|

市場調査レポート

商品コード

1851936

ステビア:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Stevia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ステビア:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年08月08日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

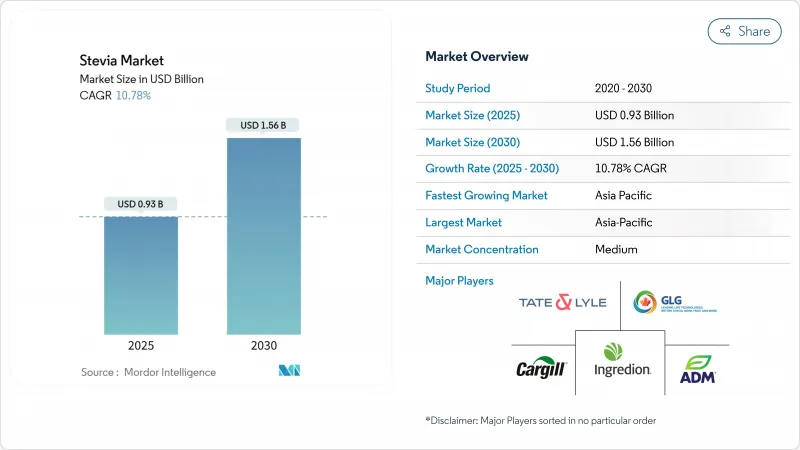

ステビアの市場規模は、2025年に9億3,000万米ドルと評価され、2030年には15億6,000万米ドルに達し、CAGRは10.78%と大きく成長すると予測されています。

この成長は、レバウディオサイドMや酵素修飾配糖体に対するFDAのGRAS通知など、製品の安全性を確保し、より幅広い採用を促進する規制上の支援の増加が原動力となっています。砂糖の消費に関する健康上の懸念の高まりは、肥満や糖尿病の蔓延と相まって、植物由来の代替品の採用をメーカーに促しており、ステビアは砂糖削減のための重要なソリューションとなっています。アジア太平洋地域は、その規模と専門知識により、ステビアの栽培と加工におけるリーダーであり続けています。しかし、関税政策や労働慣行をめぐる監視などの課題により、バイヤーは別の調達方法を模索しています。さらに、バイオコンバージョンと精密発酵技術の進歩により、生産コストが削減され、ステビアの味覚プロファイルが改善され、より幅広い用途での使用が可能となっています。

世界のステビア市場の動向と洞察

天然および植物由来の甘味料への消費者の嗜好の変化

人工甘味料に代わる天然甘味料への消費者の嗜好が、甘味料市場におけるステビアの優位性を後押ししています。特に、クリーンラベルへの要求や成分の透明性が購買に影響する先進国市場において顕著です。2025年5月のFDAによるステビオール配糖体のGRAS承認のような規制の進歩は、安全性と汎用性を確認することで信頼を高めています。また、外食産業や製造業者などの機関投資家も、健康志向で持続可能な製品に対する需要に応えるため、ステビアを採用しています。ステビアの一貫した弾力性のある需要は、甘味料市場における重要な促進要因であり、業界の進化に欠かせない存在です。

ステビアを使用した新製品発売による市場成長の押し上げ

メーカー各社は、飲料、乳製品、焼き菓子にステビアの多用途性を活用しながら、味覚の課題に取り組むことで、製品イノベーションを推進しています。例えば、Cargill社とDSM-Firmenich社のEverSweetラインは、精密発酵を利用して、後味のない砂糖に似たReb MとReb D分子を作り出しています。2024年、欧州連合(EU)は発酵をベースとしたステビア製品を承認し、同地域での広範な発売を可能にしました。製造工程の改善によりコストも下がり、ステビアは人工甘味料に代わる現実的な選択肢となっています。コカ・コーラのような飲食品大手は、より優れた味覚プロファイル、規制上の裏付け、コスト効率に支えられ、糖分ゼロの製剤に投資しており、食品カテゴリー全体のイノベーションを促進しています。

農業的要因によるステビアの葉の価格変動

ステビアの生産者は、不安定な農産物価格、予測不可能な天候、地政学的事象による課題に直面しており、サプライチェーンを混乱させ、価格予測を複雑にしています。特定の地域に生産が集中することで、気候変動によって悪化する局地的な混乱によるリスクが高まる。強制労働の懸念から米国税関が中国産のステビア抽出物を差し押さえるなど、地政学的緊張は脆弱性を浮き彫りにします。中国やインドからの輸入品に対する関税は、メーカーを調達先の多様化に向かわせ、短期的なコストは上昇させるが、国内生産を後押ししています。2023年3月に設立されたスレンダ社の5,000万米ドルのフロリダ工場は、国際市場への依存度を下げることを目的としています。企業はサプライチェーンを強化し、持続可能なステビア市場を確保するため、垂直統合を採用し、精密発酵を模索しています。

セグメント分析

2024年、粉末ステビアの市場シェアは95.34%に達し、飲食品製造に適した選択肢としての地位を確立します。その優位性は、安定性、長い保存期間、製造プロセスとの適合性にあります。粉末タイプは、取り扱いの容易さ、正確な投与、コスト効率の高い生産により支持されており、大規模な用途に理想的です。ホーエンハイム大学の調査では、その汎用性が強調されており、使用量は飲料で160~700mg/kg、乳製品デザートで500~1000mg/kgとなっています。耐湿性と熱安定性により、液体では品質が損なわれる可能性のある製パンにも適しています。

液体ステビアは、2025年から2030年までのCAGRが12.58%と予測され、最も急成長しているフォーマット分野として浮上しています。この成長の原動力となっているのは、溶解性や味に関するこれまでの課題に対処した技術的進歩です。完全な溶解性と正確な甘味コントロールを必要とする糖質ゼロ飲料の需要の高まりは、液体フォーマットの採用を促進する重要な要因です。コカ・コーラのような業界大手は、革新的な組成物や噴霧乾燥製剤を通じて、レバウディオサイドMの溶解性の改善に積極的に取り組んでいます。さらに、IngredionのClean Taste Solubility Solutionは、飲料メーカーの進化するニーズを満たすために味と機能性の両方を強化し、液体ステビアアプリケーションの進歩を示しています。

地域分析

2024年、アジア太平洋地域は世界のステビア市場の31.43%のシェアを占め、2025年から2030年にかけて12.20%のCAGRで成長すると予測されています。成長の原動力は、中国、インド、日本における確立された栽培と消費量の増加です。インド化学工業協会は、この地域の栽培から製造までのシームレスなサプライチェーンを強調しています。しかし、主導的地位を占める中国は、強制労働疑惑をめぐる米国税関からの規制課題に直面しており、メーカーは調達の再考を迫られています。一方、政府のイニシアティブに支えられて成長するインドのステビアセクターは、代替策を提供しています。ステビオシド蓄積のためのナノテクノロジーなどのイノベーションが、この地域の地位をさらに強化しています。

規制が確立され消費者に受け入れられている北米は、伝統的な飲食品セクターにおける市場の飽和により、成長の鈍化に直面しています。テート&ライルとマヌス社との提携は、ステビアReb Mの生産におけるサプライチェーンの進歩を浮き彫りにしています。欧州市場は、クリーンラベルや減糖製品の需要に牽引され、高級ステビア用途へとシフトしています。開発者は、乳製品、飲料、ベーカリー製品用のフレーバーマスキング技術や新しいブレンドで味の課題に取り組んでいます。

ステビアの原産地である南米は、栽培の専門知識と新たな加工能力を兼ね備えています。しかし、マクロ経済の不安定性とインフラの問題が、拡張性を制限しています。生産者は職人的農業と持続可能な調達に重点を置き、グローバルバイヤーはトレーサビリティとESGベンチマークを優先しています。パラグアイは伝統的なリーフ栽培の拠点であり続け、本物志向のブランドにアピールしています。中東とアフリカでは、健康意識と規制による支援が高まっているが、現地での生産は限られています。サウジアラビアとアラブ首長国連邦の砂糖入り飲料に対する50%の物品税は、ステビアの採用を促進しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 天然甘味料や植物性甘味料への消費者嗜好の変化

- 市場成長を後押しするステビア新製品発表の急増

- 医薬品と栄養補助食品での利用拡大

- 抽出・加工技術の進歩

- 世界の糖尿病と肥満の増加

- 機能性食品と栄養強化食品における利用の拡大

- 市場抑制要因

- 農業要因による価格の変動

- 厳しい規制要件と長い甘味料の承認プロセス

- 製品の入手可能性に影響を与えるサプライチェーンの混乱

- 従来の甘味料に比べて製造コストが高い

- 消費者行動分析

- 規制の見通し

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 形状別

- パウダー

- 液体

- 成分タイプ別

- オーガニック

- 従来型

- 用途別

- ベーカリー

- 菓子

- 飲料

- 乳製品

- 卓上型甘味料

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- オランダ

- ポーランド

- ベルギー

- スウェーデン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland Company

- GLG Life Tech Corporation

- Morita Kagaku Kogyo Co. Ltd

- Pyure Brands LLC

- Sunwin Stevia International, Inc.

- Evolva Holding SA

- Wisdom Natural Brands(SweetLeaf)

- SweeGen Inc.

- Arzeda Corp.

- Guilin Layn Natural Ingredients Corp.

- Zhucheng Haotian Pharma Co. Ltd

- Steviva Brands Inc.

- Xinghua GL Stevia Co., Ltd

- Ganzhou Julong High-Tech Industrial Co. Ltd

- Shandong Huaxian Stevia Co., Ltd.

- Jining Aoxing Stevia Products Co., Ltd.

- The Real Stevia Company AB