|

|

市場調査レポート

商品コード

1856924

農業用生物製剤の世界市場:タイプ別、由来別、剤形別、適用形態別、作物タイプ別、地域別 - 2030年までの予測Agricultural Biologicals Market by Type (Biocontrol, Biostimulants, Biofertilizers), Source (Microbials, Semiochemicals, Natural Products), Formulation, Mode of Application (Foliar Spray, Seed Treatment, Soil Treatment) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 農業用生物製剤の世界市場:タイプ別、由来別、剤形別、適用形態別、作物タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年10月03日

発行: MarketsandMarkets

ページ情報: 英文 397 Pages

納期: 即納可能

|

概要

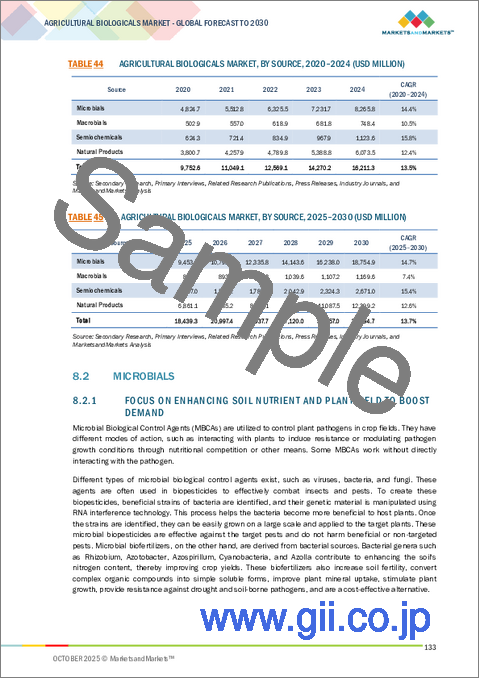

農業用生物製剤の市場規模は、2025年には184億4,000万米ドルと推定され、予測期間中のCAGRは13.7%と見込まれており、2030年には349億9,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(米ドル)、数量(KT) |

| セグメント別 | タイプ別、由来別、剤形別、適用形態別、作物タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

FiBL &IFOAM-Organics Internationalによると、有機農業は188カ国に存在し、少なくとも450万人の農家によって9,600万ヘクタール以上の農地が有機栽培されています。2022年には、オーガニック食品および飲料の世界売上高はほぼ1,420億米ドルに急増します。このように広く受け入れられ、市場収益が高成長しているのは、持続可能で化学薬品を使わない農業に対する消費者の強い嗜好を反映しており、農業用生物学的製剤市場に直接利益をもたらしています。有機製品に対する需要が高まるにつれて、生物刺激剤、生物農薬、生物肥料のような天然で環境に優しい投入物に対する需要も高まり、この分野の技術革新と拡大を促進しています。

Syngenta Group(スイス)、BASF(ドイツ)、FMC Corporation(米国)、Corteva(米国)、Bayer AG(ドイツ)、UPL(インド)などの主要企業が農業用生物剤市場を独占しています。これらの企業は、農業用生物学的製剤の分野における製品の上市や技術革新に多額の投資を行っています。例えば、Bayer AGは2023年3月、作物の幅広い真菌性病害を対象とする生物学的殺菌剤Serenade ASOを発売し、農家に従来の化学殺菌剤に代わる効果的で持続可能な代替品を提供しました。FMCコーポレーションは、2023年8月に、枯草菌を配合した最先端の作物保護製品である生物殺菌剤エンタジアを発売し、持続可能な農業に大きな進歩をもたらしました。

FAOによると、世界の作物生産の最大40%が、植物の病害虫によって毎年失われています。コーヒーの葉さび病やバナナのフザリウム萎凋病などの植物病害は、世界経済に対して年間2,200億米ドル以上の損害を与えていると推定されています。さらに、砂漠イナゴやアカヤシゾウムシなどの侵入昆虫は、少なくとも700億米ドルの年間損失をもたらしています。このような大きな経済的影響は、効果的な害虫管理の必要性を浮き彫りにし、農業生物学的製剤市場における生物防除分野の成長を促進しています。生物農薬は、化学農薬に代わる持続可能で環境に優しい代替品であり、蔓延する脅威と闘うために人気を集めています。

成長の原動力は、有機栽培された持続可能な食品に対する消費者需要の増加です。オーガニック産業調査2022によると、米国のオーガニック果物・野菜は製品市場全体の15%を占め、2021年の売上高は210億米ドルを超え、前年比4.5%増となっています。この成長の大きな原動力となったのは、果物や野菜を含む青果物カテゴリーです。実際、乾燥豆、果物、野菜といったカテゴリーは、前年比でそれぞれ6%、6.5%の伸びを示しました。このテーマは、有機農産物に対する消費者の関心の高まりと一致しており、生物刺激剤、生物農薬、生物肥料を含む農業用生物学的製剤の需要を牽引しています。

米国とカナダにおける広大な農地、確立された先進的農業慣行、研究開発への高額の投資、持続可能な農業を育成するための整った規制の枠組みといった要因が、予測期間中も北米地域の市場支配を後押しすると思われます。これらの国々では、生物農薬と生物肥料を生産システムに組み込むための制度的メカニズムが確立されています。この動向は端的に言えば、化学農薬への依存を減らし、農業の持続可能性を促進するための取り組みです。

米国では、有機食品生産法(Organic Foods Production Act)のような連邦政府の政策や、有機農法や生物農法に関する州レベルの活動が、農業用生物農薬市場を牽引しています。農業用生物学的製剤市場の成長を促すその他の要因としては、有機農産物に対する消費者の需要の高まりやIPM戦略の採用増加などが挙げられます。カナダでは、持続可能な農業と環境ケアの領域における積極的な取り組みが、生物学的製品の使用をさらに促進しています。FiBL &IFOAM-Organics International(2024)によると、2023年には北米全体で360万ヘクタール以上の有機農業が行われ、米国では206万ヘクタール、カナダでは156万ヘクタールで、この地域の農地の0.8%を占めています。こうした有機農業への積極的な取り組みは、農業用生物学的製剤市場における北米のリードを強めています。

当レポートでは、世界の農業用生物製剤市場について調査し、タイプ別、由来別、剤形別、適用形態別、作物タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済見通し

- 市場力学

- AI/生成AIが農業用生物製剤市場に与える影響

第6章 業界動向

- イントロダクション

- 2025年の米国関税の影響- 農業用生物製剤市場

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

第7章 農業用生物製剤市場(タイプ別)

- イントロダクション

- バイオコントロール

- バイオ肥料

- バイオスティミュラント

第8章 農業用生物製剤市場(由来別)

- イントロダクション

- 微生物

- 天然製品

- マクロビアル

- 情報化学物質

第9章 農業用生物製剤市場(剤形別)

- イントロダクション

- 液体

- ドライ

第10章 農業用生物製剤市場(適用形態別)

- イントロダクション

- 葉面散布

- 種子処理

- 土壌処理

- その他

第11章 農業用生物製剤市場(作物タイプ別)

- イントロダクション

- 穀物

- 油糧種子と豆類

- 果物と野菜

- その他の作物

第12章 農業用生物製剤市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- イタリア

- 英国

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- アフリカ

- 中東

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- BASF SE

- SYNGENTA

- FMC CORPORATION

- UPL

- BAYER AG

- CORTEVA

- BIOFIRST GROUP

- LALLEMAND INC.

- NUFARM

- MOSAIC

- SUMITOMO CHEMICAL CO., LTD.

- INDIGO AG, INC.

- NOVONESIS GROUP

- BIOCERES CROP SOLUTIONS

- KOPPERT

- その他の企業

- ROVENSA NEXT

- MERISTEM CROP PERFORMANCE GROUP LLC

- SUSTAINABLE AGRO SOLUTIONS, S.A.U.

- CERTIS USA L.L.C.

- BIONEMA

- ANDERMATT GROUP AG

- BIOCONSORTIA

- APHEA.BIO

- GENICA

- NORDIC MICROBES A/S