|

|

市場調査レポート

商品コード

1650854

ソフトウェアデファインドビークル(SDV)の世界市場:SDVタイプ別、E/Eアーキテクチャ別、車両タイプ別、地域別 - 予測(~2030年)Software Defined Vehicle Market by SDV Type (Semi-SDV. SDV), E/E Architecture (Distributed, Domain Centralised, Zonal Control), Vehicle Type (Passenger Car and Light Commercial Vehicle) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ソフトウェアデファインドビークル(SDV)の世界市場:SDVタイプ別、E/Eアーキテクチャ別、車両タイプ別、地域別 - 予測(~2030年) |

|

出版日: 2025年02月01日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のソフトウェアデファインドビークルの市場規模は、2024年の2,135億米ドルから2030年までに1兆2,376億米ドルに達すると予測され、CAGRで34.0%の成長が見込まれます。

SDVは、次のようなさまざまな要因により、ますます普及しています。消費者は、ドライバーごとにカスタマイズされた設定や選好により、高度にパーソナライズされた運転体験から利益を得ることができます。OEMにとって、SDVはソフトウェアベースの機能やサービスを販売できるようにすることで、新たな収益源を開発します。さらに、有料モビリティモデルの台頭により、カーシェアリングやサブスクリプションのような柔軟な利用オプションが提供され、現代の消費者の選好に対応しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | SDVタイプ、E/Eアーキテクチャ、車両タイプ、地域 |

| 対象地域 | アジア太平洋、北米、欧州 |

「E/Eアーキテクチャ別では、ゾーンコントローラーアーキテクチャが予測期間に市場における主要セグメントとなる可能性が高いです。」

SDVは、運転の快適性、車両の安全性、故障検出の向上を目的に開発された電子機能の数々を搭載しています。Tesla(米国)、NIO(中国)、XPENG(中国)、ZEEKR(中国)、Li Auto Inc.(中国)などのSDVプロバイダーは、SDVの先進の統合ソフトウェア機能を利用するために、ゾーンコントロールユニットに始まるソフトウェアファーストのアプローチを採用しています。レガシーOEMも、SDVの移行に伴い、ゾーンコンピュートシステムへの移行を計画しています。Volkswagenは、2026年から自社の車両にXPENGのCESアーキテクチャを統合し、ゾーンコントロールセントラルコンピューティングを搭載する予定です。Hyundai、Mercedes、BMWなどの他のOEMも2026年~2028年にゾーンコントロールアーキテクチャに移行し、最新の車両プラットフォームに組み込む予定です。ゾーンコントロールにより、OEMは車両1台あたり4~10台のHPCを通じて車両全体を制御することができ、車両内の過剰な配線の必要性を減らすことができます。したがって、ゾーンコントロールへの移行は、SDVの可能性を完全に実現するための重要なステップであり、より合理的で、適応性が高く、効率的な車両アーキテクチャを提供するものです。

「欧州は市場に高い成長可能性を示します。」

欧州は、厳しい安全要件とよりよいユーザーエクスペリエンスへのニーズを特徴とする市場に大きな成長機会をもたらしています。欧州には、Volkswagen、BMW、Renault、Stellantis、Mercedes-Benzなど、SDVへの移行を進めている主要OEMがあります。欧州では、OEM各社が戦略的提携や買収を通じて拡大しています。例えば2023年2月、CARIAD GmbHはHexad GmbHのMobility Services Platform部門を買収し、Volkswagen Groupのデジタル自動車エコシステム向けのクラウドサービス機能を強化しました。この買収により、75人を超えるHexadの開発者がCARIADに統合され、グループブランド全体のデジタルサービス向上に向けたソフトウェア開発が強化されました。また、2024年3月には、Volkswagen Groupの23の地域工場を活用し、欧州におけるSDVの開発と生産をサポートする予定です。

当レポートでは、世界のソフトウェアデファインドビークル(SDV)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- SDVエコシステムの企業にとって魅力的な機会

- SDV市場の将来:地域別

- SDV市場の将来:SDVタイプ別

- SDV市場の将来:車両タイプ別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- エコシステム分析

- OEM

- Tier 1ハードウェアプロバイダー

- Tier 2企業

- チッププロバイダー

- ソフトウェアプロバイダー

- クラウドプロバイダー

- SDVの進化

- 特許分析

- 規制情勢

- 自動運転車の使用に関する規制:国別

- 規制機関、政府機関、その他の組織

- 主な会議とイベント(2025年~2026年)

- 技術分析(SDVの主要イネーブラー)

- イントロダクション

- セントラルHPC

- ゾーンコントローラー

- OTAアップデート

- スケーラブルE/Eアーキテクチャ

- OEMのSDVシフトの比較

- レガシーOEMがSDVシフトに向けて採用した戦略

- SDVエコシステムにおける技術企業とクラウドプロバイダーの比較

- SDVに移行するOEMのE/Eアーキテクチャプラン

- ケーススタディ分析

第6章 SDV市場の将来:E/Eアーキテクチャ別

- イントロダクション

- 分散アーキテクチャ

- ドメイン集中アーキテクチャ

- ゾーンコントロールアーキテクチャ

第7章 SDV市場の将来:SDVタイプ別

- イントロダクション

- SDV

- セミSDV

- 重要考察

第8章 SDV市場の将来:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 重要考察

第9章 SDV市場の将来:地域別

- イントロダクション

- アジア太平洋

- 生成AIの影響の分析

- 中国

- 日本

- 韓国

- 欧州

- 生成AIの影響の分析

- ドイツ

- フランス

- 英国

- スペイン

- 北米

- 生成AIの影響の分析

- 米国

- カナダ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略

- 市場シェア分析(2023年)

- 収益分析(2019年~2023年)

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要SDVプロバイダー

- TESLA

- LI AUTO INC.

- ZEEKR

- XPENG INC.

- NIO

- RIVIAN

- SDVに移行する主要OEM

- VOLKSWAGEN AG

- HYUNDAI MOTOR CORPORATION

- FORD MOTOR COMPANY

- GENERAL MOTORS

- RENAULT GROUP

- TOYOTA MOTOR CORPORATION

- STELLANTIS

- MERCEDES-BENZ AG

- BYD

- BMW

- 主要技術インテグレーター

- NVIDIA CORPORATION

- QUALCOMM TECHNOLOGIES INC.

- BLACKBERRY LIMITED

- VECTOR INFORMATIK GMBH

- GOOGLE INC.

- AMAZON INC.

- MICROSOFT

- APEX.AI

- MOBILEYE

- TENCENT

- ALIBABA

- HORIZON ROBOTICS

- TATA TECHNOLOGIES

- KPIT TECHNOLOGIES

第12章 MARKETSANDMARKETSによる提言

- 後方統合によりソフトウェアシステムを開発するレガシーOEM

- 内燃機関車におけるSDVへの移行は遅くなり、市場は高級車が主導する

- ドメイン集中アーキテクチャとゾーンコントロールに移行するレガシーOEM

- 結論

第13章 付録

List of Tables

- TABLE 1 FUTURE OF SDV MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 2 FUTURE OF SDV MARKET DEFINITION, BY SDV TYPE

- TABLE 3 FUTURE OF SDV MARKET DEFINITION, BY E/E ARCHITECTURE

- TABLE 4 INCLUSIONS AND EXCLUSIONS

- TABLE 5 USD EXCHANGE RATES

- TABLE 6 NETWORK SPEED REQUIRED FOR PERFORMANCE

- TABLE 7 PAID SERVICES PROVIDED BY KEY OEMS

- TABLE 8 IMPACT OF MARKET DYNAMICS

- TABLE 9 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 LIST OF PATENTS GRANTED IN SOFTWARE-DEFINED VEHICLE MARKET, 2021-2024

- TABLE 11 TESTING PARAMETERS FOR NEW CAR MODELS

- TABLE 12 LEGISLATION FOR ADAS/AUTONOMOUS VEHICLES IN US

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 OEMS PROVIDING OVER-THE-AIR UPDATES

- TABLE 18 COMPUTE PLATFORM PROVIDERS

- TABLE 19 CLOUD PROVIDERS

- TABLE 20 REFERENCE OS AND SOFTWARE SUITE PROVIDERS

- TABLE 21 OEM PLANS FOR NEW E/E ARCHITECTURE

- TABLE 22 FUTURE OF SDV MARKET, BY SDV TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 23 FUTURE OF SDV MARKET, BY SDV TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 24 FUTURE OF SDV MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 25 FUTURE OF SDV MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 26 PASSENGER CAR: FUTURE OF SDV MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 27 PASSENGER CAR: FUTURE OF SDV MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 28 LIGHT COMMERCIAL VEHICLE: FUTURE OF SDV MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 29 LIGHT COMMERCIAL VEHICLE: FUTURE OF SDV MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 30 FUTURE OF SDV MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 31 FUTURE OF SDV MARKET, BY REGION, 2024-2030 (USD BILLION)

- TABLE 32 FUTURE OF SDV MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 33 FUTURE OF SDV MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 34 ASIA PACIFIC: FUTURE OF SDV MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 35 ASIA PACIFIC: FUTURE OF SDV MARKET, 2024-2030 (THOUSAND UNITS)

- TABLE 36 EUROPE: FUTURE OF SDV MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 37 EUROPE: FUTURE OF SDV MARKET, 2024-2030 (THOUSAND UNITS)

- TABLE 38 NORTH AMERICA: FUTURE OF SDV MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 39 NORTH AMERICA: FUTURE OF SDV MARKET, 2024-2030 (THOUSAND UNITS)

- TABLE 40 KEY PLAYER STRATEGIES, 2021-2024

- TABLE 41 FUTURE OF SDV MARKET: VEHICLE TYPE FOOTPRINT, 2023

- TABLE 42 FUTURE OF SDV MARKET: REGION FOOTPRINT, 2023

- TABLE 43 FUTURE OF SDV MARKET: LIST OF KEY START-UPS/SMES

- TABLE 44 FUTURE OF SDV MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 45 FUTURE OF SDV MARKET: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 46 FUTURE OF SDV MARKET: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 47 TESLA: COMPANY OVERVIEW

- TABLE 48 TESLA: PRODUCTS OFFERED

- TABLE 49 TESLA: PRODUCT LAUNCHES

- TABLE 50 TESLA: DEALS

- TABLE 51 LI AUTO INC.: COMPANY OVERVIEW

- TABLE 52 LI AUTO INC.: PRODUCTS OFFERED

- TABLE 53 LI AUTO INC.: PRODUCT LAUNCHES

- TABLE 54 LI AUTO INC.: DEALS

- TABLE 55 ZEEKR: COMPANY OVERVIEW

- TABLE 56 ZEEKR: PRODUCTS OFFERED

- TABLE 57 ZEEKR: PRODUCT LAUNCHES

- TABLE 58 ZEEKR: DEALS

- TABLE 59 ZEEKR: EXPANSIONS

- TABLE 60 ZEEKR: OTHERS

- TABLE 61 XPENG INC.: COMPANY OVERVIEW

- TABLE 62 XPENG INC.: PRODUCTS OFFERED

- TABLE 63 XPENG INC.: PRODUCT LAUNCHES

- TABLE 64 XPENG INC.: DEALS

- TABLE 65 XPENG INC.: OTHERS

- TABLE 66 NIO: COMPANY OVERVIEW

- TABLE 67 NIO: PRODUCTS OFFERED

- TABLE 68 NIO: PRODUCT LAUNCHES

- TABLE 69 NIO: DEALS

- TABLE 70 RIVIAN: COMPANY OVERVIEW

- TABLE 71 RIVIAN: PRODUCTS OFFERED

- TABLE 72 RIVIAN: PRODUCT LAUNCHES

- TABLE 73 RIVIAN: DEALS

- TABLE 74 VOLKSWAGEN AG: COMPANY OVERVIEW

- TABLE 75 VOLKSWAGEN AG: PRODUCTS OFFERED

- TABLE 76 VOLKSWAGEN AG: PRODUCT LAUNCHES

- TABLE 77 VOLKSWAGEN AG: DEALS

- TABLE 78 VOLKSWAGEN AG: EXPANSIONS

- TABLE 79 HYUNDAI MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 80 HYUNDAI MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 81 HYUNDAI MOTOR CORPORATION: DEALS

- TABLE 82 FORD MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 83 FORD MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 84 FORD MOTOR COMPANY: PRODUCT LAUNCHES

- TABLE 85 FORD MOTOR COMPANY: DEALS

- TABLE 86 FORD MOTOR COMPANY: OTHERS

- TABLE 87 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 88 GENERAL MOTORS: PRODUCTS OFFERED

- TABLE 89 GENERAL MOTORS: PRODUCT LAUNCHES

- TABLE 90 GENERAL MOTORS: DEALS

- TABLE 91 RENAULT GROUP: COMPANY OVERVIEW

- TABLE 92 RENAULT GROUP: PRODUCTS OFFERED

- TABLE 93 RENAULT GROUP: PRODUCT LAUNCHES

- TABLE 94 RENAULT GROUP: DEALS

- TABLE 95 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 96 TOYOTA MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 97 TOYOTA MOTOR CORPORATION: DEALS

- TABLE 98 STELLANTIS: COMPANY OVERVIEW

- TABLE 99 STELLANTIS: PRODUCTS OFFERED

- TABLE 100 STELLANTIS: PRODUCT LAUNCHES

- TABLE 101 STELLANTIS: DEALS

- TABLE 102 MERCEDES-BENZ AG: COMPANY OVERVIEW

- TABLE 103 MERCEDES-BENZ AG: PRODUCTS OFFERED

- TABLE 104 MERCEDES-BENZ AG: PRODUCT LAUNCHES

- TABLE 105 MERCEDES-BENZ AG: DEALS

- TABLE 106 BYD: COMPANY OVERVIEW

- TABLE 107 BYD: PRODUCTS OFFERED

- TABLE 108 BYD: PRODUCT LAUNCHES

- TABLE 109 BYD: DEALS

- TABLE 110 BMW: COMPANY OVERVIEW

- TABLE 111 BMW: PRODUCTS OFFERED

- TABLE 112 BMW: PRODUCT LAUNCHES

- TABLE 113 BMW: DEALS

- TABLE 114 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 115 QUALCOMM TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 116 BLACKBERRY LIMITED: COMPANY OVERVIEW

- TABLE 117 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- TABLE 118 GOOGLE INC.: COMPANY OVERVIEW

- TABLE 119 AMAZON INC.: COMPANY OVERVIEW

- TABLE 120 MICROSOFT: COMPANY OVERVIEW

- TABLE 121 APEX.AI: COMPANY OVERVIEW

- TABLE 122 MOBILEYE: COMPANY OVERVIEW

- TABLE 123 TENCENT: COMPANY OVERVIEW

- TABLE 124 ALIBABA: COMPANY OVERVIEW

- TABLE 125 HORIZON ROBOTICS: COMPANY OVERVIEW

- TABLE 126 TATA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 127 KPIT TECHNOLOGIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FUTURE OF SDV MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 9 DEMAND AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 10 SDV GROWTH FACTORS: DATA STREAMS FUEL NEW FEATURES AND SERVICES

- FIGURE 11 GLOBAL SDV SHIFT SCENARIO

- FIGURE 12 KEY PLAYERS: SDV SHIFT COMPARISON

- FIGURE 13 SEMI-SDV TO BE TRANSITIONAL PHASE IN SHIFT TO SDV

- FIGURE 14 INCREASING DEMAND FOR BETTER DRIVING EXPERIENCE AND OEM PLANS FOR ALTERNATIVE REVENUE STREAMS TO DRIVE MARKET

- FIGURE 15 EUROPE TO BE FASTEST-GROWING MARKET WITH MAJOR EUROPEAN AUTOMAKERS SHIFTING TO DIGITAL FIRST ECOSYSTEM

- FIGURE 16 SEMI-SDV SEGMENT TO ACT AS TRANSITION PHASE FOR SDV SHIFT

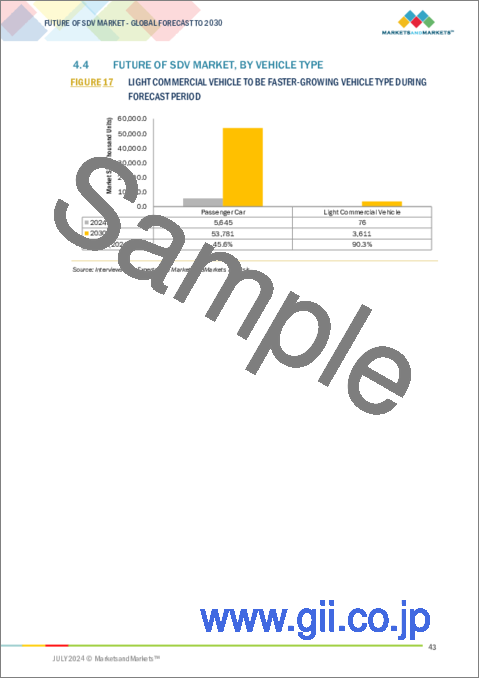

- FIGURE 17 LIGHT COMMERCIAL VEHICLE TO BE FASTER-GROWING VEHICLE TYPE DURING FORECAST PERIOD

- FIGURE 18 INTEGRATED COMPONENTS OF SOFTWARE-DEFINED VEHICLES

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 COST SAVINGS BY REGULAR OVER-THE-AIR UPDATES

- FIGURE 21 PERSONALIZED CLIENT ENGAGEMENT: BENEFITS TO CUSTOMERS

- FIGURE 22 QUALCOMM'S SNAPDRAGON DIGITAL CHASSIS PLATFORM

- FIGURE 23 5G USE CASES IN AUTOMOTIVE SECTOR

- FIGURE 24 OVER-THE-AIR UPDATE METHOD

- FIGURE 25 WORKING OF INTRUSION DETECTION SYSTEMS

- FIGURE 26 SERVICE-ORIENTED VEHICLE DIAGNOSTICS

- FIGURE 27 AUTOMOTIVE TECHNOLOGY STACK

- FIGURE 28 DIGITAL TWIN ECOSYSTEM

- FIGURE 29 ECOSYSTEM ANALYSIS

- FIGURE 30 OEM'S SHIFT TOWARD SOFTWARE-DEFINED VEHICLES

- FIGURE 31 NUMBER OF PATENTS GRANTED FOR SOFTWARE-DEFINED VEHICLES, 2014-2024

- FIGURE 32 CENTRAL HIGH-PERFORMANCE COMPUTING IN SDV

- FIGURE 33 NXP SEMICONDUCTORS: ZONE CONTROL POC

- FIGURE 34 OVER-THE-AIR FIRMWARE UPDATE THROUGH DEVICE MANAGEMENT SYSTEM

- FIGURE 35 TRENDS OF FUTURE E/E-ARCHITECTURE

- FIGURE 36 COMPARISON OF SDV OFFERINGS BY LEADING OEMS

- FIGURE 37 STRATEGIES FOLLOWED BY KEY LEGACY OEMS FOR SDV SHIFT

- FIGURE 38 OEM DASHBOARD ON SDV OFFERING AND EFFORTS BY KEY LEGACY OEMS

- FIGURE 39 CURRENT E/E ARCHITECTURE SCENARIO

- FIGURE 40 SHIFT IN E/E ARCHITECTURE FOR VEHICLE ELECTRONICS CONTROL

- FIGURE 41 SDV SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 FUTURE OF SDV MARKET, BY REGION, 2024-2030

- FIGURE 44 ASIA PACIFIC: FUTURE OF SDV MARKET SNAPSHOT

- FIGURE 45 SDV MARKET IN CHINA (2023)

- FIGURE 46 EUROPE: FUTURE OF SDV MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- FIGURE 47 NORTH AMERICA: FUTURE OF SDV MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE ANALYSIS, 2023

- FIGURE 49 REVENUE ANALYSIS OF OEMS, 2019-2023

- FIGURE 50 FUTURE OF SDV MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 51 FUTURE OF SDV MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 52 FUTURE OF SDV MARKET: OVERALL FOOTPRINT FOR OEMS TRANSITIONING TO SDV, 2023

- FIGURE 53 FUTURE OF SDV MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 54 VALUATION OF TOP 5 COMPANIES (OEMS)

- FIGURE 55 FINANCIAL METRICS OF TOP 5 PLAYERS (OEMS)

- FIGURE 56 TESLA: COMPANY SNAPSHOT

- FIGURE 57 TESLA: SDV SHIFT JOURNEY

- FIGURE 58 LI AUTO INC.: COMPANY SNAPSHOT

- FIGURE 59 LI AUTO INC.: SDV SHIFT JOURNEY

- FIGURE 60 ZEEKR: SDV SHIFT JOURNEY

- FIGURE 61 XPENG INC.: COMPANY SNAPSHOT

- FIGURE 62 XPENG INC.: SDV SHIFT JOURNEY

- FIGURE 63 NIO: COMPANY SNAPSHOT

- FIGURE 64 NIO: SDV SHIFT JOURNEY

- FIGURE 65 RIVIAN: COMPANY SNAPSHOT

- FIGURE 66 RIVIAN: SDV SHIFT JOURNEY

- FIGURE 67 VOLKSWAGEN AG: COMPANY SNAPSHOT

- FIGURE 68 VOLKSWAGEN AG: SDV SHIFT JOURNEY

- FIGURE 69 HYUNDAI MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 HYUNDAI MOTOR CORPORATION: SDV SHIFT JOURNEY

- FIGURE 71 FORD MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 72 FORD MOTOR COMPANY: SDV SHIFT JOURNEY

- FIGURE 73 GENERAL MOTORS: COMPANY SNAPSHOT

- FIGURE 74 GENERAL MOTORS: SDV SHIFT JOURNEY

- FIGURE 75 RENAULT GROUP: COMPANY SNAPSHOT

- FIGURE 76 RENAULT GROUP: SDV SHIFT JOURNEY

- FIGURE 77 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 TOYOTA MOTOR CORPORATION: SDV SHIFT JOURNEY

- FIGURE 79 STELLANTIS: COMPANY SNAPSHOT

- FIGURE 80 STELLANTIS: SDV SHIFT JOURNEY

- FIGURE 81 STELLANTIS: VEHICLE PLATFORMS

- FIGURE 82 MERCEDES-BENZ AG: COMPANY SNAPSHOT

- FIGURE 83 MERCEDES-BENZ AG: SDV SHIFT JOURNEY

- FIGURE 84 BYD: COMPANY SNAPSHOT

- FIGURE 85 BYD: SDV SHIFT JOURNEY

- FIGURE 86 BMW: COMPANY SNAPSHOT

- FIGURE 87 BMW: SDV SHIFT JOURNEY

- FIGURE 88 NVIDIA CORPORATION: SDV OFFERINGS

- FIGURE 89 QUALCOMM TECHNOLOGIES INC.: SDV OFFERING

- FIGURE 90 QUALCOMM TECHNOLOGIES INC.: SNAPDRAGON DIGITAL CHASSIS

- FIGURE 91 BLACKBERRY LIMITED: SDV OFFERING

- FIGURE 92 VECTOR INFORMATIK GMBH: SDV OFFERING

- FIGURE 93 GOOGLE INC.: SDV OFFERING

- FIGURE 94 AMAZON INC.: SDV OFFERING

- FIGURE 95 STRATEGIC RECOMMENDATIONS FOR OEMS IN SDV MARKET

The Software Defined Vehicle Market size is projected to grow from USD 213.5 billion in 2024 to USD 1,237.6 billion by 2030, at a CAGR of 34.0%. SDVs are becoming increasingly popular due to various factors such as Consumers benefit from a highly personalized driving experience, with settings and preferences customized as per drivers. For OEMs, SDVs open up new revenue streams by allowing them to sell software-based features and services. Moreover, the rise of pay-per-use mobility models offers flexible usage options like car-sharing and subscriptions, catering to modern consumer preferences.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | SDV Type, E/E Architecture, Vehicle Type (Passenger Car and Light Commercial Vehicle) and Region - Global Forecast to 2030 |

| Regions covered | Asia Pacific, North America, and Europe. |

"Zonal Controller Architecture is likely to be the leading segment in the Software Defined Vehicle market by E/E Architecture during the forecast period."

SDVs come with an array of electronic features developed for improved driving comfort, vehicle safety, and fault detection. SDV providers such as Tesla (US), NIO (China), XPENG (China), ZEEKR (China), and Li Auto Inc. (China) have adopted a software-first approach in which they start with zonal control units to utilize the advanced and integrated software features of SDVs. Legacy OEMs also plan to shift to zonal compute systems with their SDV shift. Volkswagen plans to integrate XPENG's CES architecture in its vehicles, starting from 2026, which will be equipped with zonal control central computing. Other OEMs such as Hyundai, Mercedes, and BMW also plan to shift to zonal control architecture by 2026-2028, incorporated in their latest vehicle platforms. Zonal controllers allow OEMs to control the whole vehicle through 4-10 HPCs per vehicle and reduce the need for excessive wiring in the vehicles. Thus, the transition to zonal control is seen as a significant step towards fully realizing the potential of SDVs, offering a more streamlined, adaptable, and efficient vehicle architecture.

"Europe shows high growth potential for Software Defined Vehicle market."

Europe presents a huge growth opportunity for the Software Defined Vehicle market, which is characterized by stringent safety requirements and a need for better user experience. It is home to leading OEMs such as Volkswagen, BMW, Renault, Stellantis, and Mercedes-Benz, which are transitioning toward SDVs. In Europe, OEMs are expanding in the region through strategic partnerships and acquisitions. For instance, in February 2023, CARIAD GmbH acquired Hexad GmbH's Mobility Services Platform unit which enhanced its cloud service capabilities for Volkswagen Group's digital automotive ecosystem. This acquisition integrated over 75 Hexad developers into CARIAD which strengthened its software development for improved digital services across Group brands. Also, in March 2024, Volkswagen Group plans to utilize its 23 regional plants to support the development and production of SDVs in Europe.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the SDV market. The break-up of the primaries is as follows:

- By Company Type: Tier I - 42%, Tier II - 40%, and OEM -18%,

- By Designation: C-level Executives- 57%, Directors - 29%, and Executives - 14%

- By Region: North America - 39%, Europe - 33%, and Asia Pacific - 28%

The Software Defined Vehicle market comprises major manufacturers such as Tesla (US), Li Auto Inc. (China), NIO (China), Rivian (US), XPENG Inc. (China), and ZEEKR (China), etc.

Research Coverage:

The study covers the Software Defined Vehicle market across various segments. It aims to estimate the market size and future growth potential of this market across different segments such as SDV type, vehicle type, E/E architecture, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes Software Defined Vehicle Market by SDV type (Semi-SDV, SDV), vehicle type (Passenger Car, Light Commercial Vehicle), E/E architecture, (Distributed Architecture, Domain Centralised Architecture, Zonal Control Architecture) and region Region (Asia Pacific, Europe, and North America).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Software Defined Vehicle market. A detailed analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the Software Defined Vehicle market. This report covers a competitive analysis of SMEs/startups in the Software Defined Vehicle market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Software Defined Vehicle market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Reduced recall and manufacturing costs, personalized client engagement, integration of ADAS digital cockpits, and increasing adoption of 5G technology), restraints (Limited over-the-air updates and increase in risk of cyberattacks), opportunities (Remote diagnostics, Pay-per-use mobility, SDV platform monetization and Digital twin for emergency repair), and challenges (Complex software updates and security patching and risk of data breach) influencing the growth of the Software Defined Vehicle market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Software Defined Vehicle market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Software Defined Vehicle market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Software Defined Vehicle market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Tesla (US), Li Auto Inc. (China), NIO (China), Rivian (US), XPENG Inc. (China), and ZEEKR (China), among others in the Software Defined Vehicle market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.1 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants (OEMs, hardware providers, tech integrators)

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 List of primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SDV ECOSYSTEM

- 4.2 FUTURE OF SDV MARKET, BY REGION

- 4.3 FUTURE OF SDV MARKET, BY SDV TYPE

- 4.4 FUTURE OF SDV MARKET, BY VEHICLE TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Reduced recall and manufacturing costs

- 5.2.1.2 Personalized client engagement

- 5.2.1.3 Integration of ADAS digital cockpits

- 5.2.1.4 Increasing adoption of 5G technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited over-the-air updates

- 5.2.2.2 Increase in risk of cyberattacks in SDVs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Remote diagnostics

- 5.2.3.2 Pay-per-use mobility

- 5.2.3.3 SDV platform monetization

- 5.2.3.4 Digital twin for emergency repair

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex software updates and security patching

- 5.2.4.2 Risk of data breach

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 OEMS

- 5.3.2 TIER 1 HARDWARE PROVIDERS

- 5.3.3 TIER 2 PLAYERS

- 5.3.4 CHIP PROVIDERS

- 5.3.5 SOFTWARE PROVIDERS

- 5.3.6 CLOUD PROVIDERS

- 5.4 EVOLUTION OF SDV

- 5.5 PATENT ANALYSIS

- 5.5.1 INTRODUCTION

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATIONS ON AUTONOMOUS VEHICLE USAGE, BY COUNTRY

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TECHNOLOGY ANALYSIS (KEY ENABLERS OF SDV)

- 5.8.1 INTRODUCTION

- 5.8.2 CENTRAL HPC

- 5.8.3 ZONAL CONTROLLERS

- 5.8.4 OVER-THE-AIR UPDATES

- 5.8.5 SCALABLE E/E ARCHITECTURE

- 5.9 OEM SDV SHIFT COMPARISON

- 5.10 STRATEGIES FOLLOWED BY LEGACY OEMS FOR SDV SHIFT

- 5.10.1 OEM DASHBOARD FOR SDV OFFERINGS BY KEY OEMS

- 5.11 COMPARISON OF TECH PLAYERS AND CLOUD PROVIDERS IN SDV ECOSYSTEM

- 5.12 E/E ARCHITECTURE PLANS OF OEMS SHIFTING TO SDV

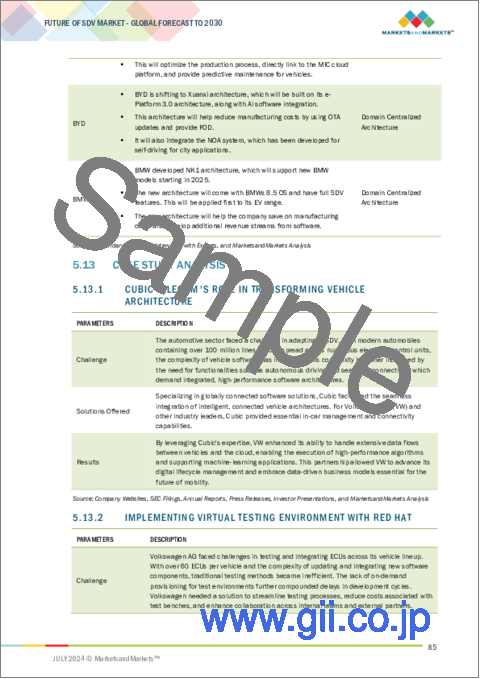

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CUBIC TELECOM'S ROLE IN TRANSFORMING VEHICLE ARCHITECTURE

- 5.13.2 IMPLEMENTING VIRTUAL TESTING ENVIRONMENT WITH RED HAT

- 5.13.3 VOLKSWAGEN'S STRATEGIC FOCUS ON SOFTWARE INNOVATION

- 5.13.4 STANDARDIZING OVER-THE-AIR UPDATES WITH ESYNC ALLIANCE

- 5.13.5 CONTINENTAL AUTOMOTIVE EDGE PLATFORM IN COLLABORATION WITH AWS

- 5.13.6 REVOLUTIONIZING AUTOMOTIVE SOFTWARE DEVELOPMENT WITH BLACKBERRY IVY AND AWS

- 5.13.7 AWS AND BLACKBERRY'S APPROACH TO MODERNIZING VEHICLE SOFTWARE

- 5.13.8 NVIDIA'S DRIVE PLATFORM POWERS VOLVO'S AUTONOMOUS VISION

- 5.13.9 TESLA'S JOURNEY INTO SOFTWARE-DEFINED VEHICLES

- 5.13.10 BMW'S STRATEGIC SHIFT IN AUTOMOTIVE SOFTWARE

6 FUTURE OF SDV MARKET, BY E/E ARCHITECTURE

- 6.1 INTRODUCTION

- 6.2 DISTRIBUTED ARCHITECTURE

- 6.3 DOMAIN CENTRALIZED ARCHITECTURE

- 6.4 ZONAL CONTROL ARCHITECTURE

7 FUTURE OF SDV MARKET, BY SDV TYPE

- 7.1 INTRODUCTION

- 7.2 SDV

- 7.2.1 INCREASED FLEXIBILITY AND AGILITY THROUGH OVER-THE-AIR UPDATES TO DRIVE SDV SHIFT

- 7.3 SEMI-SDV

- 7.3.1 TRANSITIONAL PHASE TOWARD MORE ADVANCED ZONAL CONTROL ARCHITECTURE

- 7.4 KEY PRIMARY INSIGHTS

8 FUTURE OF SDV MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 PASSENGER CAR

- 8.2.1 CONSUMER EXPECTATIONS FOR SEAMLESS, TECH-DRIVEN EXPERIENCES TO DRIVE MARKET

- 8.3 LIGHT COMMERCIAL VEHICLE

- 8.3.1 RAPID ADOPTION OF SOFTWARE-DEFINED LIGHT COMMERCIAL VEHICLES FOR GOODS TRANSPORT IN NORTH AMERICA TO DRIVE MARKET

- 8.4 KEY PRIMARY INSIGHTS

9 FUTURE OF SDV MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 GENERATIVE AI IMPACT ANALYSIS

- 9.2.2 CHINA

- 9.2.2.1 Platformization and SDV ecosystem development to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Government and OEM partnerships to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Global expansion of South Korean OEMs to drive market

- 9.3 EUROPE

- 9.3.1 GENERATIVE AI IMPACT ANALYSIS

- 9.3.2 GERMANY

- 9.3.2.1 Strong engineering landscape and leading component providers and OEMs shifting to SDV offerings to drive market

- 9.3.3 FRANCE

- 9.3.3.1 OEM initiatives and partnerships with software providers to drive market

- 9.3.4 UK

- 9.3.4.1 Government regulations to drive SDV adoption

- 9.3.5 SPAIN

- 9.3.5.1 OEMs planning to develop software architecture for SDVs to drive market

- 9.4 NORTH AMERICA

- 9.4.1 GENERATIVE AI IMPACT ANALYSIS

- 9.4.2 US

- 9.4.2.1 Technological advancements and OTA updates by OEMs to drive market

- 9.4.3 CANADA

- 9.4.3.1 Strategic partnerships and infrastructure development to drive market

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES

- 10.3 MARKET SHARE ANALYSIS, 2023

- 10.4 REVENUE ANALYSIS, 2019-2023

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.5.5.1 Company footprint

- 10.5.5.2 Vehicle type footprint

- 10.5.5.3 Region footprint

- 10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- 10.8.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY SDV PROVIDERS

- 11.1.1 TESLA

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 LI AUTO INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ZEEKR

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.3.4 Others

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 XPENG INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Others

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 NIO

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 RIVIAN

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.1 TESLA

- 11.2 KEY OEMS SHIFTING TO SDV

- 11.2.1 VOLKSWAGEN AG

- 11.2.1.1 Business overview

- 11.2.1.2 Products offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.3.3 Expansions

- 11.2.2 HYUNDAI MOTOR CORPORATION

- 11.2.2.1 Business overview

- 11.2.2.2 Products offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Deals

- 11.2.3 FORD MOTOR COMPANY

- 11.2.3.1 Business overview

- 11.2.3.2 Products offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches

- 11.2.3.3.2 Deals

- 11.2.3.3.3 Others

- 11.2.4 GENERAL MOTORS

- 11.2.4.1 Business overview

- 11.2.4.2 Products offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches

- 11.2.4.3.2 Deals

- 11.2.5 RENAULT GROUP

- 11.2.5.1 Business overview

- 11.2.5.2 Products offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches

- 11.2.5.3.2 Deals

- 11.2.6 TOYOTA MOTOR CORPORATION

- 11.2.6.1 Business overview

- 11.2.6.2 Products offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Deals

- 11.2.7 STELLANTIS

- 11.2.7.1 Business overview

- 11.2.7.2 Products offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches

- 11.2.7.3.2 Deals

- 11.2.8 MERCEDES-BENZ AG

- 11.2.8.1 Business overview

- 11.2.8.2 Products offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches

- 11.2.8.3.2 Deals

- 11.2.9 BYD

- 11.2.9.1 Business overview

- 11.2.9.2 Products offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches

- 11.2.9.3.2 Deals

- 11.2.10 BMW

- 11.2.10.1 Business overview

- 11.2.10.2 Products offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches

- 11.2.10.3.2 Deals

- 11.2.1 VOLKSWAGEN AG

- 11.3 KEY TECH INTEGRATORS

- 11.3.1 NVIDIA CORPORATION

- 11.3.2 QUALCOMM TECHNOLOGIES INC.

- 11.3.3 BLACKBERRY LIMITED

- 11.3.4 VECTOR INFORMATIK GMBH

- 11.3.5 GOOGLE INC.

- 11.3.6 AMAZON INC.

- 11.3.7 MICROSOFT

- 11.3.8 APEX.AI

- 11.3.9 MOBILEYE

- 11.3.10 TENCENT

- 11.3.11 ALIBABA

- 11.3.12 HORIZON ROBOTICS

- 11.3.13 TATA TECHNOLOGIES

- 11.3.14 KPIT TECHNOLOGIES

12 RECOMMENDATIONS BY MARKETSANDMARKETS

- 12.1 LEGACY OEMS BACKWARD-INTEGRATING TO DEVELOP THEIR SOFTWARE SYSTEMS

- 12.2 TRANSITION TO SDV TO BE SLOWER IN ICE VEHICLES AND MARKET TO BE LED BY LUXURY VEHICLES

- 12.3 LEGACY OEMS SHIFTING TO DOMAIN CENTRALIZED ARCHITECTURE AND ZONAL CONTROL

- 12.4 CONCLUSION

13 APPENDIX

- 13.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.4.1 FURTHER BREAKDOWN OF FUTURE OF SDV MARKET, BY VEHICLE TYPE AT COUNTRY-LEVEL (FOR COUNTRIES PRESENT IN THE REPORT)

- 13.4.2 ADDITIONAL COUNTRIES (APART FROM THOSE ALREADY CONSIDERED IN REPORT) WITH SIGNIFICANT SDV MARKET

- 13.4.3 COMPANY INFORMATION

- 13.4.4 PROFILES OF ADDITIONAL MARKET PLAYERS (UP TO FIVE)

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS