|

|

市場調査レポート

商品コード

1341048

カスタマーエクスペリエンスマネジメントの世界市場:オファリング別(ソリューション、サービス)、接触ポイント別、展開タイプ別、組織規模別、業界別(旅行・ホスピタリティ、BFSI、小売、ヘルスケア、IT・通信)、地域別-2028年までの予測Customer Experience Management Market by Offering (Solutions, Services), Touchpoint, Deployment Type, Organization Size, Vertical (Travel & Hospitality, BFSI, Retail, Healthcare, IT & Telecom) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| カスタマーエクスペリエンスマネジメントの世界市場:オファリング別(ソリューション、サービス)、接触ポイント別、展開タイプ別、組織規模別、業界別(旅行・ホスピタリティ、BFSI、小売、ヘルスケア、IT・通信)、地域別-2028年までの予測 |

|

出版日: 2023年08月23日

発行: MarketsandMarkets

ページ情報: 英文 261 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

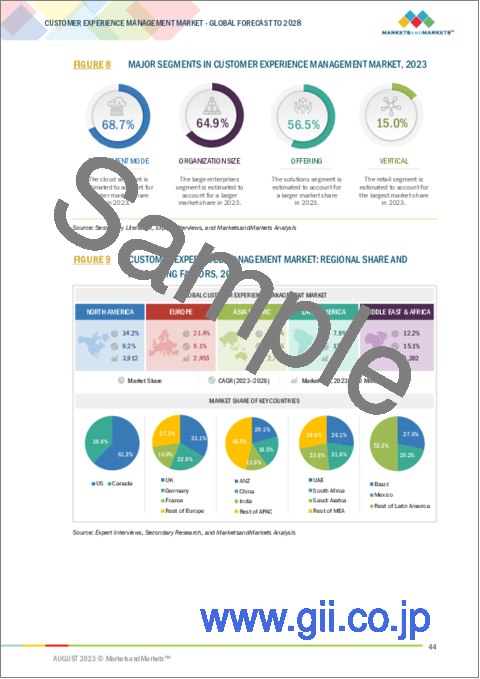

世界のカスタマーエクスペリエンスマネジメントの市場規模は、2023年に114億米ドルと推定され、予測期間中のCAGRは12.2%と見込まれており、2028年には204億米ドルに達すると予測されています。

カスタマーエクスペリエンスマネジメント市場は、技術革新と卓越した顧客対応への注力に後押しされて大きく拡大しています。企業はカスタマーエクスペリエンスマネジメントソリューションの可能性を活用することで、エンゲージメントの調整、実用的なインサイトの収集、複数の接触ポイントにおける一貫したエクスペリエンスの提供を実現しています。このパラダイムシフトは、企業が顧客と関わり、ロイヤルティを高め、ブランドアドボカシーを育成する方法に革命をもたらしています。データ分析からパーソナライズされた戦略まで、カスタマーエクスペリエンスマネジメントソリューションは業界を再形成し、満足度を高め、急速に進化する市場で持続可能な成長を推進しています。

企業が総合的なカスタマーエクスペリエンスマネジメント戦略の重要性を認識するようになるにつれ、専門的なサービスへの需要が急増すると予想されます。こうしたサービスには、コンサルティングや導入からトレーニングやサポートに至るまで、さまざまなものが含まれます。特定のビジネス・ニーズを満たし、顧客エンゲージメントを強化するためのソリューションのカスタマイズに重点を置くサービスセグメントは、企業の顧客満足度とロイヤルティ目標の達成を導く上で極めて重要な役割を果たしています。このように包括的なサービスが重視されることで、顧客経験管理(CEM)市場の成長軌道に大きく寄与し、CEMの導入を成功させる上での重要性が強調されることになります。

大企業は、予測期間中、顧客経験管理の情勢において大きな市場シェアを維持する見通しです。大企業の豊富なリソース、技術力、確立された市場プレゼンスは、洗練された顧客中心戦略の採用を可能にしています。大企業は、顧客に合わせた対話、データ主導の洞察、シームレスなマルチチャネルエンゲージメントに重点を置くことで、先進的なカスタマーエクスペリエンスマネジメントソリューションの導入を主導しています。この積極的なアプローチにより、アナリティクス、人工知能、最先端のプラットフォームを活用し、顧客満足度の向上と競合優位性の確立を実現しています。市場が進化を続けるなか、大企業の永続的な影響力が業界の流れを形成し、その市場シェアを大きく維持することになります。

当レポートでは、世界のカスタマーエクスペリエンスマネジメント市場について調査し、オファリング別、接触ポイント別、展開タイプ別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 業界の動向

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォースモデル

- 技術分析

- 顧客/購入者に影響を与える動向/混乱

- 特許分析

- 平均販売価格分析

- 使用例

- 2023年~2024年の主な会議とイベント

- 主要な利害関係者と購入基準

- 規制状況

- カスタマーエクスペリエンスマネジメントテクノロジーの進化

- カスタマーエクスペリエンスマネジメント市場の今後の方向性

- カスタマーエクスペリエンスマネジメントが隣接するニッチ技術に与える影響

第6章 カスタマーエクスペリエンスマネジメント市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 カスタマーエクスペリエンスマネジメント市場、接触ポイント別

- イントロダクション

- ウェブサイト

- 店舗

- コールセンター

- モバイルアプリ

- ソーシャルメディア

- メール

- バーチャルアシスタント

- その他

第8章 カスタマーエクスペリエンスマネジメント市場、展開タイプ別

- イントロダクション

- オンプレミス

- クラウド

第9章 カスタマーエクスペリエンスマネジメント市場、組織規模別

- イントロダクション

- 大企業

- 中小企業

第10章 カスタマーエクスペリエンスマネジメント市場、業界別

- イントロダクション

- IT・通信

- BFSI

- 小売

- ヘルスケア

- 自動車

- 旅行とホスピタリティ

- メディアとエンターテイメント

- 公的機関

- その他

第11章 カスタマーエクスペリエンスマネジメント市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 主要な市場の発展

- 主要企業の市場シェア分析

- 過去の収益分析

- 企業評価マトリックスの概要

- 主要企業の企業評価マトリックス:調査手法と定義

- 企業の製品フットプリント分析

- 企業市場ランキング分析

- スタートアップ/中小企業向けの企業評価マトリックス:調査手法と定義

第13章 企業プロファイル

- 主要参入企業

- ORACLE

- ADOBE

- SAP

- IBM

- AVAYA

- OPENTEXT

- NICE

- SAS

- VERINT SYSTEMS

- TERADATA

- TECH MAHINDRA

- NOKIA

- INMOMENT

- ZENDESK

- SITECORE

- SPRINKLR

- MEDALLIA

- スタートアップ/中小企業

- MIXPANEL

- NGDATA

- ALGONOMY

- SKYVERA

- AMPERITY

- CLARABRIDGE

- MINDTOUCH

- SOGOLYTICS

- SEGMENT.IO

第14章 隣接市場および関連市場

第15章 付録

The global customer experience management market is estimated to be worth USD 11.4 billion in 2023 and is projected to reach USD 20.4 billion by 2028, at a CAGR of 12.2% during the forecast period. The customer experience management market is experiencing significant expansion propelled by technological innovations and a focus on exceptional customer interactions. Businesses are harnessing the potential of customer experience management solutions to tailor engagements, gather actionable insights, and deliver consistent experiences across multiple touchpoints. This paradigm shift is revolutionizing the way companies engage with customers, enhancing loyalty, and cultivating brand advocacy. From data analytics to personalized strategies, customer experience management solutions are reshaping industries, fostering satisfaction, and driving sustainable growth in a rapidly evolving market.

The services segment to record a higher growth rate during the forecast period

As businesses increasingly recognize the significance of holistic customer experience management strategies, the demand for specialized services is expected to surge. These services encompass a range of offerings, from consulting and implementation to training and support. With a focus on tailoring solutions to meet specific business needs and enhance customer engagement, the services segment plays a pivotal role in guiding companies towards achieving their customer satisfaction and loyalty goals. This emphasis on comprehensive services is set to contribute significantly to the growth trajectory of the customer experience management market, underscoring its importance in enabling successful CEM implementation.

Large Enterprises are expected to hold a larger market share during the forecast period

Large Enterprises are poised to maintain a significant market share in the customer experience management landscape throughout the forecast period. Their extensive resources, technological capabilities, and established market presence enable them to adopt sophisticated customer-centric strategies. By focusing on tailored interactions, data-driven insights, and seamless multichannel engagement, Large Enterprises are leading the way in implementing advanced customer experience management solutions. This proactive approach allows them to leverage analytics, artificial intelligence, and cutting-edge platforms, thus enhancing customer satisfaction and solidifying their competitive edge. As the market continues to evolve, the enduring influence of Large Enterprises is set to shape the course of the industry, sustaining their substantial market share.

Asia Pacific to have higher growth rate during the forecast period

With a dynamic blend of technological advancements and a burgeoning consumer landscape, this region offers fertile ground for nurturing customer-centric strategies. As businesses increasingly recognize the value of personalized engagements, data-informed insights, and streamlined interactions, the Asia Pacific market emerges as a hub for innovation in customer experience management. Empowered by a commitment to digital transformation and a cultural emphasis on customer satisfaction, businesses within this region are well-positioned to drive the evolution of customer experience practices. The Asia Pacific's growing economic significance and technological prowess position it as a key catalyst for growth, promising to redefine global standards in customer interactions and experiences.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primaries is as follows:

- By Company Type: Tier 1 - 62%, Tier 2 - 23%, and Tier 3 - 15%

- By Designation: C-level - 38%, Directors - 30% and Others - 32%

- By Region: North America -40%, Europe -15%, APAC - 35%, Middle East and Africa- 5% and Latin America- 5%

The major players in the customer experience management market are Adobe (US), IBM (US), Oracle (US), Avaya (US), Nice (Israel), Nokia (Finland), SAP (Germany), OpenText (Canada), Tech Mahindra (India), Verint Systems (US), Zendesk (US), Teradata (US), Sprinklr (US), Medallia (US), InMoment (US), SAS (US), Clarabridge (US), Sitecore (US), NGDATA (Belgium), Amperity (US), Mixpanel (US), Segment.io (US), Skyvera (US), MindTouch (US), Algonomy (US), and Sogolytics (US).

The study includes an in-depth competitive analysis of these key players in the customer experience management market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the customer experience management market market across different segments. It aims at estimating the market size and the growth potential across different segments based on offering, touchpoint, deployment type, organization size, verticals , and regions. The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall customer experience management market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

As businesses recognize the pivotal role of customer satisfaction and loyalty, there is a mounting demand for comprehensive customer experience management solutions. These encompass a range of tools, from advanced analytics and AI-driven insights to integrated communication platforms, enabling organizations to gain a deeper understanding of customer preferences, fine-tune strategies, and deliver consistent experiences. While challenges like the need for alignment and technology integration are acknowledged, the report underscores the dynamic landscape of customer-centric strategies and evolving market trends, the report also offers valuable insights into the future trajectory of the customer experience management market.

- Product Development/Innovation: Detailed insights on coming technologies, R&D activities, and product & solution launches in the customer experience management market

- Market Development: Comprehensive information about lucrative markets - the report analyses the customer experience management market across varied regions

- Market Diversification: Exhaustive information about new products & solutions being developed, untapped geographies, recent developments, and investments in the customer experience management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Adobe (US), IBM (US), Oracle (US), Avaya (US), Nice (Israel), Nokia (Finland), SAP (Germany), OpenText (Canada), Tech Mahindra (India), Verint Systems (US), Zendesk (US), Teradata (US), Sprinklr (US), Medallia (US), InMoment (US), SAS (US), Clarabridge (US), Sitecore (US), NGDATA (Belgium), Amperity (US), Mixpanel (US), Segment.io (US), Skyvera (US), MindTouch (US), Algonomy (US), and Sogolytics (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CUSTOMER EXPERIENCE MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary participants

- FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 3 CUSTOMER EXPERIENCE MANAGEMENT MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SPENDING-SIDE ANALYSIS)

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 CUSTOMER EXPERIENCE MANAGEMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (1/2)

- FIGURE 5 CUSTOMER EXPERIENCE MANAGEMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (2/2)

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT

- FIGURE 6 CUSTOMER EXPERIENCE MANAGEMENT MARKET: RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 7 CUSTOMER EXPERIENCE MANAGEMENT MARKET, 2021-2028

- FIGURE 8 MAJOR SEGMENTS IN CUSTOMER EXPERIENCE MANAGEMENT MARKET, 2023

- FIGURE 9 CUSTOMER EXPERIENCE MANAGEMENT MARKET: REGIONAL SHARE AND KEY DRIVING FACTORS, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN CUSTOMER EXPERIENCE MANAGEMENT MARKET

- FIGURE 10 GROWING NEED TO ENHANCE CUSTOMER LOYALTY TO DRIVE MARKET

- 4.2 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING

- FIGURE 11 SOLUTIONS SEGMENT TO LEAD MARKET IN 2023

- 4.3 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE

- FIGURE 12 MANAGED SERVICES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- 4.4 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE

- FIGURE 13 DEPLOYMENT & INTEGRATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- 4.5 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL

- FIGURE 14 RETAIL SEGMENT TO LEAD MARKET IN 2023

- 4.6 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT MODE

- FIGURE 15 CLOUD SEGMENT TO LEAD MARKET IN 2023

- 4.7 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.8 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING AND KEY COUNTRY

- FIGURE 17 SOLUTIONS SEGMENT AND AUSTRALIA & NEW ZEALAND TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.9 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY

- FIGURE 18 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 CUSTOMER EXPERIENCE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased need to establish learning behavior with customers

- 5.2.1.2 Demand for enhanced customer satisfaction and responsiveness

- 5.2.1.3 Need for companies to drive increased customer loyalty

- 5.2.1.4 Focus on establishing coordination among customer contact channels and customer experience management personnel

- 5.2.1.5 Growing emphasis on customer lifetime value

- 5.2.1.6 Rising demand for customer experience management solutions

- 5.2.1.7 Need for better customer engagement strategy

- 5.2.1.8 Need for CEM solutions to reduce customer churn rates

- 5.2.1.9 Need to maintain customer engagement through omnichannels

- 5.2.2 RESTRAINTS

- 5.2.2.1 Use of incomplete data while calculating CE matrix

- 5.2.2.2 Data synchronization complexities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in collection of information using single platform

- 5.2.3.2 Increasing use of insights to predict customer intents

- 5.2.3.3 Increasing extraction of information extracted from CEM solutions for optimal strategies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of innovation

- 5.2.4.2 Difficulty in ensuring CE RoI

- 5.2.4.3 Concerns over data privacy and security

- 5.2.4.4 Difficulty in getting different CE feedback through channels

- 5.2.4.5 Lack of synchronization in customer experience data collected from different touchpoints within various domains

- 5.3 INDUSTRY TRENDS

- 5.3.1 VALUE CHAIN ANALYSIS

- FIGURE 20 CUSTOMER EXPERIENCE MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- 5.3.2 ECOSYSTEM ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 5.3.3 PORTER'S FIVE FORCES MODEL

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON CUSTOMER EXPERIENCE MANAGEMENT MARKET

- 5.3.3.1 Threat of new entrants

- 5.3.3.2 Threat of substitutes

- 5.3.3.3 Bargaining power of suppliers

- 5.3.3.4 Bargaining power of buyers

- 5.3.3.5 Intensity of competitive rivalry

- 5.3.4 TECHNOLOGY ANALYSIS

- 5.3.4.1 Big data and analytics

- 5.3.4.2 Cloud computing

- 5.3.4.3 Artificial intelligence and machine learning

- 5.3.4.4 Natural language processing

- 5.3.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERS

- FIGURE 21 REVENUE SHIFT IN CUSTOMER EXPERIENCE MANAGEMENT MARKET

- 5.3.6 PATENT ANALYSIS

- FIGURE 22 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 3 YEARS

- FIGURE 23 NUMBER OF PATENTS GRANTED, 2018-2022

- 5.3.7 AVERAGE SELLING PRICE ANALYSIS

- 5.3.8 USE CASES

- TABLE 5 USE CASE 1: ORACLE

- TABLE 6 USE CASE 2: ORACLE

- TABLE 7 USE CASE 3: SAP

- TABLE 8 USE CASE 4: OPENTEXT

- TABLE 9 USE CASE 5: INMOMENT

- TABLE 10 USE CASE 6: MEDALLIA

- TABLE 11 USE CASE 7: SITECORE

- TABLE 12 USE CASE 8: CLARABRIDGE

- TABLE 13 USE CASE 9: NOKIA

- TABLE 14 USE CASE 10: ORACLE

- TABLE 15 USE CASE 11: OPENTEXT

- 5.3.9 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2023-2024

- 5.3.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.10.1 Key stakeholders in buying process

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.10.2 Buying criteria

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA OF TOP THREE VERTICALS

- 5.3.11 REGULATORY LANDSCAPE

- 5.3.11.1 Regulatory bodies, government agencies, and other organizations

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.11.2 North America

- 5.3.11.2.1 US

- 5.3.11.2.2 Canada

- 5.3.11.3 Europe

- 5.3.11.4 Asia Pacific

- 5.3.11.4.1 South Korea

- 5.3.11.4.2 China

- 5.3.11.4.3 India

- 5.3.11.4.4 Japan

- 5.3.11.5 Middle East & Africa

- 5.3.11.5.1 UAE

- 5.3.11.5.2 KSA

- 5.3.11.6 Latin America

- 5.3.11.6.1 Brazil

- 5.3.11.6.2 Mexico

- 5.3.11.2 North America

- 5.3.12 EVOLUTION OF CUSTOMER EXPERIENCE MANAGEMENT TECHNOLOGY

- 5.3.12.1 Manual Interaction (Pre-digital Era)

- 5.3.12.2 Emergence of Digital Channels (Late 20th Century)

- 5.3.12.3 Customer Relationship Management (CRM) Systems (1990s-Early 2000s)

- 5.3.12.4 Multichannel Engagement (Mid-2000s-Early 2010s)

- 5.3.12.5 Analytics and Data-driven Insights (Mid-2010s)

- 5.3.12.6 Omnichannel Experience (Late 2010s)

- 5.3.12.7 Artificial Intelligence and Personalization (Late 2010s-Early 2020s)

- 5.3.12.8 Real-time Engagement (Early 2020s)

- 5.3.12.9 Predictive and Prescriptive Analytics (Present and Beyond)

- 5.3.13 FUTURE DIRECTION OF CUSTOMER EXPERIENCE MANAGEMENT MARKET

- 5.3.13.1 Hyper-Personalization

- 5.3.13.2 Predictive Customer Service

- 5.3.13.3 Emotional and Sentimental Analysis

- 5.3.13.4 Seamless Omnichannel Experience

- 5.3.13.5 Voice and Natural Language Interfaces

- 5.3.13.6 Augmented Reality (AR) and Virtual Reality (VR)

- 5.3.13.7 Collaborative Customer Experience

- 5.3.13.8 Human-AI Collaboration

- 5.3.13.9 Data Integration and Unified Customer Profiles

- 5.3.13.10 Ethical AI and Privacy

- 5.3.14 IMPACT OF CUSTOMER EXPERIENCE MANAGEMENT ON ADJACENT NICHE TECHNOLOGIES

- 5.3.14.1 Big Data and Analytics

- 5.3.14.2 Augmented Reality (AR) and Virtual Reality (VR)

- 5.3.14.3 Chatbots and Natural Language Processing

- 5.3.14.4 Biometric Identification

- 5.3.14.5 Robotics and Automation

6 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 23 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 24 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 RISING CUSTOMER EXPECTATION FOR TAILORED EXPERIENCES TO FUEL MARKET

- 6.2.2 SOLUTIONS: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 25 SOLUTIONS: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 SOLUTIONS: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 OMNICHANNEL

- 6.2.3.1 Demand for unified customer experience across all channels to propel market

- 6.2.4 MACHINE LEARNING

- 6.2.4.1 Need for machine learning's data-driven insights and personalized integration to revolutionize market

- 6.2.5 ANALYTICS

- 6.2.5.1 Need to leverage data insights for enhanced customer interactions and informed decision-making to drive market

- 6.2.6 WORKFORCE OPTIMIZATION

- 6.2.6.1 Focus on enhancing efficiency and employee-customer interactions to boost growth

- 6.3 SERVICES

- 6.3.1 RISING EMPHASIS ON PERSONALIZED INTERACTION AND CUSTOMER SATISFACTION TO BOOST MARKET

- 6.3.2 SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- FIGURE 27 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 27 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 28 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 29 SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

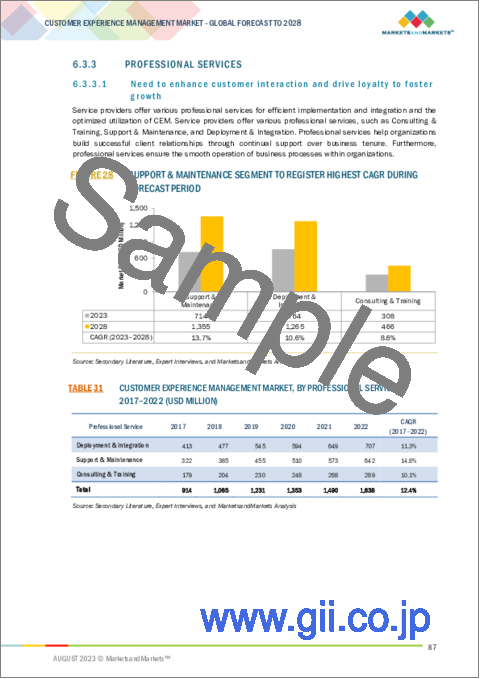

- 6.3.3 PROFESSIONAL SERVICES

- 6.3.3.1 Need to enhance customer interaction and drive loyalty to foster growth

- FIGURE 28 SUPPORT & MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 32 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3.2 Deployment & integration

- TABLE 35 DEPLOYMENT & INTEGRATION: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 DEPLOYMENT & INTEGRATION: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3.3 Support & maintenance

- TABLE 37 SUPPORT & MAINTENANCE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 SUPPORT & MAINTENANCE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3.4 Consulting & training

- TABLE 39 CONSULTING & TRAINING: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 CONSULTING & TRAINING: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4 MANAGED SERVICES

- 6.3.4.1 Need to facilitate seamless operations to drive market

- TABLE 41 MANAGED SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 MANAGED SERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY TOUCHPOINT

- 7.1 INTRODUCTION

- 7.2 WEBSITES

- 7.2.1 DEMAND FOR PERSONALIZED INTERACTIONS AND ELEVATED CUSTOMER SATISFACTION TO FOSTER GROWTH

- 7.3 STORES

- 7.3.1 STORES TO FACILITATE PERSONALIZED INTERACTIONS AND FOSTER LOYALTY

- 7.4 CALL CENTERS

- 7.4.1 FOCUS ON PERSONALIZING TRANSACTIONS TO DRIVE MARKET

- 7.5 MOBILE APPS

- 7.5.1 FOCUS ON PERSONALIZING TRANSACTIONS TO DRIVE MARKET

- 7.6 SOCIAL MEDIA

- 7.6.1 FOCUS ON FOSTERING REAL-TIME ENGAGEMENT TO DRIVE MARKET EXPANSION

- 7.7 EMAILS

- 7.7.1 FOCUS ON FOSTERING CUSTOMER INTERACTION AND ENGAGEMENT TO DRIVE MARKET EXPANSION

- 7.8 VIRTUAL ASSISTANTS

- 7.8.1 VIRTUAL ASSISTANTS TO OFFER PERSONALIZED INTERACTIONS AND STREAMLINED PROCESSES

- 7.9 OTHER TOUCHPOINTS

8 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE

- 8.1 INTRODUCTION

- FIGURE 29 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 43 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 44 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 NEED TO STRENGTHEN LOCALIZED CONTROL AND DATA COMPLIANCE TO DRIVE MARKET

- 8.2.2 ON-PREMISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 45 ON-PREMISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 ON-PREMISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 ADOPTION OF SCALABLE SOLUTIONS TO TRANSFORM CUSTOMER SERVICE TO PROPEL GROWTH

- 8.3.2 CLOUD: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 47 CLOUD: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 CLOUD: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

9 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 30 LARGE ENTERPRISES TO ACCOUNT FOR HIGHER MARKET SIZE DURING FORECAST PERIOD

- TABLE 49 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 50 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 9.2 LARGE ENTERPRISES

- 9.2.1 LARGE ENTERPRISES TO LEAD MARKET WITH TECHNOLOGY, ANALYTICS, AND PERSONALIZED INTERACTIONS FOR ENHANCED CUSTOMER SATISFACTION AND LOYALTY

- 9.2.2 LARGE ENTERPRISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 51 LARGE ENTERPRISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.3.1 GROWING ADOPTION OF AGILE STRATEGIES TO STRENGTHEN PERSONALIZED INTERACTION TO BOOST GROWTH

- 9.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 53 SMALL AND MEDIUM-SIZED ENTERPRISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 SMALL AND MEDIUM-SIZED ENTERPRISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

10 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 31 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 55 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 56 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 IT & TELECOM

- 10.2.1 NEED FOR IMPROVED SATISFACTION AND LOYALTY IN IT & TELECOM SECTOR TO DRIVE MARKET

- 10.2.2 IT & TELECOM: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 57 IT & TELECOM: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 IT & TELECOM: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 BFSI

- 10.3.1 RISING DEMAND TO USE DATA INSIGHTS IN BFSI SECTOR TO BOOST GROWTH

- 10.3.2 BFSI: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 59 BFSI: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 BFSI: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 RETAIL

- 10.4.1 OMNICHANNEL EXPERIENCES, PERSONAL INTERACTIONS, AND STREAMLINED PROCESSES IN RETAIL TO BOOST MARKET

- 10.4.2 RETAIL: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 61 RETAIL: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 RETAIL: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 HEALTHCARE

- 10.5.1 FOCUS ON IMPROVING PATIENT-CENTRIC CARE TO DRIVE MARKET EXPANSION

- 10.5.2 HEALTHCARE: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 63 HEALTHCARE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 HEALTHCARE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 AUTOMOTIVE

- 10.6.1 INCREASING INNOVATION AND PERSONALIZATION IN AUTOMOTIVE SECTOR TO FOSTER GROWTH

- 10.6.2 AUTOMOTIVE: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 65 AUTOMOTIVE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 TRAVEL & HOSPITALITY

- 10.7.1 RISING ADOPTION OF TAILORED SERVICES IN TRAVEL & HOSPITALITY SECTOR TO DRIVE MARKET

- 10.7.2 TRAVEL & HOSPITALITY: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 67 TRAVEL & HOSPITALITY: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 TRAVEL & HOSPITALITY: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 MEDIA & ENTERTAINMENT

- 10.8.1 NEED FOR IMMERSIVE CONTENT AND SEAMLESS EXPERIENCES TO BOOST GROWTH

- 10.8.2 MEDIA & ENTERTAINMENT: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 69 MEDIA & ENTERTAINMENT: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 MEDIA & ENTERTAINMENT: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 PUBLIC SECTOR

- 10.9.1 FOCUS ON ENHANCING DIGITAL SERVICES IN PUBLIC SECTOR TO LEAD TO MARKET EXPANSION

- 10.9.2 PUBLIC SECTOR: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- TABLE 71 PUBLIC SECTOR: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 PUBLIC SECTOR: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 OTHER VERTICALS

- TABLE 73 OTHER VERTICALS: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 74 OTHER VERTICALS: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

11 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 32 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 75 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 33 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- 11.2.3 NORTH AMERICA: MARKET REGULATIONS

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 77 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.4 US

- 11.2.4.1 Adoption of latest technologies and presence of major players to contribute to market growth

- TABLE 91 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 92 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 93 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 94 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 95 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 96 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 97 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 98 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 99 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 100 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 101 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 102 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2.5 CANADA

- 11.2.5.1 Rising investments in technology to boost adoption of CEM solutions

- TABLE 103 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 104 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 105 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 106 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 107 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 108 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 109 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 110 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 111 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 112 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 113 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 114 CANADA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- 11.3.3 EUROPE: MARKET REGULATIONS

- TABLE 115 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 116 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 117 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 118 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 119 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 120 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 121 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 122 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 124 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 125 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 126 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 127 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 128 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Need for businesses to cater to changing customer demand to drive market

- TABLE 129 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 130 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 131 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 132 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 133 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 134 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 135 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 136 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 137 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 138 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 139 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 140 UK: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3.5 GERMANY

- 11.3.5.1 Increasing presence of companies offering digital customer experience management solutions to propel growth

- 11.3.6 FRANCE

- 11.3.6.1 Rising digital transformation to lead to adoption of customer experience management services

- 11.3.7 ITALY

- 11.3.7.1 Growing digitalization and tailored customer interactions to propel market

- 11.3.8 SPAIN

- 11.3.8.1 Integration of advanced technology and customer-centric strategies to drive market growth

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- 11.4.3 ASIA PACIFIC: MARKET REGULATIONS

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 141 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Focus of businesses on adopting customer-centric approaches to drive market

- 11.4.5 INDIA

- 11.4.5.1 Growing demand for enhanced personalized experiences to boost market growth

- 11.4.6 CHINA

- 11.4.6.1 Rapid adoption of digital transformation solutions and changing customer demands to drive market

- TABLE 155 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 156 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 157 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 158 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 159 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 160 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 161 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 162 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 163 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 164 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 165 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 166 CHINA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.4.7 JAPAN

- 11.4.7.1 Strong commitment toward innovation and promoting customer-centric values to boost growth

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.5.3 MIDDLE EAST & AFRICA: MARKET REGULATIONS

- TABLE 167 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.4 UAE

- 11.5.4.1 Increasing awareness regarding importance of advanced technologies to drive market

- 11.5.5 SAUDI ARABIA

- 11.5.5.1 Fast-paced adoption of cloud-based services to drive market

- 11.5.6 SOUTH AFRICA

- 11.5.6.1 Adoption of strategic approaches to build differentiated experiences for customers to lead market

- 11.5.7 REST OF THE MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- 11.6.3 LATIN AMERICA: MARKET REGULATIONS

- TABLE 181 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017-2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.4 BRAZIL

- 11.6.4.1 Growing presence of companies focusing on enhancing customer experience to boost growth

- 11.6.5 MEXICO

- 11.6.5.1 Adoption of cloud-based services by organizations to propel market

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 195 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 KEY MARKET DEVELOPMENTS

- 12.3.1 PRODUCT LAUNCHES

- TABLE 196 CUSTOMER EXPERIENCE MANAGEMENT MARKET: PRODUCT LAUNCHES, 2019-2023

- 12.3.2 DEALS

- TABLE 197 CUSTOMER EXPERIENCE MANAGEMENT MARKET: DEALS, 2020-2023

- 12.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 198 CUSTOMER EXPERIENCE MANAGEMENT MARKET: INTENSITY OF COMPETITIVE RIVALRY

- FIGURE 36 MARKET SHARE ANALYSIS

- 12.5 HISTORICAL REVENUE ANALYSIS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS, 2020-2022

- 12.6 COMPANY EVALUATION MATRIX OVERVIEW

- 12.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: METHODOLOGY AND DEFINITIONS

- TABLE 199 PRODUCT FOOTPRINT WEIGHTAGE

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 38 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 12.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 200 COMPANY FOOTPRINT, BY PRODUCT

- TABLE 201 COMPANY FOOTPRINT, BY OFFERING

- TABLE 202 COMPANY FOOTPRINT, BY INDUSTRY

- TABLE 203 COMPANY FOOTPRINT, BY REGION

- 12.9 COMPANY MARKET RANKING ANALYSIS

- FIGURE 39 RANKING OF KEY PLAYERS IN CUSTOMER EXPERIENCE MANAGEMENT MARKET, 2023

- 12.10 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: METHODOLOGY AND DEFINITIONS

- TABLE 204 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 12.10.1 PROGRESSIVE COMPANIES

- 12.10.2 RESPONSIVE COMPANIES

- 12.10.3 DYNAMIC COMPANIES

- 12.10.4 STARTING BLOCKS

- FIGURE 40 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

13 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 13.1 MAJOR PLAYERS

- 13.1.1 ORACLE

- TABLE 205 ORACLE: BUSINESS OVERVIEW

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- TABLE 206 ORACLE: PRODUCTS OFFERED

- TABLE 207 ORACLE: PRODUCT LAUNCHES

- TABLE 208 ORACLE: DEALS

- 13.1.2 ADOBE

- TABLE 209 ADOBE: BUSINESS OVERVIEW

- FIGURE 42 ADOBE: COMPANY SNAPSHOT

- TABLE 210 ADOBE: PRODUCTS OFFERED

- TABLE 211 ADOBE: PRODUCT LAUNCHES

- TABLE 212 ADOBE: DEALS

- 13.1.3 SAP

- TABLE 213 SAP: BUSINESS OVERVIEW

- FIGURE 43 SAP: COMPANY SNAPSHOT

- TABLE 214 SAP: PRODUCTS OFFERED

- TABLE 215 SAP: PRODUCT LAUNCHES

- TABLE 216 SAP: DEALS

- 13.1.4 IBM

- TABLE 217 IBM: BUSINESS OVERVIEW

- FIGURE 44 IBM: COMPANY SNAPSHOT

- TABLE 218 IBM: PRODUCTS OFFERED

- TABLE 219 IBM: PRODUCT LAUNCHES

- TABLE 220 IBM: DEALS

- 13.1.5 AVAYA

- TABLE 221 AVAYA: BUSINESS OVERVIEW

- FIGURE 45 AVAYA: COMPANY SNAPSHOT

- TABLE 222 AVAYA: PRODUCTS OFFERED

- TABLE 223 AVAYA: PRODUCT LAUNCHES

- TABLE 224 AVAYA: DEALS

- 13.1.6 OPENTEXT

- TABLE 225 OPENTEXT: BUSINESS OVERVIEW

- FIGURE 46 OPENTEXT: COMPANY SNAPSHOT

- TABLE 226 OPENTEXT: PRODUCTS OFFERED

- TABLE 227 OPENTEXT: PRODUCT LAUNCHES

- TABLE 228 OPENTEXT: DEALS

- 13.1.7 NICE

- TABLE 229 NICE: BUSINESS OVERVIEW

- FIGURE 47 NICE: COMPANY SNAPSHOT

- TABLE 230 NICE: PRODUCTS OFFERED

- TABLE 231 NICE: PRODUCT LAUNCHES

- TABLE 232 NICE: DEALS

- 13.1.8 SAS

- TABLE 233 SAS: BUSINESS OVERVIEW

- TABLE 234 SAS: PRODUCTS OFFERED

- TABLE 235 SAS: PRODUCT LAUNCHES

- TABLE 236 SAS: DEALS

- 13.1.9 VERINT SYSTEMS

- TABLE 237 VERINT SYSTEMS: BUSINESS OVERVIEW

- FIGURE 48 VERINT SYSTEMS: COMPANY SNAPSHOT

- TABLE 238 VERINT SYSTEMS: PRODUCTS OFFERED

- TABLE 239 VERINT SYSTEMS: PRODUCT LAUNCHES

- TABLE 240 VERINT SYSTEMS: DEALS

- 13.1.10 TERADATA

- TABLE 241 TERADATA: BUSINESS OVERVIEW

- FIGURE 49 TERADATA: COMPANY SNAPSHOT

- TABLE 242 TERADATA: PRODUCTS OFFERED

- TABLE 243 TERADATA: OTHERS

- TABLE 244 TERADATA: DEALS

- 13.1.11 TECH MAHINDRA

- 13.1.12 NOKIA

- 13.1.13 INMOMENT

- 13.1.14 ZENDESK

- 13.1.15 SITECORE

- 13.1.16 SPRINKLR

- 13.1.17 MEDALLIA

- 13.2 STARTUPS/SMES

- 13.2.1 MIXPANEL

- 13.2.2 NGDATA

- 13.2.3 ALGONOMY

- 13.2.4 SKYVERA

- 13.2.5 AMPERITY

- 13.2.6 CLARABRIDGE

- 13.2.7 MINDTOUCH

- 13.2.8 SOGOLYTICS

- 13.2.9 SEGMENT.IO

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 LIMITATIONS

- 14.2 SOCIAL MEDIA ANALYTICS MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.3 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT

- TABLE 245 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 246 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 14.2.4 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION

- TABLE 247 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION, 2015-2020 (USD MILLION)

- TABLE 248 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 14.2.5 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 249 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 250 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 14.2.6 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 251 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 252 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 14.2.7 SOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICAL

- TABLE 253 SOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 254 SOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2021-2026 (USD MILLION)

- 14.2.8 SOCIAL MEDIA ANALYTICS MARKET, BY REGION

- TABLE 255 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 256 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 14.3 CUSTOMER ANALYTICS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 CUSTOMER ANALYTICS MARKET, BY COMPONENT

- TABLE 257 CUSTOMER ANALYTICS MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- TABLE 258 SOLUTIONS: CUSTOMER ANALYTICS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 259 SERVICES: CUSTOMER ANALYTICS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- 14.3.4 CUSTOMER ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 260 CUSTOMER ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018-2025 (USD MILLION)

- 14.3.5 CUSTOMER ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 261 CUSTOMER ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018-2025 (USD MILLION)

- 14.3.6 CUSTOMER ANALYTICS MARKET, BY APPLICATION

- TABLE 262 CUSTOMER ANALYTICS MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

- 14.3.7 CUSTOMER ANALYTICS MARKET, BY DATA SOURCE

- TABLE 263 CUSTOMER ANALYTICS MARKET, BY DATA SOURCE, 2018-2025 (USD MILLION)

- 14.3.8 CUSTOMER ANALYTICS MARKET, BY INDUSTRY VERTICAL

- TABLE 264 CUSTOMER ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2018-2025 (USD MILLION)

- 14.3.9 CUSTOMER ANALYTICS MARKET, BY REGION

- TABLE 265 CUSTOMER ANALYTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS