|

市場調査レポート

商品コード

1550305

日本のプラスチックキャップとクロージャー:市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Japan Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 日本のプラスチックキャップとクロージャー:市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年09月02日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

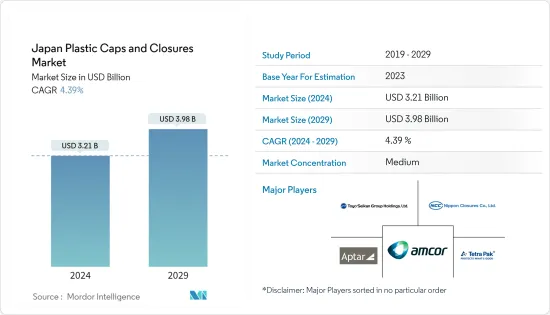

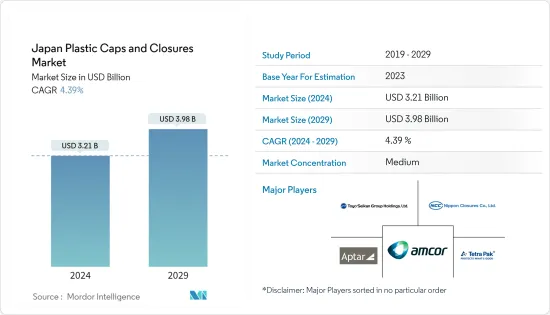

日本のプラスチックキャップとクロージャー市場規模は、2024年に32億1,000万米ドルと推定・予測され、予測期間中(2024-2029年)にCAGR 4.39%で成長し、2029年には39億8,000万米ドルに達すると予測されます。

出荷台数では、2024年の182億1,000万台から2029年には217億8,000万台へと、予測期間(2024~2029年)のCAGRは3.65%で成長すると予測されます。

主なハイライト

- 日本の飲食品産業は、西洋料理への消費者の嗜好の変化と、大量消費向けから消費者向けまで幅広い製品群に牽引されて、増加の一途をたどっています。米国農務省(USDA)のデータによると、2023年には、日本は米国の農産物にとって第4位の市場として浮上し、輸入総額は130億米ドルに達し、米国は日本の海外食品・飲料のトップ・サプライヤーとしての地位を固める。

- 日本では、ジュースやボトル入り飲料水のようなノンアルコール飲料への需要が高まっており、プラスチック製キャップの需要を押し上げています。米国農務省のデータは、日本が米国のノンアルコール飲料、特にミネラルウォーターやジュースを好むようになっていることを強調しています。同時に、日本の消費者はより健康的な飲料やノンアルコールビールに傾倒しており、プラスチック製キャップとクロージャーの必要性をさらに高めています。

- 日本のメーカーは製品の差別化に重点を置き、持続可能で高品質、競合価格の製品に投資を振り向け、進化する消費者の需要に応えています。日本クロージャーのような企業は、リサイクル可能なプラスチックキャップ研究のパイオニアであり、環境フットプリントを削減するためにバイオマス含有率30%のキャップを導入し、市場成長を後押ししています。

- しかし、日本のプラスチック市場は課題に直面しています。需要と供給の不均衡によって変動するプラスチック価格は、プラスチック製キャップとクロージャーの製造コストに直接影響し、市場の成長を妨げる可能性があります。加えて、日本ではプラスチック廃棄物の増加が二重の課題となっており、プラスチック包装ソリューションの需要を制約しています。

日本のプラスチックキャップとクロージャー市場の動向

ネジ式キャップが最も高いシェアを占める

- ねじ込み式キャップは、その気密性の高い密封性により、食品、飲食品、化粧品、医薬品などさまざまな分野で幅広い用途を見いだすことができます。

- 日本のメーカーは、主にHDPE、LDPE、ポリプロピレンなどの樹脂材料からこれらのキャップを製造し、連続的なものから非連続的なものまで、さまざまなタイプのネジ山を提供しています。これらのキャップは、特に飲料ボトル用として人気が高く、包装の美観を高め、製品の風味と品質を保つ上で極めて重要な役割を果たすため、様々な用途で需要が拡大しています。

- Amcor Group GmbHやAptar Group Inc.などの主要企業が市場をリードしており、様々なエンドユーザーに対応するためにネジ付きキャップをカスタマイズしています。例えば、Amcorの13/415mmねじ込みリブ付きライナーレスキャップは、特に医薬品とパーソナルケアの最終用途向けに調整されています。これらのキャップの多用途性と利点は、飲食品からホームケア、ペットケア、栄養補助食品に至るまで、業界の垣根を越えてその採用を推進しています。

- 日本では、ポリエチレン(PE)、ポリプロピレン(PP)、その他の樹脂を使用したねじ込み式キャップが増加傾向にあり、製品需要を押し上げています。この急増は、主にパッケージング・ソリューションのために原料プラスチックの消費量が増加していることが大きな要因となっています。経済産業省の最近の統計によると、2024年4月のポリエチレン(PE)消費量は84.03トン、ポリプロピレン(PP)消費量は105.75トンに達しました。

食品セグメントが市場を独占する見込み

- 食品製造の進歩は、日本の食生活に顕著な変化をもたらし、伝統的な生鮮食品から大量生産・加工食品へと移行しました。この変化により、特に日本の若い世代や共働き世帯に好まれる加工済み食材や調理済み食品が増加し、市場の大幅な成長を牽引しています。

- 米国農務省(USDA)によると、高齢化が進む日本では、タンパク質が豊富で栄養価の高い食品を好む傾向が強まっています。食品包装用プラスチックキャップとクロージャーの需要急増は、日本の食肉加工品に対する食欲の高まりに直接対応するものであり、プラスチックキャップとクロージャーの生産増加に対応する必要があります。

- 日本では、ジャム、ピクルス、香辛料、ナッツ類は通常、プラスチック製密閉キャップ付きのボトルや容器に入っています。これらの密閉容器は、汚染や改ざんを防ぎ、開封や分注に便利なように設計されています。製品の賞味期限を延ばし、外的要因から保護し、包装内の酸素濃度を管理する上で極めて重要な役割を果たすことから、市場成長を牽引する重要性が強調されます。

- 加工肉、乳製品、ベーカリー製品、野菜に及ぶ日本の米国への輸入依存は、堅調な食品小売部門によって大きく左右されています。日本税関のデータによると、米国は肉製品の26%、加工野菜の12%、生鮮果実の6%、加工果実の4%を日本に供給しており、日本市場におけるプラスチックキャップとクロージャーの需要をさらに煽っています。

日本のプラスチックキャップとクロージャー産業の概要

日本のプラスチックキャップとクロージャー市場は適度に統合されており、以下のような国内企業が存在します。 Nippon Closures, Toyo Seiken Group Holdings Ltd, and International players including Amcor Group GmbH, Aptar Group Inc., and Tetra Pak. 市場で地位を築くために、企業は新製品開発、パートナーシップ、合併と買収、コラボレーションに重点を置いています。

- 2024年4月米国に本社を置くAptar Group Inc.は、最新製品であるフューチャーディスクトップクロージャーを発表しました。この革新的なクロージャーは美容・パーソナルケア分野向けに設計され、ポリエチレン(PE)のみで作られているため、完全にリサイクル可能です。その安全なロックリングは特筆すべきもので、輸送の信頼性を高め、最終的にエンドユーザーにプレミアムな体験をもたらします。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場力学

- 市場促進要因

- 国内における飲食品セクターの台頭

- 市場における革新的製品への需要の高まり

- 市場の課題

- 日本におけるプラスチック価格の変動

第6章 業界の規制と政策と規格

第7章 市場セグメンテーション

- 樹脂別

- ポリエチレン(PE)

- ポリエチレンテレフタレート(PET)

- ポリプロピレン(PP)

- その他のプラスチック素材(ポリスチレン、PVC、ポリカーボネートなど)

- 製品タイプ別

- ネジ式

- ディスペンサー

- ネジなし

- 小児用

- 最終用途産業別

- 食品

- 飲料

- ボトル入り飲料水

- 炭酸飲料

- アルコール飲料

- ジュース&エナジードリンク

- その他の飲料

- パーソナルケア&化粧品

- 家庭用化学品

- その他の最終用途産業

第8章 競合情勢

- 企業プロファイル

- Amcor Group GmbH

- Aptar Group Inc.

- Sonoco Products Company

- Nippon Closures Co. Ltd.

- Toyo Seiken Group Holdings Ltd.

- Nihon Yamamura Glass Co. Ltd.

- Tetra Laval International S.A.

- Mikasa Industry Co. Ltd.

第9章 リサイクルと持続可能性の展望

第10章 将来の展望

The Japan Plastic Caps And Closures Market size is estimated at USD 3.21 billion in 2024, and is expected to reach USD 3.98 billion by 2029, growing at a CAGR of 4.39% during the forecast period (2024-2029). In terms of shipment volume, the market is expected to grow from 18.21 billion units in 2024 to 21.78 billion units by 2029, at a CAGR of 3.65% during the forecast period (2024-2029).

Key Highlights

- The Japanese food and beverage industry is on the rise, driven by shifting consumer tastes toward Western cuisine and a broad spectrum of products, ranging from bulk to consumer-oriented. According to data from the United States Department of Agriculture (USDA), in 2023, Japan emerged as the fourth largest market for United States agricultural goods, with imports totaling USD 13 billion, solidifying the United States as Japan's top foreign food and beverage supplier.

- Japan's increasing appetite for non-alcoholic beverages, like juices and bottled water, boosts the demand for plastic caps. Data from the USDA highlights Japan's growing preference for US non-alcoholic beverages, especially mineral water and juices. Concurrently, Japanese consumers are leaning towards healthier drinks and non-alcoholic beers, further fueling the need for plastic caps and closures.

- Japanese manufacturers focus on product differentiation, channeling investments into sustainable, high-quality, and competitively priced offerings to cater to evolving consumer demands. Companies like Nippon Closures Co. Ltd. are pioneering research in recyclable plastic caps, even introducing caps with 30% biomass content to reduce environmental footprints, bolstering market growth.

- However, Japan's plastic market faces challenges. Fluctuating plastic prices, driven by demand-supply imbalances, directly impact the production costs of plastic caps and closures, potentially hindering market growth. Additionally, the country's mounting plastic waste poses a dual challenge, constraining the demand for plastic packaging solutions.

Japan Plastic Caps and Closures Market Trends

Threaded Caps Segment to Have the Highest Share

- Threaded caps find extensive applications across various sectors, including food, beverages, cosmetics, and pharmaceuticals, due to their airtight sealing properties, which are crucial for preventing leaks and maintaining product integrity, especially in Japan.

- Japanese manufacturers craft these caps predominantly from resin materials like HDPE, LDPE, and polypropylene, offering variations in thread types, from continuous to non-continuous closures. These caps, especially popular for beverage bottles, enhance packaging aesthetics and play a pivotal role in preserving the product's flavor and quality, thus amplifying their demand across a spectrum of applications.

- Key players such as Amcor Group GmbH and Aptar Group Inc. lead the market, customizing their threaded caps to cater to various end-users. For instance, Amcor's 13/415 mm threaded ribbed linerless cap is specifically tailored to pharmaceutical and personal care end-use. The versatility and benefits of these caps have propelled their adoption, transcending industries from food and beverages to home care, pet care, and nutraceuticals.

- In Japan, the utilization of Polyethylene (PE), Polypropylene (PP), and other resins for crafting threaded caps are on the rise, bolstering product demand. This surge is largely propelled by Japan's escalating consumption of raw material plastics, primarily for packaging solutions. Recent figures from the Ministry of Economy, Trade, and Industry (METI) reveal that in April 2024, Polyethylene (PE) consumption stood at 84.03 Metric Tons, while Polypropylene (PP) consumption reached 105.75 Metric Tons.

Food Segment Expected to Dominate the Market

- Advancements in food manufacturing have led to a notable shift in the Japanese diet, transitioning from traditional fresh produce to mass-produced and processed foods. This change has seen a rise in pre-processed ingredients and ready-to-eat meals, especially favored by Japan's younger generation and dual-income households, driving substantial market growth.

- According to the United States Department of Agriculture (USDA), Japan's aging demographic increasingly values protein-rich and nutritious foods. The surging demand for plastic caps and closures in food packaging directly responds to Japan's heightened appetite for processed meat products, necessitating a corresponding rise in plastic lid and closure production.

- In Japan, jams, pickles, spices, and nuts are typically found in bottles or containers with airtight plastic closures. These closures prevent contamination and tampering and are engineered for convenient opening and dispensing. Their pivotal role in extending product shelf life, safeguarding against external elements, and managing oxygen levels within the packaging underscores their significance in driving market growth.

- Japan's reliance on the United States for imports, spanning processed meat, dairy, bakery items, and vegetables, is largely steered by the robust food retail sector. Japan Customs data reveals that the U.S. supplies Japan with 26% of its meat products, 12% of processed vegetables, 6% of fresh fruits, and 4% of processed fruits, further fueling the demand for plastic caps and closures in the Japanese market.

Japan Plastic Caps and Closures Industry Overview

The Japanese plastic caps and closures market is moderately consolidated, with domestic players such as Nippon Closures Co. Ltd, Toyo Seiken Group Holdings Ltd, and International players including Amcor Group GmbH, Aptar Group Inc., and Tetra Pak. To solidify their footprint in the market, the players focus on new product development, partnerships, mergers and acquisitions, and collaborations.

- April 2024: Aptar Group Inc., a United States-based company in Japan, unveiled its latest product, the Future Disc Top closure. This innovative closure, designed for the beauty and personal care sector, is crafted exclusively from Polyethylene (PE), making it entirely recyclable. Its secure locking ring is noteworthy, a feature that enhances its transit reliability, ultimately resulting in a premium experience for end-users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Food and Beverage Sector in the Country

- 5.1.2 Increased Demand for Innovative Products in the Market

- 5.2 Market Challenge

- 5.2.1 Volatility in Plastic Prices in Japan

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded

- 7.2.2 Dispensing

- 7.2.3 Unthreaded

- 7.2.4 Child-Resistant

- 7.3 By End-Use Industries

- 7.3.1 Food

- 7.3.2 Beverage

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices & Energy Drinks

- 7.3.2.5 Other Beverages

- 7.3.3 Personal Care & Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-Use Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Group GmbH

- 8.1.2 Aptar Group Inc.

- 8.1.3 Sonoco Products Company

- 8.1.4 Nippon Closures Co. Ltd.

- 8.1.5 Toyo Seiken Group Holdings Ltd.

- 8.1.6 Nihon Yamamura Glass Co. Ltd.

- 8.1.7 Tetra Laval International S.A.

- 8.1.8 Mikasa Industry Co. Ltd.