|

|

市場調査レポート

商品コード

1208806

培養肉の世界市場 - 市場規模、動向、競合企業、予測(2023年)The Global Market for Cultured Meat - Market Size, Trends, Competitors, and Forecasts (2023) |

||||||

|

|||||||

| 培養肉の世界市場 - 市場規模、動向、競合企業、予測(2023年) |

|

出版日: 2023年12月31日

発行: BioInformant

ページ情報: 英文 192 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

当レポートでは、世界の培養肉市場について調査し、市場の概要とともに、製品タイプ別、原料別、形態別、流通チャネル別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 培養肉の概要

- 報告書の陳述

- イントロダクション

- エグゼクティブサマリー

第2章 培養肉の歴史、科学、技術

- 命名法

- 培養肉の歴史

- 培養肉の科学

第3章 培養肉の潜在的な利点

- 持続可能性

- 環境上の利点

- 動物福祉

- 食品安全

- ノベルフード

第4章 培養肉の物理的および化学的側面

- 構造と質感

- 色

- フレーバー

- 栄養成分

第5章 培養肉生産技術と進歩

- ステップ1:種細胞の取得

- ステップ2:種細胞の大規模な拡張

- ステップ3:種細胞の分化誘導

- ステップ4:肉製品への培養細胞の組み立て

- 培養肉の大量生産に向けた技術的課題

- 培養肉技術の新たな応用例

- 培養肉の小売市場への参入:考えうるシナリオ

第6章 人工培養肉の培地コスト分析

- 医薬品グレードの培地コスト内訳

- 食品グレード基礎培地成分コスト内訳

- 細胞培養培地コストを削減する潜在的なシナリオ

第7章 調査情勢

第8章 特許の情勢

第9章 投資の情勢

第10章 培養肉産業:現在の状況、ブレークスルー、歴史的出来事

- 培養肉企業の世界の存在感

- 開発中の培養肉製品

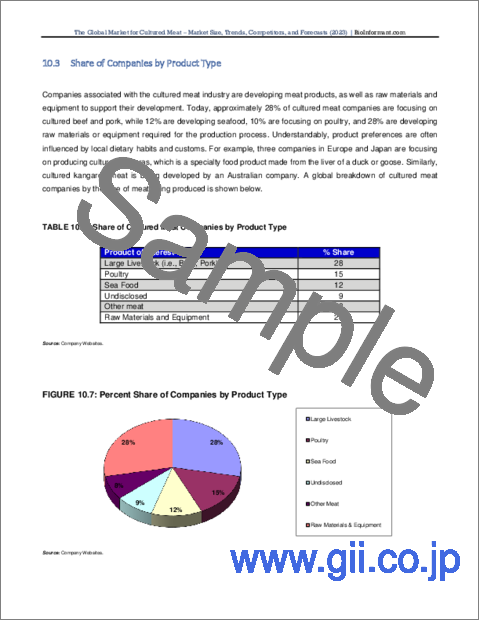

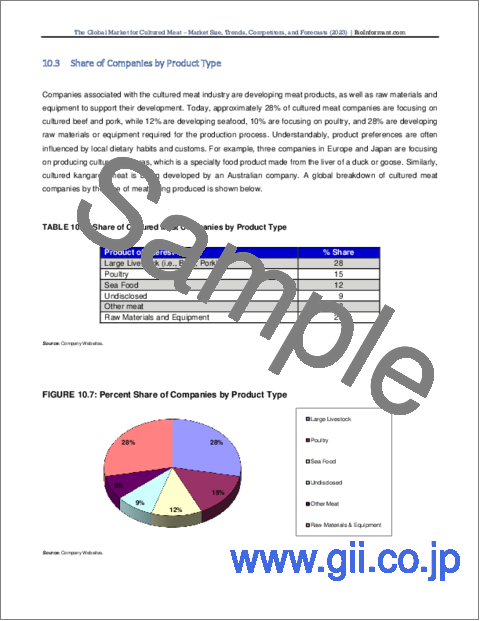

- 製品タイプ別企業シェア

- 培養肉産業の画期的なイベント

- 培養肉部門における最近の主な進展

- テイスティングイベント

- 培養肉生産の最先端

- 培養肉が市場に出る時期

- 培養肉産業における現在の限界

- パイロットプラントのセットアップへの競争

- ハイブリッド製品:最初に市場に参入

- 培養肉と従来の食肉のコスト・パリティ

- イスラエルにおける世界初の培養肉施設

- 培養肉非営利団体の急増

第11章 スタートアップの情勢

第12章 規制状況

- オーストラリア- ニュージーランド

- カナダ

- 米国

- 欧州連合

- 英国

- シンガポール

- 日本

第13章 培養肉市場:市場規模、動向、および将来の予測

第14章 培養肉市場:企業プロファイル

- 3D Bio-Tissues Ltd.

- Agulos Biotech, LLC

- Aleph Farms

- Alife Foods

- Ants Innovate

- Artemys Foods

- ArtMeat

- Avant Meats Company Limited

- Back of the Yard Algae Sciences

- Balletic Foods

- Because Animals

- Bene Meat Technologies AS

- BIFE Laboratorios-Craveri

- Biftek, Inc.

- BioBQ

- BioFood Systems

- BIOMILQ

- BioMilk, Ltd

- BioTech Foods

- BlueNalu, Inc

- Blue Ridge Bantam

- Bluu Biosciences

- Boston Meats, Inc

- Bruno Cell SRL

- Cass Materials Pty Ltd.

- CELL AG TECH

- Cell Guidance Systems Ltd.

- CELLINK

- Cellivate Technologies

- CellMEAT

- Celltainer Biotech BV

- Cellular Agriculture, Ltd

- CellulaREvolution

- CellX

- Clear Meat Private Limited

- Core Biogenesis

- Cubiq Foods

- Cultured Blood

- Cultured Decadence

- DaNAgreen Co., Ltd.

- Defined Bioscience, Inc.

- Dipole Materials

- Diverse Farms

- East Just, Inc.

- Finless Foods, Inc

- Fork & Goode

- Future Fields

- Future Meat Technologies

- Gelatex Technologies, Ltd.

- HCS Pharma

- Heuros

- HigherSteaks

- Hoxton Farms

- Incuvers

- Innocent Meat UG

- IntegriCulture, Inc

- Jellatech

- JOINN Biologics

- KosmodeHealth

- Lab Farm Foods

- Luyef Biotechnologies

- MagicCavier

- Magic Valley, Pty, Ltd.

- Matrix Meats

- Meatable

- MeaTech 3D Ltd.

- Metalytics, Inc.

- Mirai Foods AG

- Mission Barns

- Mogale Meat Co

- Mosa Meat

- Multus Media

- MyoWorks, Pvt. Ltd.

- Mzansi Meat, Co.

- New Age Meats

- Novel Farms, Inc.

- NUProtein Co., Ltd.

- Orbillion Bio

- ORF Genetics Ltd.

- Ospin Modular Bioprocessing

- Peace of Meat

- Perfect Day Foods

- Roslin Technologies Ltd.

- Shiok Meats

- SingCell Tx Pte. Ltd

- SunP Biotech

- SuperMeat

- Tantti Laboratory, Inc.

- TeOra

- Tiamat Sciences

- TissueByNET Co., Ltd.

- TurtleTree Labs

- Umami Meats

- Unicorn Biotechnologies

- Upside Foods, Inc

- Vivax Bio

- Vow

- Wildtype

- White Board Foods

LIST OF FIGURES

- Figure 2.1: Nomenclature Usage among Startups

- Figure 3.1: Protein Conversion Efficiency of Cultured Meat

- Figure 3.2: Comparison of Environmental Impacts of Cultured Meat with other Meats

- Figure 5.1: Main Production Process of Cultured Meat

- Figure 5.2: Cultured Meat to the Market: Possible Scenario

- Figure 6.1: Estimated Cost per Liter of Medium for Each Cost Reduction Scenario

- Figure 7.1: Number of PubMed Publications on Cultured Meat by Year

- Figure 7.2: Major Keywords used in Scientific Literature

- Figure 8.1: Patent Applications for Scaffolds

- Figure 9.1: Total Capital Invested in Cultured Meat Industry by Year

- Figure 9.2: Capital Invested by Type of Cultured Meat by Year

- Figure 9.3: Top Ten Companies Regarding the Capital Investment

- Figure 10.1: Global Presence of Cultured Meat Companies by Geography

- Figure 10.2: JUST's Cultured Chicken Nugget

- Figure 10.3: Memphis Meat's Deep Fried Cultured Chicken Tender

- Figure 10.4: Memphis Meats' Cultured Beef Meat Ball

- Figure 10.5: Cultured Pork Belly and Bacon from Higher Steaks

- Figure 10.6: Cultured Pork Sausage by New Age Meats

- Figure 10.7: Percent Share of Companies by Product Type

- Figure 10.8: Aleph Farms' Cooked Cultured Steak

- Figure 10.9: Israeli PM Tasting Aleph Farm's Cultured Steak

- Figure 10.10: SuperMeat's "The Chicken," a Hybrid Restaurant Concept and Pilot Plant

- Figure 10.11: Lab Farm Foods' Cultured Chicken Nuggets and Pork Liver Pate

- Figure 10.12: Avant Meats' Cultured Fish Fillets

- Figure 10.13: Wildtype's Cultured Sushi-Grade Salmon

- Figure 10.14: Shiok Meats' Cultured Lobster Meat

- Figure 10.15: Location of Large-Scale Manufacturing Facilities by Geography

- Figure 10.16: Percent Share of Scaffold Types gaining Focus

- Figure 10.17: Future Meat's Cultured Meat Facility at Rehovot

- Figure 13.1: Global Consumption of Meat by Type, 1990-2030

- Figure 13.2: Global Market for Conventional Meat by Type, 2000-2030

- Figure 13.3: Changing Landscape of Global Meat Market

- Figure 13.4: Global Cultured Meat Market by Geography, with Forecasts through 2032

- Figure 13.5: Global Market for Cultured Meat by Meat Type, with Forecasts through 2032

- Figure 14.1: Schematic of MeaTech's 3D Bioprinting of Cultured Meat

LIST OF TABLES

- Table 3.1: Comparison of Traditional Meat Production and Cultured Meat Production

- Table 5.1: Cultured Meat Production Processes and Challenges

- Table 5.2: Major Cultured Meat-Related Startups

- Table 5.3: Emerging Applications for Cultured Meat Technology

- Table 6.1: Cost of Ingredients in Pharmaceutical Grade Essential 8 Medium

- Table 6.2: Cost of Ingredients within DMEM/F12 Basal Medium for a 20,000 Liter Batch

- Table 6.3: Projected Cost and Fold Reduction under Scenarios A through G

- Table 7.1: Select Four Research Projects on Cultured Meat

- Table 7.2: Cultured Meat Research Lab Database

- Table 7.3: Funding Opportunities for Research on Cultured Meat

- Table 7.4: Collaborative Researchers in Cultured Meat Sector

- Table 8.1: Number of Granted and Pending Patents/Applications by Company

- Table 8.2: Types of Patent Claims

- Table 9.1: Top Ten Companies Regarding Capital Investment

- Table 9.1: Cultured Meat Companies by Size of Investments

- Table 9.2: Companies Funded by Agronomics

- Table 9.3: Public Sector Investments in Cultured Meat Sector

- Table 9.4: Global Investments into the Cultured Meat Sector

- Table 9.5: Complete List of Venture Investments into the Cultured Meat Sector

- Table 9.6: Most Active Investors in Cultured Meat Industry

- Table 10.1: Cultured Meat Products under Development

- Table 10.2: Share of Cultured Meat Companies by Product Type

- Table 10.3: Landmark Events in the Cultured Meat Industry

- Table 10.4: Leading Edge of Cultured Meat Production

- Table 10.5: Members of International Cellular Agriculture Nonprofit Consortium

- Table 11.1: Complete List of Cultured Meat Startups

- Table 11.2: New Entrants into Cultured Meat Industry by Product Type

- Table 11.3: Startups Specializing in Growth Factors

- Table 13.1: Global Market for Cultured Meat by Geography, with Projections through 2032

- Table 13.2: Global Market for Cultured Meat by Type, with Projections through 2032

Cultured meat refers to lab-grown meat created using cell culture techniques. It is produced by growing stem cell cells collected from cattle, chicken, pigs, fish, and lamb, as well as other types of livestock and seafood. In addition to meat production, cultured meat techniques can be used to ethically manufacture animal byproducts, such as leather, fur, milk, and hen-free egg whites, for example. Cultured meat is ethically produced, because livestock is not used within the manufacturing processes beyond collecting the initial cells for culture.

The rise of the cultured meat market is being supported by the sustainability of the process, as well as the industry's ability to provide "tailor-made nutrition" through its meat and seafood products. Recent surveys indicate that nearly 50% of the consumers do not have any reservation about cultured meat. Over the next 10 to 20 years, the cultured meat market will act as a major disruptor to the conventional meat market.

By 2040, a projected 60% of the world's meat supply will be created from cells grown within bioreactors.

The Global Market for Cultured Meat

The number of startups focused on developing cultured meat-and the required cell culture media, supplements, and methods to produce them-has been expanding rapidly year-over-year. Today, there are nearly a hundred companies worldwide developing cultured meat components, services, and end-products, compared to only four companies five years ago in 2016. Nearly 40 life science firms have launched products to supply market competitors with the essential inputs they need to support cultured meat and seafood production.

Because cultured meat is an early-stage industry, the language to describe it is evolving in real-time. Currently, company executives use a range of terms to describe the field, including but not limited to: cultured meat, cultivated meat, cell-based meat, clean meat, cellular agriculture, lab-grown meat, slaughter-free meat, and ethically grown meat.

Although the cultured meat market is a nascent industry, 2020 was a landmark year because a cultured chicken product developed by the company Eat Just made its debut on a restaurant menu in Singapore, after the country's food agency approved its sale to the public. The regulatory approval of this lab-grown meat within Singapore provides hope that other regulatory approvals could follow worldwide.

Flow of capital into the cultured meat industry has also grown substantially in recent years, reaching an astounding $1.0 billion in recent months. Additionally, investments in 2020 surpassed $360 million, a figure that was (6X) time greater than the previous year in 2019.

Major investments within the cultured meat market have included Cargill's investment into Memphis Meats and Aleph Farms, as well as Tyson Foods Venture Fund's investments into Memphis Meats and Future Meat Technologies. Wealthy investors are also piling into the cultured meat market. For example, billionaires Bill Gates and Richard Branson threw their weight (and $17 million) into the Silicon Valley start-up Memphis Meats. The start-up company rose to fame when it produced the world's first lab-grown meatballs made by cultivating cow muscle tissue within a sterile environment.

Another notable investor is Dr. Rick Klausner. A lead investor in the Dutch company Meatable, he is the former director of the U.S. National Cancer Institute (NCI) and former Executive Director of Global Health for the Bill & Melinda Gates Foundation.

Additionally, the cultured meat industry has received public-sector R&D funding awards within the U.S. and EU. Meanwhile, China signed a $300 million deal to buy lab grown meat produced in Israel in a deal that openly signals its intent to supply cultured meat products to its population of 1.4 billion (15% of the global population).

This cultured meat report explores the following details:

- The history and science of cultured meat production

- Benefits and advantages of cultured meat production

- Production technologies to support cultured meat production

- Emerging applications within the cultured meat market

- Cost of cell culture medium to support cultured meat production

- Cell lines, culture media, scaffolding, and bioprocess designs to support cultured meat production

- The geographic distribution of cultured meat research laboratories

- Funding opportunities for research into cultured meat production

- Rates and volumes of scientific publications about cultured meat technologies

- Collaborative researchers within the cultured meat market

- Granted and pending patents for cultured meat products and technologies

- Capital investments made from 2016 to present into cultured meat companies

- Leading investors funding the cultured meat market

- The global distribution of cultured meat companies

- Current cultured meat products under development

- Strategic partnerships within the cultured meat industry

- Estimated time for cultured meat products to reach commercialization and widespread adoption

- Timelines and requirements for cultured meat to reach cost parity with conventional meat

- Government regulation of cultured meat by region

- Global consumption and market size for the conventional meat market

- Anticipated disruption timeline for the conventional meat market

- Global market size for cultured meat, segmented by geography and meat type

- Future market size for the cultured meat, segmented by geography, meat type, and year

- Profiles of all known cultured meat companies and their products under development

Key questions answered in this report include:

- What are alternative names for cultured meat?

- What are the technological and nutritional advantages of cultured meat?

- Do the cultured meat products have the same color, flavor, and nutrients of conventional meat?

- What are the methods and technologies involved in the production of cultured meat?

- What is the current production cost of cultured meat and what will it be in the future?

- Does cultured meat technology have other applications within the food sector?

- What is being done to bring down the cost of cultured meat to be on par with conventional meat?

- How many research labs in the world are engaged with cultured meat research?

- How many laboratories are offering collaborative research on cultured meat?

- How many scientific papers have been published about cultured meat since 2000 and what are the year-over-year trends?

- Who are the major patent holders within the cultured meat market?

- How much capital has been invested into the cultured meat sector from 2016 to present?

- How much capital has been invested into cultured meat by type?

- How much venture capital have cultured meat companies received?

- What is the current status of the cultured meat industry?

- What types of cultured meat products are under development by current market competitors?

- What are recent developments and newsworthy events within the global market?

- How long it will take for the cultured meat products to reach commercialization?

- How long will cultured meat take to reach widespread adoption?

- What is the size of the cultured meat market, segmented by geography and type of meat?

- What will the size of the cultured meat market grow to by 2032, segmented by geography, type of meat, and year?

Companies Mentioned:

|

|

This report features all known market competitors worldwide, including their core technologies and products under development. It describes the current state of cultured meat market, as well as emerging technologies, patents, funding events, scientific papers, strategic partnerships, and importantly, the market's presumed trajectory toward global adoption.

Importantly, it presents a comprehensive market size breakdown (segmented by type of meat and geography), as well as future projections through 2032.

Cultured meat is fast becoming a real alternative to its farm-grown counterpart as billionaire entrepreneurs, venture firms, and industry heavyweights invest into companies from across this nascent field. With the competitive nature of this global market, you don't have the time to do the research. Claim this report to become immediately informed, without sacrificing hours of unnecessary research or missing critical opportunities.

TABLE OF CONTENTS

1. CULTURED MEAT OVERVIEW

- 1.1. Statement of the Report

- 1.2. Introduction

- 1.3. Executive Summary

2. HISTORY, SCIENCE, & TECHNOLOGY OF CULTURED MEAT

- 2.1. Nomenclature

- 2.2. History of Cultured Meat

- 2.3. The Science of Cultured Meat

- 2.3.1. Cell Lines

- 2.3.2. Cell Culture Media

- 2.3.3. Bioprocess Design

- 2.3.4. Scaffolding

- 2.3.5. End Product Considerations

3. POTENTIAL BENEFITS OF CULTURED MEAT

- 3.1. Sustainability

- 3.2. Environmental Benefits

- 3.3. Animal Welfare

- 3.4. Food Safety

- 3.5. Novel Foods

4. PHYSICAL AND CHEMICAL ASPECTS OF CULTURED MEAT

- 4.1. Structure and Texture

- 4.2. Color

- 4.3. Flavor

- 4.4. Nutritional Composition

5. CULTURE MEAT PRODUCTION TECHNOLOGIES AND ADVANCES

- 5.1. Step 1: Acquisition of Seed Cells

- 5.2. Step 2: Large-Scale Expansion of Seed Cells

- 5.3. Step 3: Induced Differentiation of Seed Cells

- 5.4. Step 4: Assembly of Cultured Cells into Meat Products

- 5.5. Technical Challenges for Large-Scale Production of Cultured Meat

- 5.5.1. Animal Component-Free Medium for Cell Culture

- 5.5.2. Intelligent Bioreactor for Scale Up

- 5.5.3. Degradable/Edible Scaffold for a 3D Structure

- 5.5.4. Technological Challenges in Cultured Meat Production

- 5.5.5. The Biggest Challenge

- 5.5.6. Mass Production Technology

- 5.5.7. Other Technological Challenges

- 5.5.8. Production Cost of Cultured Meat

- 5.6. Additional Emerging Applications of Cultured Meat Technology

- 5.7. Cultured Meat Reaching the Retail Market: Possible Scenarios

6. ANALYSIS OF CULTURE MEDIUM COSTS FOR LAB-GROWN MEAT

- 6.1. Cost Breakdown of Pharmaceutical Grade Culture Media

- 6.2. Cost Breakdown of Food Grade Basal Medium Ingredients

- 6.3. Potential Scenarios to Reduce Cell Culture Medium Cost

- 6.3.1. Projected Cost and Fold Reduction (Cost Comparisons)

7. RESEARCH LANDSCAPE

- 7.1. Cell Line Research at ETH Zurich

- 7.2. Culture Media Research at New Castle University

- 7.3. Research at University of Wisconsin, Madison for Scaffolding

- 7.4. Research on Bioprocess Design at University of BATH

- 7.5. Cultured Meat Research Lab Database

- 7.5.1. Funding for Academic Research on Cultured Meat

- 7.5.2. Research Funding: Cultured Meat

- 7.5.3. Collaborative Researchers in Cultured Meat Sector

- 7.6. Scientific Publications on Cultured Meat

8. PATENT LANDSCAPE

- 8.1. Types of Patent Claims

- 8.2. NoTable Patent Holders in Cultured Meat

- 8.2.1. Impossible Foods

- 8.2.3. Beyond Meat

- 8.2.4. JUST

- 8.2.5. UPSIDE Foods (Memphis Meats)

- 8.2.6. Perfect Day Foods

- 8.3. Patent Applications for Scaffolds

9. INVESTMENT LANDSCAPE

- 9.1. Capital Invested by Type of Cultured Meat

- 9.3. Cultured Meat Companies by Size of Investment

- 9.4. Agronomics: The Largest Investor

- 9.5. Public Sector Investments in Cultured Meat Sector

- 9.6. A Bird's-Eye View of Investments in Cultured Meat Sector

- 9.6.1. A Complete List of Venture Investments in the Cultured Meat Industry

- 9.6.2. Most Active Investors in the Cultured Meat Industry

10. CULTURED MEAT INDUSTRY: CURRENT STATUS, BREAKTHROUGHS, AND HISTORIC EVENTS

- 10.1. Global Presence of Cultured Meat Companies

- 10.2. Cultured Meat Products under Development

- 10.2.1. Chicken Nugget from JUST

- 10.2.2. Chicken Tender from Memphis Meats (UPSIDE Foods)

- 10.2.3. Cultured Beef Meat Ball by Memphis Meats (UPSIDE Foods)

- 10.2.4. Cultured Pork Belly and Bacon from Higher Steaks

- 10.2.5. Cultured Pork Sausage by New Age Meats

- 10.3. Share of Companies by Product Type

- 10.4. Cultured Meat Industry's Landmark Events

- 10.4.1. First QSR Partnership in Cultured Meat Space

- 10.4.2. First Partnership in Cultured Meat Space

- 10.4.3. First Restaurant Concept in Cultured Meat Space

- 10.4.4. First Acquisition in Cultured Meat Space

- 10.4.5. First Commercial Sale of Cultured Meat Product

- 10.4.6. First Series B Fund Raising in Cultured Meat Space

- 10.4.7. First U.S. Government's R&D Funding for Cultured Meat

- 10.4.8. First E.U. R&D Funding for Cultured Meat

- 10.4.9. First Paper on Soy Protein Scaffolding

- 10.5. Major Recent Developments in Cultured Meat Sector

- 10.5.1. Aleph Farms' Partnerships with Mitsubishi and BRF S.A.

- 10.5.2. BlueNalu's $60 Million Convertible-Note Financing

- 10.5.3. Future Meat Produces Cultured Chicken Breast for $7.50

- 10.5.4. Breakthrough Energy's Recommended Policy Priorities

- 10.6. Tasting Events

- 10.6.1. Israeli PM Tasting Aleph Farms Cultured Steak

- 10.6.2. SuperMeat's "The Chicken" Project

- 10.6.3. Lab Farm Foods' Cultured Chicken Nuggets and Pork Liver Pate

- 10.6.4. Avant Meat's Cultured Fish Fillets

- 10.6.5. Wildtype's Cultured Sushi-Grade Salmon

- 10.6.6. Shiok Meats' Tasting Event for its Cultured Lobster

- 10.7. The Leading Edge of Cultured Meat Production

- 10.7.1. Factory Capacity for Supplying 10% of the Conventional Meat Market

- 10.7.2. An Option for New Bioreactor Designs

- 10.7.3. Location of Large-Scale Manufacturing Facilities by Geography

- 10.7.4. Cultured Meat at a Premium Price

- 10.8. Time for Cultured Meat to Reach the Market

- 10.9. Current Limitations in Cultured Meat Industry

- 10.9.1. Design and Optimization of Bioreactors

- 10.9.2. Serum-Free Culture Media Development

- 10.10. The Race toward Pilot Plant Setup

- 10.11. Hybrid Products: The First to Reach the Market

- 10.12. Cost Parity of Cultured Meat with Conventional Meat

- 10.12.1. Other Cost Considerations

- 10.13. World's First Cultured Meat Facility in Israel

- 10.14. Proliferation of Cultured Meat Nonprofits

11. STARTUP LANDSCAPE

- 11.1. Complete List of Cultured Meat Startups

- 11.2. New Startups Focusing on Enabling Technologies

- 11.3. Startups Specializing in the Development of Growth Factors

12. REGULATORY LANDSCAPE

- 12.1. Australia-New Zealand

- 12.2. Canada

- 12.3. United States

- 12.4. European Union

- 12.5. United Kingdom

- 12.6. Singapore

- 12.7. Japan

13. CULTURED MEAT MARKET: MARKET SIZE, TRENDS, AND FUTURE PROJECTIONS

- 13.1. Global Market for Conventional Meat by Type

- 13.2. Changing Landscape of Global Meat Market

- 13.4. Global Market for Cultured Meat by Geography, with Forecasts through 2032

- 13.5. Global Market for Cultured Meat by Type, with Forecasts through 2032

14. CULTURED MEAT MARKET: COMPANY PROFILES

- 14.1. 3D Bio-Tissues Ltd.

- 14.2. Agulos Biotech, LLC

- 14.3. Aleph Farms

- 14.3.1. Commercial Production: BioFarm

- 14.3.2. Partnership with BRF S.A

- 14.3.3. Aleph's Series B Funding

- 14.4. Alife Foods

- 14.5. Ants Innovate

- 14.6. Artemys Foods

- 14.7. ArtMeat

- 14.8. Avant Meats Company Limited

- 14.8.1. Collaboration with QuaCell

- 14.8.2. Collaboration with A*STAR

- 14.8.3. Funding from Major Sea Food Company VHC

- 14.9. Back of the Yard Algae Sciences

- 14.10. Balletic Foods

- 14.11. Because Animals

- 14.11.1. Seed Stage Financial Round

- 14.12. Bene Meat Technologies AS

- 14.13. B.I.F.E. Laboratorios-Craveri

- 14.13.1. First B.I.F.E Tasting

- 14.14. Biftek, Inc.

- 14.15. BioBQ

- 14.16. BioFood Systems

- 14.17. BIOMILQ

- 14.17.1. Backing from Bill Gate's Investment Firm

- 14.18. BioMilk, Ltd.

- 14.18.1. Coco Cola's Investment in Biomilk, Ltd.

- 14.19. BioTech Foods

- 14.19.1. BioTech Foods to Lead $6.3 Million Cultured Meat Project

- 14.20. BlueNalu, Inc.

- 14.20.1. Partnership with Nutreco

- 14.20.2. Collaboration with Nomad Foods

- 14.20.3. MoU with Mitsubishi

- 14.20.4. $60 Million Debt Financing

- 14.20.5. MoU with Pulmuone

- 14.21. Blue Ridge Bantam

- 14.22. Bluu Biosciences

- 14.22.1. Investment from DX Ventures

- 14.23. Boston Meats, Inc.

- 14.23.1. Boston Meats raised $1.5 Million in Equity

- 14.24. Bruno Cell SRL

- 14.25. Cass Materials Pty Ltd.

- 14.26. CELL AG TECH

- 14.27. Cell Guidance Systems Ltd.

- 14.28. CELLINK

- 14.28.1. Collaboration with UPM Biomedicals

- 14.29. Cellivate Technologies

- 14.30. CellMEAT

- 14.30.1. Pre-Series A Round of Funding

- 14.31. Celltainer Biotech BV

- 14.32. Cellular Agriculture, Ltd.

- 14.32.1. Collaboration with Naturbeads

- 14.33. CellulaREvolution

- 14.34. CellX

- 14.35. Clear Meat Private Limited

- 14.36. Core Biogenesis

- 14.36.1. $3.1 Million to Scale Growth Factors

- 14.37. Cubiq Foods

- 14.37.1. Raises $5.5 Million in a Funding Round

- 14.38. Cultured Blood

- 14.39. Cultured Decadence

- 14.39.1. $1.6 Million Pre-Seed Financing

- 14.40. DaNAgreen Co., Ltd.

- 14.41. Defined Bioscience, Inc.

- 14.42. Dipole Materials

- 14.43. Diverse Farms

- 14.44. East Just, Inc.

- 14.44.1. Good Meat Division of Eat Just Secured $170 Million

- 14.44.2. Additional $97 Funding for Good Meat Division

- 14.44.3. First-Ever Cultured Meat Facility Planned in MEENA Region

- 14.45. Finless Foods, Inc.

- 14.45.1. Finless Raised $3.5 Million Seed Round

- 14.46. Fork & Goode

- 14.47. Future Fields

- 14.48. Future Meat Technologies

- 14.48.1. $26.76 Million in Funding Raised by Future Meat

- 14.48.2. Future Meat's Partnership with Nestle

- 14.49. Gelatex Technologies, Ltd.

- 14.50. HCS Pharma

- 14.51. Heuros

- 14.52. HigherSteaks

- 14.53. Hoxton Farms

- 14.53.1. Hoston Raised $3.75 Million in Seed Funding

- 14.54. Incuvers

- 14.55. Innocent Meat UG

- 14.56. IntegriCulture, Inc.

- 14.56.1. Series A Fund Raising

- 14.56.2. Collaboration with Shiok Meats

- 14.56.3. Grant Award of $2.2 Million

- 14.57. Jellatech

- 14.57.1. Pre-Seed Round of $2 Million

- 14.58. JOINN Biologics

- 14.58.1. $150 Million Series B Round

- 14.59. KosmodeHealth

- 14.60. Lab Farm Foods

- 14.61. Luyef Biotechnologies

- 14.62. MagicCavier

- 14.63. Magic Valley, Pty, Ltd.

- 14.64. Matrix Meats

- 14.64.1. Seed Fund

- 14.65. Meatable

- 14.65.1. Joint Development Agreement

- 14.66. MeaTech 3D Ltd.

- 14.67. Metalytics, Inc.

- 14.68. Mirai Foods AG

- 14.68.1. Mirai's Second Close of Seed Round

- 14.69. Mission Barns

- 14.69.1. Series A to Scale Up

- 14.70. Mogale Meat Co.

- 14.70.1. Mogale's BioBank

- 14.70.2. Investment by CULT Food Science Corporation

- 14.71. Mosa Meat

- 14.71.1. Series B Investment Round

- 14.72. Multus Media

- 14.72.1. Proliferum M

- 14.72.2. $2.2 Million Seed Round of Funding

- 14.73. MyoWorks, Pvt. Ltd.

- 14.74. Mzansi Meat, Co.

- 14.75. New Age Meats

- 14.76. Novel Farms, Inc.

- 14.77. NUProtein Co., Ltd.

- 14.78. Orbillion Bio

- 14.78.1. $5 Million Raised to Culture Uncommon Meats

- 14.79. ORF Genetics Ltd.

- 14.80. Ospin Modular Bioprocessing

- 14.81. Peace of Meat

- 14.81.1. Meat-Tech 3D Ltd. to Acquire Peace of Meat

- 14.82. Perfect Day Foods

- 18.82.1. $350 Million Series D Funding

- 14.82.2. Collaboration with A*STAR

- 14.83. Roslin Technologies Ltd.

- 14.84. Shiok Meats

- 14.84.1. Acquisition of Gaia Foods

- 14.84.2. Bridge Funding from NoTable Investors

- 14.84.3. Shiok Meats' Partnering with IntegriCulture

- 14.84.4. $12.6 Million Series A Funding

- 14.85. SingCell Tx Pte. Ltd

- 14.86. SunP Biotech

- 14.87. SuperMeat

- 14.88. Tantti Laboratory, Inc.

- 14.89. TeOra

- 14.90. Tiamat Sciences

- 14.91. TissueByNET Co., Ltd.

- 14.92. TurtleTree Labs

- 14.93. Umami Meats

- 14.94. Unicorn Biotechnologies

- 14.95. Upside Foods, Inc.

- 14.95.1. Upside Chicken

- 14.96. Vivax Bio

- 14.96.1. Bioprinter FABION 2

- 14.96.2. Viscoll Collagen

- 14.97. Vow

- 14.98. Wildtype

- 14.99. White Board Foods