|

市場調査レポート

商品コード

1637828

UCaaS(Unified Communication-as-a-Service):市場シェア分析、産業動向、成長予測(2025年~2030年)Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| UCaaS(Unified Communication-as-a-Service):市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

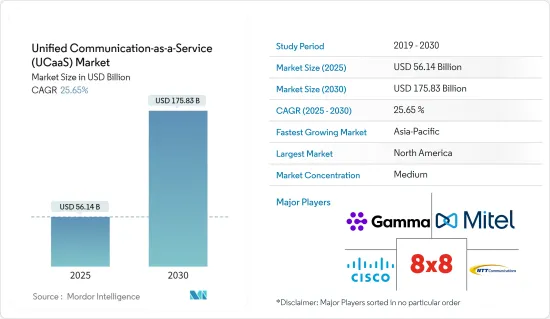

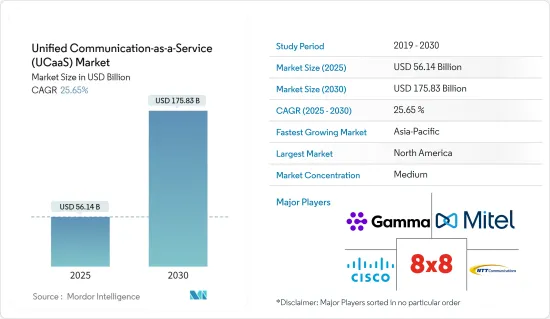

UCaaS(Unified Communication-as-a-Service)市場規模は、2025年に561億4,000万米ドルと推定され、2030年には1,758億3,000万米ドルに達すると予測され、予測期間(2025~2030年)のCAGRは25.65%です。

在宅勤務(WFH)モデルの動向の高まりは、UCaaSソリューションの利用を雇用者に促しています。企業にとってUCaaSソリューションは、運用コストを見直し、限界収益の減少を防ぐのに有益だからです。

主要ハイライト

- UCaaS(Unified Communication-as-a-Service)は、さまざまなコミュニケーションアプリケーションとコラボレーションアプリケーションを1つの中央プラットフォームに統合するクラウドサービスです。UCaaSを利用することで、企業はコミュニケーション・チャネルを最適化し、コストを削減し、効率を向上させることができます。

- UCaaSは、音声やビデオ会議、コミュニケーション、電子メール、コラボレーションソフトウェアなど、幅広いコミュニケーションツールを記載しています。UCaaSは、インターネット接続を通じて、ユーザーがどこにいても、どのデバイスからでも、これらのツールにアクセスできるプラットフォームです。あらゆる規模の企業にとって魅力的なオプションであり、高価なハードウェア、ソフトウェア、メンテナンス・コストを負担する必要がなくなります。例えば、インド政府は2023年5月、ウェブ会議会社のZoom Video Communicationsに、インド全土、国内長距離(NLD)、国際長距離(ILD)をカバーするアクセス権を持つユニファイドライセンスを付与しました。これにより、クラウドベースのPBXサービスであるZoom Phoneをインド国内の企業に提供できるようになります。

- さらに、5G技術と高速インターネットの採用は、予測期間中に市場を押し上げると予想されます。なぜなら、5Gネットワークは、高速で最小限の遅延を必要とするビデオ会議や音声会議に使いやすいからです。5G Americasによると、2023年までに世界の第5世代加入者は19億人になると予想されています。2024年には28億人、2027年には59億人になると予測されています。

- スマートモバイルガジェットの導入が進み、関連ツールが改善されたことで、リモートワークや分散勤務の戦術が強化されています。同様に、企業は事業所全体で「BYOD(Bring Your Device)」ルールを採用しています。このアプローチは、組織が効率を高め、社内の交流を洗練させ、異なる価格を根絶するのに役立ちそうです。これは、予測期間中、最終的にサービスとしてのユニファイドコミュニケーション市場の成長を後押しすると予想されます。

- デジタル化への嗜好の高まりを考慮すると、顧客がさまざまな通信手段を利用し続ける中で、顧客サービスが大きな課題として浮上することが予想されます。

- さらに、ユニファイドコミュニケーション(UC)に対する需要は過去10年間で拡大しました。パンデミック(世界的大流行)の発生後、ユニファイドコミュニケーション(UC)の需要は例外的な高まりを見せた。COVID-19の出現により、デジタルトランスフォーメーションは、企業の生存、成長、市場リーダーシップを確保するための緊急要件となりました。いつでも、どこでも、統一された、摩擦のない、安全なデータやアプリケーションへのアクセスの必要性が飛躍的に高まった。

UCaaS(Unified Communication-as-a-Service)市場動向

レガシーシステムからクラウドベースのコミュニケーションサービスへの移行が成長を牽引

- ビジネスコミュニケーションの増加に伴い、企業は複雑さを管理し、コストを削減し、全体的な生産性を高める方法を模索しています。このため、クラウドベースの概念であるユニファイドコミュニケーション・アズ・アサービスの利用が増加しています。

- さらに、より多くの企業が柔軟性やハイブリッドな働き方に適応し、クラウドベースのソリューションを採用することで、従業員がデバイスや部署、タイムゾーンを越えて対応できるようになっています。

- さらに、ユニファイドコミュニケーション(UC)のクラウドソリューションは、オンサイトのホスティングインフラを必要とせず、拡大が容易で、最新の機能とセキュリティを備えているため、一般的に費用対効果が高いです。クラウドのセキュリティがすべての企業にとって主要な懸念事項の1つとなっている一連の重大な情報漏えい事件により、データセンターのセキュリティへの投資が増加しています。

- プライベートクラウドサーバーは、単一の企業にホスティングサービスを提供するインフラです。高いレベルのデータセキュリティとプライバシー保護を維持しながら、俊敏性、拡大性、複雑な計算活動や運用のための多数の仮想マシン構築能力など、あらゆる利点を記載しています。

北米が大きな市場シェアを占める見込み

- この地域は、主に最近のモビリティの急増と、I.T.のコンシューマライゼーションによる5G接続の爆発的増加により、調査された市場成長に大きく貢献しています。

- 米国では、小売、銀行・金融、医療、IT、通信といったエンドユーザーの業種が、どこにいてもすべての通信、音声、ビデオ、チャットを、より直接的でシームレスな体験を求めています。このようなニーズを満たすために、企業はUCCの要件を処理するために信頼できる単一のベンダーによる統一された展開と管理ソリューションを求めています。5Gの登場により、リモート接続ツールを単一のUCaaSプラットフォームに統合できるようになると考えられます。

- この地域は、オンラインとオフラインのチャネルを効率的に統合し、統合された顧客体験をもたらすことで定評があります。一般的なサービスは、オンラインショッピングプラットフォーム、ソーシャル・ネットワーク、モビリティアプリケーション、小売店、カスタマー・アシスタンス・チャネルなど、さまざまなチャネルと顧客を接続することを目的としています。

- さらに、UCaaSの需要は、このセグメントにおける数多くの多国籍企業の存在によって牽引されています。人工知能の拠点となることで、組織は最新技術によって進化しており、世界規模でAI関連サービスを提供する組織が大幅に増加しています。

UCaaS(Unified Communication-as-a-Service)産業概要

8x8 Inc.、Mitel Networks、Verizonなどの大手企業により、市場参入企業間の競争企業間の敵対関係は高く、UCaaS(Unified Communication-as-a-Service)市場は適度にセグメント化されています。これらの企業は、研究開発活動に多額の投資を行うことでイノベーションをもたらす能力を持つため、競争上の優位性を得ることができます。戦略的パートナーシップ、合併、買収により、これらの企業はかなりの市場シェアを占めるに至っています。

- 2023年10月、Mitelは以前から発表していた、Atosグループのコミュニケーション&コラボレーションサービス(CCS)とユニファイドコミュニケーション&コラボレーション(UCC)事業を含むUnifyの買収を正式に完了しました。この買収により、同社は顧客ベースを100カ国以上、7,500万人以上に拡大しました。

- 2023年6月、CiscoはAT&T-Mobileネットワークと提携し、Webex Callingをネイティブに統合しました。この提携により、単一のビジネス携帯電話番号を通じて、モバイルファーストでパワフルな統合コラボレーション体験が提供されることが期待されます。このような開発は、産業の成長を促進すると期待されています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の利害関係者分析

- 産業の魅力-ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響

第5章 市場力学

- 市場促進要因

- 従来のUCソリューションに対する需要を促進する従量課金モデルの出現

- 新たな企業コラボレーションの出現につながる労働力力学の変化

- レガシーシステムからクラウドベースのコミュニケーションサービスへの移行が成長を牽引

- 市場課題

- 最新のユニファイドコミュニケーション(UC)への移行準備の遅れ

- UC産業における主要ビジネスモデル

第6章 技術概要

第7章 市場セグメンテーション

- 企業規模別

- 中小企業

- 大企業

- エンドユーザー産業別

- BFSI

- 小売

- 医療

- 政府・公共機関

- ITと電気通信

- その他産業別

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 競合情勢

- 企業プロファイル

- 8X8 Inc.

- Cisco Systems Inc.

- Mitel Networks Corporation

- Gamma Communication PLC

- NTT Communication Corporation

- Vodafone Group PLC

- Telia Company AB

- KPN NV

- BT Group PLC

- Verizon Communications Inc.

- Nextiva

- Soluno(Destiny NV)

- VADS Berhad

- Singapore Telecommunications Limited

- PLDT Enterprise

- Telstra Corporation Limited

- PCCW Global

- Maxis Communications

第9章 重要な提言

- 主要戦略提言

- 地域の需要とポジショニングに関するアナリストの見解

- 最も採用されている戦略の分析

第10章 市場の将来

The Unified Communication-as-a-Service Market size is estimated at USD 56.14 billion in 2025, and is expected to reach USD 175.83 billion by 2030, at a CAGR of 25.65% during the forecast period (2025-2030).

The increasing trend of work from home (WFH) model is compelling employers to use UCaaS solutions as it's beneficial for companies to reevaluate their operational costs and save their marginal revenue from declining.

Key Highlights

- Unified Communications as a Service is the cloud service that brings together different communication and collaboration applications in one central platform. UCaaS allows businesses to optimise their communication channels, reduce costs and improve efficiency.

- UCaaS provides a wide range of communication tools, including voice and video conferencing, communications, email or collaborate software. The platform provides users with access to these tools through an Internet connection wherever they are, on any device. It's an appealing option for businesses of all sizes, eliminating the need to incur expensive hardware, software and maintenance costs. For instance, in May 2023, the Indian government granted Zoom Video Communications, a web conferencing company, a Unified License with access covering all of India, National Long Distance (NLD), and International Long Distance (ILD). This will allow it to offer Zoom Phone, a cloud-based private branch exchange (PBX) service, to enterprises in the country.

- In addition, the introduction of 5G technology and high-speed internet is anticipated to boost the market in the forecasted period, Because the 5G network is easy to use for video and Audio Conferencing, which requires high speed and minimal latency. According to 5G Americas, there are expected to be 1.9 billion fifth generation subscribers in the world by 2023. By 2024 and by 2027, this number is projected to be 2.8 billion and 5.9 billion respectively.

- The rising implementation of smart mobile gadgets and association tool improvements empower remote work and dispersed workforce tactics. Similarly, establishments employ a 'bring your device' (BYOD) rule across their business facilities. This approach will likely help organizations upsurge efficiency, refine internal interaction, and eradicate different prices. This is anticipated to eventually bolster the unified communication as a service market growth during the forecast period.

- Considering the growing preference for digitization, customer service is expected to emerge as a major challenge as customers continue to use various modes of communication.

- Moreover, the demand for Unified Communications has grown over the last decade. It witnessed an exceptional rise after the pandemic outbreak. With the emergence of COVID-19, digital transformation became an urgent requirement for businesses to ensure their survival, growth, and market leadership. The need for unified, frictionless, and secure access to data and applications anytime, anywhere exponentially increased.

Unified Communication as a Service (UCaaS) Market Trends

Migration from Legacy Systems to Cloud-Based Communication Services to Witness the Growth

- As business communications increase, companies are looking for ways of managing complexity, cutting costs and boosting overall productivity. This has led to an increase in the use of unified communications as a service, a cloud based concept.

- Furthermore, more companies are adapting to the flexibility and hybrid working practices as well as adopting cloud based solutions so that employees can be accommodated across devices, departments or timezones.

- Moreover, because they do not need an on site hosting infrastructure and are easy to scale as well as have the latest features and security, cloud solutions for Unified Communications as a Service typically deliver greater cost effectiveness. Due to a series of major breaches that make the security of clouds one of the main concerns for all companies, there has been an increase in investment in data center security.

- A private cloud server is an infrastructure that provides hosted services to a single enterprise. It provides all the advantages, such as agility, scalability, and ability to build many virtual machines for complicated computational activities and operations, while retaining a high level of data security and privacy protection.

North America Expected to Hold a Significant Market Share

- The region is significantly contributing to the studied market growth, primarily due to the recent surge in mobility and the explosion of 5G connections due to the consumerization of I.T., which has aided enterprises in adopting I.P. telephony and UCaaS to allow remote employees to simulate in-office work experiences.

- In the U.S., end-user verticals, such as retail, banking and finance, healthcare, information technology, and telecommunications, seek a more direct and seamless experience for all of their communications, audio, video, and chat, no matter where they are. To fulfill this need, enterprises are looking for a unified deployment and management solution from a single vendor they can rely on to handle their UCC requirements. They'll be able to integrate remote connectivity tools on a single UCaaS platform with the advent of 5G.

- The region has a reputation for the efficient integration of online and offline channels, which results in an integrated customer experience. Prevailing services aim to connect customers with a variety of channels, including e.g. online shopping platforms, social networks, mobility applications, retail stores and customer assistance channels.

- In addition, demand for UCaaS is driven by the presence of a number of multinational companies in this area. By becoming a hub for artificial intelligence, organizations are evolving through modern technology, and there is considerable growth in organizations providing AI related services at global scale.

Unified Communication as a Service (UCaaS) Industry Overview

The competitive rivalry between market players is high owing to some major players like 8x8 Inc., Mitel Networks, Verizon, and many others, and the Unified Communication-as-a-Service (UCaaS) Market is moderately fragmented. These companies can gain a competitive advantage due to their ability to bring about innovations by investing heavily in research and development activities. Strategic partnerships, mergers, and acquisitions have allowed these companies to occupy a substantial market share.

- In October 2023, Mitel officially completed its previously announced acquisition of Unify, which includes Communication and Collaboration Services (CCS) and Unified Communications and Collaboration (UCC) businesses of the Atos group. With this acquisition, the company has now increased its customers base to more than 75 million users in over 100 countries.

- In June 2023, Cisco partnered with AT&T mobile network to natively integrate Webex Calling. This partnership is expected to deliver a mobile-first, powerful, and unified collaboration experience via a single business mobile number. Such developments are expected to drive the industry growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Pay-as-you-go Model Driving Demand over Legacy UC Solutions

- 5.1.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of Enterprise Collaboration

- 5.1.3 Migration from Legacy Systems to Cloud-Based Communication Services to Witness the Growth

- 5.2 Market Challenges

- 5.2.1 Low Readiness to Move to Modern Unified Communications

- 5.3 Key Business Models in the UC Industry

6 TECHNOLOGY OVERVIEW

7 MARKET SEGMENTATION

- 7.1 By Size of Enterprise

- 7.1.1 Small and Medium Enterprises

- 7.1.2 Large Enterprises

- 7.2 By End-user Vertical

- 7.2.1 BFSI

- 7.2.2 Retail

- 7.2.3 Healthcare

- 7.2.4 Government and Public Sector

- 7.2.5 IT and Telecom

- 7.2.6 Other End-user Verticals

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 8X8 Inc.

- 8.1.2 Cisco Systems Inc.

- 8.1.3 Mitel Networks Corporation

- 8.1.4 Gamma Communication PLC

- 8.1.5 NTT Communication Corporation

- 8.1.6 Vodafone Group PLC

- 8.1.7 Telia Company AB

- 8.1.8 KPN NV

- 8.1.9 BT Group PLC

- 8.1.10 Verizon Communications Inc.

- 8.1.11 Nextiva

- 8.1.12 Soluno (Destiny NV)

- 8.1.13 VADS Berhad

- 8.1.14 Singapore Telecommunications Limited

- 8.1.15 PLDT Enterprise

- 8.1.16 Telstra Corporation Limited

- 8.1.17 PCCW Global

- 8.1.18 Maxis Communications

9 KEY RECOMMENDATIONS

- 9.1 Key Strategic Recommendations

- 9.2 Analyst's View on Regional Demand and Positioning

- 9.3 Analysis of Most Adopted Strategies