|

|

市場調査レポート

商品コード

1378209

空間コンピューティングの世界市場:技術タイプ別、コンポーネント別、業界別、地域別-2028年までの予測Spatial Computing Market by Technology Type (AR Technology, VR Technology, MR Technology), Component (Hardware, Software, Services), Vertical (Media & Entertainment, Manufacturing, Retail & eCommerce) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 空間コンピューティングの世界市場:技術タイプ別、コンポーネント別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年11月02日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 技術タイプ別、コンポーネント別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

空間コンピューティングの市場規模は、2023年の979億米ドルから2028年には2,805億米ドルに成長し、予測期間中の年間平均成長率(CAGR)は23.4%になると予測されています。

政府のイニシアチブの増加、5G技術の継続的な開拓、航空宇宙・防衛分野における空間コンピューティングと隣接技術の取り込みは、空間コンピューティング市場を成長させる機会を提供します。消費者のプライバシーの厳格な維持・保全は、空間コンピューティング市場の成長にとって大きな課題となっています。

拡張現実(AR)、仮想現実(VR)、複合現実(MR)を包含する空間コンピューティングソフトウェアは、幅広い産業分野で導入が進んでいます。これらのソフトウェアソリューションは、デジタル世界と物理的世界を融合させ、周囲の環境との関わり方を強化するように設計されています。市場では、空間コンピューティングソフトウェアは、没入型ゲームやバーチャルツーリズム体験から、ヘルスケア、教育、製造、アーキテクチャなどの業界に革命を起こすアプリケーションに使用されています。例えばヘルスケアでは、外科医がARベースのソフトウェアを使用してより正確な処置を行い、教育では学生がインタラクティブで没入型の学習体験に取り組むことができます。製造業では製品設計や品質管理のために、建築家では建物の3Dビジュアライゼーションのために、これらのソリューションが採用されています。

複合現実(MR)デバイスは、拡張現実(AR)と仮想現実(VR)の両方の要素を融合させたハイブリッドアプローチです。マイクロソフトのHoloLensのようなこれらのデバイスは、ユーザーがデジタル環境と物理的環境と同時に相互作用することを可能にします。MRデバイスは、空間マッピング、深度を感知するカメラ、現実と仮想のコンテンツの組み合わせを使用し、物理世界と仮想オブジェクトやホログラムをシームレスに融合させます。MRは、ユーザーが現実世界の周囲に仮想コンテンツを配置し、操作し、相互作用できるようにすることで、空間コンピューティングに実装されます。この技術は、デザイン、エンジニアリング、医療トレーニングなど、様々な専門的な場面で応用されており、ユーザーは3Dモデルをリアルタイムで視覚化し、操作することで、空間的な理解と問題解決を高めることができます。

当レポートでは、世界の空間コンピューティング市場について調査し、技術タイプ別、コンポーネント別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- 生態系マッピング

- サプライチェーン分析

- 技術分析

- 価格分析

- 貿易分析

- ビジネスモデル分析

- 特許分析

- ポーターのファイブフォース分析

- 関税と規制状況

- 主要な会議とイベント

- 購入者に影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 空間コンピューティング市場、技術タイプ別

- イントロダクション

- AR技術

- VR技術

- MR技術

第7章 空間コンピューティング市場、コンポーネント別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第8章 空間コンピューティング市場、業界別

- イントロダクション

- メディアとエンターテイメント

- 小売と電子商取引

- 製造業

- 教育と訓練

- 不動産

- ヘルスケア

- 航空宇宙と防衛

- 旅行とホスピタリティ

- その他

第9章 空間コンピューティング市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- 概要

- 主要参入企業が採用した戦略/有力企業

- 収益分析

- 会社の財務指標

- 主要な市場参入企業の世界スナップショット

- 市場シェア分析

- ベンダー製品/ブランドの比較

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 主要な市場の発展

第11章 企業プロファイル

- 主要参入企業

- META(FACEBOOK)

- MICROSOFT

- APPLE

- SONY

- QUALCOMM

- SAMSUNG

- EPSON

- PTC

- EPIC GAMES

- その他の企業

- MAGIC LEAP

- HTC

- LENOVO

- INTEL

- NVIDIA

- EON REALITY

- ULTRALEAP

- VUZIX

- VARJO

- ZAPPAR

- TAQTILE

- BLIPPAR

- 3D CLOUD BY MARXENT

- 4EXPERIENCE

- AVEGANT

第12章 隣接市場および関連市場

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Technology Type, Component, and Vertical. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The Spatial computing market size is expected to grow from USD 97.9 billion in 2023 to USD 280.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 23.4% during the forecast period. The increase in government initiatives, continuous development in 5G technology, and incorporation of spatial computing and adjacent technologies in the aerospace & defense sector offer opportunities to grow the spatial computing market. Strict maintenance and preservation of consumer privacy pose a significant challenge to the growth of the Spatial computing market.

"By component, the software segment to have the highest market share during the forecast period."

Spatial computing software, encompassing augmented reality (AR), virtual reality (VR), and mixed reality (MR), is being increasingly implemented across a broad spectrum of industries. These software solutions are designed to merge the digital and physical worlds, enhancing the way we interact with our surroundings. In the market, spatial computing software is used for applications ranging from immersive gaming and virtual tourism experiences to revolutionizing industries like healthcare, education, manufacturing, and architecture. In healthcare, for example, surgeons use AR-based software for more precise procedures, while in education, students can engage in interactive and immersive learning experiences. Manufacturing industries are adopting these solutions for product design and quality control, and architects use them for 3D building visualization.

"By hardware, the MR devices segment is expected to grow at the highest CAGR during the forecast period. "

Mixed Reality (MR) devices represent a hybrid approach that blends elements of both Augmented Reality (AR) and Virtual Reality (VR). These devices, such as HoloLens by Microsoft, enable users to simultaneously interact with digital and physical environments. MR devices use spatial mapping, depth-sensing cameras, and a combination of real and virtual content to blend the physical world with virtual objects or holograms seamlessly. MR is implemented in spatial computing by allowing users to place, manipulate, and interact with virtual content in their real-world surroundings. This technology is applied in various professional settings, such as design, engineering, and medical training, where users can visualize and manipulate 3D models in real-time, enhancing spatial understanding and problem-solving.

"By vertical, the media & entertainment segment is projected to record the highest market share during the forecast period."

The consumer segment consists of gaming & sports and entertainment applications. The entertainment applications include museums (archeology), theme parks, art galleries, and exhibitions. Spatial computing technology offers remarkable results in terms of visual effects when used in gaming and sports broadcasts. The gaming sector has been an early adopter of new 3D and extended reality technologies. These technologies can be used to enhance the gaming experience of players by creating virtual objects and characters that are linked to defined locations in the real world. Players can easily interact with digital objects in the real world.

The breakup of the profiles of the primary participants is below:

- By Company Type: Tier I: 29%, Tier II: 45%, and Tier III: 26%

- By Designation: C-Level Executives: 30%, Director Level: 25%, and *Others: 45%

- By Region: North America: 40%, Europe: 30%, Asia Pacific: 25%, **RoW: 5%

- Others include sales managers, marketing managers, and product managers

*RoW include Middle East & Africa and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the key players operating in the Spatial computing market are - IBM (US), SAP (Germany), Google (US), Microsoft (US), Salesforce (US), AWS (US), Oracle (US), Alibaba Cloud (China), Tencent Cloud (China), and Workday (US).

Research coverage:

The market study covers the Spatial computing market across segments. It aims to estimate the market size and the growth potential of this market across different segments, such as component, technology type, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Spatial computing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the Spatial computing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Spatial computing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Spatial computing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Spatial computing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Meta, Microsoft, Apple, Sony, and Qualcomm in the spatial computing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 SPATIAL COMPUTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 SPATIAL COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF SPATIAL COMPUTING VENDORS

- FIGURE 6 SUPPLY-SIDE ANALYSIS: ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 DEMAND-SIDE ANALYSIS: REVENUE GENERATED FROM SPATIAL COMPUTING PRODUCTS AND SERVICES

- FIGURE 8 APPROACH 2 (DEMAND SIDE): SPATIAL COMPUTING MARKET

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- 2.7 IMPACT OF RECESSION ON GLOBAL SPATIAL COMPUTING MARKET

- TABLE 3 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- 3.1 RECESSION IMPACT

- FIGURE 9 TOP-GROWING SEGMENTS IN SPATIAL COMPUTING MARKET

- FIGURE 10 SPATIAL COMPUTING MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR SPATIAL COMPUTING MARKET PLAYERS

- FIGURE 11 EMERGENCE OF ADVANCED TECHNOLOGIES AND DIGITAL INITIATIVES TO DRIVE ADOPTION OF SPATIAL COMPUTING

- 4.2 SPATIAL COMPUTING MARKET, BY HARDWARE

- FIGURE 12 VR DEVICES TO BE LARGEST SPATIAL COMPUTING TECHNOLOGY DURING FORECAST PERIOD

- 4.3 SPATIAL COMPUTING MARKET, BY COMPONENT

- FIGURE 13 SPATIAL COMPUTING SOFTWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023 AND 2028

- 4.4 SPATIAL COMPUTING MARKET, BY VERTICAL

- FIGURE 14 MEDIA & ENTERTAINMENT VERTICAL TO BE LARGEST IN 2023 AND 2028

- 4.5 SPATIAL COMPUTING MARKET: REGIONAL SCENARIO

- FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SPATIAL COMPUTING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Virtualization in fashion, art, and retail industries

- 5.2.1.2 Increase in adoption of extended reality in healthcare sector

- 5.2.1.3 Availability of affordable hardware

- 5.2.1.4 Advancements in real-time rendering engines

- 5.2.1.5 Replacement technology to reduce 'virtual meeting fatigue'

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rise in health concerns associated with excessive usage of VR/XR devices

- 5.2.2.2 Diversity of AR/VR platforms and complex development landscape

- 5.2.2.3 Lack of technical knowledge and expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in government initiatives toward cloud computing

- 5.2.3.2 Continuous development in 5G technology

- 5.2.3.3 Incorporation of spatial computing and adjacent technologies in aerospace & defense sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Low-latency imaging displays

- 5.2.4.2 Local government restrictions coupled with environmental impact

- 5.2.4.3 Strict maintenance and preservation of consumer privacy

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 MICROSOFT REVOLUTIONIZED CHEMICAL RECYCLING INDUSTRY WITH ENCINA

- 5.3.2 PTC IMPLEMENTED ROBUST PLM SYSTEM TO BRIDGE DEVELOPMENT GAPS AND PROVIDE BETTER SUPPORT TO CONGATEC

- 5.3.3 MAGIC LEAP AIMED TO ACE SPATIAL COMPUTING TECHNIQUES USING JABIL'S ADVANCED TECHNOLOGIES AND TOOLS

- 5.3.4 ALTOURA ENABLED QANTAS OFFER PILOTS VISUAL TRAINING

- 5.3.5 ANSYS HELPED BOSCH REDUCE TIME-TO-MARKET

- 5.4 ECOSYSTEM MAPPING

- FIGURE 17 SPATIAL COMPUTING MARKET: ECOSYSTEM

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 18 SPATIAL COMPUTING MARKET: SUPPLY CHAIN

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 ARTIFICIAL INTELLIGENCE

- 5.6.2 BIG DATA

- 5.6.3 INTERNET OF THINGS

- 5.6.4 DATA ANALYTICS

- 5.6.5 MACHINE LEARNING

- 5.6.6 5G TECHNOLOGY

- 5.6.7 DEPTH SENSING CAMERAS

- 5.6.8 LIDAR SENSORS

- 5.6.9 SLAM

- 5.6.10 3D MODELING AND VISUALIZATION

- 5.6.11 GESTURAL AND VOICE INTERFACES

- 5.6.12 HUMAN-COMPUTER INTERACTION

- 5.6.13 3D PRINTING

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWARE

- TABLE 4 AVERAGE SELLING PRICE OF SPATIAL COMPUTING HEADSETS OFFERED BY KEY PLAYERS

- FIGURE 19 AVERAGE SELLING PRICE OF MR HEADSETS OFFERED BY KEY PLAYERS, 2023 (USD)

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE

- TABLE 5 AVERAGE SELLING PRICE TREND OF SDKS OFFERED BY KEY PLAYERS

- TABLE 6 AVERAGE SELLING PRICE TREND OF SPATIAL COMPUTING SOFTWARE OFFERED BY KEY PLAYERS

- 5.7.3 AVERAGE SELLING PRICE TREND OF HARDWARE, BY REGION

- FIGURE 20 AVERAGE SELLING PRICE TREND OF MR DEVICES, BY REGION, 2023 (USD)

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- TABLE 7 IMPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.8.2 EXPORT SCENARIO

- TABLE 8 EXPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.9 BUSINESS MODEL ANALYSIS

- FIGURE 21 SPATIAL COMPUTING MARKET: BUSINESS MODELS

- 5.9.1 BUSINESS MODEL FOR HARDWARE VENDORS

- 5.9.2 BUSINESS MODEL FOR SOFTWARE VENDORS

- 5.9.3 BUSINESS MODEL FOR SERVICE VENDORS

- 5.9.4 REVENUE GENERATION MODELS

- 5.9.5 PARTNERSHIPS & ECOSYSTEM

- 5.10 PATENT ANALYSIS

- FIGURE 22 NUMBER OF PATENTS PUBLISHED, 2012-2023

- FIGURE 23 TOP FIVE GLOBAL PATENT OWNERS

- TABLE 9 TOP TEN PATENT OWNERS

- TABLE 10 PATENTS GRANTED TO VENDORS IN SPATIAL COMPUTING MARKET

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 IMPACT OF PORTER'S FIVE FORCES

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TARIFF & REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- TABLE 12 US: MFN TARIFFS FOR HS CODE: 9004 EXPORTED

- TABLE 13 US: MFN TARIFFS FOR HS CODE: 9004 IMPORTED

- 5.12.2 REGULATIONS, BY REGION

- 5.12.2.1 North America

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2.2 Europe

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2.3 Asia Pacific

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2.4 Rest of the World

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS

- TABLE 18 SPATIAL COMPUTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 25 MAJOR YCC TRENDS TO DRIVE FUTURE REVENUE PROSPECTS IN SPATIAL COMPUTING MARKET

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USER VERTICALS

- 5.15.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP END USER VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP END USERS

6 SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE

- 6.1 INTRODUCTION

- 6.1.1 TECHNOLOGY TYPE: SPATIAL COMPUTING MARKET DRIVERS

- FIGURE 28 MR TECHNOLOGY TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 21 SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 22 SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- 6.2 AR TECHNOLOGY

- 6.2.1 INCREASE IN ADOPTION OF AR IN ENTERTAINMENT, RETAIL, AND GAMING

- TABLE 23 AR TECHNOLOGY IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

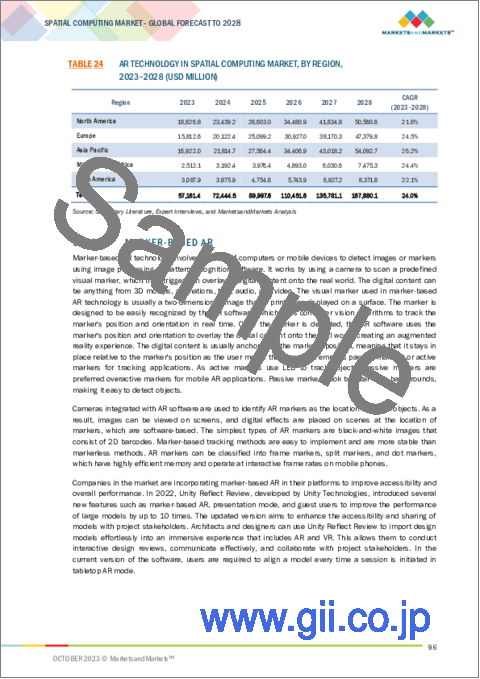

- TABLE 24 AR TECHNOLOGY IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 MARKER-BASED AR

- 6.2.3 MARKERLESS AR

- 6.3 VR TECHNOLOGY

- 6.3.1 HIGH TRACTION IN GAMING WITH EXPANSION TO DIVERSE APPLICATIONS

- TABLE 25 VR TECHNOLOGY IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 VR TECHNOLOGY IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 SEMI-IMMERSIVE VR

- 6.3.3 FULLY IMMERSIVE VR

- 6.4 MR TECHNOLOGY

- 6.4.1 COMBINING PHYSICAL AND DIGITAL ELEMENTS TO AUGMENT HEALTHCARE PROCEDURES WITH MEDICAL VISUALIZATION

- TABLE 27 MR TECHNOLOGY IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 MR TECHNOLOGY IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 OBJECT INTERACTION MR

- 6.4.3 DIGITAL OVERLAY MR

7 SPATIAL COMPUTING MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.1.1 COMPONENT: SPATIAL COMPUTING MARKET DRIVERS

- FIGURE 29 HARDWARE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 29 SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 30 SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.2 HARDWARE

- FIGURE 30 MR DEVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 32 SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 33 SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 AR DEVICES

- 7.2.1.1 Growth in use of mobile phones for 3D navigation with real-time overlay

- 7.2.1.2 Smartphone-based AR

- 7.2.1.3 AR Glasses

- 7.2.1.4 AR Headsets

- 7.2.1.5 Other AR Devices

- TABLE 35 AR DEVICES IN SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 AR DEVICES IN SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 VR DEVICES

- 7.2.2.1 Increased demand for VR HMDs across verticals for different applications

- 7.2.2.2 Tethered VR Headsets

- 7.2.2.3 Standalone VR Headsets

- 7.2.2.4 Smartphone-based VR Headsets

- 7.2.2.5 Other VR Devices

- TABLE 37 VR DEVICES IN SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 VR DEVICES IN SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 MR DEVICES

- 7.2.3.1 Ability to visualize and manipulate 3D models in real-time, enhancing spatial understanding

- 7.2.3.2 Smartphone-based MR

- 7.2.3.3 MR Glasses

- 7.2.3.4 MR Headsets

- 7.2.3.5 Other MR Devices

- TABLE 39 MR DEVICES IN SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 MR DEVICES IN SPATIAL COMPUTING HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SOFTWARE

- FIGURE 31 TRAINING SIMULATION SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 41 SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 43 SPATIAL COMPUTING SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 SPATIAL COMPUTING SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.1 SOFTWARE DEVELOPMENT KIT (SDK)

- 7.3.1.1 Tools and kits to engineer more AR/VR experiences and applications

- TABLE 45 SOFTWARE DEVELOPMENT KIT IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 SOFTWARE DEVELOPMENT KIT IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 GAME ENGINE

- 7.3.2.1 Frameworks to build virtual worlds and immersive gaming adventures

- TABLE 47 GAME ENGINE IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 GAME ENGINE IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.3 MODELING & VISUALIZATION SOFTWARE

- 7.3.3.1 Designing interactive visual experiences with extreme precision and detail

- TABLE 49 MODELING & VISUALIZATION SOFTWARE IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 MODELING & VISUALIZATION SOFTWARE IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.4 CONTENT MANAGEMENT SYSTEM (CMS)

- 7.3.4.1 Management of VR and AR multimedia content across multiple platforms

- TABLE 51 CONTENT MANAGEMENT SYSTEM IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 CONTENT MANAGEMENT SYSTEM IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.5 TRAINING SIMULATION SOFTWARE

- 7.3.5.1 Simulating realistic training modules to save time and cost

- TABLE 53 TRAINING SIMULATION SOFTWARE IN SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 TRAINING SIMULATION SOFTWARE IN SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.6 OTHER SOFTWARE

- TABLE 55 OTHER SPATIAL COMPUTING SOFTWARE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 OTHER SPATIAL COMPUTING SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 SERVICES

- FIGURE 32 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 57 SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 58 SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 59 SPATIAL COMPUTING SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 SPATIAL COMPUTING SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.1 PROFESSIONAL SERVICES

- 7.4.1.1 Lack of in-house expertise and increase in complexity of solutions

- TABLE 61 SPATIAL COMPUTING PROFESSIONAL SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 SPATIAL COMPUTING PROFESSIONAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.1.2 Consulting

- 7.4.1.3 System Integration & Implementation

- 7.4.1.4 Support & Maintenance

- 7.4.2 MANAGED SERVICES

- 7.4.2.1 Enabling organizations to focus on core competencies

- TABLE 63 SPATIAL COMPUTING MANAGED SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 SPATIAL COMPUTING MANAGED SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.2.2 Security

- 7.4.2.3 Content management

- 7.4.2.4 Performance monitoring

8 SPATIAL COMPUTING MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: SPATIAL COMPUTING MARKET DRIVERS

- FIGURE 33 TRAVEL & HOSPITALITY TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 65 SPATIAL COMPUTING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 66 SPATIAL COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 MEDIA & ENTERTAINMENT

- 8.2.1 INCREASE IN POPULARITY OF IMMERSIVE GAMING

- TABLE 67 SPATIAL COMPUTING MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 SPATIAL COMPUTING MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 MEDIA & ENTERTAINMENT: APPLICATIONS OF SPATIAL COMPUTING

- 8.2.2.1 Gaming

- 8.2.2.2 Sports

- 8.2.2.3 Social Media

- 8.2.2.4 Other Media & Entertainment Applications

- 8.3 RETAIL & ECOMMERCE

- 8.3.1 RESTRUCTURING VIRTUAL SHOPPING EXPERIENCES

- TABLE 69 SPATIAL COMPUTING MARKET IN RETAIL & ECOMMERCE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 SPATIAL COMPUTING MARKET IN RETAIL & ECOMMERCE, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2 RETAIL & ECOMMERCE: APPLICATIONS OF SPATIAL COMPUTING

- 8.3.2.1 Jewelry

- 8.3.2.2 Beauty & Cosmetics

- 8.3.2.3 Apparel fitting

- 8.3.2.4 Other Retail & eCommerce Applications

- 8.4 MANUFACTURING

- 8.4.1 IMPROVED TRAINING FOR WORKFORCE BY VISUALIZING CONTENT

- TABLE 71 SPATIAL COMPUTING MARKET IN MANUFACTURING, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 SPATIAL COMPUTING MARKET IN MANUFACTURING, BY REGION, 2023-2028 (USD MILLION)

- 8.4.2 MANUFACTURING: APPLICATIONS OF SPATIAL COMPUTING

- 8.4.2.1 Digital Factory

- 8.4.2.2 Digital Twin

- 8.4.2.3 Industrial Training

- 8.4.2.4 Other Manufacturing Applications

- 8.5 EDUCATION & TRAINING

- 8.5.1 AR/VR LABORATORIES AND MUSEUMS TO OFFER IMMERSIVE LEARNING EXPERIENCES

- TABLE 73 SPATIAL COMPUTING MARKET IN EDUCATION & TRAINING, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 SPATIAL COMPUTING MARKET IN EDUCATION & TRAINING, BY REGION, 2023-2028 (USD MILLION)

- 8.5.2 EDUCATION & TRAINING: APPLICATIONS OF SPATIAL COMPUTING

- 8.5.2.1 Immersive Learning

- 8.5.2.2 Training Simulations

- 8.5.2.3 Virtual Field Trips

- 8.5.2.4 Other Education & Training Applications

- 8.6 REAL ESTATE

- 8.6.1 AR-BASED INSIGHTS AND PROPERTY TOURS

- TABLE 75 SPATIAL COMPUTING MARKET IN REAL ESTATE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 SPATIAL COMPUTING MARKET IN REAL ESTATE, BY REGION, 2023-2028 (USD MILLION)

- 8.6.2 REAL ESTATE: APPLICATIONS OF SPATIAL COMPUTING

- 8.6.2.1 Virtual Property Tours

- 8.6.2.2 Remote Property Viewing

- 8.6.2.3 Design Visualization & Customization

- 8.6.2.4 Other Applications

- 8.7 HEALTHCARE

- 8.7.1 SAVING LIVES, TIME, AND COSTS WITH SPATIAL COMPUTING TECHNOLOGIES

- TABLE 77 SPATIAL COMPUTING MARKET IN HEALTHCARE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 78 SPATIAL COMPUTING MARKET IN HEALTHCARE, BY REGION, 2023-2028 (USD MILLION)

- 8.7.2 HEALTHCARE: APPLICATIONS OF SPATIAL COMPUTING

- 8.7.2.1 Surgery

- 8.7.2.2 Patient Management

- 8.7.2.3 Medical Training

- 8.7.2.4 Other Healthcare Applications

- 8.8 AEROSPACE & DEFENSE

- 8.8.1 IMPROVING SITUATIONAL AWARENESS AND PLANNING EFFECTIVE RESPONSE WITH IMMERSIVE SIMULATIONS

- TABLE 79 SPATIAL COMPUTING MARKET IN AEROSPACE & DEFENSE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 SPATIAL COMPUTING MARKET IN AEROSPACE & DEFENSE, BY REGION, 2023-2028 (USD MILLION)

- 8.8.2 AEROSPACE & DEFENSE: APPLICATIONS OF SPATIAL COMPUTING

- 8.8.2.1 Flight simulations

- 8.8.2.2 Design & prototyping

- 8.8.2.3 Remote assistance & maintenance

- 8.8.2.4 Other aerospace & defense applications

- 8.9 TRAVEL & HOSPITALITY

- 8.9.1 USHERING IN ERA OF VIRTUAL TOURISM AND BEFOREHAND TRAVEL EXPERIENCES

- TABLE 81 SPATIAL COMPUTING MARKET IN TRAVEL & HOSPITALITY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 82 SPATIAL COMPUTING MARKET IN TRAVEL & HOSPITALITY, BY REGION, 2023-2028 (USD MILLION)

- 8.9.2 TRAVEL & HOSPITALITY: APPLICATIONS OF SPATIAL COMPUTING

- 8.9.2.1 Virtual hotel tours

- 8.9.2.2 Virtual theme parks

- 8.9.2.3 Museums, zoos, and other cultural institutions

- 8.9.2.4 Other travel & hospitality applications

- 8.10 OTHER VERTICALS

- TABLE 83 SPATIAL COMPUTING MARKET IN OTHER VERTICALS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 SPATIAL COMPUTING MARKET IN OTHER VERTICALS, BY REGION, 2023-2028 (USD MILLION)

9 SPATIAL COMPUTING MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 85 SPATIAL COMPUTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 SPATIAL COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: SPATIAL COMPUTING MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 87 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: SPATIAL COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Convergence of spatial computing with MR, XR to encourage US service providers to scale

- TABLE 101 US: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 102 US: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Emerging startups to provide innovative platforms and solutions

- TABLE 103 CANADA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 104 CANADA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: SPATIAL COMPUTING MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 105 EUROPE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 106 EUROPE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 108 EUROPE: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 109 EUROPE: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 110 EUROPE: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 111 EUROPE: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 112 EUROPE: SPATIAL COMPUTING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 EUROPE: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 114 EUROPE: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 115 EUROPE: SPATIAL COMPUTING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 116 EUROPE: SPATIAL COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 117 EUROPE: SPATIAL COMPUTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 EUROPE: SPATIAL COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Companies to adopt spatial computing solutions to enhance operational efficiency

- TABLE 119 UK: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 120 UK: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 German spatial computing and telecom companies to witness increased collaborations to build robust solutions

- TABLE 121 GERMANY: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 122 GERMANY: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.3.5 FRANCE

- 9.3.5.1 Huge investments by global spatial computing providers because of changing customer behavior

- TABLE 123 FRANCE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 124 FRANCE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.3.6 ITALY

- 9.3.6.1 Higher demand for AR/VR-based tourism

- TABLE 125 FRANCE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 126 FRANCE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 127 REST OF EUROPE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 128 REST OF EUROPE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: SPATIAL COMPUTING MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 129 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Adoption of spatial computing in China to help achieve resiliency and scalability

- TABLE 143 CHINA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 144 CHINA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.4.4 JAPAN

- 9.4.4.1 Focus on cloud systems, IoT, and spatial computing with growing competitiveness in automotive and industrial robots industries

- TABLE 145 JAPAN: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 146 JAPAN: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Initiatives by governments and startups toward technology adoption

- TABLE 147 AUSTRALIA & NEW ZEALAND: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 148 AUSTRALIA & NEW ZEALAND: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Immense investments across verticals, especially gaming, healthcare, and military

- TABLE 149 SOUTH KOREA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 150 SOUTH KOREA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.4.7 REST OF ASIA PACIFIC

- TABLE 151 REST OF ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 153 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3 SAUDI ARABIA

- 9.5.3.1 Increase in purchasing power and inclination toward advanced technologies

- TABLE 167 SAUDI ARABIA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 168 SAUDI ARABIA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.5.4 UAE

- 9.5.4.1 IT resource deployment, intelligent storage services, and remote monitoring capabilities

- TABLE 169 UAE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 170 UAE: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 171 REST OF MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: SPATIAL COMPUTING MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 173 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 174 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 176 LATIN AMERICA: SPATIAL COMPUTING HARDWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 178 LATIN AMERICA: SPATIAL COMPUTING SOFTWARE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 180 LATIN AMERICA: SPATIAL COMPUTING SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2019-2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: SPATIAL COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Rise in technology assimilation among enterprises and consumers

- TABLE 187 BRAZIL: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 188 BRAZIL: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.6.4 MEXICO

- 9.6.4.1 Emerging 3D integrated industries, AR, VR, and advanced technologies embedded industries

- TABLE 189 MEXICO: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 190 MEXICO: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.6.5 REST OF LATIN AMERICA

- TABLE 191 REST OF LATIN AMERICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: SPATIAL COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 193 OVERVIEW OF STRATEGIES ADOPTED BY KEY SPATIAL COMPUTING VENDORS

- 10.3 REVENUE ANALYSIS

- FIGURE 37 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018-2022 (USD BILLION)

- 10.4 COMPANY FINANCIAL METRICS

- FIGURE 38 TRADING COMPARABLES, 2023 (EV/EBITDA)

- 10.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 39 SPATIAL COMPUTING MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- 10.6 MARKET SHARE ANALYSIS

- FIGURE 40 SPATIAL COMPUTING MARKET SHARE ANALYSIS, 2022

- TABLE 194 SPATIAL COMPUTING MARKET: DEGREE OF COMPETITION

- 10.7 COMPARISON OF VENDOR PRODUCTS/BRANDS

- TABLE 195 VENDOR PRODUCT/BRAND COMPARISON

- 10.8 COMPANY EVALUATION MATRIX

- FIGURE 41 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 10.8.1 STARS

- 10.8.2 EMERGING LEADERS

- 10.8.3 PERVASIVE PLAYERS

- 10.8.4 PARTICIPANTS

- FIGURE 42 SPATIAL COMPUTING MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- 10.8.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 196 KEY COMPANY FOOTPRINT

- 10.9 STARTUP/SME EVALUATION MATRIX

- FIGURE 43 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- FIGURE 44 SPATIAL COMPUTING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.9.5 COMPETITIVE BENCHMARKING

- TABLE 197 SPATIAL COMPUTING MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 198 STARTUP/SME FOOTPRINT

- 10.10 KEY MARKET DEVELOPMENTS

- 10.10.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 199 PRODUCT LAUNCHES & ENHANCEMENTS, 2020-2023

- 10.10.2 DEALS

- TABLE 200 DEALS, 2020-2023

11 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 META (FACEBOOK)

- TABLE 201 META: BUSINESS OVERVIEW

- FIGURE 45 META: COMPANY SNAPSHOT

- TABLE 202 META: PRODUCTS OFFERED

- TABLE 203 META: PRODUCT LAUNCHES

- TABLE 204 META: DEALS

- 11.2.2 MICROSOFT

- TABLE 205 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 46 MICROSOFT: COMPANY SNAPSHOT

- TABLE 206 MICROSOFT: PRODUCTS OFFERED

- TABLE 207 MICROSOFT: PRODUCT LAUNCHES

- TABLE 208 MICROSOFT: DEALS

- 11.2.3 APPLE

- TABLE 209 APPLE: BUSINESS OVERVIEW

- FIGURE 47 APPLE: COMPANY SNAPSHOT

- TABLE 210 APPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 APPLE: PRODUCT LAUNCHES

- TABLE 212 APPLE: DEALS

- 11.2.4 SONY

- TABLE 213 SONY: BUSINESS OVERVIEW

- FIGURE 48 SONY: COMPANY SNAPSHOT

- TABLE 214 SONY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SONY: PRODUCT LAUNCHES

- TABLE 216 SONY: DEALS

- 11.2.5 QUALCOMM

- TABLE 217 QUALCOMM: BUSINESS OVERVIEW

- FIGURE 49 QUALCOMM: COMPANY SNAPSHOT

- TABLE 218 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 QUALCOMM: DEALS

- TABLE 220 QUALCOMM: OTHERS

- 11.2.6 GOOGLE

- TABLE 221 GOOGLE: BUSINESS OVERVIEW

- FIGURE 50 GOOGLE: COMPANY SNAPSHOT

- TABLE 222 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 GOOGLE: PRODUCT LAUNCHES

- TABLE 224 GOOGLE: DEALS

- 11.2.7 SAMSUNG

- TABLE 225 SAMSUNG: BUSINESS OVERVIEW

- FIGURE 51 SAMSUNG: COMPANY SNAPSHOT

- TABLE 226 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 SAMSUNG: PRODUCT LAUNCHES

- TABLE 228 SAMSUNG: DEALS

- 11.2.8 EPSON

- TABLE 229 EPSON: BUSINESS OVERVIEW

- FIGURE 52 EPSON: COMPANY SNAPSHOT

- TABLE 230 EPSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 EPSON: PRODUCT LAUNCHES

- TABLE 232 EPSON: DEALS

- 11.2.9 PTC

- TABLE 233 PTC: BUSINESS OVERVIEW

- FIGURE 53 PTC: COMPANY SNAPSHOT

- TABLE 234 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 PTC: PRODUCT LAUNCHES

- TABLE 236 PTC: DEALS

- 11.2.10 EPIC GAMES

- TABLE 237 EPIC GAMES: BUSINESS OVERVIEW

- TABLE 238 EPIC GAMES: PRODUCTS OFFERED

- TABLE 239 EPIC GAMES: PRODUCT LAUNCHES

- TABLE 240 EPIC GAMES: DEALS

- 11.3 OTHER PLAYERS

- 11.3.1 MAGIC LEAP

- 11.3.2 HTC

- 11.3.3 LENOVO

- 11.3.4 INTEL

- 11.3.5 NVIDIA

- 11.3.6 EON REALITY

- 11.3.7 ULTRALEAP

- 11.3.8 VUZIX

- 11.3.9 VARJO

- 11.3.10 ZAPPAR

- 11.3.11 TAQTILE

- 11.3.12 BLIPPAR

- 11.3.13 3D CLOUD BY MARXENT

- 11.3.14 4EXPERIENCE

- 11.3.15 AVEGANT

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 RELATED MARKETS

- 12.2 AR VR SOFTWARE MARKET

- TABLE 241 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 242 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 243 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 244 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 245 AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 246 AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 247 AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 248 AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 METAVERSE MARKET

- TABLE 249 METAVERSE MARKET, BY COMPONENT, 2018-2021 (USD BILLION)

- TABLE 250 METAVERSE MARKET, BY COMPONENT, 2022-2027 (USD BILLION)

- TABLE 251 METAVERSE MARKET, BY VERTICAL, 2018-2021 (USD BILLION)

- TABLE 252 METAVERSE MARKET, BY VERTICAL, 2022-2027 (USD BILLION)

- TABLE 253 METAVERSE MARKET, BY REGION, 2018-2021 (USD BILLION)

- TABLE 254 METAVERSE MARKET, BY REGION, 2022-2027 (USD BILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS