|

|

市場調査レポート

商品コード

1712471

世界のCCaaS市場:2025-2029年Global CCaaS Market: 2025-2029 |

||||||

|

|||||||

| 世界のCCaaS市場:2025-2029年 |

|

出版日: 2025年04月28日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

”CCaaS:AWS、Genesys、NICEが2025年の競合リーダーボードのトップに”

| 主要統計 | |

|---|---|

| 2025年のCCaaSコンタクトセンターへのモバイルメッセージ: | 405億 |

| 2029年のCCaaSコンタクトセンターへのモバイルメッセージ: | 4,754億 |

| 2025年から2029年のCCaaSモバイルメッセージングトラフィックの成長率: | 1,074% |

| 予測期間: | 2025-2029年 |

当調査パッケージは、今後5年間で大きな変化を迎えるCCaaS (Contact Centre-as-a-Service) 市場について詳細かつ洞察に満ちた分析を提供します。本調査により、CCaaSベンダーのステークホルダーは、CCaaS市場がどのように進化するかをよりよく理解することができ、顧客体験の向上と生成AIの導入に対する需要が、既存のコンタクトセンターサービスの提供にどの程度影響を与えるかを評価することができます。

本調査パッケージは、以下の主要業界におけるCCaaS市場の評価を提供します:

|

|

本調査パッケージでは、CCaaS市場内の主要チャネルの市場内訳に加え、CCaaSベンダーにとっての主要な展開機会と課題を明らかにします。

本調査パッケージには、CCaaSベンダーのトラフィックと将来のサブスクリプション収益に関するデータと予測を含む、個別に購入可能ないくつかのオプションが含まれています。さらに、市場内の主要動向と将来機会を明らかにする洞察に満ちた調査や、CCaaS分野の主要ベンダー18社に関する広範な分析も含まれています。

主な特徴

- 市場力学:CCaaS市場の変化から生じる主要動向と市場機会に関する洞察が読者の利益となります。本調査では、OTTメッセージングやRCSを通じた会話型コミュニケーション、エージェントやカスタマーエクスペリエンス機能への生成AIの統合など、CCaaSベンダーにとっての主要な成長機会を取り上げています。また、これらの開発によって生成される視覚・音声データの増加に伴い、CCaaSベンダーが直面する規制やセキュリティの課題についても評価し、これらの課題を解決するための推奨事項を提示しています。さらに、主要61カ国におけるCCaaSの現在の市場開拓と今後の成長に関する地域別の市場成長率分析を掲載し、主要な注目市場を特定しています。

- 主な要点と戦略的提言:CCaaS市場における主な発展機会と知見を詳細に分析し、CCaaSベンダーに対する主要な戦略的提言も掲載しています。

- ベンチマーク業界予測:CCaaS市場の5カ年予測データベースを提供し、各セクターのビジネスサブスクリプション収益とトラフィック予測を提供します。これらの分野分割には、音声、RCS、OTTメッセージング、SMS、チャットボット、ビデオ、電子メールが含まれます。

- Juniper Research競合リーダーボード:CCaaSベンダー主要18社の能力を評価し、市場実績、収益、将来の事業見通しなどの基準でベンダーを採点します。

サンプルビュー

市場動向・戦略レポート

市場データ・予測レポート

当調査スイートには、86の表と39,000以上のデータポイントから成る包括的な5カ年予測データセットへのアクセスが含まれています。

調査の指標は以下の通りです:

|

|

トラフィックメトリクスは、以下の主要市場について提供されています:

|

|

Juniper Researchインタラクティブ予測 (Excel) には以下の機能があります:

- 統計分析:データ期間中のすべての地域と国について表示される特定の指標を検索できます。グラフは簡単に変更でき、クリップボードへのエクスポートも可能です。

- 国別データツール:このツールでは、予測期間中のすべての地域と国の指標を見ることができます。検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:特定の国を選択して比較することができます。このツールには、グラフをエクスポートする機能が含まれています。

- What-if分析:5つのインタラクティブなシナリオを通じて、予測指標を独自の前提条件と比較することができます。

競合リーダーボードレポート

競合リーダーボードレポートでは、CCaaS分野の主要ベンダー18社について、詳細な評価と市場でのポジショニングを提供しています。

|

|

目次

市場動向・戦略

第1章 重要ポイント・戦略的提言

- 重要ポイント・戦略的提言

- 重要ポイント

- 戦略的提言

第2章 CCaaS:将来の市場展望

- CCaaS:イントロダクション

- 会話体験

- CCaaSにおけるAI

- 顧客体験におけるAI

- エージェントエクスペリエンスにおけるAI

- i.マルチエージェントオーケストレーション

- CCaaSにおけるAIの規制

- 統合プラットフォーム

- 分析とCDP

- オムニチャネルエンゲージメント

- IoTを活用した顧客サービス

- CCaaS技術の区分

- ボイス

- SMS

- RCS

- OTT

- ビデオ

- チャットボット

- Webベースのチャットボット

- アプリベースのチャットボット

- メール

第3章 CCaaS市場区分別評価

- 市場区分別評価:イントロダクション

- 銀行・金融

- 小売・Eコマース

- ヘルスケア

- ホスピタリティ・旅行

- 製造

- メディア&エンターテイメント

第4章 国別準備指数

- 国別準備指数:イントロダクション

- 注目市場

- 北米

- 西欧

- インド

- 成長市場

- バングラデシュ

- アルゼンチン

- 中国

- 飽和市場

- 新興国市場

競合のリーダーボード

第1章 Juniper Researchの競合リーダーボード

第2章 ベンダープロファイル

- CCaaSベンダープロファイル

- 8x8

- Avaya

- AWS

- Cisco

- CM.com

- Content Guru

- Dialpad

- Enghouse Interactive

- Five9

- Genesys

- Infobip

- NICE

- Sinch

- Talkdesk

- Tata Communications

- Twilio

- UJET

- Vonage

- リーダーボード調査手法

- 制限と解釈

データ・予測

第1章 市場予測・主なポイント

- CCaaSサービスに加入している企業総数

- CCaaSプラットフォームの総収益

第2章 CCaaS音声市場

- CCaaSコンタクトセンターへの音声通話総数

第3章 モバイルメッセージング市場

- 調査手法

- CCaaSプラットフォームで処理されたP2A SMSトラフィック総数

- CCaaSコンタクトセンターで処理されたP2A RCSトラフィック総数

- CCaaSコンタクトセンターで処理されたP2A OTTトラフィック総数

第4章 チャットボット市場

- CCaaSチャットボット市場予測:Webベースのチャットボット

- CCaaSチャットボット市場予測:アプリベースのチャットボット

- CCaaSコンタクトセンターで処理されたチャットボットメッセージ総数

第5章 ビデオマーケット

- CCaaSコンタクトセンターへのビデオ通話総数

第6章 CCaaSメール市場

- CCaaSコンタクトセンターへのメールトラフィック総数

'CCaaS: AWS, Genesys, and NICE Top 2025 Competitor Leaderboard'

| KEY STATISTICS | |

|---|---|

| Mobile messages to CCaaS contact centres in 2025: | 40.5bn |

| Mobile messages to CCaaS contact centres in 2029: | 475.4bn |

| 2025 to 2029 CCaaS mobile messaging traffic growth: | 1,074% |

| Forecast period: | 2025-2029 |

Overview

Our "Contact Centre-as-a-Service (CCaaS)" research suite provides detailed and insightful analysis of a market set for significant change over the next five years. It enables stakeholders from CCaaS vendors to better understand how the CCaaS market will evolve, assessing the extent to which demand for enhanced customer experience and the implementation of generative AI will impact the provision of existing contact centre services.

This research provides an assessment of the CCaaS market in key industry verticals including:

|

|

This is in addition to a breakdown of the key channels within the CCaaS market; identifying key deployment opportunities and challenges for CCaaS vendors.

The CCaaS market suite includes several different options that can be purchased separately, including data and forecasts for traffic and future subscription revenue for CCaaS vendors. Additionally, it includes an insightful study uncovering key trends and future opportunities within the market, as well as an extensive analysis of 18 leading vendors in the CCaaS space. The coverage can also be purchased as a full research suite, which contains all these elements and includes a substantial discount.

Collectively, they provide a critical tool for understanding this ever-changing market; allowing CCaaS vendors to capitalise on trends and shape their future strategy. This research suite's unparalleled coverage makes it an incredibly useful resource for projecting the future of a market set for change.

All report content is delivered in the English language.

Key Features

- Market Dynamics: Readers benefit from insight into key trends and market opportunities resulting from changes within the CCaaS market. This study addresses key growth opportunities for CCaaS vendors, including conversational communications via over-the-top (OTT) messaging and rich communications services (RCS), and the integration of generative AI into agent and customer experience features. It assesses regulatory and security challenges posed to CCaaS vendors with the increased volume of visual and audio data produced with these developments, providing recommendations for how these must be navigated. Moreover, it includes a regional market growth rate analysis on the current development and future growth of CCaaS across 61 key countries, identifying key focus markets.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the CCaaS market, accompanied by key strategic recommendations for CCaaS vendors.

- Benchmark Industry Forecasts: 5-year forecast databases are provided for the CCaaS market, providing business subscription revenue and traffic splits for each sector. These sector splits include voice, RCS, OTT messaging, SMS, chatbots, video, and email.

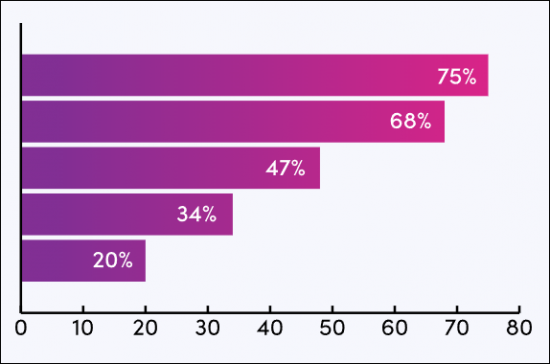

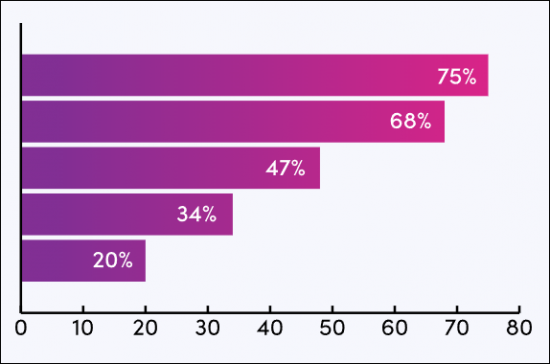

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 18 CCaaS vendors via the Juniper Research Competitor Leaderboard; scoring these vendors on criteria such as market performance, revenue and future business prospects.

SAMPLE VIEW

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "CCaaS" market includes access to a comprehensive five-year forecast dataset comprising 86 tables and over 39,000 datapoints.

Metrics in the research suite include:

|

|

Traffic metrics are provided for the following key market verticals:

|

|

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions via five interactive scenarios.

Market Trends & Strategies Report

This trends analysis report examines the "CCaaS" market landscape in detail, assessing market trends and factors shaping the evolution of this rapidly changing market. This essential strategy report delivers a comprehensive analysis of the strategic opportunities for CCaaS providers, market challenges, and how stakeholders must navigate these.

This analysis also provides CCaaS market splits for communications channels such as voice, SMS, RCS and OTT messaging, and key industry opportunities for CCaaS vendors to capitalise on. It also includes an evaluation of the key country-level opportunities for CCaaS growth, with the Country Readiness Index.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 18 leading vendors in the "CCaaS" space. The vendors are positioned as established leaders, leading challengers, or disruptors and challengers, based on capacity and capability assessments:

|

|

This competitive analysis document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways and Strategic Recommendations

- 1.2. Key Takeaways

- 1.3. Strategic Recommendations

2. CCaaS: Future Market Outlook

- 2.1. Introduction to CCaaS

- Figure 2.1: Total CCaaS Subscription Revenue ($9.2 billion), Split by 8 Key Regions, 2025

- 2.2. Conversational Experiences

- 2.3. AI in CCaaS

- 2.3.1. AI in Customer Experience

- Figure 2.2: AI in Customer Experience Infographic

- 2.3.2. AI in Agent Experience

- i. Multi-agent Orchestration

- 2.3.3. Regulation of AI in CCaaS

- 2.3.1. AI in Customer Experience

- 2.4. Integrated Platforms

- 2.5. Analytics and CDPs

- 2.6. Omnichannel Engagement

- 2.7. IoT-driven Customer Services

- 2.8. CCaaS Technology Splits

- Figure 2.3: Total CCaaS Traffic (m), Split by Channel, 2025

- 2.8.1. Voice

- Figure 2.4: Total Number of Voice Calls Made to CCaaS Contact Centres (m), Split by 8 Key Regions, 2025-2029

- 2.8.2. SMS

- Figure 2.5: Total P2A SMS Traffic Handled by CCaaS Platforms (m), Split by 8 Key Regions, 2025-2029

- 2.8.3. RCS

- Figure 2.6: Total RCS-capable Mobile Subscribers (m), Split by 8 Key Regions, 2025-2029

- 2.8.4. OTT

- Figure 2.7: Total Person-to-Application (P2A) OTT Traffic Delivered to CCaaS Contact Centres (m), Split by 8 Key Regions, 2025-2029

- 2.8.5. Video

- 2.8.6. Chatbots

- Figure 2.8: Total Chatbot Sessions Handled by CCaaS Platforms (m), Split by Channel, 2025-2029

- i. Web-based Chatbots

- ii. App-based Chatbots

- 2.8.7. Email

3. CCaaS Market Segment Evaluation

- 3.1. Introduction to Market Segment Evaluation

- Figure 3.1: Key CCaaS Industry Verticals Infographic

- 3.1.1. Banking and Finance

- 3.1.2. Retail and eCommerce

- 3.1.3. Healthcare

- 3.1.4. Hospitality and Travel

- 3.1.5. Manufacturing

- 3.1.6. Media and Entertainment

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: CCaaS Country Readiness Index Regional Definitions

- Table 4.2: Juniper Research Country Readiness Index Scoring Criteria: CCaaS

- Figure 4.3: Juniper Research Country Readiness Index: CCaaS

- Table 4.4: CCaaS Country Readiness Index: Market Segments

- 4.2. Focus Markets

- Figure 4.5: Total Number of Large Businesses (m), Split by Focus Markets, 2025

- 4.2.1. North America

- Figure 4.6: Total CCaaS Subscription Revenue ($m), Split by US and Canada, 2025-2029

- 4.2.2. West Europe

- 4.2.3. India

- 4.3. Growth Markets

- Figure 4.7: Total CCaaS Subscription Revenue ($m), Split by Growth Markets, 2025-2029

- 4.3.1. Bangladesh

- 4.3.2. Argentina

- Figure 4.8: Total P2A OTT Traffic Delivered to CCaaS Contact Centres (m), Argentina, 2025-2029

- 4.3.3. China

- 4.4. Saturated Markets

- 4.5. Developing Markets

- Figure 4.9: Total CCaaS Subscription Revenue ($m), Split by Developing Markets, 2025

- Table 4.10: Juniper Research's Country Readiness Index Heatmap: North America

- Table 4.11: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 4.12: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 4.13: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 4.14: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 4.15: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.16: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.17: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard: Vendors & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: CCaaS

- Table 1.3: Juniper Research Competitor Leaderboard: Vendors

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: CCaaS Vendors

2. Vendor Profiles

- 2.1. CCaaS Vendor Profiles

- 2.1.1. 8x8

- i. Corporate Information

- Table 2.1: 8x8's Select Financial Information ($m), 2021-2024

- Table 2.2: 8x8's Recent Acquisitions, 2018 to Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. Avaya

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.3: Avaya's Experience Platform

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. AWS

- i. Corporate Information

- Table 2.4: AWS' Revenue ($bn), 2022-2024

- ii. Geographical Spread

- Figure 2.5: Amazon Web Service Infrastructure Deployments Map, 2025

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.6: Amazon Connect Overview

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.4. Cisco

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. CM.com

- i. Corporate Information

- Table 2.7: Acquisitions Made by CM.com, 2020-present

- Table 2.8: CM.com's Select Financial Information (Euro-m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.6. Content Guru

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Dialpad

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Enghouse Interactive

- i. Corporate Information

- Table 2.9: Enghouse Interactive's Most Recent Acquisitions, 2020-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.9. Five9

- i. Corporate Information

- Table 2.10: Five9's Select Financial Information ($m), 2020-2023

- Table 2.11: Five9's Acquisitions, 2020-present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.10. Genesys

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Infobip

- i. Corporate Information

- Table 2.12: Infobip's Acquisitions - April 2021 to Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.12. NICE

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.13: NICE's CXone Mpower

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Sinch

- i. Corporate Information

- Table 2.14: Sinch's Recent Acquisitions, 2020-2021

- Table 2.15: Sinch's Select Financial Information ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.14. Talkdesk

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Tata Communications

- i. Corporate Information

- Table 2.16: Tata Communications' Select Financial Information (Indian Rupee- in crore), FY 2022-23 & FY 2023-24

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.16. Twilio

- i. Corporate Information

- Table 2.17: Twilio's Acquisitions, November 2019 to Present

- Table 2.18: Twilio's Revenue ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.17. UJET

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.18. Vonage

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. 8x8

- 2.2. Juniper Research Leaderboard Methodology

- 2.3. Limitations & Interpretations

- Table 2.19: Juniper Research Competitor Leaderboard Scoring Criteria: CCaaS Vendors

Data & Forecasting

1. Market Forecast & Key Takeaways

- 1.1. Introduction to CCaaS Forecasts

- 1.2. CCaaS Subscription Revenue Methodology & Assumptions

- Figure 1.1: CCaaS Subscription Revenue Forecast Methodology

- 1.2.1. Total Businesses Subscribing to CCaaS Services

- Figure & Table 1.2: Total Number of Businesses that Subscribe to CCaaS Services (m), Split by 8 Key Regions, 2025-2029

- 1.2.2. Total CCaaS Platform Revenue

- Figure & Table 1.3: Total CCaaS Subscription Revenue ($m), Split by 8 Key Regions, 2025-2029

- Table 1.4: Average CCaaS Spend per Business per annum ($), Split by 8 Key Regions, 2025-2029

2. CCaaS Voice Market

- 2.1. Introduction to CCaaS Voice Market

- 2.1.1. Voice Market Methodology

- Figure 2.1: Voice Market Methodology

- 2.1.2. Total Number of Voice Calls Made to CCaaS Contact Centres

- Figure & Table 2.2: Total Number of Calls Made to CCaaS Contact Centres (m), Split by 8 Key Regions, 2025-2029

- 2.1.1. Voice Market Methodology

3. Mobile Messaging Market

- 3.1. Introduction to CCaaS Mobile Messaging Market

- Figure 3.1: Total P2A Mobile Messaging Traffic Delivered to CCaaS Contact Centres (40,486.6 billion), Split by SMS, RCS and OTT, 2025

- 3.1.1. CCaaS Mobile Messaging Market Methodology

- Figure 3.2: CCaaS SMS Market Methodology

- Figure 3.3: CCaaS RCS Messaging Forecast Methodology

- Figure 3.4: CCaaS OTT Messaging Forecast Methodology

- 3.1.2. Total P2A SMS Traffic Handled by CCaaS Platforms

- Figure & Table 3.5: Total P2A SMS Traffic Handled by CCaaS Platforms (m), Split by 8 Key Regions, 2025-2029

- 3.1.3. Total P2A RCS Traffic Handled by CCaaS Contact Centres

- Figure & Table 3.6: Total Number of P2A RCS Messages Handled by CCaaS Platforms (m), Split by 8 Key Regions, 2025-2029

- 3.1.4. Total P2A OTT Traffic Handled by CCaaS Contact Centres

- Figure & Table 3.7: Total P2A OTT Traffic Delivered to CCaaS Contact Centres (m), Split by 8 Key Regions, 2025-2029

4. Chatbots Market

- 4.1. Introduction to CCaaS Chatbot Services

- 4.1.1. CCaaS Chatbots Market Forecast: Web-based Chatbots

- 4.1.2. CCaaS Chatbots Market Forecast: App-based Chatbots

- Figure 4.1: CCaaS Web-based Chatbots Forecast Methodology

- Figure 4.2: CCaaS App-based Chatbots Forecast Methodology

- 4.1.3. Total Chatbot Messages Being Handled by CCaaS Contact Centres

- Figure & Table 4.3: Total Chatbot Messages Handled by CCaaS Platforms (m), Split by 8 Key Regions, 2025-2029

- Table 4.4: Total Chatbot Messages Handled by CCaaS Platforms (m), Split by Channel, 2025-2029

5. Video Market

- 5.1. Introduction to CCaaS Video Market

- 5.1.1. CCaaS Video Market Methodology

- Figure 5.1: CCaaS Video Forecast Methodology

- 5.1.2. Total Number of Video Calls to CCaaS Contact Centres

- Figure & Table 5.2: Total Number of Video Calls to CCaaS Contact Centres (m), Split by 8 Key Regions, 2025-2029

- 5.1.1. CCaaS Video Market Methodology

6. CCaaS Email Market

- 6.1. Introduction to CCaaS Email Market

- 6.1.1. CCaaS Email Market Forecast Methodology

- Figure 6.1: CCaaS Email Market Forecast Methodology

- 6.1.2. Total Email Traffic Delivered to CCaaS Contact Centres

- Figure & Table 6.2: Total Email Traffic Delivered to CCaaS Contact Centres (m), Split by 8 Key Regions, 2025-2029

- 6.1.1. CCaaS Email Market Forecast Methodology