|

市場調査レポート

商品コード

1906979

飼料添加物:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 飼料添加物:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

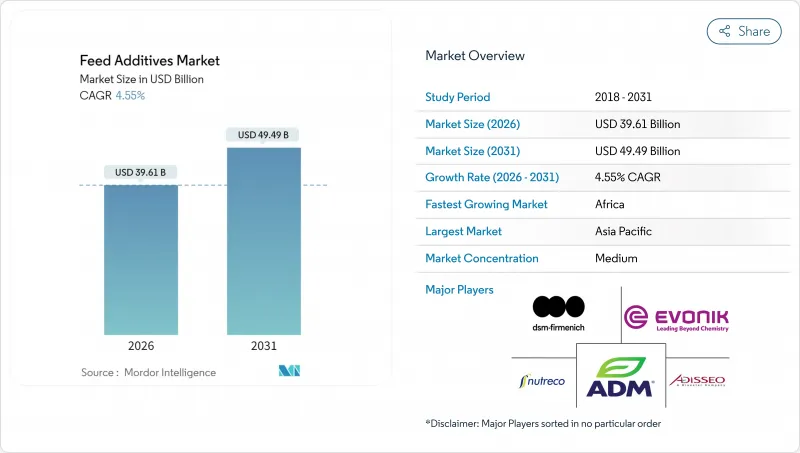

2026年の飼料添加物市場規模は396億1,000万米ドルと推定され、2025年の378億8,000万米ドルから成長が見込まれます。

2031年には494億9,000万米ドルに達し、2026年から2031年にかけてCAGR4.55%で拡大する見通しです。

需要は、抗生物質系成長促進剤の全面禁止が進む中、機能性代替品を中心にシフトしています。一方、精密発酵技術の流れは、廃棄タンパク質をペプチド豊富な原料に変換し、配合コストを削減するとともに、クリーンラベルを求める購買層に訴求しています。中国、欧州連合、米国における承認枠組みの進化に対応する企業は、調和された申請書類により市場投入までの時間を短縮し、地理的範囲を拡大できるため、より速い成長を遂げています。原料専門企業と統合型食肉生産者との戦略的提携は、データ駆動型製品開発を加速させ、畜舎内パフォーマンス指標と添加物選択の連動性を強化しています。環境宣言が購買決定に影響を与えるようになり、メタン低減・低リンソリューションが主流飼料に採用され、全地域でプレミアム価格帯が確立されつつあります。

世界の飼料添加物市場の動向と洞察

抗生物質成長促進剤の使用禁止

抗生物質成長促進剤に対する規制上の制限は、従来の市場を超えて加速しており、中国では2024年に、欧州連合(EU)規則2019/6で確立された基準に準じた包括的な禁止措置が実施されました。米国食品医薬品局(FDA)が2024年10月に米国飼料管理官協会(AAFCO)との覚書を終了したことは、より厳格な監督への転換を示しており、新規代替品の承認を迅速化するための「動物用食品原料相談プロセス」を開始しました。この規制の進化により、抗菌剤耐性の懸念なく成長性能を維持できる機能性代替品、特に有機酸、精油、プロバイオティクス配合物に対する即時的な需要が生まれています。この移行は養豚生産において最も課題が多く、生産者からは初期適応期間中に飼料要求率が5~8%悪化したとの報告があり、実績のある代替品に対するプレミアム価格が形成されています。

一人当たり食肉消費量の増加

世界の一人当たり肉消費量は上昇傾向を継続し、2024年には年間43.2kgに達しました。特に発展途上国で顕著な増加が見られます。インドの肉消費量は前年比12%増加し、アフリカ市場では都市化が進むにつれ食生活の変化が加速し、さらに劇的な変化が起きています。この消費拡大は飼料添加物需要に直結しており、生産者はタンパク質要求量をコスト効率良く満たす効率向上ソリューションを求めています。この動向は特にアミノ酸および酵素分野に恩恵をもたらします。これらの分野における最適化により飼料要求率が8~12%改善され、2024年初頭以降世界的に15%上昇した穀物コストの高騰の中でも収益性を維持するために極めて重要です。

厳格化する承認規制

新規飼料添加物の規制承認プロセスは大幅に長期化しており、欧州食品安全機関(EFSA)における包括的な資料審査には平均36ヶ月を要します(2019年は24ヶ月)。米国食品医薬品局(FDA)の新規動物用食品成分相談プロセスは一部手続きを効率化しましたが、安全性評価のための追加データ要求により、承認期間が6~12ヶ月延長される可能性があります。こうした遅延は、規制上の先例が限られている精密発酵由来製品や新規酵素製剤などの革新的製品に特に影響を及ぼしています。企業は新規添加物1品目あたり200万~500万米ドルを規制対応に費やしているもの、承認が保証されるわけではなく、これにより中小の革新企業には障壁が生じ、市場力学が鈍化しています。

セグメント分析

精密栄養学の革命により、アミノ酸は2025年に21.85%という圧倒的な市場シェアを獲得しました。これは生産者が飼料コスト上昇(原料費が前年比18%増加)に対抗するため、タンパク質利用効率を最適化した結果です。メチオニンとリシンは供給集中により高価格帯を維持しており、メチオニン生産能力の70%をわずか3社の世界のサプライヤーが支配しています。米国飼料管理官協会(AAFCO)および欧州食品安全機関(EFSA)のガイドラインに基づく規制枠組みは、作用機序データが実証された製品をますます優遇しており、科学的根拠に基づく配合が従来の経験的アプローチに対して競争優位性を生み出しています。

抗酸化剤は2031年までCAGR4.25%で最も成長が速いセグメントとして浮上しています。市場では天然由来・クリーンラベルの抗酸化剤への顕著な移行が見られ、食品サプライチェーン全体における天然原料への消費者嗜好の広がりを反映しています。酵素分野は、植物性飼料からリンを遊離させるフィターゼの革新により着実な成長を維持しています。一方、ビタミン分野では、中国における供給混乱によるマージン圧迫が生じており、ビタミンEやビオチンなどの主要化合物では45%の価格変動が発生しています。

本飼料添加物市場レポートは、添加物別(酸性化剤、アミノ酸など)、動物別(水産養殖、家禽など)、地域別(アフリカ、アジア太平洋、欧州、中東、北米など)に分類されています。市場予測は金額(米ドル)および数量(メトリックトン)で提供されます。

地域別分析

2025年にアジア太平洋地域が占める31.05%の市場シェアは、同地域の産業規模の畜産事業と、添加物の承認・使用に関する欧州連合(EU)基準を反映した高度な規制枠組みを反映しています。中国における新たな飼料添加物登録要件の実施は、小規模サプライヤーが改正規制枠組みで要求される包括的な書類準備に必要なリソースを欠いていることから、市場統合の機会を生み出しています。

アフリカは2031年までCAGR3.05%と最も高い成長可能性を示しており、ケニア、ナイジェリア、エジプトにおける都市化の動向によるタンパク質消費パターンの変化や、畜産システム近代化に向けた政府主導の取り組みがこれを支えています。同大陸の成長軌道は、従来は物流制約により制限されていた高品質飼料添加物のコールドチェーン流通を可能にするインフラ整備を反映しています。エジプトに新設されたDSM-Firmenich社のプレミックス工場(年間生産能力1万トン)は、多国籍企業が地域市場の潜在力に確信を持っていることを示すとともに、現地生産能力を提供することで輸入依存度を低減します。

北米の生産者は、米国食品医薬品局(FDA)の新たな「動物用飼料成分相談枠組み」による規制プロセスの効率化により恩恵を受けています。これにより、新規添加物の承認期間が従来の手続きと比較して15~20%短縮されました。ブラジルとアルゼンチンが主導する南米市場では、輸出志向型の生産システムが安定した品質基準を要求しており、製品のトレーサビリティと国際的な食品安全要件への適合性を保証するプレミアム添加物ソリューションの機会が生まれています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3か月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

- 調査手法

第2章 エグゼクティブサマリー主要な調査結果

第3章 レポート提供

第4章 主要な業界動向

- 家畜頭数分析

- 家禽

- 反芻動物

- 豚

- 飼料生産分析

- 水産養殖

- 家禽

- 反芻動物

- 豚

- 規制の枠組み

- アルゼンチン

- オーストラリア

- ブラジル

- カナダ

- チリ

- 中国

- エジプト

- フランス

- ドイツ

- インド

- インドネシア

- イラン

- イタリア

- 日本

- ケニア

- メキシコ

- オランダ

- フィリピン

- ロシア

- サウジアラビア

- 南アフリカ

- 韓国

- スペイン

- タイ

- トルコ

- 英国

- 米国

- ベトナム

- バリューチェーン及び流通チャネル分析

- 市場促進要因

- 抗生物質成長促進剤の使用禁止

- 一人当たり肉消費量の増加

- 畜産物の工業化

- 腸内健康と飼料効率への関心の高まり

- 機能性添加物としての精密発酵製品別

- カーボンフットプリント表示がメタン低減添加剤を促進

- 市場抑制要因

- 厳格な承認規制

- 原料価格の変動性

- 合成添加物に対する消費者の懐疑的な見方

- バイオテクノロジー酵素の生産能力のボトルネック

第5章 市場規模と成長予測(金額と数量)

- 添加物別

- 酸性化剤

- 添加剤別

- フマル酸

- 乳酸

- プロピオン酸

- その他の酸性化剤

- 添加剤別

- アミノ酸

- 添加剤別

- リジン

- メチオニン

- スレオニン

- トリプトファン

- その他のアミノ酸

- 添加剤別

- 抗生物質

- 添加剤別

- バシトラシン

- ペニシリン系

- テトラサイクリン系

- タイロシン

- その他の抗生物質

- 添加剤別

- 抗酸化物質

- 添加剤別

- ブチル化ヒドロキシアニソール(BHA)

- ブチル化ヒドロキシトルエン(BHT)

- クエン酸

- エトキシキン

- プロピルガレート

- トコフェロール

- その他の抗酸化物質

- 添加剤別

- バインダー

- 添加剤別

- 天然バインダー

- 合成バインダー

- 添加剤別

- 酵素

- 添加剤別

- 炭水化物分解酵素

- フィターゼ

- その他の酵素

- 添加剤別

- フレーバー&甘味料

- 添加剤別

- フレーバー

- 甘味料

- 添加剤別

- 鉱物

- 添加剤別

- 主要ミネラル

- 微量ミネラル

- 添加剤別

- マイコトキシン解毒剤

- 添加剤別

- バインダー

- バイオトランスフォーマー

- 添加剤別

- フィトジェニックス

- 添加剤別

- エッセンシャルオイル

- ハーブ&スパイス

- その他の植物性原料

- 添加剤別

- 顔料

- 添加剤別

- カロテノイド

- クルクミン&スピルリナ

- 添加剤別

- プレバイオティクス

- 添加剤別

- フルクトオリゴ糖

- ガラクトオリゴ糖

- イヌリン

- ラクツロース

- マンナンオリゴ糖

- キシロオリゴ糖

- その他のプレバイオティクス

- 添加剤別

- プロバイオティクス

- 添加剤別

- ビフィズス菌

- エンテロコッカス

- 乳酸菌

- ペディオコッカス

- 連鎖球菌

- その他のプロバイオティクス

- 添加剤別

- ビタミン

- 添加剤別

- ビタミンA

- ビタミンB

- ビタミンC

- ビタミンE

- その他のビタミン

- 添加剤別

- 酵母

- 添加剤別

- 生酵母

- セレン酵母

- 使用済み酵母

- トルラ乾燥酵母

- ホエイ・イースト

- 酵母由来製品

- 添加剤別

- 酸性化剤

- 動物別

- 養殖業

- 動物別

- 魚

- エビ

- その他の養殖種

- 動物別

- 家禽

- 動物別

- ブロイラー

- レイヤー

- その他の家禽類

- 動物別

- 反芻動物

- 動物種別

- 肉用牛

- 乳用牛

- その他の反芻動物

- 動物種別

- 豚

- その他の動物

- 養殖業

- 地域別

- アフリカ

- 国別

- エジプト

- ケニア

- 南アフリカ

- その他アフリカ

- 国別

- アジア太平洋地域

- 国別

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- フィリピン

- 韓国

- タイ

- ベトナム

- その他アジア太平洋地域

- 国別

- 欧州

- 国別

- フランス

- ドイツ

- イタリア

- オランダ

- ロシア

- スペイン

- トルコ

- 英国

- その他欧州地域

- 国別

- 中東

- 国別

- イラン

- サウジアラビア

- その他中東

- 国別

- 北米

- 国別

- カナダ

- メキシコ

- 米国

- その他北米地域

- 国別

- 南米

- 国別

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 国別

- アフリカ

第6章 競合情勢

- 主要な戦略的動きs

- 市場シェア分析

- 企業概況

- 企業プロファイル

- DSM-Firmenich AG

- Evonik Industries AG

- SHV(Nutreco NV)

- Archer Daniel Midland Co.

- Adisseo

- BASF SE

- Elanco Animal Health Inc.

- Solvay S.A.

- IFF(Danisco Animal Nutrition)

- Novus International, Inc.

- Kemin Industries, Inc.

- Alltech, Inc.

- Phibro Animal Health Corporation

- Zoetis Inc.

- Archer Daniel Midland Co.