|

|

市場調査レポート

商品コード

1515619

エンベデッド・ファイナンスの世界市場:市場規模、シェア、成長分析 - タイプ別、ビジネスモデル別、業界別、地域別 - 2029年までの予測Embedded Finance Market Size, Share, Growth Analysis, By Type (embedded payments, embedded lending, embedded insurance, embedded wealth management), Business Model, Industry (retail & eCommerce, healthcare) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| エンベデッド・ファイナンスの世界市場:市場規模、シェア、成長分析 - タイプ別、ビジネスモデル別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月05日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

エンベデッド・ファイナンスの市場規模は、2024年には1,126億米ドル、2029年には2,374億米ドルに達すると予測され、年間平均成長率(CAGR)は16.1%になるとみられています。

エンベデッド・ファイナンスは、非金融環境に組み込むことで金融商品へのアクセスを向上させます。また、企業はエコシステムの中で商品やサービスとして安全な金銭のやり取りを提供できるようになります。さらに、エンベデッド・ファイナンスを統合することで、ユーザー体験が容易になり、プロバイダーと最終消費者のエコシステムにおける価値提案が最適化されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | タイプ別、ビジネスモデル別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

エンベデッド・ペイメントは、eコマースサイト、モバイルアプリケーション、IoTデバイスなどの非金融プラットフォームに決済を統合し、ユーザーエクスペリエンスを向上させ、取引のハードルを最小限に抑えるため、世界のエンベデッド・ファイナンス市場を独占する可能性が高くなっています。この統合は、デジタル空間内での迅速かつ安全な取引完了を可能にするため、さまざまな業界で高まるデジタル化のテーマとうまく合致します。消費者は、即座に安全な決済を実行できることを切望しています。このような利点は、組み込み型決済によって提供され、あらゆる規模の企業にとって拡張性が高いという利点もあります。これらの分析から、エンベデッド・ファイナンス市場では、統合性と機能性を重視するビジネスが拡大しているため、組み込み型決済が予測期間中最大のセグメントであり続けることは明らかです。

タイプ別では、組み込み型融資が予測期間中に高い成長率を維持する見込みです。エンベデッド・レンディングは、購入や請求書の支払いといった少額だが一般的な取引に容易に適合することができ、施設の利用がより便利になるため、エンベデッド・ファイナンス市場の中でより高い成長率を維持すると予測されています。これはさらに、効率的なビッグデータ処理と信用調査やローンのカスタマイズにおけるAIによって簡素化されたユーザー・インターフェースによって補完されます。さらに、融資を組み込むことで、金融業界の顧客以外にも市場アクセスが拡大し、銀行がサービスを提供していない中小企業や社会層がターゲットとなります。これは、フィンテック企業、現在の金融機関、その他のセクターがパートナーシップを結び、アクセスを強化することであり、その背景には、安定性のための法的構造の調整と資金調達の後押しがあります。これらすべての要因が相まって、組み込み型融資は予測期間において他の類型と比較して大きな成長を遂げることになります。

当レポートでは、世界のエンベデッド・ファイナンス市場について調査し、タイプ別、ビジネスモデル別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 業界動向

第6章 エンベデッド・ファイナンス市場(タイプ別)

- イントロダクション

- エンベデッド・ペイメント

- エンベデッド・レンディング

- エンベデッド・インシュアランス

- 埋め込み型投資/資産管理

- その他

第7章 エンベデッド・ファイナンス市場(ビジネスモデル別)

- イントロダクション

- B2B

- B2C

第8章 エンベデッド・ファイナンス市場(業界別)

- イントロダクション

- 小売・eコマース

- ヘルスケア

- 教育

- 通信

- 輸送、モビリティ、物流

- 旅行・ホスピタリティ

- その他

第9章 エンベデッド・ファイナンス市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

- ブランド/製品比較分析

- 主要なエンベデッド・ファイナンスプロバイダーの企業評価と財務指標

第11章 企業プロファイル

- 主要参入企業

- STRIPE, INC.

- PAYPAL HOLDINGS, INC.

- AMAZON.COM, INC.

- FIS

- VISA INC.

- PLAID, INC.

- KLARNA BANK AB

- CROSS RIVER BANK

- ZETA SERVICES INC.

- MARQETA, INC.

- WISE PAYMENTS LIMITED

- GOLDMAN SACHS

- JPMORGAN CHASE & CO.

- ALIPAY+

- スタートアップ/中小企業

- UNIT FINANCE INC.

- SOLARIS SE

- PARAFIN, INC.

- BELVO

- KASKO LTD.

- TINT TECHNOLOGIES INC.

- MEZU, INC.

- FORTIS PAYMENT SYSTEMS

- ADDITIV AG

- GALILEO FINANCIAL TECHNOLOGIES, LLC

- TREVIPAY

第12章 隣接/関連市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2023

- TABLE 2 KEY PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 RISK ASSESSMENT

- TABLE 5 EMBEDDED FINANCE MARKET: ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 INDICATIVE PRICING ANALYSIS OF EMBEDDED FINANCE, BY TYPE (USD)

- TABLE 11 AVERAGE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION (USD)

- TABLE 12 PORTER'S FIVE FORCES' IMPACT ON EMBEDDED FINANCE MARKET

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR INDUSTRIES

- TABLE 14 KEY BUYING CRITERIA FOR INDUSTRIES

- TABLE 15 EMBEDDED FINANCE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 17 EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 18 EMBEDDED PAYMENTS: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 19 EMBEDDED PAYMENTS: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 20 EMBEDDED LENDING: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 21 EMBEDDED LENDING: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

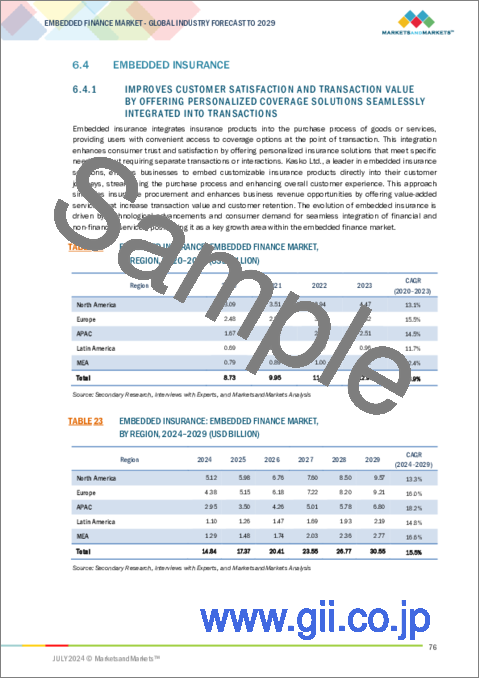

- TABLE 22 EMBEDDED INSURANCE: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 23 EMBEDDED INSURANCE: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 24 EMBEDDED INVESTMENT/WEALTH MANAGEMENT: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 25 EMBEDDED INVESTMENT/WEALTH MANAGEMENT: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 26 OTHER TYPES: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 27 OTHER TYPES: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 28 EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 29 EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 30 B2B: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 31 B2B: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 32 B2C: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 33 B2C: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 34 EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 35 EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 36 RETAIL & E-COMMERCE: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 37 RETAIL & E-COMMERCE: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 38 HEALTHCARE: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 39 HEALTHCARE: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 40 EDUCATION: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 41 EDUCATION: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 42 TELECOM: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 43 TELECOM: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 44 TRANSPORTATION, MOBILITY, AND LOGISTICS: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 45 TRANSPORTATION, MOBILITY, AND LOGISTICS: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 46 TRAVEL & HOSPITALITY: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 47 TRAVEL & HOSPITALITY: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 48 OTHER INDUSTRIES: EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 49 OTHER INDUSTRIES: EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 50 EMBEDDED FINANCE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 51 EMBEDDED FINANCE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 52 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 53 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 54 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 55 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 56 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 57 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 58 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 59 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 60 US: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 61 US: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 62 US: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 63 US: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 64 US: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 65 US: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 66 EUROPE: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 67 EUROPE: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 68 EUROPE: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 69 EUROPE: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 70 EUROPE: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 71 EUROPE: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 72 EUROPE: EMBEDDED FINANCE MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 73 EUROPE: EMBEDDED FINANCE MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 74 UK: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 75 UK: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 76 UK: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 77 UK: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 78 UK: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 79 UK: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 80 ITALY: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 81 ITALY: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 82 ITALY: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 83 ITALY: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 84 ITALY: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 85 ITALY: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 86 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 87 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 88 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 89 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 90 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 91 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 92 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 93 ASIA PACIFIC: EMBEDDED FINANCE MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 94 CHINA: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 95 CHINA: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 96 CHINA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 97 CHINA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 98 CHINA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 99 CHINA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 100 INDIA: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 101 INDIA: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 102 INDIA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 103 INDIA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 104 INDIA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 105 INDIA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 106 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 107 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 108 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 109 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 110 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 111 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 112 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY REGION/COUNTRY, 2020-2023 (USD BILLION)

- TABLE 113 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET, BY REGION/COUNTRY, 2024-2029 (USD BILLION)

- TABLE 114 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 115 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 116 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 117 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 118 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 119 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 120 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 121 GCC COUNTRIES: EMBEDDED FINANCE MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 122 KSA: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 123 KSA: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 124 KSA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 125 KSA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 126 KSA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 127 KSA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 128 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 129 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 130 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 131 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 132 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 133 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 134 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 135 LATIN AMERICA: EMBEDDED FINANCE MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 136 BRAZIL: EMBEDDED FINANCE MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 137 BRAZIL: EMBEDDED FINANCE MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 138 BRAZIL: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2020-2023 (USD BILLION)

- TABLE 139 BRAZIL: EMBEDDED FINANCE MARKET, BY BUSINESS MODEL, 2024-2029 (USD BILLION)

- TABLE 140 BRAZIL: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 141 BRAZIL: EMBEDDED FINANCE MARKET, BY INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 142 OVERVIEW OF STRATEGIES ADOPTED BY KEY EMBEDDED FINANCE VENDORS

- TABLE 143 EMBEDDED FINANCE MARKET: DEGREE OF COMPETITION

- TABLE 144 TYPE FOOTPRINT

- TABLE 145 BUSINESS MODEL FOOTPRINT

- TABLE 146 INDUSTRY FOOTPRINT

- TABLE 147 REGIONAL FOOTPRINT

- TABLE 148 EMBEDDED FINANCE MARKET: KEY STARTUPS/SMES

- TABLE 149 EMBEDDED FINANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 150 EMBEDDED FINANCE MARKET: PRODUCT LAUNCHES, MARCH 2023-JUNE 2024

- TABLE 151 EMBEDDED FINANCE MARKET: DEALS, JULY 2023-JUNE 2024

- TABLE 152 STRIPE, INC.: COMPANY OVERVIEW

- TABLE 153 STRIPE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 STRIPE, INC.: PRODUCT LAUNCHES

- TABLE 155 STRIPE, INC.: DEALS

- TABLE 156 STRIPE, INC.: EXPANSIONS

- TABLE 157 PAYPAL HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 158 PAYPAL HOLDINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 PAYPAL HOLDINGS, INC.: PRODUCT LAUNCHES

- TABLE 160 PAYPAL HOLDINGS, INC.: DEALS

- TABLE 161 AMAZON.COM, INC.: COMPANY OVERVIEW

- TABLE 162 AMAZON.COM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 AMAZON.COM, INC.: PRODUCT LAUNCHES

- TABLE 164 AMAZON.COM, INC.: DEALS

- TABLE 165 FIS: COMPANY OVERVIEW

- TABLE 166 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 FIS: PRODUCT LAUNCHES

- TABLE 168 FIS: DEALS

- TABLE 169 VISA INC.: COMPANY OVERVIEW

- TABLE 170 VISA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 VISA INC.: DEALS

- TABLE 172 VISA INC.: OTHERS

- TABLE 173 PLAID, INC.: COMPANY OVERVIEW

- TABLE 174 PLAID, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 PLAID, INC.: PRODUCT LAUNCHES

- TABLE 176 PLAID, INC.: DEALS

- TABLE 177 KLARNA BANK AB: COMPANY OVERVIEW

- TABLE 178 KLARNA BANK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 KLARNA BANK AB: PRODUCT LAUNCHES

- TABLE 180 KLARNA BANK AB: DEALS

- TABLE 181 CROSS RIVER BANK: COMPANY OVERVIEW

- TABLE 182 CROSS RIVER BANK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 CROSS RIVER BANK: DEALS

- TABLE 184 ZETA SERVICES INC.: COMPANY OVERVIEW

- TABLE 185 ZETA SERVICES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ZETA SERVICES INC.: PRODUCT LAUNCHES

- TABLE 187 ZETA SERVICES INC.: DEALS

- TABLE 188 MARQETA, INC.: COMPANY OVERVIEW

- TABLE 189 MARQETA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 MARQETA, INC.: PRODUCT LAUNCHES

- TABLE 191 MARQETA, INC.: DEALS

- TABLE 192 DIGITAL PAYMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 193 DIGITAL PAYMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 194 DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018-2022 (USD MILLION)

- TABLE 195 DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023-2028 (USD MILLION)

- TABLE 196 DIGITAL PAYMENT MARKET, BY PAYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 197 DIGITAL PAYMENT MARKET, PAYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 198 DIGITAL PAYMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 199 DIGITAL PAYMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 200 DIGITAL PAYMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 201 DIGITAL PAYMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 202 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 203 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 204 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 205 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 206 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 207 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 EMBEDDED FINANCE MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN EMBEDDED FINANCE MARKET

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 BOTTOM-UP (SUPPLY SIDE) ANALYSIS: COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF EMBEDDED FINANCE MARKET

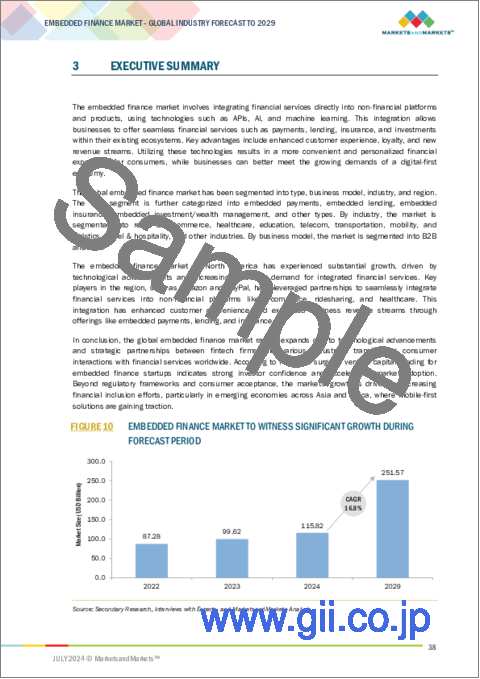

- FIGURE 10 EMBEDDED FINANCE MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 11 EMBEDDED FINANCE MARKET: REGIONAL SNAPSHOT

- FIGURE 12 TECHNOLOGICAL ADVANCEMENTS AND INCREASING CONSUMER DEMAND TO DRIVE EMBEDDED FINANCE MARKET

- FIGURE 13 TOP GROWING SEGMENTS IN MARKET IN 2024

- FIGURE 14 RETAIL & E-COMMERCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 B2B SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 16 EMBEDDED PAYMENTS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 17 EMBEDDED PAYMENTS AND B2B SEGMENTS TO HOLD SIGNIFICANT MARKET SHARES IN 2024

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: EMBEDDED FINANCE MARKET

- FIGURE 19 EVOLUTION OF EMBEDDED FINANCE

- FIGURE 20 KEY PLAYERS IN EMBEDDED FINANCE MARKET ECOSYSTEM

- FIGURE 21 EMBEDDED FINANCE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION (USD)

- FIGURE 23 LIST OF MAJOR PATENTS FOR EMBEDDED FINANCE

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS: EMBEDDED FINANCE MARKET

- FIGURE 25 EMBEDDED FINANCE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR INDUSTRIES

- FIGURE 27 KEY BUYING CRITERIA FOR TOP INDUSTRIES

- FIGURE 28 TOOLS, FRAMEWORKS, AND TECHNIQUES: EMBEDDED FINANCE MARKET

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 EMBEDDED LENDING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 B2C SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

- FIGURE 36 SHARE OF LEADING COMPANIES IN EMBEDDED FINANCE MARKET, 2023

- FIGURE 37 MARKET RANKING ANALYSIS OF TOP 5 PLAYERS

- FIGURE 38 EMBEDDED FINANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 39 OVERALL COMPANY FOOTPRINT

- FIGURE 40 EMBEDDED FINANCE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 41 BRAND/PRODUCT COMPARISON ANALYSIS

- FIGURE 42 FINANCIAL METRICS OF KEY EMBEDDED FINANCE VENDORS

- FIGURE 43 COMPANY VALUATION OF KEY EMBEDDED FINANCE VENDORS

- FIGURE 44 PAYPAL HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 45 AMAZON.COM, INC.: COMPANY SNAPSHOT

- FIGURE 46 FIS: COMPANY SNAPSHOT

- FIGURE 47 VISA INC.: COMPANY SNAPSHOT

- FIGURE 48 MARQETA, INC.: COMPANY SNAPSHOT

The embedded finance market is estimated at USD 112.6 billion in 2024 to USD 237.4 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 16.1%. Embedded finance improves access to financial products by including them in non-financial environments. They also enable organizations to provide secure monetary exchanges as products or services within their ecosystems. Additionally, integrating embedded finance eases user experiences and optimizes value propositions in the ecosystem for providers and the end consumer.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | by type, business model, industry |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

"By type, the embedded payments are expected to have the largest market size during the forecast period. "

Embedded Payments will likely dominate the global embedded finance market owing to its integration of payments into non-financial platforms such as e-commerce sites, mobile applications, and IoT devices to refine the user experience and minimize transaction hurdles. This integration aligns well with the growing theme of digitization across various industries as it enables the swift and safe completion of transactions within digital spaces. Consumers are keen on the ability to run payments that are instant and secure; such benefits are offered by embedded payments, providing the added advantage of being scalable for firms of all sizes. Based on these analyses, it is quite clear that embedded payments will continue to remain the largest segment within the embedded finance market during the foreseen period due to the growing business focus on integration and functionality.

"By type, embedded lending is expected to hold a higher growth rate during the forecast period." It is projected that embedded lending will have a better growth rate within the market of embedded finance since it can easily fit in with small but common transactions such as purchasing and payment of bills, which makes using the facilities more convenient. This is further complemented by the simplified user interface due to efficient big data processing and AI in credit checking and customization of loans. Moreover, embedding lending increases market access beyond the financial industry clients, targeting the SMEs and society segments not served by banks. This is through partnerships between fintech companies, the present financial organizations, and other sectors to enhance access, backed by adjusting legal structures for stability and boosting funding. All these factors combine to place embedded lending for vast growth compared to other typologies in the forecast period.

"North America is estimated to have the largest market share during the forecast period."

North America is expected to dominate the embedded finance market globally within the given forecast period because of technological developments such as the widespread usage of the internet and owning smartphones. Moreover, adopting new technology and a supportive regulatory environment in North America empowers the development of embedded finance solutions. Also, North America is one of the largest, most consumer-centric markets with a desire for effortless financial experiences. Therefore, it will remain a catalyst for advancements and growth of embedded finance.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the embedded finance market.

- By Company Type: Tier 1 - 62%, Tier 2 - 23%, and Tier 3 - 15%

- By Designation: C-level -38%, D-level - 30%, and Others - 22%

- By Region: North America - 40%, Europe - 15%, Asia Pacific - 35%, and Rest of the World - 10%.

The major players in the embedded finance market are Stripe, Inc. (US), PayPal Holdings, Inc. (US), Amazon.com, Inc. (US), Plaid, Inc. (US), Klarna Bank AB (Sweden), FIS (US), Visa Inc. (US), Cross River Bank (US), Zeta Services Inc. (US), Marqeta, Inc. (US), Wise Payments Limited (UK), Goldman Sachs (UK), JPMorgan Chase & Co. (US), Alipay+ (China), Unit Finance Inc. (US), Solaris SE (Germany), Parafin, Inc. (US), Belvo (Mexico), Kasko Ltd. (UK), Tint Technologies Inc. (US), Mezu, Inc. (US), Fortis Payment Systems (US), Additiv AG (Switzerland), Galileo Financial Technologies, LLC (US), Trevipay (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their embedded finance market footprint.

Research Coverage

The market study covers embedded finance market size across different segments. It aims at estimating the market size and the growth potential across various segments, including Type (embedded payments, embedded lending, embedded insurance, embedded investment/wealth management, other types), Business Model (B2B, B2C), Industry (retail & eCommerce, healthcare, education, telecom, transportation/mobility/logistics, travel & hospitality, other industries), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global embedded finance market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (digitalization of financial services, consumer demand for convenience, technological advancements), restraints (regulatory complexities, data privacy concerns, high implementation costs), opportunities (financial inclusion, enhanced customer engagement), and challenges (cybersecurity risks, interoperability issues, market competition) influencing the growth of the embedded finance market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the embedded finance market.

3. Market Development: Comprehensive information about lucrative markets - the report analyses the embedded finance market across various regions.

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the embedded finance market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading companies including Stripe, Inc. (US), PayPal Holdings, Inc. (US), Amazon.com, Inc. (US), Plaid, Inc. (US), Klarna Bank AB (Sweden), FIS (US), Visa Inc. (US), Cross River Bank (US), Zeta Services Inc. (US), Marqeta, Inc. (US), Wise Payments Limited (UK), Goldman Sachs (UK), JPMorgan Chase & Co. (US), Alipay+ (China), Unit Finance Inc. (US), Solaris SE (Germany), Parafin, Inc. (US), Belvo (Mexico), Kasko Ltd. (UK), Tint Technologies Inc. (US), Mezu, Inc. (US), Fortis Payment Systems (US), Additiv AG (Switzerland), Galileo Financial Technologies, LLC (US), Trevipay (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary interviews

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 TOP-DOWN APPROACH

- 2.3.1.1 Supply-side analysis

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 EMBEDDED FINANCE MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3.1 TOP-DOWN APPROACH

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 IMPLICATION OF RECESSION ON EMBEDDED FINANCE MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN EMBEDDED FINANCE MARKET

- 4.2 EMBEDDED FINANCE MARKET: TOP GROWING SEGMENTS

- 4.3 EMBEDDED FINANCE MARKET, BY INDUSTRY

- 4.4 EMBEDDED FINANCE MARKET, BY BUSINESS MODEL

- 4.5 EMBEDDED FINANCE MARKET, BY TYPE

- 4.6 NORTH AMERICA: EMBEDDED FINANCE MARKET, BY TYPE AND BUSINESS MODEL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Digitalization of financial services

- 5.2.1.2 Consumer demand for convenience

- 5.2.1.3 Technological advancements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory complexities

- 5.2.2.2 Data privacy concerns

- 5.2.2.3 High implementation costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Financial inclusion

- 5.2.3.2 Enhanced customer engagement

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity risks

- 5.2.4.2 Interoperability issues

- 5.2.4.3 Market competition

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF EMBEDDED FINANCE

- 5.3.2 ECOSYSTEM ANALYSIS

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 Booksy switched to Stripe for faster payouts and omnichannel payments

- 5.3.3.2 With Plaid, Zip automated essential compliance work, securing shopping experience for millions of customers

- 5.3.3.3 Shopify built Shopify Balance with Stripe to give small businesses easier way to manage money

- 5.3.3.4 Adorama and PayPal's solutions created picture-perfect portrait of success

- 5.3.4 VALUE CHAIN ANALYSIS

- 5.3.5 REGULATORY LANDSCAPE

- 5.3.5.1 Regulatory Bodies, Government Agencies, and Other Organizations

- 5.3.5.1.1 Financial Stability Board (FSB)

- 5.3.5.1.2 Consumer Financial Protection Bureau (CFPB)

- 5.3.5.2 North America

- 5.3.5.2.1 US

- 5.3.5.2.2 Canada

- 5.3.5.3 Europe

- 5.3.5.4 Asia Pacific

- 5.3.5.4.1 Australia

- 5.3.5.4.2 Singapore

- 5.3.5.4.3 Hong Kong

- 5.3.5.5 Middle East & Africa

- 5.3.5.5.1 UAE

- 5.3.5.5.2 South Africa

- 5.3.5.6 Latin America

- 5.3.5.6.1 Brazil

- 5.3.5.1 Regulatory Bodies, Government Agencies, and Other Organizations

- 5.3.6 PRICING ANALYSIS

- 5.3.6.1 Indicative pricing analysis, by type

- 5.3.6.2 Average pricing analysis, by solution

- 5.3.7 TECHNOLOGY ANALYSIS

- 5.3.7.1 Key Technologies

- 5.3.7.1.1 Application Programming Interfaces (APIs)

- 5.3.7.1.2 Cloud Computing

- 5.3.7.1.3 Artificial Intelligence (AI) and Machine Learning (ML)

- 5.3.7.2 Complementary Technologies

- 5.3.7.2.1 Open Banking

- 5.3.7.2.2 Biometrics

- 5.3.7.2.3 Blockchain

- 5.3.7.3 Adjacent Technologies

- 5.3.7.3.1 Internet of Things (IoT)

- 5.3.7.3.2 Big Data Analytics

- 5.3.7.3.3 Regulatory Technology (RegTech)

- 5.3.7.1 Key Technologies

- 5.3.8 PATENT ANALYSIS

- 5.3.8.1 List of major patents

- 5.3.9 PORTER'S FIVE FORCES' ANALYSIS

- 5.3.9.1 Threat of new entrants

- 5.3.9.2 Threat of substitutes

- 5.3.9.3 Bargaining power of suppliers

- 5.3.9.4 Bargaining power of buyers

- 5.3.9.5 Intensity of competitive rivalry

- 5.3.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.11.1 Key stakeholders in buying process

- 5.3.11.2 Buying criteria

- 5.3.12 KEY CONFERENCES AND EVENTS

- 5.3.13 TECHNOLOGY ROADMAP FOR EMBEDDED FINANCE MARKET

- 5.3.13.1 Short-term roadmap (2023-2025)

- 5.3.13.2 Mid-term roadmap (2026-2028)

- 5.3.13.3 Long-term roadmap (2029-2030)

- 5.3.14 BEST PRACTICES IN EMBEDDED FINANCE MARKET

- 5.3.14.1 Integrate Financial Services Seamlessly

- 5.3.14.2 Prioritize Compliance and Security

- 5.3.14.3 Offer Personalized Financial Services

- 5.3.14.4 Focus on User-centric Design

- 5.3.14.5 Leverage Data Analytics and Insights

- 5.3.15 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.15.1 Subscription-based Model

- 5.3.15.2 Pay-per-use Model

- 5.3.15.3 Freemium Model

- 5.3.15.4 Transaction-based Model

- 5.3.15.5 Advertising-based Model

- 5.3.16 THREE MODELS OF EMBEDDED PAYMENTS

- 5.3.16.1 Referral partnership

- 5.3.16.2 Payment facilitation

- 5.3.16.3 Payment facilitation-as-a-service

- 5.3.17 EMBEDDED FINANCE MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.18 INVESTMENT AND FUNDING SCENARIO

6 EMBEDDED FINANCE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 TYPE: EMBEDDED FINANCE MARKET DRIVERS

- 6.2 EMBEDDED PAYMENTS

- 6.2.1 STREAMLINED INTEGRATION OF PAYMENT PROCESSING INTO NON-FINANCIAL PLATFORMS TO ENHANCE USER EXPERIENCE AND BOOST TRANSACTION EFFICIENCY

- 6.3 EMBEDDED LENDING

- 6.3.1 SIMPLIFIES FINANCING OPTIONS AND BOOSTS CONSUMER SPENDING AND LOYALTY BY INTEGRATING CREDIT AND LOAN SERVICES DIRECTLY WITHIN PLATFORMS

- 6.4 EMBEDDED INSURANCE

- 6.4.1 IMPROVES CUSTOMER SATISFACTION AND TRANSACTION VALUE BY OFFERING PERSONALIZED COVERAGE SOLUTIONS SEAMLESSLY INTEGRATED INTO TRANSACTIONS

- 6.5 EMBEDDED INVESTMENT/WEALTH MANAGEMENT

- 6.5.1 INTEGRATION OF FINANCIAL ADVISORY AND INVESTMENT SERVICES WITHIN DIGITAL PLATFORMS TO PROVIDE COMPREHENSIVE FINANCIAL SOLUTIONS, ENHANCING USER ENGAGEMENT AND SATISFACTION

- 6.6 OTHER TYPES

7 EMBEDDED FINANCE MARKET, BY BUSINESS MODEL

- 7.1 INTRODUCTION

- 7.1.1 BUSINESS MODEL: EMBEDDED FINANCE MARKET DRIVERS

- 7.2 B2B

- 7.2.1 ENHANCES EFFICIENCY AND SCALABILITY IN BUSINESS OPERATIONS, DRIVING INNOVATION IN TRANSACTION MANAGEMENT AND FINANCIAL INSIGHTS.

- 7.3 B2C

- 7.3.1 IMPROVES CONVENIENCE AND LOYALTY IN CONSUMER-FACING PLATFORMS, ENHANCING SHOPPING EXPERIENCES WITH SEAMLESS PAYMENT SOLUTIONS.

8 EMBEDDED FINANCE MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- 8.1.1 INDUSTRY: EMBEDDED FINANCE MARKET DRIVERS

- 8.2 RETAIL & E-COMMERCE

- 8.2.1 ENHANCING SALES AND CHECKOUT EXPERIENCES WITH SEAMLESS PAYMENTS AND CREDIT SERVICES

- 8.2.2 USE CASES

- 8.2.2.1 E-commerce platforms enabling embedded lending solutions for MSMEs

- 8.3 HEALTHCARE

- 8.3.1 SIMPLIFYING MEDICAL BILLING AND IMPROVING AFFORDABILITY THROUGH INSTALLMENT PLANS AND SPECIALIZED FINANCING SOLUTIONS

- 8.3.2 USE CASES

- 8.3.2.1 Optional add-on travel insurance offered by Indian Railways while booking tickets online

- 8.4 EDUCATION

- 8.4.1 STREAMLINING GLOBAL TUITION PAYMENTS AND STUDENT LOANS, IMPROVING FINANCIAL MANAGEMENT FOR INSTITUTIONS AND STUDENTS.

- 8.4.2 USE CASES

- 8.4.2.1 Personalized education finance solutions by EdTech companies

- 8.5 TELECOM

- 8.5.1 EXPANDING MOBILE BANKING AND DIGITAL PAYMENTS, FOSTERING FINANCIAL INCLUSION THROUGH PARTNERSHIPS WITH TELECOM OPERATORS

- 8.6 TRANSPORTATION, MOBILITY, AND LOGISTICS

- 8.6.1 OPTIMIZING PAYMENTS FOR RIDESHARING AND LOGISTICS, ENHANCING OPERATIONAL EFFICIENCY

- 8.6.2 USE CASES

- 8.6.2.1 Seamless payments and micro-insurance integration in ride-hailing apps

- 8.7 TRAVEL & HOSPITALITY

- 8.7.1 OFFERING SEAMLESS PAYMENT OPTIONS AND ENHANCING BOOKING EXPERIENCES

- 8.8 OTHER INDUSTRIES

- 8.8.1 USE CASES

- 8.8.1.1 Integrated payments and home loan services on real estate aggregator platforms

- 8.8.1.2 AgriTech platforms offering integrated finance for farmers

- 8.8.1 USE CASES

9 EMBEDDED FINANCE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: EMBEDDED FINANCE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- 9.2.3 US

- 9.2.3.1 Embedded finance platforms to fundamentally reshape traditional banking services in US by embedding financial capabilities into everyday consumer experiences

- 9.2.4 CANADA

- 9.2.4.1 Uptake of embedded finance solutions in Canada to reflect growing preference among tech-savvy consumers for integrated financial experiences that simplify transactions and enhance financial management

- 9.3 EUROPE

- 9.3.1 EUROPE: EMBEDDED FINANCE MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- 9.3.3 UK

- 9.3.3.1 Consumers to favor convenience and accessibility offered by mobile banking apps that provide traditional banking services as well as incorporate advanced features

- 9.3.4 GERMANY

- 9.3.4.1 Fintech startups partnering with traditional financial institutions to integrate banking services into retail and digital platforms, catering to evolving consumer preferences for convenience and efficiency

- 9.3.5 FRANCE

- 9.3.5.1 French regulators to play pivotal role in creating favorable environment for fintech innovations

- 9.3.6 ITALY

- 9.3.6.1 Key stakeholders in Italy's embedded finance ecosystem encompass adapting to digital transformation alongside agile fintech enterprises leveraging technology to innovate financial solutions

- 9.3.7 SPAIN

- 9.3.7.1 Spain witnessing surge in adoption of embedded finance solutions, underscoring broader trend toward integrating financial services into non-financial digital platforms

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: EMBEDDED FINANCE MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- 9.4.3 CHINA

- 9.4.3.1 Consumers increasingly rely on digital platforms for everything, from everyday purchases to sophisticated financial planning

- 9.4.4 JAPAN

- 9.4.4.1 Plaid, Stripe, and Wallester to be pivotal in shaping future of financial services in Japan

- 9.4.5 INDIA

- 9.4.5.1 Digital payments through embedded finance solutions in India witnessed remarkable surge of 183% year-on-year in transaction volumes

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Adoption of embedded finance solutions in Australia witnessed notable uptick, with 30% increase in digital wallet transactions compared to previous year

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: EMBEDDED FINANCE MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.5.3 GCC COUNTRIES

- 9.5.3.1 GCC's strategic location and role as global business hub to amplify potential of embedded finance to drive economic diversification and enhance financial inclusion

- 9.5.3.2 UAE

- 9.5.3.2.1 Partnerships between e-commerce platforms and financial institutions to enable seamless payment experiences and enhanced customer satisfaction

- 9.5.3.3 KSA

- 9.5.3.3.1 Surge in partnerships between fintech companies and traditional businesses in KSA to drive market growth

- 9.5.3.4 Rest of GCC Countries

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Mobile-centric economy where significant portion of population accesses financial services through smartphones to drive market growth in South Africa

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: EMBEDDED FINANCE MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- 9.6.3 BRAZIL

- 9.6.3.1 Brazil's robust digital infrastructure, including high smartphone penetration and increasing internet connectivity, to drive market growth

- 9.6.4 MEXICO

- 9.6.4.1 Mexico's supportive regulatory environment and growing fintech ecosystem, facilitating collaborations, to drive innovation and broaden scope of financial solutions available to consumers

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 MARKET RANKING ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING

- 10.7 COMPETITIVE SCENARIO AND TRENDS

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

- 10.8 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.9 COMPANY VALUATION AND FINANCIAL METRICS OF KEY EMBEDDED FINANCE PROVIDERS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 STRIPE, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 PAYPAL HOLDINGS, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 AMAZON.COM, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 FIS

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 VISA INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 PLAID, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.7 KLARNA BANK AB

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.8 CROSS RIVER BANK

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.9 ZETA SERVICES INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.10 MARQETA, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.11 WISE PAYMENTS LIMITED

- 11.1.12 GOLDMAN SACHS

- 11.1.13 JPMORGAN CHASE & CO.

- 11.1.14 ALIPAY+

- 11.1.1 STRIPE, INC.

- 11.2 STARTUPS/SMES

- 11.2.1 UNIT FINANCE INC.

- 11.2.2 SOLARIS SE

- 11.2.3 PARAFIN, INC.

- 11.2.4 BELVO

- 11.2.5 KASKO LTD.

- 11.2.6 TINT TECHNOLOGIES INC.

- 11.2.7 MEZU, INC.

- 11.2.8 FORTIS PAYMENT SYSTEMS

- 11.2.9 ADDITIV AG

- 11.2.10 GALILEO FINANCIAL TECHNOLOGIES, LLC

- 11.2.11 TREVIPAY

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 DIGITAL PAYMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.3 SOLUTIONS

- 12.3.1 DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE

- 12.3.2 DIGITAL PAYMENT MARKET, BY PAYMENT MODE

- 12.3.3 DIGITAL PAYMENT MARKET, BY VERTICAL

- 12.3.4 DIGITAL PAYMENT MARKET, BY REGION

- 12.4 PAYMENT PROCESSING SOLUTIONS MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.3 PAYMENT PROCESSING SOLUTIONS, BY PAYMENT METHOD

- 12.4.4 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL

- 12.4.5 PAYMENT PROCESSING SOLUTIONS MANAGEMENT MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS