|

市場調査レポート

商品コード

1910849

ゲーミングアクセサリー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Gaming Accessories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ゲーミングアクセサリー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

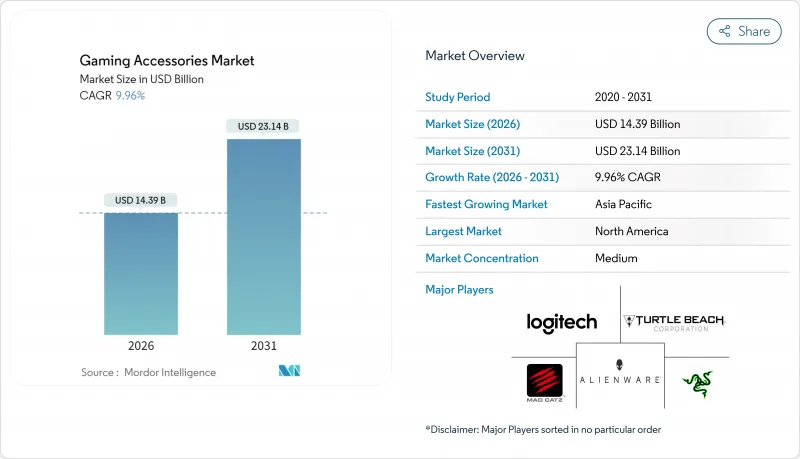

ゲーミングアクセサリー市場は、2025年の130億9,000万米ドルから2026年には143億9,000万米ドルへ成長し、2026年から2031年にかけてCAGR9.96%で推移し、2031年までに231億4,000万米ドルに達すると予測されています。

この成長軌跡は、単純な周辺機器から、プレイ・生産性・コンテンツ制作を統合するソフトウェア連携型エコシステムへの業界変遷を反映しています。成長の原動力となったのは、eスポーツの専門化、ハードウェア障壁を低減するクラウドゲーミングプラットフォームの台頭、そして低遅延インターフェースを必要とするAI搭載周辺機器の第一波でした。メーカー各社はまた、クロスプラットフォーム利用の増加に対応し、設計ロードマップにユニバーサル互換性を組み込みました。一方、触覚フィードバックや初期段階のニューラルインターフェース調査は、アクセサリーを受動的な入力から能動的な感覚フィードバックへと進化させました。2024年9月にコルセアがファナテックを買収したような戦略的動きは、主要企業が差別化された技術とサプライチェーン管理を確保するために垂直統合を追求する姿勢を示しています。

世界のゲーミングアクセサリー市場の動向と洞察

世界のゲーマー人口とeスポーツ視聴者数の急増

競技ゲームへの参加が急増し、プレミアム周辺機器が主流の期待へと変貌しました。2024年に世界のeスポーツ収益が43億米ドルに迫る中、ライブ配信されるトーナメントではプロ仕様のセットアップが披露され、カジュアルプレイヤーがこれを模倣するようになりました。教育機関も同様に標準化された機器を採用し、高性能ヘッドセット、キーボード、マウスをカリキュラムに組み込みました。このプロフェッショナル化により、ミリ秒単位の精度が購入判断の中心となり、低遅延インターフェースへの需要が持続しました。デモンストレーション効果により、パフォーマンス志向のアマチュアがトーナメントグレードの技術を求め、対象顧客層が拡大し、買い替えサイクルが長期化しました。

継続的な製品革新(RGB、触覚フィードバック、ワイヤレス)

周辺機器は装飾的機能を超え、機能的な性能向上要因へと進化しました。ワイヤレスヘッドセットやマウスは有線並みの低遅延を実現し、デスクスペースを解放するとともに人間工学的改善をもたらしました。触覚フィードバックは振動を超え、ノースウェスタン大学の研究チームはねじれや圧迫感を再現する柔軟なワイヤレスデバイスを発表し、ゲームにおける空間認識の深化への道を開きました。RGB照明は装飾からリアルタイムテレメトリーへと移行し、ゲーム状態やデバイスの健全性を示すようになりました。メーカーにとって、こうした多層的な機能性は、コモディティ化の圧力により製品ライフサイクルが短縮される市場において、製品の関連性を長期間維持する要因となりました。

電子機器への高関税

貿易摩擦によりゲームハードウェアのコストが急騰しました。2025年4月、ベトナムで組み立てられたNintendo Switch 2には米国が46%の関税を課し、日本のゲームカードには24%の関税が適用されました。周辺機器メーカーは関税非課税地域へ生産拠点を移管し、物流の複雑化と在庫リスクが増大しました。米国家電協会(CTA)は、関税引き上げにより米国の購買力が年間最大1,430億米ドルも減少し、周辺機器への自由裁量支出が抑制される恐れがあると警告しました。8BitDoなどの一部ニッチブランドは米国向け倉庫出荷を停止し、国内在庫が逼迫して価格上昇を招きました。

セグメント分析

ヘッドセットは、指向性オーディオとクリアなボイスチャットが競技プレイにおいて決定的な要素であり続けたため、2025年にゲーミングアクセサリー市場の27.92%のシェアを獲得しました。このセグメントの優位性は、ノイズキャンセリングマイクやトーナメント環境を再現する空間音響ファームウェアによって強化されました。ゲーミングチェアは2031年までにCAGR11.02%を示し、長時間オンライン作業を行うストリーマーやコンテンツクリエイター向けに人間工学に基づいた座席を義務付ける職場安全規制が後押ししました。キーボードとマウスカテゴリーは定番製品として安定を維持し、光学スイッチ技術の進歩により作動時間が短縮されました。コントローラー、マウスパッド、ケーブル管理キットはエコシステム需要を満たし、クロスセリング効果を発揮しました。レイザー社の2025年発売「Skibidi」ヘッドセットは、搭載AIによる言語翻訳機能により、純粋なドライバー性能ではなくソフトウェア機能が価値を定義する新たな領域を示唆しました。

没入型シートも同様の軌跡をたどりました。「プロジェクト・キャロル」のプロトタイプは、近距離サラウンドサウンドと触覚フィードバックをヘッドレストに直接統合し、家具を単なる受動的な支えから感覚のポータルへと昇華させました。こうした革新は、将来の差別化がファームウェア更新、クラウド連携プロファイル、機械学習駆動のパーソナライゼーションを中心に展開し、製品寿命を延長するとともにサブスクリプション型アドオンを促進することを示唆しています。

2025年時点でPC周辺機器はゲーミングアクセサリー市場規模の43.25%を占め、マクロ機能豊富なキーボードや重量調整可能なマウスを必要とするコンテンツ制作ワークフローの需要に支えられました。一方、モバイル向け機器は競争力のあるスマートフォン向けタイトルや通信事業者主催のリーグ戦を背景に、2031年までCAGR12.11%を記録しました。コンソール向けアクセサリーは、プレイステーションやXboxの設置台数に連動した安定した需要を維持しました。一方、複数のゲーム端末を併用する家庭では、クロスプラットフォーム対応デバイスが支持を集めました。クラウドプラットフォームが応答時間を短縮する中、ゲーミングアクセサリー市場では低遅延要件が厳格化。PC、携帯型コンソール、スマートTV間で互換性のある高ポーリングレート無線ドングルへの投資が促進されました。

メーカー各社は、ホストシステムを検知し感度カーブをリアルタイムで再構成するファームウェアスイートをバンドルしました。Meta Quest向けに開発されたロジテックの2024年モデル「MX Ink」スタイラスは、クリエイティブとゲーミングのハイブリッド使用事例がデバイス境界を曖昧にする実例を示しています。今後、クラウドサービスがローカル処理と入力応答性を完全に分離すれば、PCの優位性が損なわれる可能性があります。

地域別分析

2025年に北米が31.74%のシェアを維持した背景には、結束したeスポーツインフラ、強力なスポンサー資金、そして根付いたストリーミングクリエイター文化がありました。小売業者は、インフルエンサーによる開封動画を活かした調整された発売スケジュールにより、販売促進の加速化に恩恵を受けました。2025年の関税ショックは着陸コストを押し上げ、資本の固定化を最小限に抑えるため、在庫プール化とジャストインタイム補充が促されました。

アジア太平洋地域の二桁CAGR達成には、設計から納品までのサイクルを短縮した中国の製造エコシステムと、東南アジアの堅調なモバイルeスポーツシーンが大きく寄与しました。インドとマレーシアにおける政府のテックパーク支援は、地域特有の美学や予算帯をターゲットとしたアクセサリー系スタートアップを育成。地域通信事業者はゲームパス契約を5G契約とバンドルし、ウェルカムキットに同梱されたコントローラー販売を促進しました。

欧州市場は人間工学に基づく適合性を軸に成熟しました。ドイツが施行したチェア安全認証は事実上の世界基準となりました。北欧諸国は持続可能な素材を優先し、世界の調達基準に影響を与えています。ラテンアメリカのゲーマーは、リチウム電池製品への高い輸入関税のため中価格帯の有線デバイスに傾倒しましたが、アルゼンチンとブラジルでは地域トーナメントの開催が始まり、ヘッドセットのアップグレードを促進しました。中東・アフリカでは、プレミアムコンソールの販売がアクセサリーの需要拡大を牽引し、特にラマダン期間中のプロモーションシーズンには小売業者が分割払いオプションを拡充しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストサポート(3ヶ月間)

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 世界のゲーマー人口とeスポーツ視聴者数の急増

- 継続的な製品革新(RGB、触覚フィードバック、ワイヤレス技術)

- クラウドゲーミングとクロスプラットフォームエコシステムの拡大

- 新興経済国における可処分所得の増加

- ゲーミングチェアの需要を促進する人間工学に基づく規制

- 女性ゲーマー層向け、美観を重視したアクセサリー

- 市場抑制要因

- 電子機器に対する高い輸入関税

- 製品のコモディティ化と短い買い替えサイクル

- 半導体およびセンサーのサプライチェーン制約

- 電子廃棄物(E-waste)政策によるコンプライアンスコストの増加

- 業界バリューチェーン分析

- テクノロジーの展望

- 規制情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- ヘッドセット

- ゲーミングキーボード

- ゲーミングマウス

- ゲームパッド/コントローラー

- ゲーミングチェア

- その他の製品タイプ

- デバイス互換性別

- PC

- コンソール

- モバイル

- クロスプラットフォーム/ ユニバーサル

- 流通チャネル別

- オンライン小売

- オフライン小売

- 専門ゲームショップ

- 家電量販店

- ハイパーマーケットおよびスーパーマーケット

- 価格帯別

- 経済規模(51米ドル未満)

- 中価格帯(51米ドル~150米ドル)

- プレミアム(150米ドル以上)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Corsair Gaming, Inc.

- Logitech International S.A.

- Razer Inc.

- Turtle Beach Corporation

- Kingston Technology Company, Inc.(HyperX)

- Sony Group Corporation(PlayStation Accessories)

- Microsoft Corporation(Xbox Accessories)

- SteelSeries ApS(GN Store Nord A/S)

- Cooler Master Technology Inc.

- Anker Innovations Limited

- Thermaltake Technology Co., Ltd.

- ASUS Tek Computer Inc.(ROG)

- Acer Inc.(Predator)

- Dell Technologies Inc.(Alienware)

- Lenovo Group Limited(Legion)

- HP Inc.(OMEN)

- Mad Catz Global Limited

- PDP Performance Designed Products LLC

- Hyperkin Inc.

- Scuf Gaming International, LLC