|

|

市場調査レポート

商品コード

1742427

精密発酵成分の世界市場:成分別、微生物別、エンドユーザー別、食品・飲料用途別、地域別 - 予測(~2030年)Precision Fermentation Ingredients Market by Ingredient (Whey & Casein Protein, Egg White, Collagen Protein, Heme Protein), Microbe (Yeast, Algae, Fungi, Bacteria), End User, Food & Beverage Application, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 精密発酵成分の世界市場:成分別、微生物別、エンドユーザー別、食品・飲料用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年05月29日

発行: MarketsandMarkets

ページ情報: 英文 314 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の精密発酵成分の市場規模は、2025年の50億2,000万米ドルから2030年までに363億1,000万米ドルに達すると予測され、予測期間にCAGRで48.6%の成長が見込まれます。

市場は、複数の要因に後押しされて急成長を示しています。その最たるものは、消費者の環境意識と倫理意識が高まるにつれて、持続可能な動物性でないタンパク源に対する需要が高まっていることです。精密発酵は、従来の畜産に比べて環境フットプリントが著しく低い高品質なタンパク質を生産することでソリューションを提供します。バイオテクノロジーと合成生物学の進歩は、精密発酵プロセスの効率性と拡張性を高め、多様な成分の生産を可能にしています。さらに、ヴィーガニズムや植物中心の食生活の動向の高まりにより、消費者は動物由来の製品に代わるものを求めるようになり、市場の拡大がさらに推進されています。持続可能な食品生産を支援する政府の取り組みや食品技術への投資も、市場の成長を促進する上で重要な役割を果たしています。これらの要因により、食品・飲料、医薬品、化粧品などのさまざまな部門で精密発酵の採用が進んでいます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(米ドル)、数量(1,000トン) |

| セグメント | 成分、微生物、エンドユーザー、食品・飲料用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

「微生物タイプセグメントでは、精密発酵成分市場の真菌セグメントが大きなシェアを占めています。」

真菌は、その多用途性、高い生産性、工業的発酵における確立された使用により、精密発酵成分市場の微生物タイプセグメントで大きなシェアを占めています。アスペルギルスニガー、トリコデルマリーゼイ、サッカロマイセスセレビシエなどの真菌類は、酵素、風味増強剤、有機酸、代替タンパク質を含む幅広い成分の生産に一般的に使用されています。目的化合物を大量に分泌し、さまざまなpHレベルに耐え、安価な生息環境で増殖する能力を持つため、大規模生産において費用対効果が高いです。さらに、合成生物学と代謝工学の進歩により、真菌株のさらなる最適化が可能になり、収量と製品の特異性が向上しています。食品・飲料、パーソナルケア製品において持続可能で機能的な成分の需要が高まる中、真菌は精密発酵情勢を形成する上で重要な役割を果たし続けています。

「成分タイプセグメントでは、ヘムタンパク質セグメントが精密発酵成分市場の最大のシェアを占めています。」

ヘムタンパク質は、植物性の代替品において動物性の食肉の味、色、食感を再現する上で重要な役割を果たすことにより、精密発酵成分市場でもっとも急成長しているセグメントとして浮上しています。従来の食肉を忠実に模倣した食肉類似品に対する消費者の需要が高まる中、企業はヘムをより効率的かつ持続的に生産するため、精密発酵にますます注目するようになっています。発酵大豆レグヘモグロビンを使用するImpossible Foodsのようなブランドの成功は、ヘムタンパク質の商業的可能性をさらに立証し、このセグメントへの投資と研究開発の増加を促しています。

「欧州が世界の精密発酵成分市場で急速に成長すと推定されます。」

欧州が精密発酵成分市場で大きく成長すると予測されます。この急成長は、持続可能で倫理的かつ機能的な食品に対する消費者の強い需要に加え、持続可能な食品システムを促進し、革新的な食品技術への投資を奨励する欧州連合のGreen DealやFarm to Fork Strategyのような政府の支援政策によってもたらされます。ドイツ、英国、フランスなどの国々は、先進のバイオテクノロジー部門と、倫理的な植物性の機能性食品を求める消費者の需要を活用して、主導的な役割を果たしています。この地域の持続可能性と革新への取り組みは、欧州を世界の精密発酵情勢における主要地域として位置づけています。

当レポートでは、世界の精密発酵成分市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 精密発酵成分市場の企業にとって魅力的な機会

- 北米の精密発酵成分市場:最終用途別、国別

- 精密発酵成分市場:主要サブマーケットのシェア

- 精密発酵成分市場:成分タイプ別、地域別

- 精密発酵成分市場:微生物タイプ別、地域別

- 精密発酵成分市場:最終用途別、地域別

- 精密発酵成分市場:食品・飲料用途別、地域別

第5章 市場の概要

- イントロダクション

- マクロ経済指標

- 世界人口の増加

- 代替タンパク質市場の拡大

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 精密発酵成分市場に対するAI/生成AIの影響

- イントロダクション

- 精密発酵成分市場における生成AIの使用

- ケーススタディ分析

第6章 産業動向

- イントロダクション

- 2025年の米国関税の影響 - 精密発酵成分市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- バリューチェーン分析

- 原材料調達

- 微生物株の開発

- 発酵処理

- 精製・下流処理

- 流通・最終用途

- 貿易分析

- HSコード3502の輸出シナリオ

- HSコード3502の輸入シナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- エコシステム分析

- デマンドサイド

- サプライサイド

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 北米

- 欧州連合

- アジア太平洋

- その他の地域

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

第7章 精密発酵成分市場:成分タイプ別

- イントロダクション

- ホエイ・カゼインタンパク質

- 卵白

- コラーゲンタンパク質

- ヘムタンパク質

- 酵素

- その他の成分

第8章 精密発酵成分市場:微生物タイプ別

- イントロダクション

- 酵母

- 細菌

- 真菌

- 藻類

第9章 精密発酵成分市場:最終用途別

- イントロダクション

- 食品・飲料

- 医薬品

- 化粧品・その他

第10章 精密発酵成分市場:食品・飲料用途別

- イントロダクション

- 食肉・魚介類

- 乳製品代替品

- 卵代替品

- その他の用途

第11章 精密発酵成分市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- フランス

- ドイツ

- 英国

- スペイン

- オランダ

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- シンガポール

- 韓国

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2020年~2025年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランドの比較

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- GELTOR

- PERFECT DAY, INC.

- THE EVERY COMPANY

- IMPOSSIBLE FOODS INC.

- IMAGINDAIRY LTD.

- SHIRU, INC.

- FORMO FOODS GMBH

- EDEN BREW

- CHANGE FOODS

- NEW CULTURE

- HELAINA INC.

- NAPLASOL

- MYCOTECHNOLOGY, INC.

- REMILK LTD.

- TRITON ALGAE INNOVATIONS

- その他の企業(中小企業/スタートアップ)

- MELT&MARBLE

- REVYVE

- NOURISH INGREDIENTS PTY LTD.

- FYBRAWORKS FOODS

- STANDING OVATION

- VIVICI

- ONEGO BIO

- UPDAIRY

- EVODIABIO

- DE NOVO FOODS, INC.

第14章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 培養肉市場

- 市場の定義

- 市場の概要

- 乳製品代替品市場

- 市場の定義

- 市場の概要

第15章 付録

List of Tables

- TABLE 1 PRECISION FERMENTATION INGREDIENTS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 3 PRECISION FERMENTATION INGREDIENTS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 4 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 5 EXPORT VALUE OF HS CODE 3502, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 IMPORT VALUE OF HS CODE 3502, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 KEY PATENTS PERTAINING TO PRECISION FERMENTATION INGREDIENTS, 2015-2025

- TABLE 9 PRECISION FERMENTATION INGREDIENTS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES ON PRECISION FERMENTATION INGREDIENTS MARKET

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD & BEVERAGE APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA FOR FOOD & BEVERAGE APPLICATIONS

- TABLE 16 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (USD MILLION)

- TABLE 17 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (USD MILLION)

- TABLE 18 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 19 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 20 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 21 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 23 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 24 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

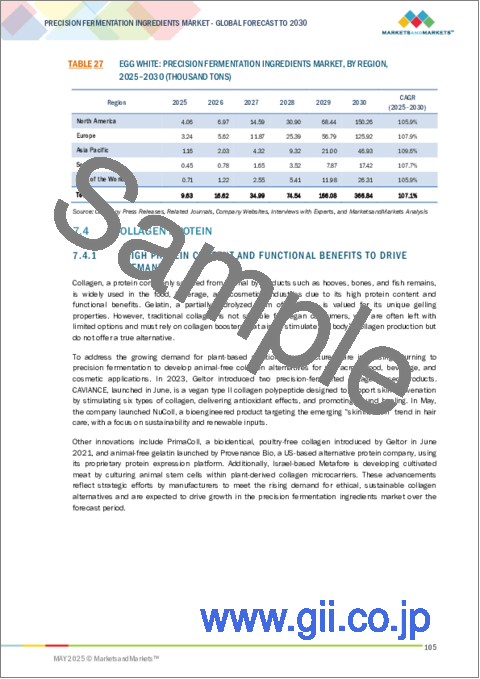

- TABLE 27 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 28 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 31 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 32 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 35 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 36 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 39 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 40 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 43 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 44 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (USD MILLION)

- TABLE 45 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (USD MILLION)

- TABLE 46 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 47 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 48 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 51 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 52 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 55 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 56 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 59 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 THOUSAND TONS)

- TABLE 60 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 63 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 64 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 65 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 66 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (THOUSAND TONS)

- TABLE 67 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (THOUSAND TONS)

- TABLE 68 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 71 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 72 PHARMACEUTICALS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 PHARMACEUTICALS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 PHARMACEUTICALS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 75 PHARMACEUTICALS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 76 COSMETICS & OTHERS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 COSMETICS & OTHERS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 COSMETICS & OTHERS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 79 COSMETICS & OTHERS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 80 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 81 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (THOUSAND TONS)

- TABLE 83 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (THOUSAND TONS)

- TABLE 84 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 87 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 88 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 91 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 92 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 95 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 96 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 99 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 100 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 103 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 104 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (THOUSAND TONS)

- TABLE 107 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (THOUSAND TONS)

- TABLE 108 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 111 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 112 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 115 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 116 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (THOUSAND TONS)

- TABLE 119 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (THOUSAND TONS)

- TABLE 120 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 122 US: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 123 US: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 125 CANADA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 126 MEXICO: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 127 MEXICO: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 129 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (THOUSAND TONS)

- TABLE 131 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (THOUSAND TONS)

- TABLE 132 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 135 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 136 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 139 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 140 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (THOUSAND TONS)

- TABLE 143 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (THOUSAND TONS)

- TABLE 144 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 146 FRANCE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 147 FRANCE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 148 GERMANY: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 149 GERMANY: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 150 UK: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 151 UK: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 152 SPAIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 153 SPAIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 154 NETHERLANDS: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 155 NETHERLANDS: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 156 REST OF EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 157 REST OF EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (THOUSAND TONS)

- TABLE 161 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (THOUSAND TONS)

- TABLE 162 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 165 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 166 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 169 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 170 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (THOUSAND TONS)

- TABLE 173 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (THOUSAND TONS)

- TABLE 174 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 176 CHINA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 177 CHINA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 178 INDIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 179 INDIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 180 JAPAN: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 181 JAPAN: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 182 AUSTRALIA & NEW ZEALAND: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 183 AUSTRALIA & NEW ZEALAND: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 184 SINGAPORE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 185 SINGAPORE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH KOREA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 187 SOUTH KOREA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (THOUSAND TONS)

- TABLE 193 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (THOUSAND TONS)

- TABLE 194 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 197 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 198 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (USD MILLION)

- TABLE 199 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 201 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 202 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 203 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (THOUSAND TONS)

- TABLE 205 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (THOUSAND TONS)

- TABLE 206 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 207 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 208 BRAZIL: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 209 BRAZIL: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 210 ARGENTINA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 211 ARGENTINA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 214 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 215 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 216 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2020-2024 (THOUSAND TONS)

- TABLE 217 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2025-2030 (THOUSAND TONS)

- TABLE 218 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (USD MILLION)

- TABLE 219 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (USD MILLION)

- TABLE 220 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 221 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 222 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (USD MILLION)

- TABLE 223 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (USD MILLION)

- TABLE 224 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2020-2024 (THOUSAND TONS)

- TABLE 225 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025-2030 (THOUSAND TONS)

- TABLE 226 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (USD MILLION)

- TABLE 227 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 228 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2020-2024 (THOUSAND TONS)

- TABLE 229 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (THOUSAND TONS)

- TABLE 230 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 231 REST OF THE WORLD: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 232 AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 233 AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 235 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2020-2024 (THOUSAND TONS)

- TABLE 237 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2025-2030 (THOUSAND TONS)

- TABLE 238 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 240 ISRAEL: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 241 ISRAEL: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 242 UAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 243 UAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 246 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PRECISION FERMENTATION INGREDIENTS MARKET, 2020-2025

- TABLE 247 PRECISION FERMENTATION INGREDIENTS MARKET: DEGREE OF COMPETITION

- TABLE 248 PRECISION FERMENTATION INGREDIENTS MARKET: REGION FOOTPRINT

- TABLE 249 PRECISION FERMENTATION INGREDIENTS MARKET: INGREDIENT TYPE FOOTPRINT

- TABLE 250 PRECISION FERMENTATION INGREDIENTS MARKET: MICROBE TYPE FOOTPRINT

- TABLE 251 PRECISION FERMENTATION INGREDIENTS MARKET: END USE FOOTPRINT

- TABLE 252 PRECISION FERMENTATION INGREDIENTS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 253 PRECISION FERMENTATION INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 254 PRECISION FERMENTATION INGREDIENTS MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 255 PRECISION FERMENTATION INGREDIENTS MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 256 PRECISION FERMENTATION INGREDIENTS MARKET: EXPANSIONS, JANUARY 2020-APRIL 2025

- TABLE 257 GELTOR: COMPANY OVERVIEW

- TABLE 258 GELTOR: FUNDING OVERVIEW

- TABLE 259 GELTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 GELTOR: PRODUCT LAUNCHES

- TABLE 261 GELTOR: DEALS

- TABLE 262 PERFECT DAY, INC.: COMPANY OVERVIEW

- TABLE 263 PERFECT DAY, INC.: FUNDING OVERVIEW

- TABLE 264 PERFECT DAY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 PERFECT DAY, INC.: PRODUCT LAUNCHES

- TABLE 266 PERFECT DAY, INC.: DEALS

- TABLE 267 PERFECT DAY, INC.: EXPANSIONS

- TABLE 268 THE EVERY COMPANY: COMPANY OVERVIEW

- TABLE 269 THE EVERY COMPANY: FUNDING OVERVIEW

- TABLE 270 THE EVERY COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 THE EVERY COMPANY: PRODUCT LAUNCHES

- TABLE 272 THE EVERY COMPANY: DEALS

- TABLE 273 THE EVERY COMPANY: EXPANSIONS

- TABLE 274 IMPOSSIBLE FOODS INC.: COMPANY OVERVIEW

- TABLE 275 IMPOSSIBLE FOODS INC.: FUNDING OVERVIEW

- TABLE 276 IMPOSSIBLE FOODS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 IMPOSSIBLE FOODS INC.: PRODUCT LAUNCHES

- TABLE 278 IMPOSSIBLE FOODS INC.: DEALS

- TABLE 279 IMPOSSIBLE FOODS INC.: EXPANSIONS

- TABLE 280 IMAGINDAIRY LTD.: COMPANY OVERVIEW

- TABLE 281 IMAGINDAIRY LTD.: FUNDING OVERVIEW

- TABLE 282 IMAGINDAIRY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 IMAGINDAIRY LTD.: PRODUCT LAUNCHES

- TABLE 284 IMAGINDAIRY LTD.: DEALS

- TABLE 285 IMAGINDAIRY LTD.: EXPANSIONS

- TABLE 286 SHIRU, INC.: COMPANY OVERVIEW

- TABLE 287 SHIRU, INC.: FUNDING OVERVIEW

- TABLE 288 SHIRU, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SHIRU, INC.: PRODUCT LAUNCHES

- TABLE 290 SHIRU, INC.: DEALS

- TABLE 291 FORMO FOODS GMBH: COMPANY OVERVIEW

- TABLE 292 FORMO FOODS GMBH: FUNDING OVERVIEW

- TABLE 293 FORMO FOODS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 FORMO FOODS GMBH: PRODUCT LAUNCHES

- TABLE 295 FORMO FOODS GMBH: DEALS

- TABLE 296 EDEN BREW: COMPANY OVERVIEW

- TABLE 297 EDEN BREW: FUNDING OVERVIEW

- TABLE 298 EDEN BREW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 EDEN BREW: PRODUCT LAUNCHES

- TABLE 300 EDEN BREW: DEALS

- TABLE 301 CHANGE FOODS: COMPANY OVERVIEW

- TABLE 302 CHANGE FOODS: FUNDING OVERVIEW

- TABLE 303 CHANGE FOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 CHANGE FOODS: DEALS

- TABLE 305 NEW CULTURE: COMPANY OVERVIEW

- TABLE 306 NEW CULTURE: FUNDING OVERVIEW

- TABLE 307 NEW CULTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 NEW CULTURE: PRODUCT LAUNCHES

- TABLE 309 NEW CULTURE: DEALS

- TABLE 310 HELAINA INC.: COMPANY OVERVIEW

- TABLE 311 HELAINA INC.: FUNDING OVERVIEW

- TABLE 312 HELAINA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 HELAINA INC.: PRODUCT LAUNCHES

- TABLE 314 NAPLASOL: COMPANY OVERVIEW

- TABLE 315 NAPLASOL: FUNDING OVERVIEW

- TABLE 316 NAPLASOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 NAPLASOL: DEALS

- TABLE 318 NAPLASOL: OTHER DEVELOPMENTS

- TABLE 319 MYCOTECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 320 MYCOTECHNOLOGY, INC: FUNDING OVERVIEW

- TABLE 321 MYCOTECHNOLOGY, INC: PRODUCTS OFFERED

- TABLE 322 MYCOTECHNOLOGY, INC: DEALS

- TABLE 323 MYCOTECHNOLOGY, INC.: OTHER DEVELOPMENTS

- TABLE 324 REMILK LTD.: COMPANY OVERVIEW

- TABLE 325 REMILK LTD.: FUNDING OVERVIEW

- TABLE 326 REMILK LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 REMILK LTD.: DEALS

- TABLE 328 REMILK LTD.: EXPANSIONS

- TABLE 329 TRITON ALGAE INNOVATIONS: COMPANY OVERVIEW

- TABLE 330 TRITON ALGAE INNOVATIONS: FUNDING OVERVIEW

- TABLE 331 TRITON ALGAE INNOVATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 TRITON ALGAE INNOVATIONS: PRODUCT LAUNCHES

- TABLE 333 TRITON ALGAE INNOVATIONS: DEALS

- TABLE 334 MELT&MARBLE: COMPANY OVERVIEW

- TABLE 335 MELT&MARBLE: FUNDING OVERVIEW

- TABLE 336 MELT&MARBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 MELT&MARBLE: DEALS

- TABLE 338 MELT&MARBLE: EXPANSIONS

- TABLE 339 REVYVE: COMPANY OVERVIEW

- TABLE 340 REVYVE: FUNDING OVERVIEW

- TABLE 341 REVYVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 REVYVE: PRODUCT LAUNCHES

- TABLE 343 REVYVE: DEALS

- TABLE 344 NOURISH INGREDIENTS PTY LTD.: COMPANY OVERVIEW

- TABLE 345 NOURISH INGREDIENTS PTY LTD: FUNDING OVERVIEW

- TABLE 346 NOURISH INGREDIENTS PTY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 NOURISH INGREDIENTS PTY LTD.: DEALS

- TABLE 348 NOURISH INGREDIENTS PTY LTD.: EXPANSIONS

- TABLE 349 FYBRAWORKS FOODS: COMPANY OVERVIEW

- TABLE 350 FYBRAWORKS FOODS: FUNDING OVERVIEW

- TABLE 351 FYBRAWORKS FOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 STANDING OVATION: COMPANY OVERVIEW

- TABLE 353 STANDING OVATION: FUNDING OVERVIEW

- TABLE 354 STANDING OVATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 STANDING OVATION: DEALS

- TABLE 356 VIVICI: COMPANY OVERVIEW

- TABLE 357 ONEGO BIO: COMPANY OVERVIEW

- TABLE 358 UPDAIRY: COMPANY OVERVIEW

- TABLE 359 EVODIABIO: COMPANY OVERVIEW

- TABLE 360 DE NOVO FOODS, INC.: COMPANY OVERVIEW

- TABLE 361 ADJACENT MARKETS TO PRECISION FERMENTATION INGREDIENTS

- TABLE 362 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (USD MILLION)

- TABLE 363 CULTURED MEAT MARKET IN OPTIMISTIC SCENARIO, BY SOURCE, 2023-2034 (TONS)

- TABLE 364 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 365 DAIRY ALTERNATIVES MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 PRECISION FERMENTATION INGREDIENTS MARKET SEGMENTATION

- FIGURE 2 PRECISION FERMENTATION INGREDIENTS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY DATA FROM PRIMARY SOURCES

- FIGURE 5 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 PRECISION FERMENTATION INGREDIENTS MARKET: DEMAND-SIDE CALCULATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 PRECISION FERMENTATION INGREDIENTS MARKET SHARE (2024) AND CAGR (2025-2030), BY REGION

- FIGURE 15 ADVANCEMENTS IN SYNTHETIC BIOLOGY AND RISING DEMAND FOR CLEAN LABEL AND FUNCTIONAL INGREDIENTS TO DRIVE MARKET

- FIGURE 16 FOOD & BEVERAGES SEGMENT AND US TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 17 US TO ACCOUNT FOR LARGEST MARKET SHARE (BY VALUE) IN 2025

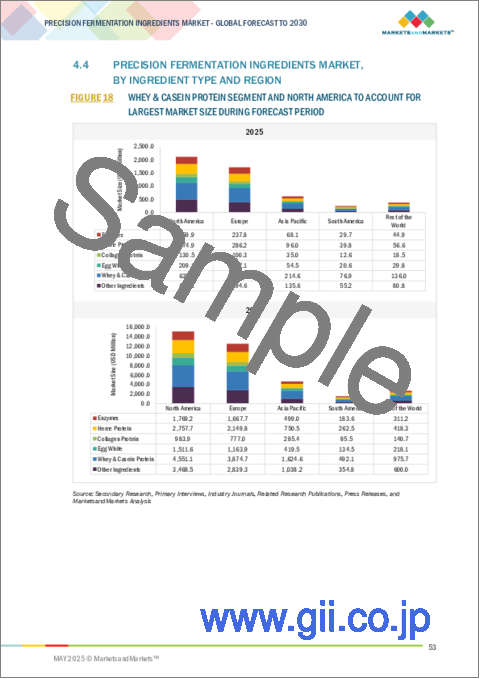

- FIGURE 18 WHEY & CASEIN PROTEIN SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 19 YEAST SEGMENT AND NORTH AMERICA TO LEAD MARKET DURING REVIEW PERIOD

- FIGURE 20 FOOD & BEVERAGES SEGMENT AND NORTH AMERICA TO DOMINATE MARKET DURING STUDY PERIOD

- FIGURE 21 DAIRY ALTERNATIVES SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING STUDY PERIOD

- FIGURE 22 WORLD POPULATION, BY YEAR, 2000-2024

- FIGURE 23 NUMBER OF COMPANIES IN ALTERNATIVE PROTEIN MARKET, BY TECHNOLOGY, 2023

- FIGURE 24 PRECISION FERMENTATION INGREDIENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ADOPTION OF GEN AI IN PRECISION FERMENTATION INGREDIENTS MARKET

- FIGURE 26 PRECISION FERMENTATION INGREDIENTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 EXPORT VALUE OF HS CODE 3502: KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 28 IMPORT VALUE OF HS CODE 3502: KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PRECISION FERMENTATION INGREDIENTS, BY MICROBE TYPE, 2021-2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF PRECISION FERMENTATION INGREDIENTS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 31 PRECISION FERMENTATION INGREDIENTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 PRECISION FERMENTATION INGREDIENTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PRECISION FERMENTATION INGREDIENTS MARKET, 2015-2025

- FIGURE 35 PRECISION FERMENTATION INGREDIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD & BEVERAGE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR FOOD & BEVERAGE APPLICATIONS

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO OF FEW MAJOR PLAYERS, 2015-2025

- FIGURE 39 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 41 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2025 VS. 2030 (USD MILLION)

- FIGURE 42 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 43 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET SNAPSHOT

- FIGURE 46 PRECISION FERMENTATION INGREDIENTS MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 47 PRECISION FERMENTATION INGREDIENTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 PRECISION FERMENTATION INGREDIENTS MARKET: COMPANY FOOTPRINT

- FIGURE 49 PRECISION FERMENTATION INGREDIENTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 BRAND COMPARISON

The market for precision fermentation ingredients is projected to grow from USD 5.02 billion in 2025 to USD 36.31 billion by 2030, at a CAGR of 48.6% during the forecast period. The market is experiencing rapid growth, propelled by several key factors. Foremost is the increasing demand for sustainable and animal-free protein sources as consumers become more environmentally and ethically conscious. Precision fermentation offers a solution by producing high-quality proteins with a significantly lower environmental footprint compared to traditional animal farming. Advancements in biotechnology and synthetic biology have enhanced the efficiency and scalability of precision fermentation processes, enabling the production of a diverse range of ingredients. Additionally, the rising trend of veganism and plant-based diets has further fueled market expansion as consumers seek alternatives to animal-derived products. Government initiatives supporting sustainable food production and investments in food technology have also played a crucial role in fostering market growth. Collectively, these factors are driving the adoption of precision fermentation across various sectors, including food and beverages, pharmaceuticals, and cosmetics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Thousand Tons) |

| Segments | By Ingredient, Microbe, End User, Food & Beverage Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

"The fungi segment holds a significant share in the microbe type segment of the precision fermentation ingredients market"

Fungi hold a significant share in the microbe type segment of the precision fermentation ingredients market due to their versatility, high productivity, and well-established use in industrial fermentation. Fungal species such as Aspergillus niger, Trichoderma reesei, and Saccharomyces cerevisiae are commonly used for producing a wide range of ingredients, including enzymes, flavor enhancers, organic acids, and alternative proteins. Their ability to secrete large amounts of target compounds, tolerate varying pH levels, and grow on inexpensive substrates makes them cost-effective for large-scale production. Moreover, advancements in synthetic biology and metabolic engineering have enabled further optimization of fungal strains, enhancing yield and product specificity. As demand grows for sustainable and functional ingredients in food, beverages, and personal care products, fungi continue to play a key role in shaping the precision fermentation landscape.

"The heme protein segment holds the largest share in the ingredient type segment of the precision fermentation ingredients market"

Heme protein is emerging as the fastest-growing segment within the precision fermentation ingredients market, driven by its critical role in replicating the taste, color, and texture of animal-based meat in plant-based alternatives. With rising consumer demand for meat analogs that closely mimic traditional meat, companies are increasingly turning to precision fermentation to produce heme more efficiently and sustainably. The success of brands like Impossible Foods, which uses fermented soy leghemoglobin, has further validated the commercial viability of heme protein, prompting increased investment and R&D in this segment.

"Europe is estimated to grow at a significant rate in the global precision fermentation ingredients market"

Europe is projected to experience significant growth in the precision fermentation ingredients market. This surge is driven by strong consumer demand for sustainable, ethical, and functional food products, alongside supportive governmental policies such as the European Union's Green Deal and Farm to Fork Strategy, which promote sustainable food systems and encourage investment in innovative food technologies. Countries like Germany, the UK, and France are leading the charge, leveraging their advanced biotechnology sectors and consumer demand for ethical, plant-based, and functional food products. The region's commitment to sustainability and innovation positions Europe as a key player in the global precision fermentation landscape.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the precision fermentation ingredients market.

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World -10%

Prominent companies in the market include Perfect Day, Inc. (US), Geltor (US), The EVERY Company (US), Impossible Foods Inc. (US), ImaginDairy Ltd. (Israel), Shiru, Inc. (US), FORMO FOODS GMBH (Germany), EDEN BREW (Australia), Change Foods (US), New Culture (US), Helaina Inc. (US), Naplasol (Belgium), Myco Technology, Inc. (US), Remilk Ltd. (Israel), and Triton Algae Innovations (US).

Other players include Melt&Marble (Sweden), Revyve (Netherlands), Nourish Ingredients Pty Ltd. (Australia), Fybrawork Foods (US), Standing Ovation (France), Vivici (Netherlands), Onego Bio (Finland), Updairy (Brazil), EvodiaBio (Denmark), and De Novo Foodlabs, Inc. (US).

Research Coverage:

This research report categorizes the precision fermentation ingredients market by ingredient type (whey & casein protein, egg white, collagen protein, heme protein, enzymes, and other ingredients), microbe type (yeast, bacteria, fungi, and algae), end use (food & beverages, pharmaceuticals, cosmetics, and others), food & beverage application (meat & seafood, dairy alternatives, egg alternatives, and other applications), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the precision fermentation ingredients market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the precision fermentation ingredients market. This report covers a competitive analysis of upcoming startups in the market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to Buy this Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall precision fermentation ingredients and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing investments in the precision fermentation industry), restraints (high production cost), opportunities (cost reduction), and challenges (regulatory challenges) influencing the growth of the precision fermentation ingredients market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the precision fermentation ingredients market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the precision fermentation ingredients market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the precision fermentation ingredients market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players, such as Perfect Day, Inc. (US), Geltor (US), The EVERY Company (US), Impossible Foods Inc. (US), and ImaginDairy Ltd. (Israel), and other players in the precision fermentation ingredients market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 MARKET DEFINITION

- 1.2 MARKET SCOPE

- 1.2.1 MARKET SEGMENTATION

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY/VALUE UNIT

- 1.4.2 VOLUME CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FERMENTATION INGREDIENTS MARKET

- 4.2 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE AND COUNTRY

- 4.3 PRECISION FERMENTATION INGREDIENTS MARKET: SHARE OF KEY SUBMARKETS

- 4.4 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE AND REGION

- 4.5 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE AND REGION

- 4.6 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE AND REGION

- 4.7 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN GLOBAL POPULATION

- 5.2.2 EXPANSION OF ALTERNATIVE PROTEIN MARKET

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing adoption of precision fermentation ingredients

- 5.3.1.2 Increasing investments in precision fermentation industry

- 5.3.1.3 Rising innovation in precision fermentation ingredients

- 5.3.2 RESTRAINTS

- 5.3.2.1 High production costs

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Development of novel protein production systems

- 5.3.3.2 Reduction in production costs

- 5.3.4 CHALLENGES

- 5.3.4.1 Regulatory challenges

- 5.3.4.2 Lack of production scale-up

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON PRECISION FERMENTATION INGREDIENTS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN PRECISION FERMENTATION INGREDIENTS MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 AI-powered precision fermentation: Live Green's disruptive approach to replacing animal-based and synthetic ingredients

- 5.4.3.2 Shiru's disruptive model in precision fermentation ingredients market

- 5.4.3.3 Arsenale Bioyards' scaling of precision fermentation for cost-effective biomanufacturing

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFF - PRECISION FERMENTATION INGREDIENTS MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 PRICE IMPACT ANALYSIS

- 6.2.4 IMPACT ON COUNTRY/REGION

- 6.2.4.1 US

- 6.2.4.2 Europe

- 6.2.4.3 Asia Pacific

- 6.2.5 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SOURCING

- 6.3.2 MICROBIAL STRAIN DEVELOPMENT

- 6.3.3 FERMENTATION PROCESSING

- 6.3.4 PURIFICATION & DOWNSTREAM PROCESSING

- 6.3.5 DISTRIBUTION & END-USE APPLICATION

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO OF HS CODE 3502

- 6.4.2 IMPORT SCENARIO OF HS CODE 3502

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Synthetic biology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Bioreactor automation systems

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Plant-based encapsulation

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 INTRODUCTION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND-SIDE

- 6.7.2 SUPPLY-SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Canada

- 6.11.3 EUROPEAN UNION

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 Australia

- 6.11.4.2 Singapore

- 6.11.4.3 India

- 6.11.4.4 South Korea

- 6.11.4.5 China

- 6.11.4.6 Japan

- 6.11.5 REST OF THE WORLD

- 6.11.5.1 Israel

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 PARTNERSHIP BETWEEN NOURISH INGREDIENTS AND CABIO BIOTECH TO SCALE PRECISION-FERMENTED FATS PRODUCTION

- 6.15.2 LAUNCH OF VIVITEIN BLG BY VIVICI IN US ACTIVE NUTRITION MARKET

- 6.15.3 PIONEERING OF DUAL FORMAT ANIMAL-FREE WHEY PROTEIN BY BON VIVANT IN US MARKET

7 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE

- 7.1 INTRODUCTION

- 7.2 WHEY & CASEIN PROTEIN

- 7.2.1 RISING USE IN DAIRY ALTERNATIVES AND SPORTS NUTRITION PRODUCTS DUE TO HIGH BIOAVAILABILITY AND SOLUBILITY TO DRIVE DEMAND

- 7.3 EGG WHITE

- 7.3.1 ECO-FRIENDLY PROPERTY AND INCREASED YIELD EFFICIENCY TO DRIVE DEMAND

- 7.4 COLLAGEN PROTEIN

- 7.4.1 HIGH PROTEIN CONTENT AND FUNCTIONAL BENEFITS TO DRIVE DEMAND

- 7.5 HEME PROTEIN

- 7.5.1 RISING POPULARITY OF PLANT-BASED MEAT TO DRIVE DEMAND

- 7.6 ENZYMES

- 7.6.1 GROWING FOCUS ON ANIMAL-FREE PRODUCTION SYSTEMS AND CLEAN-LABEL INGREDIENTS TO DRIVE DEMAND

- 7.7 OTHER INGREDIENTS

- 7.7.1 AMINO ACIDS AND VITAMINS

8 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE

- 8.1 INTRODUCTION

- 8.2 YEAST

- 8.2.1 GENETIC STABILITY AND ABILITY TO EXPRESS COMPLEX PROTEINS AND LIPIDS TO DRIVE DEMAND

- 8.3 BACTERIA

- 8.3.1 RISING USE IN MANUFACTURING ESSENTIAL NUTRIENTS, ENZYMES, AND BIOACTIVE COMPOUNDS TO DRIVE DEMAND

- 8.4 FUNGI

- 8.4.1 ABILITY TO PRODUCE COMPLEX PROTEINS, ENZYMES, AND FLAVOR COMPOUNDS WITH HIGH EFFICIENCY AND SCALABILITY TO DRIVE DEMAND

- 8.5 ALGAE

- 8.5.1 HIGH NUTRITIONAL VALUE AND SUSTAINABLE PROFILE TO DRIVE DEMAND

9 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGES

- 9.2.1 DEMAND FOR SUSTAINABLE AND ANIMAL-FREE ALTERNATIVES TO DRIVE MARKET

- 9.3 PHARMACEUTICALS

- 9.3.1 DEMAND FOR HIGH-PURITY, BIO-IDENTICAL COMPOUNDS FOR THERAPEUTIC APPLICATIONS TO DRIVE MARKET

- 9.4 COSMETICS & OTHERS

- 9.4.1 GROWING DEMAND FOR NATURAL AND SUSTAINABLE BEAUTY PRODUCTS TO DRIVE MARKET

10 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION

- 10.1 INTRODUCTION

- 10.2 MEAT & SEAFOOD

- 10.2.1 DEMAND FOR AUTHENTIC PLANT-BASED MEAT AND FISH ANALOGUES TO DRIVE SEGMENT

- 10.3 DAIRY ALTERNATIVES

- 10.3.1 RISING CONSUMER DEMAND FOR ANIMAL-FREE DAIRY PRODUCTS TO DRIVE SEGMENT

- 10.4 EGG ALTERNATIVES

- 10.4.1 INCREASING EGG PRICES TO DRIVE SEGMENT

- 10.5 OTHER APPLICATIONS

11 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Government initiatives, increasing investments, and supportive regulatory frameworks to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increasing demand for sustainable and animal-free alternatives to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Rising demand for sustainable and alternative protein sources to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 FRANCE

- 11.3.1.1 Robust culinary culture and focus on sustainability to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Rising demand for sustainable ingredients to boost market

- 11.3.3 UK

- 11.3.3.1 Increasing demand for sustainable and ethical food alternatives and rising investments in biotech sector to drive market

- 11.3.4 SPAIN

- 11.3.4.1 Increasing demand for plant-based and clean-label products to drive market

- 11.3.5 NETHERLANDS

- 11.3.5.1 Corporate innovation, academic expertise, and government support to drive market

- 11.3.6 REST OF EUROPE

- 11.3.1 FRANCE

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government focus on achieving food security to drive market

- 11.4.2 INDIA

- 11.4.2.1 Rising demand for sustainable, animal-free protein alternatives to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Government focus on sustainability and carbon footprint reduction to drive market

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Strong biotechnology research ecosystem and supportive regulatory framework to drive market

- 11.4.5 SINGAPORE

- 11.4.5.1 Robust infrastructure and investor-friendly climate to drive market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Development of novel precision fermentation ingredients to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Strong agricultural base and expanding network of food tech startups to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Increasing consumer interest in sustainable and plant-based food alternatives to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 AFRICA

- 11.6.1.1 Increasing demand for sustainable food solutions to drive market

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Israel

- 11.6.2.1.1 Strong food-tech ecosystem and supportive government initiatives to drive market

- 11.6.2.2 UAE

- 11.6.2.2.1 Rising demand for sustainable, plant-based food options to drive market

- 11.6.2.3 Rest of Middle East

- 11.6.2.1 Israel

- 11.6.1 AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- 12.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.4.5.1 Company footprint

- 12.4.5.2 Region footprint

- 12.4.5.3 Ingredient type footprint

- 12.4.5.4 Microbe type footprint

- 12.4.5.5 End use footprint

- 12.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.5.5.1 Detailed list of key startups/SMEs

- 12.5.5.2 Competitive benchmarking of key startups/SMEs

- 12.6 BRAND COMPARISON

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

- 12.7.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 GELTOR

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 PERFECT DAY, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 THE EVERY COMPANY

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 IMPOSSIBLE FOODS INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 IMAGINDAIRY LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SHIRU, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.4 MnM view

- 13.1.7 FORMO FOODS GMBH

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.7.4 MnM view

- 13.1.8 EDEN BREW

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.4 MnM view

- 13.1.9 CHANGE FOODS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MnM view

- 13.1.10 NEW CULTURE

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.10.4 MnM view

- 13.1.11 HELAINA INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.4 MnM view

- 13.1.12 NAPLASOL

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Other developments

- 13.1.12.4 MnM view

- 13.1.13 MYCOTECHNOLOGY, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.13.3.2 Other developments

- 13.1.13.4 MnM view

- 13.1.14 REMILK LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.14.3.2 Expansions

- 13.1.14.4 MnM view

- 13.1.15 TRITON ALGAE INNOVATIONS

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.15.4 MnM view

- 13.1.1 GELTOR

- 13.2 OTHER PLAYERS (SMES/STARTUPS)

- 13.2.1 MELT&MARBLE

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Deals

- 13.2.1.3.2 Expansions

- 13.2.2 REVYVE

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.3.2 Deals

- 13.2.3 NOURISH INGREDIENTS PTY LTD.

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.3.2 Expansions

- 13.2.4 FYBRAWORKS FOODS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.5 STANDING OVATION

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.6 VIVICI

- 13.2.7 ONEGO BIO

- 13.2.8 UPDAIRY

- 13.2.9 EVODIABIO

- 13.2.10 DE NOVO FOODS, INC.

- 13.2.1 MELT&MARBLE

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 CULTURED MEAT MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 DAIRY ALTERNATIVES MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS