|

|

市場調査レポート

商品コード

1620869

エクステンデッド・リアリティの世界市場:企業規模別、技術別、オファリング別、デバイスタイプ別、用途別、地域別 - 2029年までの予測Extended Reality Market by Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Head-mounted Displays, Head-up Displays, Sensors, Controllers and Processors, Displays, Gaming, Retail, E-commerce and E-learning - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| エクステンデッド・リアリティの世界市場:企業規模別、技術別、オファリング別、デバイスタイプ別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月17日

発行: MarketsandMarkets

ページ情報: 英文 315 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

エクステンデッド・リアリティの市場規模は、2024年の244億2,000万米ドルから2029年には848億6,000万米ドルに成長し、予測期間内のCAGRは28.3%になると予想されています。

この背景には、技術の優位性の高まり、分野横断的なアプリケーションの増加、没入型アクティビティへのニーズの高まりがあります。高解像度と低遅延のデバイスを含むエクステンデッド・リアリティハードウェアの進歩は、5GネットワークとAIの準備が整ったことと共に、エクステンデッド・リアリティの能力を向上させ、その結果、用途全体の利用を改善しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 企業規模別、技術別、オファリング別、デバイスタイプ別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

拡張現実(AR)技術は、予測期間においてエクステンデッド・リアリティ市場で2番目に高いCAGRを記録すると予測されています。ARによって、顧客はバーチャルな服を試着したり、拡張された方法で商品と対話したりといった体験を楽しむことができます。不動産では、ARはオープンハウスの代わりに物件のバーチャルツアーを可能にし、買い手を納得させるのに役立ちます。ARはヘルスケア産業において、外科医や医学生、さらには患者を支援します。ARは製造業や自動車産業でも利用されています。ARは、機器にライブの指示を重ねて表示することで、技術者を支援し、パフォーマンスを向上させ、ミスを最小限に抑えます。さらに、AR対応のスマートフォン、タブレット、その他のハンドヘルド機器やウェアラブル機器の普及も、市場成長を高める要因となっています。さまざまなビジネスでARの重要性が認識されるにつれ、AR対応機器の利用頻度が高まっています。したがって、エクステンデッド・リアリティ市場のこうした成長動向は、予測期間中のエクステンデッド・リアリティ市場の成長動向にプラスの影響を与えるとみられています。

予測期間中、企業・商業分野がエクステンデッド・リアリティ市場で2番目に大きなシェアを占めると予測されます。仮想現実(VR)、拡張現実(AR)、複合現実(MR)を含むエクステンデッド・リアリティ技術は、ビジネスプロセス、トレーニング、顧客サービスを強化するため、小売業、ヘルスケア、製造業、教育など、地域を問わず広く受け入れられています。例えば製造分野では、企業は物理的なモデルを使わずに複雑な作業を行う従業員のトレーニングにエクステンデッド・リアリティを採用しており、時間とコストの節約に役立っています。小売業の場合、エクステンデッド・リアリティ技術によって顧客が仮想環境で商品を試せるようになり、顧客体験の向上と売上増につながります。このようなエクステンデッド・リアリティ技術の進歩は、主に近い将来のビジネス・プロセスに対応し、効率化、コスト削減、顧客とのインタラクションの向上をもたらします。その結果、予測期間中、企業や営利企業がエクステンデッド・リアリティ市場の主要な市場シェアを占める可能性が高いです。

当レポートでは、世界のエクステンデッド・リアリティ市場について調査し、企業規模別、技術別、オファリング別、デバイスタイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ、2020年~2024年

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 技術分析

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- ケーススタディ分析

- 価格分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 規制状況

- AI/生成AIがエクステンデッド・リアリティ市場に与える影響

第6章 エクステンデッド・リアリティデバイスのタイプ

- イントロダクション

- モバイルエクステンデッド・リアリティデバイス

- PCエクステンデッド・リアリティデバイス

第7章 エクステンデッド・リアリティビジネスの展望

- イントロダクション

- 消費者エンゲージメント

- ビジネスエンゲージメント

第8章 エクステンデッド・リアリティ市場、企業規模別

- イントロダクション

- 中小企業

- 中規模企業

- 大企業

第9章 エクステンデッド・リアリティ市場、技術別

- イントロダクション

- AR技術

- VR技術

- MR技術

第10章 エクステンデッド・リアリティ市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

第11章 エクステンデッド・リアリティ市場、デバイスタイプ別

- イントロダクション

- ARデバイス

- VRデバイス

- MRデバイス

第12章 エクステンデッド・リアリティ市場、用途別

- イントロダクション

- 消費者

- 商業

- 企業

- ヘルスケア

- 航空宇宙・防衛

- エネルギー

- 自動車

- その他

第13章 エクステンデッド・リアリティ市場、地域、

- イントロダクション

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東・アフリカ

- 南米

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 2019年~2023年のトップ5企業の収益分析

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- 製品/ブランド比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- META PLATFORMS, INC.

- MICROSOFT

- SONY GROUP CORPORATION

- APPLE INC.

- HTC CORPORATION

- PTC INC.

- SEIKO EPSON CORPORATION

- QUALCOMM TECHNOLOGIES, INC.

- SAMSUNG ELECTRONICS CO., LTD.

- その他の企業

- LENOVO

- INTEL CORPORATION

- PANASONIC HOLDINGS CORPORATION

- EON REALITY

- CONTINENTAL AG

- VISTEON CORPORATION

- XIAOMI CORPORATION

- MAXST CO., LTD.

- MAGIC LEAP, INC.

- VIRTUIX

- ULTRALEAP

- VUZIX CORPORATION

- NORTHERN DIGITAL INC.

- TATA ELXSI

- FUSION VR

第16章 付録

List of Tables

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN EXTENDED REALITY ECOSYSTEM

- TABLE 3 EXTENDED REALITY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- TABLE 6 USE CASES OF WEBAR

- TABLE 7 INDICATIVE PRICING OF XR DEVICES PROVIDED BY KEY PLAYERS, 2023 (USD)

- TABLE 8 INDICATIVE PRICING OF SDKS OFFERED BY KEY PLAYERS, 2023 (USD)

- TABLE 9 KEY PATENTS, 2020-2023

- TABLE 10 IMPORT DATA FOR HS CODE 9004-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 9004-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 EXTENDED REALITY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 18 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 19 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 20 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 21 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 22 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 23 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 24 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

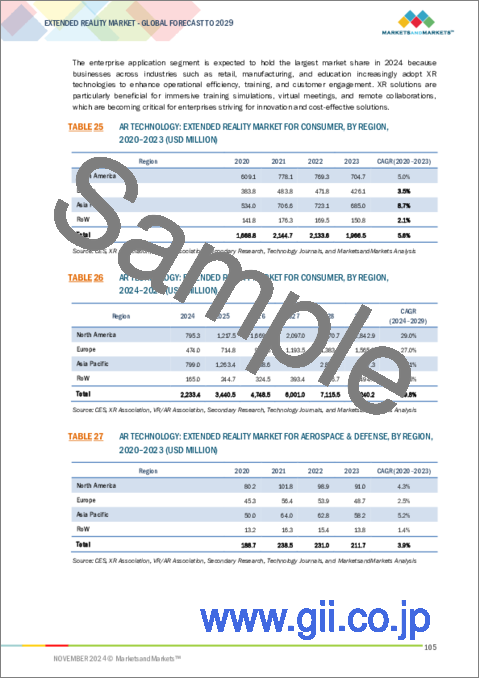

- TABLE 25 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR CONSUMER, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR CONSUMER, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR HEALTHCARE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR HEALTHCARE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR ENTERPRISE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR ENTERPRISE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR COMMERCIAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR COMMERCIAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR AUTOMOTIVE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR AUTOMOTIVE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR ENERGY, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR ENERGY, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 AR TECHNOLOGY: EXTENDED REALITY MARKET FOR OTHER APPLICATIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 AR TECHNOLOGY: EXTENDED REALITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 AR TECHNOLOGY: EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 44 AR TECHNOLOGY: EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 45 AR TECHNOLOGY: EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 46 AR TECHNOLOGY: EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 47 AR TECHNOLOGY: EXTENDED REALITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 48 AR TECHNOLOGY: EXTENDED REALITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 49 AR TECHNOLOGY: EXTENDED REALITY MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 AR TECHNOLOGY: EXTENDED REALITY MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 AR TECHNOLOGY: EXTENDED REALITY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 52 AR TECHNOLOGY: EXTENDED REALITY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 53 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 54 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 55 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 56 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 57 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 58 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 59 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR CONSUMER, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR CONSUMER, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR COMMERCIAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR COMMERCIAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR ENTERPRISE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR ENTERPRISE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR HEALTHCARE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR HEALTHCARE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 VR TECHNOLOGY: EXTENDED REALITY MARKET FOR OTHER APPLICATIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 VR TECHNOLOGY: EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 74 VR TECHNOLOGY: EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 75 VR TECHNOLOGY: EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 76 VR TECHNOLOGY: EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 77 VR TECHNOLOGY: EXTENDED REALITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 VR TECHNOLOGY: EXTENDED REALITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 VR TECHNOLOGY: EXTENDED REALITY MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 VR TECHNOLOGY: EXTENDED REALITY MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 VR TECHNOLOGY: EXTENDED REALITY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 82 VR TECHNOLOGY: EXTENDED REALITY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 83 MR TECHNOLOGY: EXTENDED REALITY MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 84 MR TECHNOLOGY: EXTENDED REALITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 85 MR TECHNOLOGY: EXTENDED REALITY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 86 MR TECHNOLOGY: EXTENDED REALITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 87 MR TECHNOLOGY: EXTENDED REALITY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 MR TECHNOLOGY: EXTENDED REALITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 MR TECHNOLOGY: EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 MR TECHNOLOGY: EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 MR TECHNOLOGY: EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 92 MR TECHNOLOGY: EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 93 MR TECHNOLOGY: EXTENDED REALITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 MR TECHNOLOGY: EXTENDED REALITY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 95 MR TECHNOLOGY: EXTENDED REALITY MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 MR TECHNOLOGY: EXTENDED REALITY MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 MR TECHNOLOGY: EXTENDED REALITY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 MR TECHNOLOGY: EXTENDED REALITY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 EXTENDED REALITY MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 100 EXTENDED REALITY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 101 HARDWARE: EXTENDED REALITY MARKET FOR AR DEVICES, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 102 HARDWARE: EXTENDED REALITY MARKET FOR AR DEVICES, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 103 HARDWARE: EXTENDED REALITY MARKET FOR VR DEVICES, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 104 HARDWARE: EXTENDED REALITY MARKET FOR VR DEVICES, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 105 HARDWARE: EXTENDED REALITY MARKET FOR MR DEVICES, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 106 HARDWARE: EXTENDED REALITY MARKET FOR MR DEVICES, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 107 HARDWARE: EXTENDED REALITY MARKET FOR AR DEVICES, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 HARDWARE: EXTENDED REALITY MARKET FOR AR DEVICES, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 HARDWARE: EXTENDED REALITY MARKET FOR VR DEVICES, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 110 HARDWARE: EXTENDED REALITY MARKET FOR VR DEVICES, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 111 HARDWARE: EXTENDED REALITY MARKET FOR MR DEVICES, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 HARDWARE: EXTENDED REALITY MARKET FOR MR DEVICES, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 SOFTWARE: EXTENDED REALITY MARKET FOR AR DEVICES, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 114 SOFTWARE: EXTENDED REALITY MARKET FOR AR DEVICES, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 115 SOFTWARE: EXTENDED REALITY MARKET FOR VR DEVICES, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 116 SOFTWARE: EXTENDED REALITY MARKET FOR VR DEVICES, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 SOFTWARE: EXTENDED REALITY MARKET FOR MR DEVICES, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 118 SOFTWARE: EXTENDED REALITY MARKET FOR MR DEVICES, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 119 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 120 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 121 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 122 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 123 AR DEVICES: EXTENDED REALITY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 124 AR DEVICES: EXTENDED REALITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 125 AR DEVICES: EXTENDED REALITY MARKET FOR HMDS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 126 AR DEVICES: EXTENDED REALITY MARKET FOR HMDS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 127 AR DEVICES: EXTENDED REALITY MARKET FOR HUDS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 128 AR DEVICES: EXTENDED REALITY MARKET FOR HUDS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 VR DEVICES: EXTENDED REALITY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 130 VR DEVICES: EXTENDED REALITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 131 VR DEVICES: EXTENDED REALITY MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 132 VR DEVICES: EXTENDED REALITY MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 133 EXTENDED REALITY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 134 EXTENDED REALITY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 135 CONSUMER: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 136 CONSUMER: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 137 COMMERCIAL: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 138 COMMERCIAL: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 139 ENTERPRISE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 140 ENTERPRISE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 141 HEALTHCARE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 142 HEALTHCARE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 143 AEROSPACE & DEFENSE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 144 AEROSPACE & DEFENSE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 145 ENERGY: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 146 ENERGY: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 147 AUTOMOTIVE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 148 AUTOMOTIVE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 149 OTHER APPLICATIONS: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 150 OTHER APPLICATIONS: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 151 EXTENDED REALITY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 152 EXTENDED REALITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 154 ASIA PACIFIC: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 155 ASIA PACIFIC: EXTENDED REALITY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: EXTENDED REALITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 157 NORTH AMERICA: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 158 NORTH AMERICA: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 159 NORTH AMERICA: EXTENDED REALITY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 160 NORTH AMERICA: EXTENDED REALITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 161 EUROPE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 162 EUROPE: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 163 EUROPE: EXTENDED REALITY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 164 EUROPE: EXTENDED REALITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 165 ROW: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 166 ROW: EXTENDED REALITY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 167 ROW: EXTENDED REALITY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 168 ROW: EXTENDED REALITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: EXTENDED REALITY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: EXTENDED REALITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 171 EXTENDED REALITY MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 172 MARKET SHARE ANALYSIS OF KEY COMPANIES OFFERING EXTENDED REALITY TECHNOLOGIES/DEVICES, 2023

- TABLE 173 EXTENDED REALITY MARKET: REGION FOOTPRINT

- TABLE 174 EXTENDED REALITY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 175 EXTENDED REALITY MARKET: DEVICE TYPE FOOTPRINT

- TABLE 176 EXTENDED REALITY MARKET: OFFERING FOOTPRINT

- TABLE 177 EXTENDED REALITY MARKET: APPLICATION FOOTPRINT

- TABLE 178 EXTENDED REALITY MARKET: LIST OF STARTUPS/SMES

- TABLE 179 EXTENDED REALITY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 EXTENDED REALITY MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, MARCH 2020-OCTOBER 2024

- TABLE 181 EXTENDED REALITY MARKET: DEALS, MARCH 2020-OCTOBER 2024

- TABLE 182 META PLATFORMS, INC.: COMPANY OVERVIEW

- TABLE 183 META PLATFORMS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 184 META PLATFORMS, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 185 META PLATFORMS, INC.: DEALS

- TABLE 186 META PLATFORMS, INC.: OTHER DEVELOPMENTS

- TABLE 187 MICROSOFT: COMPANY OVERVIEW

- TABLE 188 MICROSOFT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 189 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 190 MICROSOFT: DEALS

- TABLE 191 MICROSOFT: OTHER DEVELOPMENTS

- TABLE 192 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 193 SONY GROUP CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 194 SONY GROUP CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 195 SONY GROUP CORPORATION: DEALS

- TABLE 196 APPLE INC.: COMPANY OVERVIEW

- TABLE 197 APPLE INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 198 APPLE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 199 APPLE INC.: DEALS

- TABLE 200 GOOGLE: COMPANY OVERVIEW

- TABLE 201 GOOGLE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 202 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 203 GOOGLE: DEALS

- TABLE 204 GOOGLE: OTHER DEVELOPMENTS

- TABLE 205 HTC CORPORATION: COMPANY OVERVIEW

- TABLE 206 HTC CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 207 HTC CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 208 PTC INC.: COMPANY OVERVIEW

- TABLE 209 PTC INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 PTC INC.: DEALS

- TABLE 211 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 212 SEIKO EPSON CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 213 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 SEIKO EPSON CORPORATION: DEALS

- TABLE 215 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 216 QUALCOMM TECHNOLOGIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 217 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 219 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 220 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 221 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 222 SAMSUNG ELECTRONICS CO., LTD.: DEALS

List of Figures

- FIGURE 1 EXTENDED REALITY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EXTENDED REALITY MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIZE): BOTTOM-UP APPROACH TO ESTIMATE SIZE OF EXTENDED REALITY MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RESEARCH ASSUMPTIONS

- FIGURE 9 AR TECHNOLOGY SEGMENT TO SECURE LARGEST MARKET SHARE IN 2029

- FIGURE 10 SOFTWARE OFFERINGS TO CAPTURE LARGER MARKET SHARE IN 2024

- FIGURE 11 CONSUMER APPLICATIONS TO LEAD EXTENDED REALITY MARKET IN 2024

- FIGURE 12 NORTH AMERICA DOMINATED EXTENDED REALITY MARKET IN 2023

- FIGURE 13 GROWING USE OF XR IN EDUCATION, INDUSTRIAL, HEALTHCARE, AND GAMING APPLICATIONS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 14 AR TECHNOLOGY SEGMENT TO CAPTURE LARGEST SHARE OF EXTENDED REALITY MARKET IN 2029

- FIGURE 15 SOFTWARE SEGMENT TO HOLD MAJORITY OF EXTENDED REALITY MARKET SHARE IN 2029

- FIGURE 16 VR DEVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF EXTENDED REALITY MARKET IN 2029

- FIGURE 17 CONSUMER SEGMENT TO HOLD COMMANDING SHARE OF EXTENDED REALITY MARKET IN 2029

- FIGURE 18 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR EXTENDED REALITY IN 2029

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN GLOBAL EXTENDED REALITY MARKET FROM 2024 TO 2029

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN EXTENDED REALITY MARKET

- FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON EXTENDED REALITY MARKET

- FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON EXTENDED REALITY MARKET

- FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES ON EXTENDED REALITY MARKET

- FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON EXTENDED REALITY MARKET

- FIGURE 25 EXTENDED REALITY VALUE CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM ANALYSIS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- FIGURE 31 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 32 EXTENDED REALITY MARKET: ECOSYSTEM

- FIGURE 33 AVERAGE SELLING PRICE TREND OF EXTENDED REALITY PRODUCTS, 2020-2023

- FIGURE 34 AVERAGE SELLING PRICE TREND OF AR DEVICES, BY REGION, 2020-2023

- FIGURE 35 AVERAGE SELLING PRICE TREND OF VR DEVICES, BY REGION, 2020-2023

- FIGURE 36 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 37 IMPORT SCENARIO FOR HS CODE 9004-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 38 EXPORT SCENARIO FOR HS CODE 9004-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 39 IMPACT OF AI/GEN AI ON EXTENDED REALITY MARKET

- FIGURE 40 TYPES OF EXTENDED REALITY DEVICES

- FIGURE 41 ENTERPRISES USING EXTENDED REALITY SOLUTIONS, BY SIZE

- FIGURE 42 EXTENDED REALITY MARKET, BY TECHNOLOGY

- FIGURE 43 AR TECHNOLOGY SEGMENT TO HOLD LARGEST SHARE OF EXTENDED REALITY MARKET IN 2029

- FIGURE 44 MARKERLESS AR TO LEAD EXTENDED REALITY MARKET, BY TECHNOLOGY, THROUGHOUT FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO RECORD HIGHEST CAGR IN EXTENDED REALITY MARKET FOR AR TECHNOLOGY FROM 2024 TO 2029

- FIGURE 46 SEMI-IMMERSIVE AND FULLY IMMERSIVE SEGMENT TO DOMINATE EXTENDED REALITY MARKET FOR VR TECHNOLOGY FROM 2024 TO 2029

- FIGURE 47 EXTENDED REALITY MARKET, BY OFFERING

- FIGURE 48 SOFTWARE SEGMENT TO HOLD LARGER SHARE OF EXTENDED REALITY MARKET IN 2029

- FIGURE 49 EXTENDED REALITY MARKET, BY DEVICE TYPE

- FIGURE 50 MR DEVICES SEGMENT TO EXHIBIT HIGHEST CAGR IN EXTENDED REALITY MARKET FROM 2024 TO 2029

- FIGURE 51 ENTERPRISE APPLICATIONS TO SECURE LARGEST SHARE OF EXTENDED REALITY MARKET FOR HMD DEVICES FROM 2024 TO 2029

- FIGURE 52 EXTENDED REALITY MARKET, BY APPLICATION

- FIGURE 53 CONSUMER SEGMENT TO ACCOUNT FOR LARGEST SHARE OF EXTENDED REALITY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 54 MR TECHNOLOGY SEGMENT TO REGISTER HIGHEST CAGR IN EXTENDED REALITY MARKET FOR HEALTHCARE APPLICATIONS FROM 2024 TO 2029

- FIGURE 55 EXTENDED REALITY MARKET, BY REGION

- FIGURE 56 ASIA PACIFIC TO DOMINATE EXTENDED REALITY MARKET FROM 2024 TO 2029

- FIGURE 57 ASIA PACIFIC: EXTENDED REALITY MARKET SNAPSHOT

- FIGURE 58 NORTH AMERICA: EXTENDED REALITY MARKET SNAPSHOT

- FIGURE 59 EUROPE: EXTENDED REALITY MARKET SNAPSHOT

- FIGURE 60 REVENUE ANALYSIS OF TOP 5 PLAYERS IN EXTENDED REALITY MARKET, 2019-2023

- FIGURE 61 MARKET SHARE ANALYSIS OF KEY COMPANIES OFFERING EXTENDED REALITY TECHNOLOGIES/DEVICES, 2023

- FIGURE 62 EXTENDED REALITY MARKET: COMPANY VALUATION, 2024

- FIGURE 63 EXTENDED REALITY MARKET: FINANCIAL METRICS, 2024

- FIGURE 64 EXTENDED REALITY MARKET: BRAND/DEVICE/TECHNOLOGY COMPARISON

- FIGURE 65 EXTENDED REALITY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 66 EXTENDED REALITY MARKET: COMPANY FOOTPRINT

- FIGURE 67 EXTENDED REALITY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 68 META PLATFORMS, INC.: COMPANY SNAPSHOT

- FIGURE 69 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 70 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 72 GOOGLE: COMPANY SNAPSHOT

- FIGURE 73 HTC CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 PTC INC.: COMPANY SNAPSHOT

- FIGURE 75 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 77 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

The extended reality market is expected to grow from USD 24.42 billion in 2024 to USD 84.86 billion in 2029, with a CAGR of 28.3% within the forecast period. This is due to the growing superiority of technologies, increased applications across sectors, and the growing need for immersive activities. Advances in extended reality hardware, including devices with higher resolution and lower latency, along with the ready availability of 5G networks and AI, are improving extended reality abilities, thus improving usage across applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Enterprise Size, Outlook, Technology, Device type, Offering, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Based technology, AR Technology to register the second highest CAGR in the extended reality market during the forecast period."

It is anticipated that Augmented Reality (AR) technology will have the second-highest CAGR in the extended reality market in the forecast period. The AR allows customers to enjoy experiences such as trying virtual clothes or interacting with products in an enhanced manner. In real estate, AR enables virtual tours of the property instead of open houses, helping convince the buyer. AR assists surgeons, medical students, and even patients in the healthcare industry. AR is also used in the manufacturing and automotive industries. AR aids technicians through displaying superimposed live instructions on the equipment thus enhancing performance and minimizing mistakes. In addition, the proliferation of AR-ready smartphones, tablets, and other handheld and wearable devices is also a factor adding to market growth. With growing recognition of AR's significance in different businesses, the frequency of AR-enabled equipment utilization is rising. Therefore, such growth trends in the augmented reality market will positively affect the growth trends in the extended reality market during the forecasted period.

"Enterprises & Commercial to account for the second largest market share in the market during the forecast period."

During the forecast period, the enterprise and commercial sectors are expected to hold the second-largest share of the extended reality market. Extended reality technologies, including virtual reality (VR), augmented reality (AR), and mixed reality (MR), have been widely accepted in retail, healthcare, manufacturing, and education across regions because they enhance business processes, training, and customer service. For instance, in the manufacturing segment, companies employ extended reality in training employees in complicated tasks without any physical models, which helps save time and cost. In case of retail, extended reality technology enables customers to test the products in a virtual environment, leading to enhanced customer experience and increased sales. The advancement of these extended reality technologies primarily addresses business processes in the near future, posing efficiency, cost reduction, and improved customer interaction. As a result, enterprises and commercial enterprises are likely to hold a major market share of the extended reality market in the forecast period.

"Asia Pacific accounted for the second largest market share in 2024."

Asia Pacific accounted for the second-largest market share in 2024. This is primarily due to growth in the healthcare, commercial, and consumer sectors. The rising number of companies is also supporting this growth. Investments in the commercial and consumer markets, particularly in Japan, India, and China, are a major factor behind this trend. The high demand for extended reality devices and software from the commercial sector is expected to drive the extended reality market in Asia Pacific. The region is an attractive market for cell phones, tablets, laptops, and television manufacturers. Companies such as Samsung Electronics Co., Ltd. and LG Electronics are based in South Korea, while Sony Group Corporation, Sharp Corporation, and Panasonic Holdings Corporation are based in Japan. Asia Pacific registers the highest demand for consumer products such as smartphones, tablets, laptops, and TV sets.

The break-up of the profile of primary participants in the extended reality market-

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, Tier 3 - 40%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 40%, Europe - 25%, Asia Pacific - 20%, Rest of the World - 15%

The report profiles key players such as Meta Platform Inc. (US), Microsoft (US), Sony Group Corp. (Japan), Apple Inc. (US), Google (US), HTC Corp (Taiwan), PTC Inc. (US), Seiko Epson Corporation (Japan), Qualcomm Technologies Inc. (US), Samsung Electronics Co. Ltd (South Korea), Lenovo Group Ltd. (China).

Research Coverage

The report segments the extended reality market and forecasts its size by type, enterprises, outlook, technology, device type, offering, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Value chain analysis has been included in the report, along with the key players and their competitive analysis in the extended reality ecosystem.

Reasons to buy the report:

The report will help market leaders/new entrants in this market with information on the closest approximate revenues for the overall extended reality market and related segments. It will also help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing use of XR in education, industrial training, healthcare, entertainment, and gaming, availability of affordable VR devices, rising demand for spatial computing in XR technologies, and growing demand for GenAI in XR technologies), restraints (High installation and maintenance costs of XR devices and rapid technology changes in extended reality devices), opportunities (Expanding use of XR in the automotive, aerospace and defence sectors, ongoing advancements in 5G technology, and rise in the global travel and tourism industry), and challenges (Protecting consumer privacy, issues with display delays and limited field of view)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new solution and service launches in the extended reality market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the extended reality market across various regions.

- Market Diversification: Exhaustive information about new solutions and services, untapped geographies, recent developments, and investments in the extended reality market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and solution and service offerings of leading players, including Meta Platform Inc. (US), Microsoft (US), Sony Group Corp (Japan), Apple (US), and Google (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Secondary sources

- 2.1.2.2 List of key secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Estimating market size using bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Estimating market size using top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EXTENDED REALITY MARKET

- 4.2 EXTENDED REALITY MARKET, BY TECHNOLOGY

- 4.3 EXTENDED REALITY MARKET, BY OFFERING

- 4.4 EXTENDED REALITY MARKET, BY DEVICE TYPE

- 4.5 EXTENDED REALITY MARKET, BY APPLICATION

- 4.6 EXTENDED REALITY MARKET, BY REGION

- 4.7 EXTENDED REALITY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of XR in education, industrial, healthcare, and gaming applications

- 5.2.1.2 Increasing focus of technology providers on developing affordable VR devices

- 5.2.1.3 Integration of spatial computing technology in XR applications

- 5.2.1.4 Surging deployment of GenAI in XR applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation, configuration, and maintenance costs of XR devices

- 5.2.2.2 Disadvantages of constant advances in XR technology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of newer applications of XR in automotive and aerospace & defense sectors

- 5.2.3.2 Ongoing advancements in 5G technology

- 5.2.3.3 Thriving travel & tourism industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges associated with protecting consumer privacy

- 5.2.4.2 Issues related to latency and limited field of view

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- 5.6 PORTER'S FIVE FORCES ANALYSIS.

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 BARGAINING POWER OF SUPPLIERS

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Motion tracking

- 5.8.1.2 3D rendering and modeling

- 5.8.1.3 Mobile AR

- 5.8.1.4 Near-eye displays

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Artificial intelligence (AI) and machine learning (ML)

- 5.8.2.2 Web-based AR

- 5.8.2.3 AR-powered displays

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Metaverse

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 ECOSYSTEM ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PTC OFFERS GATE AR PLATFORM TO MERCK' TO ASSIST STAFF IN DAILY OPERATIONS

- 5.11.2 AWS HELPS VOLKSWAGEN GROUP SPEED UP PREPARING 3D CONTENT AND REMOTE RENDERING PROCESS

- 5.11.3 PTC OFFERS VUFORIA STUDIO TO PROVIDE DYNAMIC SALES TRAINING TO ROYAL ENFIELD TEAMS

- 5.11.4 ELLICOM AND OVA DESIGN TRAINING SIMULATION TO OFFER IMMERSIVE LEARNING EXPERIENCE TO HYDRO-QUEBEC EMPLOYEES

- 5.11.5 OCULUS AND OSSO VR CREATE TRAINING MODULES TO GUIDE JOHNSON & JOHNSON INSTITUTE SURGEONS TO IMPLANT ORTHOPEDIC DEVICES

- 5.12 PRICING ANALYSIS

- 5.12.1 INDICATIVE PRICING OF EXTENDED REALITY SOLUTIONS OFFERED BY KEY PLAYERS, BY DEVICE TYPE, 2023

- 5.12.2 INDICATIVE PRICING OF SDKS OFFERED BY KEY PLAYERS, 2023

- 5.12.3 AVERAGE SELLING PRICE TREND OF EXTENDED REALITY PRODUCTS, 2020-2023

- 5.12.4 AVERAGE SELLING PRICE TREND OF AR/VR DEVICES, BY REGION, 2020-2023

- 5.13 PATENT ANALYSIS

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT SCENARIO (HS CODE 9004)

- 5.14.2 EXPORT SCENARIO (HS CODE 9004)

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 IMPACT OF AI/GEN AI ON EXTENDED REALITY MARKET

6 TYPES OF EXTENDED REALITY DEVICES

- 6.1 INTRODUCTION

- 6.2 MOBILE EXTENDED REALITY DEVICES.

- 6.2.1 SMARTPHONE EXTENDED REALITY DEVICES

- 6.2.2 STANDALONE EXTENDED REALITY DEVICES

- 6.3 PC EXTENDED REALITY DEVICES.

7 EXTENDED REALITY BUSINESS OUTLOOK

- 7.1 INTRODUCTION

- 7.2 CONSUMER ENGAGEMENT

- 7.3 BUSINESS ENGAGEMENT

8 EXTENDED REALITY MARKET, BY ENTERPRISE SIZE

- 8.1 INTRODUCTION

- 8.2 SMALL ENTERPRISES

- 8.3 MID-SIZED ENTERPRISES

- 8.4 LARGE ENTERPRISES

9 EXTENDED REALITY MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 AR TECHNOLOGY

- 9.2.1 MARKER-BASED AR

- 9.2.1.1 Growing use in advertising, education, and interactive product demonstration applications to drive market

- 9.2.1.2 Passive markers

- 9.2.1.3 Active markers

- 9.2.2 MARKERLESS AR

- 9.2.2.1 Rising demand for smartphones, laptops, and tablets to fuel segmental growth

- 9.2.2.2 Model-based tracking

- 9.2.2.3 Image processing-based tracking

- 9.2.3 ANCHOR-BASED AR

- 9.2.3.1 Growing use of anchor-based AR to overlay virtual images in real space to drive market

- 9.2.1 MARKER-BASED AR

- 9.3 VR TECHNOLOGY

- 9.3.1 NON-IMMERSIVE

- 9.3.1.1 Elevating adoption of non-immersive VR in interactive educational learning to fuel segmental growth

- 9.3.2 SEMI-IMMERSIVE AND FULLY IMMERSIVE

- 9.3.2.1 Ability to offer richer experience in controlled environment to accelerate demand

- 9.3.1 NON-IMMERSIVE

- 9.4 MR TECHNOLOGY

- 9.4.1 EXCELLENCE IN BLENDING REAL WORLD WITH DIGITAL ONE TO SPUR DEMAND

- 9.4.2 HOLOGRAPHIC

- 9.4.3 IMMERSIVE

10 EXTENDED REALITY MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 SENSORS

- 10.2.1.1 Increasing demand for sensors in motion detection and environmental interaction to fuel segmental growth

- 10.2.1.2 Accelerometers

- 10.2.1.3 Gyroscopes

- 10.2.1.4 Magnetometers

- 10.2.1.5 Proximity sensors

- 10.2.2 SEMICONDUCTOR COMPONENTS

- 10.2.2.1 Rising focus on developing lightweight and portable XR devices to foster segmental growth

- 10.2.2.2 Controllers and processors

- 10.2.2.3 Integrated circuits

- 10.2.3 DISPLAYS AND PROJECTORS

- 10.2.3.1 Ability to bridge virtual and physical worlds by rendering immersive visuals for users to boost demand

- 10.2.4 POSITION TRACKERS

- 10.2.4.1 Excellence in tracking users' movements and spatial orientation within virtual, augmented, or mixed-reality environments to facilitate adoption

- 10.2.5 CAMERAS

- 10.2.5.1 Ability to measure depth and size of objects in XR technologies to spur demand

- 10.2.6 OTHER COMPONENTS

- 10.2.1 SENSORS

- 10.3 SOFTWARE

- 10.3.1 ANTICIPATED MASS CONSUMER ADOPTION TO SUPPORT MARKET GROWTH

- 10.3.2 SOFTWARE DEVELOPMENT KITS

- 10.3.3 CLOUD-BASED SOFTWARE

11 EXTENDED REALITY MARKET, BY DEVICE TYPE

- 11.1 INTRODUCTION

- 11.2 AR DEVICES

- 11.2.1 HMDS

- 11.2.1.1 Rising use by medical professionals and gamers to drive market

- 11.2.1.2 AR smart glasses

- 11.2.1.3 Smart helmets

- 11.2.2 HUDS

- 11.2.2.1 Increasing adoption in automotive applications to display crucial information for drivers to propel market

- 11.2.1 HMDS

- 11.3 VR DEVICES

- 11.3.1 HEAD-MOUNTED DISPLAYS

- 11.3.1.1 Commercialization of advanced HMDs by Sony and Samsung to boost adoption

- 11.3.2 PROJECTORS & DISPLAY WALLS

- 11.3.2.1 Portability and high-quality projection capabilities to boost demand

- 11.3.3 GESTURE-TRACKING DEVICES

- 11.3.3.1 Growing use in healthcare and gaming applications to contribute to segmental growth

- 11.3.1 HEAD-MOUNTED DISPLAYS

- 11.4 MR DEVICES

- 11.4.1 ABILITY TO MERGE PHYSICAL AND DIGITAL WORLDS TO CREATE IMMERSIVE EXPERIENCES TO ACCELERATE DEMAND

12 EXTENDED REALITY MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 CONSUMER

- 12.2.1 RISING USE OF XR TECHNOLOGY TO OFFER IMMERSIVE GAMING EXPERIENCES AND KEEP AUDIENCES ENGAGED TO FUEL SEGMENTAL GROWTH

- 12.2.2 GAMING

- 12.2.3 SPORTS AND ENTERTAINMENT

- 12.2.3.1 Sports

- 12.2.3.2 Entertainment

- 12.3 COMMERCIAL

- 12.3.1 GROWING TREND OF VIRTUAL DESTINATION PREVIEWS AND TRY-ONS FOR APPAREL, JEWELRY, AND FURNITURE PLACEMENT VISUALIZATIONS TO FOSTER SEGMENTAL GROWTH

- 12.3.2 RETAIL AND E-COMMERCE

- 12.3.2.1 Jewelry

- 12.3.2.2 Beauty and cosmetics

- 12.3.2.3 Apparel fitting

- 12.3.2.4 Grocery shopping

- 12.3.2.5 Footwear

- 12.3.2.6 Furniture and light design

- 12.3.2.7 Advertisements and demonstration

- 12.3.3 TRAVEL AND TOURISM

- 12.3.4 E-LEARNING

- 12.4 ENTERPRISE

- 12.4.1 INCREASING NEED TO TRAIN EMPLOYEES ON COMPLEX OR HAZARDOUS TASKS IN RISK-FREE VIRTUAL SETTING TO BOOST DEMAND

- 12.5 HEALTHCARE

- 12.5.1 ELEVATING USE OF AR AND VR IN SURGICAL SIMULATION AND TRAINING, REHABILITATION, AND PHARMACY MANAGEMENT TO AUGMENT SEGMENTAL GROWTH

- 12.5.2 SURGERIES

- 12.5.3 FITNESS MANAGEMENT

- 12.5.4 PATIENT MANAGEMENT

- 12.5.5 PHARMACY MANAGEMENT

- 12.5.6 MEDICAL TRAINING AND EDUCATION

- 12.5.7 OTHER HEALTHCARE APPLICATIONS

- 12.6 AEROSPACE & DEFENSE

- 12.6.1 SURGING ADOPTION OF XR IN TRAINING SIMULATIONS FOR PILOTS AND AR IN BATTLEFIELD VISUALIZATION FOR SOLDIERS TO STIMULATE SEGMENTAL GROWTH

- 12.7 ENERGY

- 12.7.1 ESCALATING USE OF 3D MODELS TO PROVIDE HANDS-ON TRAINING ON COMPLEX EQUIPMENT IN SAFE ENVIRONMENT TO DRIVE SEGMENTAL GROWTH

- 12.8 AUTOMOTIVE

- 12.8.1 INTEGRATION OF AR HUD TECHNOLOGY INTO ADAS TO PROVIDE SAFER AND MORE COMFORTABLE DRIVING EXPERIENCE TO SUPPORT MARKET GROWTH

- 12.9 OTHER APPLICATIONS

- 12.9.1 TELECOMMUNICATIONS/IT DATA CENTERS

- 12.9.2 AGRICULTURE

- 12.9.3 REAL ESTATE

- 12.9.4 GEOSPATIAL MINING

- 12.9.5 TRANSPORTATION & LOGISTICS

- 12.9.6 CONSTRUCTION

- 12.9.7 PUBLIC SAFETY

13 EXTENDED REALITY MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.2.2 CHINA

- 13.2.2.1 Increasing investment in AR and VR technologies to augment market growth

- 13.2.3 JAPAN

- 13.2.3.1 Rising adoption of cutting-edge technologies for healthcare training and simulation to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Reliance on innovative technologies for immersive training and enhanced patient experiences to boost market growth

- 13.2.5 INDIA

- 13.2.5.1 Increasing research and development of innovative technologies to fuel market growth

- 13.2.6 REST OF ASIA PACIFIC

- 13.3 NORTH AMERICA

- 13.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.3.2 US

- 13.3.2.1 Rapid advances in hardware, software, and connectivity technologies to augment market growth

- 13.3.3 CANADA

- 13.3.3.1 Strong presence of startups developing wearable and other emerging technologies to boost market growth

- 13.3.4 MEXICO

- 13.3.4.1 Rising emphasis on promoting disruptive technologies to fuel market growth

- 13.4 EUROPE

- 13.4.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.4.2 GERMANY

- 13.4.2.1 Mounting adoption of emerging technologies in manufacturing sector to bolster market growth

- 13.4.3 UK

- 13.4.3.1 Rising deployment of AR technology in video gaming to fuel market growth

- 13.4.4 FRANCE

- 13.4.4.1 Increasing investment in technology development projects to contribute to market growth

- 13.4.5 ITALY

- 13.4.5.1 Growing awareness about immersive technologies to accelerate market growth

- 13.4.6 REST OF EUROPE

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Rising adoption of AR and VR technologies in healthcare sector to bolster market growth

- 13.5.2.2 GCC countries

- 13.5.2.3 Africa & Rest of Middle East

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Growing demand for innovative technologies for commercial applications to stimulate market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 REVENUE ANALYSIS OF TOP 5 COMPANIES, 2019-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 14.6 PRODUCT/BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Technology footprint

- 14.7.5.4 Device type footprint

- 14.7.5.5 Offering footprint

- 14.7.5.6 Application footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 META PLATFORMS, INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches and enhancements

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 MICROSOFT

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches and enhancements

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 SONY GROUP CORPORATION

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches and enhancements

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 APPLE INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches and enhancements

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 GOOGLE

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches and enhancements

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 HTC CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches and enhancements

- 15.1.7 PTC INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches and enhancements

- 15.1.7.3.2 Deals

- 15.1.8 SEIKO EPSON CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches and enhancements

- 15.1.8.3.2 Deals

- 15.1.9 QUALCOMM TECHNOLOGIES, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches and enhancements

- 15.1.9.3.2 Deals

- 15.1.10 SAMSUNG ELECTRONICS CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches and enhancements

- 15.1.10.3.2 Deals

- 15.1.1 META PLATFORMS, INC.

- 15.2 OTHER PLAYERS

- 15.2.1 LENOVO

- 15.2.2 INTEL CORPORATION

- 15.2.3 PANASONIC HOLDINGS CORPORATION

- 15.2.4 EON REALITY

- 15.2.5 CONTINENTAL AG

- 15.2.6 VISTEON CORPORATION

- 15.2.7 XIAOMI CORPORATION

- 15.2.8 MAXST CO., LTD.

- 15.2.9 MAGIC LEAP, INC.

- 15.2.10 VIRTUIX

- 15.2.11 ULTRALEAP

- 15.2.12 VUZIX CORPORATION

- 15.2.13 NORTHERN DIGITAL INC.

- 15.2.14 TATA ELXSI

- 15.2.15 FUSION VR

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS