|

|

市場調査レポート

商品コード

1384294

培養肉の世界市場:原料別、最終用途別、地域別-2034年までの予測Cultured Meat Market by Source (Poultry, Beef, Seafood, Pork, Duck), End Use (Nuggets, Burgers, Meatballs, Sausages, Hot Dogs), and Region (North America, Europe, Asia Pacific, South America, Middle East & Africa) - Global Forecast to 2034 |

||||||

カスタマイズ可能

|

|||||||

| 培養肉の世界市場:原料別、最終用途別、地域別-2034年までの予測 |

|

出版日: 2023年11月14日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2034年 |

| 基準年 | 2023年 |

| 予測期間 | 2028年~2034年 |

| 検討単位 | 金額(米ドル)、数量(トン) |

| セグメント別 | 原料別、最終用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

培養肉の市場規模は2023年に2億米ドル、2034年には11億米ドルに達すると予測され、2028年から2034年までのCAGRは16.5%と見込まれています。

2023年以降の今後5年間の市場成長率は16.1%と予測されます。従来型農業における動物の扱いやと畜をめぐる倫理的懸念の高まりが、代替食料源の探求の原動力となっています。消費者は、非人道的な環境、過密飼育、抗生物質の使用、食用として飼育される動物のしばしばストレスの多い生活に懸念を強めています。このような意識から、食品生産の領域において、無残で、より思いやりのある選択肢を求める声が急増しています。培養肉は、人工肉あるいはクリーンミートとも呼ばれ、動物を飼育・と畜処理する必要性を回避しながら、世界の食肉への欲求を満たすという、説得力のある解決策を提示しています。この革新的なアプローチは、倫理的価値観に沿った製品を求める消費者の共感を呼び、食品業界に大きな変化をもたらし、代替タンパク源の進歩を促進します。

鶏肉セグメントは、主に抗生物質と疾病リスクの大幅な削減により、培養肉市場において最も迅速な成長のために位置づけられています。従来の養鶏では、成長を促進し病気と闘うために抗生物質が過剰に使用され、抗生物質耐性やこれらの耐性株がヒトに感染する懸念があっています。対照的に養殖家禽は、管理された無菌環境で生産できるため、抗生物質の必要性を大幅に減らすことができます。また、養鶏場には混雑したストレスの多い環境がないため、動物間で病気が蔓延するリスクも軽減されます。これは、差し迫った公衆衛生上の懸念に対応するだけでなく、より安全で抗生物質不使用の食肉を求める消費者にも魅力的です。食品の選択において健康と安全が最重要視される中、培養肉市場における鶏肉分野は、こうした重要な要因に後押しされて急成長する態勢を整えています。

米国は技術革新と研究の世界的リーダーであり、培養肉産業を発展させる強力な基盤を提供しています。同国は強固なバイオテクノロジーと細胞農業部門を誇り、世界的に有名な研究機関や培養肉開発に専念する新興企業によって支えられています。さらに米国には、健康志向の個人、環境意識の高い消費者、倫理的で持続可能な食品を求める消費者など、大規模かつ多様な消費者層が存在します。このような広範な市場アピールは、米国を培養肉採用の一等地として位置づけています。代替蛋白源に対する政府の支持姿勢と規制の枠組み、官民双方からの多額の投資が、この産業を前進させています。さらに、米国には食品イノベーションを受け入れてきた歴史があり、培養肉が支持を得るための肥沃な土壌となっています。これらすべての要因が相まって、米国は培養肉市場において支配的な地位を確立しており、最大の市場シェアを占めると予測されています。

当レポートでは、世界の培養肉市場について調査し、原料別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- マクロ経済指標

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 関税と規制状況

- 規制の枠組み

- 特許分析

- 貿易分析

- 価格分析

- 培養肉市場:生態系市場マップ

- 技術分析

- ケーススタディ

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2023年~2024年の主要な会議とイベント

第7章 培養肉市場、原料別

- イントロダクション

- 鶏肉

- 豚肉

- 牛肉

- 魚介類

- 鴨肉

第8章 培養肉市場、最終用途別

- イントロダクション

- ナゲット

- ハンバーガー

- ミートボール

- ソーセージ

- ホットドッグ

- その他

第9章 培養肉市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 市場シェア分析、2022年

- 主要参入企業が採用した戦略

- 収益分析

- 主要な市場参入企業の世界スナップショット

- 企業評価マトリックス

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- MOSA MEAT

- UPSIDE FOODS

- EAT JUST, INC.

- INTEGRICULTURE INC.

- MEWERY

- BIOCRAFT, INC.

- FINLESS FOODS, INC.

- AVANT MEATS

- BLUENALU

- FORK & GOOD

- MISSION BARNS

- CUBIQ FOODS

- IVY FARM TECHNOLOGIES LIMITED

- MEATABLE 224 TABLE 226 MEATABLE:BUSINESS OVERVIEW

- スタートアップ/中小企業/その他の企業

- BIOTECH FOODS

- O MEAT

- BIOBQ

- PEARLITA FOODS

- WILDBIO

- GOURMEY

- PEACE OF MEAT

- WILD TYPE

- LABFARM

- SHIOK MEATS PTE LTD

- CLEARMEAT

- EAT JUST, INC.

第12章 隣接市場および関連市場

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2034 |

| Base Year | 2023 |

| Forecast Period | 2028-2034 |

| Units Considered | Value (USD), Volume (Tonnes) |

| Segments | By Source, End Use, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

The cultured meat market projected to reach USD 0.2 billion in 2023 and USD 1.1 billion by 2034, at a CAGR of 16.5% from 2028 to 2034. The market for next five years since 2023 is projected to grow at 16.1%. Growing ethical concerns surrounding the treatment and slaughter of animals in conventional agriculture have become a driving force behind the quest for alternative food sources. Consumers are increasingly concerned by the inhumane conditions, overcrowding, use of antibiotics, and the often stressful lives of animals raised for food. This awareness has led to a surge in demand for cruelty-free and more compassionate choices in the realm of food production. Cultured meat, also known as lab-grown or clean meat, presents a compelling solution as it offers the prospect of satisfying the world's appetite for meat while bypassing the need to raise and slaughter animals. This innovative approach resonates with consumers who seek products that align with their ethical values, creating a significant shift in the food industry and driving the advancement of alternative protein sources.

"Poultry in the by source segment is expected to be one of the fastest growing sub-segments in the market."

The poultry segment is positioned for the swiftest growth in the cultured meat market, primarily due to the substantial reduction in antibiotics and disease risk. In traditional poultry farming, the overuse of antibiotics to promote growth and combat diseases has raised concerns about antibiotic resistance and the transmission of these resistant strains to humans. Cultured poultry, in contrast, can be produced in a controlled, sterile environment, significantly reducing the need for antibiotics. The absence of crowded and stressful conditions in poultry farms also mitigates the risk of diseases spreading among animals. This not only addresses pressing public health concerns but also appeals to consumers seeking safer, antibiotic-free meat options. As health and safety become paramount in food choices, the poultry segment in the cultured meat market is poised for rapid growth, driven by these critical factors.

US is projected to have the largest share during the forecast period.

US is a global leader in technological innovation and research, which provides a strong foundation for advancing the cultured meat industry. The country boasts a robust biotechnology and cellular agriculture sector, supported by world-renowned research institutions and startups dedicated to developing cultured meat. Furthermore, the US has a sizable and diverse consumer base, including health-conscious individuals, environmentally-aware consumers, and those seeking ethical and sustainable food choices. This broad market appeal positions the U.S. as a prime location for cultured meat adoption. The government's supportive stance and regulatory frameworks for alternative protein sources, along with substantial investment from both public and private sectors, are propelling the industry forward. Additionally, the US has a history of embracing food innovations, making it a fertile ground for cultured meat to gain traction. All of these factors collectively establish US as a dominant player in the cultured meat market, projected to hold the largest market share.

The break-up of the profile of primary participants in the cultured meat market:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: CXOs - 25%, Managers - 50%, Executives-25%

- By Region: Asia Pacific - 40%, Europe - 25%, North America - 25%, and Rest of the World - 10%

Prominent companies include Mosa Meat (Netherlands), UPSIDE FOODS (US), JUST, Inc. (US), and Integriculture Inc. (Japan), and BioCraft, Inc (US), among others.

Research Coverage:

This research report classifies the cultured meat market based on various factors, including source (such as Poultry, Beef, Pork, Duck, and Seafood), end use (Nuggets, Burgers, Meatballs, Sausages, and Others), and regions (North America, Europe, Asia Pacific, South America, and Rest of the World). The report provides comprehensive insights into market dynamics, encompassing drivers, limitations, challenges, and opportunities that influence the growth of the cultured meat market. Additionally, it offers a thorough analysis of key industry players, their business profiles, solutions, services, strategies, contracts, partnerships, agreements, new product launches, mergers, acquisitions, and recent developments in the cultured meat market. The report also includes a competitive analysis of emerging startups within the cultured meat market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cultured meat market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for alternative protein, focus on animal welfare), restraints (Stringent regulatory environment, high set up cost), opportunities (High per capita meat consumption and imports in emerging South eas Asian countries), and challenges (Skeptisim among consumers) influencing the growth of the cultured meat market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cultured meat market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the cultured meat market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cultured meat market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mosa Meat (Netherlands), UPSIDE FOODS (US), JUST, Inc. (US), and Integriculture Inc. (Japan), and BioCraft, Inc (US) among others in the cultured meat market strategies. The report also helps stakeholders understand the cultured meat market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 CULTURED MEAT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON SOURCE, BY REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 4 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 STUDY LIMITATIONS AND RISK ASSESSMENT

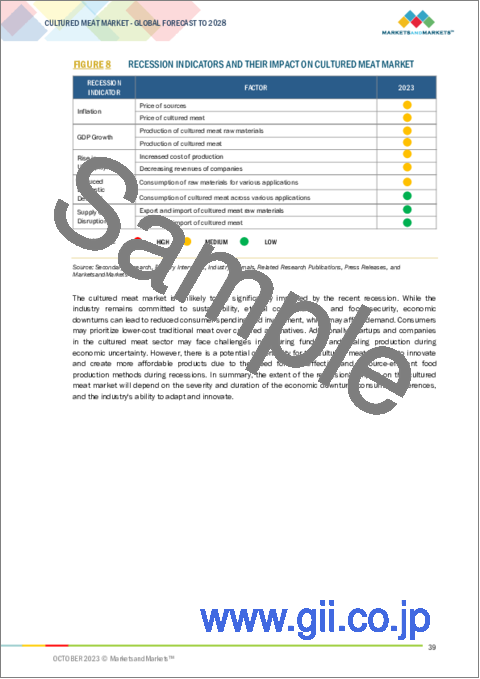

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 MACRO INDICATORS OF RECESSION

- FIGURE 5 INDICATORS OF RECESSION

- FIGURE 6 WORLD INFLATION RATE, 2011-2021

- FIGURE 7 GLOBAL GROSS DOMESTIC PRODUCT, 2011-2021 (USD TRILLION)

- FIGURE 8 RECESSION INDICATORS AND THEIR IMPACT ON CULTURED MEAT MARKET

3 EXECUTIVE SUMMARY

- TABLE 2 CULTURED MEAT MARKET SNAPSHOT, 2028 VS. 2034 (NORMAL SCENARIO)

- FIGURE 9 CULTURED MEAT MARKET SIZE, BY SOURCE (NORMAL SCENARIO), 2028 VS. 2034 (USD MILLION)

- FIGURE 10 CULTURED MEAT MARKET SIZE, BY END USE (NORMAL SCENARIO), 2028 VS. 2034 (USD MILLION)

- FIGURE 11 REGION-WISE CULTURED MEAT MARKET SHARE AND CAGR (NORMAL SCENARIO), 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN CULTURED MEAT MARKET

- FIGURE 12 GROWING HEALTH CONCERNS RELATED TO TRADITIONAL MEAT AND SHORTFALL IN SUPPLY OF MEAT PRODUCTS TO DRIVE CULTURED MEAT MARKET GROWTH IN NORMAL SCENARIO

- 4.2 CULTURED MEAT MARKET, BY REGION, 2028 VS. 2034 (USD MILLION) (NORMAL SCENARIO)

- FIGURE 13 NORTH AMERICA PROJECTED TO DOMINATE CULTURED MEAT MARKET BY 2034

- 4.3 CULTURED MEAT MARKET, BY END USE, 2028 VS. 2034 (USD MILLION) (NORMAL SCENARIO)

- FIGURE 14 NUGGETS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 EUROPE: CULTURED MEAT MARKET, BY SOURCE, 2028 (NORMAL SCENARIO)

- FIGURE 15 POULTRY SEGMENT PROJECTED TO DOMINATE MARKET BY 2028

- 4.5 CULTURED MEAT MARKET, BY KEY COUNTRY (NORMAL SCENARIO)

- FIGURE 16 CANADA PROJECTED TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET FOR CULTURED MEAT IN NORMAL SCENARIO

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 CULTURED MEAT MARKET DYNAMICS

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 CULTURED MEAT TO BE RESILIENT AND SUSTAINABLE PROTEIN SOURCE

- 5.3.2 CRUCIAL ROLE OF INVESTMENT TRENDS IN CULTURED MEAT INNOVATION

- 5.3.3 DRIVERS

- 5.3.3.1 Increasing demand for alternative protein

- 5.3.3.2 Technological advancements in cellular agriculture

- 5.3.3.3 Enhanced food safety

- 5.3.3.4 Investments by key industry giants

- 5.3.3.5 Environmental sustainability

- 5.3.3.6 Focus on animal welfare

- 5.3.3.7 Health benefits offered by cultured meat

- 5.3.4 RESTRAINTS

- 5.3.4.1 Stringent regulatory environment

- 5.3.4.2 High setup cost

- 5.3.5 OPPORTUNITIES

- 5.3.5.1 High per capita meat consumption and imports in emerging Southeast Asian economies

- FIGURE 18 PROJECTED PER CAPITA POULTRY CONSUMPTION IN SOUTHEAST ASIAN COUNTRIES, 2021-2029

- 5.3.6 CHALLENGES

- 5.3.6.1 Skepticism among consumers

- TABLE 3 SURVEY CONDUCTED ON "ATTITUDES TO IN VITRO MEAT: A SURVEY OF POTENTIAL CONSUMERS IN THE UNITED STATES"

- 5.3.6.2 Increased demand for plant-based protein

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 19 CULTURED MEAT MARKET: VALUE CHAIN ANALYSIS

- 6.2.1 CELL SOURCING

- 6.2.2 CELL CULTIVATION

- 6.2.3 CELL DIFFERENTIATION

- 6.2.4 TISSUE STRUCTURING

- 6.2.5 POST-PRODUCTION PROCESSING

- 6.2.6 QUALITY CONTROL

- 6.2.7 PACKAGING & DISTRIBUTION

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 20 REVENUE SHIFT FOR CULTURED MEAT MARKET

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 REGULATORY FRAMEWORK

- 6.5.1 NORTH AMERICA

- 6.5.1.1 US

- 6.5.1.2 Canada

- 6.5.2 EUROPE

- 6.5.3 ASIA PACIFIC

- 6.5.1 NORTH AMERICA

- 6.6 PATENT ANALYSIS

- FIGURE 21 NUMBER OF PATENTS GRANTED FOR CULTURED MEAT IN GLOBAL MARKET, 2013-2022

- FIGURE 22 REGIONAL ANALYSIS OF PATENTS GRANTED IN CULTURED MEAT MARKET

- TABLE 7 LIST OF MAJOR PATENTS PERTAINING TO CULTURED MEAT MARKET, 2013-2022

- 6.7 TRADE ANALYSIS

- TABLE 8 IMPORT VALUE OF CULTURED MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 9 EXPORT VALUE OF CULTURED MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- 6.8 PRICING ANALYSIS

- 6.8.1 INDICATIVE AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 10 NUGGETS: GLOBAL CULTURED MEAT MARKET, BY REGION, 2020-2022 (USD PER KG)

- TABLE 11 BURGERS: GLOBAL CULTURED MEAT MARKET, BY REGION, 2020-2022 (USD PER KG)

- TABLE 12 MEATBALLS: GLOBAL CULTURED MEAT MARKET, BY REGION, 2020-2022 (USD PER KG)

- 6.9 CULTURED MEAT MARKET: ECOSYSTEM MARKET MAP

- 6.9.1 DEMAND SIDE

- 6.9.2 SUPPLY SIDE

- FIGURE 23 CULTURED MEAT: MARKET MAP

- TABLE 13 CULTURED MEAT MARKET: ECOSYSTEM

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 SCAFFOLDING TECHNOLOGY

- 6.10.2 3D BIOPRINTING

- 6.11 CASE STUDIES

- 6.11.1 REVOLUTIONIZING CELL CULTURE WITH ETHICAL AND FBS-FREE SOLUTIONS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 CULTURED MEAT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING CULTURED MEAT FOR DIFFERENT END USES

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CULTURED MEAT, BY END USE (%)

- 6.13.3 BUYING CRITERIA

- TABLE 16 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 25 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 17 KEY CONFERENCES AND EVENTS IN CULTURED MEAT MARKET, 2023-2024

7 CULTURED MEAT MARKET, BY SOURCE

- 7.1 INTRODUCTION

- FIGURE 26 CULTURED MEAT MARKET SIZE IN OPTIMISTIC SCENARIO, BY SOURCE, 2028 VS. 2034 (USD MILLION)

- FIGURE 27 CULTURED MEAT MARKET SIZE IN NORMAL SCENARIO, BY SOURCE, 2028 VS. 2034 (USD MILLION)

- FIGURE 28 CULTURED MEAT MARKET SIZE IN PESSIMISTIC SCENARIO, BY SOURCE, 2028 VS. 2034 (USD MILLION)

- TABLE 18 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 19 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 20 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 21 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 22 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 23 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- 7.2 POULTRY

- 7.2.1 HIGH DEMAND FROM QUICK-SERVICE RESTAURANTS TO DRIVE DEMAND FOR CULTURED POULTRY MEAT PRODUCTS

- TABLE 24 CULTURED POULTRY MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 25 CULTURED POULTRY MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 26 CULTURED POULTRY MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 27 CULTURED POULTRY MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 28 CULTURED POULTRY MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 29 CULTURED POULTRY MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 7.3 PORK

- 7.3.1 CULTURED PORK MARKET TO THRIVE AMID GLOBAL DEMAND SURGE AND SUSTAINABILITY CONCERNS

- TABLE 30 CULTURED PORK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 31 CULTURED PORK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 32 CULTURED PORK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 33 CULTURED PORK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 34 CULTURED PORK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 35 CULTURED PORK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 7.4 BEEF

- 7.4.1 RISING DEMAND FOR SUSTAINABLE & ETHICAL PROTEIN TO DRIVE CULTURED BEEF MARKET GROWTH

- TABLE 36 CULTURED BEEF MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 37 CULTURED BEEF MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 38 CULTURED BEEF MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 39 CULTURED BEEF MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 40 CULTURED BEEF MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 41 CULTURED BEEF MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 7.5 SEAFOOD

- 7.5.1 RISING CONSUMPTION OF FISH MAW TO CONTRIBUTE TO CULTURED MEAT MARKET GROWTH

- TABLE 42 CULTURED SEAFOOD MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 43 CULTURED SEAFOOD MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 44 CULTURED SEAFOOD MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 45 CULTURED SEAFOOD MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 46 CULTURED SEAFOOD MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 47 CULTURED SEAFOOD MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 7.6 DUCK

- 7.6.1 HIGH AVAILABILITY OF DUCK MEAT IN SUPERMARKETS TO DRIVE GROWTH

- TABLE 48 CULTURED DUCK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 49 CULTURED DUCK MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 50 CULTURED DUCK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 51 CULTURED DUCK MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 52 CULTURED DUCK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 53 CULTURED DUCK MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

8 CULTURED MEAT MARKET, BY END USE

- 8.1 INTRODUCTION

- FIGURE 29 CULTURED MEAT MARKET SIZE IN NORMAL SCENARIO, BY END USE, 2028 VS. 2034 (USD MILLION)

- FIGURE 30 CULTURED MEAT MARKET SIZE IN OPTIMISTIC SCENARIO, BY END USE, 2028 VS. 2034 (USD MILLION)

- FIGURE 31 CULTURED MEAT MARKET SIZE IN PESSIMISTIC SCENARIO, BY END USE, 2028 VS. 2034 (USD MILLION)

- TABLE 54 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 55 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (T0NS)

- TABLE 56 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 57 CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 58 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 59 CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- 8.2 NUGGETS

- 8.2.1 COST-EFFICIENCY AND REGULATORY ACCEPTANCE TO DRIVE MARKET GROWTH

- TABLE 60 NUGGETS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 61 NUGGETS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 62 NUGGETS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 63 NUGGETS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 64 NUGGETS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 65 NUGGETS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 8.3 BURGERS

- 8.3.1 INNOVATIONS AND SCALING EFFORTS TO DRIVE MARKET GROWTH

- TABLE 66 BURGERS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 67 BURGERS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 68 BURGERS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 69 BURGERS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 70 BURGERS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 71 BURGERS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 8.4 MEATBALLS

- 8.4.1 COMBINATION OF ENVIRONMENTAL AWARENESS, TECHNOLOGICAL PROGRESS, AND CULINARY VERSATILITY TO PROPEL MARKET GROWTH

- TABLE 72 MEATBALLS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 73 MEATBALLS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 74 MEATBALLS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 75 MEATBALLS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 76 MEATBALLS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 77 MEATBALLS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 8.5 SAUSAGES

- 8.5.1 INCREASED DEMAND FOR CLEAN MEAT PRODUCTS TO DRIVE MARKET GROWTH

- TABLE 78 SAUSAGES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 79 SAUSAGES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 80 SAUSAGES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 81 SAUSAGES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 82 SAUSAGES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 83 SAUSAGES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 8.6 HOT DOGS

- 8.6.1 CULTURED HOT DOG MARKET TO GROW AMID GLOBAL MEAT DEMAND AND SUSTAINABILITY CONCERNS

- TABLE 84 HOT DOGS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 85 HOT DOGS: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 86 HOT DOGS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 87 HOT DOGS: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 88 HOT DOGS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 89 HOT DOGS: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- 8.7 OTHER END USES

- TABLE 90 OTHER END USES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 91 OTHER END USES: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 92 OTHER END USES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 93 OTHER END USES: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY REGION, 2023-2034 (TONS)

- TABLE 94 OTHER END USES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (USD MILLION)

- TABLE 95 OTHER END USES: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY REGION, 2023-2034 (TONS)

9 CULTURED MEAT MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 CANADA TO DOMINATE CULTURED MEAT MARKET AND RECORD HIGHEST CAGR DURING FORECAST PERIOD (NORMAL SCENARIO)

- TABLE 96 OPTIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023-2034 (USD MILLION)

- TABLE 97 OPTIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023-2034 (TONS)

- TABLE 98 NORMAL SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023-2034 (USD MILLION)

- TABLE 99 NORMAL SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023-2034 (TONS)

- TABLE 100 PESSIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023-2034 (USD MILLION)

- TABLE 101 PESSIMISTIC SCENARIO: CULTURED MEAT MARKET, BY REGION, 2023-2034 (TONS)

- 9.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: CULTURED MEAT MARKET SNAPSHOT (NORMAL SCENARIO)

- TABLE 102 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 103 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 104 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 105 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 106 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 107 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 108 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 109 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 110 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 111 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 112 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 113 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 114 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 115 NORTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 116 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 117 NORTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 118 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 119 NORTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 US

- 9.2.2.1 Rising US meat consumption to spark demand for cultured meat

- 9.2.3 CANADA

- 9.2.3.1 Canada's meat export strength to drive cultured meat evolution

- 9.2.4 MEXICO

- 9.2.4.1 Mexico's cultured meat pioneers to drive market growth

- 9.3 EUROPE

- TABLE 120 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 121 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 122 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 123 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 124 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 125 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 126 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 127 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 128 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 129 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 130 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 131 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 132 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 133 EUROPE: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 134 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 135 EUROPE: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 136 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 137 EUROPE: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- 9.3.1 EUROPE: RECESSION IMPACT

- 9.3.2 GERMANY

- 9.3.2.1 High acceptance of cultured meat in Germany to drive market growth

- 9.3.3 UK

- 9.3.3.1 UK to be prominent hub for cellular agriculture, thereby driving market growth

- 9.3.4 NETHERLANDS

- 9.3.4.1 Increased presence of cultured meat manufacturers and research centers to facilitate market growth

- 9.3.5 FRANCE

- 9.3.5.1 Unsupportive regulatory environment expected to hinder market growth

- 9.3.6 SPAIN

- 9.3.6.1 Strategic developments undertaken by market players to drive growth

- 9.3.7 ITALY

- 9.3.7.1 Governmental ban on cultured meat to restrict market growth

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- TABLE 138 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 139 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 140 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 141 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 142 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 144 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 145 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 146 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 148 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 150 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 152 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 154 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 155 ASIA PACIFIC: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- 9.4.2 CHINA

- 9.4.2.1 Substantial investments and governmental support to propel market growth

- 9.4.3 JAPAN

- 9.4.3.1 Increasing protein-rich diet to facilitate market growth

- 9.4.4 SINGAPORE

- 9.4.4.1 Increasing acceptance among consumers and governmental approval to drive market growth

- 9.4.5 INDIA

- 9.4.5.1 Increased environmental threats owing to upsurge in meat consumption to facilitate market growth

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Environmental awareness to fuel demand for cultured meat in Australia

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 SOUTH AMERICA

- TABLE 156 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 157 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 158 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 159 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 160 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 161 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 162 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 163 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 164 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 165 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 166 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 167 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 168 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 169 SOUTH AMERICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 170 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 171 SOUTH AMERICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 172 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 173 SOUTH AMERICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- 9.5.1 SOUTH AMERICA: RECESSION IMPACT

- 9.5.2 BRAZIL

- 9.5.2.1 Brazil's established meat industry to drive market growth

- 9.5.3 REST OF SOUTH AMERICA

- 9.6 MIDDLE EAST & AFRICA

- TABLE 174 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 176 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 178 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY COUNTRY, 2023-2034 (TONS)

- TABLE 180 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 182 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 184 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 186 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 188 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN NORMAL SCENARIO, BY END USE, 2023-2034 (TONS)

- TABLE 190 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: CULTURED MEAT MARKET IN PESSIMISTIC SCENARIO, BY END USE, 2023-2034 (TONS)

- 9.6.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.6.2 UAE

- 9.6.2.1 Gradual developments in cultured meat sector to drive market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS, 2022

- TABLE 192 CULTURED MEAT MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 10.3 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 193 STRATEGIES ADOPTED BY KEY PLAYERS IN CULTURED MEAT MARKET

- 10.4 REVENUE ANALYSIS

- 10.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 34 CULTURED MEAT MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 35 CULTURED MEAT MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.7 COMPANY FOOTPRINT

- TABLE 194 COMPANY FOOTPRINT, BY SOURCE

- TABLE 195 COMPANY FOOTPRINT, BY REGION

- TABLE 196 OVERALL COMPANY FOOTPRINT

- 10.8 STARTUP/SME EVALUATION MATRIX

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 36 CULTURED MEAT MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.8.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 197 CULTURED MEAT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 198 CULTURED MEAT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

- TABLE 199 CULTURED MEAT MARKET: DEALS, 2019-2023

- 10.9.2 OTHERS

- TABLE 200 CULTURED MEAT MARKET: OTHERS, 2019-2023

11 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 11.1 MAJOR PLAYERS

- 11.1.1 MOSA MEAT

- TABLE 201 MOSA MEAT: BUSINESS OVERVIEW

- TABLE 202 MOSA MEAT: DEALS

- TABLE 203 MOSA MEAT: OTHERS

- 11.1.2 UPSIDE FOODS

- TABLE 204 UPSIDE FOODS: BUSINESS OVERVIEW

- TABLE 205 UPSIDE FOODS: DEALS

- TABLE 206 UPSIDE FOODS: OTHERS

- 11.1.3 EAT JUST, INC.

- TABLE 207 EAT JUST, INC.: BUSINESS OVERVIEW

- TABLE 208 EAT JUST, INC.: DEALS

- 11.1.4 INTEGRICULTURE INC.

- TABLE 209 INTEGRICULTURE INC.: BUSINESS OVERVIEW

- TABLE 210 INTEGRICULTURE INC.: DEALS

- 11.1.5 MEWERY

- TABLE 211 MEWERY: BUSINESS OVERVIEW

- 11.1.6 BIOCRAFT, INC.

- TABLE 212 BIOCRAFT, INC.: BUSINESS OVERVIEW

- 11.1.7 FINLESS FOODS, INC.

- TABLE 213 FINLESS FOODS, INC.: BUSINESS OVERVIEW

- TABLE 214 FINLESS FOODS, INC.: DEALS

- 11.1.8 AVANT MEATS

- TABLE 215 AVANT MEATS: BUSINESS OVERVIEW

- TABLE 216 AVANT MEATS: DEALS

- TABLE 217 AVANT MEATS: OTHERS

- 11.1.9 BLUENALU

- TABLE 218 BLUENALU: BUSINESS OVERVIEW

- TABLE 219 BLUENALU: DEALS

- TABLE 220 BLUENALU: OTHERS

- 11.1.10 FORK & GOOD

- TABLE 221 FORK & GOOD: BUSINESS OVERVIEW

- 11.1.11 MISSION BARNS

- TABLE 222 MISSION BARNS: BUSINESS OVERVIEW

- TABLE 223 MISSION BARNS: DEALS

- 11.1.12 CUBIQ FOODS

- TABLE 224 CUBIQ FOODS: BUSINESS OVERVIEW

- 11.1.13 IVY FARM TECHNOLOGIES LIMITED

- TABLE 225 IVY FARM TECHNOLOGIES LIMITED: BUSINESS OVERVIEW

- 11.1.14 MEATABLE 224 TABLE 226 MEATABLE: BUSINESS OVERVIEW

- 11.2 STARTUPS/SMES/OTHER PLAYERS

- 11.2.1 BIOTECH FOODS

- TABLE 227 BIOTECH FOODS: BUSINESS OVERVIEW

- 11.2.2 O MEAT

- TABLE 228 O MEAT: BUSINESS OVERVIEW

- 11.2.3 BIOBQ

- TABLE 229 BIOBQ: BUSINESS OVERVIEW

- 11.2.4 PEARLITA FOODS

- TABLE 230 PEARLITA FOODS: BUSINESS OVERVIEW

- 11.2.5 WILDBIO

- TABLE 231 WILDBIO: BUSINESS OVERVIEW

- 11.2.6 GOURMEY

- TABLE 232 GOURMEY: BUSINESS OVERVIEW

- 11.2.7 PEACE OF MEAT

- TABLE 233 PEACE OF MEAT: BUSINESS OVERVIEW

- 11.2.8 WILD TYPE

- 11.2.9 LABFARM

- 11.2.10 SHIOK MEATS PTE LTD

- 11.2.11 CLEARMEAT

- 11.2.12 EAT JUST, INC.

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 MEAT SUBSTITUTES MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- TABLE 234 MEAT SUBSTITUTES MARKET, BY SOURCE, 2017-2020 (USD MILLION)

- TABLE 235 MEAT SUBSTITUTES MARKET, BY SOURCE, 2021-2027 (USD MILLION)

- TABLE 236 MEAT SUBSTITUTES MARKET, BY SOURCE, 2017-2020 (KT)

- TABLE 237 MEAT SUBSTITUTES MARKET, BY SOURCE, 2021-2027 (KT)

- 12.4 PLANT-BASED MEAT MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- TABLE 238 PLANT-BASED MEAT MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 239 PLANT-BASED MEAT MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 240 PLANT-BASED MEAT MARKET, BY SOURCE, 2019-2021 (TONS)

- TABLE 241 PLANT-BASED MEAT MARKET, BY SOURCE, 2022-2027 (TONS)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS