|

|

市場調査レポート

商品コード

1533195

IoTセキュリティの世界市場 - 市場規模、シェア、成長分析:サービス別、ソリューション別、用途別、地域別、産業予測(~2029年)IoT Security Market Size, Share, Growth Analysis, By Offering, Solution (IAM, Data Encryption, Device Authentication), Application (Smart Manufacturing, Connected Healthcare), Region - Global Industry Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| IoTセキュリティの世界市場 - 市場規模、シェア、成長分析:サービス別、ソリューション別、用途別、地域別、産業予測(~2029年) |

|

出版日: 2024年08月09日

発行: MarketsandMarkets

ページ情報: 英文 325 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

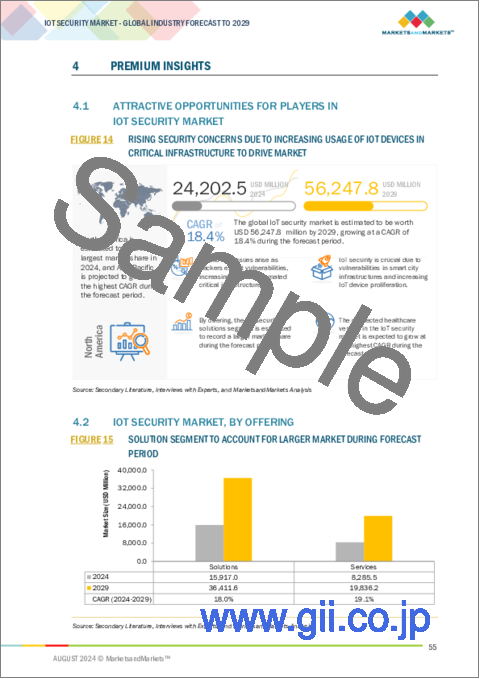

世界のIoTセキュリティの市場規模は、2024年の242億米ドルから2029年までに562億米ドルに達すると予測され、予測期間にCAGRで18.4%の成長が見込まれます。

デジタルトランスフォーメーションの時代において、あらゆる産業がIoTをビジネスに統合することで自動化を採用しています。この自動化により、業務効率は格段に向上しますが、同時にシステムはサイバー攻撃に対して脆弱になります。このため、IoTセキュリティソリューションおよびサービスを採用した、より安全な重要インフラへの需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 提供、データ機密性、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「ソリューション別では、データ暗号化・トークン化が予測期間に高いCAGRで成長する見込みです。」

IoTの展開がさまざまな産業で拡大する中、堅牢なデータ保護ソリューションへの需要が、IoTセキュリティ情勢の中で暗号化・トークン化技術の成長を促進します。IoTデバイスによって生成される膨大な量のデータを不正アクセスから保護する必要があり、侵害が最重要課題となっています。規制遵守の義務付けが進み、データプライバシーに対する消費者の意識が高まる中、セキュリティ対策の採用は加速すると予測されます。トークン化は、機密情報を非機密データトークンに置き換えてデータ侵害のリスクを低減し、暗号化は保存中および転送中のデータを保護します。IoTの展開がさまざまな産業で拡大するにつれて、強固なデータ保護ソリューションに対する需要が、IoTセキュリティ環境における暗号化・トークン化技術の成長を促進します。

「サービス別では、マネージドサービスが予測期間に高いCAGRで成長する見込みです。」

IoTマネージドサービスの成長は、専門家の監督を必要とする多数のデバイスとプロトコルから構成されるIoTネットワークの複雑化によって促進されます。製造、医療、輸送などのさまざまな部門の組織が、IoTシステムを効率的に構成し、モニターし、保守するためのマネージドサービスの必要性を認識しています。マルチクラウド利用の増加と自動化の需要は、スケーラビリティとコスト効率から、マネージドサービスの要求を高めています。データアナリティクスとセキュリティ対策強化への注目が高まるにつれて、企業は特定のニーズに合わせた包括的なソリューションを提供できるマネージドサービスプロバイダー(MSP)を求めるようになっています。

当レポートでは、世界のIoTセキュリティ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- IoTセキュリティ市場の企業にとって魅力的な機会

- IoTセキュリティ市場:提供別

- IoTセキュリティ市場:ソリューション別

- IoTセキュリティ市場:サービス別

- IoTセキュリティ市場:用途別

- 市場投資シナリオ

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- IoTセキュリティの進化

- ケーススタディ分析

- バリューチェーン分析

- OEM/ハードウェアプロバイダー

- セキュリティソリューション、サービスプロバイダー

- システムインテグレーター

- 販売、流通

- エンドユーザーグループ

- エコシステム

- ポーターのファイブフォース分析モデル分析

- 特許分析

- 価格分析

- 主要企業のIoTセキュリティの平均販売価格の動向:ソリューション別

- 参考価格分析:ソリューション別

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- IoTセキュリティ市場に対する生成AIの影響

- 主なユースケースと市場の将来性

- 相互接続された隣接エコシステムに対する生成AIの影響

- 顧客ビジネスに影響を与える動向/混乱

- IoTセキュリティ市場におけるベストプラクティス

- 規制情勢

- 一般データ保護規則

- 連邦情報セキュリティ管理法

- PCI DSS

- サーベンスオクスリー法

- SOC2

- HIPAA

- グラムリーチブライリー法

- 規制機関、政府機関、その他の組織

- 主なステークホルダーと購入基準

- 主な会議とイベント(2024年~2025年)

- ビジネスモデル分析

- 投資と資金調達のシナリオ

第6章 IoTセキュリティ市場:提供別

- イントロダクション

- ソリューション

- サービス

第7章 IoTセキュリティ市場:データ機密性別

- イントロダクション

- 高機密性データ

- 低/中機密性データ

第8章 IoTセキュリティ市場:用途別

- イントロダクション

- スマート製造

- スマートエネルギー・ユーティリティ

- スマートホーム・コンシューマーエレクトロニクス

- スマート政府

- スマートリテール

- コネクテッドロジスティクス

- コネクテッド医療

- その他の用途

第9章 IoTセキュリティ市場:地域別

- イントロダクション

- 北米

- 北米のIoTセキュリティ市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のIoTセキュリティ市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のIoTセキュリティ市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのIoTセキュリティ市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカのIoTセキュリティ市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業

- 収益分析

- 主要IoTセキュリティベンダーの評価と財務指標

- 市場シェア分析

- 製品/ブランドの比較

- CISCO

- THALES

- NXP SEMICONDUCTOR

- CHECK POINT

- AWS

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- MICROSOFT

- FORTINET

- AMAZON WEB SERVICES

- IBM

- INTEL

- CISCO

- THALES GROUP

- INFINEON

- ALLOT

- ATOS

- CHECK POINT

- PALO ALTO NETWORKS

- MOBILEUM

- ENTRUST

- NXP SEMICONDUCTORS

- KASPERSKY

- その他の主要企業

- MAGICCUBE

- CLAROTY

- ORDR

- ARMIS

- NOZOMI NETWORKS

- KEYFACTOR

- PARTICLE INDUSTRIES, INC.

- KARAMBA SECURITY

- FORESCOUT TECHNOLOGIES INC

第12章 隣接/関連市場

- イントロダクション

- 制限事項

- 運用技術(OT)セキュリティ市場-2029年までの世界予測

- サイバーセキュリティ市場-2028年までの世界予測

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 IOT SECURITY MARKET: ASSUMPTIONS

- TABLE 4 IOT SECURITY MARKET: LIMITATIONS

- TABLE 5 IOT CONNECTIONS, 2022 VS. 2028 (BILLION)

- TABLE 6 COUNTRY-WISE ADOPTION OF IPV6, 2022

- TABLE 7 CASE STUDY 1: PALO ALTO HELPS NDIT TEAM TO MANAGE NETWORK TRAFFIC LOAD

- TABLE 8 CASE STUDY 2: PROHEATLH USES ORDR SCE PLATFORM TO IMPROVE SECURITY OF IOT DEVICES FOR PROHEALTH

- TABLE 9 CASE STUDY 3: ENDPOINT SECURITY SOLUTIONS FROM TREND MICRO MINIMIZE SCALATIONS FOR ANTHEM BIOSCIENCES

- TABLE 10 IOT SECURITY MARKET: ECOSYSTEM

- TABLE 11 PORTER'S FIVE FORCES IMPACT ANALYSIS

- TABLE 12 AVERAGE SELLING PRICE TREND OF IOT SECURITY AMONG KEY PLAYERS, BY SOLUTION, 2024

- TABLE 13 INDICATIVE PRICING MODEL OF IDENTITY AND ACCESS MANAGEMENT SOLUTION - IOT SECURITY MARKET, 2024

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 20 IOT SECURITY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 21 BUSINESS MODEL

- TABLE 22 IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 23 IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 24 IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 25 IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 26 IDENTITY AND ACCESS MANAGEMENT: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 27 IDENTITY AND ACCESS MANAGEMENT: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 DATA ENCRYPTION AND TOKENIZATION: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 29 DATA ENCRYPTION AND TOKENIZATION: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 INTRUSION DETECTION SYSTEM /INTRUSION PREVENTION SYSTEM: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 31 INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 DEVICE AUTHENTICATION AND MANAGEMENT: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 33 DEVICE AUTHENTICATION AND MANAGEMENT: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 SECURE COMMUNICATION PROTOCOLS: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 35 SECURE COMMUNICATION PROTOCOLS: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 PUBLIC KEY INFRASTRUCTURE CERTIFICATE LIFECYCLE MANAGEMENT: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 37 PUBLIC KEY INFRASTRUCTURE CERTIFICATE LIFECYCLE MANAGEMENT: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 DISTRIBUTED DENIAL OF SERVICE PROTECTION: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 39 DISTRIBUTED DENIAL OF SERVICE PROTECTION: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

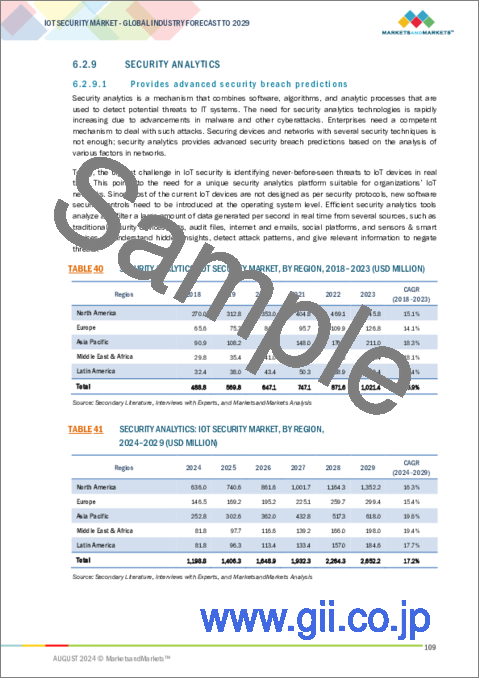

- TABLE 40 SECURITY ANALYTICS: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 41 SECURITY ANALYTICS: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 VIRTUAL FIREWALL: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 43 VIRTUAL FIREWALL: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 45 IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 46 PROFESSIONAL SERVICES: IOT SECURITY MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 47 PROFESSIONAL SERVICES: IOT SECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 48 IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 49 IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 SMART MANUFACTURING: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 51 SMART MANUFACTURING: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 SMART ENERGY AND UTILITIES: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 53 SMART ENERGY AND UTILITIES: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 SMART HOME & CONSUMER ELECTRONICS: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 55 SMART HOME & CONSUMER ELECTRONICS: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 SMART GOVERNMENT: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 57 SMART GOVERNMENT: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 SMART RETAIL: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 59 SMART RETAIL: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 CONNECTED LOGISTICS: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 61 CONNECTED LOGISTICS: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 CONNECTED HEALTHCARE: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 63 CONNECTED HEALTHCARE: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 65 IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 72 NORTH AMERICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 73 NORTH AMERICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: IOT SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: IOT SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 78 US: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 79 US: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 80 US: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 81 US: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 82 US: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 83 US: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 84 US: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 85 US: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 86 US: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 87 US: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 88 CANADA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 89 CANADA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 90 CANADA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 91 CANADA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 92 CANADA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 93 CANADA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 94 CANADA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 95 CANADA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 96 CANADA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 97 CANADA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 EUROPE: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 99 EUROPE: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 100 EUROPE: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 101 EUROPE: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 103 EUROPE: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 104 EUROPE: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 105 EUROPE: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 107 EUROPE: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 108 EUROPE: IOT SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 109 EUROPE: IOT SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 110 UK: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 111 UK: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 112 UK: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 113 UK: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 114 UK: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 115 UK: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 116 UK: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 117 UK: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 118 UK: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 119 UK: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 120 GERMANY: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 121 GERMANY: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 122 GERMANY: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 123 GERMANY: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 124 GERMANY: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 125 GERMANY: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 126 GERMANY: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 127 GERMANY: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 128 GERMANY: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 129 GERMANY: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 FRANCE: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 131 FRANCE: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 132 FRANCE: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 133 FRANCE: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 134 FRANCE: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 135 FRANCE: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 136 FRANCE: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 137 FRANCE: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 138 FRANCE: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 139 FRANCE: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 140 ITALY: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 141 ITALY: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 142 ITALY: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 143 ITALY: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 144 ITALY: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 145 ITALY: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 146 ITALY: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 147 ITALY: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 148 ITALY: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 149 ITALY: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 150 REST OF EUROPE: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 151 REST OF EUROPE: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 152 REST OF EUROPE: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 153 REST OF EUROPE: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 154 REST OF EUROPE: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 155 REST OF EUROPE: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 156 REST OF EUROPE: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 157 REST OF EUROPE: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 158 REST OF EUROPE: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 159 REST OF EUROPE: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 160 ASIA PACIFIC: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 161 ASIA PACIFIC: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 162 ASIA PACIFIC: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 163 ASIA PACIFIC: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 164 ASIA PACIFIC: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 165 ASIA PACIFIC: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 166 ASIA PACIFIC: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 167 ASIA PACIFIC: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 168 ASIA PACIFIC: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 169 ASIA PACIFIC: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: IOT SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: IOT SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 172 CHINA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 173 CHINA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 174 CHINA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 175 CHINA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 176 CHINA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 177 CHINA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 178 CHINA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 179 CHINA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 180 CHINA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 181 CHINA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 182 JAPAN: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 183 JAPAN: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 184 JAPAN: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 185 JAPAN: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 186 JAPAN: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 187 JAPAN: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 188 JAPAN: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 189 JAPAN: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 190 JAPAN: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 191 JAPAN: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 192 INDIA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 193 INDIA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 194 INDIA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 195 INDIA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 196 INDIA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 197 INDIA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 198 INDIA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 199 INDIA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 200 INDIA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 201 INDIA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 224 MIDDLE EAST: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 225 MIDDLE EAST: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 226 MIDDLE EAST: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 227 MIDDLE EAST: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 228 MIDDLE EAST: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 229 MIDDLE EAST: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 230 MIDDLE EAST: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 231 MIDDLE EAST: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 232 MIDDLE EAST: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 233 MIDDLE EAST: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 234 MIDDLE EAST: IOT SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 235 MIDDLE EAST: IOT SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 236 GCC: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 237 GCC: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 238 GCC: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 239 GCC: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 240 GCC: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 241 GCC: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 242 GCC: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 243 GCC: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 244 GCC: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 245 GCC: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 246 GCC: IOT SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 247 GCC: IOT SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 248 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 249 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 253 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE 2024-2029 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 258 AFRICA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 259 AFRICA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 260 AFRICA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 261 AFRICA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 262 AFRICA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 263 AFRICA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 264 AFRICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 265 AFRICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 266 AFRICA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 267 AFRICA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 268 LATIN AMERICA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 269 LATIN AMERICA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 270 LATIN AMERICA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 271 LATIN AMERICA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 272 LATIN AMERICA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 273 LATIN AMERICA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 274 LATIN AMERICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 275 LATIN AMERICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 276 LATIN AMERICA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 277 LATIN AMERICA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 278 LATIN AMERICA: IOT SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 279 LATIN AMERICA: IOT SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 280 BRAZIL: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 281 BRAZIL: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 282 BRAZIL: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 283 BRAZIL: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 284 BRAZIL: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 285 BRAZIL: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 286 BRAZIL: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 287 BRAZIL: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 288 BRAZIL: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 289 BRAZIL: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 290 MEXICO: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 291 MEXICO: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 292 MEXICO: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 293 MEXICO: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 294 MEXICO: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 295 MEXICO: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 296 MEXICO: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 297 MEXICO: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 298 MEXICO: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 299 MEXICO: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 306 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 307 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 308 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 309 REST OF LATIN AMERICA: IOT SECURITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 310 OVERVIEW OF STRATEGIES ADOPTED BY KEY IOT SECURITY VENDORS

- TABLE 311 IOT SECURITY MARKET: DEGREE OF COMPETITION

- TABLE 312 IOT SECURITY MARKET: OFFERING FOOTPRINT

- TABLE 313 IOT SECURITY MARKET: APPLICATION FOOTPRINT

- TABLE 314 IOT SECURITY MARKET: REGIONAL FOOTPRINT

- TABLE 315 IOT SECURITY MARKET: KEY STARTUPS/SMES

- TABLE 316 APPLICATION FOOTPRINT OF STARTUPS/SMES

- TABLE 317 REGIONAL FOOTPRINT OF STARTUPS/SMES

- TABLE 318 IOT SECURITY MARKET: PRODUCT LAUNCHES, JANUARY 2023-JUNE 2024

- TABLE 319 IOT SECURITY MARKET: DEALS, JANUARY 2023-JUNE 2024

- TABLE 320 MICROSOFT: COMPANY OVERVIEW

- TABLE 321 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 MICROSOFT: PRODUCT LAUNCHES

- TABLE 323 MICROSOFT: DEALS

- TABLE 324 FORTINET: COMPANY OVERVIEW

- TABLE 325 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 FORTINET: DEALS

- TABLE 327 AMAZON WEB SERVICES: COMPANY OVERVIEW

- TABLE 328 AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 AMAZON WEB SERVICES: PRODUCT LAUNCHES

- TABLE 330 AMAZON WEB SERVICES: DEALS

- TABLE 331 IBM: COMPANY OVERVIEW

- TABLE 332 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 IBM: PRODUCT LAUNCHES

- TABLE 334 IBM: DEALS

- TABLE 335 INTEL: COMPANY OVERVIEW

- TABLE 336 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 INTEL: DEALS

- TABLE 338 CISCO: COMPANY OVERVIEW

- TABLE 339 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 CISCO: PRODUCT LAUNCHES

- TABLE 341 CISCO: DEALS

- TABLE 342 THALES GROUP: COMPANY OVERVIEW

- TABLE 343 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 THALES GROUP: PRODUCT LAUNCHES

- TABLE 345 THALES GROUP: DEALS

- TABLE 346 INFINEON: COMPANY OVERVIEW

- TABLE 347 INFINEON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 INFINEON: PRODUCT LAUNCHES

- TABLE 349 INFINEON: DEALS

- TABLE 350 ALLOT: COMPANY OVERVIEW

- TABLE 351 ALLOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 ALLOT: DEALS

- TABLE 353 ATOS: COMPANY OVERVIEW

- TABLE 354 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 ATOS: DEALS

- TABLE 356 ATOS: OTHER DEVELOPMENTS

- TABLE 357 CHECK POINT: COMPANY OVERVIEW

- TABLE 358 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 CHECK POINT: DEALS

- TABLE 360 PALO ALTO NETWORKS: COMPANY OVERVIEW

- TABLE 361 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 PALO ALTO: PRODUCT LAUNCHES

- TABLE 363 PALO ALTO NETWORKS: DEALS

- TABLE 364 MOBILEUM: COMPANY OVERVIEW

- TABLE 365 MOBILEUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 366 MOBILEUM: DEALS

- TABLE 367 ENTRUST: COMPANY OVERVIEW

- TABLE 368 ENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 ENTRUST: PRODUCT LAUNCHES

- TABLE 370 ENTRUST: DEALS

- TABLE 371 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 372 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 374 NXP SEMICONDUCTORS: DEALS

- TABLE 375 KASPERSKY: COMPANY OVERVIEW

- TABLE 376 KASPERSKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 ADJACENT MARKETS AND FORECASTS

- TABLE 378 OT SECURITY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 379 OT SECURITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 380 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY SOLUTION, 2018-2023 (USD MILLION)

- TABLE 381 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 382 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 383 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 384 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 385 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 386 OPERATIONAL TECHNOLOGY MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 387 OPERATIONAL TECHNOLOGY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 388 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 389 OPERATIONAL TECHNOLOGY SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 390 CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 391 CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 392 CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 393 CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 394 CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 395 CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 396 CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 397 CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 398 CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 399 CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 400 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 401 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 402 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 403 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 404 CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 405 CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 406 CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 407 CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 408 CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 409 CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 IOT SECURITY MARKET: RESEARCH DESIGN

- FIGURE 2 IOT SECURITY MARKET: DATA TRIANGULATION

- FIGURE 3 IOT SECURITY MARKET: TOP-DOWN APPROACH

- FIGURE 4 IOT SECURITY MARKET: BOTTOM-UP APPROACH

- FIGURE 5 APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOFTWARE/SERVICES OF IOT SECURITY VENDORS

- FIGURE 6 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 7 IOT SECURITY MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 8 APPROACH 2 - BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 9 COMPANY EVALUATION MATRIX (KEY PLAYERS): CRITERIA WEIGHTAGE

- FIGURE 10 COMPANY EVALUATION MATRIX (STARTUPS): CRITERIA WEIGHTAGE

- FIGURE 11 GLOBAL IOT SECURITY MARKET SIZE AND Y-O-Y GROWTH RATE, 2022-2029

- FIGURE 12 SEGMENTS WITH SIGNIFICANT MARKET SHARE AND GROWTH RATE

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 14 RISING SECURITY CONCERNS DUE TO INCREASING USAGE OF IOT DEVICES IN CRITICAL INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 15 SOLUTION SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 16 IAM TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 17 PROFESSIONAL SERVICES TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 18 SMART MANUFACTURING TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN IOT SECURITY MARKET

- FIGURE 21 ORIGIN OF IOT ATTACK, BY COUNTRY (%)

- FIGURE 22 INCREASE IN DATA VOLUMES DUE TO 5G TO ACCELERATE GROWTH OF IOT SECURITY MARKET

- FIGURE 23 LACK OF STANDARDIZATION IN IOT PROTOCOL TO RESTRICT MARKET GROWTH

- FIGURE 24 EVOLUTION OF IOT SECURITY

- FIGURE 25 IOT SECURITY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 IOT SECURITY MARKET: ECOSYSTEM

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS: IOT SECURITY MARKET

- FIGURE 28 NUMBER OF PATENTS GRANTED FOR IOT SECURITY MARKET, 2014-2024

- FIGURE 29 IOT SECURITY MARKET: REGIONAL ANALYSIS OF PATENTS GRANTED

- FIGURE 30 AVERAGE SELLING PRICE TREND OF IOT SECURITY AMONG KEY PLAYERS, BY SOLUTION, 2024

- FIGURE 31 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING IOT SECURITY MARKET ACROSS INDUSTRIES

- FIGURE 32 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- FIGURE 33 REVENUE SHIFT IN IOT SECURITY MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 36 LEADING GLOBAL IOT SECURITY STARTUPS AND SMES BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2020-2024

- FIGURE 37 SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 IDENTITY AND ACCESS MANAGEMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 MANAGED SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 SMART MANUFACTURING SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: IOT SECURITY MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: IOT SECURITY MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY IOT SECURITY VENDORS, 2019-2023 (USD MILLION)

- FIGURE 45 FINANCIAL METRICS OF KEY IOT SECURITY VENDORS

- FIGURE 46 VALUATION OF KEY IOT SECURITY VENDORS (USD BILLION)

- FIGURE 47 IOT SECURITY MARKET SHARE, 2023 (%)

- FIGURE 48 BRAND COMPARISON/VENDOR PRODUCT LANDSCAPE

- FIGURE 49 IOT SECURITY MARKET: KEY COMPANY EVALUATION QUADRANT (2023)

- FIGURE 50 IOT SECURITY MARKET: COMPANY FOOTPRINT

- FIGURE 51 IOT SECURITY MARKET: STARTUP/SME EVALUATION QUADRANT (2023)

- FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 53 FORTINET: COMPANY SNAPSHOT

- FIGURE 54 AMAZON WEB SERVICES: COMPANY SNAPSHOT

- FIGURE 55 IBM: COMPANY SNAPSHOT

- FIGURE 56 INTEL: COMPANY SNAPSHOT

- FIGURE 57 CISCO: COMPANY SNAPSHOT

- FIGURE 58 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 59 INFINEON: COMPANY SNAPSHOT

- FIGURE 60 ATOS: COMPANY SNAPSHOT

- FIGURE 61 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 62 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 63 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

The global IoT security market size is projected to grow from USD 24.2 billion in 2024 to USD 56.2 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 18.4% during the forecast period. In the era of digital transformation, all the verticals are adopting automation by integrating IoT into their businesses. This automation makes the operations much more efficient but also makes the systems vulnerable to cyberattacks. This has increased the demand for more secure critical infrastructure with the adoption of IoT security solutions and services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | Offering, Data Sensitivity, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"By solution, Data Encryption and Tokenization is expected to grow at higher CAGR during the forecast period"

The demand for robust data protection solutions will drive the growth of encryption and tokenization technologies within the IoT security landscape as IoT deployments expand across various industries. There is a need to protect the vast amount of data generated by IoT devices from unauthorized access, and breaches become paramount. With increasing regulatory compliance mandates and heightened consumer awareness of data privacy, the adoption of security measures is expected to accelerate. Tokenization replaces sensitive information with non-sensitive data tokens, reducing the risk of data breaches, while encryption safeguards data at rest and in transit. As IoT deployments expand across various industries, the demand for robust data protection solutions will drive the growth of encryption and tokenization technologies within the IoT security landscape.

"By services, Managed services is expected to grow at higher CAGR during forecast period"

The growth of IoT managed services will be driven by the increasing complexity of IoT networks, which consist of numerous devices and protocols requiring expert oversight. Organizations across various sectors, including manufacturing, healthcare, and transportation, are recognizing the need for managed services to ensure their IoT systems are efficiently configured, monitored, and maintained. The rise in multi-cloud applications and the demand for automation enhance the requirement of managed services, because of scalability and cost-effectiveness. The growing focus on data analytics and enhanced security measures is propelling enterprises to seek managed service providers (MSPs) that can deliver comprehensive solutions tailored to their specific needs.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 15%, Tier 2 - 40%, and Tier 3 - 45%

- By Designation: C-level Executives- 40% , Directors - 35%, Others - 25%

- By Region: North America - 45%, Asia Pacific - 30%, Europe - 15%, Rest of the World - 10%

Major vendors in the global IoT security market include Microsoft (US), Fortinet (US), AWS (US), IBM (US), Intel (US), Cisco (US), Thales Group (France), Infineon (Germany) , Allot (Israel), Atos (France), Checkpoint (US), Palo Alto Networks (US), Mobileum (US), Entrust (US), NXP Semiconductors (Netherlands), and Kaspersky (Switzerland), MagicCube (US), Claroty (US), Ordr (US), Armis (US), Nozomi Networks (US), Keyfactor (US), Particle Industries (US), Karamba Security (Israel), and Forescout (US) in the IoT security market.

The study includes an in-depth competitive analysis of the key players in the IoT security market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the IoT security market and forecasts its size by Offering (solution and services), by Data Sensitivity (High Sensitivity Data, Low and Moderate Sensitivity Data), by Application (Smart Manufacturing, Smart Energy & Utilities, Connected Logistics & Transportation, Smart Home and Consumer Electronics, Connected Healthcare, Smart Government & Defense, Smart Retail, and Others). The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall IoT security market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rapid increase in IoT security incidents related to Industry 4.0, Need to effectively deal with IoT vulnerabilities, growing number of IoT security regulations, rising security concerns related to critical infrastructure, increase in data volumes due to 5G, standardization of IPv6 ), restraints (Lack of awareness about new variants of IoT threats, budgetary constraints of SMEs in developing economies), opportunities (New wave of IoT applications due to 5G networks, development of smart infrastructure), and challenges (Lack of standardization in IoT protocol, threat to enterprise networks from shadow IoT devices, need to ensure secure communication across networks)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the IoT security market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the IoT security market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the IoT security market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in IoT security market strategies, including Microsoft (US), Fortinet (US), AWS (US), IBM (US), and Intel (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- 2.5.1 FOR LARGE PLAYERS

- 2.5.2 FOR STARTUPS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IOT SECURITY MARKET

- 4.2 IOT SECURITY MARKET, BY OFFERING

- 4.3 IOT SECURITY MARKET, BY SOLUTION

- 4.4 IOT SECURITY MARKET, BY SERVICES

- 4.5 IOT SECURITY MARKET, BY APPLICATION

- 4.6 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid increase in IoT security incidents related to Industry 4.0

- 5.2.1.2 Need to deal with IoT vulnerabilities effectively

- 5.2.1.3 Growing number of IoT security regulations

- 5.2.1.4 Rising security concerns related to critical infrastructure

- 5.2.1.5 Increase in data volumes due to 5G

- 5.2.1.6 Standardization of IPv6

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness about new variants of IoT threats

- 5.2.2.2 Budgetary constraints of SMEs in developing economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New wave of IoT applications due to 5G networks

- 5.2.3.2 Development of smart infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization in IoT protocol

- 5.2.4.2 Threat to enterprise networks from shadow IoT devices

- 5.2.4.3 Need to ensure secure communication across networks

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF IOT SECURITY

- 5.4 CASE STUDY ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 OEM/HARDWARE PROVIDERS

- 5.5.2 SECURITY SOLUTIONS AND SERVICE PROVIDERS

- 5.5.3 SYSTEM INTEGRATORS

- 5.5.4 SALES AND DISTRIBUTION

- 5.5.5 END USER GROUPS

- 5.6 ECOSYSTEM

- 5.7 PORTER'S FIVE FORCES MODEL ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.1.1 Lack of entry barriers

- 5.7.1.2 High market growth

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.2.1 Buyer propensity for low-cost solutions

- 5.7.2.2 Ease of substitution

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.3.1 Low switching cost

- 5.7.3.2 Low strength of supply chain and distribution channel

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.4.1 High buyer price sensitivity

- 5.7.4.2 Low buyer concentration

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.5.1 High concentration ratio

- 5.7.5.2 Powerful competitive strategies

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.8 PATENT ANALYSIS

- 5.8.1 LIST OF TOP PATENTS IN IOT SECURITY MARKET, 2022-2024

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF IOT SECURITY AMONG KEY PLAYERS, BY SOLUTION

- 5.9.2 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Zero Trust Network Access (ZTNA)

- 5.10.1.2 Connectivity solutions

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Cloud computing

- 5.10.2.2 Big Data and Analytics

- 5.10.2.3 Artificial intelligence and machine learning

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Blockchain

- 5.10.3.2 Cybersecurity

- 5.10.1 KEY TECHNOLOGIES

- 5.11 IMPACT OF GENERATIVE AI ON IOT SECURITY MARKET

- 5.11.1 TOP USE CASES & MARKET POTENTIAL

- 5.11.1.1 Key use cases

- 5.11.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- 5.11.2.1 Big Data and Analytics

- 5.11.2.2 Blockchain

- 5.11.2.3 Digital twin

- 5.11.2.4 Cloud computing

- 5.11.2.5 Augmented Reality (AR) technology

- 5.11.1 TOP USE CASES & MARKET POTENTIAL

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 BEST PRACTICES IN IOT SECURITY MARKET

- 5.13.1 ADOPTION OF IOT SECURITY

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 GENERAL DATA PROTECTION REGULATION

- 5.14.2 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

- 5.14.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.14.4 SARBANES-OXLEY ACT

- 5.14.5 SOC2

- 5.14.6 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.14.7 GRAMM-LEACH-BLILEY ACT

- 5.14.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 KEY CONFERENCES & EVENTS IN 2024-2025

- 5.17 BUSINESS MODEL ANALYSIS

- 5.18 INVESTMENT AND FUNDING SCENARIO

6 IOT SECURITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: IOT SECURITY MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 OFFER MULTIPLE FEATURES TO PROTECT DEVICES FROM ATTACKS

- 6.2.2 IDENTITY AND ACCESS MANAGEMENT

- 6.2.2.1 Prevents unauthorized access to networks

- 6.2.3 DATA ENCRYPTION AND TOKENIZATION

- 6.2.3.1 Replaces sensitive data with unique identification symbols

- 6.2.4 INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM

- 6.2.4.1 Monitors network for malicious activities or policy violations

- 6.2.5 DEVICE AUTHENTICATION AND MANAGEMENT

- 6.2.5.1 Authenticates unique identity of connected devices

- 6.2.6 SECURE COMMUNICATION PROTOCOLS

- 6.2.6.1 Enables seamless connection between devices

- 6.2.7 PUBLIC KEY INFRASTRUCTURE CERTIFICATE LIFECYCLE MANAGEMENT

- 6.2.7.1 Provides framework to verify identity of devices

- 6.2.8 DISTRIBUTED DENIAL OF SERVICE (DDOS) PROTECTION

- 6.2.8.1 Prevents disruptions of normal services

- 6.2.9 SECURITY ANALYTICS

- 6.2.9.1 Provides advanced security breach predictions

- 6.2.10 VIRTUAL FIREWALL

- 6.2.10.1 Provides security features with added benefits

- 6.3 SERVICES

- 6.3.1 PREVENT UNAUTHORIZED ACCESS, DISCLOSURE, OR MODIFICATION OF DATA

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Help to speed up IoT security solution development

- 6.3.2.2 Implementation services

- 6.3.2.2.1 Enable organizations to offer transparent and secure IoT experience

- 6.3.2.3 Support and maintenance services

- 6.3.2.3.1 Offer clients ongoing repair and inspection assistance

- 6.3.2.4 Consulting services

- 6.3.2.4.1 Provide customization for maximum product assurance

- 6.4 MANAGED SERVICES

- 6.4.1 PROVIDE WIDE-RANGING TECHNICAL SUPPORT TO CUSTOMERS

7 IOT SECURITY MARKET, BY DATA SENSITIVITY

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: IOT SECURITY MARKET, BY DATA SENSITIVITY

- 7.2 HIGH-SENSITIVITY DATA

- 7.2.1 THEFT OF DATA LIKELY TO CAUSE SERIOUS LOSSES

- 7.3 LOW- AND MODERATE-SENSITIVITY DATA

- 7.3.1 POSSIBILITY OF MISUSE TO COMMIT FRAUD OR IDENTITY THEFT

8 IOT SECURITY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: IOT SECURITY MARKET, BY APPLICATION

- 8.2 SMART MANUFACTURING

- 8.2.1 RISING NEED TO ENHANCE EFFICIENCY OF BUSINESS PROCESSES AND PRODUCTION OUTPUT TO DRIVE MARKET

- 8.3 SMART ENERGY & UTILITIES

- 8.3.1 GROWING USE OF SECURITY SOLUTIONS TO PROTECT PERSONAL DATA TO DRIVE MARKET

- 8.4 SMART HOME & CONSUMER ELECTRONICS

- 8.4.1 GROWING RISK OF MALWARE AND OTHER FORMS OF ATTACKS TO DRIVE MARKET

- 8.5 SMART GOVERNMENT

- 8.5.1 DEMAND FOR IOT SECURITY TO PROTECT CRITICAL INFORMATION TO DRIVE MARKET

- 8.6 SMART RETAIL

- 8.6.1 RISING REQUIREMENT TO SECURE MULTIPLE NETWORK POINTS TO DRIVE MARKET

- 8.7 CONNECTED LOGISTICS

- 8.7.1 RISING NEED TO SECURE IOT DEVICES TO PREVENT LOSS OF LIFE OR GOODS TO DRIVE MARKET

- 8.8 CONNECTED HEALTHCARE

- 8.8.1 IOT SECURITY ESSENTIAL TO SAFEGUARD PATIENT DATA TO DRIVE MARKET

- 8.9 OTHER APPLICATIONS

9 IOT SECURITY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: IOT SECURITY MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 US

- 9.2.3.1 Connected device adoption to drive IoT market

- 9.2.4 CANADA

- 9.2.4.1 Government's focus on cybersecurity and IoT to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: IOT SECURITY MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UK

- 9.3.3.1 Innovation and proactive policies to drive growth

- 9.3.4 GERMANY

- 9.3.4.1 Industry integration and future challenges to drive IoT security leadership

- 9.3.5 FRANCE

- 9.3.5.1 Smart cities, Industry 4.0, and government initiatives to drive market

- 9.3.6 ITALY

- 9.3.6.1 Focus on industrial transformation and digitalization to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: IOT SECURITY MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Exploring cutting-edge solutions in China's evolving IoT cybersecurity space to drive market

- 9.4.4 JAPAN

- 9.4.4.1 Stringent standards and technological advancements to power growth

- 9.4.5 INDIA

- 9.4.5.1 Significant government initiatives and expanding internet penetration to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: IOT SECURITY MARKET DRIVERS

- 9.5.2 THE MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 MIDDLE EAST

- 9.5.3.1 Digital transformation and 5G to drive demand

- 9.5.3.2 Gulf Cooperation Council (GCC)

- 9.5.3.2.1 Industrial IoT and AI to drive growth in manufacturing and energy sectors

- 9.5.3.2.2 United Arab Emirates(UAE)

- 9.5.3.2.2.1 Government initiatives to drive market growth

- 9.5.3.2.3 Kingdom of Saudi Arabia (KSA)

- 9.5.3.2.3.1 AI and machine learning to power IoT solutions across industries

- 9.5.3.2.4 Kuwait

- 9.5.3.2.4.1 Positive developments and integration with AI to drive growth

- 9.5.3.2.5 Bahrain

- 9.5.3.2.5.1 Robust digital infrastructure and regulatory support to drive growth

- 9.5.3.2.6 Rest of GCC

- 9.5.3.3 Rest of Middle East

- 9.5.4 AFRICA

- 9.5.4.1 Mobile network expansion to pave way for Africa's IoT revolution

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: IOT SECURITY MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Government initiatives and rising internet penetration to drive market

- 9.6.4 MEXICO

- 9.6.4.1 Addressing security concerns and standardization issues for sustainable IoT growth to drive demand

- 9.6.5 REST OF LATIN AMERICA

- 9.6.5.1 Collaborative government initiatives to drive IoT adoption

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 VALUATION AND FINANCIAL METRICS OF KEY IOT SECURITY VENDORS

- 10.5 MARKET SHARE ANALYSIS

- 10.6 PRODUCT/BRAND COMPARISON

- 10.6.1 CISCO

- 10.6.2 THALES

- 10.6.3 NXP SEMICONDUCTOR

- 10.6.4 CHECK POINT

- 10.6.5 AWS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Offerings footprint

- 10.7.5.3 Application footprint

- 10.7.5.4 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 MICROSOFT

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strategies

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 FORTINET

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strategies

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 AMAZON WEB SERVICES

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strategies

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 IBM

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.4 MNM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 INTEL

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 CISCO

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.7 THALES GROUP

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.8 INFINEON

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.9 ALLOT

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.10 ATOS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.11 CHECK POINT

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.12 PALO ALTO NETWORKS

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.13 MOBILEUM

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.14 ENTRUST

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.15 NXP SEMICONDUCTORS

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.16 KASPERSKY

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.1 MICROSOFT

- 11.2 OTHER KEY PLAYERS

- 11.2.1 MAGICCUBE

- 11.2.2 CLAROTY

- 11.2.3 ORDR

- 11.2.4 ARMIS

- 11.2.5 NOZOMI NETWORKS

- 11.2.6 KEYFACTOR

- 11.2.7 PARTICLE INDUSTRIES, INC.

- 11.2.8 KARAMBA SECURITY

- 11.2.9 FORESCOUT TECHNOLOGIES INC

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 OPERATIONAL TECHNOLOGY (OT) SECURITY MARKET - GLOBAL FORECAST TO 2029

- 12.4 CYBERSECURITY MARKET - GLOBAL FORECAST TO 2028

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS