|

|

市場調査レポート

商品コード

1474946

ノンアルコールワインの市場規模、シェア、動向分析レポート:製品別、ABV別、包装別、流通チャネル別、地域別、セグメント予測、2024年~2030年Non-alcoholic Wine Market Size, Share & Trends Analysis Report By Product (Sparkling, Still), By ABV (%), By Packaging (Bottles, Cans), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| ノンアルコールワインの市場規模、シェア、動向分析レポート:製品別、ABV別、包装別、流通チャネル別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年04月08日

発行: Grand View Research

ページ情報: 英文 180 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

ノンアルコールワイン市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界のノンアルコールワイン市場規模は2030年までに37億8,000万米ドルに達し、2024年から2030年までのCAGRは7.9%で成長すると予測されています。

この成長は、ウェルネス重視の高まり、より健康的なライフスタイルへの顕著なシフト、従来のアルコール飲料に関連する健康リスクに対する意識の高まりに大きく影響されています。消費者はますます健康と幸福を優先するようになっており、アルコール分を含まずにワインを楽しむ経験を提供する代替品への需要が急増しています。

ノンアルコールワイン業界のメーカーは、研究開発(R&D)に積極的に投資しています。その目的は、進化する消費者の嗜好に沿った高品質の製品を製造することです。この戦略的重点は、魅力的で多様なノンアルコールワインの選択肢を提示することで、より大きな市場シェアを獲得することに向けられています。

近年、ノンアルコールワイン業界ではパッケージの嗜好が変化しており、缶の人気が急上昇しています。金属缶、特にアルミやスチール製の缶が、ノンアルコールワインの包装ソリューションとして台頭してきました。缶は軽量でコンパクトであるため、外出先での消費に理想的な選択肢であり、活動的でダイナミックな日課を補完する飲料を求める個人の嗜好に応えています。

主要な市場参加者は、新製品の発売、生産能力の拡大、技術革新に注力しています。市場参入企業の中には、新製品のイントロダクション、生産能力の拡大、技術革新の進展に注目している企業もあります。これらの企業は、シャルドネ、メルロー、カベルネ・ソーヴィニヨンなど、多種多様な品種を提供することでノンアルコールワインを差別化し、従来のアルコールワインに匹敵する選択肢を提供することを目指しています。競合ブランドは、洗練された風味と一流の品質を備えたノンアルコールワインを提供することを優先し、従来のワインに匹敵する体験を保証しています。

ノンアルコールワイン市場レポートハイライト

- 製品別では、スティルワインセグメントは2024年から2030年にかけてCAGR 8.9%を記録すると予測されます。より健康的な飲料に対する消費者の嗜好の高まりが、ノンアルコールワインの需要を牽引すると予測されます。

- 2023年の市場シェアはスパークリングワインが60.41%でした。スパークリングノンアルコールワインは、アルコールを摂取しないことを選択した人々に、洗練されたお祝いの選択肢を提供します。

- 予測期間中、アジア太平洋地域が最速の成長を記録すると予想されます。過度のアルコール摂取に伴う健康リスクに対する認識が高まり、より健康的なライフスタイルへのシフトが進み、アルコール代替品を選ぶ消費者が増加しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 ノンアルコールワイン市場の変数、動向、範囲

- 市場系統の展望

- 業界バリューチェーン分析

- 原材料の展望

- 製造業と技術の展望

- 利益率分析

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会

- 市場の課題

- 業界分析- ポーターのファイブフォース分析

- 市場参入戦略

第4章 消費者行動分析

- 人口統計分析

- 消費者の動向と嗜好

- 購入決定に影響を与える要因

- 消費者向け製品タイプの採用

- 主な観察と発見

第5章 ノンアルコールワイン市場:製品の推定・動向分析

- 製品の変動分析と市場シェア、2023年・2030年

- スパークリングワイン

- スティル

第6章 ノンアルコールワイン市場:ABVの推定・動向分析

- ABVの変動分析と市場シェア、2023年・2030年

- ABV(0.0%)

- ABV(0.5%以下)

- ABV(1.2%以下)

第7章 ノンアルコールワイン市場:地域の推定・動向分析

- 地域の変動分析と市場シェア、2023年・2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- フィンランド

- ベルギーとルクセンブルク

- ハンガリー

- アジア太平洋地域

- 中国

- 日本

- オーストラリア

- 中南米

- ブラジル

- 中東・アフリカ

- 南アフリカ

第8章 競合分析

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 参入企業の概要

- 財務実績

- 製品ベンチマーク

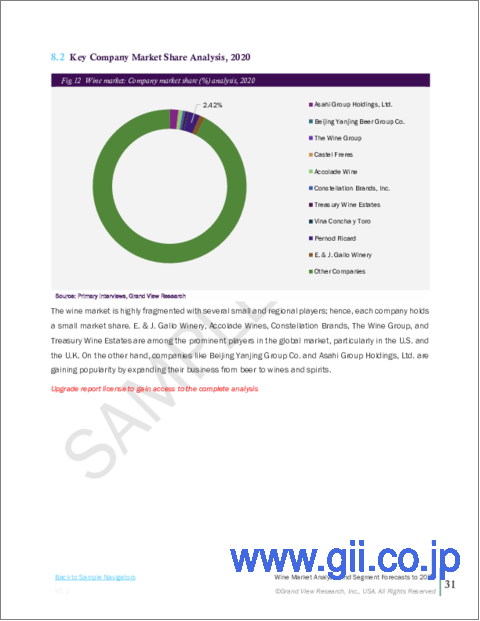

- 企業市場シェア分析、2023年(%)

- 企業ヒートマップ分析

- 戦略マッピング

- 製品プロモーション

- コラボレーション

- 製品発売

- 分析した主要企業のリスト:

- Schloss Wachenheim AG

- Australian Vintage Limited

- Sutter Home Wine Estate

- Miguel Torres SA

- DGB(Pty)Ltd.

- Bodega La Tautila

- Gruvi

- Chateau Diana Winery

- Hill Street Beverage Company Inc.

- Ariel Vineyards

- Neobulles SA

- Thomson and Scott

- Giacobazzi Ae Figli srl

- Pierre Chavin

- Weingut Leitz KG

- San Antonio Winery(Stella Rosa)

- Proxies

- Giesen

List of Tables

- Table 1 Non-Alcoholic Wine Market Revenue Estimates and Forecasts, By Product, 2018 - 2030 (USD Million, Metric Tons)

- Table 2 Non-Alcoholic Wine Market Revenue Estimates and Forecasts, By ABV (%), 2018 - 2030 (USD Million, Metric Tons)

- Table 3 Non-Alcoholic Wine Market Revenue Estimates and Forecasts, By Packaging, 2018 - 2030 (USD Million, Metric Tons)

- Table 4 Non-Alcoholic Wine Market Revenue Estimates and Forecasts, By Distribution Channel, 2018 - 2030 (USD Million, Metric Tons)

- Table 5 Company Market Share, 2023

List of Figures

- Fig. 1 Non-alcoholic wine market segmentation

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Primary research approaches

- Fig. 5 Primary research process

- Fig. 6 Market snapshot

- Fig. 7 Segment snapshot

- Fig. 8 Competitive landscape Snapshot

- Fig. 9 Digital camera market size, 2023 (USD Million)

- Fig. 10 Non-alcoholic wine market size, 2018 to 2030 (USD Million)

- Fig. 11 Non-alcoholic wine market: Value chain analysis

- Fig. 12 Non-alcoholic wine market: Profit-margin analysis

- Fig. 13 Non-alcoholic wine market dynamics

- Fig. 14 Non-alcoholic wine market: Porter's Five Forces analysis

- Fig. 15 Factors affecting buying decisions for non-alcoholic wine

- Fig. 16 Non-alcoholic wine market, by product: Key takeaways

- Fig. 17 Non-alcoholic wine market, by product: Market share, 2023 & 2030

- Fig. 18 Non-alcoholic wine market estimates & forecasts, by stereo vision, 2018 - 2030 (USD Million)

- Fig. 19 Non-alcoholic wine market estimates & forecasts, by sparkling wine, 2018 - 2030 (USD Million)

- Fig. 20 Non-alcoholic wine market estimates & forecasts, by still wine, 2018 - 2030 (USD Million)

- Fig. 21 Non-alcoholic wine market, by ABV (%): Key takeaways

- Fig. 22 Non-alcoholic wine market, by ABV (%): Market share, 2023 & 2030

- Fig. 23 Non-alcoholic wine market estimates & forecasts, by ABV(0.0%), 2018 - 2030 (USD Million)

- Fig. 24 Non-alcoholic wine market estimates & forecasts, by ABV(up to 0.5%), 2018 - 2030 (USD Million)

- Fig. 25 Non-alcoholic wine market estimates & forecasts, by ABV(up to 1.5%), 2018 - 2030 (USD Million)

- Fig. 26 Non-alcoholic wine market, by packaging: Key takeaways

- Fig. 27 Non-alcoholic wine market, by packaging: Market share, 2023 & 2030

- Fig. 28 Non-alcoholic wine market estimates & forecasts, by bottles, 2018 - 2030 (USD Million)

- Fig. 29 Non-alcoholic wine market estimates & forecasts, by cans, 2018 - 2030 (USD Million)

- Fig. 30 Non-alcoholic wine market, by distribution channel: Key takeaways

- Fig. 31 Non-alcoholic wine market, by distribution channel: Market share, 2023 & 2030

- Fig. 32 Non-alcoholic wine market estimates & forecasts, by on-trade, 2018 - 2030 (USD Million)

- Fig. 33 Non-alcoholic wine market estimates & forecasts, by off-trade, 2018 - 2030 (USD Million)

- Fig. 34 Non-alcoholic wine market estimates & forecasts, by hypermarkets & supermarkets, 2018 - 2030 (USD Million)

- Fig. 35 Non-alcoholic wine market estimates & forecasts, by online, 2018 - 2030 (USD Million)

- Fig. 36 Non-alcoholic wine market estimates & forecasts, by specialty stores & tasting rooms, 2018 - 2030 (USD Million)

- Fig. 37 Non-alcoholic wine market estimates & forecasts, by others, 2018 - 2030 (USD Million)

- Fig. 38 Non-alcoholic wine market, by region, 2023 & 2030, (USD Million)

- Fig. 39 Regional marketplace: Key takeaways

- Fig. 40 North America non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 42 U.S. non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 43 Canada non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Mexico non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Europe non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 46 UK non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Germany non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 48 France non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 49 Spain non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Finland non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 51 Belgium & Luxembourg non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Hungary non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 53 Asia Pacific non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 54 China non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Japan non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 56 Australia non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 57 Central and South America non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 58 Brazil non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 59 Middle East & Africa non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 60 South Africa non-alcoholic wine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 61 Company market share analysis, 2023

- Fig. 62 Strategic framework of non-alcoholic wine market

Non-alcoholic Wine Market Growth & Trends:

The global non-alcoholic wine market size is expected to reach USD 3.78 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030, according to a new report by Grand View Research, Inc. This growth is significantly influenced by the rising emphasis on wellness, a noticeable shift towards healthier lifestyles, and an increased awareness of the health risks associated with traditional alcoholic beverages. Consumers are increasingly prioritizing their health and well-being, leading to a surge in demand for alternatives that offer the experience of enjoying wine without alcohol content.

Manufacturers in the non-alcoholic wine industry are actively channeling investments into research and development (R&D) initiatives. The objective is to manufacture high-quality products that align with the evolving preferences of consumers. This strategic focus is geared towards capturing a larger market share by presenting an array of appealing and diverse non-alcoholic wine options.

In recent years, there has been a transformation in packaging preferences within the non-alcoholic wine industry, with a remarkable surge in the popularity of cans. Metallic cans, specifically those crafted from aluminum and steel, have emerged as the packaging solution of choice for non-alcoholic wines. The lightweight and compact nature of cans makes them an ideal choice for on-the-go consumption, catering to the preferences of individuals seeking beverages that complement their active and dynamic routines.

Key market players are focusing on new product launches, capacity expansions, and technological innovations. Some prominent market participants are directing their attention toward new product introductions, expanding production capacities, and advancing technological innovations. These companies distinguish their non-alcoholic wine offerings by providing a wide variety of varietals such as chardonnay, merlot, cabernet sauvignon, and others, aiming to offer options that rival traditional alcoholic wines. Competitive brands prioritize the delivery of non-alcoholic wines with refined flavor profiles and top-notch quality to ensure a comparable experience to that of traditional wines.

Non-alcoholic Wine Market Report Highlights:

- Based on product, the still wine segment is projected to register a CAGR of 8.9% from 2024 to 2030. The rising consumer preference for healthier beverages is anticipated to drive the demand for non-alcoholic wines.

- Sparkling wine held a market share of 60.41% in 2023. Sparkling non-alcoholic wines offer a sophisticated and celebratory alternative for those who choose not to consume alcohol.

- Asia Pacific is expected to register the fastest growth during the forecast period. There is a growing awareness of the health risks associated with excessive alcohol consumption, leading to a shift towards healthier lifestyles and an increasing number of consumers opting for alcoholic alternatives.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Product Types & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Product Outlook

- 2.3. ABV (%) Outlook

- 2.4. Packaging Outlook

- 2.5. Distribution Channel

- 2.6. Regional Outlook

Chapter 3. Non-Alcoholic Wine Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Raw Material Outlook

- 3.2.2. Manufacturing and Technology Outlook

- 3.2.3. Profit Margin Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Market Opportunities

- 3.3.4. Market Challenges

- 3.4. Industry Analysis - Porter's Five Forces Analysis

- 3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographics Analysis

- 4.2. Consumer Trends and Preferences

- 4.3. Factors Affecting Buying Decision

- 4.4. Consumer Product Type Adoption

- 4.5. Key Observations & Findings

Chapter 5. Non-Alcoholic Wine Market: Product Estimates & Trend Analysis

- 5.1. Product Movement Analysis & Market Share, 2023 & 2030

- 5.2. Sparkling wine

- 5.2.1. Sparkling wine market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3. Still

- 5.3.1. Still wine market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 6. Non-Alcoholic Wine Market: ABV(%) Estimates & Trend Analysis

- 6.1. ABV (%) Movement Analysis & Market Share, 2023 & 2030

- 6.2. ABV (0.0%)

- 6.2.1. ABV(0.0%) market estimates and forecast, 2018 - 2030 (USD Million)

- 6.3. ABV (Up to 0.5%)

- 6.3.1. ABV (Up to 0.5%) market estimates and forecast, 2018 - 2030 (USD Million)

- 6.4. ABV (Up to 1.2%)

- 6.4.1. ABV (Up to 1.2%) market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 7. Non-Alcoholic Wine Market: Regional Estimates & Trend Analysis

- 7.1. Regional Movement Analysis & Market Share, 2023 & 2030

- 7.2. North America

- 7.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.2.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.2.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.2.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.2.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.2.6. U.S.

- 7.2.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.2.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.2.6.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.2.6.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.2.6.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.2.7. Canada

- 7.2.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.2.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.2.7.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.2.7.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.2.7.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.2.8. Mexico

- 7.2.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.2.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.2.8.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.2.8.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.2.8.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3. Europe

- 7.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.6. Germany

- 7.3.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.6.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.6.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.6.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.7. UK

- 7.3.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.7.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.7.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.7.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.8. France

- 7.3.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.8.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.8.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.8.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.9. Spain

- 7.3.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.9.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.9.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.9.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.9.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.10. Finland

- 7.3.10.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.10.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.10.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.10.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.10.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.11. Belgium & Luxembourg

- 7.3.11.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.11.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.11.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.11.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.11.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.3.12. Hungary

- 7.3.12.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.12.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.3.12.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.3.12.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.3.12.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.4.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.4.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.4.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.4.6. China

- 7.4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.4.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.4.6.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.4.6.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.4.6.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.4.7. Japan

- 7.4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.4.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.4.7.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.4.7.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.4.7.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.4.8. Australia

- 7.4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.4.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.4.8.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.4.8.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.4.8.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.5. Central & South America

- 7.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.5.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.5.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.5.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.5.6. Brazil

- 7.5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.5.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.5.6.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.5.6.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.5.6.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.6. Middle East & Africa

- 7.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.6.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.6.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.6.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- 7.6.6. South Africa

- 7.6.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.6.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million)

- 7.6.6.3. Market estimates and forecast, by ABV(%), 2018 - 2030 (USD Million)

- 7.6.6.4. Market estimates and forecast, by packaging, 2018 - 2030 (USD Million)

- 7.6.6.5. Market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Chapter 8. Competitive Analysis

- 8.1. Recent developments & impact analysis, by key market participants

- 8.2. Company Categorization

- 8.3. Participant's Overview

- 8.4. Financial Performance

- 8.5. Product Benchmarking

- 8.6. Company Market Share Analysis, 2023 (%)

- 8.7. Company Heat Map Analysis

- 8.8. Strategy Mapping

- 8.8.1. Product Promotion

- 8.8.2. Collaboration

- 8.8.3. Product Launch

- 8.9. List of key companies analyzed in this section include:

- 8.9.1. Schloss Wachenheim AG

- 8.9.2. Australian Vintage Limited

- 8.9.3. Sutter Home Wine Estate

- 8.9.4. Miguel Torres S.A

- 8.9.5. DGB (Pty) Ltd.

- 8.9.6. Bodega La Tautila

- 8.9.7. Gruvi

- 8.9.8. Chateau Diana Winery

- 8.9.9. Hill Street Beverage Company Inc.

- 8.9.10. Ariel Vineyards

- 8.9.11. Neobulles SA

- 8.9.12. Thomson and Scott

- 8.9.13. Giacobazzi A.e Figli srl

- 8.9.14. Pierre Chavin

- 8.9.15. Weingut Leitz KG

- 8.9.16. San Antonio Winery (Stella Rosa)

- 8.9.17. Proxies

- 8.9.18. Giesen