|

市場調査レポート

商品コード

1851411

パッケージングオートメーション:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| パッケージングオートメーション:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月07日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

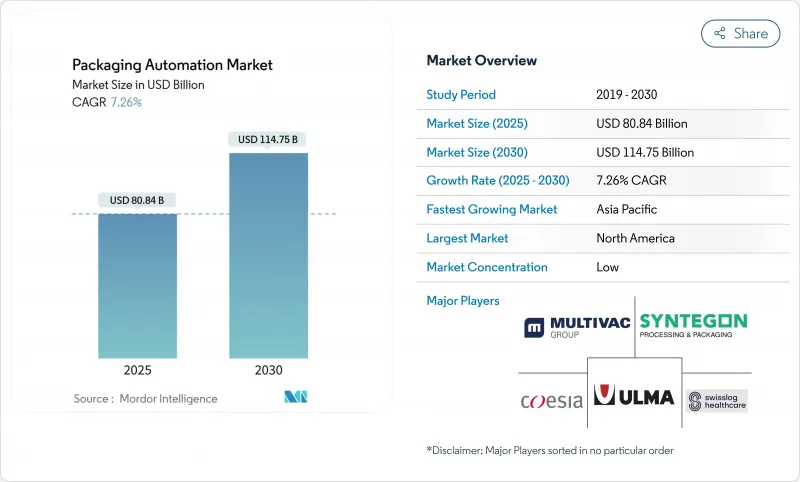

パッケージングオートメーション市場規模は2025年に808億4,000万米ドル、2030年には1,147億5,000万米ドルに達すると予測され、CAGRは7.26%を記録します。

インテリジェント製造システムへの継続的な投資により、労働力格差が縮小し、ライン精度が向上し、規制への期待が高まっています。この分野は、eコマースによる生産量の伸びと、厳格な医薬品のシリアル化によって利益を得ており、ラインはスループットとトレーサビリティのバランスを取ることを余儀なくされています。北米がリーダーシップを維持しているが、アジア太平洋は中国の数十億米ドル規模のロボット投資に支えられ、最も急速に拡大しています。売上は依然としてハードウェアが支配的だが、ユーザーが所有権よりも稼働時間の保証を求めるようになり、サービス中心の成果主義モデルが加速しています。段ボール、紙器、マテリアルハンドリングの各サプライヤーの統合は、顧客のフットプリントを拡大し、オートメーションプロバイダーに新たなスケールを生み出します。

世界のパッケージングオートメーション市場の動向と洞察

F&B、製薬、eコマースの各分野で自動化の採用が増加

包装機械の出荷台数は2024年に上昇し、大量生産される食品業務に加え、フレキシブルな少量生産形式を要求する製薬ラインによって後押しされます。製薬メーカーは、個別化された医薬品の包装を可能にするため、2025年に1,600億米ドルをサイトのアップグレードに投入します。eコマース・フルフィルメント・センターは、何千もの箱のバリエーションを生み出すライトサイジング・システムを採用し、労働生産性を高めながら段ボール使用量を半減させる。あるセクターで実証されたソリューションが別のセクターに移行し、パッケージングオートメーションの市場浸透が加速するにつれて、業界横断的な技術移転が加速します。このような機運が相まって、限られたダウンタイムでSKUクラス間をシフトできる適応型ロボットと統合ビジョンへの需要が増幅されます。

eコマースによる高速二次梱包需要

モバイルロボットと組み合わされた適切なサイズのボックスシステムは、数ヶ月のうちに物流現場の生産性を97%向上させ、二次梱包がいかに重要な効率化レバーとなっているかを明確にしました。可変寸法オートメーションは現在、パッケージングオートメーション市場の41.42%を占めているが、これは混合注文を迅速に処理する必要性を反映しています。アジア太平洋地域のオンライン小売売上は急増しており、2024年には地域の設備投資額は180億米ドルにまで拡大すると予測されています。欧米のオムニチャネルモデルと相まって、ラインスピード、ソフトウェアオーケストレーション、人間工学に基づいたパレタイジングに持続的な圧力がかかり、パッケージングオートメーション市場全体の継続的なアップグレードを刺激しています。

高い資本コストとサイバーセキュリティリスク

本格的なパッケージング・セルには多額の先行投資が必要であり、多くの中小企業はこれを法外なものと感じています。同時に、コネクティビティの向上により、運用技術がサイバー脅威にさらされ、製造業は産業インシデントの4分の1以上を占めています。企業は、オートメーション・ハードウェアとレイヤード・セキュリティの両方に投資しなければならず、予算が伸び悩み、導入が遅れています。Robots-as-a-Serviceモデルは、OPEXに支出をシフトし、サブスクリプション内で管理されたサイバーセキュリティを提供することにより、この2つのハードルに対処します。このアプローチは、バランスシートへの影響を軽減するが、パッケージングオートメーション市場全体で拡大するには、まだ市場教育が必要です。

セグメント分析

2024年のパッケージングオートメーション市場シェアはケース包装が32.12%を占め、流通時の商品保護に不可欠な役割を担っていることが明らかになりました。持続可能性がより薄い段ボールと精密な接着剤塗布を後押ししているため、ケース・セグメント内の成長は安定しています。パレタイジングは、売上高こそ小さいもの、CAGR 12.31%で拡大しています。ファナックの新しいCRX-25iAコボットは、30kgの荷重を扱うことができ、簡単にティーチングペンダントを提供しながら、セルのフットプリントを圧縮します。協働作用ロボットは試運転を短縮し、作業者のエルゴノミクスを改善するため、このセグメントは自動化普及の先行指標となります。

上流では、柔軟な無菌フォーマットが個別化治療に対応するため、充填機が医薬品への投資を獲得しています。ラベリングラインは、医薬品と飲料の規制トレーサビリティを満たすシリアル化モジュールを追加します。ラッピングとキャッピングは、軽量フィルムの進歩を背景に増加し、バンディング技術は試験的導入でプラスチックを80%削減しました。袋詰めラインは、耐久性の高いハルドックス鋼で耐用年数を延ばした研磨材分野で脚光を浴びています。これらの製品間の相互作用は、複数のタスクを融合して適応性のあるパッケージングオートメーション市場ソリューションとするエンド・ツー・エンド・セルへの動きを示唆しています。

食品メーカーは2024年にパッケージングオートメーション市場の28.53%を占め、大量SKUと厳格な衛生基準の恩恵を受けています。医薬品包装は、そのベースラインは小さいもの、注射療法の増加に伴い11.98%のCAGRが見込まれています。Syntegon社のPharmatag 2025ラインは、厳格な無菌下で液体を充填する一方で、小ロットにも対応できるよう迅速にフォーマットを切り替えます。アジア太平洋の飲料ラインは、中間層の需要増に対応するため、高速缶詰とスリービングを導入。

パーソナルケアブランドは、自動化されたマルチラインオーダーピッキングによる豪華なカスタムパックに注力しています。化学薬品メーカーは腐食性のある媒体への暴露を制限するため、フェストのEX認証アクチュエータを活用した密閉充填とシーリングを採用しています。医薬品のシリアライゼーションが偽造品対策として消費財に移行し、パッケージングオートメーション市場の応用範囲が広がるにつれ、技術のクロスオーバーが加速しています。

地域分析

北米は2024年のパッケージングオートメーション市場に34.14%寄与しており、高度な製造インフラとFDAのシリアル化義務化を活用しています。医薬品メーカーは2025年に1,600億米ドルを投じて設備をアップグレードし、クリーンルーム対応ロボットの需要を維持します。ABBのミシガン州における2,000万米ドルの拡張は、ベンダーが地域の顧客にコミットしていることを強調しています。eコマースのフルフィルメント拠点が急増し、適応性の高い二次梱包の需要が高まる。

アジア太平洋地域は、2030年までのCAGRが10.64%で最速の地域です。中国は2024年に産業用ロボットに66億米ドルを投じ、ロボット密度を倍増させるという政策を反映。上海で開催されるProPak 2025には、スマート・パッケージング・ソリューションの出展者が2,500社以上集まり、この地域の手作業ラインからデジタル工場へのシフトを強調します。Estun Automationのような国内サプライヤーは、競争力のある価格のロボットアームでシェアを獲得し、現地でパッケージングオートメーション市場を拡大しています。

欧州では、持続可能性に関する規制やインダストリー4.0補助金を通じて導入を推進しています。スウェーデンのある施設では、自動バンディングによってプラスチックラップを80%削減し、循環型経済の目標を達成しました。ドイツの先進機械メーカーが輸出競争力を維持するためにAIモジュールを追加。また、中東とアフリカでは、食糧安全保障を強化するために自動化された乳製品ラインを試験的に導入し、ブラジルの南米工場では、地域の飲料需要の増加に対応するためにパレタイザーを導入しています。このような多様な取り組みにより、世界のパッケージングオートメーション市場の裾野が広がっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- FandB、製薬、eコマースの各分野で自動化の導入が進む

- eコマースによる高速二次包装需要

- ロボット導入が加速する労働力不足

- AIによる予知保全でダウンタイムを短縮(アンダーレーダー)

- 中小企業向けモジュラー型コボットセル(アンダーレーダー)

- サステナビリティ主導の材料削減自動化(アンダーレーダー)

- 市場抑制要因

- 高い資本コストとサイバーセキュリティ・リスク

- 熟練オペレーターの不足

- 独自の制御ソフトウェアへのベンダーのロックイン(アンダーレーダー)

- 衛生区域(アンダーレーダー)用の認定されたオープンソースのマシンビジョンライブラリの欠如

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- 充填

- ラベリング

- ケース包装

- 袋詰め

- パレタイジング

- キャップ

- ラッピング

- その他の製品タイプ

- エンドユーザー別

- 食品

- 飲料

- 医薬品

- パーソナルケアとトイレタリー

- 工業・化学

- その他のエンドユーザー

- オートメーションレベル別

- 全自動ライン

- 半自動ライン

- 協業/ハイブリッド・システム

- ソリューション別

- ハードウェア(ロボット、コンベア、センサー)

- ソフトウェア(SCADA、MES、アナリティクス)

- サービス(設置、メンテナンス、レトロフィット)

- 包装段階別

- 一次パッケージングオートメーション

- 二次パッケージングオートメーション

- 三次/エンド・オブ・ライン・オートメーション

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリアおよびニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Multivac Group

- Coesia S.p.A.

- ULMA Packaging

- Syntegon Technology

- Swisslog Healthcare

- Rockwell Automation Inc.

- Sealed Air Corporation

- Mitsubishi Electric Corporation

- Automated Packaging Systems LLC

- ABB Ltd.

- Fanuc Corp.

- KUKA AG

- Schneider Electric SE

- Siemens AG

- Tetra Pak International SA

- ProMach Inc.

- Barry-Wehmiller Companies Inc.

- Sidel Group

- Ishida Co. Ltd.

- Yaskawa Motoman Robotics