|

|

市場調査レポート

商品コード

1796403

セカンドライフEVバッテリーの世界市場:用途、EV販売力学、EV電池需要と潜在転換率、バリューチェーン、エコシステムとビジネスモデルの分析、地域 - 予測(~2030年)Second Life EV Battery Market by Application (Utility Scale, Commercial/Industrial, Residential), EV Sales Dynamics, EV Battery Demand & Potential Conversion Rate, Value Chain, Ecosystem & Business Model Analysis, and Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| セカンドライフEVバッテリーの世界市場:用途、EV販売力学、EV電池需要と潜在転換率、バリューチェーン、エコシステムとビジネスモデルの分析、地域 - 予測(~2030年) |

|

出版日: 2025年08月08日

発行: MarketsandMarkets

ページ情報: 英文 105 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

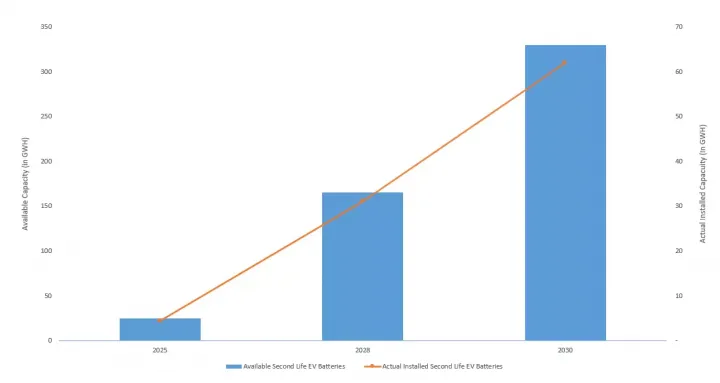

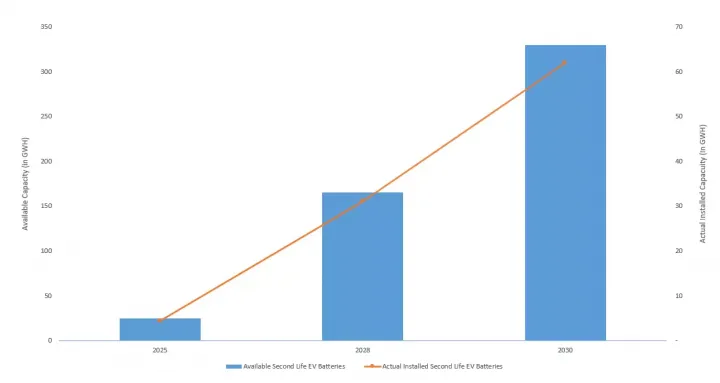

世界のセカンドライフEVバッテリーの市場規模は、2025年に推定25~30GWHであり、2030年までに330~350GWHに達すると予測され、予測期間にCAGRで約65%の成長が見込まれます。

市場の急成長は、循環型経済原則とエネルギー安全保障を促進する積極的で支持的な規制枠組みや、産業戦略、技術資金によって大きく後押しされています。EU Battery DirectiveやHorizon Europeのような資金提供プログラムは、欧州のバッテリー転用インフラを強化し、明確な使用済み基準を設定することを目的としています。Inflation Reduction Actに基づく税額控除やDOEが資金提供するパイロットプロジェクト(米国)などの連邦政府の優遇措置や、アジア諸国における補助金や野心的なバッテリーのリサイクル・リユース目標による官民パートナーシップの拡大は、エネルギー転換目標を支援すると同時に、セカンドライフEVバッテリー市場の需要を加速させています。

商工業セグメントは、セカンドライフEVバッテリーの2番目に大きな用途です。

商工業用途セグメントは、バックアップ電源、デマンドチャージ削減、EV充電ステーション、モバイル・モジュラーストレージ、倉庫やデータセンターでの太陽エネルギー最適化などの需要が高まっており、セカンドライフEVバッテリーの利用に弾みがつくと予測されます。中でもEV充電ステーションは、このセグメントの有望なユースケースです。EVバッテリーには70~80%の残存容量があり、無停電電源装置(UPS)やマイクログリッドの安定化に用いる年間50~150サイクルといった中サイクル需要への適応性があり、このことがバックアップ電源やピーク負荷管理への利用を支えています。Nissan、Renault、Tesla、Connected Energy(英国)、Enel X(イタリア)などの主要企業は、電力企業や技術パートナーと協力しながら、C&I部門でのセカンドライフバッテリーの展開を進めています。例えば、Connected Energyは英国のEV充電ハブにシステムを導入し、Enel Xはイタリアの空港でエネルギー貯蔵ソリューションを試験的に導入しています。Daimlerの15メガワット産業用蓄電システムや、AmazonによるロジスティクスセンターへのセカンドライフEVバッテリーの展開のような他のプロジェクトは、企業の持続可能性目標に向けた取り組みに寄与するとみられます。さらに、これらのバッテリーをオンサイト太陽光発電や風力発電と統合することで、グリッドの電力への依存を減らし、カーボンフットプリントを年間10~20%最小化することで、持続可能性と費用対効果が向上します。戦略的には、企業は電力需要の高い場所に蓄電・再使用施設を併設することで経済的利益を最大化し、最適化されたエネルギー管理とコスト削減を可能します。

欧州がセカンドライフEVバッテリーの大きなシェアを占めます。

欧州は、循環型経済への強い関心と支持的な規制環境を持つ、セカンドライフEVバッテリーの主要市場の1つです。この地域には、世界的な自動車OEMやEVバッテリーの転用企業があります。再生可能エネルギー発電の42%近くを再生可能エネルギーで賄うという目標を掲げていることから、ユーティリティ・グリッドスケールの蓄電池や産業用バックアップの需要が高まっています。これに伴い、Renaultは2018年、新品と中古のEVバッテリーを組み合わせたAdvanced Battery Storageプログラムを開始しました。これは60MWhのエネルギーを持つバッテリーで、フランスとドイツの各地に設置され、再生可能エネルギー源から発電された電力を貯蔵するための設備を備えています。Nissan、BMW、Audiといった他のOEMによる同様のプロジェクトは、2030年までの欧州のネットゼロ目標に沿ったものです。

当レポートでは、世界のセカンドライフEVバッテリーについて調査分析し、市場のエコシステム、技術ロードマップ、バリューチェーン、さまざまなビジネスモデルとその収益源などの情報を提供しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 市場の評価

- イントロダクション

- 市場規模と成長軌道

- バッテリーEVの売上と予測

- EVバッテリー市場の需要と予測

- バッテリー化学ポートフォリオ戦略

- コストパフォーマンスマトリクス:化学別

- セカンドライフEVバッテリー:技術ロードマップ

- バッテリー評価技術

- バッテリーマネジメントシステムの革新

- システム統合イノベーション

- ソフトウェアプラットフォーム戦略

- セカンドライフ転換率へのEV市場浸透率

第4章 バリューチェーン分析

- バリューチェーン

- セカンドライフEVバッテリー:各段階の付加価値

- 収集・ロジスティクス

- テスト・評価

- リファービッシュ・転用

- アプリケーション開発・統合

- 流通・市場展開

- 使用済み製品のリサイクル

第5章 EVバッテリー再利用市場:用途別

- イントロダクション

- ユーティリティスケールグリッドサービス

- 商工業

- 住宅用途

第6章 地域市場の分析

- イントロダクション

- 北米

- 概要

- 主な投資促進要因と政府の取り組み

- 成長の見通しと結論

- 欧州

- 概要

- 2030年までの戦略的連携、スケーラブルな応用、市場準備度

- 見通しと結論

- アジア太平洋

- 概要

- 製造リーダーシップの卓越性

- 見通しと結論

第7章 競合情勢

- 競合ポジショニング

- ビジネスモデル

- 所有モデル

- 収益源

- 顧客獲得戦略

- 収益性の分析

- 世界のOEMによるセカンドライフEVバッテリー設置プロジェクトとその容量

- 主なバッテリー転用業者とその現在の容量、予測される将来の容量

第8章 戦略的提言

第9章 主要企業の戦略的プロファイル

- 自動車OEM

- TESLA

- TOYOTA MOTOR CORPORATION

- NISSAN MOTOR CO., LTD.

- AB VOLVO

- VOLKSWAGEN GROUP

- BMW AG

- エネルギー貯蔵・セカンドライフバッテリーの専門家

- CONNECTED ENERGY

- B2U STORAGE SOLUTIONS, INC.

- REJOULE

- EATON

- E.BATTERY SYSTEMS AG

第10章 付録

List of Tables

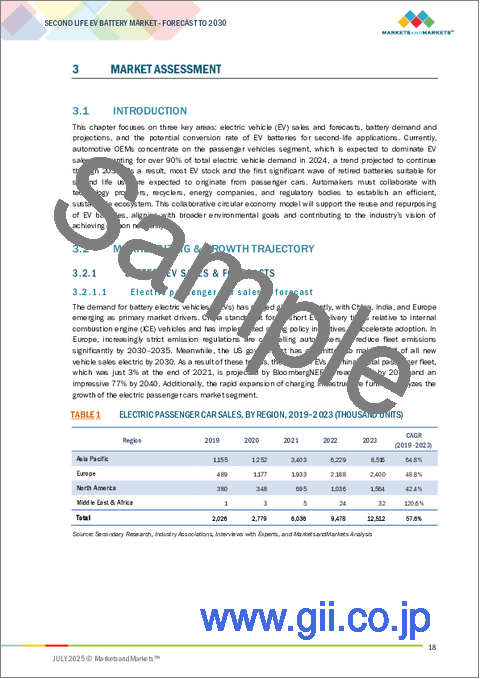

- TABLE 1 ELECTRIC PASSENGER CAR SALES, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 2 ELECTRIC PASSENGER CAR SALES, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 3 ELECTRIC COMMERCIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 4 ELECTRIC COMMERCIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 5 EV BATTERY MARKET, BY BATTERY TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 6 EV BATTERY MARKET, BY BATTERY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 7 EV BATTERY MARKET, BY BATTERY TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 8 BATTERY CHEMISTRIES IN CURRENT AND UPCOMING EV MODELS, BY OEM, 2025-2026

- TABLE 9 ASIA PACIFIC: CELL SUPPLIER-WISE BATTERY DEMAND PATTERN, 2022-2024 (MWH)

- TABLE 10 EUROPE: CELL SUPPLIER-WISE BATTERY DEMAND PATTERN, 2022-2024 (MWH)

- TABLE 11 NORTH AMERICA: CELL SUPPLIER-WISE BATTERY DEMAND PATTERN, 2022-2024 (MWH)

- TABLE 12 LITHIUM-ION: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 13 LITHIUM-ION: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 14 LITHIUM-ION: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 15 COMPARISON BETWEEN LITHIUM-ION BATTERY CHEMISTRIES

- TABLE 16 LITHIUM IRON PHOSPHATE: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 17 LITHIUM IRON PHOSPHATE: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 18 LITHIUM IRON PHOSPHATE: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 19 NICKEL MANGANESE COBALT: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 20 NICKEL MANGANESE COBALT: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 21 NICKEL MANGANESE COBALT: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

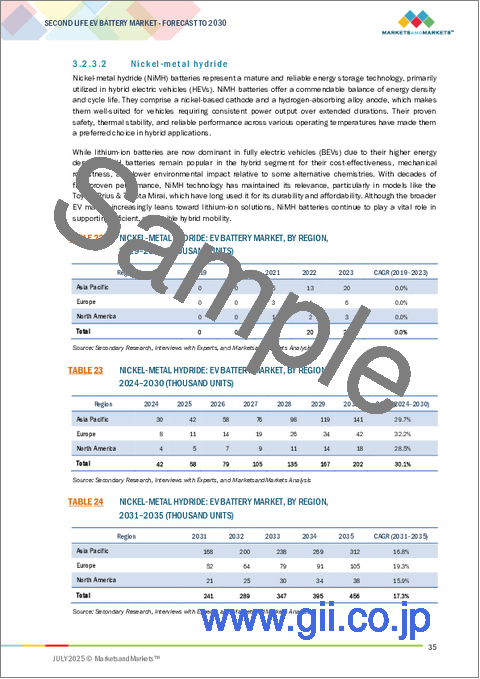

- TABLE 22 NICKEL-METAL HYDRIDE: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 23 NICKEL-METAL HYDRIDE: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 24 NICKEL-METAL HYDRIDE: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 25 SOLID-STATE BATTERIES: RECENT DEVELOPMENTS

- TABLE 26 SOLID-STATE BATTERIES: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 27 SOLID-STATE BATTERIES: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 28 SOLID-STATE BATTERIES: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 29 OTHER BATTERY TYPES: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 30 OTHER BATTERY TYPES: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 31 OTHER BATTERY TYPES: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 32 EV BATTERY CHEMISTRIES: COST VS. PERFORMANCE COMPARISON

- TABLE 33 NON-INVASIVE TESTING METHODS

- TABLE 34 LIST OF COMPANIES INVOLVED IN NON-INVASIVE TESTING METHODS

- TABLE 35 ADVANTAGES OF AI-BASED DEGRADATION PREDICTION TECHNOLOGY

- TABLE 36 BENEFITS OF ADAPTIVE CONTROL ALGORITHMS IN SECOND LIFE EV BATTERY MANAGEMENT SYSTEM (BMS)

- TABLE 37 MAJOR COMPANIES INVOLVED IN SECOND LIFE BATTERY INTEGRATION INNOVATION

- TABLE 38 LIST OF COMPANIES WORKING ON MODULAR ARCHITECTURE INTEGRATION FOR SECOND LIFE EV BATTERIES

- TABLE 39 KEY DEVELOPMENTS UNDERTAKEN BY COMPANIES IN POWER ELECTRONICS

- TABLE 40 COMPANIES WORKING ON ENERGY MANAGEMENT SYSTEM (EMS) FOR SECOND LIFE EV BATTERIES

- TABLE 41 VALUE CHAIN: STAGE-WISE VALUE DISTRIBUTION (%)

- TABLE 42 RECENT DEVELOPMENTS UNDERTAKEN BY PLAYERS IN MAINTAINING COLLECTION & LOGISTICS OF SECOND LIFE EV BATTERIES

- TABLE 43 RECENT DEVELOPMENTS UNDERTAKEN BY KEY PLAYERS IN TESTING AND ASSESSMENT OF SECOND LIFE EV BATTERIES

- TABLE 44 RECENT DEVELOPMENTS UNDERTAKEN BY KEY PLAYERS IN REFURBISHMENT AND REPURPOSING OF SECOND LIFE EV BATTERIES

- TABLE 45 KEY PLAYERS INVOLVED IN APPLICATION DEVELOPMENT AND INTEGRATION OF SECOND LIFE BATTERIES

- TABLE 46 KEY PLAYERS INVOLVED IN APPLICATION DISTRIBUTION AND MARKET DEPLOYMENT OF SECOND LIFE BATTERY

- TABLE 47 KEY PLAYERS INVOLVED IN END-OF-LIFE RECYCLING OF SECOND LIFE BATTERIES

- TABLE 48 KEY UTILITY-SCALE SECOND LIFE EV BATTERY STORAGE PROJECTS AND DEPLOYMENTS

- TABLE 49 KEY COMMERCIAL & INDUSTRIAL APPLICATIONS

- TABLE 50 EV CHARGING STATIONS AND SITES EQUIPPED WITH SECOND LIFE EV BATTERIES, BY REGION

- TABLE 51 NORTH AMERICA: KEY PLAYERS AND THEIR DEVELOPMENTS

- TABLE 52 EUROPE: KEY PLAYERS AND THEIR DEVELOPMENTS

- TABLE 53 ASIA PACIFIC: KEY PLAYERS AND THEIR DEVELOPMENTS

- TABLE 54 OWNERSHIP MODELS & THEIR BUSINESS OUTCOMES

- TABLE 55 BUSINESS MODELS & THEIR CASH FLOW APPROACH

- TABLE 56 KEY OEMS' SECOND LIFE EV BATTERY INSTALLATION PROJECTS & THEIR CAPACITIES

- TABLE 57 KEY BATTERY REPURPOSERS AND THEIR CURRENT VS. PROJECTED CAPACITY

- TABLE 58 TESLA: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 59 TESLA: GLOBAL EV SALES, 2022-2024

- TABLE 60 TOYOTA MOTOR CORPORATION: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 61 TOYOTA MOTOR CORPORATION: GLOBAL EV SALES, 2022-2024

- TABLE 62 NISSAN MOTORS CO., LTD.: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 63 NISSAN MOTORS CO., LTD.: GLOBAL EV SALES, 2022-2024

- TABLE 64 AB VOLVO: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 65 VOLKSWAGEN GROUP: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 66 VOLKSWAGEN GROUP: GLOBAL EV SALES, 2022-2024

- TABLE 67 BMW AG: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 68 BMW AG: GLOBAL EV SALES, 2022-2024

- TABLE 69 CONNECTED ENERGY: PRODUCTS OFFERED

- TABLE 70 B2U STORAGE SOLUTIONS, INC.: PRODUCTS OFFERED

- TABLE 71 REJOULE: PRODUCTS OFFERED

- TABLE 72 REJOULE: PROJECTS

- TABLE 73 EATON: RECENT FINANCIALS, 2023 VS. 2024

- TABLE 74 EATON: PRODUCTS OFFERED

- TABLE 75 E.BATTERY SYSTEMS AG: PRODUCTS OFFERED

List of Figures

- FIGURE 1 LIFE CYCLE OF EV BATTERIES OFFERING SECOND LIFE APPLICATIONS

- FIGURE 2 SECOND LIFE EV BATTERY INDUSTRY ECOSYSTEM

- FIGURE 3 SECOND LIFE EV BATTERY MARKET OUTLOOK

- FIGURE 4 ELECTRIC COMMERCIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024 VS. 2030 (UNITS)

- FIGURE 5 LITHIUM-ION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 6 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 LITHIUM-ION: COMPARISON BETWEEN WH/KG AND WH/L

- FIGURE 8 EVS EQUIPPED WITH LITHIUM-ION BATTERIES

- FIGURE 9 LITHIUM-ION BATTERY CELL SPECIFICATIONS

- FIGURE 10 COMPARISON BETWEEN LFP AND LITHIUM-ION BATTERIES

- FIGURE 11 COMPARISON BETWEEN LFP AND NCA/NMC BATTERY CHEMISTRIES

- FIGURE 12 FEATURES AND ADVANTAGES OF SODIUM-ION BATTERIES

- FIGURE 13 GLOBALLY AVAILABLE SECOND LIFE EV BATTERY CAPACITY VS. ACTUAL INSTALLED SECOND LIFE EV BATTERY CAPACITY, 2025 VS. 2030 (GIGAWATT-HOURS)

- FIGURE 14 SECOND LIFE EV BATTERY VALUE CHAIN: VALUE ADDED BY STAGE

- FIGURE 15 SECOND LIFE EV BATTERY MARKET, BY APPLICATION, 2025-2030 (GWH)

- FIGURE 16 GLOBAL EV BATTERY CAPACITY AVAILABILITY VS. ACTUAL INSTALLATION, 2025-2030 (GWH)

- FIGURE 17 SECOND LIFE EV BATTERY MARKET, BY REGION, 2025-2030 (GWH)

- FIGURE 18 SECOND LIFE EV BATTERIES: POTENTIAL BUSINESS MODELS

- FIGURE 19 STRATEGIC RECOMMENDATIONS FOR VARIOUS STAKEHOLDERS

The second life EV battery market is estimated at ~25-30 GWH in 2025 and is projected to reach ~330-350 GWH in 2030 at a CAGR of ~65% during the forecast period. The rapid growth of the second life EV battery market is significantly driven by proactive, supportive regulatory frameworks, industrial strategies, and technology funding to promote circular economy principles and energy security. Initiatives like the EU Battery Directive and funding programs like Horizon Europe are aimed at boosting battery repurposing infrastructure and setting clear end-of-life standards in Europe. Federal incentives, including tax credits under the Inflation Reduction Act and DOE-funded pilot projects (US) and scaling public-private partnerships, with subsidies and ambitious battery recycling & reuse targets in Asian countries, support energy transition targets while accelerating the second life EV battery market demand.

The commercial & industrial segment is the second prominent application of second Life EV batteries.

The commercial & industrial application segment is expected to gain momentum for second life EV battery usage with the growing demand for backup power, demand charge reduction, EV charging stations, mobile & modular storage, and solar energy optimization in warehouses or data centers. Among these, EV charging stations represent this segment's promising use case. EV batteries are left with 70-80% residual capacity and adaptability to medium-cycle demands, such as 50-150 cycles annually for uninterruptible power supply (UPS) and microgrid stabilization, which support their usage for backup power and peak load management. Leading companies like Nissan, Renault, Tesla, Connected Energy (UK), and Enel X (Italy) are advancing second-life battery deployments in the C&I sector, often collaborating with utilities and technology partners. For example, Connected Energy has implemented systems at UK EV charging hubs, while Enel X pilots energy storage solutions at Italian airports. Other projects like Daimler's 15 MW industrial storage system and Amazon's deployment of second life EV batteries into logistics centers will contribute to the commitment toward their corporate sustainability goals. Furthermore, integrating these batteries with on-site solar or wind generation improves sustainability and cost-effectiveness by reducing reliance on grid power and minimizing the carbon footprint by 10-20% annually. Strategically, businesses can maximize economic benefits by co-locating storage and reuse facilities at high-power demand sites, enabling optimized energy management and cost savings.

Europe accounts for a significant market share of second life EV batteries.

Europe is one of the prominent markets for second-life EV batteries with a strong focus on the circular economy and a supportive regulatory environment. The region is home to global automotive OEMs and repurposing companies for EV batteries. Regional efforts such as integration of advanced renewable energy with a target to generate nearly 42% of electricity from these sources will drive demand for utility & grid-scale storage and industrial backups. In line with this, Renault launched an "advanced battery storage program" in 2018 using a combination of new and used EV batteries. It has an energy of 60 MWh battery and is installed in various parts across France and Germany, and is equipped to store electricity generated from renewable sources. Similar projects from other OEMs like Nissan, BMW, and Audi are aligned with Europe's net-zero target by 2030. In addition, some of the promising European EV battery repurposers include Connected Energy (UK), Allye Energy (UK), Zenobe (UK), Voltfang (Germany), BeePlanet Factory (Spain), Libattion (Switzerland), and The Mobility House (Germany). These players are responsible for developing large-scale stationary storage using batteries from passenger cars, trucks & buses, and commercial fleets. Government support, such as USD 1.97 billion allocated through Horizon Europe for battery innovation, combined with corporate initiatives like Volkswagen's plan to reuse 40 GWh of second-life batteries, is helping reduce entry barriers. Additionally, the region's well-established recycling ecosystem, spearheaded by companies like Northvolt, contributes to the scalability of the market. In line with the strong pipeline of new entrants in the repurposed arena and the high-end project activity in Europe, this regional leadership is expected to remain instrumental in the long run.

Research Coverage:

The report provides an in-depth analysis of the second-life EV battery market, focusing on the market ecosystem, technology roadmap, value chain analysis, various business model & their revenue streams, and potential installation demand by application (utility-scale grid services, commercial & industrial, and residential) and region (Asia Pacific, Europe, and North America). It examines EV sales trends (passenger cars & commercial vehicles), current & futuristic EV battery demand (lithium-ion, nickel-metal hydride, solid-state, and other battery chemistries), and performance/cost matrix by different battery chemistries, and EV market penetration to second life conversion rates.

Additionally, the report assesses the effects of the rising EV stocks and presents a future outlook based on industry-wise consumption patterns. It includes detailed information about the significant factors boosting the global demand and key growth impetuses. A thorough analysis of key industry players provides insights into their business overviews, product offerings, key strategies, contracts, partnerships, agreements, product launches, mergers, and acquisitions.

Key Benefits of Buying this Report:

The report provides valuable information for current vs. projected second-life EV battery installation capabilities across key global markets. It will assist stakeholders in understanding the competitive landscape, positioning their businesses more effectively, and planning appropriate go-to-market strategies. Additionally, the report will offer insights into the current market conditions and highlight different ownership models & their revenue profit streams within the industry.

The report provides insights into the following points:

- Analysis of critical technology roadmap parameters such as battery assessment & testing approaches, cell-level & algorithm-based battery management system, various system integration techniques, and software platform strategies

- Market Development: Comprehensive market information (the report analyzes & recommends the most dominant application demand across the considered regions under the scope)

- Market Diversification: Exhaustive information about strategic collaborations, potential geography expansion, recent projections & their capacity, and investments in the second-life EV battery industry

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/technology offerings of leading OEMs & battery storage specialists such as Tesla, Volvo, Toyota Motor Corporation, BMW Group, Nissan Motor Corporation, Connected Energy, B2U Storage solutions, and Rejoule

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 GLOBAL SECOND LIFE EV BATTERY INDUSTRY OVERVIEW

- 1.1.1 MAJOR DEMAND ZONES AND APPLICATIONS FOR SECOND LIFE EV BATTERIES

- 1.2 SECOND LIFE EV BATTERY MARKET DEFINITION & CONCEPT

- 1.3 INDUSTRY ECOSYSTEM

2 EXECUTIVE SUMMARY

- 2.1 REPORT SUMMARY

3 MARKET ASSESSMENT

- 3.1 INTRODUCTION

- 3.2 MARKET SIZING & GROWTH TRAJECTORY

- 3.2.1 BATTERY EV SALES & FORECASTS

- 3.2.1.1 Electric passenger car sales & forecast

- 3.2.1.2 Electric commercial vehicle sales & forecast

- 3.2.2 EV BATTERY MARKET DEMAND & FORECAST

- 3.2.2.1 EV battery market, by battery chemistry, 2024 vs. 2035 (Thousand Units)

- 3.2.2.2 Upcoming EV models and their battery chemistries, 2025-2026

- 3.2.2.3 Regional demand patterns for EV batteries

- 3.2.2.3.1 Asia Pacific

- 3.2.2.3.1.1 Asia Pacific: Cell supplier-wise battery demand, 2022-2024 (Megawatt-hour)

- 3.2.2.3.2 Europe

- 3.2.2.3.2.1 Europe: Cell supplier-wise battery demand, 2022-2024 (Megawatt-hour)

- 3.2.2.3.3 North America

- 3.2.2.3.3.1 North America: Cell supplier-wise battery demand, 2022-2024 (Megawatt-hour)

- 3.2.2.3.1 Asia Pacific

- 3.2.3 BATTERY CHEMISTRY PORTFOLIO STRATEGY

- 3.2.3.1 Lithium-ion categories (NMC, LFP, NCA, LTO)

- 3.2.3.1.1 Lithium-ion battery cell specifications

- 3.2.3.1.2 Lithium iron phosphate

- 3.2.3.1.3 Nickel manganese cobalt

- 3.2.3.1.4 Lithium iron manganese phosphate

- 3.2.3.2 Nickel-metal hydride

- 3.2.3.3 Solid-state batteries

- 3.2.3.4 Other battery types

- 3.2.3.1 Lithium-ion categories (NMC, LFP, NCA, LTO)

- 3.2.4 PERFORMANCE/COST MATRIX, BY CHEMISTRY

- 3.2.1 BATTERY EV SALES & FORECASTS

- 3.3 SECOND LIFE EV BATTERY: TECHNOLOGY ROADMAP

- 3.3.1 BATTERY ASSESSMENT TECHNOLOGIES

- 3.3.1.1 Non-invasive testing methods

- 3.3.1.2 AI-based degradation prediction

- 3.3.2 BATTERY MANAGEMENT SYSTEM INNOVATIONS

- 3.3.2.1 Adaptive control algorithm

- 3.3.2.2 Cell-level management system

- 3.3.3 SYSTEM INTEGRATION INNOVATIONS

- 3.3.3.1 Modular architecture development

- 3.3.3.2 Thermal management innovation

- 3.3.3.3 Advancements in power electronics

- 3.3.4 SOFTWARE PLATFORM STRATEGY

- 3.3.4.1 Energy management system

- 3.3.4.2 Market participation software

- 3.3.1 BATTERY ASSESSMENT TECHNOLOGIES

- 3.4 EV MARKET PENETRATION INTO SECOND LIFE CONVERSION RATES

4 VALUE CHAIN ANALYSIS

- 4.1 VALUE CHAIN

- 4.1.1 SECOND LIFE EV BATTERY: VALUE ADDITION BY STAGE

- 4.1.2 COLLECTION & LOGISTICS

- 4.1.2.1 Key players and their recent developments in collection & logistics

- 4.1.3 TESTING & ASSESSMENT

- 4.1.3.1 Key players and their recent developments in testing capabilities

- 4.1.4 REFURBISHMENT & REPURPOSING

- 4.1.4.1 Major specialists and their recent developments in repurposing

- 4.1.5 APPLICATION DEVELOPMENT & INTEGRATION

- 4.1.5.1 Prominent application developers & integration providers and their recent developments

- 4.1.6 DISTRIBUTION & MARKET DEPLOYMENT

- 4.1.6.1 Key market deployment players and their recent developments

- 4.1.7 END-OF-LIFE RECYCLING

- 4.1.7.1 Key end-of-life recyclers and their recent developments

5 SECOND LIFE EV BATTERY MARKET, BY APPLICATION

- 5.1 INTRODUCTION

- 5.2 UTILITY-SCALE GRID SERVICES

- 5.2.1 PROMINENT UTILITY-SCALE PROVIDERS & THEIR CAPACITIES

- 5.2.2 RENEWABLE ENERGY

- 5.2.2.1 Solar power

- 5.2.2.2 Wind energy

- 5.3 COMMERCIAL & INDUSTRIAL

- 5.3.1 EV CHARGING STATIONS

- 5.3.2 EV CHARGING STATION SITES EQUIPPED WITH SECOND LIFE EV BATTERIES, BY REGION

- 5.4 RESIDENTIAL APPLICATION

6 REGIONAL MARKET ANALYSIS

- 6.1 INTRODUCTION

- 6.2 NORTH AMERICA

- 6.2.1 OVERVIEW

- 6.2.1.1 Key players and their second life EV battery installation projects

- 6.2.2 MAJOR INVESTMENT DRIVERS & GOVERNMENT INITIATIVES

- 6.2.3 GROWTH OUTLOOK & CONCLUSION

- 6.2.1 OVERVIEW

- 6.3 EUROPE

- 6.3.1 OVERVIEW

- 6.3.1.1 Key players and their second life EV battery installation projects

- 6.3.2 STRATEGIC ALIGNMENT, SCALABLE APPLICATIONS, AND MARKET READINESS BY 2030

- 6.3.3 OUTLOOK & CONCLUSION

- 6.3.1 OVERVIEW

- 6.4 ASIA PACIFIC

- 6.4.1 OVERVIEW

- 6.4.1.1 Key players and their second life EV battery installation projects

- 6.4.2 MANUFACTURING LEADERSHIP EXCELLENCE

- 6.4.3 OUTLOOK & CONCLUSION

- 6.4.1 OVERVIEW

7 COMPETITIVE LANDSCAPE

- 7.1 COMPETITIVE POSITIONING

- 7.2 BUSINESS MODELS

- 7.2.1 OWNERSHIP MODELS

- 7.2.1.1 Battery leasing & rentals

- 7.2.1.2 Battery-as-a-service (BaaS)

- 7.2.1.3 Mobile BESS for temporary power supply

- 7.2.1.4 Energy-as-a-service (EaaS)

- 7.2.2 REVENUE STREAMS

- 7.2.3 CUSTOMER ACQUISITION STRATEGIES

- 7.2.4 PROFITABILITY ANALYSIS

- 7.2.1 OWNERSHIP MODELS

- 7.3 GLOBAL OEMS' SECOND LIFE EV BATTERY INSTALLATION PROJECTS & THEIR CAPACITIES

- 7.4 KEY BATTERY REPURPOSERS AND THEIR CURRENT VS. PROJECTED CAPACITY

8 STRATEGIC RECOMMENDATIONS

9 KEY PLAYERS' STRATEGIC PROFILES

- 9.1 AUTOMOTIVE OEMS

- 9.1.1 TESLA

- 9.1.1.1 Overview

- 9.1.1.2 Recent financials

- 9.1.1.3 Tesla: Global EV sales, by key model

- 9.1.1.4 Strategic approach toward second life EV batteries

- 9.1.1.5 Recent developments, 2019-2025

- 9.1.2 TOYOTA MOTOR CORPORATION

- 9.1.2.1 Overview

- 9.1.2.2 Recent financials

- 9.1.2.3 Toyota Motor Corporation: Global EV sales, by key model

- 9.1.2.4 Strategic approach toward second life EV batteries

- 9.1.2.5 Recent developments, 2019-2025

- 9.1.3 NISSAN MOTOR CO., LTD.

- 9.1.3.1 Overview

- 9.1.3.2 Recent financials

- 9.1.3.3 Nissan Motors Co., Ltd.: Global EV sales, by key model

- 9.1.3.4 Continued investment in global network expansion for battery collection and repurposing technologies

- 9.1.3.5 Recent developments, 2010-2025

- 9.1.4 AB VOLVO

- 9.1.4.1 Overview

- 9.1.4.2 Recent financials

- 9.1.4.3 Strategic approach toward second life EV batteries

- 9.1.4.4 Recent developments, 2022-2023

- 9.1.5 VOLKSWAGEN GROUP

- 9.1.5.1 Overview

- 9.1.5.2 Recent financials

- 9.1.5.3 Volkswagen Group: Global EV sales, by key model

- 9.1.5.4 Strategic approach toward second life EV batteries

- 9.1.5.5 Recent developments, 2021-2025

- 9.1.6 BMW AG

- 9.1.6.1 Overview

- 9.1.6.2 Recent financials

- 9.1.6.3 BMW AG: Global EV sales, by key model

- 9.1.6.4 Strategic approach toward second life EV batteries

- 9.1.6.5 Recent developments, 2020-2025

- 9.1.1 TESLA

- 9.2 ENERGY STORAGE & SECOND LIFE BATTERY SPECIALISTS

- 9.2.1 CONNECTED ENERGY

- 9.2.1.1 Overview

- 9.2.1.2 Products, capacity, and applications

- 9.2.1.3 Recent developments, 2021-2025

- 9.2.2 B2U STORAGE SOLUTIONS, INC.

- 9.2.2.1 Overview

- 9.2.2.2 Products, capacity, and application

- 9.2.2.3 Recent developments, 2021-2024

- 9.2.3 REJOULE

- 9.2.3.1 Overview

- 9.2.3.2 Products, capacity, and application

- 9.2.3.3 Projects

- 9.2.3.4 Recent developments, 2023-2025

- 9.2.4 EATON

- 9.2.4.1 Overview

- 9.2.4.2 Recent financials

- 9.2.4.3 Products, capacity, and application

- 9.2.4.4 Recent developments, 2024

- 9.2.5 E.BATTERY SYSTEMS AG

- 9.2.5.1 Overview

- 9.2.5.2 Products, capacity, and application

- 9.2.5.3 Recent developments, 2021-2025

- 9.2.1 CONNECTED ENERGY

10 APPENDIX

- 10.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 10.2 AUTHOR DETAILS