|

市場調査レポート

商品コード

1851238

食品甘味料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Food Sweetener - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 食品甘味料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月31日

発行: Mordor Intelligence

ページ情報: 英文 170 Pages

納期: 2~3営業日

|

概要

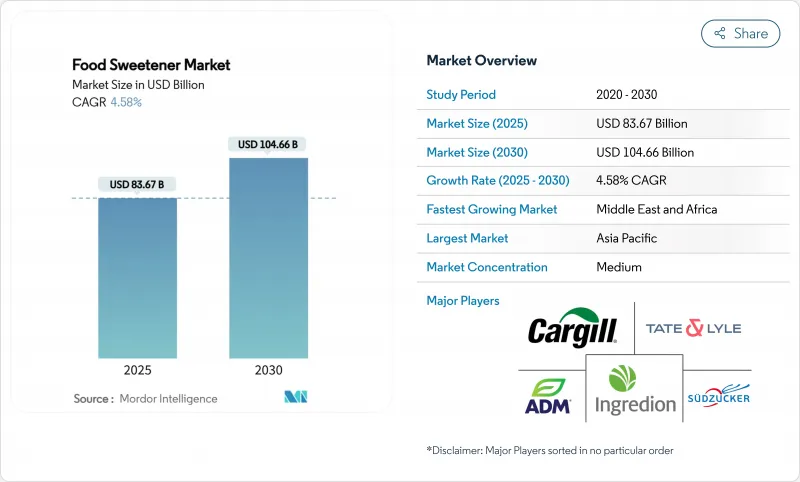

食品甘味料市場規模は2025年に836億7,000万米ドルと推定・予測され、CAGR 4.58%を反映して2030年には1,046億6,000万米ドルに達すると予測されます。

この成長には、115カ国で実施されている砂糖削減政策、消費者の健康意識の高まり、味を損なうことなくカロリー削減を可能にする成分革新の継続的進歩が拍車をかけています。人口が多く、健康的なライフスタイルの普及が進んでいるアジア太平洋地域が需要の先陣を切っている一方で、中東・アフリカ地域は急速な都市化、可処分所得の増加、食生活の進化に牽引され、最も急速な成長を遂げています。中国産エリスリトールに対する最近の米国の通商措置を踏まえ、原料サプライヤーは需要に対応するため精密発酵能力を拡大し、メーカーはリスクを軽減するためサプライチェーンを多様化しています。2024年のTate &LyleによるCP Kelcoの買収のようなM&Aは、市場の垂直統合傾向と、進化する消費者の嗜好に対応する付加価値ソリューションの開拓を浮き彫りにしています。

世界の食品甘味料市場の動向と洞察

消費者の健康志向の高まり

消費者の健康志向の高まりは、食品甘味料市場の主要促進要因です。個人の健康と幸福を優先する傾向が強まり、従来の砂糖に代わる健康的な代替品への需要が高まっています。消費者は、低カロリー、天然、非人工甘味料など、食生活の嗜好に沿った製品を積極的に求めています。このような消費者行動の変化は、メーカーにこうした嗜好に対応する様々な甘味料の革新と投入を促しています。さらに、糖尿病や肥満などの生活習慣病がますます蔓延していることが、より健康的な甘味料の必要性をさらに高めています。この動向は、予測期間中食品甘味料市場を形成し続けると予想されます。また、植物ベースやオーガニック製品の人気の高まりも、ステビア、モンクフルーツ、アガベシロップのような天然甘味料の需要に寄与しています。さらに、食品技術の進歩により、砂糖の味を模倣しながら、カロリー摂取量の減少や低血糖指数などの健康上の利点を提供する革新的な甘味料の開発が可能になっています。

肥満と糖尿病の有病率の増加

肥満と糖尿病の増加は、食品甘味料市場の重要な促進要因です。国際糖尿病連合(IDF)によると、2024年には約5億8,900万人の成人(20~79歳)が糖尿病を患っており、この数は2050年までに8億5,300万人に増加すると予測されています。このような健康危機の高まりにより、砂糖の過剰摂取による悪影響に対する意識が高まり、消費者はより健康的な代替食品を求めるようになっています。こうした健康状態が世界的に増加し続けるなか、味を損なうことなく砂糖の摂取量を管理できる代替甘味料への需要が高まっています。消費者の健康志向が高まり、低カロリー甘味料や砂糖不使用甘味料へのシフトが進んでいます。この動向は、肥満や糖尿病と闘うために砂糖の消費を減らすことを目的とした政府の取り組みや規制によってさらに後押しされています。その結果、食品甘味料市場は、健康志向の消費者の進化するニーズに対応するためにメーカーが技術革新を行っており、大きな成長を遂げています。

天然甘味料の高い製造コスト

天然甘味料に関連する高い生産コストは、食品甘味料市場の大きな抑制要因となっています。広範な栽培要件、労働集約的な抽出プロセス、高度な加工技術の必要性などの要因が、こうしたコスト上昇の一因となっています。ステビア、モンクフルーツ、その他の天然源のような原料の栽培は、しばしば特定の気候条件と多大な農業投入を必要とし、経費をさらに押し上げます。加えて、特定の原材料への依存は、季節的な入手可能性や価格の変動に左右されることが多く、問題をさらに悪化させています。例えば、悪天候やサプライチェーンの混乱は原料不足を招き、価格高騰や生産スケジュールに影響を与えます。このような課題により、天然甘味料は合成甘味料に比べてコスト競争力が劣り、製造業者による採用が制限されます。さらに、天然甘味料には、認証や食品安全基準への準拠など、厳しい規制要件があるため、生産者のコスト負担はさらに重くなります。

セグメント分析

2024年の市場シェアはショ糖が63.41%を占め、従来型の食品用途で根強い存在感を示しています。消費者に広く認知され、伝統的なレシピや加工食品での利用が定着していることが、市場の主導権維持に大きく寄与しています。ショ糖は、甘味、食感の向上、保存性など、代替甘味料では再現が難しい機能的特性により、依然としてメーカーに好まれています。さらに、手頃な価格で入手しやすいことも、市場での地位をさらに強化しています。代替甘味料への需要が高まっているにもかかわらず、ショ糖は、特に伝統的な食生活の嗜好が支配的な地域では、様々な飲食品製品の主食成分であり続けています。

一方、高強度甘味料が食品甘味料市場の成長を牽引する構えで、2030年までのCAGRは6.89%と予測されます。これらの甘味料は、低カロリーで健康志向の消費者に適していることから支持を集めています。飲食品、菓子類、その他の低カロリー食品への採用が増加しており、成長の起爆剤としての役割を浮き彫りにしています。さらに、肥満や糖尿病といった生活習慣に関連した健康状態の有病率の上昇が、砂糖代替品へのシフトを加速させ、高強度甘味料の需要を押し上げています。さらに、米国疾病予防管理センター(CDC)は、米国だけでも3,840万人以上が糖尿病に罹患しており、2024年時点で9,800万人の成人が糖尿病予備軍であることを明らかにしています。製剤技術の革新は、新しい甘味料の規制上の承認と相まって、その応用範囲も拡大しています。消費者の嗜好が進化するにつれて、高強度甘味料は、より健康的で持続可能な甘味料ソリューションの需要に対応する上で極めて重要な役割を果たすと予想されます。

固形甘味料は2024年に62.21%の市場シェアを維持するが、これは結晶構造が甘味増強以外の機能的利点をもたらす製パン・菓子類用途での定着した使用を反映しています。液体とシロップの形態は、飲料業界の成長と水性用途での溶解特性の改善に牽引され、2030年までCAGR 7.25%で加速します。剤形の好みは用途によって大きく異なり、固形剤形は卓上用途と工業用製パン用途で優位を占める一方、液状剤形は飲料製剤と乳製品用途で優れています。液状甘味料は大規模製造において、より優れた分散性と処理時間の短縮を提供することが多いため、加工上の考慮が形態の選択に影響します。

飲料メーカーは、結晶化の問題なしに正確な添加と一貫した風味プロファイルを可能にする液体甘味料システムをますます好むようになっています。スプレードライや顆粒状は、溶解速度よりも流動性や保存安定性が重視される特定の産業ニーズに対応しています。液体分野では、濃縮技術の革新により、輸送コストと保管の必要性が削減されます。シロップ製剤は、特定の味覚プロファイルや機能特性を達成するために、複数の甘味料をカスタムブレンドすることを可能にします。製剤の選択は、純粋な機能要件よりもむしろサプライチェーンの最適化を反映するようになっており、メーカーは取り扱いコストや在庫の複雑さを最小限に抑える製剤を選択するようになっています。

地域分析

2024年の食品甘味料市場は、アジア太平洋地域が38.45%のシェアを占め、その大きな人口基盤と急速な経済発展に牽引されています。この地域の中間層人口の増加と可処分所得の増加が加工食品の需要を大幅に押し上げ、それが食品甘味料の消費に拍車をかけています。さらに、飲食品産業の拡大と欧米の食習慣の影響力の高まりが、この地域の市場成長をさらに後押ししています。アジア太平洋地域の政府も食品の生産と加工を強化するための支援政策を実施しており、これが食品甘味料市場にプラスの影響を与えています。

中東とアフリカは主要な成長地域として浮上しており、2030年まで7.41%の堅調なCAGRで推移すると予測されます。消費者が低カロリー甘味料や天然甘味料を含むより健康的な食生活の選択にシフトしているため、都市化と健康意識の高まりがこの成長の主な促進要因となっています。同地域では国際的な食品動向の採用も増加しており、食品甘味料メーカーにビジネスチャンスをもたらしています。さらに、砂糖消費量の削減とより健康的な代替品の普及を目指した政府の取り組みが、予測期間中の市場拡大を後押しすると予想されます。

北米は成熟市場の特徴を示しており、高品質かつ健康志向の製品に対する消費者の嗜好を反映して、高級天然甘味料に重点が置かれています。一方、欧州では、厳しい規制と環境への懸念が市場力学を形成しているため、規制遵守と持続可能性が重視されています。南米では、糖尿病の有病率の増加と政府主導の健康への取り組みが、食品甘味料の採用を促進しています。同地域ではまた、砂糖代替品の利点に対する認識が高まっており、消費者がより健康的な代替品を選ぶようになっています。これらの地域力学は、世界の食品甘味料市場における多様な成長パターンと機会を浮き彫りにしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 消費者の健康志向の高まり

- 肥満と糖尿病の増加

- 低カロリー・砂糖不使用製品に対する需要の高まり

- 飲食品産業の拡大

- 天然甘味料に対する消費者の嗜好の高まり

- 砂糖削減を支援する政府政策

- 市場抑制要因

- 天然甘味料の高い生産コスト

- 人工甘味料の安全性に対する消費者の懐疑心

- 食品添加物の複雑な規制枠組み

- 特定地域における限定的な消費者受容

- サプライチェーン分析

- 規制の見通し

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- ショ糖

- デンプン甘味料と糖アルコール

- ブドウ糖

- 高フルクトースコーンシロップ(HFCS)

- マルトデキストリン

- ソルビトール

- キシリトール

- エリスリトール

- その他の糖アルコール

- 高強度甘味料(HIS)

- スクラロース

- アスパルテーム

- サッカリン

- ネオテーム

- ステビア

- アセスルファム-K

- シクラメート

- その他HIS

- その他

- ソース別

- 植物由来

- 発酵/バイオエンジニアリング

- 人工

- 形態別

- 固体

- 液体/シロップ

- 用途別

- 食品

- ベーカリー・菓子類

- 乳製品とデザート

- 食肉製品

- 栄養補助食品と機能性食品

- ソース、ドレッシング、スプレッド

- その他の加工食品

- 飲料

- ソフトドリンク

- スポーツドリンク

- その他の飲料

- 食品

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- スウェーデン

- ポーランド

- ベルギー

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- ペルー

- チリ

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- Market Positioning Analysis

- 企業プロファイル

- Cargill, Incorporated

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Ingredion Inc.

- Sudzucker AG

- DSM-Firmenich AG

- Associated British Foods PLC

- Tereos Group

- Roquette Freres S.A.

- Celanese Corporation

- GLG Life Tech Corp.

- Cumberland Packing Corp.

- Ajinomoto Co. Inc.

- Evolva Holding SA

- Pyure Brands LLC

- JK Sucralose Inc.

- Gadot Biochemical Industries Ltd.

- FoodChem International Corporation

- Niutang Chemical Ltd.

- Rajvi Enterprises

- Gulshan Polyols Ltd.