは、先端技術の統合です。モノのインターネット(IoT)、人工知能(AI)、ブロックチェーンなどの革新は、サプライチェーン全体で温度の影響を受けやすい製品の取り扱いや追跡方法に革命をもたらしています。IoTセンサーは、製品の状態や環境要因に関するリアルタイムのデータを提供し、すべての商品が必要な温度範囲内に保たれるようにします。AIは、生鮮品の輸送に関連するリスクを予測・管理し、ルートを最適化し、腐敗を減らすために使用されます。ブロックチェーン技術は、取引を記録し、商品の移動を追跡する安全で透明な方法を提供し、トレーサビリティとコンプライアンスを強化します。

コールドチェーン市場の成長を後押ししている要因はいくつかあります。生鮮食品に対する需要の高まりとオンライン食料品販売の増加により、生鮮品のラストワンマイル配送を処理する堅牢なコールドチェーンソリューションが必要とされています。同様に、製薬業界の拡大、特に厳密な温度管理が必要なワクチンや生物製剤の生産・流通の増加も、重要な促進要因となっています。さらに、サプライチェーンの世界な性質と、新興国からの食品・医薬品輸出の増加が、市場の拡大をさらに促しています。

当レポートでは、世界のコールドチェーン市場について調査し、市場の概要とともに、用途別、タイプ別、温度タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 コールドチェーン市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- コールドチェーン市場(用途別)

第3章 コールドチェーン市場(製品別)

- 製品セグメンテーション

- 製品概要

- コールドチェーン市場(タイプ別)

- コールドチェーン市場(温度タイプ別)

第4章 コールドチェーン市場(地域別)

- コールドチェーン市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- Americold Logistics, Inc.

- NICHIREI CORPORATION

- Lineage, Inc.

- Burris Logistics

- NewCold

- Seafrigo Group

- Blue Water Shipping

- A.P. Moller - Maersk

- CONGEBEC

- Tippmann Group

- CDS Group of Companies

- JS Davidson

- Coldman Logistics Pvt.Ltd.

- Trenton Cold Storage

- APF Cold Storage & Logistics

- その他

第6章 調査手法

Introduction to Cold Chain Market

The cold chain market is an essential and rapidly expanding segment of the global logistics industry, critical for the preservation and transportation of temperature-sensitive products. Spanning sectors such as food and beverages, pharmaceuticals, and chemicals, the cold chain involves a series of refrigerated production, storage, and distribution activities. In an optimistic forecast, the market, valued at $237.43 billion in 2024, is anticipated to grow at a CAGR of 9.08%, reaching $566.03 billion by 2034. This market is pivotal not only for maintaining the integrity and quality of perishable goods but also for ensuring public health and safety. As the global economy grows and consumer demands evolve, the importance of an efficient cold chain has never been more apparent. Population growth, urbanization, and increasing incomes are driving up the demand for fresh, high-quality perishable foods and advanced medical products, all of which require meticulous temperature management from point of origin to consumption. This has set the stage for significant growth and technological advancement within the cold chain market.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $237.43 Billion |

| 2034 Forecast | $566.03 Billion |

| CAGR | 9.08% |

One of the most notable trends within the cold chain industry is the integration of advanced technologies. Innovations such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain are revolutionizing how temperature-sensitive products are handled and tracked across the supply chain. IoT sensors provide real-time data on product condition and environmental factors, ensuring that all items remain within required temperature ranges. AI is used to predict and manage the risks associated with the transport of perishable goods, optimizing routes, and reducing spoilage. Blockchain technology offers a secure and transparent way to record transactions and track the movement of goods, enhancing traceability and compliance.

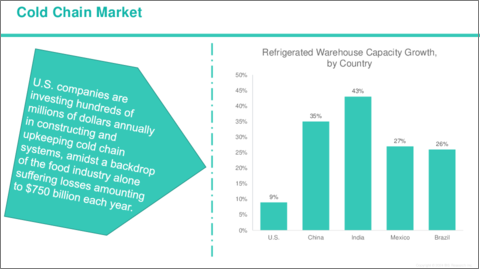

Several factors are propelling the growth of the cold chain market. The rising demand for fresh food products and the growth in online grocery sales have necessitated robust cold chain solutions to handle the last-mile delivery of perishables. Similarly, the pharmaceutical industry's expansion, particularly with the increased production and distribution of vaccines and biologics, which require strict temperature control, is another critical growth driver. Additionally, the global nature of supply chains and the increase in food and pharmaceutical exports from emerging economies are further stimulating market expansion.

In conclusion, the cold chain market is at a critical juncture, facing both unprecedented challenges and opportunities. As the world continues to globalize and the demand for safe, high-quality perishable goods increases, the industry must evolve through technological innovation and adherence to regulatory standards. Companies that can navigate this complex landscape effectively will find themselves well-positioned to capitalize on the growth of the cold chain sector, contributing to a safer, more efficient global marketplace.

Market Segmentation

Segmentation 1: by Application

- Food and Beverages

- Pharmaceutical

- Others

Segmentation 2: by Type

- Storage

- Transportation

- Packaging

- Monitoring

Segmentation 3: by Temperature Type

- Chilled (0 0C to 5 0C)

- Frozen (-18 0C to -25 0C)

- Deep-frozen (Below -25 0C)

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global cold chain market has been extensively segmented based on various categories, such as application, type, and temperature type. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global cold chain market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- Americold Logistics, Inc.

- Lineage, Inc.

- NICHIREI CORPORATION

- Burris Logistics

- Tippmann Group

- Coldman Logistics Pvt.Ltd.

Key Questions Answered in this Report:

- What are the main factors driving the demand for cold chain market?

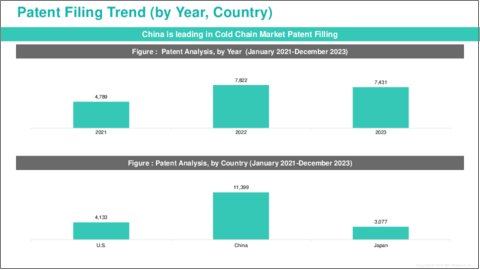

- What are the major patents filed by the companies active in the cold chain market?

- Who are the key players in the cold chain market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the cold chain market?

- What are the strategies adopted by the key companies to gain a competitive edge in cold chain market?

- What is the futuristic outlook for the cold chain market in terms of growth potential?

- What is the current estimation of the cold chain market and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for cold chain market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Cold Chain Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Cold Chain Market (by Application)

- 2.3.1 Food and Beverages

- 2.3.2 Pharmaceutical

- 2.3.3 Others

3. Cold Chain Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Cold Chain Market (by Type)

- 3.3.1 Storage

- 3.3.2 Transportation

- 3.3.3 Packaging

- 3.3.4 Monitoring

- 3.4 Cold Chain Market (by Temperature Type)

- 3.4.1 Chilled (0 0C to 5 0C)

- 3.4.2 Frozen (-18 0C to -25 0C)

- 3.4.3 Deep-frozen (Below -25 0C)

4. Cold Chain Market (by Region)

- 4.1 Cold Chain Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Americold Logistics, Inc.

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 NICHIREI CORPORATION

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Lineage, Inc.

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Burris Logistics

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 NewCold

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Seafrigo Group

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Blue Water Shipping

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 A.P. Moller - Maersk

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 CONGEBEC

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Tippmann Group

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 CDS Group of Companies

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 JS Davidson

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Coldman Logistics Pvt.Ltd.

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Trenton Cold Storage

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 APF Cold Storage & Logistics

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Others

- 5.2.1 Americold Logistics, Inc.